2026 Crypto Outlook: New Institutions, New Assets, and New Infrastructure

- Core Viewpoint: The current "return to value" in the crypto market is a necessary growing pain as the industry transitions from speculative bubbles to building the next generation of trusted financial infrastructure. It marks the industry's entry into a new development stage centered on fundamentals, compliance, and real utility.

- Key Elements:

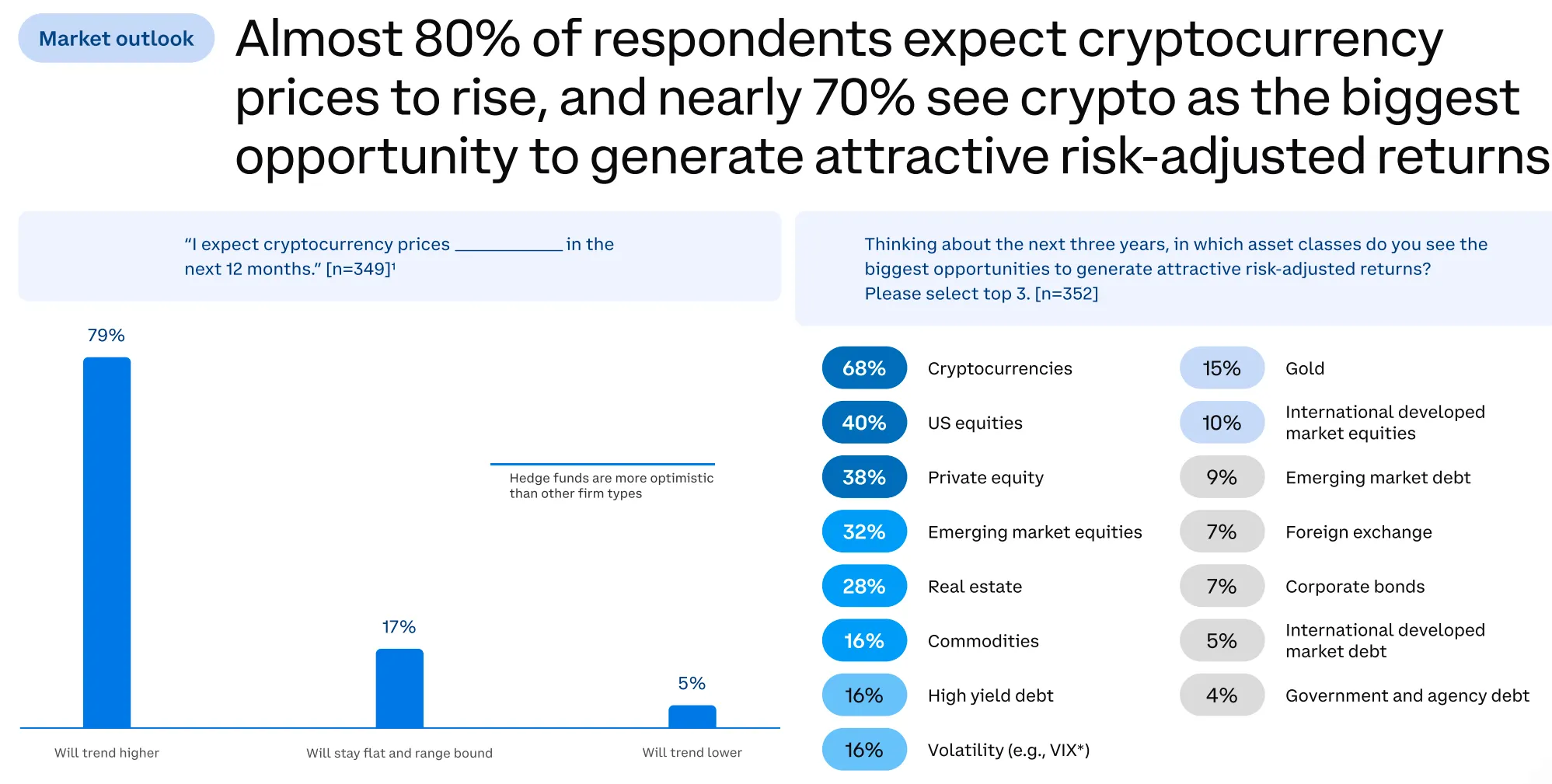

- Strengthening Institutional Confidence: EY's 2025 survey shows that nearly 80% of respondents expect cryptocurrency prices to rise, and nearly 70% view it as the greatest opportunity to achieve attractive risk-adjusted returns.

- Blockchain Reconstructs Credit: Through cryptography and consensus mechanisms, blockchain creates a "trustless" collaboration model, aiming to organize credit at lower cost and with less friction. This is a dimensional reduction attack on the traditional financial system.

- Shift in Token Pricing Logic: The market is moving away from narrative-driven speculation reliant on "future credit" toward fundamental pricing based on a project's real profitability, cash flow, and clear value capture.

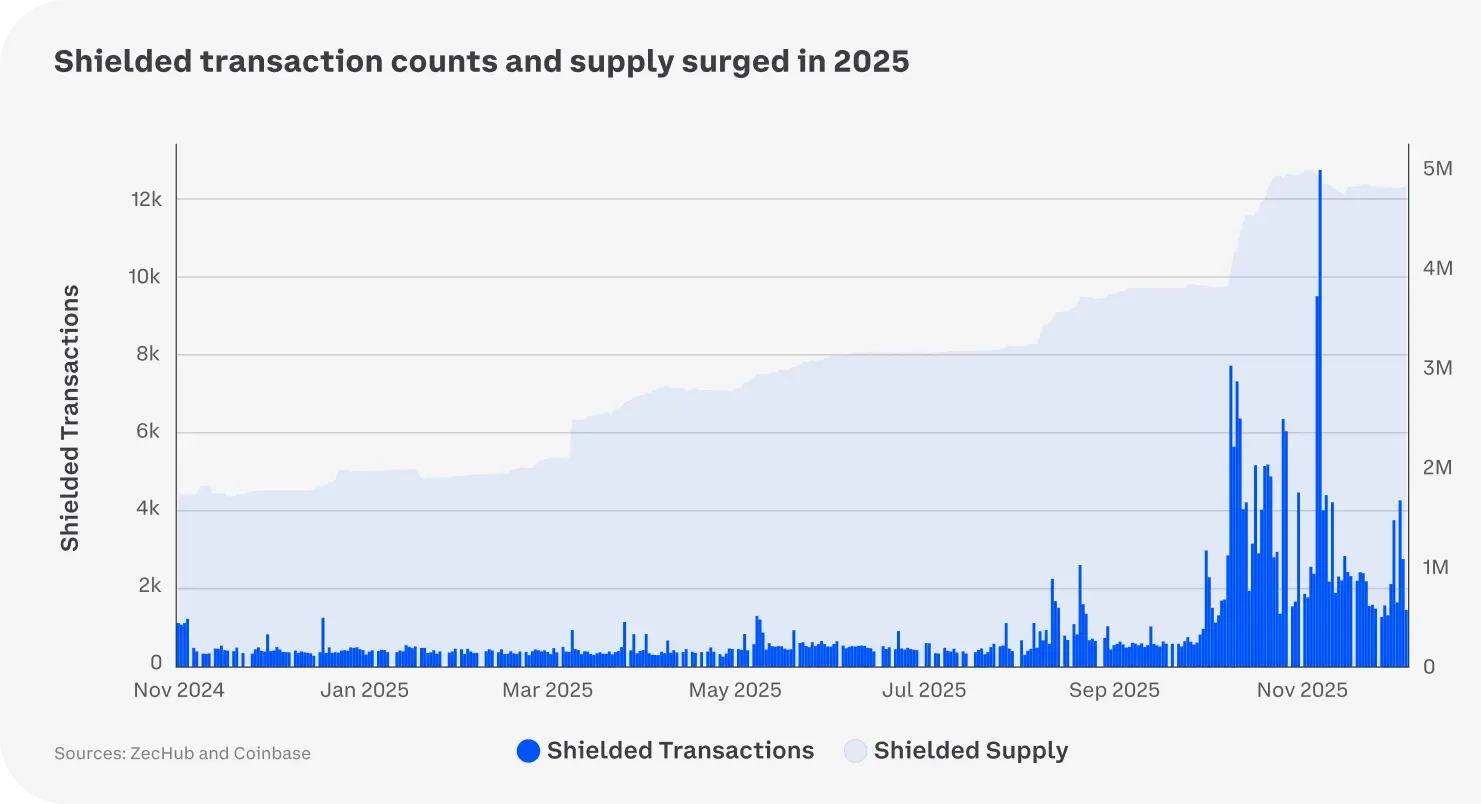

- Privacy Becomes Core Infrastructure: As real finance moves on-chain, privacy has evolved from a peripheral need to a necessary condition, serving as the decisive moat for on-chain corporate and institutional financial activities. Its transaction volume has skyrocketed since Q4 2025.

- Deep Integration of AI and Blockchain: The two are evolving from conceptual juxtaposition into a foundational paradigm. AI becomes the intelligent engine for protocols, while blockchain provides the trusted underlying layer for identity, payments, and data rights confirmation in the AI agent economy.

- Legislation Drives Compliance: 2025 was a "legislative breakout year" for cryptocurrency in the United States. Regulatory clarity has paved the way for on-chain finance to become mainstream.

This article aims to provide an analytical framework to help understand that the current "value return" is not a reluctant acceptance at the end of a bear market, but rather the necessary growing pains before the birth of the next generation of trusted financial infrastructure.

Over the past two years, the crypto industry has witnessed Bitcoin's evolution from a speculative asset and cyclical play, a reservoir during monetary easing, to its current status as a non-sovereign macro anchor asset and a strategic reserve option. Stablecoins have also transformed from their previous role as a medium for crypto speculation to becoming a healthy, on-chain US dollar facilitating cross-border on-chain payment settlements and providing a low-barrier channel for the world to access dollars.

In stark contrast is the altcoin market. To date, the vast majority of crypto projects have been disproven. The past glory of some projects is highly unlikely to be repeated, and more broadly, many projects have drowned during their preparation phase due to the industry's bleak conditions.

The tide of liquidity has receded, and speculative narratives have become increasingly scarce and dull. However, I believe this is a normal transition cycle for the blockchain industry's development—a healthy phase of clearing out crypto bubbles and illusions. The crypto industry will slowly emerge from the gloom after hitting bottom.

Institutional investor confidence in the 2026 crypto industry has significantly increased. According to EY's 2025 survey, nearly 80% of respondents expect cryptocurrency prices to rise, and nearly 70% view it as the greatest opportunity for attractive risk-adjusted returns.

1. The Emergence of Blockchain-Native Finance

1.1 Beyond RWA: From "Auxiliary Tool" to the Core of "Credit Efficiency"

The current essence of RWA is still packaging assets and debts from the traditional financial system onto the blockchain. This model is viable but only serves as an auxiliary tool for traditional finance, whereas the functionality of blockchain extends far beyond this. The true nature of financial competition today is not about the scale of capital, but about "credit efficiency."

On the surface, financial system competition appears to be about:

(1) Amount of capital

(2) Interest rate levels

(3) Market size

But the underlying logic is: Can a system organize credit with lower costs, less friction, and less abuse? Whoever can produce, price, and clear credit more efficiently possesses a long-term advantage.

1.2 The Flaw of Traditional Finance: The "Personified + Power-Based" Credit Model

In the traditional system, credit relies on:

(1) Central banks

(2) Commercial banks

(3) Government backing

(4) Legal and coercive enforcement.

This leads to a fundamental problem: credit is not neutral; it can be manipulated. Those who hold power can determine capital flows, enjoy subsidies, and socialize losses.

1.3 "Trustless" Collaboration: Locking Power into Rules

The spirit of blockchain is to establish a system that enables people to collaborate without needing to trust each other.

Blockchain, through:

(1) Cryptography

(2) Consensus mechanisms

(3) Immutable ledgers

constructs a brand-new trust model, locking power into rules and transforming ownership from permission-based to fact-based. For the first time, it embeds the "worst-case human nature assumption" into the system itself. Even with all human flaws present, it still builds a trustworthy order. This is a dimensional reduction strike against the traditional credit system.

The true advantage of blockchain lies in its underlying system's reconstruction of how credit is organized. The spirit of blockchain determines the form of the system; the form of the system determines the efficiency of the mechanisms; and the efficiency of the mechanisms ultimately manifests as advantages in cost, speed, and accessibility at the user level.

(1) Lower financial service costs

(2) More efficient financial service speeds

(3) Elimination of geographical barriers and certain thresholds

1.4 The Path: From DeFi's Starting Point to the Compliance Road of "Legislative Explosion"

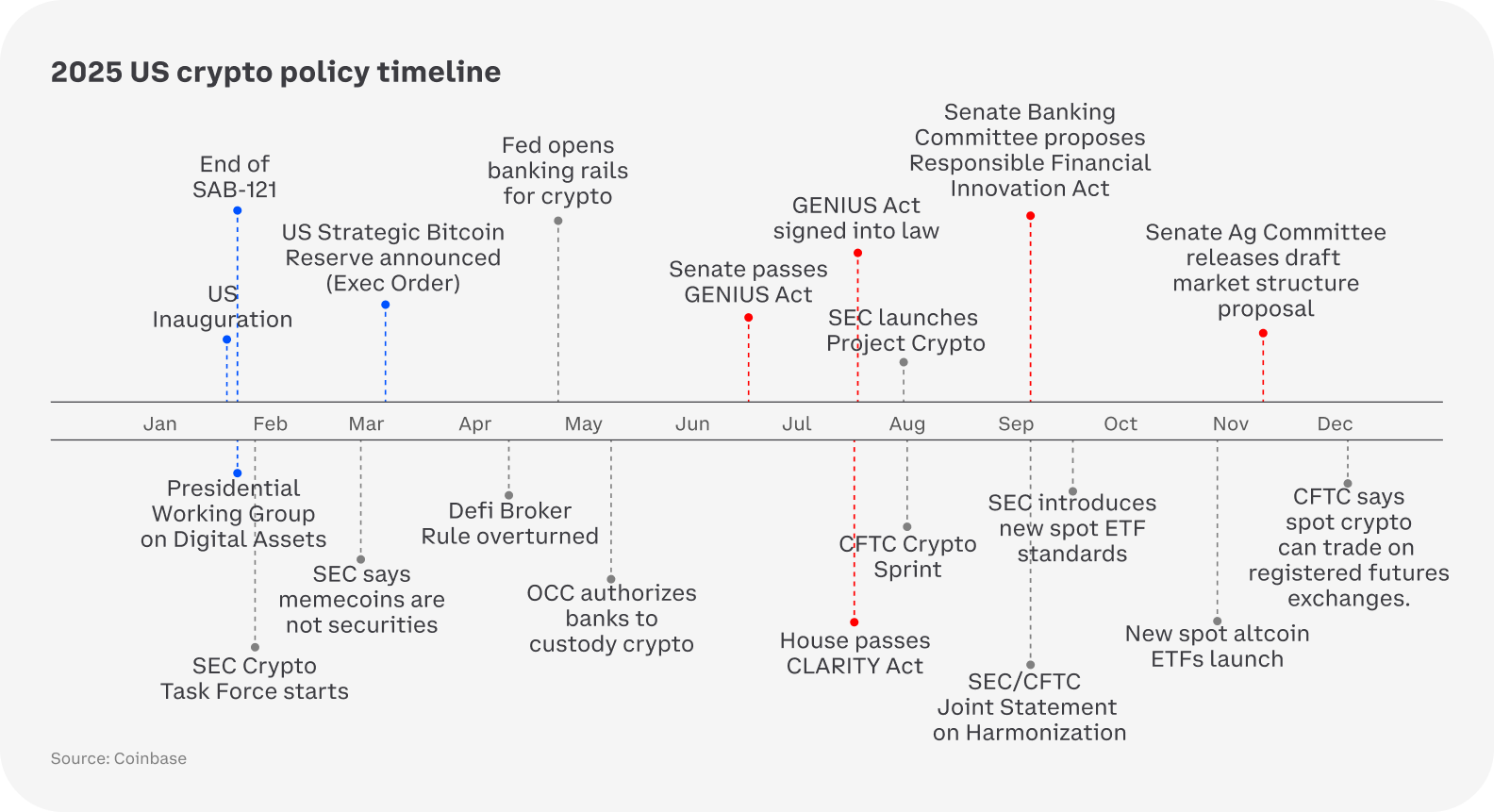

Cryptocurrency has evolved from being labeled a 'scam' to witnessing large-scale participation from mainstream traditional financial institutions. During this period, attempts at on-chain native finance and pushes for legal regulation have been ongoing. The rise of DeFi products in the summer of 2021, the earliest congressional-level attempts at cryptocurrency asset legislation starting in 2023, RWA entering the mainstream narrative in 2024, followed by the "Year of Legislative Explosion" in 2025, hold the promise that 2026 may be the first time we see on-chain finance as a true starting point for finance.

https://transak.com/blog/the-clarity-act#the-clarity-act-timeline

2025 US Government Legislative Timeline for the Cryptocurrency Industry

2. The Value Return of Tokens

In the early stages of the crypto industry, a large number of tokens achieved astonishing market cap growth despite having no real revenue or even a clear value capture path.

Why could early tokens rise with "no real revenue"?

2.1 The Market Prices Not Cash Flow, But "Future Credit"

In the industry's early days, the core pricing basis for tokens was not:

Dividends Revenue Buybacks

but rather future credit:

1. The potential to become infrastructure in the future

2. The potential to capture value in the future

3. The potential to be recognized by institutions, users, and capital in the future

Tokens were more like an "option on future institutional status and network effects." The exercise condition for this option was the collective cognition and belief of the market.

During the industry's explosive growth phase, as long as enough participants believed in a narrative—believing this public chain would become the next financial settlement layer, believing this DeFi protocol could capture ecosystem liquidity, believing its team and community had the ability to modify tokenomics at some future point to achieve value capture—then this shared belief itself became a "self-fulfilling prophecy."

Capital would flood in based on this belief, driving up prices; rising prices, in turn, reinforced the belief, attracting more capital. In this reflexive cycle, tokens cashed in on the option value of that "future credit" in advance. It was essentially a game about attention, consensus, and coordination. Tokens were the chips in this game, and the option value was determined by the level of participation and fervor in the game.

2.2 Early Super Premium Driven by Narrative Dividends and Cognitive Gaps

In the past few years, blockchain narratives still possessed high novelty:

- Financial Infrastructure Narrative (DeFi Primitives): Terra Uniswap Synthetix Curve

- Application Narratives: NFT SocialFi GameFi

- Platform Narratives: Layer2 Public Chains

- Blockchain Interconnection Infrastructure: Cosmos Polkadot

- Web3 Middleware Infrastructure Narratives: Oracles Cross-Chain Bridges Sequencers Modularity Wallets and Account Abstraction

These narratives themselves could generate cognitive dividends, attracting incremental capital. Completely new narratives naturally had an advantage at the cognitive level because they could create "attention asymmetry + comprehension asymmetry," thereby producing early pricing advantages.

1 Attention Scarcity Effect

Human attention is extremely limited.

When a narrative appears "for the first time": It is easier to notice. It is easier to be amplified by media, KOLs, and capital. Uniswap, with its extremely low cognitive cost, shattered the traditional notion that without market makers, there is no liquidity. Prices could be determined by an x*y=k formula. This "counterintuitive yet explainable" model created a strong memory and viral effect.

2 Cognitive Framework Vacuum

When a field is new:

1) There is no unified valuation model.

2) There are no success/failure precedents.

3) There is no "reasonable price anchor." CosmosHub, precisely because it lacked fundamentals, could succeed for years based on the "golden shovel for Cosmos ecosystem projects" narrative for capturing value.

In an environment of abundant macro liquidity, the process of participants flowing into the crypto market combined with early narrative dividends. Due to market reflexivity, we began witnessing the glory of various projects starting in 2021. Many capable young people realized their cognitive advantages through the cryptocurrency market, achieving legendary wealth freedom.

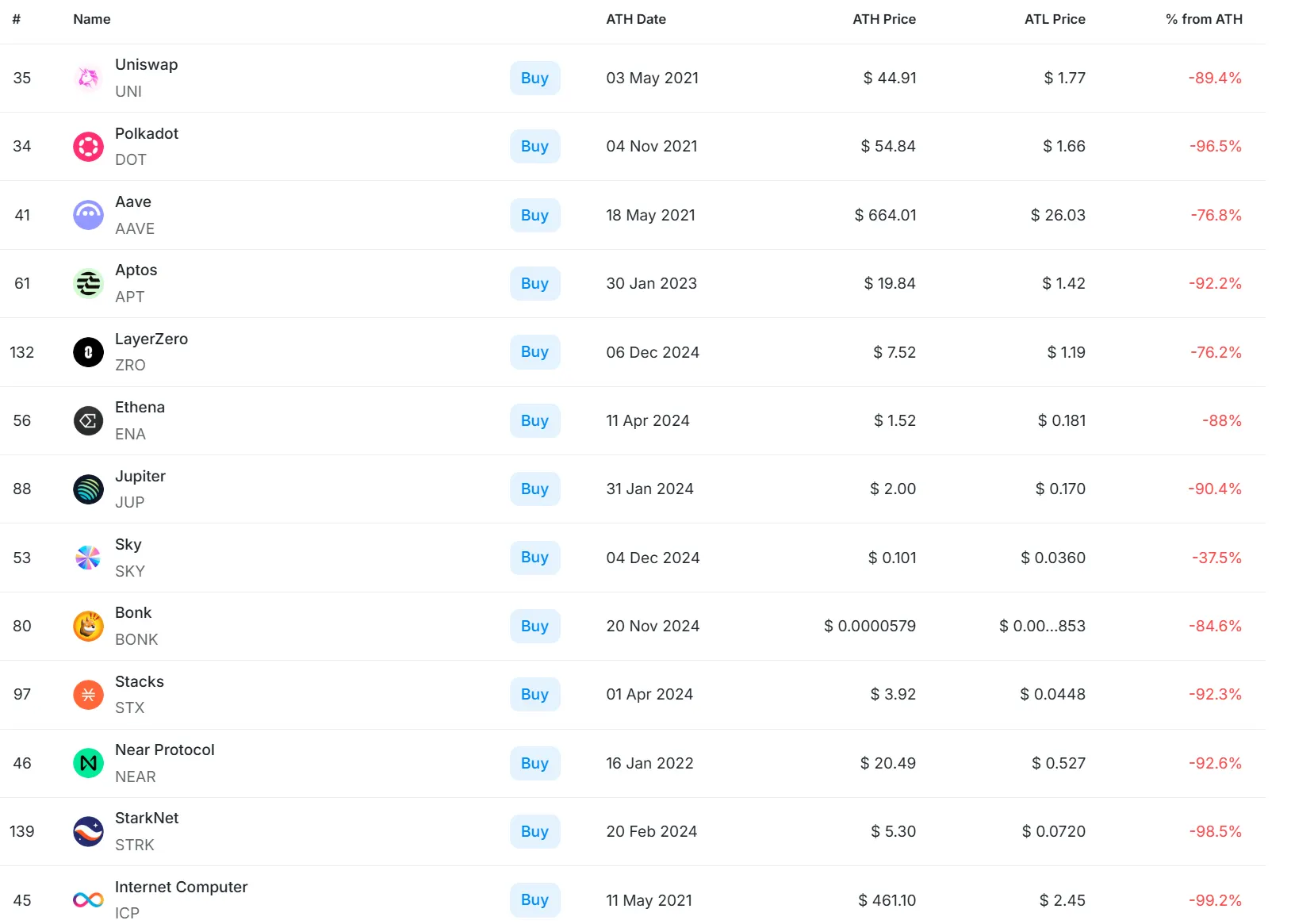

Now, macro liquidity and market conditions can no longer sustain the previous speculative frenzy. The vast majority of narratives have been disproven, and the vast majority of tokens have gone to zero or are nearly zero.

Current cryptocurrency participants are gradually realizing that the vast majority of "shitcoins" truly only have short-term market gaming value without actual value support.

Future cryptocurrency projects, if they want to gain investors' 'belief,' need to present products capable of long-term profitability and tokens with value capture mechanisms.

The market in recent years has already begun punishing inflation and empty narratives. Shorts targeting outdated narratives and inferior tokenomics have, over the past two years, slowly transferred money from many long-term bullish investors willing to provide liquidity to themselves.

Current price decline from all-time high for leading projects in various narrative sectors within the top 150 crypto tokens by market cap.

Currently, whether viewed from macro liquidity conditions or market structure, this speculative pricing framework centered on narratives and expectations is difficult to sustain. As monetary conditions tighten, risk appetite recedes, and narrative liquidity is structurally diluted, a large number of narratives that the market placed high hopes on over the past few years have gradually been disproven. The vast majority of tokens lacking real product capabilities and sustainable business models have experienced long-term price declines, with some projects even approaching zero.

In a global macro environment of highly accommodative liquidity, risk appetite significantly increased, and a large number of market participants flooded into the crypto asset market. This process overlapped with the industry's early, not yet fully understood narrative dividends. Amplified by price reflexivity, we witnessed a large number of crypto projects achieving rapid market cap inflation in short periods starting in 2021.

At this stage, the crypto market essentially provided a venue for those with cognitive leadership to quickly monetize their information advantages and judgment. Some capable early participants thus achieved wealth freedom.

Against this backdrop, market participants' perception of crypto assets is undergoing a structural shift. More and more investors are beginning to realize that the vast majority of tokens, supported only by short-term sentiment and gaming logic, have value only in specific speculative phases.

Future crypto projects, if they hope to regain investors' long-term trust, must demonstrate stable and sustainable product revenue capabilities and achieve effective capture of protocol value through clear tokenomics design.

In fact, over the past few years, the market has already begun systematically punishing token models driven by high inflation, weak value capture, and outdated narratives. In this process, pricing power is gradually shifting from "future credit" and vague expectations towards the assessment of real fundamentals, profitability, and cash flow sustainability. The crypto asset market is transitioning from an early narrative-driven stage to a more fundamentally priced stage.

3. Privacy is Shifting from "Peripheral Feature" to "Core Infrastructure"

In the early stages of the crypto industry, privacy was more often seen as an ideological demand or a niche feature:

Anonymous transactions, censorship resistance, personal freedom. Such demands are real but have long not been a core metric in mainstream blockchain competition.

3.1 From an Investment Perspective, the Privacy Sector Simultaneously Satisfies Characteristics of Being the Next Trend in Blockchain Development

- Strongly correlated with institutional adoption and government legislation worldwide. Privacy shifting from "full anonymity" to "composable, auditable" is a real-world necessity.

- Strong network effects + high migration costs, making it difficult to replicate and commoditize.

As crypto assets gradually move towards Real-World Finance, the positioning of privacy has undergone a fundamental shift: privacy is no longer a question of "whether it is needed," but rather "whether it is available."

As a16z pointed out in its 2026 outlook:

Privacy is the one feature that’s critical for the world’s finance to move onchain — and also the one feature that most blockchains lack.

Privacy is evolving from a supplementary capability to a decisive moat in chain-level competition.

Privacy transaction volume has entered a period of rapid growth starting from Q4 2025.

3.2 Why is Privacy a "Necessary Condition" for "Finance Moving On-Chain"?

Real-world finance cannot operate on a "fully transparent" ledger.

The transparency of public blockchains was an advantage in the early days but becomes a fatal flaw in real financial scenarios:

1) Enterprises cannot publicly disclose all counterparties and cash flows.

2) Institutions cannot expose their positions, trading strategies, or capital structures.

3) Users cannot accept permanently traceable asset transaction histories.

Therefore: Without privacy, the chain can only carry speculation; with privacy, the chain can carry finance. This is also why stablecoins, RWA, and institutional DeFi, after developing to a certain stage, inevitably point towards a privacy layer.

Compared to ordinary public chains, privacy-enabled chains, by hiding transaction amounts, account relationships, and behavioral paths, make a user's on-chain state non-replicable and not easily migratable, thereby significantly increasing migration costs and potential exposure risks.

People are extremely sensitive to privacy breaches cognitively. Therefore, once entering a privacy ecosystem, they tend to maintain the status quo and complete as many financial activities as possible on the same chain.

This "user stickiness" combined with network effects allows privacy chains to form a winner-take-most structure: the larger the ecosystem, the more users and capital it attracts, creating a positive feedback loop.

Meanwhile, privacy also introduces obstacles of incomplete information games and weak cross-chain connections, making advantages difficult to replicate or be replaced by other chains. Overall, privacy is not just a functional difference but a core mechanism that changes market structure, locks in value, and forms long-term competitive advantages. Therefore, it is highly likely that a few high-quality privacy chains will dominate important infrastructure and trading ecosystems in the crypto market in the future.

Privacy is moving from the ideological fringe of cryptocurrency to the core position of financial infrastructure. In an era where performance competition fails and narrative dividends fade, privacy may become one of the strongest and most enduring moats in the blockchain world.

4. AI and Blockchain Convergence: From "Pseudo-Combination" to "True Paradigm"

In past cycles, "AI+Crypto" has appeared multiple times as a speculative narrative. Most of these attempts were superficial: either forcibly fitting AI into a Web3 shell, creating "AI compute tokens" with no real demand, or simply treating blockchain as a storage tool for AI data. The essence of this "pseudo-combination" was a shallow splicing of two transformative technologies, not touching the core of their complementarity—AI lacks a trusted economic and collaboration layer, while blockchain lacks intelligence and adaptive capabilities.

However, in 2026, we are witnessing this convergence elevate from a "marketing concept" to a "fundamental paradigm." The core shift is: AI is no longer just an application on the blockchain but is becoming the "intelligence layer" of blockchain protocols. Simultaneously, blockchain is no longer just a tool for AI but is evolving into the "trust and settlement base layer" for AI agents participating in socio-economic activities at scale. This convergence will unfold along two profound directions:

4.1 AI as the "Intelligent Engine" at the Protocol Layer

Future blockchain protocols will embed AI as a core component, endowing them with dynamic optimization and autonomous management capabilities:

1) In DeFi: Lending protocols can use AI models to analyze on-chain/off-chain data in real-time, dynamically adjusting interest rates and liquidation thresholds to achieve global optimization of risk and capital efficiency.

2) In Security and Governance: AI can become an "on-chain immune system" that monitors smart contract vulnerabilities and detects abnormal transaction patterns in real-time. In DAO governance, AI agents can automate the execution of complex resolutions or simulate the long-term impact of proposals, assisting humans in making wiser decisions.