BTC.b vs wBTC: In-depth comparison of technical architecture and market landscape

- 核心观点:包装比特币市场格局正从wBTC主导转向多元竞争。

- 关键要素:

- wBTC托管权变更引发信任危机。

- BTC.b采用多机构验证与实时储备证明。

- Lombard收购BTC.b开创行业并购先例。

- 市场影响:推动DeFi协议分散风险,促进技术迭代。

- 时效性标注:中期影响

In the DeFi transformation of Bitcoin, wrapped Bitcoin has become a crucial bridge connecting native Bitcoin with the smart contract ecosystem. wBTC, as the pioneer and market leader in this field, has long held a market share exceeding $8 billion. However, with Lombard's acquisition of BTC.b—the industry's first crypto asset acquisition—the market landscape is undergoing profound changes. This report will systematically compare and analyze these two mainstream wrapped Bitcoin solutions from four dimensions: technical architecture, custody models, market positioning, and regulatory risks, providing decision-making references for institutional investors and DeFi protocols.

It's worth noting that wBTC experienced a major custody dispute in 2024. This event not only exposed the inherent risks of centralized custody models but also created market opportunities for decentralized alternatives like BTC.b. In the current context of increasingly stringent regulatory environments and rising transparency demands from institutional investors, the choice of technical architecture for packaging Bitcoin is no longer merely an engineering issue but a strategic decision concerning market trust and long-term competitiveness.

Data as of October 2025

I. Technical Architecture Comparison: Centralized vs. Multi-Institutional Validation

1.1 The Single Custodian Model of wBTC and Its Evolution

Since its launch in January 2019 by BitGo, Kyber Network, and Ren Protocol, wBTC has employed a centralized custody architecture. In this model, BitGo, as the sole custodian, holds all the native Bitcoin reserves supporting wBTC. When a user wants to convert BTC to wBTC, they need to send the Bitcoin to an address controlled by BitGo through an authorized merchant. After BitGo confirms receipt of the BTC, it mints an equivalent amount of wBTC tokens on the Ethereum network. While this process is simple and efficient, it is essentially a system entirely reliant on the credit of a single entity. The wBTC held by a user is essentially a "Bitcoin IOU" issued by BitGo, and its value depends entirely on BitGo's solvency and operational integrity.

This architecture offers significant advantages in the early market environment: BitGo, as a licensed digital asset custodian, possesses mature experience in cold wallet management and insurance coverage; the single custodian model ensures high decision-making efficiency and rapid response to market demands and technological upgrades; and the standardized minting/redemption process reduces the cognitive cost for users. However, the risk of a single point of failure remains a Damocles' sword hanging over wBTC. If BitGo suffers a hacker attack, internal fraud, or regulatory intervention, all wBTC holders will face the risk of asset loss. The historical collapse of renBTC serves as a cautionary tale—when its parent company, Alameda Research, went bankrupt in the FTX incident, renBTC's value plummeted, ultimately forcing it to cease minting new coins.

In August 2024, wBTC announced a major structural change: shifting custody from single control by BitGo to a 3-of-3 multi-signature structure jointly held by BitGo, BiT Global (Hong Kong), and BiT Global's Singapore subsidiary. The initial intention behind this change was to achieve geographical decentralization and coverage across multiple jurisdictions, theoretically reducing regulatory risks associated with any single jurisdiction. However, this adjustment sparked intense controversy within the industry, primarily due to the close ties between BiT Global and TRON founder Justin Sun. Sun is highly controversial in the crypto industry, having been involved in several projects lacking transparency. His HBTC (Huobi-wrapped Bitcoin) project ultimately failed, and its current trading price is only about 13% of the BTC price at the time. This background has led many DeFi protocols to question the new custody structure.

MakerDAO's risk assessment team, BA Labs, was the first to express concern, believing that Sun's involvement brought "unacceptable counterparty risk" and even proposed completely delisting wBTC from its lending protocol. Although MakerDAO ultimately chose to tighten risk parameters rather than completely remove wBTC after communicating with BitGo CEO Mike Belshe, this incident has severely shaken market confidence in the security of wBTC custody. Coinbase subsequently announced the delisting of wBTC from its platform and quickly launched its own competing product, cbBTC. This series of chain reactions fully exposed the vulnerability of the centralized custody model in the face of a crisis of trust. Although BitGo insists that Sun cannot unilaterally move any BTC reserves and that all transactions still require BitGo's signature, the fluctuations in market sentiment have already had a substantial impact on wBTC's long-term competitiveness.

1.2 BTC.b's Multi-Institutional Security Alliance Architecture

BTC.b (originally a cross-chain Bitcoin launched by Avalanche Bridge, now acquired by Lombard) employs a completely different technological path: a network of 15 independent validators (Security Consortium). These institutions come from different jurisdictions around the world, including traditional financial institutions, crypto-native companies, and infrastructure providers, and are jointly responsible for verifying and managing the minting and redemption process of BTC.b. Unlike wBTC, where a single entity holds the private key, BTC.b's multi-signature architecture requires at least a preset threshold of validators to sign simultaneously before any fund transaction can be executed. This design fundamentally eliminates the risk of single points of failure.

A more significant innovation lies in BTC.b's integration of Chainlink's Proof of Reserve (PoR) system. Traditional asset packs often rely on periodic audit reports from custodians to prove reserve adequacy, a method plagued by time lags and difficulty in verifying authenticity. Chainlink PoR verifies the 1:1 correspondence between on-chain BTC.b issuance and off-chain Bitcoin reserves in real time through a decentralized oracle network. Any user can query the verification results at any time, achieving truly transparent management. This architectural design, in financial engineering terms, is closer to a "distributed custodian syndicate" model than the traditional "single trustee" model, significantly enhancing the system's resilience and auditability.

From a technical implementation perspective, while BTC.b's multi-institutional verification network is more complex than wBTC, this complexity translates into a higher security margin. With 15 validators distributed across different legal jurisdictions and infrastructure environments, the system can continue to function normally even if some nodes experience technical failures, regulatory intervention, or malicious activity. This "trustless" design philosophy aligns perfectly with the core values of the blockchain industry and better meets the systemic risk management requirements of institutional investors. In contrast, while wBTC's 3-of-3 multi-signature system also introduces checks and balances, the actual control remains highly centralized due to BiT Global holding two private keys, failing to fundamentally change the nature of centralized custody.

1.3 Cross-chain compatibility and infrastructure coverage

In terms of multi-chain ecosystem development, the two exhibit different strategic orientations. wBTC initially focused on the Ethereum ecosystem, later gradually expanding to chains such as Base and Osmosis, but its expansion speed was relatively conservative. BTC.b, on the other hand, adopted an aggressive multi-chain strategy after being acquired by Lombard: in addition to maintaining Avalanche as its primary deployment network, it will rapidly expand to mainstream public chains such as Ethereum, Solana, and MegaEth. This difference reflects two different market positioning—wBTC is more like the infrastructure of the Ethereum DeFi ecosystem, while BTC.b attempts to become the cross-chain Bitcoin standard for the entire industry.

It's worth noting that BTC.b's SDK has already been adopted by two major centralized exchanges, Binance and Bybit, providing them with a direct distribution channel to tens of millions of users. In contrast, while wBTC is deeply integrated into DeFi protocols like Uniswap and Aave, it lacks strategic partnerships with top-tier centralized exchanges. This difference could have a significant impact on future market competition: when mainstream exchange users want to integrate Bitcoin into DeFi, a platform that natively supports one-click minting of BTC.b will translate its user experience advantage into a market share advantage.

II. Custody Transparency and Reserve Verification Mechanism

2.1 wBTC's Audit Model and Its Limitations

wBTC employs a regular auditing model common in the traditional financial industry to ensure reserve adequacy. BitGo periodically executes "proof-of-reserve transactions" on the Bitcoin blockchain, allowing external observers to verify that custodian addresses do indeed hold the corresponding amount of BTC. Furthermore, DAO members and authorized auditing firms can review minting/burning records to ensure that the total on-chain wBTC supply matches the off-chain BTC reserves. This model aligns with traditional financial regulatory requirements in terms of compliance and auditability, and is one of the key reasons why wBTC has gained recognition from institutional investors.

However, this auditing model inherently suffers from a time lag: audit reports are typically released quarterly or monthly, preventing users from monitoring reserve status in real time. In extreme market volatility or unforeseen events, this information asymmetry can lead to market panic and a run on funds. A deeper problem lies in the fact that auditing is essentially a "post-audit" mechanism, relying on the professional competence and independence of the auditing firm. If oversights exist in the audit process or the custodian engages in fraudulent activities, the problems may not surface until the situation worsens, by which time users have already suffered losses.

The custody change controversy in 2024 further exposed the shortcomings of wBTC's auditing mechanism. Although both BiT Global and BitGo claimed that the reserve ratio was unaffected, market trust in the new custody architecture clearly declined, and some DeFi protocols began to proactively reduce wBTC's lending collateral ratio or increase liquidation thresholds. This "trust discount" reflects that the market is not entirely confident in a reserve verification mechanism that relies solely on manual auditing, especially when the custodian's reputation is tarnished, the credibility of the audit report will be questioned as well.

2.2 The advantage of BTC.b's real-time on-chain verification

BTC.b achieved a qualitative leap by integrating the Chainlink decentralized oracle network: proof-of-reserve is no longer a periodically published static report, but a continuously updated dynamic data stream. Chainlink's multi-node network periodically queries the balance of Bitcoin escrow addresses and uploads the verification results to various blockchain networks deploying BTC.b. Any user or protocol can check the latest reserve ratio at any time, without trusting any intermediaries. This architecture far surpasses traditional auditing models in terms of transparency and real-time performance, and is more in line with the crypto industry's "code is law" philosophy.

This real-time verification mechanism is crucial for risk management. When a DeFi lending protocol accepts BTC.b as collateral, the smart contract can directly access Chainlink PoR data. If the reserve ratio is detected to be below a safety threshold, the system can automatically trigger risk control measures, such as suspending new lending, increasing the collateral ratio requirement, or initiating a liquidation process. This programmatic risk control response is far faster than human decision-making, and can more effectively protect user assets during periods of abnormal market volatility. In contrast, wBTC's reserve verification relies heavily on manual processes, and there is an unavoidable time lag between identifying a problem and taking action, which can have serious consequences in the high-frequency trading environment of DeFi.

In the long run, the introduction of Chainlink PoR also establishes a "composable trust infrastructure" for BTC.b. As more and more DeFi protocols adopt PoR as a standard risk control tool, BTC.b's technological architectural advantages will translate into ecosystem integration advantages. Developers can more easily integrate BTC.b into complex DeFi strategies without worrying about reserve transparency issues. This first-mover advantage in technological standards may become a key competitive barrier for BTC.b relative to wBTC in the coming years.

2.3 Different Paths to Regulatory Compliance

Regarding regulatory compliance, wBTC and BTC.b have chosen drastically different strategies. wBTC leans towards the traditional financial compliance path: BitGo, as a licensed custodian, is subject to oversight by US regulators and submits regular compliance reports. This model has an advantage in attracting traditional institutional investors. Especially for institutions whose internal risk control processes require the use of licensed custody services, wBTC's compliance qualifications are unmatched by other alternatives. However, this centralized compliance model also brings the "risk of regulatory concentration": if US regulatory policies suddenly tighten, BitGo may be forced to freeze wBTC at specific addresses or cease services, as has precedent in practice (such as OFAC's sanctions against Tornado Cash-related addresses).

BTC.b, on the other hand, attempts to pioneer a path of "technology-driven decentralized compliance." Through a multi-jurisdictional validator network and transparent on-chain proof-of-reserve, BTC.b can meet institutional investors' requirements for transparency and security without relying on a single licensed entity. The advantages of this model lie in its stronger resistance to censorship and global accessibility, but the challenge lies in persuading institutional clients accustomed to traditional compliance frameworks to accept this new paradigm. Lombard's strategy is to partner with multiple traditional financial institutions (as part of a validator network) to provide institutional-grade compliance assurance while maintaining a decentralized technical architecture.

It's worth noting that both the EU's MiCA regulations and the US SEC's regulatory framework for digital assets are constantly evolving. In the coming years, regulators are likely to impose stricter proof-of-reserve requirements on packaged assets. In this context, BTC.b's choice of Chainlink PoR may have a forward-looking advantage—this real-time, verifiable proof-of-reserve mechanism naturally aligns with regulators' transparency requirements without relying on traditional auditing intermediaries. In contrast, wBTC may need to significantly revamp its auditing processes to meet future regulatory standards, which will incur additional compliance costs and operational complexity.

III. Differences in Market Positioning and Product Strategy

3.1 wBTC's Market Dominance and Challenges

With its first-mover advantage and deep integration into the DeFi ecosystem, wBTC has long held an absolute leading position in the packaged Bitcoin market. Its current market capitalization is approximately $14 billion, with a circulating supply of over 127,000 BTC, and it holds a core position in mainstream DeFi protocols such as Aave, Compound, and Uniswap. This market dominance has created a powerful network effect: the more protocols integrate wBTC, the better their liquidity; the better the liquidity, the more likely new protocols are to integrate wBTC rather than other alternatives. This positive feedback loop has made wBTC's market position virtually unshakeable over the past few years.

However, the custody dispute in the second half of 2024 disrupted this stable pattern. Starting with the announcement of its partnership with BiT Global in August, wBTC's market share experienced its first significant fluctuation. While its market capitalization grew from $8 billion to the current $14 billion (primarily driven by rising Bitcoin prices), market sentiment indicators showed a decline in user confidence in its long-term reliability. Protocols like MakerDAO and Aave tightening their risk control parameters, and Coinbase directly delisting and launching competing products, all indicate that cracks are appearing in the once-unbreakable wBTC ecosystem. More importantly, this controversy exposed the "non-diversifiable reputational risk" characteristic of centralized custody models—no matter how sophisticated the technical architecture, the reputation of the entire system will be affected as long as controversial parties are involved.

From a product strategy perspective, wBTC has always focused on being a "pure Bitcoin price mapping," without offering yield features. Its primary users are DeFi participants who need to trade, lend, or provide liquidity on Ethereum. This positioning makes it an infrastructure of the Ethereum DeFi ecosystem, but it also limits its growth potential—once the market demand for simple price mapping becomes saturated, it will be difficult for wBTC to expand into new markets through product innovation. Facing competitors like cbBTC, which is backed by Coinbase and has a more user-friendly experience, as well as more decentralized alternatives like tBTC, wBTC faces significantly increased competitive pressure.

3.2 BTC.b's Dual-Product Strategy and Market Opportunities

Following its acquisition of BTC.b, Lombard adopted a more aggressive market strategy: building a complete Bitcoin DeFi product matrix through BTC.b (non-yield-generating) and LBTC (yield-generating). This dual-product strategy aims to simultaneously meet the needs of two distinct user groups: conservative investors who only require pure price exposure can choose BTC.b; while aggressive investors seeking capital efficiency can choose LBTC to generate returns through staking or lending. This product portfolio strategy is attractive in both retail and institutional markets, covering a broader user base.

More importantly, by acquiring a mature asset with a market capitalization of $55 billion, 12,000 active users, and deep integration with mainstream protocols such as Aave and BENQI, Lombard achieved a rapid expansion path of "buying market share" rather than "building from scratch." This M&A strategy is almost unprecedented in the crypto industry (previous acquisitions were mostly project mergers or token swaps, not direct acquisitions of active assets and their infrastructure), and its success may create a new industry consolidation model. For Lombard, this deal not only provided immediate scale, but more importantly, it provided proven product-market fit and a complete technology stack, significantly reducing the time and market education costs of promoting new products.

From a market timing perspective, BTC.b's expansion coincides with a trust crisis facing wBTC. As some DeFi protocols proactively reduce their reliance on wBTC for risk management reasons, they need to find alternatives, and BTC.b, with its more decentralized architecture and real-time reserve verification, becomes the most natural choice. This "alternative demand" is likely to continue to be released over the next 12-18 months, providing BTC.b with a valuable market window. If Lombard can rapidly advance multi-chain deployments, expand DeFi protocol integration, and maintain a zero-security-incident record during this critical period, BTC.b has the potential to leap from a "niche alternative" to a "mainstream option."

3.3 Comparison of Target Users and Application Scenarios

wBTC's primary user base consists of native Ethereum DeFi participants: they are familiar with smart contract operations and need to trade on DEXs like Uniswap, lend on Aave, or provide liquidity on Curve; for them, wBTC is "Bitcoin's Ethereum counterpart." This user group is relatively less price-sensitive (because wBTC is a tool-like asset rather than an investment target in most scenarios), focusing more on liquidity depth and protocol integration breadth. For these users, wBTC remains the optimal choice due to its years of accumulated liquidity advantages and extensive protocol support.

BTC.b aims to attract a broader user base, including not only native DeFi users but also CEX users and institutional investors with traditional financial backgrounds. Through integration with Binance and Bybit's SDKs, BTC.b lowers the barrier for users to enter DeFi from CEXs; through a multi-institutional verification network and real-time proof-of-reserve, BTC.b meets the stringent transparency and security requirements of institutional investors; and through a dual-product strategy (BTC.b + LBTC), Lombard offers customized options for users with different risk appetites. This ambitious "full coverage" strategy is correspondingly more difficult to implement—requiring simultaneous efforts across multiple dimensions, including product experience, security, and market education.

From an application perspective, wBTC is currently primarily used for trading, lending, and liquidity mining within DeFi protocols. BTC.b, on the other hand, aims to expand into more scenarios: offering Bitcoin staking rewards through LBTC to attract long-term holders; deploying across multiple chains to cover high-performance public chains such as Solana and Avalanche to meet low-cost trading needs; and collaborating with traditional financial institutions to explore compliant institutional-grade products. If these scenarios are successfully expanded, BTC.b's market potential will be significantly greater than wBTC's, making it not only a competitor in the "packaging Bitcoin" field but also a builder of "Bitcoin capital market infrastructure."

IV. Evolution of the Industry Landscape: From a Single Dominant Player to Diverse Competition

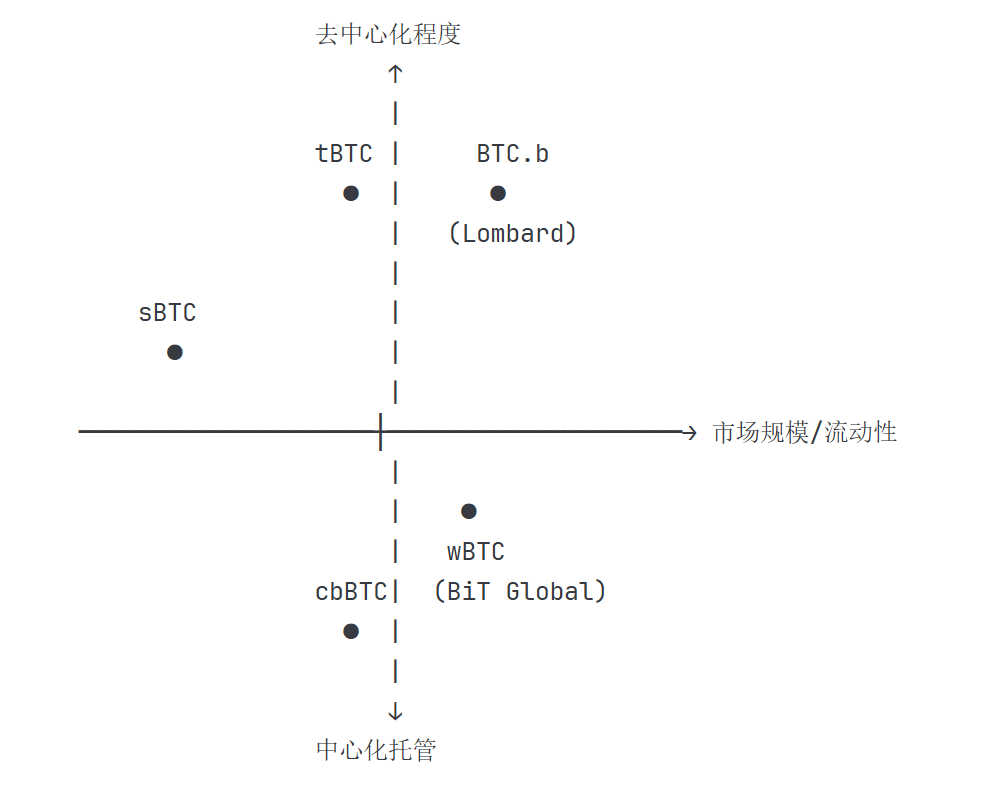

From a broader perspective, the Bitcoin wrapping market is undergoing a structural shift from "wBTC dominance" to "multiple solutions coexisting." This change is driven not only by technological innovation but also by the market's inherent need for risk diversification. When a single wrapped asset holds an excessively high market share, the entire DeFi ecosystem faces systemic risk—if wBTC encounters problems, lending protocols relying on it as collateral and liquidity pools based on it will be impacted. Therefore, mainstream DeFi protocols have an inherent incentive to support the coexistence of multiple Bitcoin wrapping solutions to achieve risk hedging.

This diversification trend benefits challengers like BTC.b, as they don't need to completely replace wBTC; they can survive and thrive by establishing an advantage in specific market segments. For example, BTC.b could focus on DeFi protocols with the highest demands for decentralization and transparency, or concentrate on emerging public blockchain ecosystems (such as Solana and Avalanche), while temporarily leaving the mainstream Ethereum market to wBTC. This "differentiated competition" strategy is less risky and more realistic. By establishing differentiated advantages in different dimensions, BTC.b can gradually expand its market share without having to directly confront wBTC.

In the long run, the Bitcoin packaging market may present a pattern of "2-3 mainstream solutions + several niche solutions": wBTC will continue to occupy a significant market share due to its first-mover advantage and deep integration, but will no longer be a monopoly; cbBTC will leverage Coinbase's platform effect to secure a place in the institutional market with high compliance requirements; and decentralized solutions such as BTC.b will establish differentiated competitive advantages in terms of technological advancement and transparency. This diversified pattern is healthy for the entire DeFi ecosystem because it reduces the risk of single points of failure while promoting continuous iteration of technological and product innovation.

V. Conclusion and Investment Implications

5.1 Paradigm Competition in Technical Architecture

The competition between wBTC and BTC.b is essentially a competition between two technological paradigms: the efficiency advantage of centralized custody versus the security advantage of decentralized architecture. wBTC achieved an efficient minting/redemption process and a mature compliance framework through a single custodian model, which was the optimal solution in the early market environment. However, with the maturation of the DeFi ecosystem and the increasing demand for transparency from users, the risk of single points of failure and trust dependence issues have become increasingly prominent. The custody dispute in 2024 was a concentrated outbreak of this contradiction.

BTC.b's choice of a multi-institutional verification + real-time proof-of-reserve approach represents a deeper application of the crypto industry's "trustlessness" concept in the asset packaging field. While this architecture is more complex and has higher coordination costs than centralized models, it fundamentally eliminates the risk of single points of failure and ensures transparency through technological means (Chainlink PoR) rather than manual processes. This technological approach aligns better with the long-term development direction of the blockchain industry and is more adaptable to potential future regulatory requirements.

From an investment perspective, both solutions have their applicable scenarios and target customers. For users who require maximum liquidity, the broadest protocol support, and have relatively relaxed requirements for custodian trust, wBTC remains the most practical choice; for users or protocols that prioritize decentralization, transparency, and long-term security, BTC.b offers an alternative that better aligns with their values. A rational market strategy might be to diversify risk between the two rather than concentrating all exposure on a single solution.

5.2 Lombard's Strategic Opportunity Window

Lombard's acquisition of BTC.b and the creation of a dual-product strategy (BTC.b + LBTC) demonstrate a clear market ambition: not only to secure a place in the Bitcoin packaging sector, but also to become a major builder of the "Bitcoin capital market infrastructure." The success of this strategy hinges on several key factors: the ability to expand BTC.b's circulating supply by 3-5 times within the next 12-18 months, reaching $1.5-2.5 billion; the ability to successfully advance multi-chain deployments and establish sufficient DeFi protocol integration within mainstream ecosystems such as Ethereum and Solana; the ability to maintain a zero-security-incident record, proving the reliability of its multi-institutional verification architecture; and the ability to attract a large number of long-term holders through LBTC's yield products, achieving differentiated expansion of its user base.

If these goals are achieved, Lombard has the opportunity to challenge wBTC's market dominance within 3-5 years. More importantly, through the acquisition of BTC.b, Lombard has pioneered a new model for M&A in the crypto industry: acquiring active assets with actual product-market fit and a user base, rather than simple token mergers or technology acquisitions. If this model proves successful, it could trigger a wave of industry consolidation, driving the crypto market from a phase of "fragmented competition" to one of "strategic mergers and acquisitions."

For DeFi protocols, over-reliance on a single wrapped Bitcoin asset has proven to pose systemic risks. It is recommended that mainstream lending protocols, DEXs, and liquidity pools, while supporting wBTC, gradually integrate alternatives such as BTC.b and cbBTC to achieve risk diversification. Specific approaches could include: setting differentiated collateral ratios and liquidation parameters for different wrapped Bitcoins to reflect their varying risk characteristics; promoting balanced development of multiple wrapped Bitcoins through liquidity incentive programs to avoid excessive market concentration; and establishing a dynamic risk assessment mechanism to monitor the proof-of-reserve and custody status of each wrapped asset in real time.

For both ordinary users and institutional investors, the following factors should be considered when choosing a Bitcoin wrapping solution: Liquidity needs – for frequent large transactions, wBTC's liquidity advantage remains irreplaceable; Security preferences – for those who highly value decentralization and transparency, BTC.b's technical architecture is more attractive; Yield needs – for those who want their Bitcoin assets to generate returns, LBTC is one of the few available options; Compliance requirements – if the institution mandates the use of licensed custody services, wBTC or cbBTC are more suitable; Holding period – short-term arbitrage trading is less sensitive to the custodian's reputation, while long-term holdings should prioritize security and transparency.

The most important investment principle is: do not concentrate all assets in a single wrapped Bitcoin solution. Just as diversification of native crypto assets can reduce portfolio risk, a diversified strategy should also be adopted in the wrapped Bitcoin space. wBTC's liquidity advantage and BTC.b's technological advantage can complement each other. By combining them, you can enjoy the trading convenience brought by high liquidity while reducing the risk of loss if a single custodian encounters problems. For holders with large positions, it is recommended to diversify 30-50% of their wrapped Bitcoin exposure across 2-3 different solutions to achieve risk hedging.