With a public offering of 1.39 billion, challenging BASE and OP, can MegaETH break through the new Layer 2 landscape?

- 核心观点:MegaETH逆势获超额认购,成Layer2新焦点。

- 关键要素:

- 公募认购13.9亿美元,超5万投资者参与。

- 技术目标10万TPS,实现毫秒级延迟。

- 团队背景强,获Vitalik等顶级资本支持。

- 市场影响:可能提振Layer2赛道信心与资金流入。

- 时效性标注:中期影响

I. Project Introduction

On October 30th, the MegaETH public offering officially concluded, with a final subscription amount reaching $1.39 billion, an overall subscription ratio of 27.8 times, attracting more than 50,000 investors. It is arguably one of the most anticipated public offerings in the crypto market this year. Surprisingly, this success occurred against the backdrop of a generally sluggish Layer 2 market. Over the past year, the market performance of Ethereum Layer 2 tokens has been dismal, with investor confidence continuously declining. Linea, a veteran project launched in September of this year, is a typical example; its token plummeted from an opening price of $0.043 to $0.011, with a total circulating market capitalization of only $825 million, a drop of nearly 74% in two months. In such a depressed market, MegaETH defied the trend, igniting market enthusiasm and almost becoming a new "beacon of faith" in the Layer 2 space.

MegaETH's ability to ignite market sentiment amidst a downturn stems primarily from its triple strengths: technology, team, and capital. Technologically, the project redefines the upper limit of Layer 2 with its performance vision of "100,000 TPS + millisecond-level latency," attempting to approach the performance experience of Web2. Regarding the team, the three co-founders are graduates of Stanford, MIT, and Harvard Business School, respectively, with Shu-Yao Kong previously serving as Head of Business Development at Consensys. This strong team background has attracted investment from top-tier capital firms and industry leaders—Dragonfly Capital, OKX Venture, Figment Capital, Big Brain Holdings, and other institutions have all participated, along with heavyweight angel investors such as Ethereum co-founder Vitalik Buterin, ConsenSys founder Joseph Lubin, and EigenLayer founder Sreeram Kannan.

Although MegaETH is still in the testnet phase and has not yet shown complete ecosystem data, it has become one of the most talked-about and anticipated projects in the Layer 2 field with its top-notch technical architecture, star team and luxurious capital lineup. It is also one of the few "super narratives" that can still bring funds and confidence back during the bear market.

II. Project Mechanism

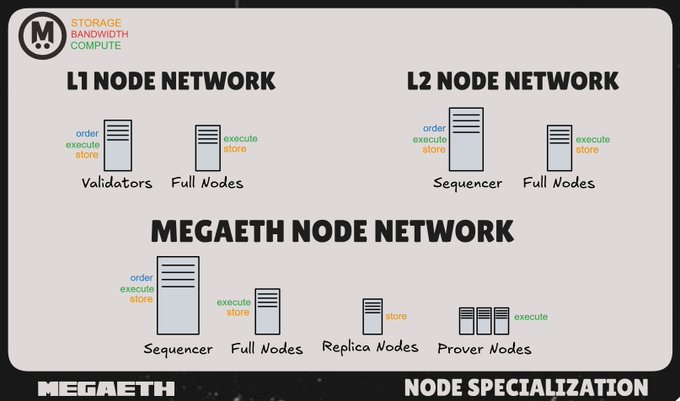

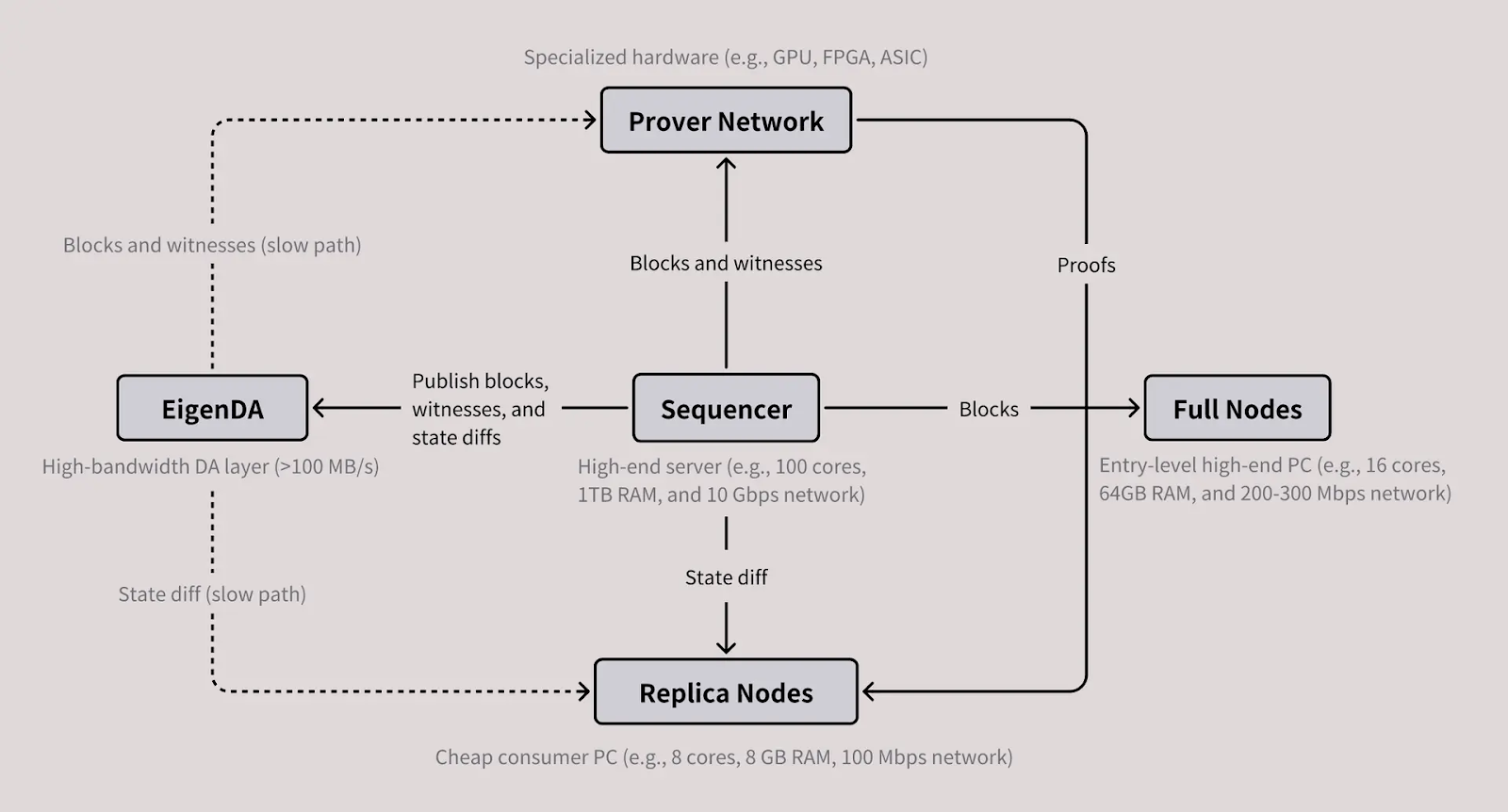

MegaETH's core mechanism revolves around two key technology layers: node specialization and real-time processing and high throughput.

1. Node Specialization

In traditional blockchains (L1), each node performs the same tasks: participating in consensus, executing transactions, and verifying blocks. While secure, this is slow because all nodes are doing repetitive work. L2 networks, on the other hand, are more flexible, allowing different nodes to collaborate and perform different tasks, making the system more efficient. For example, some nodes specialize in ordering transactions (Sequencer), while others specialize in generating or verifying proofs (Prover). MegaETH takes this a step further by introducing a new type of "Replica Node." These nodes don't re-execute every transaction; instead, they receive transaction results from the ordering nodes and only need to verify the data's correctness. This results in faster synchronization and lower hardware requirements. MegaETH uses four types of nodes:

- Sequencer: Responsible for transaction ordering and execution. There is only one active sequencer on the entire network, so there is almost no consensus delay.

- Replica nodes: directly synchronize transaction results without duplicate calculations, resulting in extremely high efficiency.

- Full Node: Re-executes all transactions for verification, often used in high-security scenarios such as bridging or market making.

- Prover: Uses cryptographic methods to verify the correctness of transaction results.

This division of labor allows MegaETH to simultaneously achieve high speed, high security, and low hardware requirements, pioneering a more efficient execution architecture within the Ethereum ecosystem.

2. Real-time processing and high throughput

Another core technological innovation of MegaETH is achieving Web2-level real-time performance, freeing the blockchain from the performance bottlenecks of traditional L1. Traditional EVM chains typically suffer from three main limitations: low transaction throughput, long block times, and difficulty in executing complex computations. MegaETH's design goal is to completely solve these problems:

- Millisecond-level block generation: Block time is approximately 10 milliseconds, allowing sequencer nodes to quickly sort and execute transactions.

- Accelerated state access: On-chain state is cached in memory to avoid frequent disk access and improve transaction processing speed.

- High throughput design: capable of processing hundreds of thousands of transactions per second, reducing redundant calculations and network pressure through state difference transmission.

- High-frequency application support: It can support applications that require fast response, such as on-chain games and high-frequency trading.

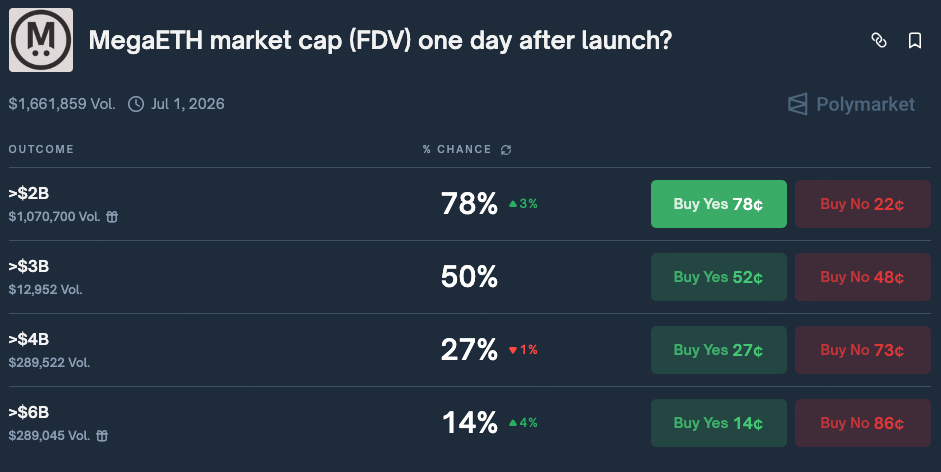

III. Market Pricing

Mega's price range and market valuation can be inferred and analyzed from multiple perspectives. First, regarding the public offering pricing, the official announcement of refunds for all users who bid below $999 million essentially sets a valuation floor for the project, meaning the public offering valuation is highly likely to be higher than $999 million, with the market generally expecting its initial market capitalization to start at the billion-dollar level. Second, from a market expectation perspective, Polymarket's forecast data shows a 78% probability that MEGA tokens will achieve a total circulating market capitalization exceeding $2 billion within 24 hours of listing. Finally, looking at pre-market trading in the secondary market, as of November 7th, MEGA's pre-market circulating market capitalization on Hyperliquid was approximately $3.9 billion.

Based on the above three data points, it can be inferred that the market valuation of MEGA is roughly between $999 million and $3.9 billion. It's worth noting that, comparing the market capitalization of leading Layer 2 projects in the same sector, their total circulating market capitalization is as follows: Optimism (OP) approximately $1.52 billion, Arbitrum (ARB) approximately $2.56 billion, ZKsync (ZK) approximately $1.48 billion, Linea approximately $825 million, Starknet (STRK) approximately $1 billion, and Scroll (SCR) approximately $149 million. Therefore, it's not unreasonable for MEGA to maintain a valuation above $1 billion at launch, but whether it can maintain this level subsequently depends on its technological implementation, the speed of ecosystem expansion, and the sustainability of capital inflows. Considering the current intense competition in the Layer 2 sector, slowing user growth, and the recent nearly 70% drop in market capitalization after Linea's launch, MEGA may face some risk of a correction if it opens at a high valuation.

IV. Popular Ecological Projects

CAP Labs

CAP is a stablecoin protocol within the MegaETH ecosystem, based on two core products: cUSD, denominated in USD, and stcUSD, which generates yield. It provides users with high-yield opportunities including arbitrage, MEV, and RWA. CAP has secured three rounds of funding totaling $11 million, with investors including MegaETH, GSR, Franklin, and ABCDE Labs. Within the MegaETH ecosystem, CAP acts as a "monetary infrastructure," providing a stable anchor asset for on-chain financial activities.

Avon Protocol

Avon Protocol is a lending protocol within the MegaETH ecosystem, uniquely introducing a central limit orders mechanism to the on-chain lending market. Both borrowers and lenders can pre-set specific terms (such as interest rates, collateral ratios, and loan amounts) in the order book, and lending positions are opened instantly upon protocol matching. This mechanism helps improve capital efficiency, reduce fund fragmentation, and better support algorithmic trading and arbitrage strategies. Mechanistically, Avon is perfectly suited to the low latency and high throughput characteristics offered by MegaETH.

NOISE

NOISE is a trend trading platform within the MegaETH ecosystem, with its core concept being to transform trends into tradable assets. Users can trade various topics and trends through the platform, not just traditional price assets. It analyzes real-time social data and public opinion through on-chain machines and then maps the results to tradable tokens or assets. NOISE has a first-mover advantage in this new paradigm of "trends as assets" thanks to the real-time, low-latency infrastructure provided by MegaETH.

Valhalla Perps

Valhalla is a decentralized perpetual contract exchange within the MegaETH ecosystem. Its goal is to provide a centralized exchange-level trading experience and depth on-chain. Currently in the testnet phase, it supports 5x leveraged contract trading for BTC and ETH. It has already completed a $1.5 million funding round, with investors including GSR, Kronos, and Robot Ventures. In MegaETH's high-speed environment, Valhalla optimizes the execution speed and capital efficiency of perpetual contracts.

Rocket

Rocket introduces the concept of a redistribution market, aiming to transform the traditionally static price speculation experience into a mobile-first, social, and real-time model. Users can invest in/predict any chart or price movement (including emojis, NFTs, prediction markets, stocks, gold, etc.) on the Rocket App and achieve instant settlement. Within the MegaETH environment, Rocket's "real-time + interactive + predictive" gameplay can be even better realized.

Nectar AI

Nectar AI is an AI virtual companion generation platform where users can currently earn points by logging in daily, spinning Gachapon, creating photos and videos, and interacting with social avatars. It will integrate AI agents on-chain and be integrated into the MegaETH environment, combining virtual avatars, social interactions, AI-generated content, and blockchain token mechanisms.

V. Future Development and Summary

Overall, MegaETH has indeed demonstrated considerable innovation at the technical level, with its instant confirmation mechanism and high-performance execution architecture offering new ideas for Ethereum scaling. However, considering the market environment and the current hype surrounding the sector, MegaETH's growth path will not be easy. Since October 11th, overall market sentiment has continued to decline, and Layer 2 blockchains have long since faded from the market's spotlight, with investment funds flowing more towards emerging themes such as AI, prediction markets, PerpDEX, and RWA. Against this backdrop, whether MegaETH can achieve the high valuation expectations of the market after its official launch remains highly uncertain.

The current Layer 2 market landscape is relatively stable, with Base and Optimism holding a leading advantage in ecosystem expansion and funding attraction, while Arbitrum maintains high developer activity. For MegaETH to stand out, it must build unique ecosystem value and application scenarios beyond performance. Meanwhile, from a broader competitive perspective, the Ethereum mainnet is also facing external pressure from high-performance public chains such as Solana and BNB Chain, further squeezing MegaETH's growth potential.

Therefore, for MegaETH to achieve long-term sustainable development, it cannot rely solely on technological innovation; it also needs to continuously strengthen its efforts in ecosystem cultivation, developer incentives, funding guidance, and application implementation. The speed of project implementation and user growth within the MegaETH ecosystem will directly impact the market performance and long-term value realization path of the MEGA token. In other words, ecosystem development will be a key determinant of whether MegaETH can break through its valuation ceiling.

Risk warning:

The information above is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no representations or warranties, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry a significant risk of loss. Past performance, hypothetical results, or simulated data are not indicative of future outcomes. The value of cryptocurrencies may rise or fall, and buying, selling, holding, or trading cryptocurrencies may involve significant risks. Before trading or holding cryptocurrencies, you should carefully assess whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.