Zcash (ZEC): In-depth discussion of privacy coin pricing, technology, and competitive landscape

- 核心观点:Zcash凭借零知识证明技术引领隐私币发展。

- 关键要素:

- 首创zk-SNARKs技术实现选择性隐私。

- 2025年价格反弹400%显示市场认可。

- 与门罗币技术路线形成差异化竞争。

- 市场影响:推动隐私技术成为数字资产核心需求。

- 时效性标注:长期影响

In the vast world of digital assets, privacy-focused cryptocurrencies occupy a unique and often controversial space. They offer a solution to the transparency issues inherent in public ledgers like Bitcoin, where every transaction is traceable. Zcash (ZEC) is one of the pioneers in this field, bringing groundbreaking cryptographic principles to the forefront of the blockchain conversation.

For those well-versed in blockchain technology, Zcash is more than just another altcoin; it's proof of the power of zero-knowledge proofs. However, its development has been fraught with volatility, technological evolution, and fierce competition. This article will delve into Zcash's price history, explore the factors influencing its market valuation, and compare its technology and market position with its main competitors—Monero (XMR) and Dash.

The Origins of Zcash: Achieving Privacy Through Advanced Cryptography

Technology Overview

Zcash is widely recognized as the first feasible project to implement **zero-knowledge proofs** on a public blockchain. Based on Bitcoin's UTXO model, it introduced zk-SNARKs (zero-knowledge concise non-interactive proofs of knowledge) technology for the first time—a cryptographic structure that allows verifiers to confirm the validity of a transaction without disclosing its contents.

In traditional blockchains like Bitcoin, all transaction details (including sender, receiver, and amount) are completely public. While this achieves transparency, it lacks privacy. Zcash's zk-SNARK system replaces information transparency with mathematical proofs of correctness. Each privacy transaction generates a cryptographic proof to verify the transaction's legitimacy while hiding all related details. The network only verifies the correctness of the proof, without needing to know "who paid whom."

Technically, Zcash supports two address types:

- Transparent addresses (t-address): Similar to Bitcoin, transaction data is publicly available.

- z-address: Uses zk-SNARK technology to hide transaction information.

Users can freely transfer funds between the two addresses, thus achieving selective privacy. This dual-address model strikes a balance between privacy and compliance: by viewing the key, users can access some transaction data when required by regulators or auditors.

In recent years, Zcash has undergone significant protocol upgrades, such as Halo 2 and Orchard (NU5), completely eliminating the early zk-SNARK's reliance on a "trusted setup." The new recursive proof architecture improves system scalability and lays the foundation for cross-chain privacy interoperability and light client verification, providing support for future Web3 privacy infrastructure and private DeFi modules.

Economic Model

Zcash adopts the same total supply cap of 21 million coins as Bitcoin, and its block reward halves every four years. However, its distribution mechanism differs to ensure continued funding for research and development. Early versions established the Founders' Reward, allocating 20% of the mining reward to early developers, investors, and the Electric Coin Company (ECC). Through community governance improvements, this mechanism evolved into the Development Fund, which continues to allocate 20% of the block reward to the ECC, the Zcash Foundation, and community-funded projects.

This mechanism ensures the sustainable operation of the project's research-driven innovation, eliminating reliance on external donations for zk-SNARK technology development, mobile SDK maintenance, and governance. As of 2025, Zcash's block reward is 3.125 ZEC per block, creating a long-term incentive balance among miners, developers, and the community.

In terms of economic function, ZEC possesses the dual attributes of a medium of exchange and a privacy-preserving token. Unlike Bitcoin, which primarily relies on scarcity and adoption to drive value, ZEC's long-term value depends more on the elasticity of privacy demand—that is, the strength of the genuine demand from users and institutions for transaction confidentiality.

On-chain data shows that the adoption rate of privacy transactions has been rising steadily between 2020 and 2025, and is positively correlated with ZEC price performance. This indicates that the market is shifting from "privacy is a minority preference" to "privacy is a core value," enabling Zcash to demonstrate stronger resilience and sustainable competitiveness in an environment of increasingly stringent regulations and heightened blockchain surveillance.

Decoding Zcash (ZEC) Price History: A Story of Highs and Lows

ZEC's price trajectory is a compelling case study of cryptocurrency market dynamics, influenced by early hype, technological milestones, broader market cycles, and persistent inflation concerns.

Explosive growth and subsequent pullback (2016-2017)

The launch of Zcash was one of the most anticipated events in crypto history. The hype surrounding its zk-SNARK technology was immense. This led to extreme supply and demand imbalances in the initial hours of trading. Due to the slow-starting mining mechanism, very few coins were available, and the initial price on some exchanges surged to absurd levels, briefly trading at thousands of dollars per coin.

This initial surge was unsustainable and purely speculative. As more ZEC entered circulation, the price plummeted, falling below $50 by early 2017. This period established a pattern of high volatility that defined ZEC for the next few years. In the first half of 2017, as the market began to understand its fundamentals beyond the initial hype, ZEC traded within a range, establishing a foundation.

The bull and bear markets of 2017-2018

Like most crypto markets, ZEC experienced a parabolic surge in late 2017 and early 2018. It soared from less than $300 to an all-time high of around $900 in January 2018. This surge was driven by overall market euphoria and a growing interest in privacy-focused assets.

However, the ensuing bear market was brutal for ZEC, arguably more severe than for many other top assets. Throughout 2018 and 2019, prices collapsed, eventually falling below pre-bull market levels. Several factors contributed to this prolonged downturn:

- Founder Reward Inflation: Zcash launched with a "Founder Reward," allocating 20% of mining rewards to ECC, the Zcash Foundation, and other early stakeholders for the first four years. While intended to fund development, this created persistent selling pressure in the market as recipients liquidated ZEC to cover operating costs. This continuous supply inflation severely suppressed prices.

- Low adoption of shielded transactions: Despite its strong privacy features, most transactions on the Zcash network remain transparent. The computational intensity of creating shielded transactions makes them slower and more expensive, leading most users to default to t-addresses. This has drawn criticism that Zcash has failed to deliver on its primary use cases.

- Regulatory fears: Privacy coins have been shrouded in the shadow of potential regulatory crackdowns. Exchanges in some jurisdictions have begun delisting ZEC and other privacy coins, fearing consequences from financial regulators. This has reduced liquidity and investor confidence.

Halving and performance after 2020

In November 2020, Zcash underwent its first halving, reducing the block reward from 12.5 ZEC to 6.25 ZEC. This event also marked the end of the original founders' reward. It was replaced by a new development fund that receives 20% of the block reward, but at a new, lower fee rate. This significantly reduced the inflation and selling pressure that had plagued the coin for four years.

The halving, coupled with the 2021 bull market, helped ZEC recover some lost ground. The price rebounded from a low of around $50 in late 2020 to over $300 in May 2021. This period also witnessed significant technological advancements. ECC focused on improving the usability of shielded transactions, culminating in the Halo Arc update, which included a unified address system and made shielded transactions the default in supported wallets.

Despite these improvements, ZEC struggled to keep pace with Bitcoin and other major altcoins in the following years. Since its 2021 high, it entered a prolonged downtrend, facing persistent market skepticism and competition. However, in 2025, Zcash made headlines with a stunning 400% rebound, signaling a renewed interest and optimism in privacy-focused cryptocurrencies. This dramatic surge may reflect a shift in attitudes towards blockchain privacy, significant advancements in Zcash technology, or speculation on new use cases and adoption. The 2025 rally serves as a powerful reminder that ZEC possesses immense potential and volatility to capture the imaginations of crypto investors when conditions are right.

Key factors influencing the value of ZEC

Understanding ZEC prices requires going beyond typical market cycles. Several unique factors are at play.

- Adoption of shielded transactions: Zcash's value proposition is directly related to its privacy features. The percentage of transactions fully shielded is a key metric for network health. Increased adoption of z-addresses will validate its core use case and could positively impact investor sentiment. The recent shift to default shielding is a crucial step in this direction.

- Regulatory Environment: Zcash and its peers are highly sensitive to regulatory news. Any hint of a general ban or forced removal in major economies could trigger a sharp price drop. Conversely, a framework for adapting to privacy-enhancing technologies (PETs) could be a major catalyst. The ECC has proactively engaged with regulators to explain how Zcash's "view key" achieves compliant privacy, but concerns remain.

- Development and Innovation: Electric Coin Company's ability to continue pushing the frontiers of zero-knowledge cryptography is crucial. The transition from zk-SNARKs to the more advanced Halo proof system (which does not require a trusted setup) is a significant milestone. Future upgrades that improve performance, reduce computational costs, and enhance privacy will be key to remaining relevant.

- Inflation and Token Economics: Zcash follows the same supply schedule as Bitcoin, with a total supply capped at 21 million tokens, halving every four years. The new development fund structure is less inflationary than the original founder rewards, but the market remains sensitive to any selling pressure from funded entities.

- Competitive Landscape: Zcash does not operate in a vacuum. Its performance is closely correlated with that of other privacy coins, particularly Monero.

Comparative Analysis: Zcash vs. Privacy Coin Competitors

To fully grasp Zcash's position, we must compare it with its main competitors: Monero (XMR) and, to a lesser extent, Dash.

Zcash (ZEC) vs. Monero (XMR)

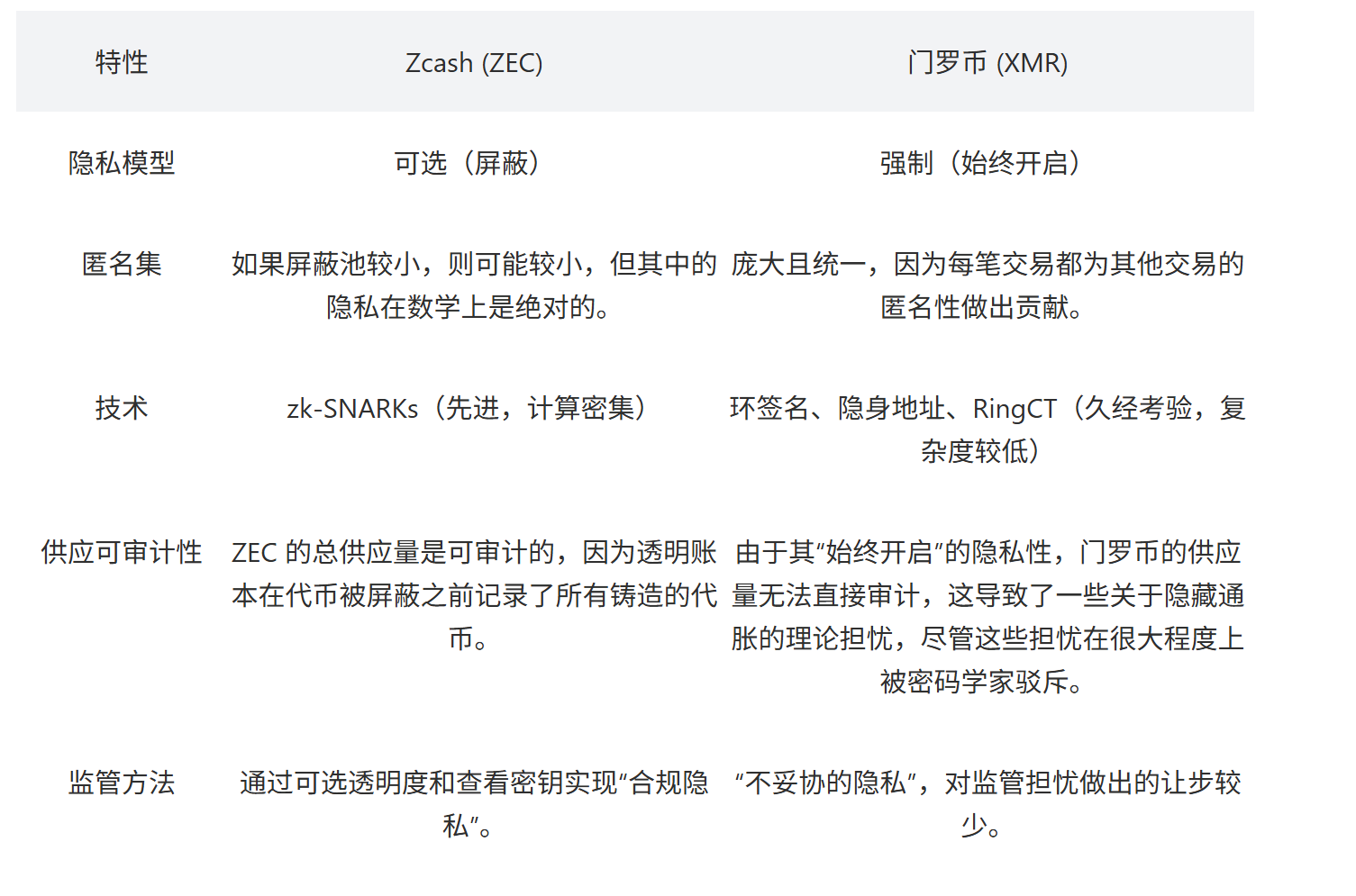

Monero is widely regarded as the king of privacy coins, and the comparison between ZEC and XMR is one of the most classic debates in the crypto space. They provide privacy through fundamentally different cryptographic approaches.

technology:

- Zcash (ZEC): Uses zk-SNARKs to achieve optional, high-strength privacy. Transactions are either completely transparent (t-to-t) or completely private (z-to-z). Privacy is absolute for shielded transactions, but not mandatory across the entire network.

- Monero (XMR): Uses a multi-layered approach that enforces this on all transactions. It combines ring signatures (hiding the sender), stealth addresses (hiding the receiver), and Ring Confidential Transactions (RingCT) (hiding the amount). This creates a vast set of anonymities for each transaction, making it extremely difficult to trace its origin.

Key differences and trade-offs:

Market performance and adoption:

Historically, Monero has maintained a more stable market capitalization and gained wider adoption in darknet markets—a controversial but real-world stress test of privacy. This is primarily because its privacy is enforced by default, leaving no room for user error.

Zcash's optional privacy is both an advantage and a weakness. It makes the coin more readily accepted by exchanges and regulators, but it also fragments its anonymity set and has resulted in low adoption rates for shielded transactions over the years. While recent upgrades aim to address this, Monero has a significant lead in establishing itself as the default choice for untraceable transactions.

Zcash (ZEC) vs. Dash

Dash is another contemporary of Zcash, but its privacy approach is much lighter and is not generally considered by privacy purists to be in the same category as ZEC or XMR.

technology:

- Dash: Features an optional privacy feature called "PrivateSend". It uses a coin-joining technique through a network of masternodes. Inputs from multiple users are combined into a single transaction and then redistributed, thus obfuscating the original transaction flow.

- Zcash: As mentioned earlier, it uses cryptographic proofs (zk-SNARKs) to completely shield transaction data.

Key differences:

Dash's PrivateSend offers probabilistic rather than cryptographic privacy. It relies on trust in the non-collusion of the masternode network and a sufficient number of participants in the mixing round to provide meaningful cover. It is significantly weaker than the cryptographic guarantees provided by Zcash's shielded transactions.

While Dash was an early innovator in privacy and governance, the market has largely come to see it more as a payments-focused cryptocurrency with optional mixing capabilities. Zcash, on the other hand, is fundamentally a privacy protocol at its core. Therefore, Zcash directly competes with Monero for the crown of "true privacy," while Dash has carved out a distinct niche market.

Trading ZEC on XT.COM: Spot and Futures Markets

If you wish to capitalize on Zcash's market volatility, you can consider trading ZEC directly on XT.COM. This exchange offers flexible options for every trader:

- ZEC Spot Trading: Buy and sell the ZEC/USDT trading pair instantly with high liquidity. Trade ZEC/USDT spot on XT.COM.

- ZEC Perpetual Contracts: Go long or short on ZEC to capitalize on bull and bear markets.Trade ZEC/USDT perpetual contracts on XT.COM.

Whether you are an experienced investor or a newcomer to the crypto market, XT.COM offers secure, efficient, and user-friendly tools for trading Zcash.

The Future of Zcash: Challenges and Opportunities

Zcash is at a crossroads. The technology behind it is more powerful and user-friendly than ever before. The shift to the default shielding paradigm via the Halo Arc update is a huge step toward realizing its original vision. The ECC development team continues to be at the forefront of zero-knowledge research and plans to further improve scalability and performance.

However, significant challenges remain.

- Overcoming market perception: Zcash needs to shed its reputation for poor performance. This can only be achieved by consistently increasing the adoption of shielded transactions, which will demonstrate its utility and attract new investment.

- Navigating the regulatory maze: The global regulatory landscape for privacy coins remains the biggest external threat. The ECC's active involvement and "compliance-based privacy" strategies may be its best defense, but the outcome is far from certain.

- Winning the privacy war: In a world where Monero’s mandatory privacy has become standard for many, Zcash must convince users that its robust yet optional model is a superior long-term solution that offers both unbreakable privacy and flexible transparency.

The ultimate bullish argument for Zcash lies in a future where digital financial privacy is no longer a niche need, but a mainstream one. If individuals and institutions begin seeking ways to shield their financial activities on public blockchains, Zcash's sophisticated, auditable, and regulatory-friendly technology could make it the solution of choice. Its journey demonstrates the slow and arduous process of building and deploying revolutionary technologies. Whether this technology will translate into long-term market success remains one of the most intriguing open questions in the cryptocurrency space.

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, operating in more than 200 countries and regions, and boasting an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1300 high-quality cryptocurrencies and over 1300 trading pairs, offering diverse trading services including spot trading , leveraged trading , and contract trading , and is equipped with a secure and reliable RWA (Real World Asset) trading market. We are committed to the philosophy of "Explore Crypto, Trust Trading," dedicated to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.