The best prediction market trading tools you should know by 2025

- 核心观点:预测市场成为2025年加密杀手级应用。

- 关键要素:

- 10月用户52.42万,交易3000万笔。

- Kalshi占45%-55%市场份额。

- 涌现多类辅助交易分析平台。

- 市场影响:推动预测赛道创新与用户增长。

- 时效性标注:中期影响

Original article by Odaily Planet Daily ( @OdailyChina )

Author|CryptoLeo ( @LeoAndCrypto )

Prediction markets have become the "killer app" of crypto in 2025. Data shows that in October, the total number of prediction market users reached 524,200 (40.4% of whom were new users), with 30 million transactions, making it the most active month in the history of prediction markets. Kalshi held a market share of approximately 45%-55% in both transaction volume and number of transactions, followed by Polymarket, while other smaller projects accounted for only about 7%-10%. If you haven't participated in prediction markets yet, you'll miss out on the best way to make money in 2025-2026.

Many people may worry about not being able to profit in the prediction market, possibly due to issues with trading strategies or skill level. To address this, Odaily has compiled a list of recently popular and useful "auxiliary projects" for the prediction market, including prediction market analysis and proxy applications. These can help you find the best trading direction in the prediction market. Most of the recommended protocols are based on Polymarket, as follows:

HashDive

HashDive is a prediction market trading analytics platform (based on Polymarket), which includes trading volume, wallet data, and market analysis. The market analysis includes: current trading volume data for events, liquidity data, the number of new YES or NO buys within the last 24 hours, and the event's expiration time and the potential yield for users buying YES/NO.

In addition, HashDive allows users to query a user's trading performance by entering their address/username, including: trading position size, number of active days, balance, profit/loss rankings for 1/7/30 days and all time periods, as well as recent/historical betting events, highest/lowest yield betting events, and average trading volume over the past 30 days. (Tracking whales)

HashDive also offers an account smart rating feature with scores ranging from -100 to 100. Higher scores typically reflect more stable and profitable trading. (Full data is available only with a deposit.)

Its Screener feature allows filtering of trading markets, results, trading volume, trader data, latest price changes, whale buy/sell data and ratios, and also includes a predictive market tree diagram grouped by category. Each square represents a market result, with the size of the square reflecting one indicator (such as trading volume) and the color reflecting another indicator (such as price change), helping users better understand the trend of an event.

The PnL Leaderboard section displays a user's profit ranking in a particular market and a ranking of the user's largest betting volume in that market.

The Whale Positions section displays the main market holdings of users on Polymarket, focusing on the largest positions (entry price, current market price, profit, etc.) of individual users in currently active and unsettled markets.

zerosupercycle

zerosupercycle is a community focused on Polymarket users, providing help and analysis through Discord. Users can discuss anything related to predicting market events and trading trends in the group, making it ideal for active users of the DC group.

PredictFolio

PredictFolio is a user analytics platform for multiple prediction markets, enabling the analysis, comparison, and tracking of any user.

PredictFolio is relatively simple, lacking the numerous sections and details of HashDive. Users can analyze top market predictions by searching for relevant data. It includes trading volume, investment size, and participating markets, and also displays profit/loss (realized/unrealized). Currently, the application offers fast query speeds and a clean interface, but it's not yet fully comprehensive and lacks the in-depth analysis capabilities of HashDive. However, it could serve as a simple market prediction query tool.

fireplace

Fireplace is a news prediction betting platform, currently on the waiting list. When trending news emerges, related betting appears. You can follow other people's bets, including premium betting deals. So far, it seems to have some social aspects in addition to predictions. I'm still on the waiting list and haven't been able to summarize Fireplace's advantages compared to other platforms.

Liquid

Liquid is a prediction market protocol I'm quite optimistic about. It's similar to betting with insurance. In a typical prediction market, a user's bet is wiped out upon loss. Liquid adds an insurance mechanism: after placing a bet, users can contribute a certain percentage as insurance. This way, even if they lose the prediction, they can receive a return far exceeding the insurance premium. For example, if you bet $1000 and contribute $150 as insurance, you'll receive $500 back if you lose. According to their official announcement, the insurance premium can be adjusted proportionally to the bet amount and the return amount. Liquid supports these returns through a Delta-neutral aggregated vault.

The insurance mechanism can give users confidence to increase the value of their betting positions, but Liquid is currently on the waiting list, and the use of transaction fees, insurance amounts, and Delta neutral amounts is unknown at this time. We will continue to monitor this situation.

Betmoar

Betmoar is a prediction market trading application and the official bot provider for Polymarket, supporting high-stakes betting search, real-time news betting, and real-time UMA decision-making.

Betmoar's news section allows users to filter recent trending news. Clicking on a news item allows users to access related markets and conduct transactions based on keywords and content.

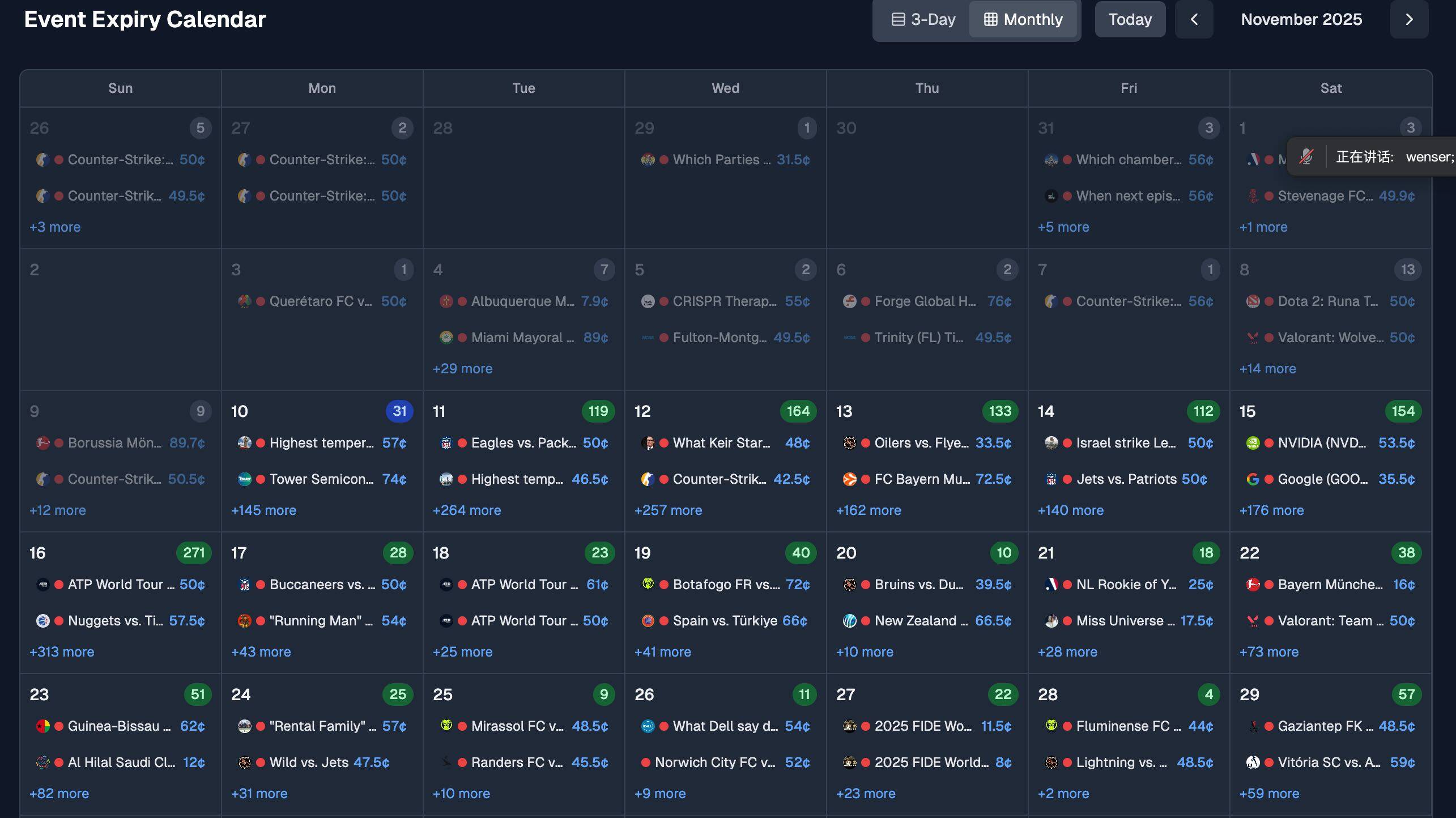

Betmoar's Clandar section displays the number of active markets, total liquidity, total trading volume, and 24-hour trading volume for all prediction markets. It also allows filtering by hot spots, deadlines, result prices, spread ranges (the spread for prediction bets, such as YES 60%, NO 40%), trading volume, and liquidity.

The calendar section is very useful to me; it allows you to filter and easily see the market forecasts you want.

Its UMA sector can make decisions on some controversial predictive market events through voting.

Users can log in to Betmoar using their email or wallet. Email login requires private key verification, but wallet login is recommended.

Sportstensor

Sportstensor is an AI network for predicting sports events, powered by the Bittensor network. It can leverage multiple AI models to create and improve prediction models in a decentralized manner, reducing reliance on any single entity or algorithm. By summarizing and analyzing data, it helps to build more suitable prediction schemes to aid in accurate predictions.

Miners can receive requests from validators that contain specific information, such as team names and match details;

Retrieve historical and current statistics related to the teams involved in the query from sports databases;

Analyze the data using a trained machine learning model to predict the teams they believe will win and their probability of winning;

The prediction results are returned to the validator for confirmation and further processing.

Many organizations currently have a great demand for high-performance predictive AI and are looking for more accurate sports AI prediction models. AI prediction models may become the next hot area in the prediction market. Those who are interested can go to its official website to register and run as a miner.

Polyfactual

Polyfactual is an AI-based analytics platform that currently offers in-depth research for predictive markets and real-time news feeds.

Its built-in AI deep analysis allows users to simply paste the Polymarket link or ask any market prediction-related questions and spend 10 PLOYFACTS tokens (its practical token, currently priced at $0.0038 with a market capitalization of $3.8 million) to receive deep AI predictive analysis provided by its model.

Polyfactual has also released a Google Chrome extension, which is quite convenient. Currently, Polyfactual has 12.6k followers on X.

Polysights

Polysights is a predictive market analytics platform that provides users with practical tools related to polymarkets. These include:

Predictive market AI insights and analysis, price and volume analysis, real-time notifications and information feeds, arbitrage and trading indicators, TG robot, etc.

I am particularly optimistic about the arbitrage function, which provides arbitrage opportunities by detecting real-time price differences on the platform and utilizing detailed market data.

Polysights is currently in beta and has recently added an insider tracking feature (this feature does not include truly 100% insider winning accounts; such accounts are difficult to find in the prediction market and also include large-scale transactions and arbitrage transactions). Users can check the positions and betting activities of insider accounts in real time. An AI agent will also be launched in the future (subject to payment).

Robin

Robin is a DeFi platform that allows users to earn yield on positions held on Polymarket. It passively provides liquidity for prediction markets, allowing traders to stake prediction tokens from platforms like Polymarket to earn income. Funds are invested in the DeFi space to generate yield during the prediction period without affecting exposure to the underlying events or introducing additional liquidation risk to stakers.

Specifically, when a user deposits their prediction result tokens (YES/NO) into Robin's staking vault, Robin automatically provides counterparty tokens to synthesize USDC and create a delta-neutral position. These tokens are then deposited into the yield protocol to earn rewards. After Polymarket completes market settlement, Robin automatically redeems the underlying YES/NO tokens and breaks down the merged USDC. The vault identifies the winning result, distributes the rewards to the correct token holders, and unlocks rewards for all stakers. Users can redeem their prediction tokens at any time during this process.

Robin is currently in the testing phase and is worth observing over the long term. In addition, Robin has also launched a points program for token airdrops during TGE.

Stand

Stand is a trading terminal for trading on Polymarket, providing real-time news and notifications. In addition to basic market queries and filtering, Stand's highlight is the Octobox feature, which supports trading in multiple prediction markets. One interface allows you to track and trade up to eight prediction markets simultaneously, and you can pull prediction market events of interest into one interface to view the trading direction and probability of success in real time.

Nevua Markets

Nevua Markets is a prediction market monitoring platform that provides users with real-time updates on prediction market events of interest. Users can select topics of interest and access related prediction markets. By relying on Nevua Markets, users can follow topics, event status, and market price alerts (equivalent to exchange listing and price breakout push notifications in the prediction market version). Users can set single and repeat alerts and receive notifications on Telegram and Discord, enabling them to trade early on prediction market events.

Conclusion

Currently, the applications I am optimistic about and will continue to observe or participate in include: HashDive, Liquid, Polyfactual tokens, Polysights, and Robin. The reasons are as follows: for example, HashDive's data diversity, Liquid's insurance mechanism (which is also a prediction protocol on BNB, and CZ mentioned a warning), Robin's airdrop points, and Polysights' arbitrage indicators.

By the way, there are many other predictive aids on the market, and this article will continue to be updated. Of course, each of the above protocols has its own strengths, and which protocol you prefer depends on your own priorities. DYOR!