The Beige Book sparked expectations of interest rate cuts, Bitcoin surged to $90,000, is the Christmas rally approaching?

Whether Chinese or foreign, everyone shares the traditional sentiment of "enjoying a proper family reunion during the holidays." The fourth Thursday of November each year is Thanksgiving, a major traditional holiday in the United States.

This Thanksgiving, cryptocurrency enthusiasts are probably most grateful that Bitcoin has returned to $90,000.

Besides the influence of the "holiday season," a Beige Book document that unexpectedly became a key basis for decision-making due to the government shutdown also helped rewrite the direction of the last monetary policy move of the year. The probability of a Federal Reserve rate cut in December surged from 20% a week ago to 86%.

With the Federal Reserve reversing its stance, major global economies simultaneously embarking on "money printing mode," and the cracks in the traditional financial system widening, crypto assets are standing at their most critical seasonal window. How will the opening of global liquidity gates affect the direction of the crypto industry? More importantly, will the upcoming holiday season bring Christmas or a Christmas disaster?

The probability of a December rate cut has surged to 86%.

According to data from Polymarket, the probability of the Federal Reserve cutting interest rates by 25 basis points at its December meeting has surged from about 20% a week ago to 86%. This is likely one of the main reasons for the recent rise in Bitcoin prices, and the reversal in probability is due to an economic report, the Beige Book.

Important report on the decision to cut interest rates

On Wednesday, the Dallas Federal Reserve's Beige Book, which compiles the latest information from all 12 districts of the United States, was officially released. Normally, it's just a routine document, but due to the government shutdown causing a large amount of key economic data to be outdated, this report has become an extremely rare and comprehensive source of information that the FOMC can rely on before making decisions.

In other words, this is one of the few windows through which the Federal Reserve can truly reflect the state of the economy at the grassroots level, given the lack of data.

The report's overall assessment is straightforward: economic activity has barely changed, labor demand continues to weaken, cost pressures on businesses have increased, and consumer spending is becoming more cautious. Beneath the surface of apparent stability, the US economy is beginning to show some structural loosening.

The most attention-grabbing part of the report is its description of changes in the job market. Over the past six weeks, the U.S. labor market has shown few positive signs. About half of the regional Federal Reserve Banks reported that local businesses are declining their hiring intentions, with some even adopting a "don't hire if you can" approach. Hiring has become significantly easier across multiple industries, a stark contrast to the severe labor shortages of the past two years. For example, in the Atlanta area of several southeastern states, many businesses are either laying off employees or only making minimal replacements; while in the Cleveland area of Ohio and Pennsylvania, some retailers are proactively reducing their workforce due to declining sales. These changes indicate that the easing of the job market is no longer an isolated phenomenon but is gradually spreading to a wider range of industries and regions.

Meanwhile, while inflationary pressures are described as "mild," the reality for businesses is more complex than the numbers suggest. Some manufacturing and retail businesses are still feeling the pressure of rising input costs, partly due to tariffs—for example, a brewery in the Minneapolis district reported that rising aluminum can prices significantly increased production costs. But more pressing is healthcare costs, mentioned by almost all districts. Providing health insurance for employees is becoming increasingly expensive, and unlike tariffs, these costs are not cyclical but rather a more difficult-to-reverse long-term trend. Businesses are thus forced to make difficult choices between raising prices and shrinking profits. Some companies pass on these costs to consumers, further pushing up prices; others choose to absorb them themselves, further squeezing profit margins. Either way, the results will ultimately be reflected in the CPI and corporate earnings performance in the coming months.

Compared to the pressures on the business side, changes on the consumer side are equally significant. High-income earners continue to drive impressive performance in high-end retail, but a wider range of American households are tightening their belts. Multiple regions have reported that consumers are increasingly reluctant to accept price increases, especially low- and middle-income families facing tight budgets, who are more inclined to postpone or forgo non-essential purchases. Feedback from car dealerships is particularly telling: with the expiration of federal tax credits, electric vehicle sales have slowed rapidly, indicating that consumers are becoming more cautious when facing large expenditures, and even previously strong sectors are beginning to show signs of fatigue.

Among the various economic disruptions, the impact of the government shutdown is clearly amplified in this report. The record-breaking length of the shutdown not only directly affected the income of federal employees, but their spending cuts also dragged down local consumption—resulting in a significant drop in car sales in the Philadelphia area. But what is truly surprising is that the shutdown also rippled through broader economic activity via other channels. Airports in parts of the Midwest were thrown into chaos by reduced passenger numbers, leading to a slowdown in business activity. Some businesses also experienced delays in orders. This chain reaction demonstrates that the economic impact of the government shutdown is far more profound than the mere "suspension of government functions" itself.

At a broader technological level, artificial intelligence is quietly reshaping the economic structure. The Beige Book respondents exhibited a subtle "dual-track phenomenon": on the one hand, AI is driving investment growth; for example, a manufacturer in the Boston area received more orders due to strong demand for AI infrastructure. On the other hand, it is causing some companies to reduce entry-level positions, as basic tasks are being partially replaced by AI tools. Similar concerns are emerging in the education sector—universities in the Boston area reported that many students worry about the future impact of AI on traditional jobs and are therefore more inclined to switch to more "risk-resistant" majors such as data science. This means that AI's reshaping of the economic structure has already permeated from the industrial level to the talent supply side.

It's worth noting that these changes presented in the Beige Book corroborate the latest data. Signs of weak employment are appearing simultaneously in multiple districts, while on the price front, the Producer Price Index (PPI) rose only 2.7% year-on-year, falling to its lowest level since July, and core prices also show a continued softening trend, with no signs of a renewed acceleration. Both employment and inflation—indicators directly related to monetary policy—are prompting the market to reassess the Federal Reserve's next move.

Economic weakness has spread to regional Federal Reserve Banks

National trends can be seen in macroeconomic data, but the reports from regional Federal Reserve banks are more like a close-up look at businesses and households, making it clear that the cooling of the US economy is not uniform, but rather presents a kind of "distributed fatigue".

In the Northeast, businesses in the Boston area generally reported a slight expansion in economic activity, with home sales regaining some momentum after a prolonged period of stagnation. However, consumer spending remained flat, employment declined slightly, and wage growth moderated. Rising food costs pushed grocery prices higher, but overall price pressures remained manageable, and the overall outlook remained cautiously optimistic.

The situation in the New York area was significantly colder. There, economic activity declined moderately, many large employers began layoffs, and employment contracted slightly. While price increases slowed, they remained high; manufacturing showed a slight recovery, but consumer spending remained weak, with only high-end retail showing resilience. Businesses generally had low expectations for the future, with many believing the economy was unlikely to improve significantly in the short term.

Further south, the Philadelphia Fed described a reality where "weakness had already emerged before the shutdown." Most industries are experiencing a mild downturn, employment is declining in tandem, price pressures are squeezing the living space of low- and middle-income families, and recent changes in government policy have also pushed many small and medium-sized enterprises to the brink.

The Richmond suburbs, further down the border, showed slightly more resilience. The overall economy maintained moderate growth, with consumers still hesitant to make large purchases, but everyday spending saw slow increases. Manufacturing activity contracted slightly, while other sectors remained largely flat. Employment showed no significant change, with employers preferring to maintain existing team sizes, and wages and prices were in a moderate upward trend.

The southern region covered by the Atlanta Fed is more like a "stagnation": economic activity is broadly flat, employment is stable, and prices and wages are rising modestly. Retail sales growth has slowed, travel activity has declined slightly, and the housing market remains under pressure, although commercial real estate is showing some signs of stabilization. Energy demand has increased slightly, while manufacturing and transportation remain sluggish.

In the central St. Louis area, overall economic activity and employment remained "unremarkable," but demand was slowing further due to the government shutdown. Prices rose moderately, but businesses were generally concerned that increases would widen over the next six months. Under the dual pressures of economic slowdown and rising costs, local business confidence had become somewhat pessimistic.

These local reports, pieced together, reveal the outline of the US economy: there is no full-blown recession, nor a clear recovery, but rather scattered signs of weakness to varying degrees. It is precisely this diverse range of local samples that forces the Federal Reserve to confront a more pressing issue before its next meeting—the costs of high interest rates are brewing in every corner of the economy.

Federal Reserve officials' attitude shift

If the Beige Book clearly presented the "expression" of the real economy, then the statements made by Federal Reserve officials over the past two weeks have further revealed a quiet shift in policy. Subtle changes in tone may appear to outsiders as merely adjustments in wording, but at this stage, any change in tone often signifies a shift in internal assessments of risk.

Several high-ranking officials have begun to emphasize the same fact: the U.S. economy is cooling, prices are falling faster than expected, and the slowdown in the labor market is "worrying." This is a significantly softer tone compared to their almost unanimous stance over the past year that "a sufficiently tight policy environment must be maintained." Their statements, especially regarding employment, have become particularly cautious, with some officials frequently using terms like "stable," "slowing," and "moving towards a more balanced direction," rather than emphasizing that the economy is "still overheated."

This way of describing things rarely appears in the later stages of a hawkish cycle; it's more like a euphemism for "we're seeing some initial signs that current policies may be tight enough."

Some officials have even begun to explicitly state that excessively tight policies could bring unnecessary economic risks. This statement itself is a signal: when they begin to guard against the side effects of "excessive tightening," it means that the policy direction is no longer one-way, but has entered a phase requiring fine-tuning and balancing.

These changes did not escape the market's notice. Interest rate traders were the first to react, with futures market pricing showing significant fluctuations within days. The expectation of a rate cut, previously thought to be "at the earliest next year," was gradually brought forward to the spring. A "rate cut before mid-year," which no one dared to discuss publicly in the past few weeks, is now appearing in the benchmark forecasts of many investment banks. The market logic is not complicated:

If employment remains weak, inflation continues to decline, and economic growth lingers near zero for an extended period, maintaining excessively high interest rates will only exacerbate the problem. The Federal Reserve will ultimately have to choose between "persisting with tightening" and "preventing a hard landing for the economy," and current signs indicate that this balance is beginning to tilt slightly.

Therefore, when the Beige Book described the economy as cooling to a "slightly cool" state, the Federal Reserve's changing attitude and market repricing behavior began to corroborate each other. The same narrative logic is taking shape: the US economy is not declining rapidly, but its momentum is slowly waning; inflation has not completely disappeared, but it is moving in a "controllable" direction; policy has not clearly shifted, but it is no longer in the same unwavering tightening stance as last year.

A New Cycle of Global Liquidity

Anxiety Behind Japan's 11.5 Trillion Yen of New Debt

While expectations are easing within the United States, major overseas economies, such as Japan, are quietly pushing the curtain on "global reflation."

The scale of Japan's latest stimulus package is far greater than the outside world imagined. On November 26, multiple media outlets, citing sources familiar with the matter, reported that the government of Prime Minister Sanae Takaichi would issue at least 11.5 trillion yen (approximately US$73.5 billion) in new bonds for the latest economic stimulus plan. This amount is almost double the stimulus budget under Shigeru Ishiba last year. In other words, Japan's fiscal policy has shifted from "caution" to "the need to prop up the economy."

Despite authorities projecting record tax revenues of 80.7 trillion yen for the current fiscal year, the market remains unconvinced. Investors are more concerned about Japan's long-term fiscal sustainability. This explains the recent sustained sell-off of the yen, the surge in Japanese government bond yields to a 20-year high, and the continued high levels of the dollar against the yen.

Meanwhile, the stimulus package is expected to boost real GDP by 24 trillion yen, with an overall economic impact of nearly $265 billion.

Domestically in Japan, efforts are being made to suppress short-term inflation through subsidies, such as a 7,000 yen subsidy per household for public utilities to be distributed for three consecutive months to stabilize consumer confidence. However, the deeper impact is on capital flows—the continued weakening of the yen is prompting more and more Asian funds to consider new investment options, and crypto assets happen to be at the forefront of the risk curve they are willing to explore.

Crypto analyst Ash Crypto has linked Japan's recent money printing to the Federal Reserve's policy shift, believing it will push the risk appetite cycle all the way into 2026. Dr. Jack Kruse, a long-time staunch Bitcoin supporter, offers a more direct interpretation: high Japanese bond yields are a signal of pressure on the fiat currency system, and Bitcoin is one of the few assets that can consistently prove itself during such cycles.

Britain's debt crisis is reminiscent of 2008.

Let's take a look at the UK, which has recently been embroiled in another major controversy.

If Japan is loosening monetary policy and China is stabilizing it, then Britain's current fiscal actions look more like adding more supplies to an already leaky ship. The newly announced budget has almost caused a collective frown from London's financial circles.

The Institute for Fiscal Studies, considered one of the most authoritative analytical institutions, offered a clear assessment: "Spend first, pay later." In other words, spending is rolled out immediately, while tax increases are delayed for several years before taking effect—a standard fiscal structure that "leaves the problems to future governments."

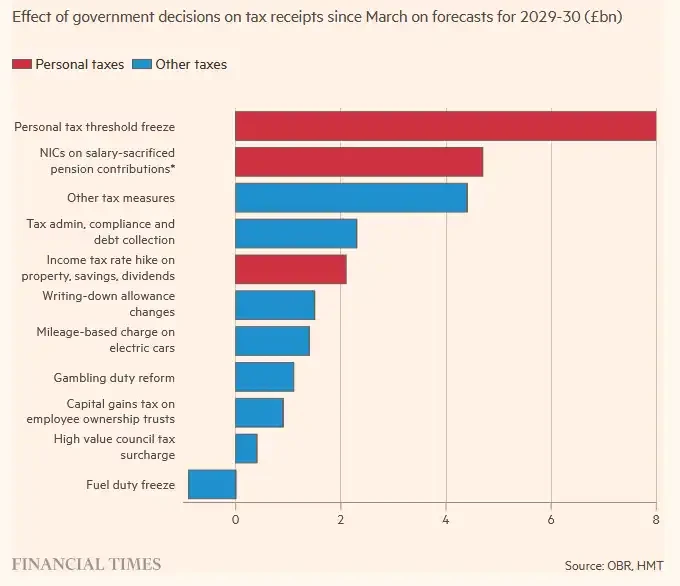

The most eye-catching aspect of the budget is extending the freeze on the personal income tax threshold. This seemingly insignificant technical measure will contribute £12.7 billion to the Treasury in the 2030-31 fiscal year. According to projections by the Office for Budget Responsibility, by the end of the budget cycle, a quarter of British workers will be pushed into the higher 40% tax bracket. This means that even if Labour MPs applaud the increases in landlord tax and dividend tax, it is still the ordinary working class who will truly bear the brunt of the pressure.

In addition, a series of tax increases are being implemented: tax breaks for the pension wage sacrifice scheme, which is expected to contribute nearly £5 billion by 2029-30; an annual "mansion tax" will be levied on properties valued at over £2 million starting in 2028; and the dividend tax will increase by two percentage points from 2026, with the basic tax rate and the higher tax rate jumping to 10.75% and 35.75%, respectively. All these policies, which appear to be "taxing the rich," will ultimately be transmitted to the whole society in a more subtle way.

The tax increase will result in an immediate expansion of welfare spending. According to OBR's calculations, by 2029-30, annual welfare spending will be £16 billion higher than previously predicted, including the additional costs of overturning the "two-child welfare cap." The outline of the fiscal pressure is becoming increasingly clear: short-term political gains, long-term fiscal black hole.

This year's budget has sparked a stronger backlash than in previous years, partly because Britain's fiscal deficit is not just "widening," but approaching crisis levels. In the past seven months, the British government has borrowed £117 billion, almost equivalent to the amount used to bail out the entire banking system during the 2008 financial crisis. In other words, the debt black hole Britain has created is not a crisis in itself, but it has reached crisis-level scale.

Even the usually mild Financial Times used the word "brutal" in a rare move, pointing out that the government still hasn't grasped a fundamental issue: in the face of prolonged economic stagnation, trying to fill the gap by repeatedly raising tax rates is doomed to failure.

Market sentiment toward the UK has become extremely pessimistic: Britain is "out of money," and the ruling party seems to have no viable growth path, pointing only to higher taxes, weaker productivity, and higher unemployment. As the fiscal deficit continues to widen, debt is highly likely to be "de facto monetized"—ultimately, the pressure will fall on the pound, becoming the market's "escape valve."

This is why more and more analyses have recently spread from traditional finance to the crypto world, with some directly concluding that when currencies begin to passively depreciate, and when wage earners and those without assets are slowly pushed to the brink, the only thing that won't be arbitrarily diluted is hard assets, including Bitcoin.

Christmas or Christmas disaster?

Every year-end, the market habitually asks: Is this year a "Christmas" or a "Christmas disaster"?

Thanksgiving is almost over, and its "seasonal benefit" to US stocks has been talked about by the market for decades.

The difference this year is that the correlation between the crypto market and the US stock market has reached nearly 0.8, with their price movements almost synchronized. On-chain accumulation signals are strengthening, while low liquidity during holidays often amplifies any upward movement into a "vacuum bounce."

The crypto community is repeatedly emphasizing the same point: holidays are the most likely window for short-term trending movements. Low trading volume means that lighter buying can push prices away from densely traded areas, especially given the recent subdued sentiment and more stable market sentiment.

A consensus can be sensed quietly forming in the market. If the US stock market experiences a small rebound after Black Friday, crypto assets will be among the most volatile. Ethereum, in particular, is considered by many institutions to be a "high-beta asset equivalent to a small-cap stock."

Furthermore, shifting the focus from Thanksgiving to Christmas, the core of the discussion has changed from "whether the market will rise" to "whether this seasonal rebound will continue into next year."

The so-called "Christmas rally" was first proposed in 1972 by Yale Hirsch, the founder of Stock Trader's Almanac. It has gradually become one of the many seasonal effects in the US stock market. It refers to the period during the last five trading days of December and the first two trading days of the following year, during which the US stock market usually experiences a surge.

The S&P 500 has risen in 58 out of the past 73 years around Christmas, a success rate of nearly 80%.

More importantly, a Christmas rally could be a harbinger of a strong stock market performance in the coming year. According to Yale Hirsch, if the Christmas rally, the first five trading days of the new year, and the January barometer are all positive, then the US stock market is likely to perform well in the new year.

In other words, these last few days of the year are the most significant micro-level window for the entire year.

For Bitcoin, the fourth quarter has historically been the period most prone to initiating trends. Both the early mining cycle and the later institutional allocation patterns have made Q4 a natural "right-side trend season." This year, however, it's compounded by new variables: expectations of US interest rate cuts, improved liquidity in Asia, increased regulatory clarity, and the return of institutional holdings.

So the question becomes a more realistic assessment: If the US stock market enters a Christmas rally, will Bitcoin surge even more? If the US stock market doesn't rally, will Bitcoin rise on its own?

All of this will determine whether those working in the crypto industry will have a Christmas or a Christmas disaster.

- 核心观点:全球流动性转向助推加密资产上涨。

- 关键要素:

- 美联储12月降息概率飙升至86%。

- 日本发行11.5万亿日元新债刺激经济。

- 英国财政危机加剧法币体系风险。

- 市场影响:加密市场或成流动性外溢主要受益者。

- 时效性标注:短期影响