BTC fell below $100,000, but whales were buying ETH at the bottom.

- 核心观点:加密市场大幅回调,巨鲸逆势抄底。

- 关键要素:

- BTC跌破10万美元,创六月新低。

- 全网爆仓超20亿美元,多单为主。

- 机构资金撤离,ETF持续净流出。

- 市场影响:加剧短期波动,考验市场信心。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

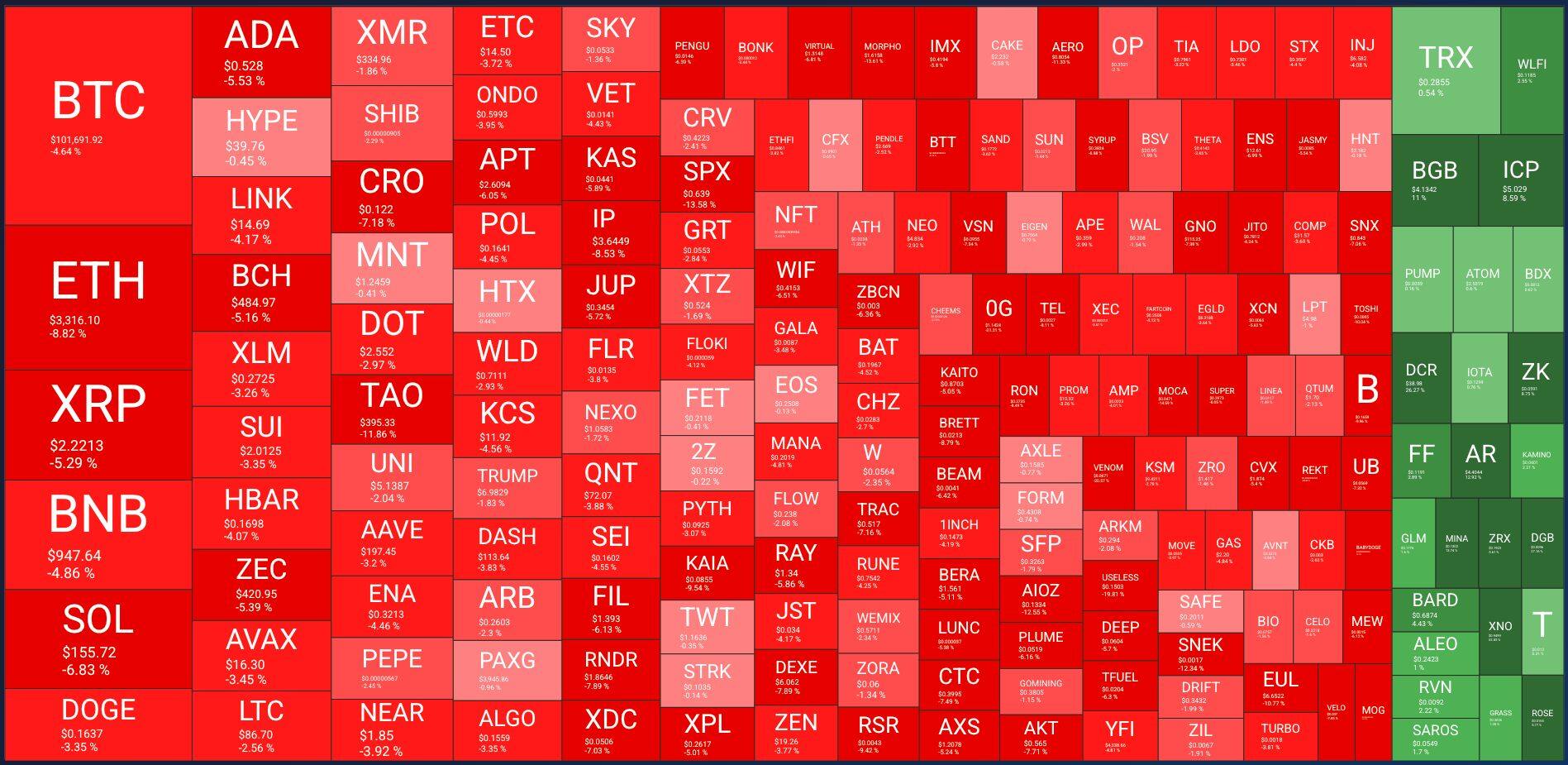

In the early hours of November 5th, the cryptocurrency market experienced a significant correction. BTC fell below the $100,000 mark, hitting a low of $98,944.36, a drop of 4.53%, marking a new low since June 22nd of this year. Other major cryptocurrencies also fared poorly, with ETH falling 8.63% in the past 24 hours, SOL falling 6.92%, BNB falling 4.6%, and XRP falling 4.75%. The altcoin market also suffered a bloodbath; according to Quantifycrypto data, 90% of the top 200 cryptocurrencies by market capitalization have been declining in the past 24 hours.

In the derivatives market, according to Coinglass data, the total liquidation amount across the network reached $2.099 billion in the past 24 hours, of which long positions accounted for $1.681 billion. BTC and ETH were the hardest hit by liquidations, amounting to $642 million and $680 million respectively.

The volatile market conditions caused many on-chain whales to unleverage, while some slower-moving players suffered liquidations. One whale on Aave (address: 0xa740...b5b6) who repeatedly borrowed and pledged wstETH had approximately $23.44 million in wstETH positions liquidated, while another whale on Aave who repeatedly borrowed and pledged long WBTC was also liquidated, with a total liquidation of $31.47 million. Even the Hyperliquid whale with a 100% win rate became a long-term holder last night, forced to liquidate its remaining long positions, accumulating a loss of approximately $39.37 million, with an overall account loss of approximately $30.02 million, wiped out by the market's volatility.

However, looking at the bigger picture, it wasn't just the crypto market that suffered a major setback last night. According to data from msx.com, US stocks generally closed lower yesterday, with the Dow Jones Industrial Average down 0.53%, the S&P 500 down 1.17%, and the Nasdaq down 2.04%; South Korean stocks also fell sharply, with the KOSPI index extending its decline to 4%; and in Japan, the Nikkei 225 index fell 2%.

Macroeconomic level: The continued US government shutdown exacerbates uncertainty surrounding a December interest rate cut.

The global financial market downturn must have macroeconomic reasons.

US government shutdown lasts a record long

The U.S. Senate failed to pass a temporary federal funding bill again on November 4th, local time. This means that the current federal government shutdown, which began on October 1st, is about to break the historical record of 35 days set at the end of 2018 and the beginning of 2019, becoming the longest government shutdown in U.S. history.

The standoff between the two parties in the United States has brought many government functions to a standstill and affected the release of many economic data. The gap in macroeconomic information has triggered panic selling in the market.

Uncertainty surrounding a December Fed rate cut intensifies

In the second half of this year, the market generally believed that the Federal Reserve would shift from quantitative tightening to quantitative easing, and traders were certain that the Fed would cut interest rates in the second half of 2025, the only difference being the amount of the cut. However, Fed Chairman Powell's speech in the early hours of October 30th increased the uncertainty surrounding the expected rate cut in December, and Nomura Securities even cancelled its expectation of another Fed rate cut in December.

In his speech, Powell stated that current data suggests the outlook has not changed significantly, but inflation remains slightly high. Furthermore, the government shutdown will temporarily drag down economic activity, and the Federal Reserve lacks a very detailed understanding of the economy. Therefore, another rate cut in December is far from a certainty.

According to CME's FedWatch tool, the probability of the Federal Reserve cutting interest rates by 25 basis points in December has dropped to 73.9%, while the probability of keeping rates unchanged is 26.1%.

At the micro level: Large funds are withdrawing, and the crypto industry is "on fire everywhere".

From a micro perspective of the crypto market, investor sentiment has been driven to extreme fear in the past two days. According to data from alternative.me, the Fear & Greed Index is 23 today (compared to 21 yesterday).

Institutions withdraw from the crypto market

On one hand, US Bitcoin spot ETFs and Ethereum spot ETFs have seen net outflows for five consecutive days, with the Bitcoin spot ETF experiencing a net outflow of $570 million and the Ethereum spot ETF experiencing a net outflow of $108 million today. Meanwhile, the DAT craze seems to be waning, with even Strategy, a benchmark company in Bitcoin treasury, slowing its buying pace; in the third quarter of 2025, Strategy only added approximately 43,000 Bitcoins.

The withdrawal of institutional funds, such as ETFs and DAT, has deprived assets like BTC of structural buying support. This has increased the impact of short-term traders and market sentiment on BTC prices, leading to more volatile market conditions. ETFs and DAT previously contributed to market confidence in the growing acceptance of cryptocurrencies by traditional finance; their simultaneous withdrawal has severely damaged market confidence, potentially triggering a bearish market sentiment and a stampede-like sell-off.

However, Bloomberg ETF analyst Eric Balchunas continues to reassure the market, stating that Bitcoin ETF inflows will follow a "two steps forward, one step back" pattern, and that the market is currently in a correction phase, emphasizing that short-term volatility is normal. "In my view, this is just part of the growth process; only children expect daily gains," Balchunas added.

The crypto industry is "on fire everywhere".

Meanwhile, the crypto industry itself is also in turmoil. Recently, numerous DeFi projects have collapsed. On November 3rd, the established DeFi project Balancer suffered a $116 million theft, ultimately due to a vulnerability in its smart contract interaction, revealing the crypto industry's chaotic and unregulated nature. Another investment project, Stream Finance, was also hacked, losing over $93 million. It has since suspended all withdrawals and deposits, but the specific reason for the hack remains undisclosed, leaving investors bewildered and losing their funds.

On the blockchain, the recently popular BSC Meme coin GIGGLE experienced a dramatic rollercoaster ride on November 3rd (related reading: GIGGLE's "Rollercoaster" Price Movement, Whose Responsibility is the BSC Ecosystem's Flash Crash? ), dragging down other Chinese Meme coins related to BSC, leaving investors in despair. Even more dramatically, following further statements from CZ and He Yi, GIGGLE's price quickly rebounded from a low of $47 to above $100 on November 4th. While the price recovered, investor sentiment was irreparably damaged.

Even in this critical moment, whales are buying ETH at rock-bottom prices.

The crypto market is facing both internal and external challenges. Arthur, founder of DeFiance Capital, said that "survival is the only goal" right now. Since entering the crypto market in 2017, the current market environment is similar to that of 2018-2019, making it one of the most difficult periods for crypto market participants.

Even in such a critical moment, whales are still buying the dip, with ETH being the most favored.

Yi Lihua begins building a position in ETH.

Liquid Capital (formerly LD Capital) founder Yi Lihua stated that he is continuing to gradually buy ETH, seeing "huge opportunities until the US government reopens." He believes there is no need to worry about ETH's spot price movement, as its fundamentals remain solid, the total size of stablecoins continues to expand, and short-term risks to US stocks are limited. Yi Lihua pointed out that while market sentiment remains under pressure, the funding situation and macroeconomic environment are gradually improving, and he remains optimistic about market performance in late November and beyond.

1011 Insider information: Whale reverses course and goes long on BTC and ETH

The previously high-flying "1011 Insider Whale" is also increasing its long positions in BTC and ETH. This whale opened short positions three days before the massive cryptocurrency crash on October 11th, ultimately profiting approximately $200 million. Now, with the crash underway, it has chosen to continue adding to its positions. As of now, the "1011 Insider Whale's" total long positions have increased to $104 million, with a floating loss exceeding $3 million. Specifically, it holds 600 BTC at an opening price of $104,785.9 and 13,000 ETH at an opening price of $3,444.81.

After "Brother Machi's" account was wiped out, he deposited more money to go long on ETH.

Meanwhile, due to the sharp market decline, "Brother Machi," who had no experience in cryptocurrency trading, had his account completely liquidated in the early hours of November 5th, leaving him with only $1,718. However, he didn't stop there. According to Hyperliquid data, at 2:17 AM on November 5th, Brother Machi deposited another $250,000 into his account, subsequently opening a 25x leveraged long position of 988 ETH. He then deposited another $275,000 USDC into HyperLiquid and opened another 25x leveraged long position in ETH.

Fortunately, the market rebounded this morning, and "Brother Machi" currently holds 1111.11 ETH with an order price of $3276.16, and has already made a profit of over $70,000.

Whale lending increases ETH holdings

Without the unlimited ammunition of "Big Brother Machi," some whales have chosen to borrow money to increase their holdings. According to Onchain Lens monitoring, the mysterious address cluster "7 Siblings" recently borrowed $61 million USDC to purchase approximately 18,000 ETH. This marks the second consecutive day of its large-scale buying activity, bringing the total investment to approximately $133.49 million in ETH purchases over the two days.

Meanwhile, according to on-chain analyst EmberCN, a whale/institution that borrowed 66,000 ETH on October 20th to short and profited approximately $24.48 million has recently switched to going long. Data shows that this address transferred approximately $482 million in USDC to Binance from the evening of November 4th to this morning, subsequently withdrawing approximately 144,000 ETH from the exchange, with an estimated average purchase price of approximately $3,341. This USDC was the source of funds used for collateralized borrowing on Aave last month.

Renowned trader Eugene has been holding long positions in ETH since "10.11".

Crypto trader Eugene also posted on the evening of November 4th, stating that he had established a long position in ETH near the low of BTC on October 11th, and called it the "last line of defense" for the bulls. He pointed out that market sentiment is excessively bearish, with "bearish" voices dominating in chat rooms and social platforms, and predicted that a wave of short squeeze may be coming.

Institutional entities are also suspected of increasing their ETH holdings.

Although Ethereum spot ETFs have seen continuous outflows recently, on-chain traces suggest that some institutional entities are still buying ETH at the bottom. According to Onchain Lens monitoring, Richard Heart, founder of HEX and PulseChain, recently transferred 27,449 ETH to a new wallet and then transferred the funds through Tornado Cash.

Meanwhile, on the morning of November 5, a newly created wallet withdrew 10,000 ETH (approximately $32.72 million) from Kraken, and on-chain evidence suggests that the address may be related to Bitmine.

Despite the current uncertain macroeconomic environment, setbacks in the crypto industry, and Bitcoin's drop below $100,000, hitting a new low since June and sparking concerns about a "bull market turning into a bear market," the bargain hunting by these whales is still sending us a signal: this is the bottom of the market, not the beginning of a new long bear market.

Once the short-term market sentiment subsides and the US government returns to normal, the crypto market will "continue to play music and dance"!