What is RWA? A Beginner's Guide to Putting Real-World Assets on the Blockchain

- 核心观点:RWA将现实资产代币化上链。

- 关键要素:

- 五大资产类型:债券、不动产、大宗商品等。

- 四步流程:确权、托管、发行、结算。

- 合规要求:地区限制与KYC认证。

- 市场影响:连接传统金融与DeFi,提升流动性。

- 时效性标注:长期影响

Blockchain is changing people's understanding of money, ownership, and transparency. It's redefining how we trade, store value, and interact with the financial system. However, until recently, blockchain applications were almost entirely focused on purely digital assets, such as cryptocurrencies and NFTs. Now, the next frontier for blockchain is to truly connect the "real world" to this digital network.

This is precisely the significance of RWA (Real World Assets) .

RWA refers to the process of tokenizing real-world financial or physical assets, putting them on the blockchain and representing them as digital tokens. Simply put, it allows traditional assets, such as bonds, real estate, or commodities, to be digitized, divided, circulated, and settled on the blockchain.

This innovation combines the strengths of two worlds: the robustness and familiarity of traditional finance (TradFi) and the efficiency and transparency of decentralized finance (DeFi). For investors and institutions, RWA is opening a new door, making the financial world more connected and inclusive.

As the first article in XT.com's RWA education series, this guide will take you through: what RWA is, how it works, its main asset types, and how to explore this emerging field securely and confidently through XT's RWA section .

Key Takeaways

- RWA transforms real-world financial or physical assets into on-chain tokens, making ownership, transfer, and settlement more convenient.

- The five most common types include: bonds, real estate, commodities, credit assets, and equity or fund shares.

- The tokenization process is clear: asset ownership confirmation, compliant custody, token issuance, information disclosure, and settlement through smart contracts.

- Before investing, please carefully review the custody certificate, fee structure, subscription and redemption rules, and regional eligibility.

- XT.com's RWA section provides a complete path from project overviews to trading pairs, helping you easily and systematically understand and participate.

This article will guide you through the five main types of RWAs.

Real-world assets (RWAs) come in many forms; they are not a single, specific product, but rather a collective term encompassing various asset types. These assets are tokenized to map real-world economic activity onto the blockchain. Below are five common types and what they mean for investors.

Bonds

Tokenized bonds (RWAs) refer to the issuance of traditional debt instruments, such as government bonds, corporate bonds, or money market instruments, in the form of digital tokens. Each token corresponds to a portion of the underlying bond, allowing investors to obtain the returns of fixed-income assets without intermediaries. These RWAs are favored by investors seeking stable returns, predictable performance, and compliance transparency.

Real estate

Real estate tokenization involves converting ownership or rental income of property into digital tokens, including residential properties, apartments, office buildings, or commercial complexes. Through tokenized real estate shares, investors can enter the real estate market with lower barriers to entry, achieving asset fractionalization and on-chain liquidity without directly managing physical properties.

Commodities

Commodity RWAs typically represent physical assets such as gold, silver, or crude oil. Each token generally corresponds to a certain quantity of the physical commodity, which is held or custodied by a custodian institution. These tokens act as digital "proofs of ownership," facilitating transfer and division of transactions by investors, and their reserve transparency can be verified through public audits. Commodity RWAs are particularly attractive to investors seeking to hedge against inflation and diversify their asset allocation.

Credit and Bills

This category primarily involves tokenizing financial instruments such as accounts receivable, loans, or trade finance. Businesses can release liquidity by converting outstanding receivables into on-chain assets, while investors can earn returns from a pool of verified credit assets. It bridges the gap between corporate financing and blockchain innovation, opening new pathways for short-term gains and alternative investments.

Equity and Fund Shares

Some RWA projects, within a compliant framework, tokenize equity or fund units. Investors can use these tokenized assets to participate in the performance of companies or the distribution of returns on fund portfolios. This approach makes previously high-barrier investment opportunities more divisible and accessible, helping both institutional and individual investors access a wider range of investment opportunities.

Regardless of the asset type, the core concept remains consistent: RWA is transforming traditional, static real-world value into flexible, programmable digital assets, enabling the world economy to truly enter the on-chain era.

How does RWA work? A complete analysis of the tokenization process.

Tokenization is a core component of RWA. It's an ordered and verifiable process that ensures each token truly represents a verified real-world asset. Its operation typically involves the following four steps:

Step 1: Confirmation and Registration of Property Rights

First, it is necessary to identify and verify the legality of the asset. This includes confirming the asset's legal ownership, valuation, and supporting documentation. Whether it's a property deed, corporate bond, or commercial invoice, the purpose of confirming ownership is to ensure that the asset truly exists, is legally valid, and is enforceable.

Step Two: Custody and Compliance

Once ownership is confirmed, the assets will be held in custody by a licensed institution, such as a bank, trust company, or regulated brokerage firm. The custodian institution is responsible for properly safeguarding the underlying assets and ensuring that the entire tokenization process complies with local laws and regulations, thereby guaranteeing security and legality.

Step 3: Issuance and Circulation

Once assets are confirmed and securely held, the project team will issue tokens on the blockchain to represent partial ownership or profit participation rights. Investors can freely trade these tokens or use them in decentralized finance scenarios such as lending and staking, enabling flexible use of the assets.

Step Four: Settlement and Disclosure

Smart contracts automatically execute operations such as profit distribution, redemption settlement, and information updates. The project team regularly publishes transparent reports, allowing investors to stay informed about the operational status of the underlying assets.

In short, tokenization allows the trust system of traditional finance to be perfectly integrated with the transparency and automation of blockchain, creating a new financial bridge that seamlessly connects the real world and the digital world.

RWA Investment Guide: Compliance Requirements and Target Audience

Compliance is a crucial aspect of the RWA ecosystem. Because these assets connect on-chain finance with regulated markets, they must adhere to specific legal and operational standards to ensure security and transparency.

Regional restrictions

Some RWA products are restricted in certain regions. For example, some projects may not be available to U.S. residents or users in jurisdictions with strict securities regulations. Please be sure to confirm eligibility in your region before investing.

Qualification requirements

To participate in RWA investments, users may need to complete a KYC (Know Your Customer) or KYB (Know Your Business) process. Some products may also require investors to have "accredited investor" or "professional investor" status, depending on the project's compliance framework.

Information Disclosure

Transparency is the foundation of trust. Every RWA project should publicly disclose key information such as its underlying assets, custodian, and risk management. On XT.com , this disclosure information is clearly displayed on each project card, helping users make informed investment decisions.

XT's goal is very clear: to combine the robustness of regulatory compliance with the openness of blockchain to create a safe, transparent, and trustworthy investment environment for global users.

Custody and verification mechanisms to understand before investing

Before participating in any RWA project, it is crucial to understand how assets are custodied and the verification mechanisms. These two aspects are the core foundation of trust.

Custodian

RWA assets are typically held in custody by regulated banks, trust companies, or professional custodians. These institutions are responsible for protecting the underlying physical or financial assets and ensuring that investors' rights are protected by law.

Verification and supporting documents

Trustworthy RWA projects will provide audit reports, attestation documents, or Proof of Reserves (PoR) to verify that the token issuance matches the actual assets in custody.

Information disclosure frequency

High-quality projects regularly disclose information updates, typically monthly, quarterly, or as needed. They also develop contingency plans to address unforeseen circumstances such as market disruptions or redemption delays.

By verifying these details, investors can effectively reduce potential risks and ensure that their investments are based on openness, transparency, and credibility.

Subscription, Redemption, and Fund Arrival: Understanding the Investment Process

The process of participating in RWA investment differs slightly from that of ordinary cryptocurrency trading. Understanding these details can help investors better plan their liquidity and funding arrangements.

Minimum subscription and redemption amount

Each RWA product has its own minimum investment and redemption thresholds. Some are geared towards institutional investors with higher minimum investment amounts, while others are geared towards general users and support flexible allocation of smaller amounts.

Settlement cycle

Most RWA products use a T+N settlement mechanism , meaning that transactions are settled within a certain number of business days after submission. External factors such as holidays or market shutdowns may affect the settlement time.

On-chain and off-chain redemption

Depending on the project structure, redemption methods can be divided into two categories:

- On-chain redemption : After the tokens are destroyed, the funds are directly distributed in the form of digital assets.

- Off-chain redemption : Funds are settled through traditional financial channels (such as bank transfers).

Efficiency and Cost

On-chain redemption is typically faster and cheaper, but not all products support this method. Before investing, carefully read the project details to understand the redemption path, arrival time, and related fees.

Understanding these rules in advance can help investors manage their funds effectively and avoid unnecessary delays or misunderstandings during the redemption process.

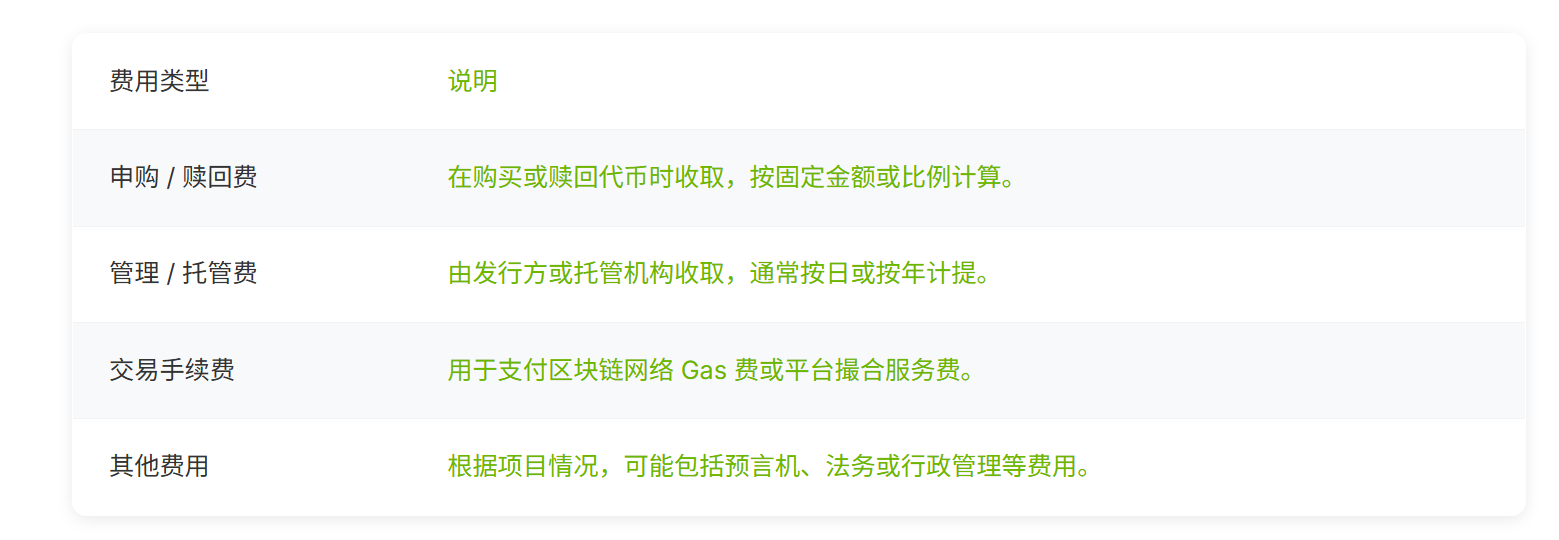

RWA's Cost Structure: How to Understand the Cost Structure

All investment products involve costs, and RWA is no exception. A clear and transparent fee structure helps you accurately assess the true returns.

Before investing, be sure to carefully read the project disclosure documents and compare them with historical settlement records to ensure the accuracy of the information. Understanding the transparency of the cost structure will help you clearly calculate actual returns and make more informed investment decisions.

Explore RWA investment opportunities easily at XT.com

To make RWA investment easier for more users, XT.com has launched a dedicated RWA section , making asset discovery and operation processes simpler and more intuitive.

Access method

- Log in to the XT platform and go to the RWA section .

- Choose the asset class card that interests you, such as "Bonds", "Real Estate", "Commodities", "Credit", or "Equities".

- Click on any item card to view details.

- Browse the corresponding trading pairs and begin to learn and explore.

Recommended reading order

Before making an investment decision, XT recommends that users learn about the following step-by-step learning path:

- Asset Overview : Understand the specific assets represented by this tokenized product.

- Custody and Compliance : Confirming the method of asset custody and legal compliance protection.

- Revenue and Expenses : Understand the sources of revenue and the related expense structure.

- Subscription and redemption rules : Understand liquidity, arrival time and redemption methods.

- Risk Disclosure : Read the potential risks and official disclosure documents.

XT's RWA section integrates all key information into one page, allowing you to learn, compare, and invest on a single platform in a highly efficient, transparent, and user-friendly manner.

RWA's Long-Term Value: Ushering in a New Era of Finance

RWA is not just a trend, but a core foundation for the next wave of financial innovation. By connecting tangible assets in the real world with blockchain technology, it injects genuine stability and verifiable value into the digital economy.

For traditional investors, RWA provides a new channel to the global market, allowing them to enjoy greater liquidity and diversified investment opportunities that were previously only available to large institutions.

For crypto investors, RWA introduces stable-yield products backed by real assets, which can complement the high volatility of digital assets and achieve a more balanced portfolio.

RWA's long-term potential extends far beyond individual gains. Imagine a world where governments issue tokenized bonds, real estate ownership can be instantly transferred across borders, and the entire economic system operates transparently on-chain. This future is gradually becoming a reality through every on-chain asset.

XT.com 's RWA strategy is leading this transformation, making tokenized finance more understandable and accessible. Through continuous innovation, education, and compliance efforts, XT is committed to helping every user confidently step into this new phase of blockchain development. Explore a new world where reality and blockchain converge; head over to the XT RWA zone now to begin your on-chain investment journey.

RWA Frequently Asked Questions (FAQs)

Q1: Explain what RWA is in one sentence.

RWA refers to tokenizing real-world assets, enabling them to be held, traded, and settled on a blockchain.

Q2: Who can participate in RWA investment?

Investment eligibility depends on the region and product type. Some projects require KYC verification or accredited investor status; please refer to the project card for specific details.

Q3: How can assets be protected?

RWA's underlying assets are held in custody by a regulated custodian. Investors can view audit reports, assurance documents, and Proof of Reserve (PoR) in the project information.

Q4: What is T+N settlement? Why are the arrival times different?

T+N means that settlement will take several business days after the transaction is submitted. Holidays or market fluctuations may cause delays.

Q5: Why does the token price sometimes exceed or fall below net asset value (NAV)?

Token prices may vary at a premium or discount depending on liquidity, market supply and demand, and the frequency of valuation updates.

Q6: What should you pay attention to before investing?

Please review key information such as custody details, disclosure frequency, fee structure, subscription and redemption rules, and regional restrictions.

Quick Links

- November 2025 Market Outlook: From FOMC to x402 Agreement, a Comprehensive Analysis of Global Hot Topics

- XT.com and Dash discuss: Instant settlement, blockchain mechanisms, and privacy innovation.

- How to invest 100,000 USDT? XT Simple Earn helps you achieve a stable passive income of 10%+.

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, operating in more than 200 countries and regions, and boasting an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1300 high-quality cryptocurrencies and over 1300 trading pairs, offering diverse trading services including spot trading , leveraged trading , and contract trading , and is equipped with a secure and reliable RWA (Real World Asset) trading market. We are committed to the philosophy of "Explore Crypto, Trust Trading," dedicated to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.