Tiger Research: Token Buybacks, a Comeback

- 核心观点:监管转变使加密回购机制重现市场。

- 关键要素:

- SEC转向评估实际去中心化程度。

- 《清晰法案》将代币重新分类为数字商品。

- Hyperliquid等协议采用自动化回购销毁机制。

- 市场影响:为合规代币经济设计开辟新空间。

- 时效性标注:中期影响

Buybacks, which stalled in 2022 due to pressure from the U.S. Securities and Exchange Commission, are now back in the spotlight. This report, written by Tiger Research , analyzes how this once-considered unworkable mechanism has re-entered the market.

Key points summary

- Hyperliquid's 99% buyback and Uniswap's renewed buyback discussions have brought buybacks back into the spotlight.

- Buybacks, once considered unworkable, are now possible thanks to the U.S. Securities and Exchange Commission’s “crypto project” and the introduction of the Clarity Act.

- However, not all buyback structures are viable, which confirms that the core requirement of decentralization remains crucial.

1. The buyback will return after three years.

Buybacks that disappeared from the crypto market after 2022 reappeared in 2025.

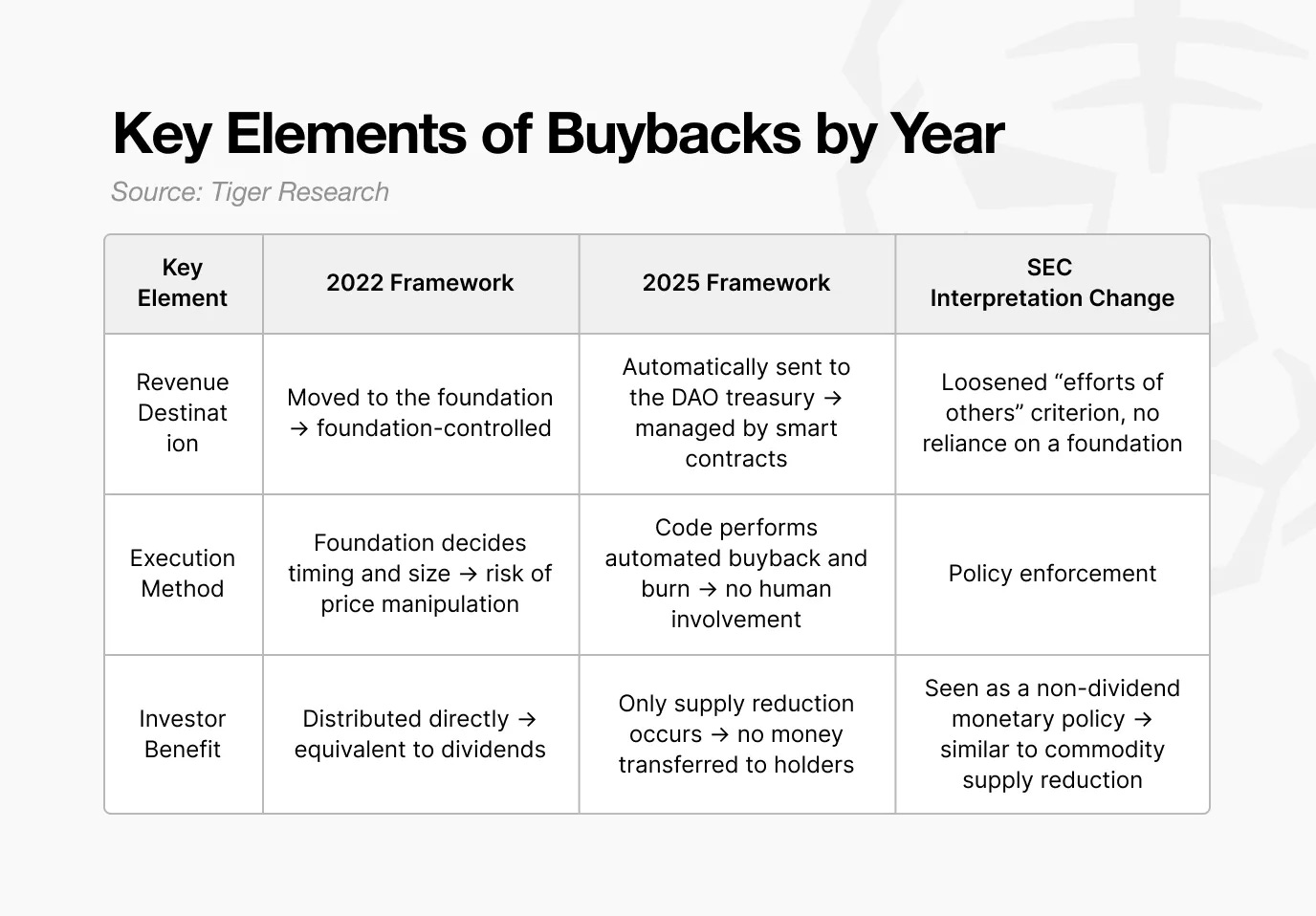

In 2022, the U.S. Securities and Exchange Commission (SEC) classified share buybacks as a securities-regulated activity. When a protocol uses its revenue to buy back its own tokens, the SEC considers this to be providing economic benefits to token holders, essentially equivalent to dividends. Because dividend distribution is a core characteristic of securities, any tokens used for buybacks may be classified as securities.

Therefore, major projects like Uniswap have either postponed their buyback plans or halted discussions altogether. There is no reason to take on direct regulatory risks.

However, by 2025, the situation had changed.

Uniswap has restarted its buyback discussions, and several protocols, including Hyperliquid and Pump.fun , have already implemented buyback programs. What was considered unfeasible a few years ago is now a trend. So, what has changed?

This report explores why buybacks were halted, how regulations and structural models evolved, and how the buyback methods differ across agreements today.

2. Why did share buybacks disappear: The SEC's securities explanation

The disappearance of buybacks is directly related to the SEC's view on securities. From 2021 to 2024, regulatory uncertainty across the entire crypto space was exceptionally high.

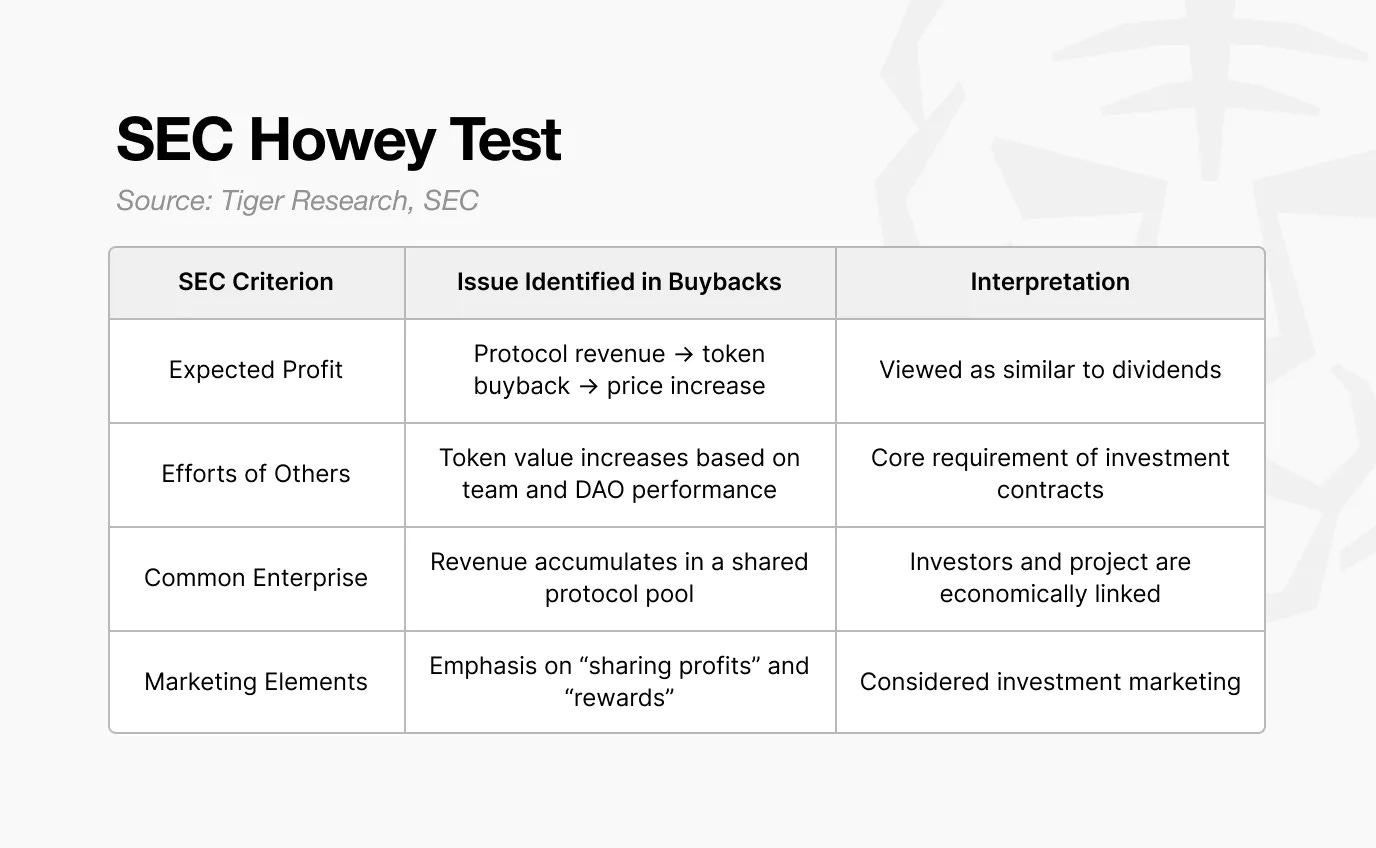

The Howey Test is a framework used by the SEC to determine whether an activity constitutes a security. It comprises four elements, and an asset that meets all four elements qualifies as an investment contract.

Based on this test, the SEC has repeatedly stated that many crypto assets fall under the category of investment contracts. Buybacks are interpreted in the same way. As regulatory pressure increases across the market, most agreements have no choice but to abandon their buyback plans.

The SEC does not view buybacks as a simple token economics mechanism. In most models, protocols use their revenue to buy back tokens and then distribute the value to token holders or ecosystem contributors. The SEC sees this as similar to dividends or shareholder distributions following a company buyback.

Because the four elements of the Howey test align with this structure, the interpretation of "repurchase = investment contract" has become increasingly entrenched. This pressure is most pronounced for large-scale agreements in the United States.

Uniswap and Compound, both operated by US-based teams, have been subject to direct regulatory scrutiny. Therefore, they must exercise extreme caution in designing their token economics and any form of revenue distribution. For example, Uniswap's fee switch has remained inactive since 2021.

Due to regulatory risks, the main protocol avoids any mechanisms that directly distribute revenue to token holders or could materially affect the token price. Terms such as "price appreciation" or "profit sharing" have also been removed from public communications and marketing.

3. SEC's Shifting Perspective: Crypto Projects

Strictly speaking, the SEC did not "approve" buybacks in 2025. What changed was its interpretation of the composition of securities.

- Gensler: Based on results and behavior (How were the tokens sold? Did the foundation directly allocate value?)

- Atkins: Based on structure and control (Is the system decentralized? Who actually controls it?)

Under Gensler's leadership in 2022, the SEC emphasized results and actions. If revenue is shared, the token tends to be considered a security. It is also considered a security if the foundation intervenes in a way that influences price.

By 2025, under Atkins' leadership, the framework shifted towards structure and control. The focus moved to who governs the system and whether operations rely on human decision-making or automated code. In short, the SEC began assessing the actual degree of decentralization.

Source: United States District Court for the Southern District of New York

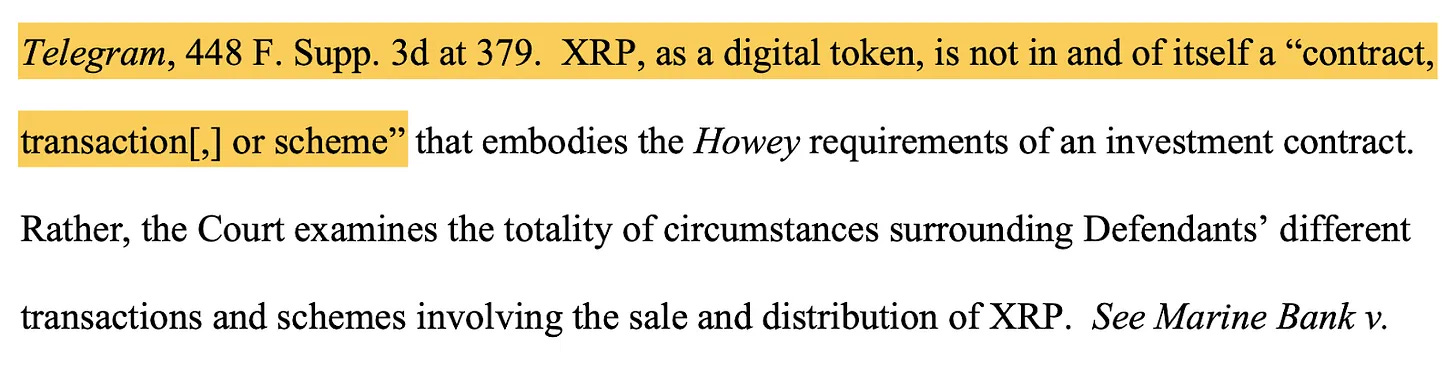

The Ripple (XRP) lawsuit has set a key precedent.

In 2023, a court ruled that XRP sold to institutional investors qualified as securities, while XRP traded by retail investors on exchanges did not. The same token can fall into different categories depending on how it is sold. This reinforces the interpretation that security status depends not on the token itself, but on the method of sale and the operating structure—a view that directly influences how buyback models are evaluated.

These shifts were later integrated under an initiative called the "Crypto Project." Following the "Crypto Project," the SEC's core issues changed:

Who actually controls the network? Are decisions made by the foundation or the DAO governance? Are revenue distribution and token burning manually scheduled, or are they executed automatically by the code?

In other words, the SEC is beginning to examine substantive decentralization, rather than just the surface structure. Two shifts in perspective have become particularly crucial.

- life cycle

- Functional Decentralization

3.1. Life Cycle

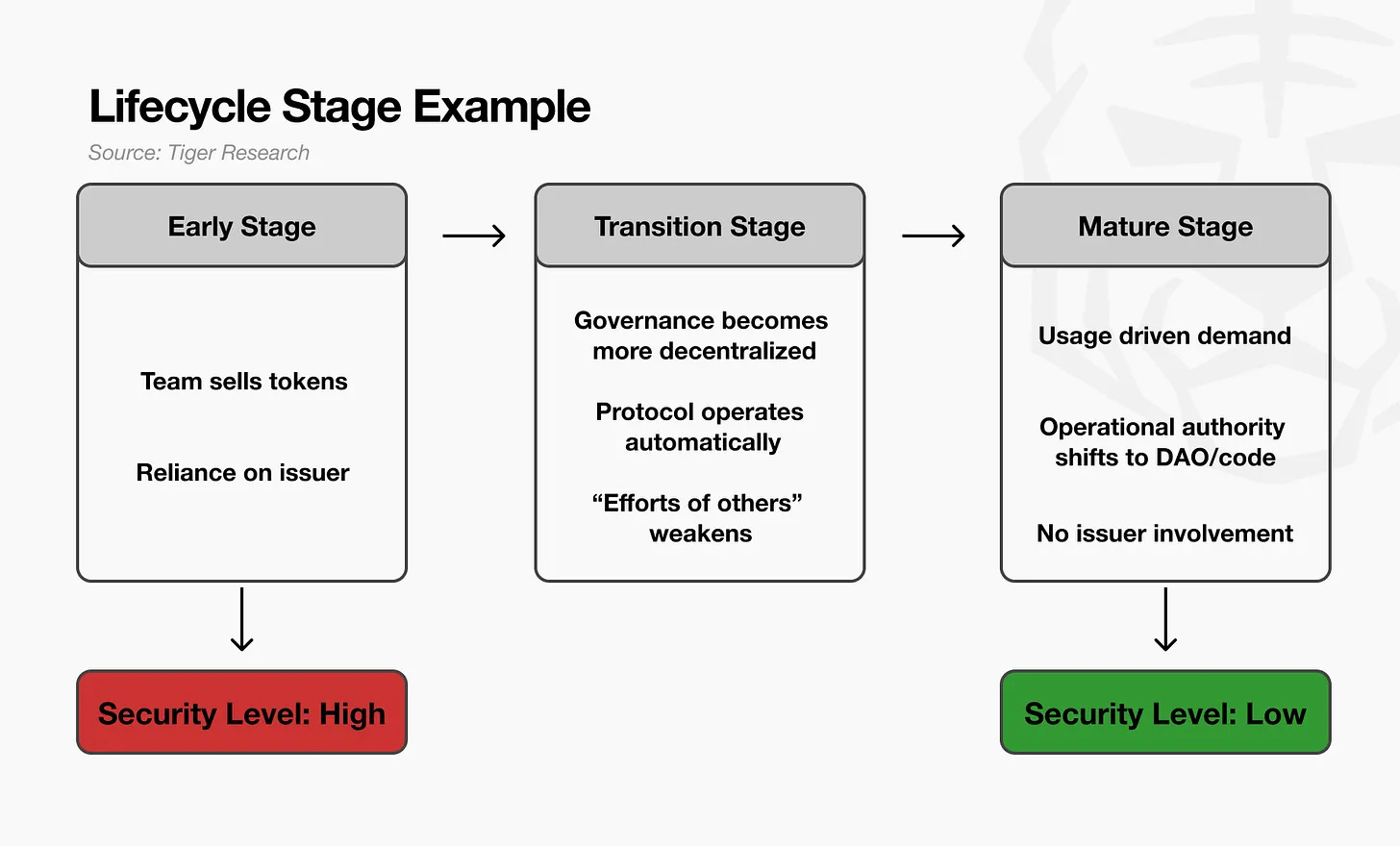

The first shift was the introduction of a token lifecycle perspective.

The SEC no longer considers tokens to be either perpetual securities or perpetual non-securities. Instead, it recognizes that the legal characteristics of tokens may change over time.

For example, in the early stages of a project, the team sells tokens to raise funds, and investors buy these tokens expecting the team's strong execution to increase their value. At this point, the structure heavily relies on the team's efforts, making this sale functionally similar to a traditional investment contract.

As networks began to see practical use, governance became more decentralized, and protocols operated reliably without direct team intervention, leading to a shift in interpretation. Price formation and system operation no longer depended on the capabilities or continuous work of a team. A key element of the SEC assessment—"reliance on the efforts of others"—was diminished. The SEC described this period as a transitional phase.

Ultimately, as the network matures, the characteristics of the tokens differ significantly from their earlier stages. Demand is driven more by practical use than speculation, and the tokens function more like a network commodity. At this point, applying traditional securities logic becomes difficult.

In short, the SEC’s lifecycle perspective acknowledges that tokens may resemble investment contracts in their early stages, but as the network becomes decentralized and self-sustaining, classifying them as securities becomes more difficult.

3.2. Functional Decentralization

The second is functional decentralization. This perspective focuses not on the number of nodes, but on who actually holds control.

For example, a protocol might have 10,000 nodes operating globally, with its DAO tokens distributed among tens of thousands of holders. On the surface, it appears to be completely decentralized.

However, if the upgrade authority for the smart contract is held by a multisignature wallet belonging to a three-person foundation, if the vault is controlled by the foundation's wallet, and if the fee parameters can be directly changed by the foundation, then the SEC does not consider this decentralized. In effect, the foundation controls the entire system.

In contrast, even if a network consists of only one hundred nodes, if all major decisions require DAO voting, if the results are executed automatically by code, and if the foundation cannot interfere arbitrarily, the SEC might consider it more decentralized.

4. The Clarity Act

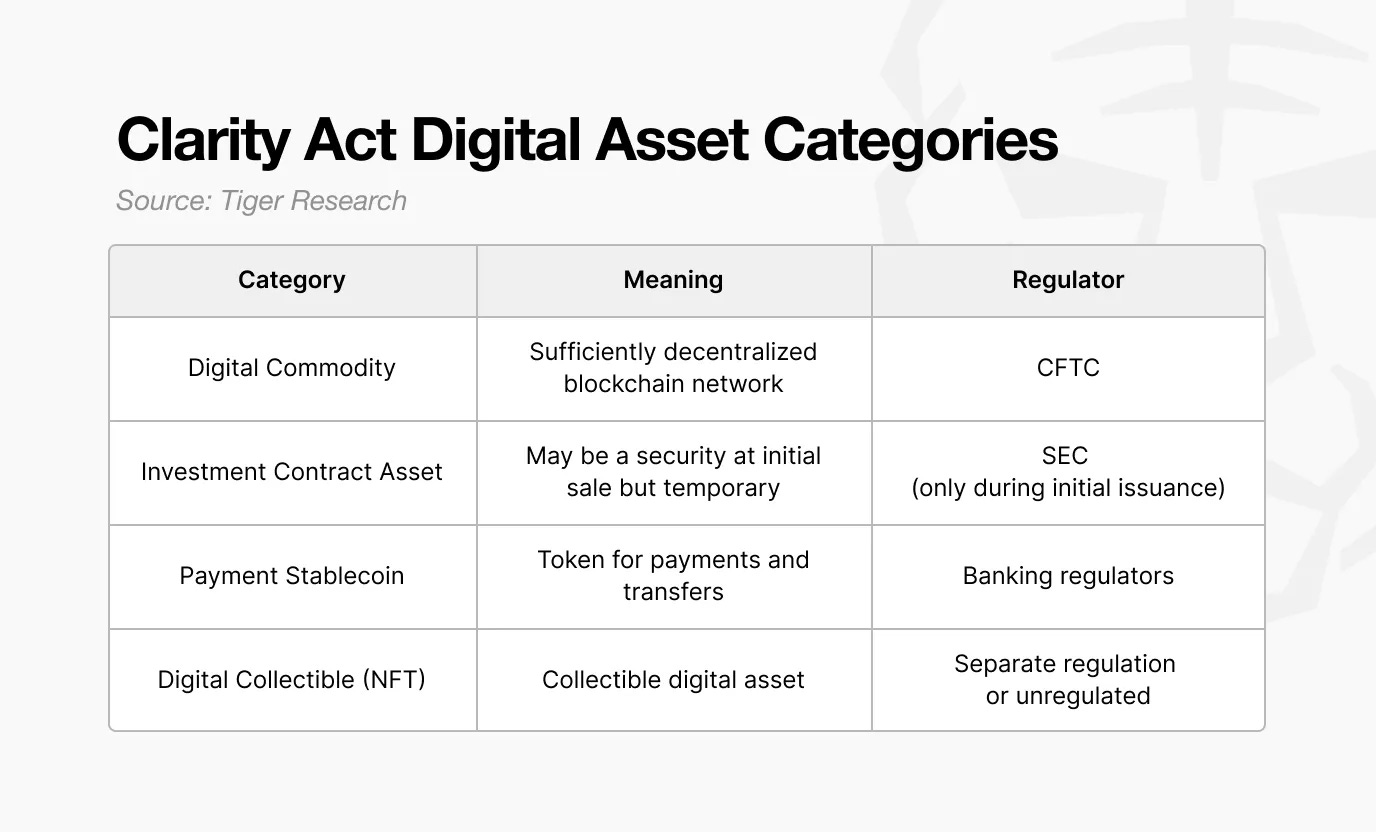

Another factor that could bring buyback discussions back to the forefront in 2025 is the Clarity Act, a legislative initiative proposed by the U.S. Congress. This act aims to redefine how tokens should be legally classified.

While the SEC’s “Crypto Project” focuses on determining which tokens qualify as securities, the Clarity Act raises a more fundamental question: What is a token as a legal asset?

The core principle is simple: a token does not become a security permanently simply because it was sold under an investment contract. This concept is similar to the SEC's lifecycle approach, but applied differently.

According to the SEC's previous explanation, if a token is sold as part of an ICO investment contract, then the token itself may be considered a security indefinitely.

The Clarity Act separates these elements. If a token is sold under an investment contract at the time of its issuance, then at that moment it is considered an "investment contract asset." But once it enters the secondary market and is traded by retail users, it is reclassified as a "digital commodity."

Simply put, a token may be a security when it is issued, but once it is fully distributed and actively traded, it becomes a regular digital asset.

This classification is important because it changes the regulatory body. Initial sales fall under the SEC's jurisdiction, while secondary market activity falls under the CFTC's. With this shift in regulation, agreements face fewer securities regulatory constraints when designing their economic structures.

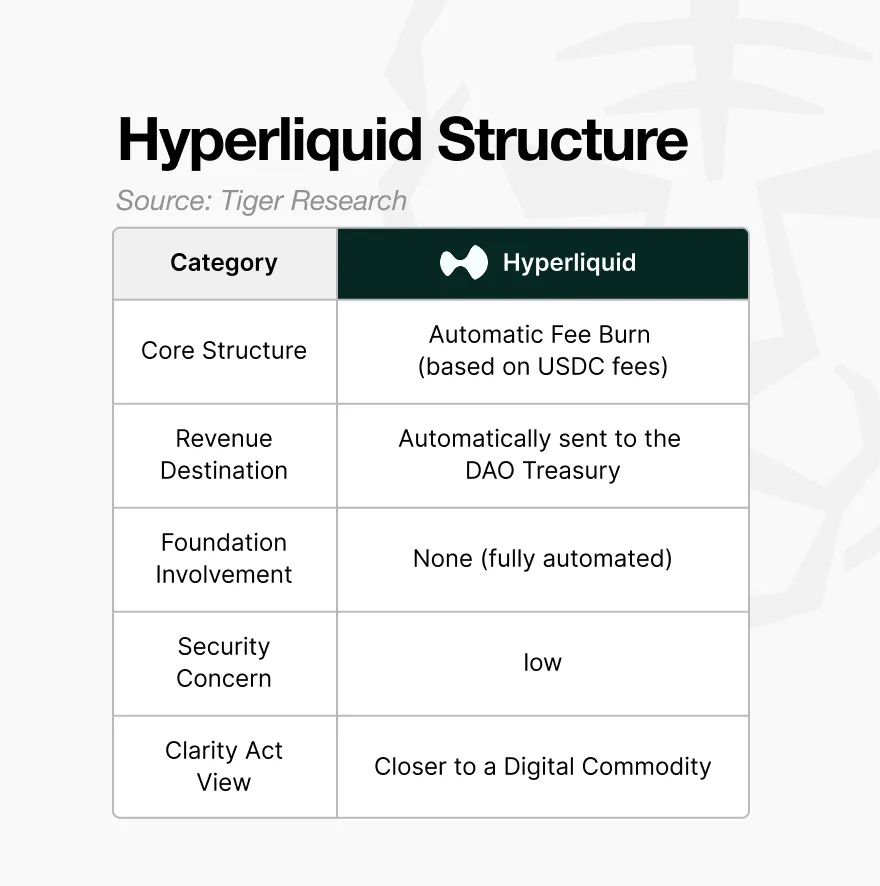

This shift directly impacts how buybacks are interpreted. If a token is classified as a digital commodity in the secondary market, then buybacks are no longer seen as "securities-like dividends." Instead, they can be interpreted as supply management, similar to monetary policy in a commodity-based system. It becomes a mechanism for operating the token economy, rather than distributing profits to investors.

Ultimately, the Clarity Act formalizes the idea that the legal characteristics of tokens can change depending on the context, which reduces the structural regulatory burden associated with buyback designs.

5. Shift to repurchase and destruction

In 2025, a combination of buybacks and automatic burn mechanisms reappeared. In this model, revenue is not directly distributed to token holders, the foundation has no control over price or supply, and the burn process is executed algorithmically. Therefore, this structure further deviates from the elements previously flagged by regulators.

Uniswap’s “Unified Proposal” announced in November 2025 clearly illustrates this shift.

In this model, a portion of transaction fees is automatically allocated to the DAO treasury, but no revenue is directly distributed to UNI holders. Instead, a smart contract purchases UNI on the open market and destroys it, thereby reducing supply and indirectly supporting value. All decisions governing this process are made through DAO voting, and the Uniswap Foundation does not interfere.

The key change lies in how this behavior is interpreted.

Early buybacks were seen as a form of "profit distribution" to investors. The 2025 model, however, redefines the mechanism as a supply adjustment, operating as part of network policy rather than intentionally influencing prices.

This structure does not conflict with the SEC's 2022 views and falls under the "digital goods" category as defined in the Clarity Act. Once tokens are considered commodities rather than securities, adjusting the supply becomes more like a monetary policy tool than a dividend-like payment.

The Uniswap Foundation stated in its proposal that "this environment has changed" and that "regulatory clarity in the United States is evolving." The key insight here is that regulators have not explicitly authorized buybacks. Instead, clearer regulatory boundaries have allowed agreements to be designed to meet compliance expectations.

In the past, any form of buyback was considered a regulatory risk. By 2025, the question has shifted from "whether buybacks should be allowed" to "whether their design can avoid triggering securities concerns."

This shift opens up space for repurchases to be implemented within a compliant framework.

6. Agreement to implement the repurchase

A representative protocol implementing a buyback and burn mechanism in 2025 is Hyperliquid. Its structure illustrates several key characteristics:

- Automation mechanism : Buybacks and destructions are based on protocol rules, rather than decisions made at the discretion of the foundation.

- Non-foundation revenue streams : Revenue does not flow into wallets controlled by the foundation, or even if it does, the foundation cannot use it to influence prices.

- No direct fee sharing : Revenue is not paid to token holders. It is used solely for supply adjustments or network operating costs.

The key point is that this model no longer promises direct economic benefits to token holders. It functions as the network's supply policy. The mechanism has been redesigned to fit the boundaries that regulators are willing to accept.

However, this does not mean that all buybacks are safe.

While buybacks are regaining momentum, not every implementation carries the same regulatory risks. The regulatory shift in 2025 opens the door to structurally compliant buybacks, rather than discretionary, one-off, or foundation-driven programs.

The SEC's logic remains consistent:

- If the foundation decides when to buy in the market, it reinforces the explanation of "intentionally supporting prices".

- Even with DAO voting, if the authority to upgrade or execute ultimately rests with the foundation, it does not meet the requirements of decentralization.

- If value is accumulated for a specific holder rather than being destroyed, it is similar to a dividend.

- If income flows from the foundation to the market for purchases, leading to price appreciation, it reinforces investor expectations and aligns with the elements of the Howey Test.

In short, discretionary, occasional, or foundation-controlled buybacks still cannot escape securities scrutiny.

It's also important to note that buybacks do not guarantee price appreciation. Burning reduces supply, but it's merely a long-term token economic mechanism. Burning cannot make weak projects stronger; conversely, strong projects can strengthen their fundamentals through a well-designed burning system.