The new landscape of public chains driven by stablecoins and RWA

- 核心观点:高性能公链填补稳定币与RWA基础设施缺口。

- 关键要素:

- Solana交易量多次超越以太坊。

- Tron稳定币月转账超6000亿美元。

- 传统公链存在性能与合规短板。

- 市场影响:推动Web3支付与资产上链加速发展。

- 时效性标注:中期影响。

summary

Since the creation of the Bitcoin genesis block in 2009, the Web 3 public blockchain landscape has undergone explosive evolution, from single-value settlement to Turing-complete smart contracts, and finally to the coexistence of multiple chains. Ethereum has long held the top spot in terms of total value locked (TVL), leveraging its first-mover advantage and robust DeFi ecosystem. However, since the second half of 2023, high-performance public chains like Solana, with their superior user experience, have launched a strong challenge in terms of transaction activity, creating a new landscape where " capital is in Ethereum, traffic is in circulation ." Meanwhile, public chains like Tron, focused on specific use cases (stablecoin settlement), have also carved out a significant niche in their respective sectors.

This report will review the growth paths of mainstream public chains and analyze the evolving logic of their "mainstream ranking" by combining two core metrics: TVL and on-chain transaction volume. We believe that as market focus shifts from generalized DeFi applications to more specific, real-world applications like stablecoin payments and RWAs (Real World Assets) , the shortcomings of traditional public chains in performance, interoperability, compliance, and privacy are gradually being exposed. This presents a structural opportunity for the development of a new generation of high-performance public chains designed specifically for these scenarios, such as BenFen.

Table of contents

1. Overview of mainstream public chains

•1.1 Review of mainstream public chains: Who they are, what are their specialties, and how they have grown

•1.2 How does the “mainstream ranking” of public chains change: A composite perspective of TVL + transaction volume

•1.3 The “common formula” of successful public chains

2. Why are the hot stablecoins and RWAs “absent” on traditional public chains?

•2.1 A brief introduction to the currently popular stablecoins and RWAs, their major trends, and their driving role in Web 3

•2.2 Insufficient aspects of mainstream public chains for stablecoins and RWA

○2.2.1 Scalability and performance bottlenecks

○2.2.2 Insufficient cross-chain interoperability

○2.2.3 Difficulties in Compliance and Regulatory Adaptation

○2.2.4 Data Privacy and Security Requirements

○2.2.5 Imperfect asset on-chain process and infrastructure

3. How does Benfen public chain fill the infrastructure gap of stablecoins and RWA?

•3.1 Move language — a secure and flexible foundation for smart contract development

•3.2 One-click issuance of stablecoins and RWA assets

•3.3 Support multiple stablecoins and multi-asset coexistence ecosystem

•3.4 Use stablecoins to pay gas fees directly, optimizing user experience

•3.5 Compliance and privacy support of this public chain

•3.6 Ecological Outlook: A Bridge Connecting Traditional Finance and Web 3

IV. Conclusion

5. References

1. Overview of mainstream public chains

1.1 Inventory of mainstream public chains: Who are they, what are their specialties, and how have they grown?

To understand the future of the public blockchain landscape, we must first review the giants that have defined the past and present. Each of them, with their unique strengths, seized market opportunities at different times and collectively shaped the Web 3 world of today.

Bitcoin (2009–): Digital Gold and the Final Settlement Layer

As the source of value for all crypto assets, Bitcoin's core positioning has always been a decentralized store of value (SoV) and a final settlement network . The limited scripting capabilities of Bitcoin are a deliberate design choice aimed at maximizing the security and stability of the network, which also determines that DeFi is not its main battlefield. Although its programmability has been expanded through the Lightning Network and Taproot activation, its main on-chain financial activities are more likely to "spill over" to other smart contract chains through forms such as wBTC. Industry statistics on total locked value (TVL) generally do not include it in the mainstream DeFi competition landscape, and major smart contract chains have long dominated the TVL rankings [1].

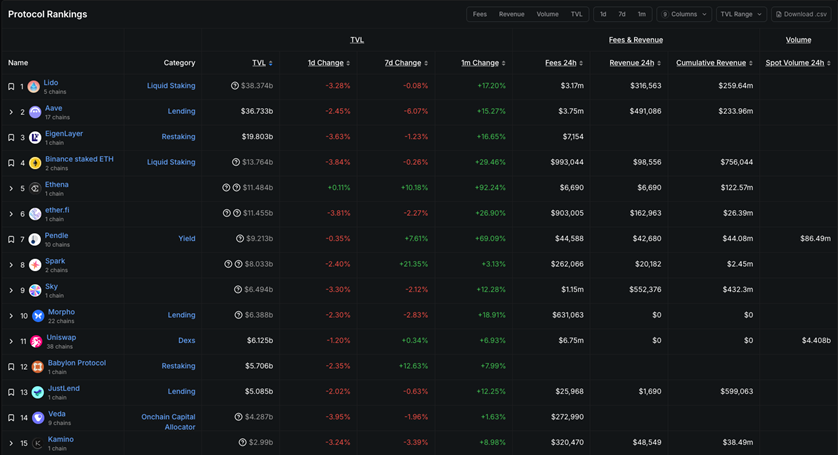

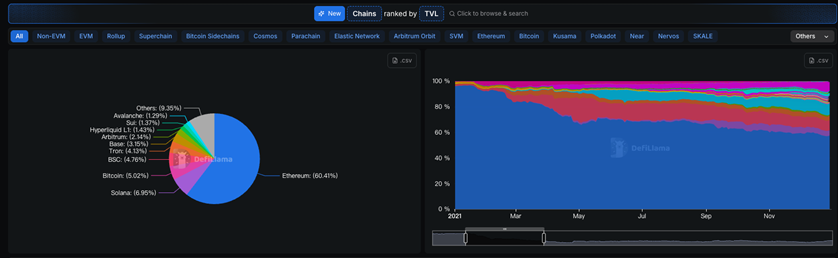

[Figure 1.1: Overview of TVL of Mainstream Smart Contract Chains]

(Source: DeFiLlama)

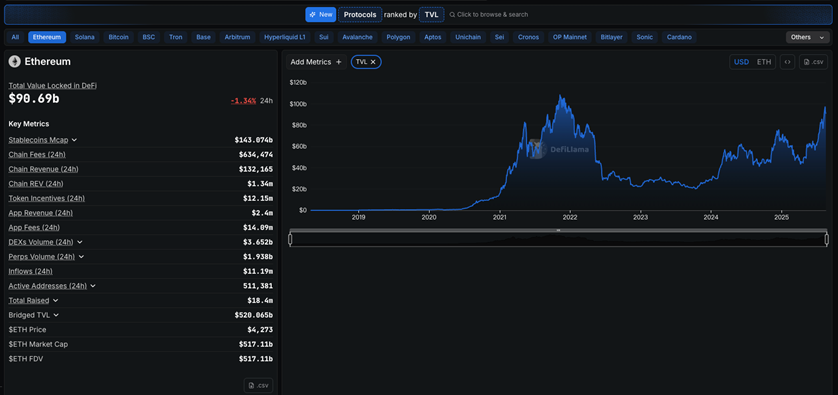

Ethereum (2015–): The absolute core of the DeFi world

Ethereum is the undisputed king of general-purpose smart contract platforms and the "ancestor" of the DeFi ecosystem, known as the "world computer." From the ICO craze in 2017, to the "DeFi Summer" in 2020, and then to the historic "The Merge" consensus transition in 2022, Ethereum has always been a gathering place for innovation and capital in the Web 3 world. Even in the face of fierce competition from the L2 ecological diversion and high-performance L1 in 2024-2025, its TVL share has long maintained the first place in the entire network[2], and it is the "asset pricing center" of the crypto world.

[Figure 1.2: Ethereum TVL Historical Trend Chart]

(Source: DeFiLlama)

BNB Chain / BSC (2020–): EVM-compatible pioneer for inclusive development

BNB Chain (formerly BSC) rose rapidly in the spring and summer of 2021 thanks to its low gas fees, full EVM compatibility, and close ties with the Binance ecosystem . It significantly lowered the threshold for new users and projects to participate, becoming the first stop for "wool parties" and long-tail assets. Its TVL market share peaked at nearly 20% in May 2021[3]. However, with the prosperity of multi-chain ecosystems such as Solana, Terra (before the crash), and Avalanche, its traffic and funds were gradually diverted, and its market share tended to stabilize.

Solana (2020–): The “Trading King” Winning with Performance

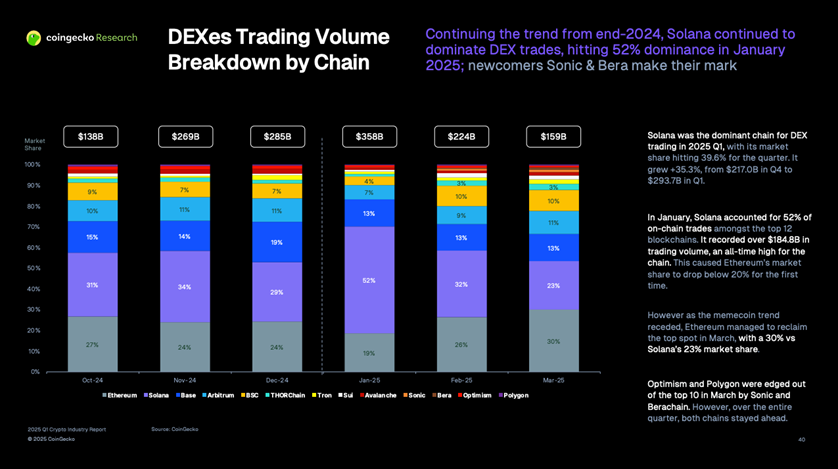

Solana took a different approach— winning with extreme performance . Its high throughput (TPS) and low transaction costs make it very suitable for scenarios with extremely high performance requirements, such as high-frequency trading, DEX, and meme coins. This advantage began to explode in the second half of 2023. According to data from the research institution Kaiko, during 2024, the daily transaction volume of Solana's on-chain DEX briefly surpassed Ethereum several times[4]. Messari further confirmed this trend in its "State of Solana Q4 2024" report, pointing out that Solana's TVL soared 486% to US$8.6 billion in the quarter[5]. Entering 2025, according to the Coingecko report, Solana's on-chain transaction share in January once reached an astonishing 52%. Although Ethereum subsequently regained the monthly crown in March with its deep liquidity, Solana has consolidated its position as the "king of trading popularity"[6].

[Figure 1.3: Major public chain DEX transaction volume share in the first quarter of 2025]

(Source: CoinGecko 2025 Q1 Crypto Industry Report)

Tron (2018–): “The King of Stablecoin Settlement”

Aside from the noisy competition in DeFi and Meme, Tron has quietly occupied a crucial ecological niche: the global retail and cross-border settlement network for stablecoins, especially USDT . With its extremely low transfer fees, Tron has become the preferred platform for small-value stablecoin payments and remittances worldwide. According to CoinDesk Data, by the first half of 2025, the monthly stablecoin transfer volume of the Tron network had stabilized at more than US$600 billion, of which more than 60% of the transactions were less than US$1,000, fully demonstrating its dominance in the retail payment field[7].

Other representatives: New forces and L2 ecology

• New generation of public chains : represented by Aptos, Sui, Sei, etc., also focus on high-performance narratives. In 2025, their ecological TVL also began to grow rapidly and entered the "germination period" [8].

• Ethereum L2 : Layer 2 solutions such as Arbitrum, Optimism, and Base, as the core strategy for Ethereum’s expansion, have undertaken a large number of transactions and TVL, and have formed a continuous tug-of-war with Solana in terms of “transaction activity” [6].

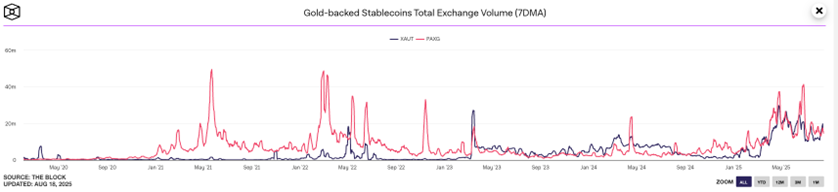

1.2 How the “mainstream ranking” of public chains changes: A composite perspective of TVL + transaction volume

The single metric of TVL (total value locked) is no longer sufficient to comprehensively measure the health of a public chain ecosystem. Especially since the DeFi Summer of 2020, with the explosion of multi-chain ecosystems, TVL (total value locked) as a measure of "capital weight" and on-chain transaction volume as a measure of "usage popularity" have formed a dual perspective for observing the public chain competition landscape. This section will focus on these two core indicators since 2020, objectively reflecting the dynamic changes in the ranking of mainstream public chains.

Figure 1.4: Overview of the ranking changes of mainstream public chains (2023 Q1 - 2025 Q2)

A. Milestones (2017–2022): Waves that shape the landscape

• 2017–2019: Ethereum standards were established. Ethereum, with its Turing-complete smart contract functionality, became the core platform for the explosion of ICOs and early DeFi protocols, and in fact established the technical standards and ecological paradigm of smart contract public chains.

• 2020: DeFi Summer: Core applications such as lending (Compound, Aave) and trading (Uniswap) within the Ethereum ecosystem experienced explosive growth, and the concept of TVL became popular. According to DappRadar data, the TVL of the entire industry reached US$189 billion in 2021, a year-on-year increase of 767%, with Ethereum maintaining an absolute dominant position for a long time[9].

• 2021: The first year of multi-chain development and the highlight of BSC. BNB Chain (BSC) successfully captured the huge long-tail assets and user demand that spilled over from Ethereum with its low fees and EVM compatibility. Its TVL market share was close to 20% at the middle of the year. At the end of the same year, Terra surpassed BSC in TVL thanks to its algorithmic stablecoin UST and the Anchor protocol’s nearly 20% annual savings rate, becoming the second largest public chain at the time, demonstrating the ability of its powerful capital narrative to attract money[10].

• 2022: Reshaping the landscape Ethereum successfully completed the “Merge” consensus transition and officially entered the PoS era. In the market gap left by the collapse of Terra, Tron quickly rose to prominence with its huge stablecoin settlement volume. According to Messari, its value settlement volume ranked second in the entire network that year[11].

B. Near-term Trends (2023–2025): Dual-Track Game and Tug of War

After entering 2023, the focus of public chain competition has become increasingly clear: Ethereum's TVL throne is difficult to shake, but the competition for "second/third place" is extremely fierce; at the same time, in the transaction volume dimension representing "usage intensity", Solana has launched a strong challenge, weakening Ethereum's absolute advantage.

• 2023-2024 mid-term (rotation period) : In terms of TVL, Tron and BNB Chain will alternately occupy the second and third positions, while Solana will begin a strong recovery after experiencing a trough. In terms of trading volume, Solana has surpassed Ethereum on a daily/monthly basis several times. For example, on May 10, 2024, its single-day DEX trading volume reached US$1.3 billion, slightly higher than Ethereum's US$1.29 billion, achieving a daily "overtaking" [4, 12].

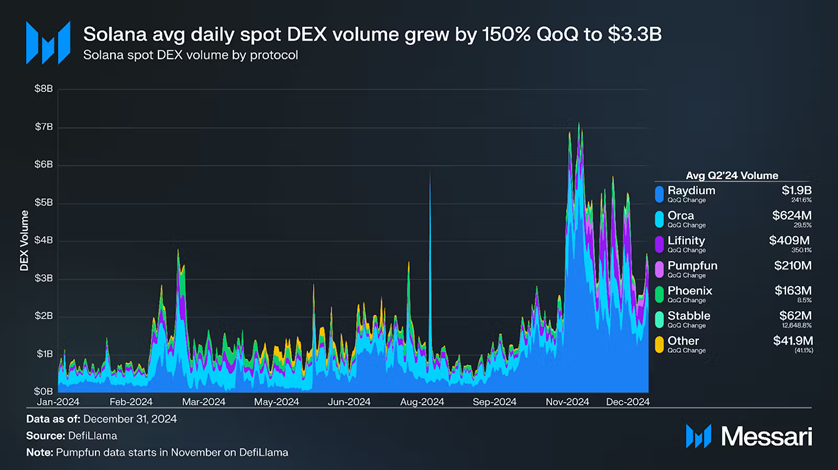

• Q4 2024 (Solana’s explosive growth) : This is the period of the most dramatic changes in the landscape. Messari pointed out that Solana’s TVL jumped to approximately $8.6 billion in that quarter, and in November it surpassed Tron to become the second largest TVL public chain in the entire network[5]. The trading volume was even more astonishing. According to data cited by Binance Square, Solana’s daily DEX trading volume in that quarter once reached nearly $3.98 billion, exceeding the total of Ethereum ($1.71 billion) and Base ($1.21 billion)[13].

• 1H 2025 (seesaw phenomenon) : Solana’s trading popularity continues, but Ethereum demonstrates its ecosystem resilience. According to Coingecko, while Solana accounted for 52% of on-chain transactions in January, Ethereum regained its lead in March with $63 billion in monthly DEX trading volume—the first time since September 2024 [6, 15].

• Parallel Trend (Tron) : Despite fierce competition in TVL and DEX trading volume, Tron continues to consolidate its position as a “payment clearing chain.” By the first half of 2025, its monthly stablecoin transfer volume will stabilize at over $600 billion, making it one of the de facto standard chains for global retail and cross-border stablecoin payments [7, 8].

Key points summary:

• TVL: ETH ranked first almost throughout the entire process, with the second place in 2024Q4–2025 being rotated more by Solana/Tron/BSC;

• Usage popularity (trading volume/DEX): Solana surpassed competitors in multiple time windows, significantly increasing its dominance in “activity and usability”;

• Payment and clearing (stablecoins): Tron dominates global retail/cross-border stablecoin transfers, becoming a “payment-oriented” infrastructure.

Key data and case supplements

• Solana transaction volume exploded : In the fourth quarter of 2024, Solana’s daily DEX transaction volume peaked at approximately $3.98 billion, exceeding the combined total of Ethereum ($1.71 billion) and Base ($1.21 billion)[13]. Looking at the entire year, according to Coinspeaker, Solana’s average monthly DEX transaction volume in 2024 reached approximately $258 billion, far exceeding Ethereum’s $86 billion[14].

• Short-term surpassing : As early as May 10, 2024, Solana’s single-day DEX trading volume reached US$1.3 billion, slightly higher than Ethereum’s US$1.29 billion, achieving a daily “overtaking” [12].

• Tron stablecoin ledger : By the first half of 2025, the monthly stablecoin transfer volume of the Tron network continued to exceed US$600 billion, solidifying its position as the core circulation ledger for global stablecoins[8].

Analysis of the driving force behind this: Why do time period rankings change?

The competition in the public chain track is, on the surface, a competition of technology and data, but behind it is a multi-dimensional comprehensive game of user experience, scenario positioning, capital narrative and ecological vitality.

A. User experience drives traffic

Network performance and transaction costs are the most intuitive feelings of users and the most direct driving force for traffic migration. One of the core reasons why Solana can challenge Ethereum in terms of transaction popularity is its low transaction fee of approximately $0.00025, which greatly meets the needs of high-frequency trading and meme coin cycle users [16]. Similarly, the early rise of BSC and the success of Tron in the stablecoin payment field are inseparable from their low-cost transaction experience.

B. Differences in scene positioning

As the market matures, general-purpose public chains begin to differentiate into specific areas of strength, forming differentiated user mindsets:

• Ethereum : The “financial center” and “cultural layer” of DeFi and NFT, expanding its all-round positioning with the L2 ecosystem.

• Solana : The “performance engine” for high-frequency trading and Meme coin cycles, specializing in scenarios with extreme requirements for speed and cost.

• Tron : The “global payment network” of stablecoins has built a deep moat in the fields of small-value, high-frequency cross-border payments and retail settlements.

C. Funding Direction and “Explosive Stories”

Capital and users always chase the most compelling stories. In 2021, BSC, leveraging the "everyone can participate" long-tail asset craze, captured 20% of TVL at its peak. That same year, Terra, with its breakout story of the Anchor protocol's 20% annualized yield, quickly attracted massive capital and climbed to the second-largest TVL. Its subsequent crash also taught the market a profound lesson. From 2024 to 2025, Solana successfully drove its trading popularity curve with its "high-performance meme-friendly" story.

D. Ecological vitality and head adsorption

The long-term value of a public chain is ultimately determined by the quality and vitality of its ecosystem. Ethereum's defensive strength is built on a suite of proven DeFi infrastructure, including Uniswap, Aave, and Lido. Solana's traffic is driven primarily by emerging, more seamless DEXes and aggregators like Jupiter and Raydium. While Tron's ecosystem isn't as rich as the aforementioned two, its massive stablecoin pool offers the strongest application scenarios, attracting all stablecoin settlement-related needs.

E. Data transparency provides traceability for competition

The rise of third-party data and research platforms like Messari, DeFiLlama, and Coingecko has made competition among public chains more transparent than ever before. Core metrics like TVL, transaction volume, and active addresses are now quantified and tracked in real time. This not only provides the community and users with tools to assess the performance of various chains, but also exacerbates the internal competition among public chains in terms of performance.

1.3 The “Common Formula” of Successful Public Chains

By reviewing the rise and fall of the above-mentioned mainstream public chains, we can find that although their respective "explosive stories" are different, those public chains that can stand out from the fierce competition and maintain their mainstream position often follow a common "formula" behind their success.

1. Low Fees + High Throughput: A Hard Prerequisite for Transaction Activity

In the era of multi-chain competition, network performance and transaction costs are the fundamental prerequisites for determining whether users "vote with their feet."

Solana’s astonishing surge in DEX trading volume in multiple time windows between 2024 and 2025 is the most direct evidence of this [4, 6, 12]. When a network can provide a sufficiently low-cost (nearly zero cost) and efficient (confirmation within seconds) trading experience, it has the hard conditions to handle the market’s most frequent, speculative, and dynamic trading needs (such as Meme coin trading).

2. A clear “main battlefield” mindset: differentiated positioning

As the market matures, general-purpose public chains that attempt to "cover everything" will find it difficult to compete with highly focused "specialized" public chains without an absolute first-mover advantage. Successful public chains often have a very clear and deeply rooted differentiated positioning.

• Ethereum : The value sedimentation layer of general smart contracts and L2 ecology .

• Solana : A high-frequency trading chain driven by extreme performance [4].

• Tron : Global stablecoin settlement chain [7].

3. Powerful Ecosystem: High Proportion of Top Applications

The prosperity of a public chain depends on leading applications that can continuously attract and retain users. These applications not only contribute to the majority of on-chain activities, but also form the moat of the ecosystem.

Figure 1.5: Solana Ecosystem DEX Trading Volume Distribution

(Source: Messari’s “State of Solana Q4 2024” report)

Ethereum’s “DeFi fundamentals” such as Uniswap, Aave, and Lido are the cornerstones of its massive TVL; Solana’s rise is highly dependent on the efficient integration and traffic distribution of DEX aggregators such as Jupiter. Messari’s report indicates that Jupiter alone accounts for approximately 38% of the Solana ecosystem’s spot DEX trading volume in the fourth quarter of 2024[5].

4. The “resonance window” between narrative and funding

The accumulation of technology and ecology is the foundation, but igniting the market often requires a strong "narrative" to attract the resonance of capital and users within a specific time window.

[Figure 1.6: Changes in Public Chain TVL Market Share in 2021]

(Source: DeFiLlama)

In 2021, BSC’s market share quickly rose to nearly 20% by leveraging its narrative of “low-fee, long-tail assets”[3]. At the end of the same year, Terra, relying on its extreme narrative of “Anchor’s 20% yield,” attracted a massive amount of capital in a short period of time, but also quickly collapsed due to overheating of the narrative, revealing the risks[10]. In 2024-2025, Solana successfully seized the narrative window of “high-performance transactions + meme”, while Ethereum, relying on its robust narrative of “deep liquidity and diverse applications,” demonstrated greater resilience when market hotspots switched[6, 15].

5. Endorsement of institutionalized research and transparent data

In the current crypto market, competition among public chains is no longer simply a contest of community influence. Third-party research institutions and data platforms, such as Messari, Kaiko, Coingecko, and DeFiLlama, provide the market with a systematic and traceable benchmark for competition through continuously updated chain-level research reports and open-source data dashboards.

[Figure 1.7: DeFiLlama public chain TVL ranking]

(Source: DeFiLlama)

The data from these platforms have become the core decision-making tools for projects, institutions and deep users to judge the pros and cons of the chain ecosystem and identify "ranking changes", which in turn has prompted public chains to pay more attention to the real on-chain data performance.

2. Why are the hot stablecoins and RWAs “absent” on traditional public chains?

In the first section, we observed that competition among mainstream public chains primarily revolved around DeFi's TVL and on-chain transaction volume. However, since 2023, the Web 3 narrative has quietly shifted. Stablecoin payment applications and the tokenization of real-world assets (RWAs) are becoming the core engines driving the industry into its next phase. However, an examination of the infrastructure of existing public chains reveals that they were not adequately designed to support these two major trends, resulting in a clear "infrastructure gap."

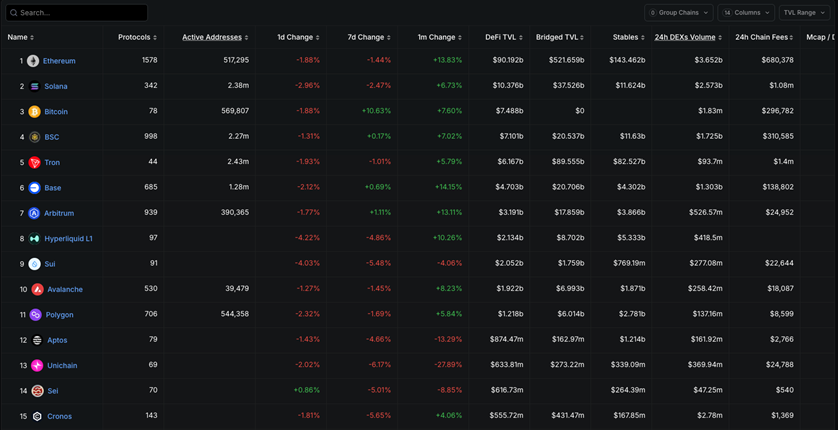

2.1 A brief introduction to the currently popular stablecoins and RWAs, their major trends, and the driving force behind Web 3

Stablecoins (represented by USDT and USDC) and RWAs (tokenization of real-world assets such as real estate and bonds) are not new concepts, but they have shown unprecedented growth momentum in recent times. The fundamental reason is that they solve the key issues for Web 3 to go mainstream: value anchoring and asset expansion .

Why are stablecoins and RWAs a major trend?

• Stablecoins, as the “dollars” of the crypto world, provide a reliable measure of value and medium of exchange for highly volatile markets. By introducing a large number of traditional assets onto the chain, RWA fundamentally broadens the asset categories and market depth of Web 3. Data shows that the global stablecoin market capitalization has exceeded US$180 billion in 2023, and according to a Consensys report, the locked-in amount of RWA-related DeFi protocols has exceeded US$7 billion during the same period [17].

[Figure 2.1: Global Stablecoin Total Market Value TVL Growth Trend Chart]

(Source: The Block Data)

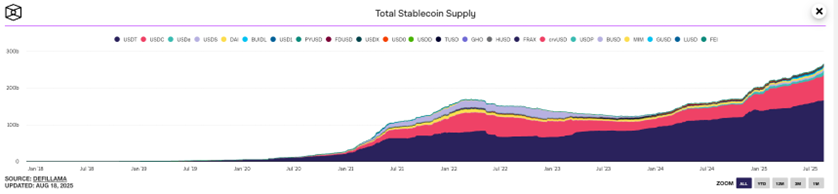

Figure 2.2: Total trading volume of gold-backed stablecoins

(Source: The Block Data)

The push for Web 3

The combination of these two trends is driving Web 3's evolution from a purely endogenous digital asset game to a broader financial ecosystem capable of interacting with the real world. The widespread adoption of stablecoins has significantly reduced the cost and time of cross-border payments, while RWAs have paved the way for application scenarios closer to traditional finance, such as asset securitization and decentralized lending. Together, these trends are accelerating the mainstream adoption of blockchain technology and expanding its user base.

2.2 Insufficient features of mainstream public chains for stablecoins and RWA

While existing public chains are powerful, they are generally "general-purpose" in design and lack native optimization for high-frequency, high-compliance, and high-privacy scenarios like stablecoin payments and RWAs. This exposes them to the following five core deficiencies when facing new challenges:

2.2.1 Scalability and Performance Bottlenecks

Large-scale payments and asset transactions require networks with extremely high processing capabilities and extremely low costs. First, the average transaction confirmation time of traditional public chains such as the Ethereum mainnet is about 15 seconds, and can even be extended to several minutes when the network is congested , which cannot meet the immediacy requirements of payment scenarios. Secondly, high and unstable gas fees are another major obstacle; during the market peak in 2021-2022, network congestion has repeatedly caused gas fees to exceed 200 Gwei, making the cost of a single stablecoin transfer exceed US$50 , which is unacceptable for small payments and high-frequency trading scenarios[18]. Finally, according to Etherscan data, Ethereum's average daily transaction volume in 2023 has stabilized at approximately 1.2 million transactions, close to its theoretical TPS upper limit , indicating that its network capacity has been basically saturated and it is difficult to support the massive transaction demand brought by large-scale stablecoins and RWA applications in the future.

2.2.2 Insufficient cross-chain interoperability

The value transfer of stablecoins and RWAs inevitably involves a multi-chain environment, but the current cross-chain bridge infrastructure is still a major disaster area for security risks. The Poly Network cross-chain bridge was hacked in 2021, resulting in losses of over $600 million , which exposed the vulnerability of cross-chain asset security[19]. At the same time, the multi-chain ecosystem has also led to serious asset fragmentation problems. Users often need to perform tedious operations between at least 3-5 different chains , which not only provides a poor experience but also significantly increases the risk of user churn. According to Chainalysis data, in 2023, losses caused by cross-chain bridge fraud and security incidents accounted for more than 50% of all DeFi security incidents , which seriously shook users' confidence in cross-chain transactions of large amounts of assets[20].

2.2.3 Difficulties in Compliance and Regulatory Adaptation

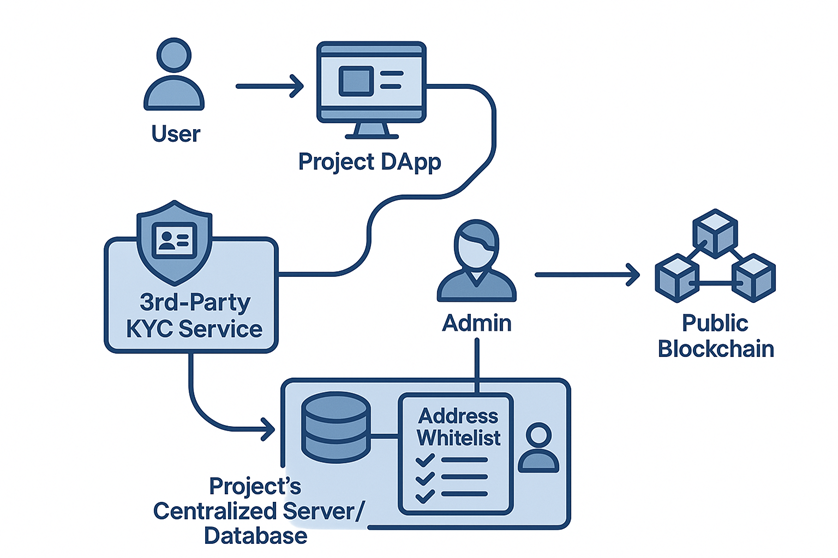

Stablecoins and RWAs are closely linked to real-world assets and are bound to face strict financial regulation. Regulators such as the SEC have strengthened their supervision of stablecoin issuers in 2023, requiring them to meet KYC/AML compliance [21]. However, most existing public chains lack native on-chain identity authentication modules , and project parties need to rely on patchwork and poorly experienced third-party solutions to achieve compliance, resulting in high compliance costs. As pointed out by the International Monetary Fund (IMF), the compliance of RWA on the chain is one of the main obstacles to its large-scale application .

Figure 2.3: Schematic diagram of the “patchwork” architecture of traditional public chains to achieve asset compliance

(Source: Self-made by the author)

2.2.4 Data Privacy and Security Requirements

The transaction data of traditional public chains is completely open and transparent, which is a huge obstacle for commercial and financial scenarios that require privacy protection , because no real-world enterprise is willing to make its complete supply chain payment records or RWA asset portfolio details involving sensitive information public. Market demand is driving technological change. According to Gartner's forecast, within the next three years, 75% of blockchain applications will need to introduce privacy protection technology to meet corporate compliance requirements [22]. Although existing public chains can integrate privacy technologies such as zero-knowledge proofs (zk-SNARKs), these usually exist as independent L2 or application layer solutions, which not only face performance and usability bottlenecks , but also exacerbate the fragmentation of the ecosystem.

2.2.5 Imperfect asset chain process and infrastructure

The tokenization of RWA is not just a technical issue, but also involves a series of complex off-chain processes such as asset certification, credit endorsement, legal confirmation, custody and auditing. However, the industry currently lacks unified and efficient standards and infrastructure . Taking the current DeFi as an example, the proportion of RWA-related smart contracts is less than 5% , which clearly shows that the relevant infrastructure is still in its very early embryonic stage. The ConsenSys report also clearly pointed out that one of the biggest challenges facing the RWA market in 2024 is the imperfect construction of on-chain asset custody and compliance audit mechanisms [17]. As a pure technical platform, the existing public chain does not provide native tools or frameworks to solve these "off-chain" challenges.

3. How does Benfen public chain fill the infrastructure gap of stablecoins and RWA?

In the second part, we analyzed the multiple shortcomings of traditional general-purpose public chains in performance, security, compliance, and usability when faced with the new wave of Web 3, namely stablecoin payments and RWA (Real World Assets). These shortcomings cannot be overcome through simple technological iterations; rather, they stem from the fact that their underlying design was not designed for such scenarios.

This chapter will discuss in detail how BenFen, as a new generation of high-performance stablecoin public chain, systematically fills these gaps through a series of native and dedicated infrastructure designs, aiming to become the core platform for the next round of Web 3 value growth.

3.1 Move Language — A Secure and Flexible Foundation for Smart Contract Development

For high-value stablecoins and RWA assets representing real-world rights, smart contract security is an insurmountable bottom line. The massive financial losses caused by contract vulnerabilities on traditional public chains (such as Ethereum) have repeatedly demonstrated this. BenFen has prioritized security from day one, with the core decision being to choose Move as the sole smart contract development language.

The Move language was designed by the Meta (formerly Facebook) team for the Diem project. Its core "Resource Type" system treats digital assets (such as tokens) as a special type, prohibiting the copying of assets out of thin air (to prevent issuance vulnerabilities) or accidental destruction (to prevent asset loss) at the language level. This means that the Move language is fundamentally immune to a series of fatal vulnerabilities commonly found in Solidity contracts, such as integer overflows and reentrancy attacks. In addition, its modular smart contract design makes it easy for developers to build and audit complex financial logic, making it very suitable for the complex business needs of stablecoins and RWAs. By adopting the Move language, BenFen has greatly reduced the security risks and development costs faced by developers when issuing and managing high-value assets.

3.2 One-click issuance of stablecoins and RWA assets

Issuing assets on traditional public chains, especially complex RWAs, is cumbersome and technically demanding, hindering their scalability. To address this pain point, BenFen provides a standardized "one-click issuance" tool that encapsulates complex on-chain operations into a simple front-end interface.

This feature, based on BenFen's advanced object-centric model, treats each token as an independent "object" and unifies asset issuance standards through a built-in official coin core module. Projects or institutions can complete compliant and transparent on-chain asset issuance by simply entering core asset parameters (such as name, symbol, and total quantity) through a configurable interface without the need for complex smart contract coding. This not only greatly improves the efficiency of asset on-chain but also provides native support for the full lifecycle management of assets (issuance, transfer, redemption, etc.), laying the foundation for the rapid expansion of the ecosystem.

[Figure 3.1: Stablecoin creation flow chart]

(Source: BenFen Public Chain White Paper)

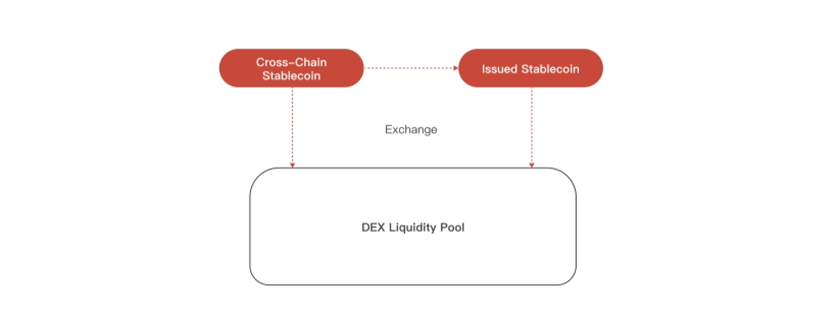

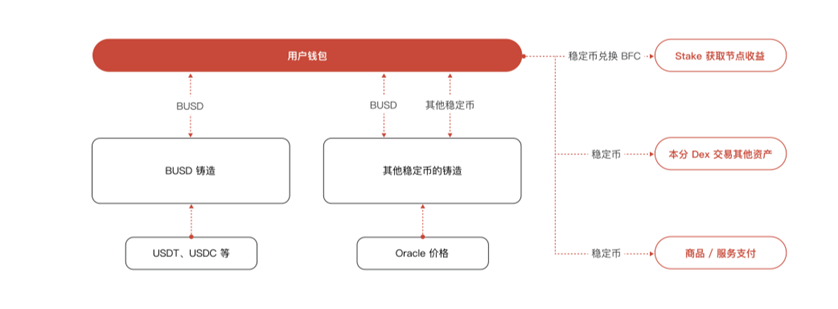

3.3 Support multiple stablecoins and multi-asset coexistence ecosystem

To address the over-centralization and single-currency limitations of US dollar stablecoins, BenFen natively supports a multi-currency stablecoin system at the protocol level. This system uses the core stablecoin BUSD (pegged 1:1 to a major US dollar stablecoin via a cross-chain bridge) as its reserve and exchange medium. Using native on-chain exchange rate oracles, it obtains real-time foreign exchange prices, enabling the efficient and low-cost issuance and circulation of stablecoins pegged to different national fiat currencies (such as BJPY and BEUR).

This multi-currency coexistence mechanism not only meets the localized payment and settlement needs of different regions around the world (such as cross-border e-commerce and local payments), but also allows more complex cross-asset interactions and transactions, providing the necessary underlying support for diversified financial scenarios such as consumer payments, lending, and wealth management, and helping to build a more inclusive global financial network.

[Figure 3.2: Stablecoin cycle diagram within the BenFen ecosystem]

(Source: BenFen Public Chain White Paper)

3.4 Use stablecoins to pay gas fees directly, optimizing user experience

Traditional public chains require users to hold their native tokens (such as ETH) to perform any on-chain operations, creating significant friction and barriers for new users. As the first public chain to natively support stablecoins for gas fees , BenFen fundamentally solves this problem.

For any transaction within the BenFen ecosystem, users can directly pay gas fees with mainstream stablecoins like BUSD, eliminating the need to pre-purchase and hold the volatile native token, BFC. This mechanism decouples transaction initiators from gas payers at the protocol level, even allowing projects to directly pay gas fees on behalf of users through sponsored transactions . This makes the user payment experience more authentic to real-world usage, significantly improving the usability of stablecoins in payment scenarios and a key step in driving Web 3 applications towards mainstream adoption.

3.5 Compliance and Privacy Support of Benfen Public Chain

BenFen directly responds to the rigid demands of stablecoins and RWA in terms of compliance and privacy through natively integrated functional modules.

• Native Compliance Framework : To address the KYC/AML compliance requirements for assets like RWA, the BenFen ecosystem has built-in the BenFen KYC on-chain identity authentication system. This system utilizes W3C’s DID and VC standards, allowing project owners to verify investor identities at the protocol level, standardizing and maximizing the efficiency of the compliance process while ensuring that users’ KYC information remains under their own sovereign control.

• Native Privacy Support : To protect sensitive information of assets like RWA, BenFen supports private accounts and private payments at the virtual machine level. Once a user's assets are deposited into a private account, their true balance is hidden on-chain. Payments between two private accounts are only visible to the outside world as an encrypted transaction record, without revealing the specific amount. This provides the necessary privacy protection for large-scale, compliant commercial applications on-chain.

3.6 Ecological Outlook: A Bridge Connecting Traditional Finance and Web 3

In summary, BenFen is not a simple replication or performance iteration of existing public chains. Instead, through a series of native, dedicated infrastructure, it systematically addresses the core shortcomings of traditional public chains in embracing stablecoin and RWA services. By providing a more secure (Move language), easier to use (stablecoin gas, one-click issuance), and more compliant (native KYC/privacy) infrastructure, BenFen is committed to building a complete stablecoin and RWA ecosystem that connects traditional finance with Web 3.

Its ultimate goal is to open up the circulation channels of on-chain and off-chain assets, help digitize and securitize trillions of traditional financial assets, and introduce high-quality partners and institutions to jointly create a win-win financial ecosystem that truly serves the flow of value in the real world.

IV. Conclusion

The development of public blockchains is at a new historical inflection point. If the core of competition in the last cycle was the Lego-like combination of "general-purpose" DeFi protocols, then the traffic in the next three years will belong to "specialized" infrastructure that can truly connect to the real world and handle large-scale payments and compliant assets.

Through analysis, this report points out that although traditional public chains such as Ethereum have a deep foundation, they are unable to natively support the core needs of stablecoin payments and RWA in terms of performance, cost, compliance and privacy, and there is an obvious "infrastructure gap".

BenFen was born precisely to address this structural gap. Rather than just another general-purpose chain attempting to compete across all sectors, BenFen, through a series of focused designs—such as the asset security provided by the Move language, the low barrier to entry offered by one-click issuance, the ultimate user experience provided by stablecoin gas, and native compliance and privacy modules—has tailored a complete, efficient, and trustworthy underlying infrastructure for the explosive growth of PayFi and RWA.

We believe that the next chapter of the public blockchain era will be written by platforms that can truly serve the real economy and reduce friction in the flow of value. BenFen, with its clear positioning and dedicated technology stack, is well-positioned for this.

5. References

1. DeFiLlama. (2025).Cryptocurrency Market Cap & DeFi TVL. Retrieved August 18, 2025, from https://defillama.com/

2. DeFiLlama. (2025).Ethereum Chain TVL. Retrieved August 18, 2025, from https://defillama.com/chain/Ethereum

3. Mint Ventures. (2021).Multi-angle Analysis of Pancake. Medium. Retrieved from https://medium.com/@mint-ventures/multi-angle-analysis-of-pancake-business-is-back-to-a-new-high-what-is-its-project-valuation-6 a 98 dfb 213 c 8

4. Kaiko Research. (2025).Kaiko's Top 10 Charts of 2024. Retrieved from https://research.kaiko.com/insights/kaikos-top-10-charts-of-2024

5. Messari. (2025).State of Solana Q 4 2024. Retrieved from https://messari.io/report/state-of-solana-q 4-2024

6. CoinGecko. (2025).2025 Q 1 Crypto Industry Report. Retrieved from https://assets.coingecko.com/reports/2025/CoinGecko-2025-Q 1-Crypto-Industry-Report.pdf

7. CryptoSlate. (2025). CoinDesk data: Tron surpasses $600 B in monthly stablecoin transfers. Retrieved from https://cryptoslate.com/coindesk-data-tron-surpasses-600 b-in-monthly-stablecoin-transfers/

8. BlockchainReporter. (2025).Chains With Top TVL Growth. Retrieved from https://blockchainreporter.net/chains-with-top-tvl-growth-ethereum-dominateds-defi-solana-bitcoin-bsc-tron-and-others-among-top-10/

9. DappRadar. (2022).2021 Dapp Industry Report. Retrieved from https://dappradar.com/blog/2021-dapp-industry-report

10. TabInsights. (2021).Ethereum dominates DeFi market while Terra overtakes BSC. Retrieved from https://tabinsights.com/article/ethereum-dominateds-defi-market-while-terra-overtakes-bsc-as-the-second-largest-defi-blockchain

11. Messari. (2023).State of Tron Q 4 2022. Retrieved fromhttps://messari.io/report/state-of-tron-q 4-2022

12. DailyCoin. (2024).Solana Overtakes Ethereum in DEX Volume. Retrieved from https://dailycoin.com/solana-overtakes-ethereum-dex-volume-is-ethereum-slipping/

13. Binance Square. (2025).Solana's DEX Trading Volume Surpasses Ethereum and Base Combined. Retrieved from https://www.binance.com/en/square/post/01-07-2025-solana-s-dex-trading-volume-surpasses-ethereum-and-base-combined-18594004884034

14. Coinspeaker. (2025).Solana Outshines Ethereum Again as DEX Volume Surges. Retrieved from https://www.coinspeaker.com/solana-outshines-ethereum-again-as-dex-volume-surges/

15. The Defiant. (2025).Ethereum Surpasses Solana to Lead DEX Volume. Retrieved from https://thedefiant.io/news/defi/ethereum-surpasses-solana-to-lead-dex-volume-63-billion-march-2025-despite-8-18-eca 38 b 52

16. The Currency Analytics. (2024). Solana DEX Volume Overtakes Ethereum and BNB. Retrieved from https://thecurrencyanalytics.com/altcoins/solana-dex-volume-overtakes-ethereum-and-bnb-in-major-defi-shift-186094

17. ConsenSys. (2023). The State of Web 3 perception around the world. Retrieved from https://consensys.io/insight-report/web 3-and-crypto-global-survey-2023

18. YCharts.Average Ethereum Gas Price Data. Retrieved from https://ycharts.com/indicators/ethereum_average_gas_price

19. CNBC. (2021). Suspected hacker behind $600 million Poly Network crypto heist did it 'for fun'. Retrieved from https://www.cnbc.com/2021/08/12/poly-network-hacker-behind-600-million-crypto-heist-did-it-for-fun.html?qsearchterm=Poly%20 Network

20. Chainalysis. (2024).The 2024 Crypto Crime Report. Retrieved from https://www.chainalysis.com/blog/2024-crypto-crime-report-introduction/

21. Solidus Labs. (2023). 2023 Crypto Enforcement Trends. Retrieved from https://www.soliduslabs.com/research/2023-crypto-enforcement-trends

22. Gartner. (2024). Gartner Identifies the Top Cybersecurity Trends for 2024. Retrieved from https://www.gartner.com/en/newsroom/press-releases/2024-02-22-gartner-identifies-top-cybersecurity-trends-for-2024

Disclaimer

This report is for informational purposes only and does not constitute any investment, legal, accounting or tax advice, nor does it constitute an offer or invitation to sell or buy any tokens or securities.

The information in this report is derived from publicly available sources and interviews. While Bixin Ventures and the BenFen team strive to ensure accuracy and reliability, they do not guarantee the accuracy or completeness of this information. The opinions, analyses, and forecasts in this report represent the author's judgment as of the date of publication and are subject to change without notice.

This report contains certain forward-looking statements that are subject to risks, uncertainties, and assumptions that may ultimately prove to be incorrect. The cryptoasset market is highly volatile and risky, and past performance should not be relied upon as an indicator of future results.

Under no circumstances will the author or publisher of this report be liable for any losses incurred by any person as a result of the use of any content in this report. Investors should conduct independent due diligence and consult a professional financial advisor before making any investment decision.