In-depth Market Forecast Report: Liquidity Paradigm, Industrial Leap, and the New Primitive Revolution

- 核心观点:预测市场正从边缘实验迈向核心金融基础设施。

- 关键要素:

- Polymarket与Kalshi形成双寡头格局。

- 监管、流动性、预言机是三大核心挑战。

- 未来创新将聚焦基础设施与衍生品组合。

- 市场影响:推动信息衍生品融入主流金融体系。

- 时效性标注:中期影响

I. Predicting the historical evolution of the market and the industry landscape

As a mechanism for pricing future events, prediction markets have evolved over thirty years, transforming from academic experiments and gray-area gambling into an independent asset class possessing informational value, liquidity, and financial attributes. These markets are centered on a "price is probability" structure, using real funds to map market participants' collective judgments on the probability of an event occurring: a binary contract settling at $1 or $0 has a trading price between $0 and $1, directly reflecting market consensus. For example, when an event contract is priced at $0.62, it means "the market believes the event has a probability of approximately 62%." This mechanism, based on the aggregation of opinions from dispersed participants, essentially constructs a quantifiable, verifiable, and real-time updated public good of information. It differs from recreational gambling and binary options-style house structures, instead representing a hybrid information financial infrastructure that combines market efficiency, collective wisdom, and dynamic trading capabilities. Unlike the negative-sum mechanism of gambling, the overall structure of prediction markets exhibits "positive-sum information output": the platform charges a small fee, while the core value comes from the probability signals aggregated by the market. This signal can be cited by the media, modeled by research institutions, and used by enterprises for risk management. It can also be directly embedded in other financial derivatives and Web3 protocols as a pricing node, thus possessing strong externalities and social value.

The roots of modern prediction markets can be traced back to the Iowa Electronic Markets (IEM) of 1988. This early experiment, led by academic institutions, allowed participants to trade contracts representing a candidate's probability of winning or vote share with small sums of money, with the explicit aim of improving prediction accuracy. Numerous studies have shown that between 1988 and 2004, the IEM significantly outperformed most traditional polls in predicting US presidential elections, demonstrating its ability to reflect true trends earlier.

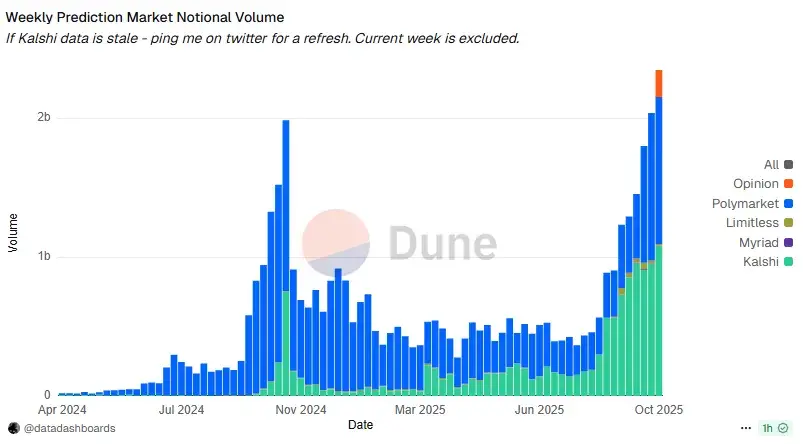

What truly propelled the industrialization leap of the prediction market was the new generation of platforms that emerged after 2020, fueled by the maturity of Layer 2, stablecoins, and cross-chain infrastructure. This new generation is exemplified by the "duopoly" formed by Polymarket and Kalshi in 2024-2025. Polymarket represents the full maturity of the decentralized approach: based on Polygon and multi-chain expansion, it achieved a product form that combines user experience and censorship resistance through the order book model (CLOB), low-friction deposits, gas-free trading, and the optimistic oracle of UMA. During the 2024 US presidential election, its monthly trading volume reached $2.6 billion, with total annual trading volume exceeding $10 billion. Its significant dissemination effect on media and social networks created a flywheel of "opinion → position → dissemination," making it the preferred platform for Web3 users entering the prediction market. Even after being penalized by the CFTC, its acquisition of the licensed exchange QCEX to reposition itself in the US market further demonstrates that compliance has become a core direction for the industry's development. Kalshi, developing in parallel with Polymarket, represents a completely different path: compliance, regulatory certainty, and penetration into mainstream financial channels. Kalshi obtained CFTC Designated Contract Market (DCM) status in 2021 and subsequently acquired a Clearing House (DCO) license, becoming a federally compliant event contract exchange in the United States. Its centralized matching structure is closer to that of traditional exchanges, supporting USD and USDC deposits. Through partnerships with brokers like Robinhood, it directly offers event contracts to mainstream investors. After the surge in sports and macroeconomic contracts in 2025, Kalshi's weekly trading volume reached $800-900 million, with a market share of 55-60%, becoming the de facto infrastructure of the US prediction market. Unlike Polymarket's on-chain openness, Kalshi's advantage lies in institutional participation, brand trust, and traditional channel distribution capabilities brought about by compliance certainty. These two factors constitute the orthogonal dual core of "on-chain composability" and "compliant availability."

Beyond the duopoly, new platforms and vertical tracks are rapidly emerging, further expanding market boundaries. Opinion, leveraging the BSC ecosystem's traffic and airdrop incentives, surpassed hundreds of millions of dollars in scale in its first week. Limitless, within the Base ecosystem, meets the demand for volatility products from crypto traders through short-term price predictions. Solana's PMX Trade directly tokenizes Yes/No contracts, exploring the deep integration of prediction markets and DEX liquidity. Sports-related platforms such as SX Network, BetDEX, and Frontrunner, with their high frequency and high stickiness, have become the largest vertical scenarios, while "creator economy prediction markets" represented by Kash, Melee, and XO Market directly financialize opinions, making KOLs' views tradable assets. At the same time, TG Bots and aggregator toolchains represented by Flipr, Polycule, and okbet are becoming another rapidly developing direction. They compress complex prediction interactions into chat interfaces, providing cross-platform price tracking, arbitrage, and fund flow monitoring, forming a new "1inch + Meme Bot" ecosystem for prediction markets.

Overall, prediction markets have undergone three major transformations over the past thirty years: from academic experiments to commercial betting exchanges, then from on-chain experiments to dual-core platforms focused on compliance and scalability, ultimately diversifying into highly diverse forms within vertical scenarios such as sports, the crypto market, and the creator economy. The window of opportunity for general-purpose platforms is narrowing, while genuine growth is more likely to come from deeply vertical scenarios, the data and tools surrounding the ecosystem, and the degree to which prediction market signals are integrated with other financial systems. Prediction markets are rapidly evolving from a "gray area toy market" into a "critical infrastructure for the global information and financial system."

II. Structural Challenges in Market Forecasting

After more than 30 years of iteration, prediction markets have evolved from experimental products to a stage of financial-grade infrastructure with increasing participation from global users and institutions. However, their development still faces three unavoidable structural bottlenecks: regulation, liquidity, and oracle governance. These three are not independent but interconnected and mutually restrictive, determining whether prediction markets can grow from "gray innovation" into a "compliant and transparent global information and derivatives system." Regulatory uncertainty limits the entry of institutional funds, insufficient liquidity weakens the effectiveness of probability signals, and if oracle governance cannot provide a reliable adjudication mechanism, the entire system will fall into a quagmire of game manipulation and outcome disputes, failing to truly become a trusted source of information for the outside world.

Regulatory issues are the primary bottleneck for prediction markets, and their complexity is particularly pronounced in the United States. Whether a prediction market is a commodity derivative, gambling, or a security-like investment contract determines its regulatory path. If classified as a commodity or derivative, it falls under CFTC regulation, treated the same as futures exchanges, and requires DCM (Designated Contract Market) and DCO (Declaration Organization) licenses—high barriers to entry and significant costs, but granting federal legal status if successful; Kalshi is a prime example. If classified as gambling, it requires separate gambling licenses in each of the 50 states, leading to exponentially increasing compliance costs and virtually eliminating the possibility of a nationwide platform. If classified as a security, it triggers strict SEC regulation, posing a significant potential risk to DeFi prediction protocols with token designs or yield promises. The fragmentation and overlap of the US regulatory system place prediction markets in a frequently disputed gray area. For example, the core issue in Kalshi's lawsuit against the New York Gaming Commission is whether the CFTC has exclusive regulatory power over event contracts. This ruling not only concerns whether Kalshi's business can operate smoothly nationwide, but also the institutional direction of the US prediction market over the next decade. Furthermore, the CFTC's enforcement of Polymarket's regulations and its ruling on Crypto.com's sports event contracts demonstrate that regardless of whether a platform's outer shell is "decentralized," as long as it provides a front-end to US users and facilitates transactions, it is essentially considered an unregistered and compliant activity based on derivatives or binary options, and will incur corresponding legal liabilities.

Outside the US, most global jurisdictions largely maintain a "dual framework": incorporating prediction markets into gambling regulations or financial derivatives systems, with very few enacting new laws specifically for prediction markets. Countries like the UK and France maintain an open attitude towards event betting under online gambling regulations, but regulatory tools such as geo-blocking, payment bans, and ISP blocking make it difficult for prediction market platforms to reach mainstream users before obtaining licenses. For entrepreneurs, the "technology neutrality" defense is no longer sufficient to evade legal risks; offshore companies, DAOs, or decentralized front-ends cannot guarantee regulatory immunity. There are only three paths to long-term survival: either embrace licensing like Kalshi did; remain completely offshore, fully open-source and decentralized, accepting the cost of being absent from mainstream markets; or shift to building compliance infrastructure, providing technical services (KYC, risk control, prediction data APIs, etc.) to licensed institutions. Regulatory uncertainty limits institutional funding participation and the depth of connection with traditional finance, making it difficult for prediction markets to truly scale.

III. Predicting Market Value Innovation and Future Opportunities

After several rounds of reshuffling due to three major constraints—regulation, liquidity, and oracle governance—the prediction market is seeing a shift in truly valuable innovation from "single-platform competition" to the "primitive layer" and "infrastructure layer." Simply put, the past decade has seen the development of "a new prediction market website"; the next decade, however, is more likely to see incremental growth come from "abstracting event contracts into informational derivatives and embedding them into the entire DeFi and financial system," transforming the prediction market from an application into a modular DeFi Lego set. The binary contracts of events themselves are merely the starting point. Once these contracts become standardized, composable, and collateralizable asset units, a whole layer of derivatives—perpetual bonds, options, indices, structured products, lending, and leverage—will naturally grow around them. The "event market" explored in the designs of D8X, Aura, and even parts of dYdX v4 essentially projects the "whether it happens" onto a 0–1 price space, further allowing high-leverage trading, enabling traders not only to bet on the direction of events but also to trade volatility and sentiment. Protocols like Gondor allow users to borrow stablecoins by staking their YES/NO shares in Polymarket, transforming previously statically locked long-term event positions into reusable collateral assets. The protocol then dynamically adjusts the LTV and liquidation logic based on market probability, financializing "opinions" into a recyclable capital instrument. Moving up the hierarchy are indexed and structured products like PolyIndex, which package a basket of events into ERC-20 index tokens, allowing users to gain comprehensive exposure to a specific theme with a single click, such as the "US Macroeconomic Policy Uncertainty Index" or a "Basket of AI Regulation and Subsidy Implementation Events." In the context of asset management, the prediction market is no longer seen as isolated trading positions, but rather as a new asset class that asset managers can incorporate into their portfolios.

The truly valuable "shovel opportunities" in the medium to long term are concentrated in four layers. First is the truth and rules layer, namely next-generation oracles and arbitration protocols. How to avoid a repeat of UMA-like disputes in terms of economic incentives and governance structures, and how to use standardized, modular tools to help ordinary users create "clearly defined and adjudicable" event markets, will directly determine the extent to which prediction markets can be accepted by institutions and the public sector. Second is the liquidity and capital efficiency layer. Customized AMMs, unified liquidity pools, collateralized lending, and yield aggregation protocols around prediction markets can transform dormant event positions into reusable assets. This not only brings new asset classes to DeFi but also creates a stronger economic moat for the platform. Third is the distribution and interaction layer, including social embedded SDKs/APIs, one-click media access components, professional terminals, and strategy tools. These directions determine the "entry point" of prediction markets and who can stand at the intersection of information and transactions to earn continuous transaction fees and technical service fees. Fourth is the compliance technology and security layer. This layer, encompassing refined geofencing, KYC/AML, risk control monitoring, and automated reporting across multiple jurisdictions, helps licensed institutions securely access prediction market data within the bounds of regulations, enabling event pricing to truly integrate into asset management, investment research, and risk management processes. Finally, the rise of AI provides a new closed loop for binding prediction markets and capital markets. On one hand, AI models can act as "super traders" in prediction markets, trading with enhanced information processing and pattern recognition capabilities, thereby improving market pricing efficiency. On the other hand, prediction markets can also serve as a "real-world evaluation arena" for AI capabilities, quantitatively assessing model quality through indicators such as real profits and losses and long-term calibration, providing an external, hard-constrained evaluation system for "AI research reports, AI investment advisors, and AI strategies." For investors, projects that understand derivative design, can safely utilize event pricing within regulatory boundaries, and bridge the gap between AI and traditional finance are likely to grow into key infrastructure assets in the entire "information-based derivatives" sector in the next cycle.

IV. Conclusion

From 16th-century papal election betting to 20th-century Wall Street presidential predictions, and then to IEM, Betfair, Polymarket, and Kalshi, the evolution of prediction markets is essentially a history of humanity's attempts to approximate "more realistic probabilities" through systems and incentives. Today, as mainstream media credibility declines and social media platforms become a mix of signals and noise, prediction markets embody the "cost of saying the wrong thing" through prices, compressing scattered global information and judgments into a quantifiable and verifiable probability curve. It is not a perfect truth machine, but it provides a more verifiable public signal than slogans and emotions. Looking ahead, the ultimate goal of prediction markets may not be the emergence of a single platform larger than Polymarket, but rather more like: becoming an "information and opinion interaction layer" embedded in social media, news websites, financial terminals, games, and creator tools; ubiquitous like a "like button," allowing each opinion to naturally correspond to a tradable probability; and continuously producing incentive-constrained "collective predictions" in a game involving both humans and AI, feeding back into decision-making and governance. To truly reach that stage, the field must first overcome three hurdles: regulatory hurdles, liquidity hurdles, and oracle governance hurdles. These three hurdles are precisely the stage for next-generation infrastructure and emerging primitives. For entrepreneurs and investors, the prediction market is by no means a "finished" field; on the contrary, it has just completed the first stage from concept to industrial prototype. What truly determines whether it can become "Web3-level information infrastructure" is the continuous innovation and institutional refinement surrounding rules, liquidity, and oracles over the next 5-10 years. In this multi-billion dollar information war, the winners are often not the loudest voices, but rather the builders who quietly lay the most solid "shovels" and "roads."