A summary of recent developments in popular Perp DEXs; find the participation method that best suits you.

- 核心观点:Perp DEX板块热度不减,空投激励是关键。

- 关键要素:

- StandX主网上线,交易量破亿并推积分活动。

- Aster月度空投持续,并加速代币回购销毁。

- Lighter获Coinbase关注,但TGE时间可能延迟。

- 市场影响:吸引用户参与,维持板块活跃度与资金流入。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Despite the recent overall market downturn, community discussion on the Perp DEX platform remains high, driven by incentives such as token airdrops, and daily trading volume has remained stable without a significant decline. Odaily Planet Daily has compiled a list of recent developments from three Perp DEX platforms with high community discussion activity, highlighting the most cost-effective strategies at this stage.

StandX: The trading points program is now live on the mainnet, and a trading competition is coming soon.

On December 10th, StandX announced on its X platform that its trading points program had launched on the mainnet, with trading volume exceeding $81 million on the first day and surpassing $100 million on December 16th. Users can earn points by depositing DUSD into Perps Wallet, Vaults, or actively participating in trading (interactive link: https://standx.com/ ).

This event is in partnership with Binance Wallet. Users who extend their Binance Wallet wallets without a private key will receive a 10% bonus on their points, which will last for four weeks until January 7, 2026. Points will be awarded retroactively, rewarding all transactions since the mainnet launch.

In addition, Justin, a core member of the team, participated in a Chinese AMA in early December. Odaily Planet Daily has compiled the following key points:

Q1: Is there a risk of the built-in stablecoin (DUSD) becoming unpegged? How secure is it?

A1: DUSD's mechanism is secure and fully collateralized, with underlying assets including mainstream assets such as BTC and ETH. It adopts a "spot long + contract short" arbitrage strategy to maintain "market neutrality." Regardless of whether the coin price rises or falls, the total asset value remains stable in USDT, earning only funding fees and not bearing the risk of coin price fluctuations.

Q2: What are the differences between the mainnet and the previous Alpha testnet?

A2: The Alpha phase uses testnet tokens, primarily for testing product features and distributing "testnet points"; while the mainnet phase uses real money, requiring users to deposit actual USDT for transactions. Currently, these points are "mainnet points," and their value and weight differ from those on the testnet.

Q3: What are the future plans for the project?

A3: StandX is about to launch a trading competition and plans to list more altcoin contract pairs. At the same time, the team will continue to optimize the product experience, aiming to make the DEX comparable to a CEX (centralized exchange).

Q4: What is the ratio of transaction points to deposit points in the short position?

A4: We haven't finalized this yet. Currently, we're separating the points for each stage and each type, so it's essentially a matter of each receiving their own rewards. Before the airdrop, we'll conduct a comprehensive evaluation of each user type and each type of points to assess their contribution to the StandX product and ecosystem as a whole, and only then will we determine the reward ratio for each project.

StandX Points Earning Guide

Method 1: Deposit DUSD to earn tDUSD (1.2x points). The specific steps are as follows:

- Use USDT/USDC mint DUSD;

- Deposit DUSD into your Perps wallet to exchange it for tDUSD;

- 1000 tDUSD/day = 1200 points;

- Lossless participation, suitable for newcomers and users who do not participate in transactions.

Method 2: Provide LP, with the following points rules:

- DUSD: Earn 1 point per DUSD per day;

- USDT/USDC: Earn 1.2 points per USDT/USDC per day.

For example, 1000 DUSD + 1000 USDT → 2200 points/day.

Method 3: Earn points through SWAP trading (for a specified trading pair). 5 points are awarded for every 100 DUSD traded.

This method of earning points is highly risky; those who "farm points" should proceed with caution.

Method 4: Invite friends, and both parties will receive an extra 5% points bonus.

Method 5: Earn credits by trading on the StandX mainnet.

- If you are profitable: the more profit you make, the more tDUSD you earn, and the higher your points.

- If there is a loss: If the loss exceeds 50% of the initial capital, points will still be awarded equal to 50% of the initial capital.

In addition, the daily trading check-in activity is worth participating in, as you can earn 10 points by completing two transactions of more than $100 each day.

The StandX trading points-earning and token airdrop scheme is still in its early stages. Judging from the daily trading volume, it is not very "busy" at the moment, and it is relatively easy to earn points, making it worthwhile to participate. Even if you don't trade to earn points, you can still save stablecoins to "get" points for free every day.

Aster: Monthly airdrops + periodic buybacks and burns; launch of a trading competition between humans and AI.

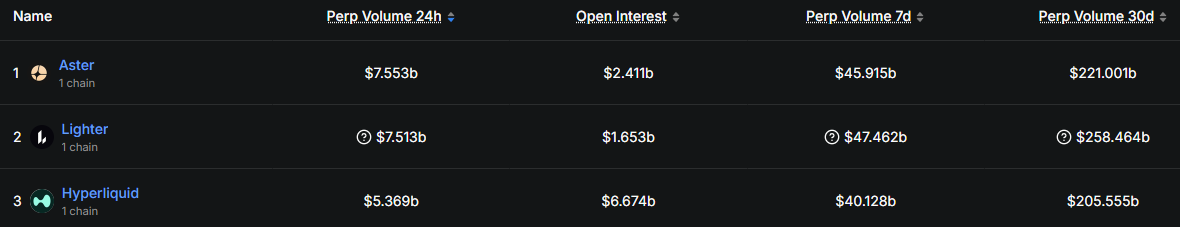

According to the latest data from DeFiLlama , Aster's daily trading volume has surpassed that of Lighter, which has the highest recent token issuance expectations, ranking first among Perp DEX projects.

Perp DEX Data

Although Aster has completed TGE, its airdrop campaign is still ongoing, with a monthly cycle, short interaction period, and clear rewards.

The fourth phase of the token airdrop is underway.

The fourth phase of Aster Harvest officially launched at 8:00 AM Beijing time on November 10th and will continue until 7:59 AM on December 22nd, 2025. This phase will allocate 1.5% of the total ASTER token supply, evenly distributed across six epochs, with 0.25% allocated per epoch.

The fifth phase of the token airdrop will begin on December 22nd and last for 6 weeks.

Phase 5, Aster Crystal, will begin after Phase 4, Aster Harvest, has concluded. Details are as follows:

- Duration: 6 weeks (December 22, 2025 to February 1, 2026);

- Allocation ratio: 1.2% of the total supply in Phase 5 (approximately 96 million ASTER), of which 0.6% can be claimed immediately after the event ends, and the other 0.6% has a 3-month lock-up period.

In addition, Aster will launch the Aster Chain testnet at the end of this year, the mainnet in Q1 of next year, and the token staking and governance functions in Q2.

Phase 4 of the acceleration program saw the repurchase program executed, with the average daily repurchase amount increasing to approximately $4 million.

According to the latest announcement from the ASTER team, the pace of the Phase 4 buyback program will be accelerated under the existing mechanism. The accelerated buyback scale will increase from approximately $3 million per day to approximately $4 million per day starting from December 8th.

The official statement indicates that this move will allow for a faster return of the Phase 4 fees accumulated since November 10th to be invested in on-chain buybacks, and will strengthen support during periods of market volatility. Based on current fee levels, it is estimated that the buyback will reach a stable execution phase within 8 to 10 days, after which the daily buyback volume will continue to be maintained between 60% and 90% of the previous day's revenue, in accordance with Phase 4 rules.

The team emphasized that all operations were carried out transparently on-chain, and the relevant execution wallet address remained unchanged ( address link: https://bscscan.com/address/0x573ca9ff6b7f164dff513077850d5cd796006ff4 ).

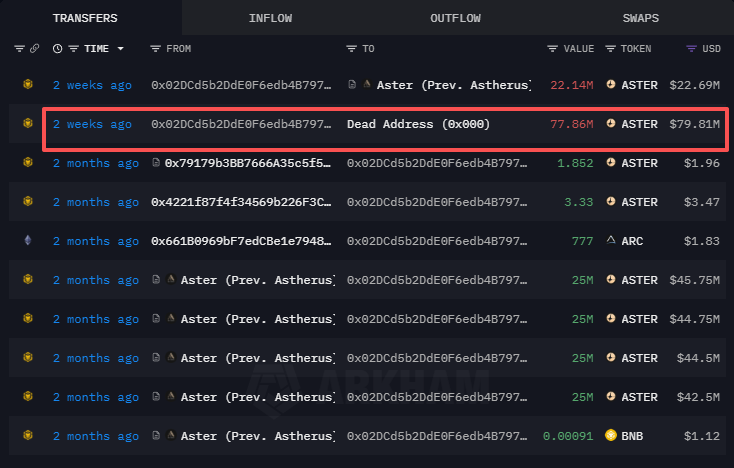

In addition, Aster destroyed 77.86 million ASTER tokens repurchased during Season 3 on December 5, worth nearly $80 million.

Launching a trading competition between humans and AI.

On December 9th, Aster announced on its X platform that a trading duel between humans and AI had launched. 70 funded human investors are competing against 30 AI agents run by @nofA_ai (each with an initial investment of $10,000). The trading duel will run from December 9th to December 23rd.

To date, only 29 out of 100 traders (human and AI) have achieved profitability. Of these, only 9 have earned over $5,000 – 8 human traders and 1 AI. The top performer is human trader Tippy, who has earned a staggering $47,000, far ahead of the competition.

Human vs. AI trading profit trend chart

Lighter: Coming to Coinbase, but TGE may be delayed.

Since Lighter announced the completion of a $68 million funding round on November 11th, bringing its company valuation to $1.5 billion, Lighter's daily trading volume has consistently ranked among the top on Perp DEX, and has held the number one position for many days. Regarding the second quarter's points, the official distribution is scheduled for every Friday. Market makers will receive 50,000 points weekly (only advanced accounts are eligible to earn points through market making), while regular trading users will receive 200,000 points weekly. Factors influencing points include trading volume, open interest, account balance, leverage, profit/loss, and trading instruments, but the specific weights have not yet been announced and remain a "blind box."

On December 13th, Coinbase Markets The announcement on the X platform that Lighter would be added to the listing roadmap has led community members to believe that Lighter is not far from being listed on TGE.

Coinbase adds Lighter to its listing roadmap

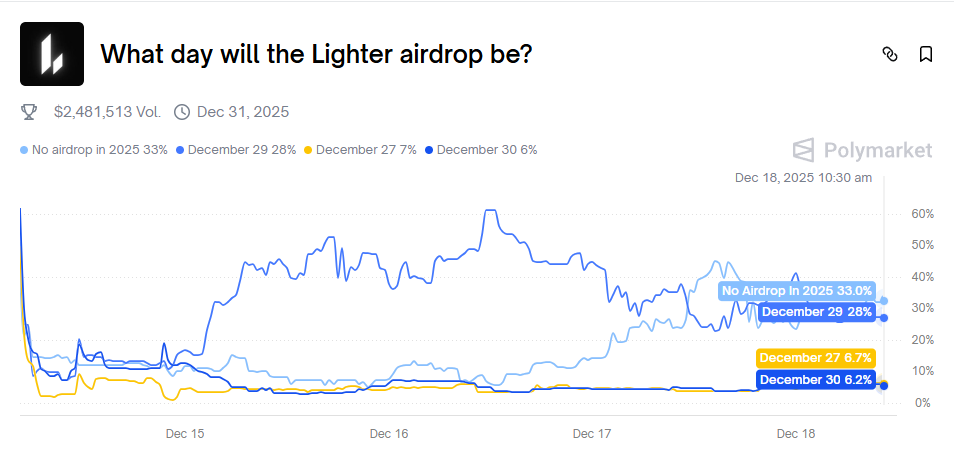

However, according to feedback from members who participated in Lighter's Japan AMA, the TGE date may be delayed to between December 24th and January 1st of next year . Affected by this news, the probability of "No" in the Polymarket platform's "Will Lighter conduct a token airdrop this year?" event rose from only 8% on December 16th to 33%.

The Polymarket platform's "Will Lighter conduct a token airdrop this year?" event

Furthermore, in a podcast interview with The Chopping Block today, Lighter founder and CEO Vladimir Novakovski, when answering questions about tokens, stated: "From an expectation management perspective, this is a marathon, not a sprint. The team and the early community don't actually expect a 'takeoff on day one' scenario. A more realistic expectation is to start from a relatively healthy position, and then, with continued product development, the overall trend will gradually move upward. Our goal is clearly not to maximize value on day one, but to ensure it's in a healthy state in the current market environment, and then iterate continuously on that foundation. We've seen too many tokens launch with a sharp rise, and then decline all the way down."