With a book loss of $1.3 billion, will Tom Lee's Ethereum gamble collapse?

- 核心观点:以太坊企业财库策略面临崩盘危机。

- 关键要素:

- Bitmine持仓亏损超13亿美元。

- 以太坊价格较峰值下跌30%。

- ETF资金流出8.5亿美元。

- 市场影响:动摇企业稳定加密货币价格叙事。

- 时效性标注:短期影响

Original title: Tom Lee's Big Crypto Bet Buckles Under Mounting Market Strain

Original author: Sidhartha Shukla, Bloomberg

Original translation by Chopper, Foresight News

Ethereum's enterprise treasury experiment is collapsing in real time.

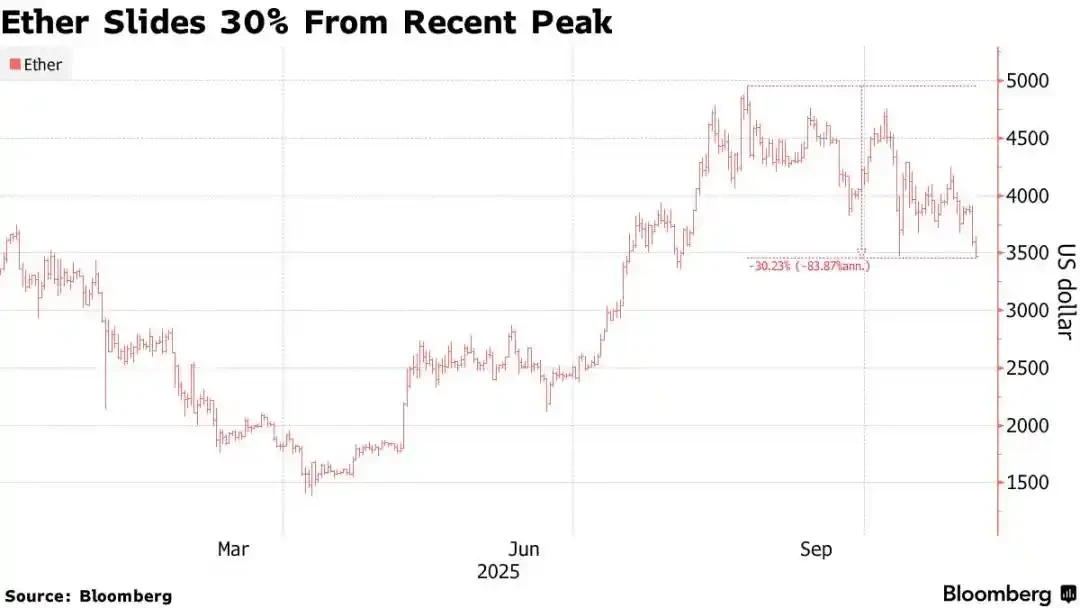

Ethereum, the world's second-largest cryptocurrency, fell below $3,300 on Tuesday, moving in tandem with market bellwethers Bitcoin and tech stocks. This drop brought Ethereum's price down 30% from its August peak, returning to levels seen before large-scale corporate buying, further solidifying its bearish stance.

According to research firm 10x Research, this reversal has left Bitmine Immersion Technologies Inc., one of Ethereum's most aggressive corporate backers, facing a paper loss of over $1.3 billion. Backed by billionaire Peter Thiel and helmed by Wall Street forecaster Tom Lee, the publicly traded company's strategy mirrored Michael Saylor's Bitcoin treasury model, purchasing 3.4 million Ethereum at an average price of $3,909. Now, Bitmine's entire cash reserve is invested, and it is facing increasing pressure.

In its report, 10x wrote: "For months, Bitmine has dominated market narratives and fund flows. Now its funds are fully invested, with a paper loss of over $1.3 billion, and no more funds available."

The report points out that retail investors who bought Bitmine stock at a premium to its net asset value (NAV) suffered even greater losses, and the market's willingness to "catch a falling knife" was limited.

Lee did not immediately respond to a request for comment, nor did a Bitmine representative respond promptly.

Bitmine's bet is far more than a simple balance sheet transaction. Behind its increased holdings lies a grander vision: that digital assets can transition from speculative tools to corporate financial infrastructure, thereby solidifying Ethereum's position in mainstream finance. Supporters argue that by incorporating Ethereum into the assets of publicly traded companies, businesses will help build a completely new decentralized economy. In this system, code replaces contracts, and tokens function as assets.

This logic fueled the summer rally. Ethereum's price briefly approached $5,000, and in July and August alone, Ethereum ETFs attracted over $9 billion in inflows. However, the situation reversed after the crypto market crash on October 10: according to data compiled by Coinglass and Bloomberg, Ethereum ETFs subsequently saw outflows of $850 million, and Ethereum futures open interest decreased by $16 billion.

Lee had predicted that Ethereum would reach $16,000 by the end of this year.

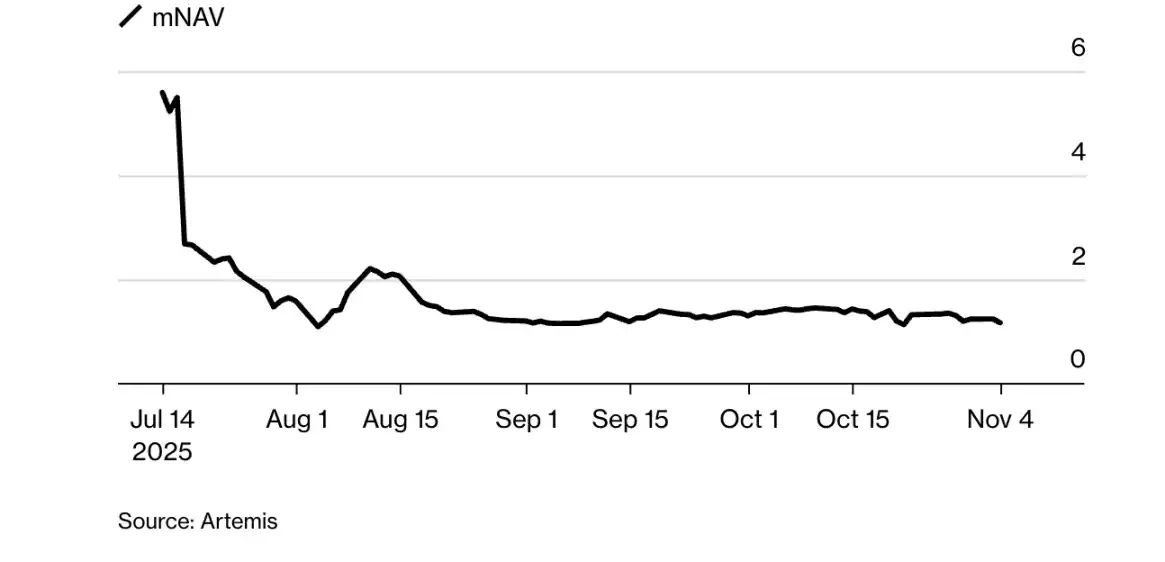

Bitmine's net asset value (mNAV) premium declined.

According to Artemis data, Bitmine's market capitalization to net asset value multiple has plummeted from 5.6 in July to 1.2, and its stock price has fallen 70% from its peak. Similar to other Bitcoin-related companies, Bitmine's stock price is now closer to its underlying holding value, as the market reassesses the previously inflated valuations of crypto asset balance sheets.

Last week, another publicly traded Ethereum treasury company, ETHZilla, sold $40 million worth of its Ethereum holdings to repurchase shares and normalize its adjusted net asset value (mNAV) ratio. The company stated in a press release at the time, "ETHZilla plans to use the remaining proceeds from the Ethereum sale for further share buybacks and intends to continue selling Ethereum to repurchase shares until the discount relative to net asset value returns to normal."

Despite the price decline, Ethereum's long-term fundamentals appear to remain strong: it still handles more on-chain value than any of its competitors' smart contract networks, and its staking mechanism gives the token both yield and deflationary properties. However, with competitors like Solana gaining momentum, ETF inflows reversing, and retail investor interest waning, the narrative that "corporate entities can stabilize cryptocurrency prices" is gradually losing its effectiveness.