In-depth analysis of Fluid: The king of lending + DEX fusion, a severely underestimated crypto infrastructure.

- 核心观点:Fluid集成DEX与货币市场,优势显著。

- 关键要素:

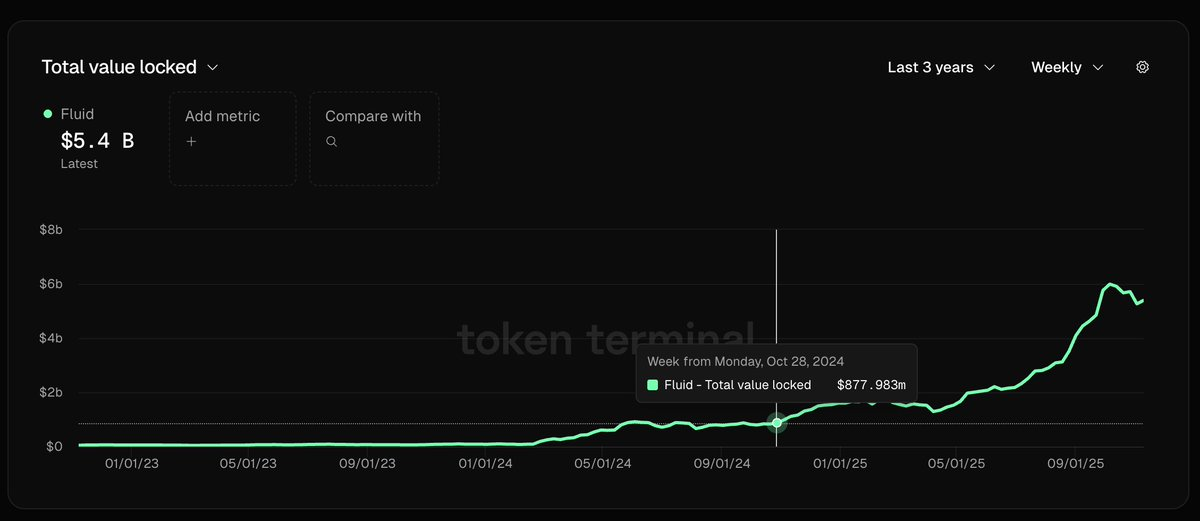

- TVL增长515%,收入超千万美元。

- 智能抵押与债务机制创造额外收益。

- DEX V2将支持波动性交易对。

- 市场影响:或成顶级DEX,推动DeFi创新。

- 时效性标注:中期影响

Author | @litocoen

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

A year and a half ago, I wrote my first article about Fluid. Back then, it was called Instadapp, and its token price was $1.74. Today, Fluid is widely recognized as one of the blue-chip cryptocurrency markets in the crypto space and ranks among the top three DEXs across the entire crypto industry. The FLUID token price has increased by 133% (compared to Instadapp's 130%), and at its peak, it surged by as much as 450%.

Although its final development trajectory did not entirely align with my initial vision, it still outperformed many tokens from the same period.

More importantly, Fluid's adoption metrics continue to show strong momentum:

Since Fluid DEX launched a year ago, Fluid's TVL (Total Value Locked) has increased by 515%.

This article aims to briefly summarize the current stage of the project and its future development direction.

Review of major progress

- Fluid became the third-largest lending protocol by active lending volume and the fourth-largest DEX by trading volume.

- Aave DAO has invested in Fluid and is collaborating on strategic projects such as GHO liquidity.

- Fluid launches on Solana, partnering with Jupiter to release "Jupiter Lend".

- Fluid holders have earned over $10 million annually.

- FLUID is already listed on Upbit, Bybit, and OKX, and will soon be available on Coinbase.

- Fluid launched a token buyback program , and within just two months, it has already repurchased 0.5% of the total supply.

What makes Fluid unique?

In short, Fluid is the first money market to integrate a DEX. In this system, assets in the money market can be used as collateral or as debt; at the same time, these assets can also participate in liquidity provision, thereby earning transaction fees.

Since its launch, lenders and borrowers on the Fluid platform have earned an additional $25 million through the so-called "Smart Collateral" and "Smart Debt" mechanisms. You don't need to be a rocket scientist to understand the logic: on Fluid, you can use collateral that earns extra fees , and debt with lower costs (due to transaction fee deductions). As shown in the image below, my USDC-USDT debt position enjoys a discounted interest rate of -0.4%.

Debt positions provide liquidity and earn transaction fees.

How can debt generate transaction fees?

This part often confuses many people because the mechanism is completely new and its logic is quite different from other lending agreements. How can one both lend money, withdraw and spend it (even in the real world), and still get a discount on transaction fees?

In other words, how can assets (i.e. liabilities) that have already "left the account" still participate in providing liquidity?

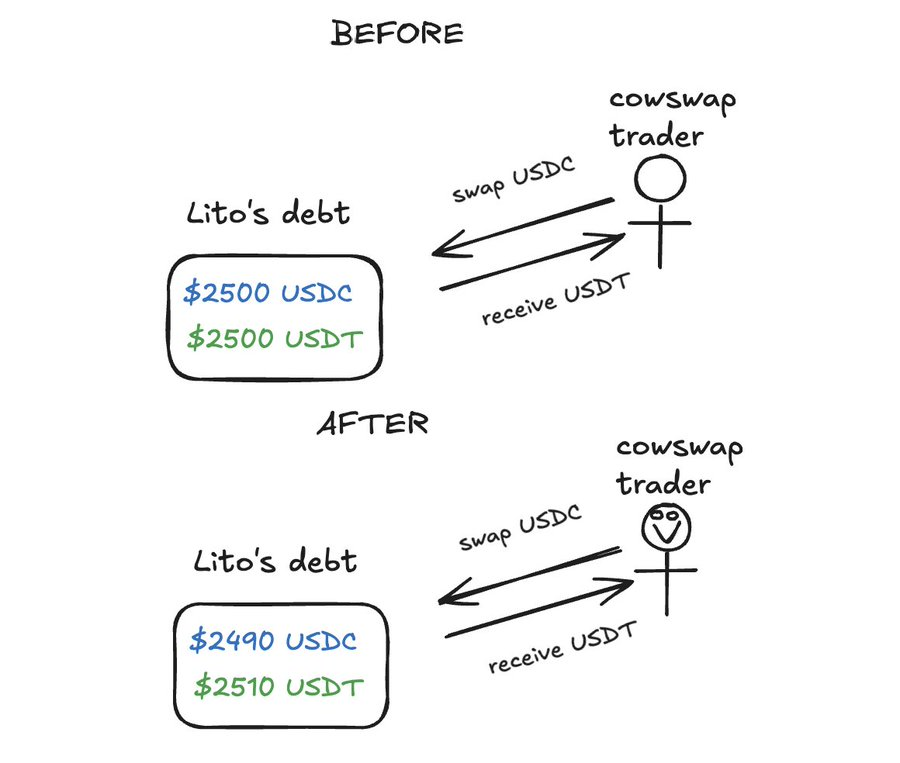

Like all debts, my debt is a liability to Fluid. When I opened a USDT–USDC Smart Debt position on Fluid, I was essentially expressing the following statement: " I am willing to hold a debt in USDT and/or USDC, and I don't care about the specific composition of the debt. " I treat these two assets as equivalents, so it makes no difference to me whether I end up repaying $5,000 USDT or $5,000 USDC.

Based on this setup, Fluid can leverage the excess liquidity in its liquidity layer to make assets available to external traders—after the transaction is completed, all that's needed is to adjust the composition of my debt.

For example: Suppose I borrowed $5,000 worth of USDT-USDC and withdrew the money to buy a watch in the real world—that money has already been spent.

Next, a trader on Cowswap wanted to exchange 10 USDC for USDT, and the transaction was routed to Fluid's USDT–USDC debt pool. The trader deposited USDC into Fluid's liquidity layer and withdrew USDT—the trader was satisfied.

How external transactions can change my debt structure through Fluid DEX

At this point, my debt still exists, but its composition has changed . As shown in the diagram above, I now owe slightly less USDC and slightly more USDT. In fact, I also earn some transaction fees, which offset or even completely cover my borrowing costs. However, for the sake of simplicity, we will not consider the transaction fees here.

Fluid's ability to utilize assets more efficiently and generate additional income makes it the best place to deposit collateral and borrow money. This also makes Fluid the top DEX for stablecoin trading pairs.

Examples of typical "smart collateral/smart debt" pools (all fully subscribed).

Compared to Curve, the LPs (Liquidity Providers) on Fluid are:

- You can earn both loan interest and transaction fees from your assets simultaneously.

- Leverage can be applied to LP positions to increase returns;

- Even the debt itself can generate transaction fees.

To illustrate the advantages of this model, consider the following scenario: On Curve, the annualized return (APR) of transaction fees in the USDC–USDT pool is 0.6%. Normally, no one with a modicum of common sense would deposit stablecoins into that Curve pool, since depositing them directly into Aave would yield a 4% return. However, on Fluid, you would gladly use this 0.6% debt yield to reduce your borrowing costs or make your collateral more efficient.

In other words, the opportunity cost for LPs on Fluid is zero —since they would have deposited collateral or borrowed anyway, any marginal reduction in capital costs is worthwhile and results in a positive net return. This means Fluid's "cost structure" is lower than all its competitors, allowing it to offer stablecoin swaps at a lower cost.

The upcoming major catalyst: DEX V2

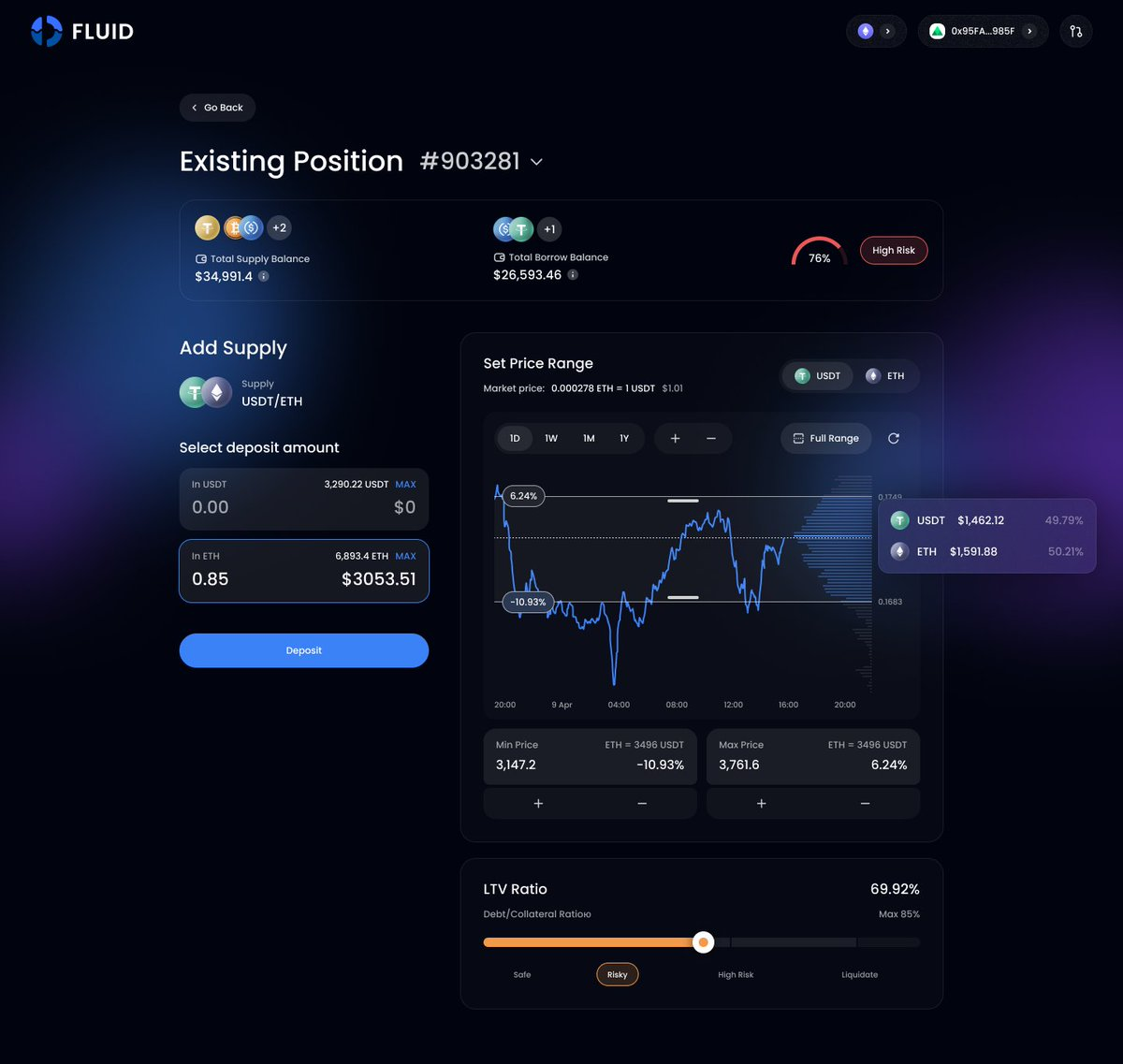

Early Preview: DEX V2 with Custom Ranges

Previously, Fluid's DEX used a centralized liquidity mechanism similar to Uniswap V3, but the liquidity range within each pool was set by governance when the pool was created, resulting in a fixed range. This design was perfectly adequate for stablecoin trading pairs that did not require active position management, but it was not suitable for trading pairs with higher volatility.

From a revenue perspective, more volatile trading pairs are more attractive to Fluid. You only need to look at the top protocols on DeFiLlama ranked by holder revenue to understand this: three of the top ten are spot exchanges (Pancakeswap, Aerodrome, and Uniswap, the latter of which will take effect after the fee conversion is implemented).

Therefore, I believe that after the release of DEX V2, Fluid has the opportunity to become the number one DEX in the entire crypto space.

Why?

In short, Fluid DEX V2 will outperform its competitors in every aspect.

Let's look at a few example liquidity pools:

1) A typical volatility altcoin pool, such as LINK/USDC (debt-free): Everything is the same as Uniswap, but note that the USDC in the pool will earn a native yield of 5% from the liquidity layer.

Result: Fluid is better.

2) An ETH/USDC smart collateral pool that allows you to borrow USDC.

Result: Fluid is better.

3) An ETH/USDC smart collateral pool, leveraged through USDC/ETH smart debt (this is only suitable for experienced market makers who love leverage and can hedge impermanent loss).

Result: Fluid is better.

Custom price ranges also allow for some interesting operations, such as setting "stink bid" limit orders on tokens like FLUID to protect against crashes like 10/10, while the USDC in your limit order can earn yields from the Fluid liquidity layer. This is simply impossible on CEXs because idle funds placed on CEXs always incur opportunity costs.

In a blog post a few months ago, Fluid also stated that DEX V2 would introduce dynamic fees (which allow for differentiated pricing of liquidity when volatility spikes, thus generating more revenue), multi-token collateral baskets (imagine using ETH, XAUT, and ENA-ETH LP as collateral), and Hooks for MEV capture, among other features.

Finally, DEX V2 also seems to pave the way for a whole host of cool new protocols in the future, such as perpetual contract protocols (which Samyak hinted at in the Fluid TG group), and making stablecoin pair trading more efficient.

Price Target

My baseline assumption is that DEX V2 will increase Fluid's revenue tenfold from its current level of approximately $12 million to over $100 million. It sounds crazy, but if you look at the market size, this expectation isn't actually exaggerated.

For example, yesterday alone, the ETH/USD trading pair on Ethereum generated $800 million in trading volume , bringing in approximately $400,000 in fees for LPs. If we assume Fluid only holds 50% of this market share and charges a 10% fee, that would generate an additional $7 million in revenue annually (almost double its current revenue). This only includes ETH on Ethereum, not L2, Solana, or other assets such as BTC, SOL, and blue-chip altcoins.

I believe FLUID remains one of the most worthwhile tokens to bet on in the following key trends:

- Stablecoins (the most important infrastructure for stablecoin trading)

- Forex on the blockchain (see the signals of collaboration with Plasma, Arc, etc.)

- Solana DeFi Exposed

- DEX and Money Market

My "crystal ball" prediction: FLUID will reach $20 within the next 6 months. If you ask me for the real target price, it will be much higher (a comparison valuation with Uniswap would put it at around $70). But I've learned from past experience that my price predictions tend to be overly optimistic—a mistake I don't want to repeat. I believe a more reliable approach is to base it on revenue forecasts and let everyone build their own assumptions based on those figures.

Frequently Asked Questions (FAQ)

Why does FLUID's performance look "poor" despite its significant growth?

The best explanation I can think of right now is that Pantera has sold nearly $30 million in the past 14 months because they need to recoup that investment from 2019 to their LPs (limited partners).

What is the FDV of FLUID?

Fluid has a market capitalization of approximately $300 million and an FDV of $300 million. The DAO still holds approximately 25% of the token supply, which should not be included in the current market capitalization or FDV, as these tokens are not intended to be sold in the near future.

Will DEX v2 be an immediate success?

I believe it will take at least three months to complete the integration of upstream aggregators and the migration of liquidity, thus revealing the full potential of DEX v2. However, we will certainly see some promising data and initial signals during this process.

Will DEX v2 be released on Solana?

Yes. Currently, Fluid has only launched its lending protocol on Solana. They will not launch DEX v1 on Solana, but will go directly to DEX v2. Given Solana's spot trading volume, this could be a significant driver of fees.