Zcash surged 10 times in a short period; is the privacy sector becoming the next narrative?

- 核心观点:Zcash暴涨预示隐私支付赛道爆发。

- 关键要素:

- 币价两月涨超10倍突破关键阻力。

- 监管压力催生隐私资产刚性需求。

- Arthur Hayes预测引发市场FOMO情绪。

- 市场影响:推动隐私币板块集体上涨。

- 时效性标注:中期影响

Introduction: When the market's attention focuses on a long-dormant cryptocurrency and witnesses its astonishing more than 10-fold increase since the end of September, this is by no means a coincidental speculation. Zcash's rapid rise not only sounds the rallying cry for the narrative of "financial privacy," but also heralds the explosion of a brand-new sector.

I. The Real Performance of Zcash's Surge: Frenzied Price and Soaring On-Chain Adoption

This frenzy led by Zcash is not just a price game, but also powerful proof of real user demand and the growth of on-chain activity.

1. Price Performance: Rebuilding Market Confidence

After years of dormancy, Zcash (ZEC) staged a breathtaking "epic awakening" in the past month. From a long period of stagnation, the price surged more than tenfold in just two months , reaching $560 at the time of this writing.

The most crucial signal of this frenzy lies in ZEC's successful and decisive breakthrough of the four-year-long bear market downtrend resistance line (see the key turning point in the chart). This is not only a historic technical breakthrough, but also sends a clear signal to the market—the sleeping giant in the privacy sector has fully awakened, immediately triggering massive speculative buying and algorithmic trading, pushing ZEC into the new spotlight.

Coingecko: ZEC price chart showing an astonishing curve of over 10 times the price increase from its lows in just two months.

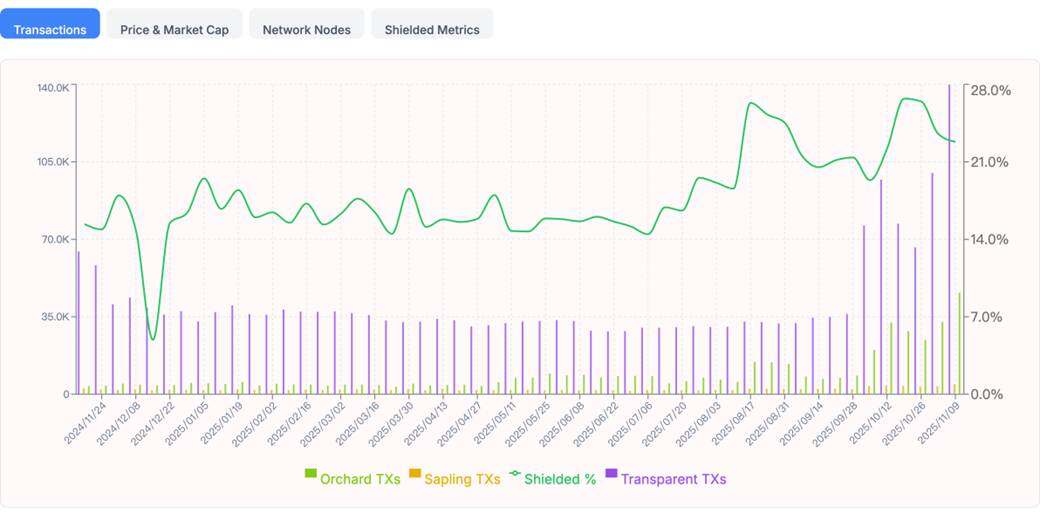

2. The golden signal from on-chain data: a surge in privacy adoption.

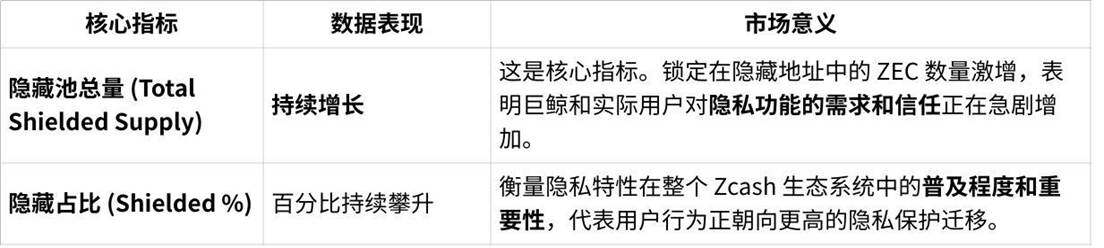

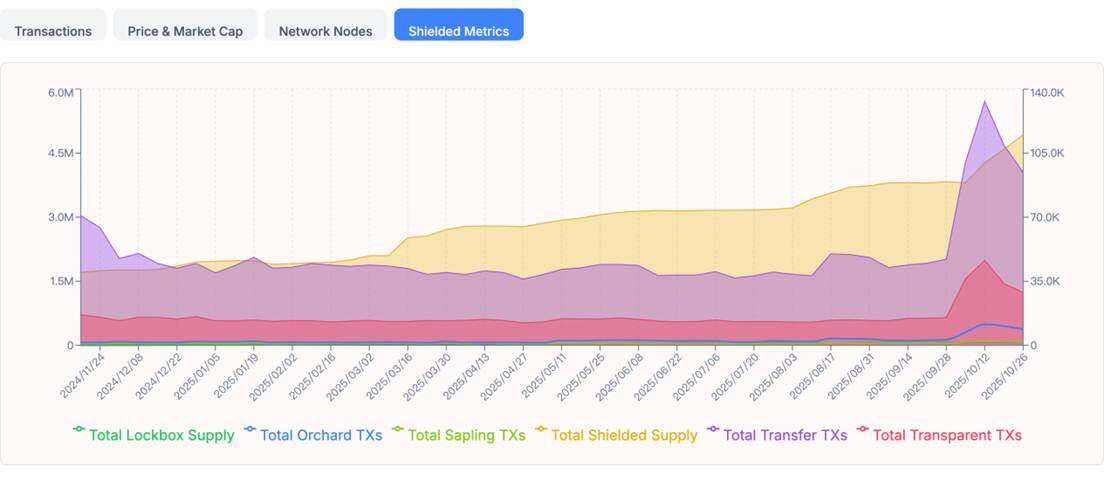

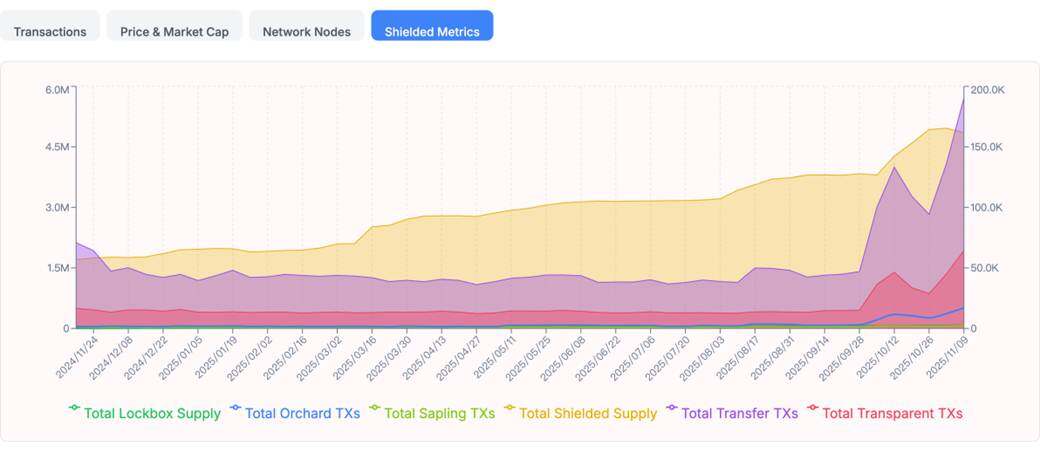

Equally important as the price surge are the positive changes in Zcash on-chain data. This data is the most authentic proof of the "return to privacy narrative":

zechub: Zcash hidden pool data

zechub: Zcash hidden pool transaction data

II. Core Reasons for the Surge: Macroeconomic Trends, Technological Awakening, and Celebrity Inspiration

Zcash's surge is the result of a combination of factors: fundamentals, macroeconomic trends, technical signals, and the influence of top KOLs. These factors collectively fueled this market frenzy.

1. Macroeconomic Background and Scarcity Expectations: The Call of the Times and the Approaching Halving

A. A surge in rigid demand under regulatory pressure:

As global regulators tighten their oversight of cryptocurrencies (such as KYC and on-chain tracking requirements) , the "nakedness anxiety" in the digital finance world has been amplified. This demand to combat censorship and protect individual financial sovereignty has reignited a strong and rigid market demand for privacy-preserving assets . Zcash, as a leader in adopting zero-knowledge proof technology (zk-SNARKs), has become a focal point for capital inflows.

B. Halving scarcity expectation: reduced selling pressure

Zcash is expected to undergo a block reward halving in November 2025. The halving will not only reduce selling pressure from miners but also create strong scarcity expectations in the market, triggering behavior similar to that before Bitcoin's halving. Traders recognize this as a prime opportunity to position themselves with ample liquidity and a clear narrative.

2. The Resonance of Technology and Capital: Long-Term Accumulation and Grayscale's Strategic Deployment

A. Awakening and breakthroughs at the technological level:

ZEC prices have successfully broken through a long-term descending resistance line that had persisted for four years, signaling a shift from a long-term bearish to a bullish outlook. During the prolonged bear market, ZEC underwent years of consolidation and troughing, allowing institutional and early investors ample time to accumulate positions . Once the price broke through this key technical resistance level, it immediately triggered numerous short-selling liquidations and algorithmic buy signals.

B. The support of institutional interest: Grayscale's trust effect

Grayscale Investments has decided to allow accredited investors to invest in the Grayscale Zcash Trust . This move has significantly increased institutional interest and speculative sentiment in the market. Grayscale's endorsement marks the formal entry of privacy assets into the view of large funds, paving the way for subsequent large-scale capital inflows .

3. A Top Opinion Leader's "Prophecy": Arthur Hayes Ignites FOMO

Of all the factors, BitMEX co-founder Arthur Hayes ’ publicly bullish analysis was undoubtedly the most crucial catalyst that ignited retail investors’ FOMO sentiment.

A. A highly impactful $10,000 prediction

Hayes published a bullish analysis predicting that ZEC could reach $10,000 in the next privacy cycle, a very high target price that has attracted significant market attention. His core argument is: " The four-year cycle is dead, the liquidity cycle lives on ." He positions Zcash as "insurance against Bitcoin's transparency," fundamentally elevating ZEC's investment value and narrative. Recently, Hayes also tweeted: "Due to the rapid price increase, ZEC has become the second-largest liquid holding in Maelstrom's (his family office) portfolio, second only to Bitcoin."

B. Impact Review: Proof of the Hayes Effect

Arthur Hayes is widely regarded as one of the most influential opinion leaders in the crypto world. As the co-founder of BitMEX, he is known for his independent and macro-level market views, and his analytical articles and public statements are frequently cited by mainstream crypto media, indeed having a certain influence on short-term market sentiment.

1. Macro Narrative and Long-Term Beliefs: A Million-Dollar Bitcoin Prediction

In May 2025, Hayes predicted on his personal blog and in subsequent media interviews that Bitcoin could reach $1 million by 2028 , a view that was subsequently widely reported by media outlets such as CoinTelegraph, The Defiant, and Decrypt. He pointed out that the main drivers of Bitcoin's price were global liquidity (especially dollar liquidity) and the expansion of central bank balance sheets , not just the halving mechanism. This macro perspective added strong logical consistency and foresight to his market analysis.

2. HYPE Token Prediction: From Commentary to Market Reaction

In August 2025, Hayes publicly stated at the WebX 2025 conference that he was bullish on HYPE, the native token of the decentralized derivatives protocol Hyperliquid, believing it could achieve a 126-fold increase within the next three years. This statement quickly sparked heated discussions in the community and was reported by media outlets such as CoinMarketCap and Yahoo Finance. While the short-term impact could not be precisely quantified, CoinMarketCap data showed that HYPE's price did rise slightly in the week following Hayes's statement, which some market observers attributed to the increased FOMO (Fear of Missing Out) sentiment brought about by the "Hayes effect." In September 2025, according to CoinMarketCap, Hayes sold some of his HYPE holdings, realizing a profit of approximately 19.2% . Although this transaction was a short-term operation, it was seen in the market as a typical example of his strategy for managing speculative cycles and liquidity, further reinforcing the market perception of the "Hayes effect."

4. The combined endorsement of top talent and technology: an amplifier of belief.

Following Hayes's prediction, more of the industry's most influential figures endorsed it, further solidifying market confidence.

• Well-known investors such as Naval Ravikant have publicly expressed their support.

• Support from Mert Mumtaz, former Coinbase engineer and CEO of Helius. Mumtaz emphasized that Zcash's upcoming technical upgrade will improve performance by 1000 times , reigniting enthusiasm for its zk-SNARK-based privacy architecture.

III. The team's reaction after the surge

Zcash's development and support entities (ECC and Zcash Foundation) avoid directly commenting on prices, but emphasize its core technological advantages and fundamental strengths for continued growth .

• Expansion of Core Development Force (Project Manhattan): Helius Labs CEO Mert Mumtaz is working to build a new, independent core team for Zcash, focusing on large-scale scalability and security , with the aim of creating a privacy-focused "Project Manhattan." This move demonstrates to the market that top talent is deeply involved in building Zcash's future.

• Driving Adoption and Infrastructure: The team actively emphasizes Zcash's core technological advantages (such as zero-knowledge proofs zk-SNARKs) and further improves the Zashi wallet. Such product innovations aim to provide a superior and more convenient privacy and cross-chain experience.

• Data Presentation and Transparency: The team and its supporters actively share on-chain data, especially the growth in the total amount of Shielded ZEC and the number of hidden transactions , to demonstrate that the price increase is supported by actual user adoption and fundamental improvements.

• Exploration towards compliance: ECC is committed to solving compliance issues for privacy coins, such as through the Selective Disclosure mechanism, which allows users to prove the source of their funds when necessary to meet the needs of institutions and regulators, while preserving core privacy.

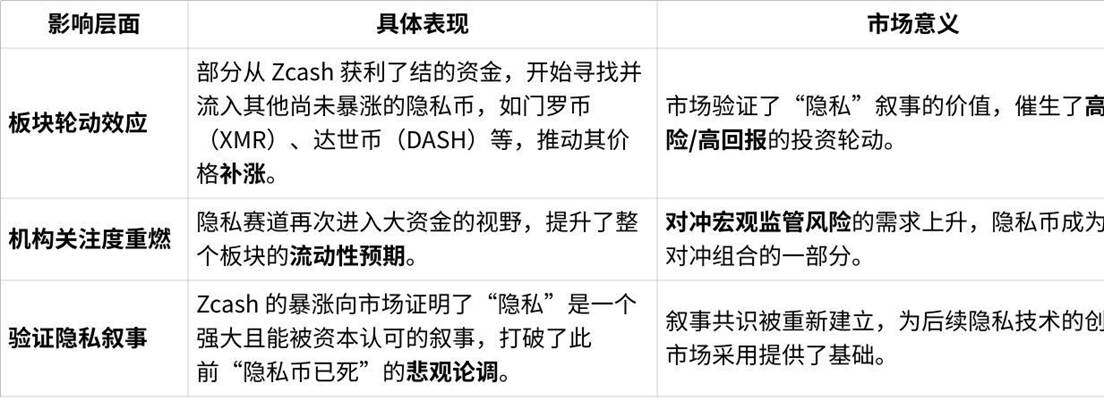

IV. The Impact of the Surge: The Collective Explosion and Differentiation in the Privacy Sector

The surge in Zcash (ZEC) has had a huge ripple effect in the cryptocurrency market. It has successfully brought the topic of "privacy" back into the spotlight, causing funds to flow from mainstream assets to this "forgotten sector," leading to a collective rise in the entire privacy coin sector. At the same time, it has also triggered profound industry reflection and comparison.

1. Market Impact

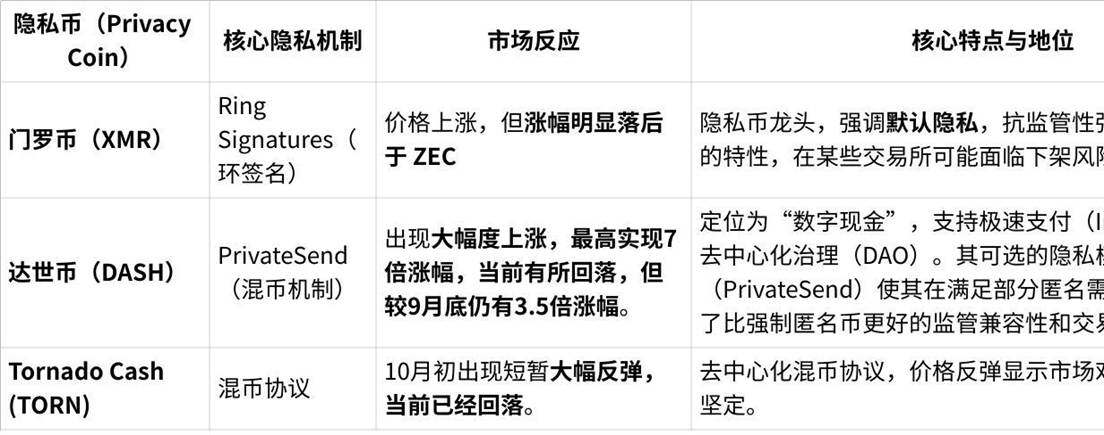

2. A Comparison of the Collective Surge and Differentiation in the Privacy Coin Sector

ZEC's success almost signaled a "privacy coin bull market," but the market performance and technological advantages of different tokens showed a clear divergence:

Zcash's high-profile performance and the collective frenzy in the sector also bring a potential risk: it may prompt global regulators to accelerate the pace of legislation and regulation of privacy coins , posing a potential threat to privacy coins that rely on centralized infrastructure (such as exchanges).

V. From "Privacy Coins" to "Privacy Payment Solutions"

The recent surge in prices of privacy coins like Zcash is not an isolated speculative event, but rather a signal that privacy is once again being the focus of attention in the crypto industry. While short-term price fluctuations are still influenced by multiple factors such as market sentiment, KOL comments, and liquidity rotation, privacy protection is becoming one of the core demands of users—a "functional vote" cast by the crypto market with real money. However, existing privacy coin systems (such as Zcash and Monero) still suffer from three major structural limitations at the technological and ecosystem levels, hindering the mainstream, large-scale, and seamless adoption of privacy technologies.

1. Limitations of "Asset Isolation"

In most privacy coin models, users must use the project's native token (ZEC, XMR) to conduct privacy transactions. This means that to obtain privacy features, users must purchase and hold a specific coin, thus incurring additional asset allocation costs and price volatility risks. This structure makes "privacy" an accessory attribute of a currency, rather than an optional service. Increasing research and industry trends show that users prefer to obtain privacy protection on existing assets (USDT, ETH, mainstream stablecoins) rather than being forced into new coin ecosystems for privacy features.

2. Limitations of "User Experience"

The user experience of privacy coins and privacy protocols generally presents a barrier to entry. For example, Zcash requires users to distinguish between transparent addresses and masked addresses (z, while the latter offers privacy, it causes wallet compatibility issues); Monero's transaction construction and signing process is relatively slow, leading to confirmation delays; and in on-chain privacy protocols (such as Railgun and Aztec), the computational cost of generating zero-knowledge proofs remains high, resulting in high gas costs. In this regard, Messari's "State of Privacy Tokens Q3 2025" report points out that "complex user experiences and high transaction costs are one of the biggest obstacles to the mainstream adoption of privacy protocols." Ideally, privacy payments should not make users perceive technical complexity; sending a privacy transaction should be as simple, instant, and secure as sending a red envelope.

3. Limitations of "Ecological Compatibility"

Most privacy coins still operate on independent blockchains, disconnected from the rapidly expanding DeFi, GameFi, and Layer-2 ecosystems. Zcash and Monero currently lack native cross-chain interoperability, making it difficult for users to utilize privacy assets within mainstream multi-chain ecosystems. As the Messari report points out, "The independence of privacy coins is their security foundation, but also their biggest obstacle to adoption—they are inherently isolated from the mainstream economic layer." The future of privacy technology should clearly not come at the expense of usability and openness. True privacy payment solutions should become underlying standards, like HTTPS on the internet, rather than isolated ecosystems.

A paradigm shift from "privacy coins" to "privacy payment solutions"

What we need is not just a privacy coin, but a "privacy payment solution" or "universal privacy layer" that can completely solve the above pain points. It needs to achieve the following:

• From asset to function: Privacy should no longer be a specific token, but should be abstracted into a function or service that can be invoked by any digital asset.

• Ecosystem composability: Seamlessly integrates with DeFi, GameFi, and other Web3 applications. Users can bridge their privacy assets to or interact with other protocols within a privacy layer while maintaining anonymity.

• User experience optimization: Transaction confirmation must be instant or near instantaneous, with low cost and a simple and intuitive operation process, allowing ordinary users to use it without any obstacles.

VI. New Opportunities in the Privacy Payment Sector: The Potential of Privacy Payment Public Blockchains as Seen from the Zcash Surge

Zcash's surge has brought privacy coins and privacy payments back into the spotlight. With Zcash breaking through long-term lows and recording a more than tenfold increase in a short period, the market has revalued the long-undervalued narrative of "privacy." For investors, this price performance is not merely a market fluctuation, but rather a strong market signal— privacy payment technology and privacy-oriented assets are entering a new cycle of attention.

Investor Perspective: From Price Signals to Sector Analysis

For many market participants, Zcash's rapid rise amplified sentiment: a rebound from its lows to around $560 within two months is a magnitude that cannot be simply dismissed as a "technical bounce." In an era of tightening global regulations and highly visible on-chain behavior, privacy protection is evolving from an "optional" to a "necessary capability," and investors are beginning to re-examine a crucial issue based on price signals:

Will privacy-preserving payments become one of the main themes of the next wave of encryption technologies and applications?

Traditional privacy coins have long oscillated between performance, usability, and regulatory pressure, and the era of simply "creating an anonymity coin" is clearly over. What the market is looking forward to is an "infrastructure that can both protect privacy and be truly used"—not just adding privacy components after the fact on existing public chains, but deeply customizing from the ground up for privacy payment scenarios.

A New Narrative After Zcash's Surge: The Awakening of the Privacy Payments Sector

Following the surge in Zcash's price, attention on the privacy payment sector has clearly increased, and market discussions have gradually shifted from "anonymous speculation" to the perspective of "privacy and financial infrastructure." Whether in crypto asset trading, cross-border fund transfers, or the multi-chain combination of DeFi protocols, users are beginning to realize that completely transparent addresses and fund flows are bringing real behavioral pressure and risk exposure.

Against this backdrop, BenFen's privacy payment solution, as a representative of the next generation of privacy public blockchains, has begun to be regarded by the industry as a sample worth observing.

Unlike traditional "plug-in privacy plugins," this subchain incorporates "privacy" into its system-level goals from the very beginning of its design:

• Instead of wrapping a mask around the L2 or application layer,

• Instead, it customizes privacy payments across the entire stack, from the underlying architecture to the application interface.

Its technology choices—the security-first Move language, the high-performance DAG consensus architecture, and the native integration capabilities of stablecoins—all point to one direction: to provide a foundational base for next-generation privacy payments that balances security, performance, and ease of use , weighing "whether it can be used," "how easy it is to use," and "how secure it is" on the same design table.

"Usable Privacy": Finding a balance between privacy and verifiability

Unlike some traditional privacy coins that only emphasize "full data masking", this subchain's technical approach is more inclined towards "usable privacy": finding a balance between privacy protection and verifiability that can be implemented in engineering.

In the underlying confidential transaction system, this subchain integrates multi-party secure computation (MPC) and key sharding technology, with the goal of achieving " data is usable but not visible ":

• Assets are transferred within the network.

• Nodes are able to achieve consensus and update their state.

• However, core sensitive information of the transaction is not exposed on the public internet in plain text.

Meanwhile, this subchain incorporates a threshold decryption mechanism at the protocol layer, allowing selective disclosure of certain transaction details only under specific conditions and with multi-party collaboration. This design preserves privacy while reserving verifiable technical interfaces for scenarios such as compliance audits and risk control checks, thus balancing privacy protection with trust infrastructure .

From a user experience perspective: Make privacy the "default option".

From the user's perspective, what this chain is trying to do is lock the complexity in the backend and make privacy a "default capability":

• Privacy transactions should be as similar as possible to regular money transfers in terms of operation.

• Users do not need to learn any additional procedures or understand complex cryptographic terminology.

• Privacy protection is performed automatically in the system background.

In terms of payment experience, through the sponsorship transaction model, project owners can pay gas fees on behalf of others, thereby achieving a near "zero gas" usage path in specific scenarios. This transforms privacy payment from a "high-threshold, expert-level function" into a daily capability that ordinary users can use naturally.

From "Anonymous Narratives" to "Practical Privacy": The Direction Represented by This Sub-Chain

Zcash's surge has brought the market back to the privacy sector; and BenfenChain's technical solution, to some extent, reflects the evolution of this sector's narrative—from a single "anonymity story" to "practical privacy infrastructure that balances performance, compliant interfaces, and everyday usability."

At its core, BenfenChain attempts to find a balance among three things:

• Privacy protection : Data is not exposed, and financial transactions are not arbitrarily profiled;

• Performance and efficiency : It can still support the needs of high-frequency payments and complex asset transfers;

• User experience : Make it as "unobtrusive" to end users as possible and lower the barrier to entry.

For individual users, this means that their daily on-chain payments, multi-chain asset management, and cross-border transactions can have an additional option of "privacy enabled by default"; for institutional players and protocol developers, it means an additional underlying framework that can be used to build privacy-friendly payment, settlement, and clearing systems.

With traditional privacy coins like Zcash once again coming into the spotlight, the "practical privacy payment" approach represented by BenfenChain is becoming a new and unmissable clue when observing the privacy sector. Privacy payments are gradually evolving from a peripheral narrative into one of the potential driving forces for the evolution of the payment system and the reshaping of the financial trust structure.