Tiger Research Bitcoin Valuation Report: Q4 Target Price $200,000

- 核心观点:比特币2025年目标价20万美元。

- 关键要素:

- 机构持续增持,ETF季度净流入78亿美元。

- MVRV-Z指数2.31,估值偏高但未达极端。

- 全球M2达96万亿美元,美联储持续降息。

- 市场影响:强化机构主导格局,推动长期上涨。

- 时效性标注:长期影响。

Author: Daniel Kim, Ryan Yoon, Jay Jo

This report, written by Tiger Research , proposes a target price of $200,000 for Bitcoin in the fourth quarter of 2025, based on factors such as continued institutional buying during volatility, the Federal Reserve's interest rate cuts, and the October plunge confirming the institutional dominance of the market.

Key Takeaways

- Institutional investors continued to increase their holdings amidst volatility – ETF net inflows remained stable in the third quarter, with MSTR increasing its holdings by 388 bitcoins in a single month, demonstrating its commitment to long-term investment.

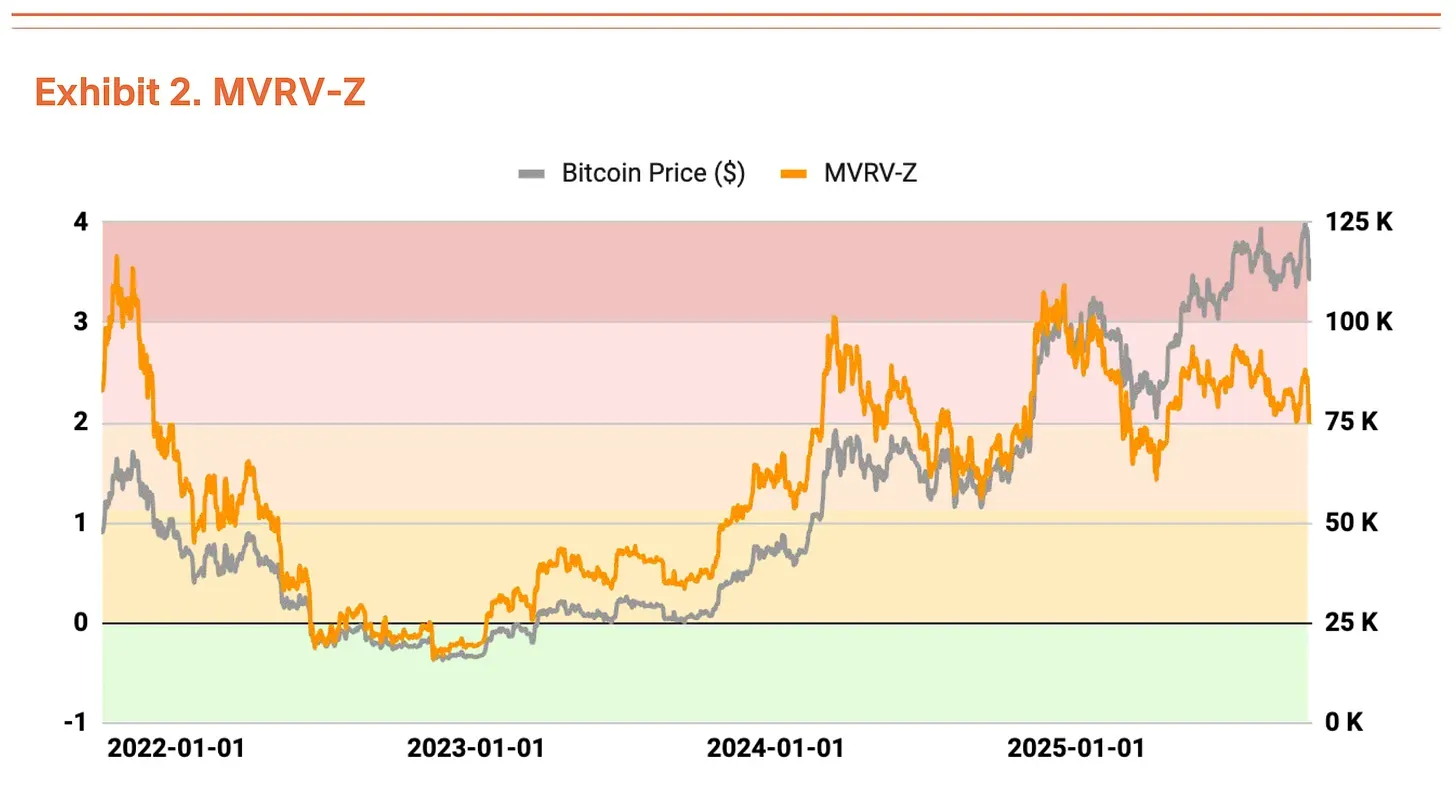

- Overheated but not yet extreme - The MVRV-Z index is 2.31, indicating that valuations are high but not yet at extreme levels. The liquidation of leveraged funds has cleared out short-term traders, creating space for the next wave of growth;

- The global liquidity environment continues to improve - the broad money supply (M2) has exceeded US$96 trillion, a record high. Expectations of a Federal Reserve interest rate cut are increasing, and it is expected that the Federal Reserve will cut interest rates 1-2 times this year.

Institutional investors buy amid US-China trade uncertainty

In the third quarter of 2025, the Bitcoin market slowed down from the strong growth in the second quarter (28% month-on-month growth) and entered a volatile sideways phase (1% month-on-month growth).

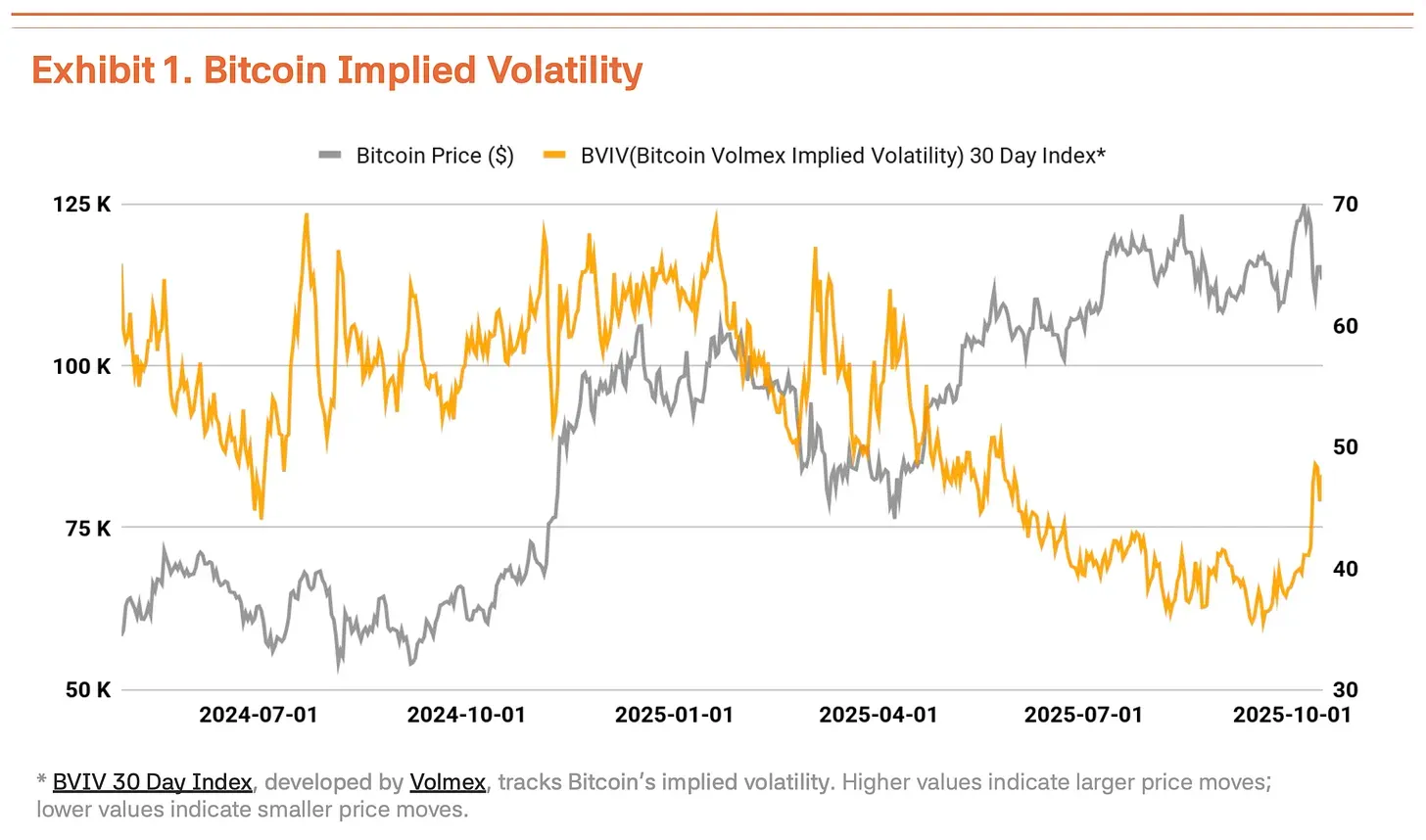

On October 6th, Bitcoin hit a record high of $126,210. However, the Trump administration's renewed trade pressure on China caused the price of Bitcoin to fall 18% to $104,000, significantly increasing volatility. According to Volmex Finance's Bitcoin Volatility Index (BVIV), Bitcoin volatility narrowed from March to September as institutional investors steadily increased their holdings, but it surged 41% after September, exacerbating market uncertainty (Chart 1).

Driven by renewed Sino-US trade friction and Trump's tough rhetoric, this pullback appears temporary. Institutional strategic buying, led by Strategy Inc. (MSTR), is actually accelerating. The macroeconomic environment also contributed to the market's recovery. Global broad money supply (M2) exceeded $96 trillion, a record high, while the Federal Reserve cut interest rates by 25 basis points to a range of 4.00%-4.25% on September 17. The Fed has hinted at one or two more rate cuts this year. A stable labor market coupled with an economic recovery has created favorable conditions for risky assets.

Institutional inflows remained strong. Net inflows into Bitcoin spot ETFs reached $7.8 billion in the third quarter. While lower than the $12.4 billion in the second quarter, the continued net inflows throughout the third quarter confirms steady buying from institutional investors. This momentum continued into the fourth quarter, with $3.2 billion recorded in the first week of October alone, a record high for weekly inflows since 2025. This suggests that institutional investors view price pullbacks as strategic entry opportunities. Strategy continued buying during the market pullback, purchasing 220 Bitcoin on October 13 and 168 Bitcoin on October 20, for a total of 388 Bitcoin in a single week. This demonstrates that institutional investors remain steadfast in their belief in Bitcoin's long-term value, regardless of short-term fluctuations.

On-chain data signals overheating, but fundamentals remain unchanged

On-chain analysis reveals some signs of overheating, though valuations are not yet worrisome. The MVRV-Z indicator (market capitalization to realized value ratio) is currently in overheated territory at 2.31, but has stabilized relative to the extreme valuation range approached in July and August (Chart 2).

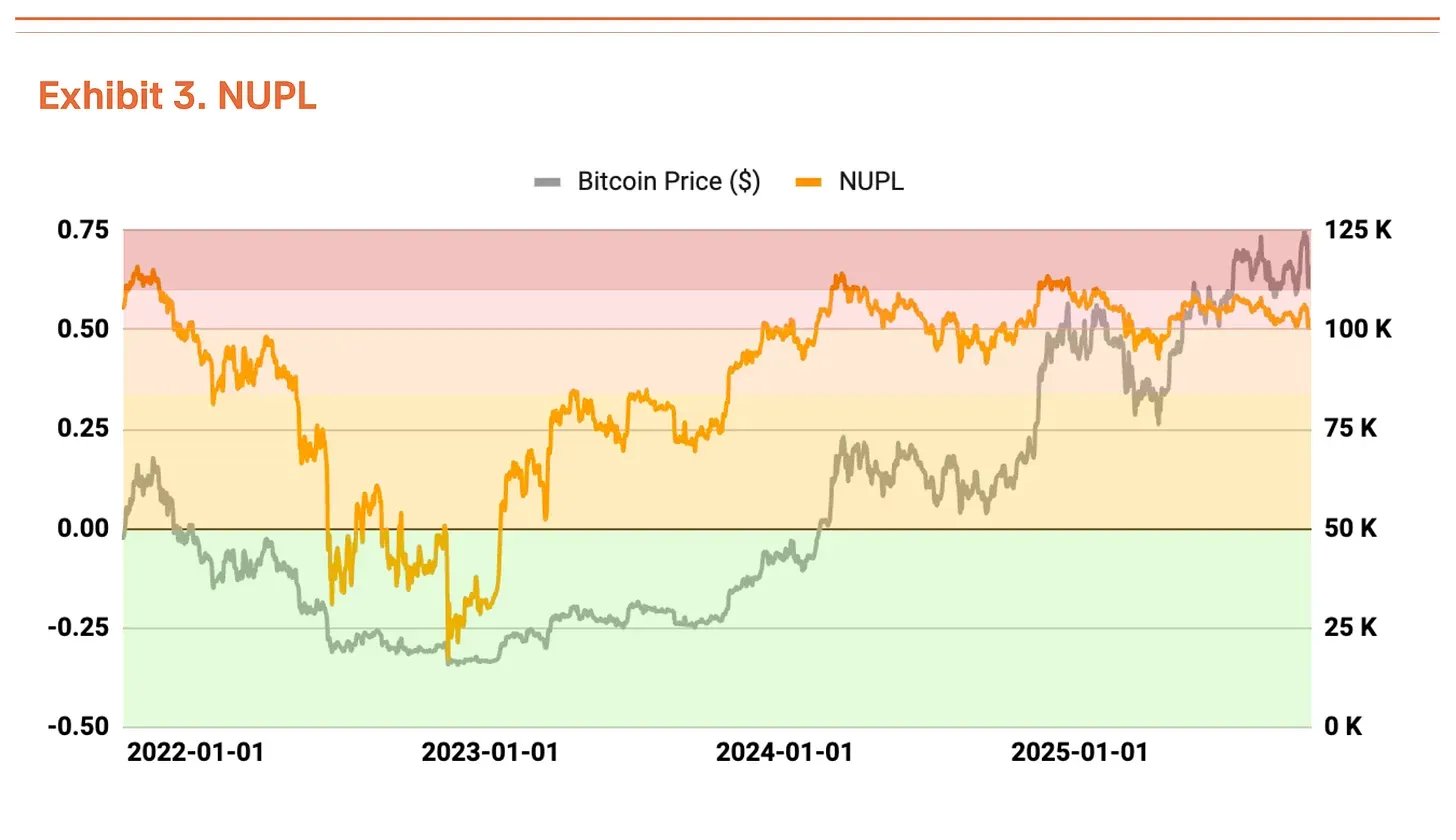

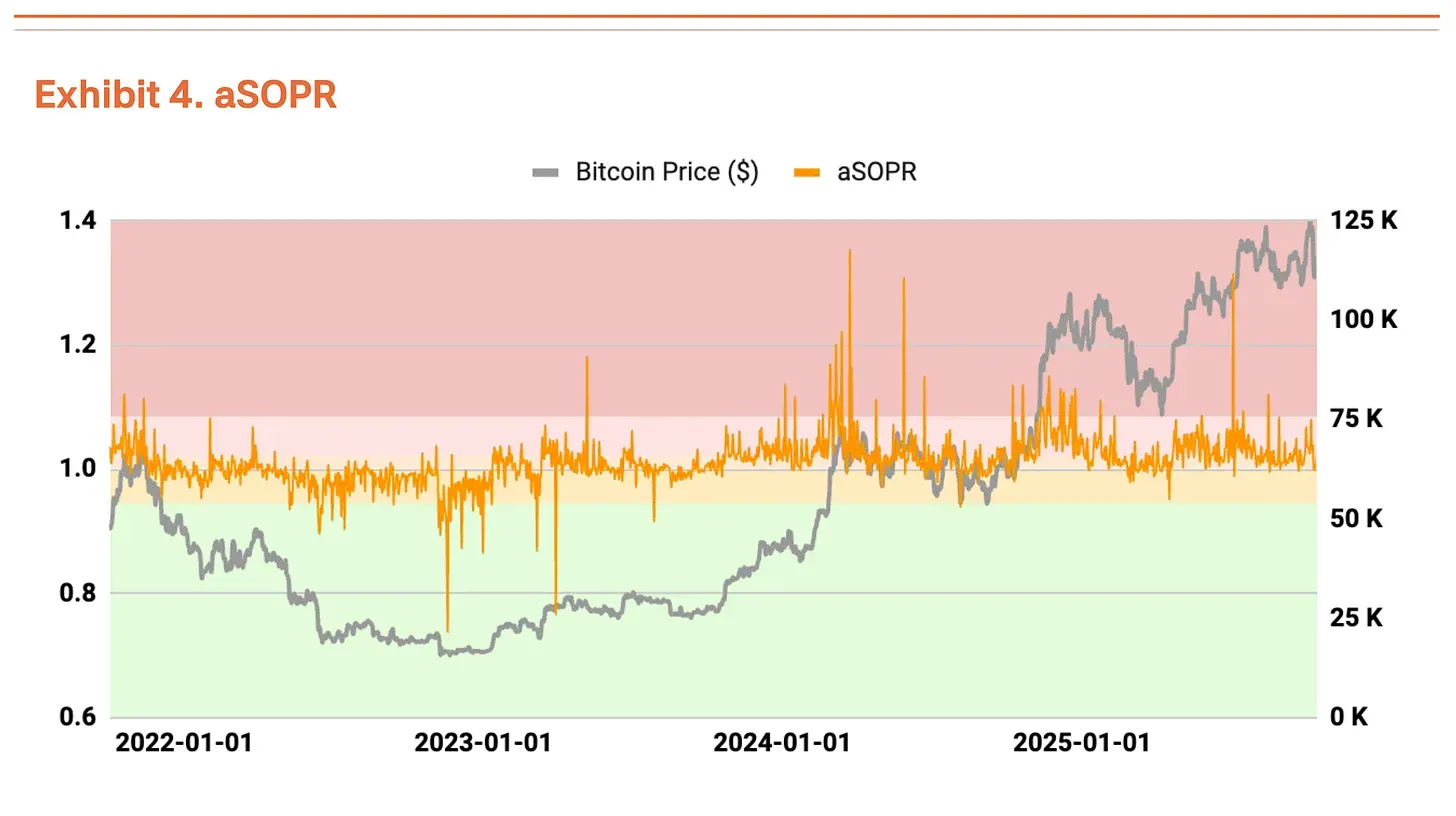

The net unrealized profit and loss ratio (NUPL) also shows signs of overheating, but has eased somewhat from the high unrealized profit levels seen in the second quarter (Chart 3). The adjusted expenditure-output profit ratio (aSOPR), which reflects investors' realized profits and losses, is very close to its equilibrium value of 1.03, suggesting no cause for concern (Chart 4).

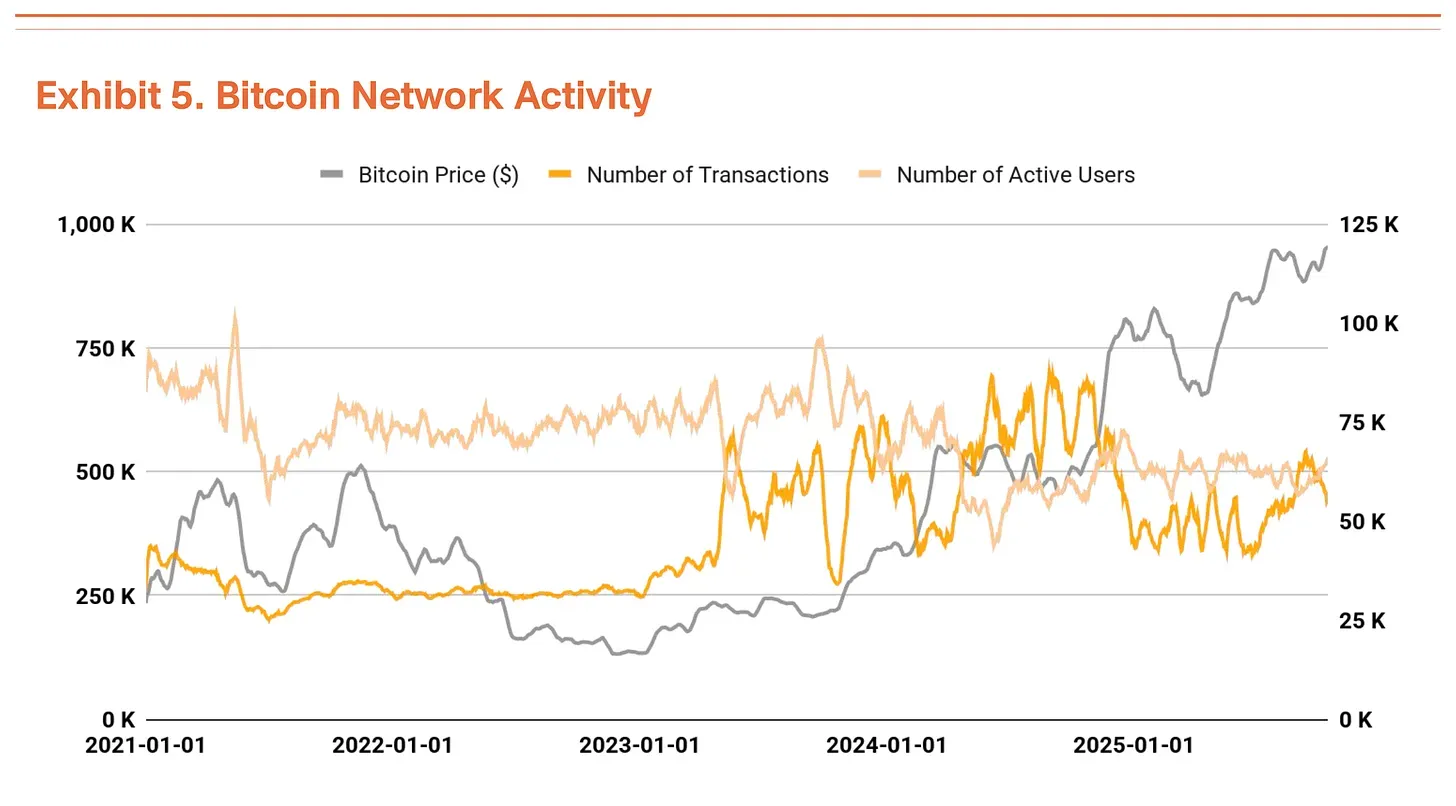

Bitcoin's transaction count and active user base remained at similar levels compared to the previous quarter, suggesting a temporary slowdown in network growth (Chart 5). Meanwhile, total transaction volume is trending upward. The decrease in transaction count and increase in transaction volume suggests that larger amounts of funds are being moved in fewer transactions, indicating an increase in large-scale capital flows.

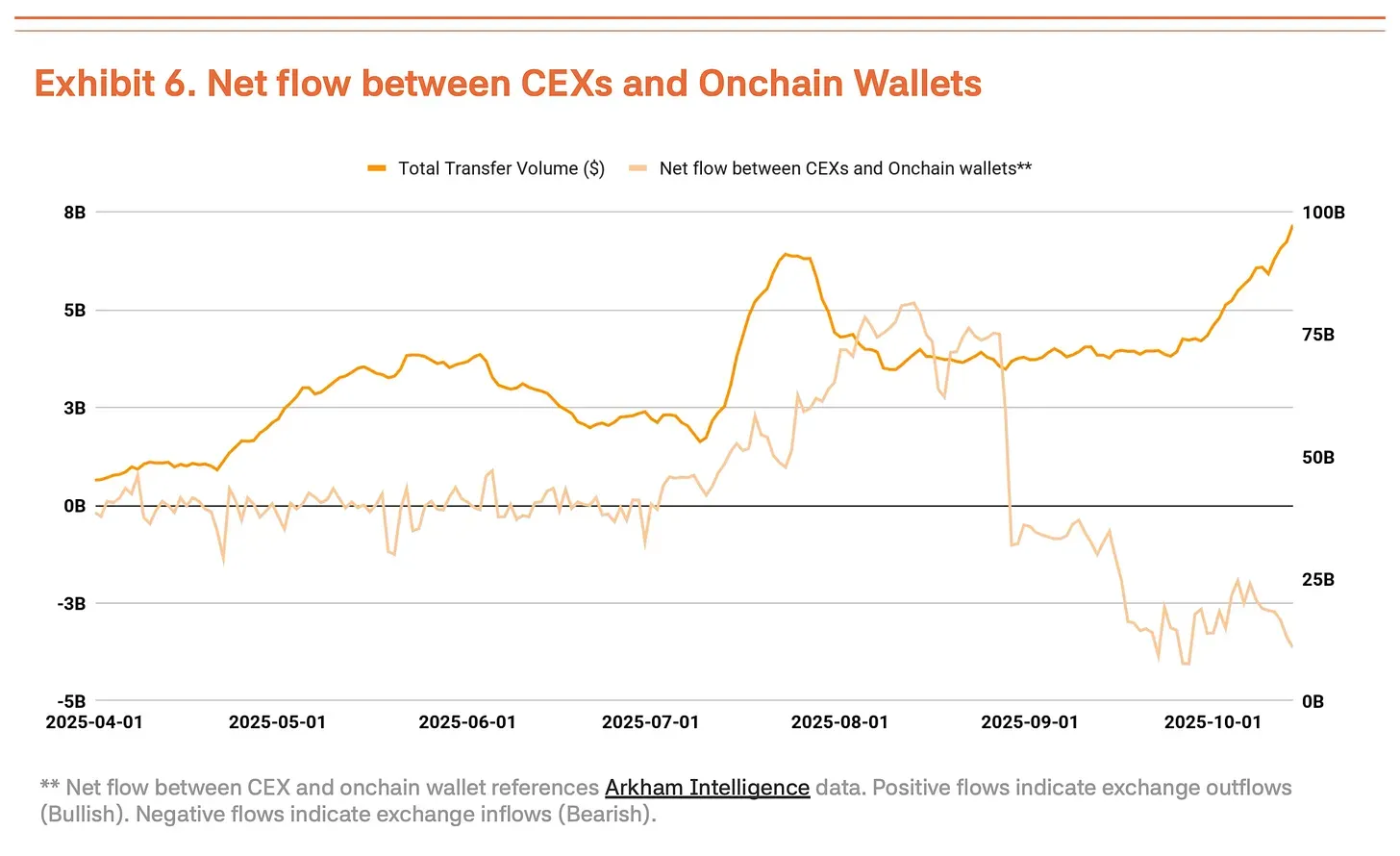

However, we shouldn't simply interpret the increase in trading volume as a positive sign. Recent increases in funds flowing into centralized exchanges often indicate that holders are preparing to sell (Chart 6). In the absence of improvements in fundamental indicators like transaction counts and active users, the increase in trading volume suggests more short-term capital flows and selling pressure amidst high volatility than genuine demand.

The October 11 crash proved that the market has shifted to institutional dominance

The collapse of centralized exchanges on October 11 (a 14% drop) demonstrated that the Bitcoin market has shifted from being dominated by retail investors to being dominated by institutions.

The key point is this: the market reaction is strikingly different from previous ones. In a similar environment at the end of 2021, panic spread among retail investors, leading to a market crash. This time, the pullback was limited. Following a large-scale liquidation, institutional investors continued to buy, demonstrating their resolute defense of the market's downside. Furthermore, institutions appear to view this as a healthy consolidation that will help eliminate excessive speculative demand.

In the short term, the sell-off will reduce the average purchase price of retail investors and increase psychological pressure, which may exacerbate volatility due to dampened market sentiment. However, if institutional investors continue to enter the market during the sideways trend, this pullback may lay the foundation for the next leg of growth.

Target price raised to $200,000

Using our TVM methodology for Q3 analysis, we arrive at a neutral base price of $154,000, a 14% increase from $135,000 in Q2. From this, we apply a -2% fundamental adjustment and a +35% macro adjustment, yielding a target price of $200,000.

The -2% fundamental adjustment reflects a temporary slowdown in network activity and an increase in deposits on centralized exchanges, indicating short-term weakness. The macro adjustment remains at 35%. Continued global liquidity expansion and institutional inflows, along with the Federal Reserve's interest rate cuts, provided a strong catalyst for the fourth quarter's gains.

A short-term pullback may be due to signs of overheating, but this represents healthy consolidation rather than a trend or shift in market perception. The continued rise in the benchmark price indicates a steady increase in Bitcoin's intrinsic value. Despite the temporary weakness, the medium- to long-term upward outlook remains solid.