The Rise and Future of Perp DEX: A Structural Revolution in On-Chain Derivatives

- Core Viewpoint: On-chain perpetual contract exchanges (Perp DEX) have evolved from experimental products into a core segment of DeFi. Their essence lies in the redistribution of derivative dividends from centralized institutions to on-chain users, and they are reshaping the underlying trust, risk pricing, and profit distribution logic of derivative trading.

- Key Elements:

- The maturation of infrastructure (e.g., Layer 2, high-performance oracles) and the trust crisis of centralized exchanges have jointly propelled the rise of Perp DEX.

- Perpetual contracts, due to their no-expiry, simple structure, and high trading frequency, have become the derivative form most suitable for DeFi.

- The core value of Perp DEX lies in changing the trust model (assets are custodied by smart contracts), achieving transparent risk pricing, and altering the profit distribution model.

- The market is transitioning from a "feasibility verification" phase to an "efficiency-driven" phase, with trading volume, users, and revenue concentrating towards a few high-performance protocols (e.g., Hyperliquid).

- The next stage of competition will revolve around execution efficiency, liquidation risk control, product integration (e.g., unified margin), and the ability to establish compliant connections with traditional finance.

Over the past two years, one of the most significant shifts in the crypto market has not been a new public chain or a hot narrative, but the slow yet steady migration of derivatives trading from centralized exchanges to on-chain platforms. In this process, Perpetual DEX (Perpetual Contract Decentralized Exchange) has gradually evolved from an experimental product into one of the most valuable sectors within the DeFi ecosystem.

If spot trading was the starting point of DeFi, then perpetual contracts are becoming its true "cash flow core."

1. Why Perp DEXs Are Rising

In the traditional crypto trading system, perpetual contracts have long been the most important profit source for centralized exchanges. Whether it's trading fees, funding rates, or additional income from liquidations, CEXs have almost monopolized the entire derivatives cash flow. For DeFi, this is not a question of "wanting to do it" but rather "having the capability to do it."

Early DeFi lacked the foundational conditions to support perpetual contracts. Insufficient on-chain performance led to high transaction latency and expensive Gas costs, while low-frequency price oracle updates meant any leveraged product could be quickly arbitraged away. Even with attempts, it was difficult to compete with CEXs in terms of user experience and risk control.

The real turning point came with the maturation of infrastructure. The proliferation of Layer 2 and the emergence of high-performance public chains significantly improved on-chain transaction throughput and latency issues; a new generation of oracle systems could provide faster and more stable price data; meanwhile, DeFi users, having weathered multiple market cycles, were no longer just "yield farmers" but had evolved into market participants with professional trading capabilities.

More importantly, the trust crisis surrounding centralized exchanges became the final straw that tipped the scales. Risks of asset freezes, misappropriation, and regulatory uncertainty led more and more high-frequency traders and large capital to re-evaluate the cost of "custody." In this context, Perp DEXs offered a new possibility: regaining control of asset ownership without sacrificing leverage and liquidity.

Fundamentally, the rise of Perp DEXs represents a redistribution of derivatives profits from centralized institutions to on-chain users.

2. Why Perpetual Contracts Are the Most Suitable Derivative Form for DeFi

Among all derivatives, perpetual contracts are almost tailor-made for DeFi. Compared to futures contracts, they have no expiry date and do not require frequent rollovers; compared to options, their structure is simple and pricing is intuitive—users only need to judge direction and leverage, without needing to understand complex Greeks or volatility models.

More importantly, perpetual contracts exhibit extremely high trading frequency. They are not "event-driven" products but infrastructure that can continuously generate trading demand. This is crucial for any protocol reliant on fee revenue and liquidity scale.

Precisely because of this, almost all successful Perp DEXs design their products around the same goal: making trading as frequent as possible while keeping friction costs as low as possible. Whether by reducing slippage, decreasing latency, or optimizing liquidation efficiency, the ultimate aim is to attract more professional traders to stay on-chain long-term.

3. What Problems Do Perp DEXs Truly Solve?

Many people simplistically view Perp DEXs as "decentralized versions of CEXs," but this underestimates their significance. Perp DEXs are not replicating centralized exchanges; they are reconstructing the underlying logic of derivatives trading.

First is the change in the trust model. In a Perp DEX, user funds are always custodied by smart contracts; the protocol itself cannot arbitrarily misappropriate assets. Risk exposure, margin, and liquidation logic are all publicly verifiable. This means traders no longer need to "trust" the platform's risk control but can directly audit the rules themselves.

Second is the transparency of risk pricing. Liquidations, mark prices, and funding rates on centralized exchanges are essentially black-box mechanisms. On-chain, these parameters are clearly defined by contracts; anyone can see how the market is liquidated and rebalanced.

Finally is the change in profit distribution. Perp DEXs do not concentrate all trading profits at the platform level. Instead, through mechanisms like LPs, Vaults, and governance tokens, they feed the cash flow generated by derivatives back to on-chain participants. This allows users to be both traders and potential "shareholders" of the protocol.

From this perspective, a Perp DEX resembles a set of on-chain risk management systems more than just a trading front-end.

4. How Do the Core Mechanisms of Perp DEXs Operate?

From a mechanism standpoint, the evolution of Perp DEXs has undergone a clear process of professionalization. Early protocols often used the vAMM model, solving the liquidity cold-start problem through virtual liquidity pools. However, this approach was prone to slippage with large trades and heavily reliant on arbitrageurs for price correction.

As trading volume grew, the order book model was gradually introduced. On-chain or semi-on-chain Orderbooks allowed market makers to place orders directly, significantly improving depth and price discovery capabilities. In reality, most protocols choose a compromise: off-chain matching with on-chain settlement, or combining AMM with limit orders to balance decentralization with trading performance.

Behind these models, it is the liquidity providers who truly bear the risk. LPs are essentially betting against all traders, earning fees and funding rates while bearing directional market risk. If the protocol's risk control design is flawed, the long-term profits of professional traders will ultimately translate into systemic losses for LPs.

Therefore, mature Perp DEXs invest significant effort in liquidation mechanisms, insurance funds, and parameter adjustments. Liquidation is not a punishment but a necessary means to maintain system stability. Those who can execute liquidations quickly and accurately during extreme market conditions possess the qualifications for long-term survival.

5. Where Does the Moat of a Perp DEX Truly Lie?

To judge whether a Perp DEX has long-term value, one cannot look solely at its interface or incentives; one must see if it has built a genuine moat.

Liquidity depth is the first threshold; without stable depth, even the best mechanisms cannot attract large capital. The liquidation system and oracle security form the second threshold; any significant delay or error can directly shake market confidence. The third threshold is the ability to retain professional traders and market makers, which depends on latency, fees, and the overall trading experience.

Ultimately, all moats point to the same question: Can the protocol achieve long-term profitability without relying on subsidies? Only by generating positive cash flow can a Perp DEX become true infrastructure, rather than a short-term narrative.

6. How to Use Data to Judge the Health of a Perp DEX

From an investment research perspective, Perp DEXs have a relatively clear evaluation framework. The relationship between trading volume and TVL reflects capital utilization efficiency. Comparing overall trader profits/losses with LP returns can reveal whether risk control is reasonable. The stability of funding rates and the frequency and dispersion of liquidations are often more important than single-day trading volume.

Furthermore, the number of active traders and the protocol's revenue structure can indicate whether the platform has genuinely built user stickiness, rather than relying on short-term incentives to inflate metrics.

7. The Most Overlooked Risks in Perp DEXs

Many risks do not stem from leverage itself but from system details. Oracle delays can be amplified during extreme market conditions; liquidity can dry up instantly during high volatility; untimely adjustments to governance parameters can also trigger chain reactions.

These risks do not occur daily, but when they do, they are often fatal. Understanding these "low-frequency, high-impact" risks is a prerequisite for using Perp DEXs.

Case Study: Hyperliquid's "Professionalization Limit Attempt" for On-Chain Perpetual Contracts

If the starting point for most Perp DEXs is still "how to replicate the CEX experience in a DeFi environment," then Hyperliquid's approach has been different from the beginning. It is not about "building a Perp" on an existing public chain but rather redesigning an entire set of underlying infrastructure specifically for the highly specialized scenario of perpetual contract trading.

Hyperliquid's choice to develop its own high-performance L1 / Appchain is essentially a very aggressive yet logically clear trade-off: sacrificing generality for specialization to achieve matching efficiency, latency, and risk control certainty. This also determines that its target users are not general DeFi users but mid-to-high-frequency traders who are extremely sensitive to execution quality, slippage, and capital efficiency.

In terms of trading mechanism, Hyperliquid employs a fully on-chain Orderbook, not vAMM or semi-off-chain matching. This point is crucial. An Orderbook means the price discovery process is closer to traditional derivatives exchanges and imposes significantly higher requirements on system performance, the liquidation engine, and the risk control model. Hyperliquid embeds liquidation and risk control at the system level, rather than as an afterthought, making its behavior during extreme market conditions more predictable.

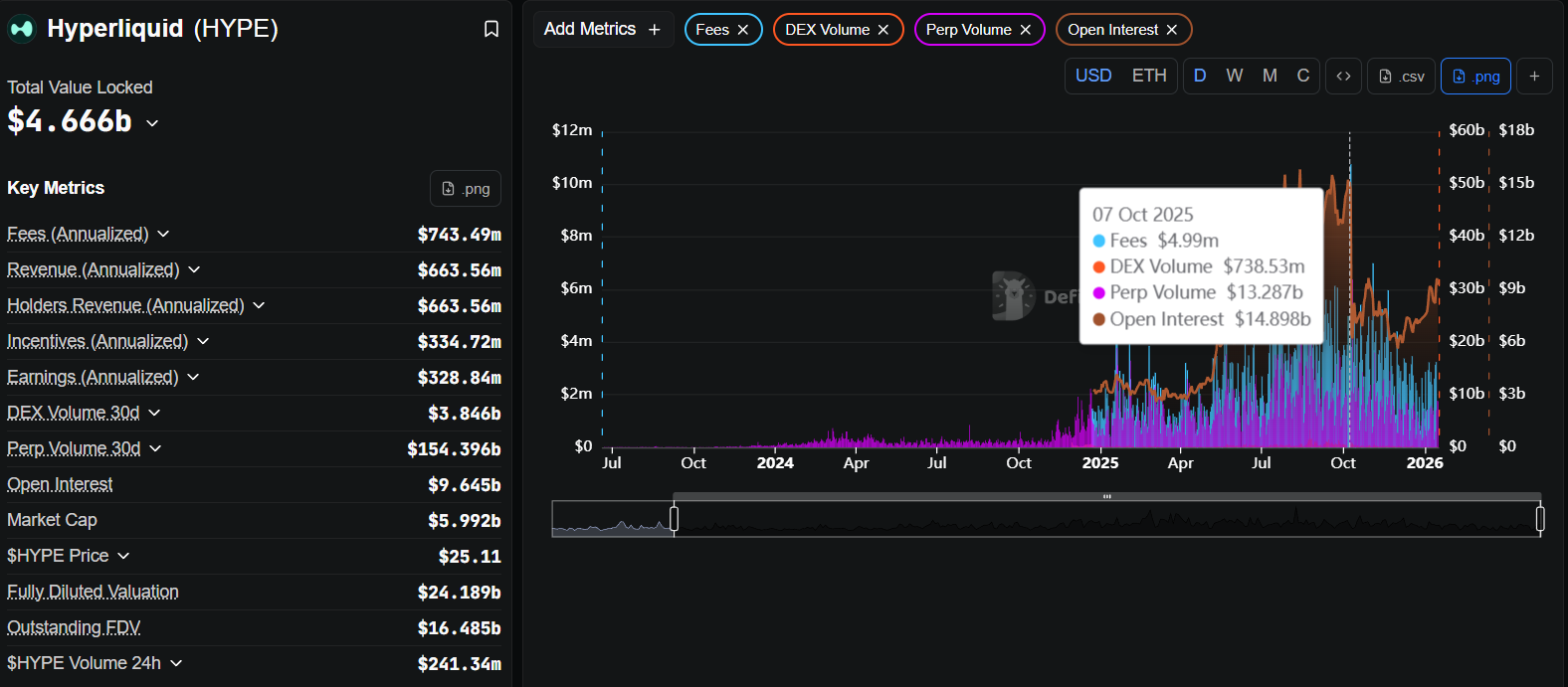

From an on-chain data perspective, what is most worth studying about Hyperliquid is not any single metric but the "combinatorial relationships" between metrics.

On DefiLlama, you can observe that Hyperliquid consistently maintains a very high ratio of daily trading volume to TVL. This is not merely a result of "wash trading" but a clear signal: the liquidity entering the system is being used frequently and intensively, not lying idle in pools waiting for subsidies. High capital efficiency often indicates high-quality traders.

Further breaking down the active trader structure on Dune reveals that Hyperliquid's daily and weekly active users do not experience brief spikes during airdrops or events but show a relatively smooth, sustained pattern. This type of curve typically corresponds to "tool-type usage" rather than "farming-type participation." For investment research, this is a very important watershed.

Combining this with Nansen to observe the behavior of large accounts makes it easier to understand Hyperliquid's real moat: there are stable, participating professional accounts within the system whose trading behaviors show strategic consistency rather than one-off gambles. This means what is happening on Hyperliquid is not "attracting users to try it out" but traders migrating their primary trading venue.

From a long-term perspective, Hyperliquid's risk lies not in its product form but in the inherent difficulty of this route—high-performance chain, Orderbook, professional traders place extremely high demands on operations, risk control, and system stability. However, once this flywheel gains momentum, its user stickiness and migration costs will be far higher than those of a typical Perp DEX.

8. Who Is Suitable for Using Perp DEXs, and Who Is Not?

Perp DEXs are more suitable for traders with clear risk management awareness, not those who rely on emotional trading. On-chain trading means you are responsible for your own positions—there is no customer service, no manual intervention. Low-to-medium leverage and clear stop-loss strategies are the basic survival rules for on-chain trading.

For LPs, this is similarly not "risk-free yield" but a passive market-making strategy. You earn fees while bearing the other side of market volatility.

9. The Next Phase for Perp DEXs

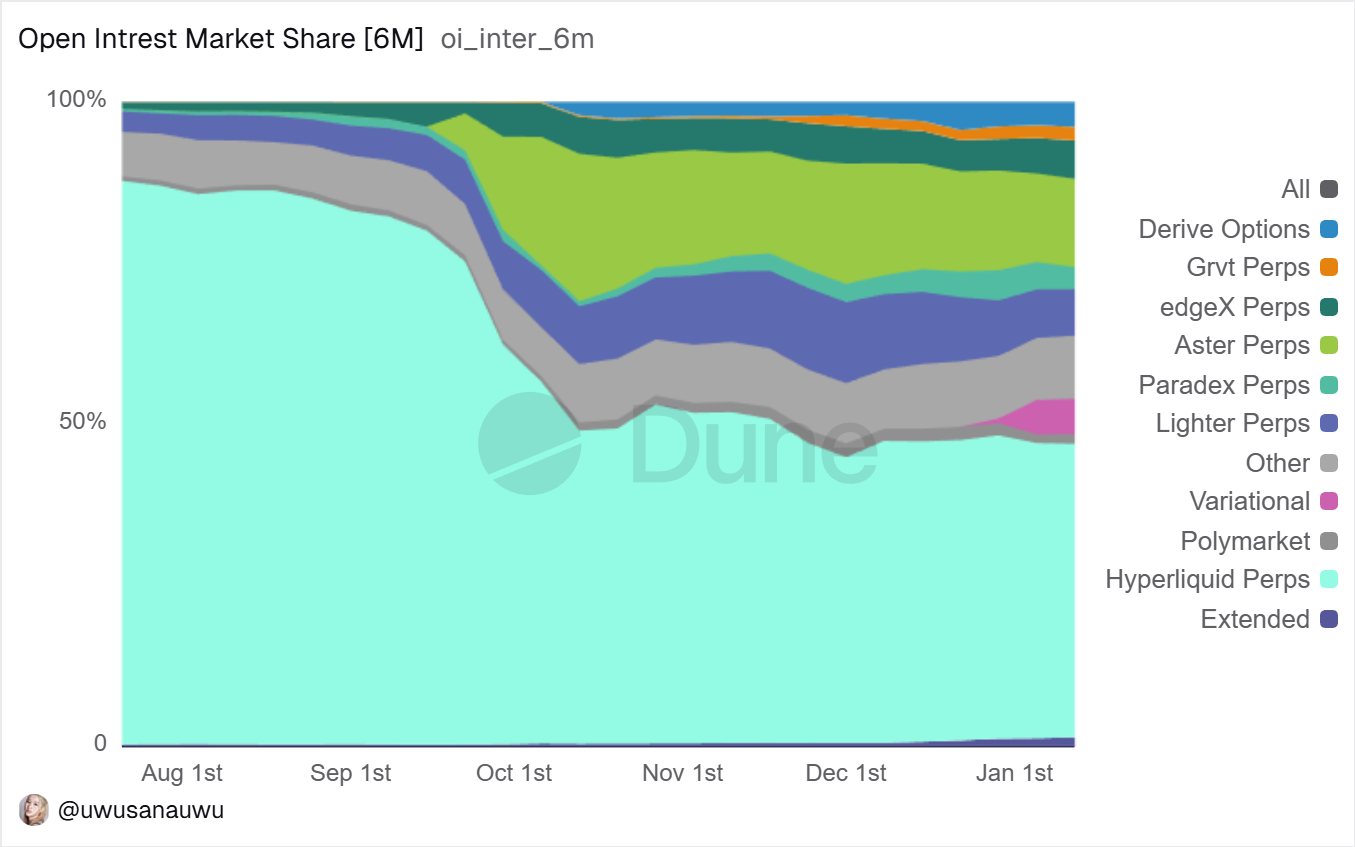

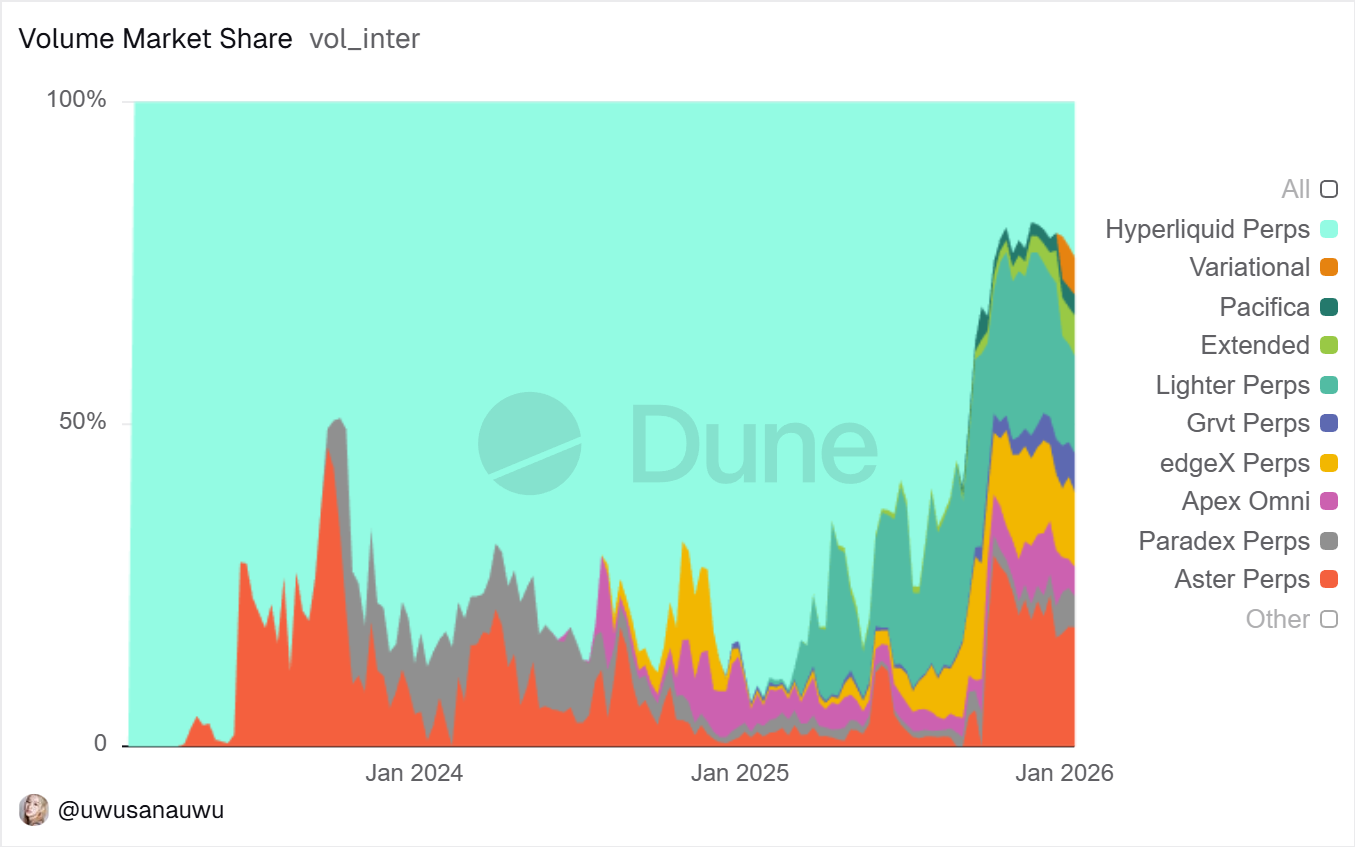

The changes experienced by the perpetual contract DEX ecosystem over the past year can no longer be simply summarized as "growth"; a more accurate description would be a systematic restructuring of trading structures and market share. If Perp DEXs from 2021–2023 were still in the product feasibility and user education stage, then 2024–2025 is the period where efficiency begins to dominate everything. Market focus has shifted from "is decentralized perpetual trading feasible?" to "which structure can sustainably support professional-grade trading?"

Starting with the most direct data, this round of change exhibits clear concentration characteristics. According to the latest statistics from DefiLlama, Hyperliquid's perpetual contract trading volume over the last 30 days reached $156 billion, already forming an overwhelming advantage in scale compared to similar protocols. For comparison, dYdX v4's volume during the same period was approximately $8.7 billion, GMX about $3.7 billion, while Aevo, which covers both options and perpetuals, maintained a monthly trading volume steadily above $15 billion. Extending the time dimension to nearly a year, this gap is not a one-off event but the result of continuous accumulation, indicating that users and liquidity are concentrating towards a few structurally superior protocols.

This concentration trend is even more evident on the revenue side. Hyperliquid generated approximately $61.4 million in fee revenue over the last 30 days, while GMX generated about $2.66 million and dYdX only $320,000 during the same period. For the first time, the Perp DEX sector has a project forming a positive feedback loop across all three curves: trading volume, active users, and real revenue. This also means the sector is no longer just about "good-looking trading data" but genuinely possesses sustainable cash flow capabilities.

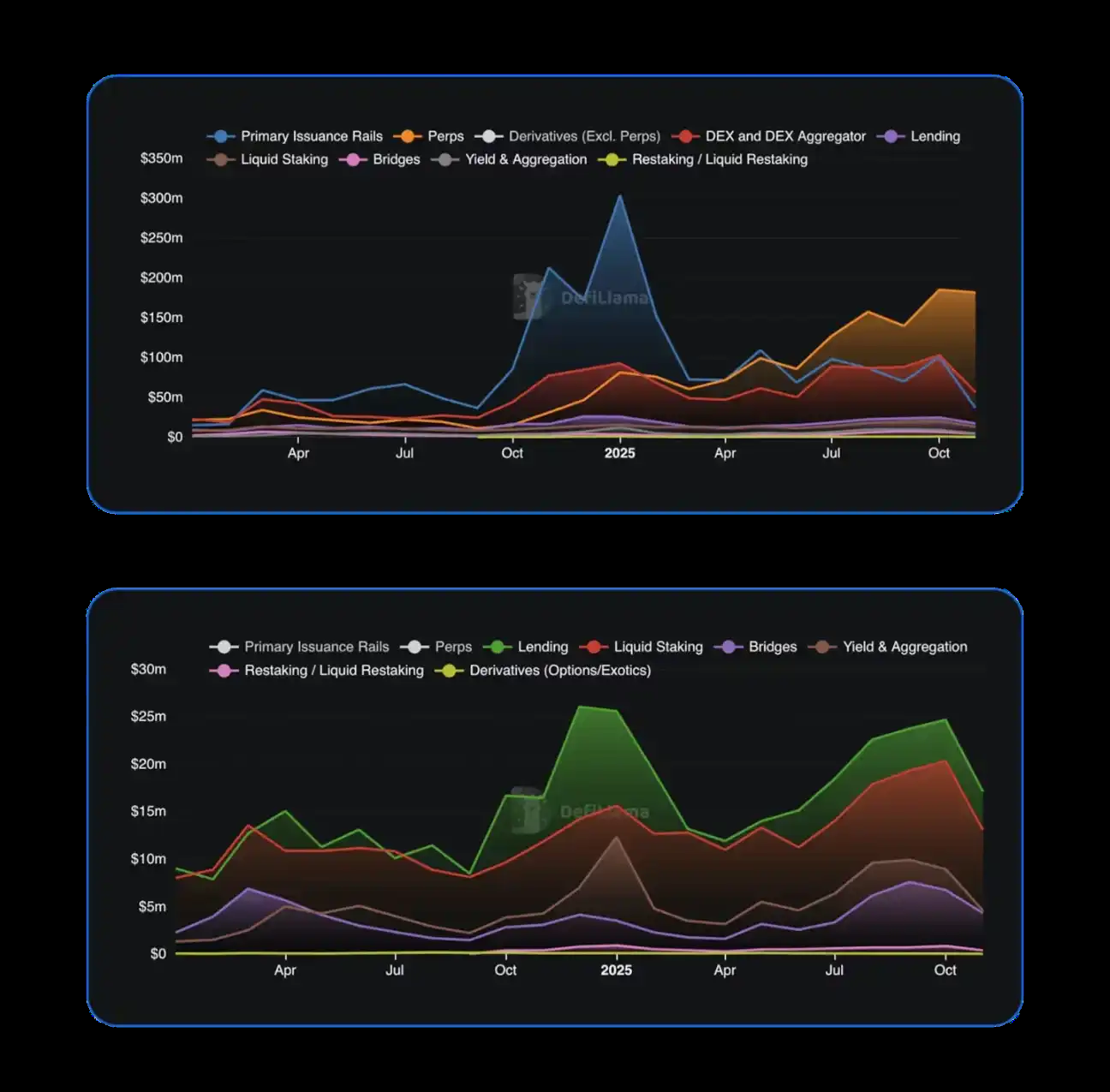

Zooming out to the entire DeFi market, this change is not an isolated phenomenon. The DeFi ecosystem entered a more mature stage in 2025. Perpetual DEXs generated approximately $7.35 trillion in new trading volume for the year, a year-on-year increase of over 170%, setting a new historical high. In contrast, the growth of spot DEXs relied more on cross-chain rotations, with overall net expansion being relatively limited. A clear migration in capital structure is underway; high-frequency, capital-efficient derivatives trading is becoming one of the core value capture scenarios on-chain. In terms of revenue share, leading perpetual DEXs like Hyperliquid, EdgeX, Lighter, and Axiom collectively contributed about 7%–8% of DeFi's total fee revenue in 2025, a proportion that already exceeds the combined total of several mature sectors like lending and staking.

Simultaneously, user structure is quietly changing. The large volume of short-term speculative trading driven by the Meme coin frenzy is gradually cooling down, and the market is beginning to return to professional demand dominated by hedging, arbitrage, and high-frequency trading. Data released by Aevo shows its platform's number of active traders is close to 250,000, significantly higher than most similar protocols. Meanwhile, the number of DYDX token holders in the dYdX ecosystem grew from 37,000 to 68,600 over one year, reflecting its process of gradually recovering user stickiness after migrating to its own chain. It is evident that competition among Perp DEXs is shifting from "attracting traffic" to "retaining professional users."

At this stage, performance metrics are becoming the hidden threshold that determines success. Differences between early Perp DEXs were more evident in product design and incentive mechanisms. Now, trade execution speed, system stability, and performance during extreme market conditions directly determine whether high-frequency traders are willing to deploy capital long-term. Hyperliquid's architecture of a dedicated L1 plus CLOB achieves millisecond-level matching and extremely low state latency. Aevo claims transaction latency is below 10ms on its customized L2. dYdX v4, after migrating to its Cosmos-based appchain, reduced its API response latency by about 98% compared to earlier versions. In contrast, GMX, which still operates on Arbitrum and Avalanche, is more susceptible to network load and latency impacts during extreme market conditions.

These differences are not merely about "good or bad experience"; they directly affect a platform's ability to host real high-frequency and institutional-grade trading. The trading volume trend chart over the last 12 months clearly shows Hyperliquid's monthly volume continuously rising to form an absolute lead; dYdX showed a clear recovery after Q2, with Q4 single-quarter volume reaching $34.3 billion; Aevo exhibited an accelerating upward trend; while GMX's growth has been relatively steady. The bar chart of revenue distribution further amplifies this structural divergence, indicating the market is pricing efficiency and performance with real fees.

Against this backdrop, the direction for the next phase of Perp DEX evolution is becoming clearer. On one hand, platforms will continue evolving towards higher-frequency, lower-latency trading forms, attempting to replicate or even surpass the matching experience of centralized exchanges on-chain. Hybrid matching models, state compression, and more combinations of off-chain computation with on-chain settlement are likely to become standard future infrastructure. On the other hand, the proliferation of dedicated AppChains or custom Rollups is almost a certain trend. dYdX's practice has proven that the advantages of a dedicated chain in throughput, governance flexibility, and parameter controllability are particularly crucial for high-frequency products like perpetual contracts.

Meanwhile, the boundary between CeFi and DeFi is being redefined. dYdX's collaboration with 21Shares to launch a DYDX ETP sends a clear signal: the liquidity of on-chain perpetual contracts is beginning to permeate the traditional financial system through compliant products. In the future, ETPs, structured products, and hedging strategies built around Perp DEXs may become important bridges connecting institutional capital with on-chain markets. Parallel to this is the further integration of on-chain derivative forms. Aevo already supports both options and perpetual contracts under a unified margin account. This model of multiple products sharing risk control and margin significantly improves capital efficiency and suggests that leading platforms in the next phase are more likely to evolve into comprehensive on-chain derivatives hubs.

Of course, scale expansion does