Ping launches c402.market, a launch pad for the x402 ecosystem, and Pump.fun?

- 核心观点:PING转型生态基础货币,推动x402资产创造。

- 关键要素:

- c402.market强制新币与PING配对交易。

- 代币发射产生持续USDC购买PING需求。

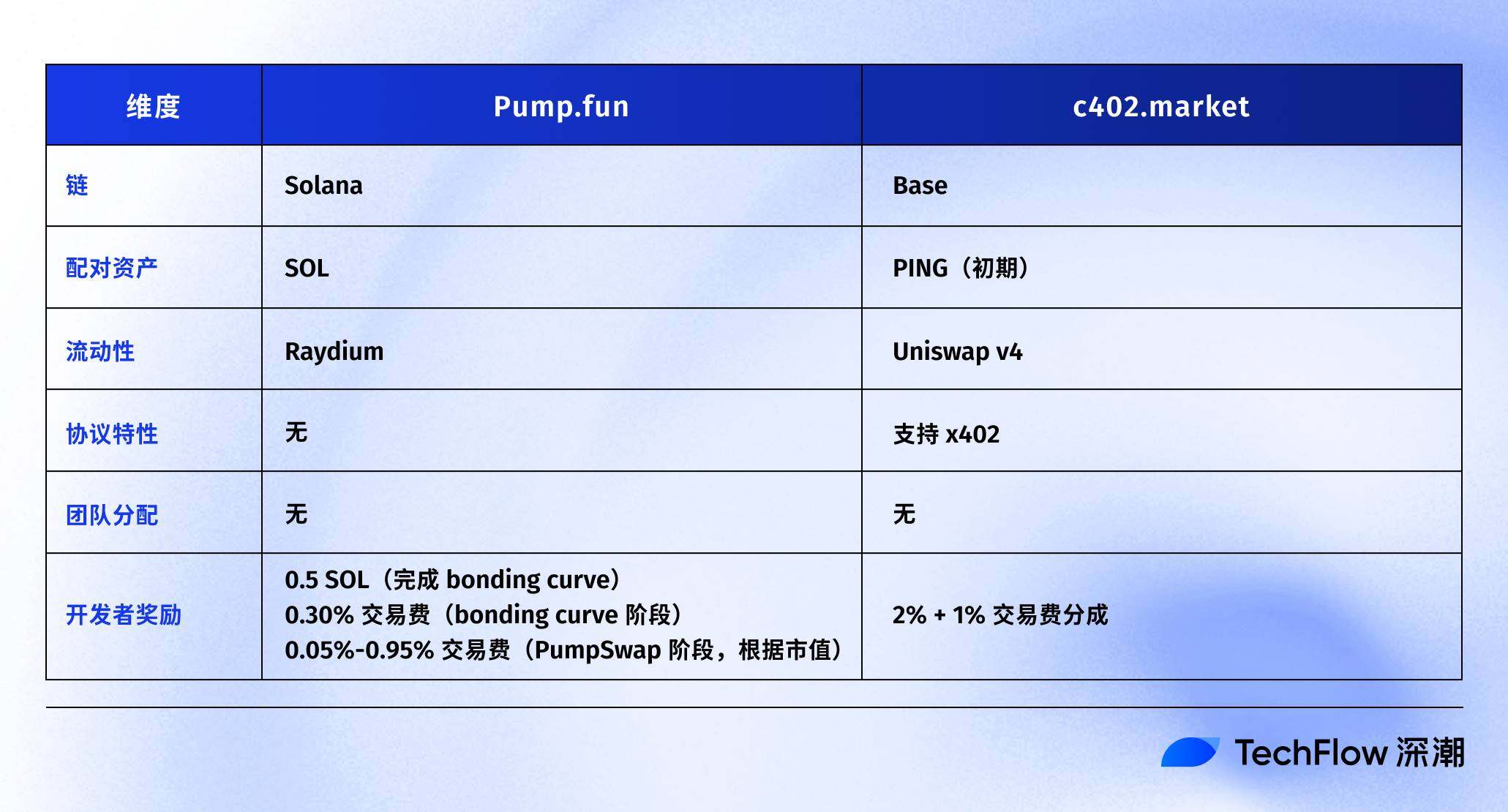

- 借鉴Pump.fun模型但支持x402支付协议。

- 市场影响:或催生x402生态局部投资机会。

- 时效性标注:短期影响

Original author: David, TechFlow

The x402 narrative was popular for half a month, but not many new assets emerged from it.

The reason for this is that x402 is geared towards payment services between AIs, which does not conform to the common practice of "asset creation" in crypto.

Another reason is that most cryptographic projects around the x402 protocol are infrastructure projects, benefiting more from the hype surrounding the technology narrative than from any substantial product progress in the short term.

The first asset created based on x402, $PING (although it's a meme), ironically became the one that started causing trouble.

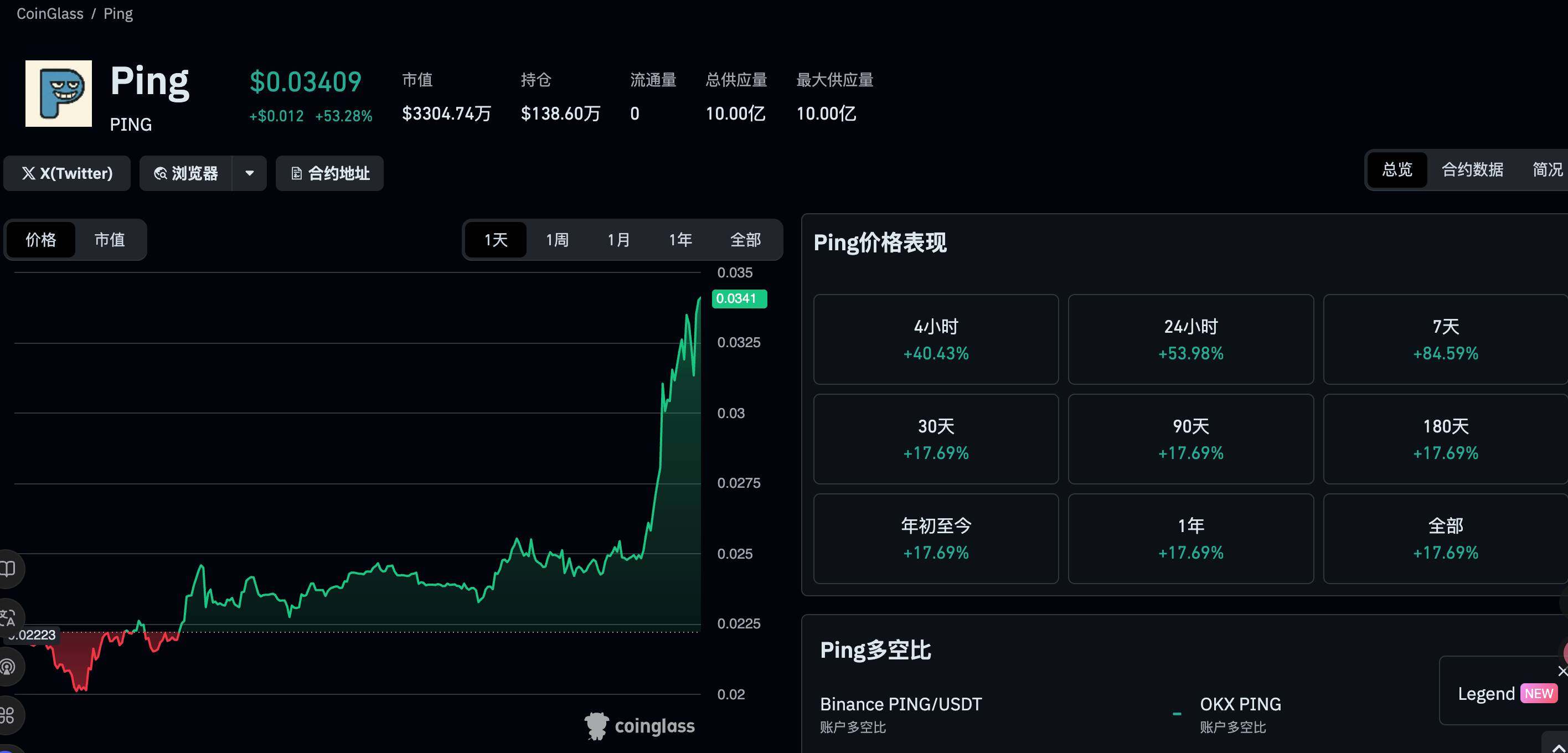

On November 10, PING's official Twitter account, @pingobserver, announced the launch of c402.market, a token issuance platform based on the x402 protocol, which was expected to officially launch at 10 p.m. that evening.

As soon as the news broke, the price of PING tokens surged from its intraday low, with a 24-hour increase of nearly 50%.

In short, the core mechanism of c402.market is that all new tokens issued on the platform will be paired with $PING for trading by default .

In other words, PING is no longer just a meme token for the x402 narrative, but has transformed into the "base currency" of the entire c402 ecosystem. If you want to participate in new projects on the platform, you need to hold PING.

This is a familiar tactic. The Pump.fun ecosystem in the Solana ecosystem has made SOL a necessity for meme-busting; various launchers on the Base chain have given ETH a real-world use case.

Now c402.market is trying to make PING play a similar role in the x402 ecosystem.

We are currently at a point in time where bull and bear markets diverge. Some people believe the market is in a bear market and there are no new narratives, so they are not optimistic about newer assets. Others believe that the "copycat season" is coming in a different form than expected, which inevitably presents some local opportunities.

With trading data for the x402 protocol declining, creating a launchpad for the x402 concept that focuses more on trading and asset creation might represent a localized opportunity in the current market.

However, can PING successfully transition from a simple meme coin to a so-called ecosystem currency? What opportunities and pitfalls lie within this for ordinary investors?

Quick review of x402 and PING

For those unfamiliar with the x402, here's a quick summary:

x402 is an open payment protocol launched by Coinbase in May 2025. It allows websites, APIs, and AI agents to make payments directly using stablecoins (mainly USDC) without requiring an account, password, or API key.

Its core mechanism is very simple, as we introduced a month ago. Simply put, when you access a service that requires payment, the server returns an HTTP 402 status code (this is a "payment required" code that has existed in the Internet protocol for a long time but has never been used), telling you how much you need to pay.

You send an on-chain payment using your wallet, then re-request. After the server verifies the request, it grants you access via an X402 . The entire process can be completed within 2 seconds with zero transaction fees.

(Related reading: Google and Visa are both investing in this area; what investment opportunities are hidden in the undervalued x402 protocol? )

The popularity of the x402 is inseparable from $PING, as the latter has brought real wealth effects.

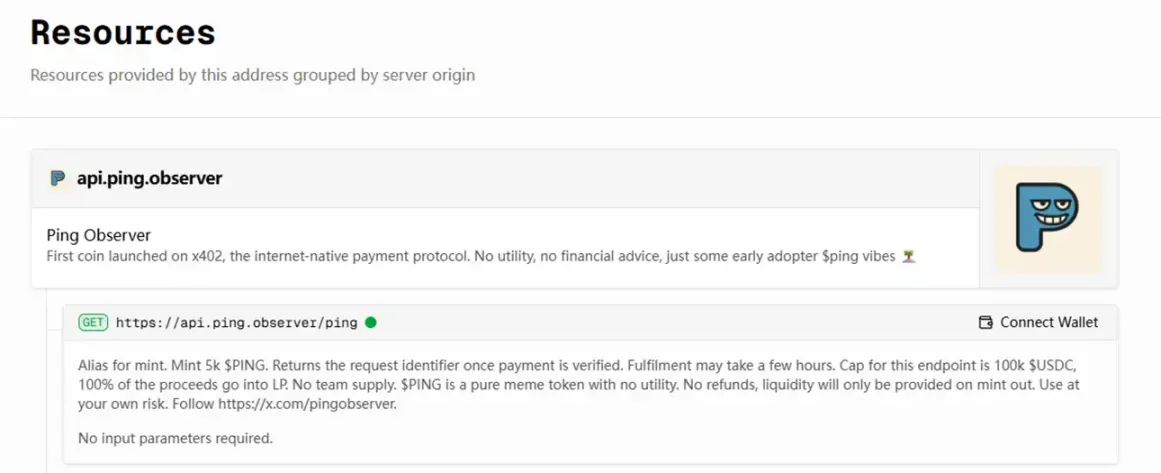

$PING is the first token issued via the x402 protocol . Users do not need to register an account on the website; they simply visit a URL, receive a "402 Payment Required" prompt, pay a small amount of USDC, and then resubmit to receive the PING tokens.

This coin itself doesn't really have any function; it's more like a meme. However, its genes come with the aura of "this is the first coin generated using x402," which is somewhat reminiscent of the previous wave of inscriptions. As a result, there has been a lot of speculation surrounding it in the past month. At the beginning of its launch, it surged by 30 times, and its market value exceeded 60 million US dollars.

However, after PING became popular, the x402 ecosystem fell into an awkward situation:

The protocol is cool, the technological narrative is strong, and the backing from major companies is solid; however, apart from PING, the meme coin, the ecosystem lacks more "assets" that allow users to participate . x402 is more like a payment infrastructure than a token issuance tool.

Most related projects are engaged in B2B businesses such as AI Agent services and API marketplaces, which are far removed from the "crypto trading needs" of ordinary crypto investors.

The market needs a place that can continuously generate new assets and allow retail investors to participate in early-stage projects. This is the background for the emergence of c402.market.

You may not like this approach, but defining it as pure hype and ignoring it is another extreme.

c402.market, Pump.fun in the x402 ecosystem?

Open the official website of c402.market, and you will see a simple yet bold slogan:

"The mintpad for internet capital markets"

Yes, it's the familiar ICP narrative again. By combining the grand terms "Internet" and "capital market," they're trying to give something that's essentially a cryptocurrency platform a revolutionary makeover.

In simple terms, c402.market is a token launch platform based on the x402 protocol , where anyone can quickly issue tokens, and these tokens are automatically paired with $PING for trading.

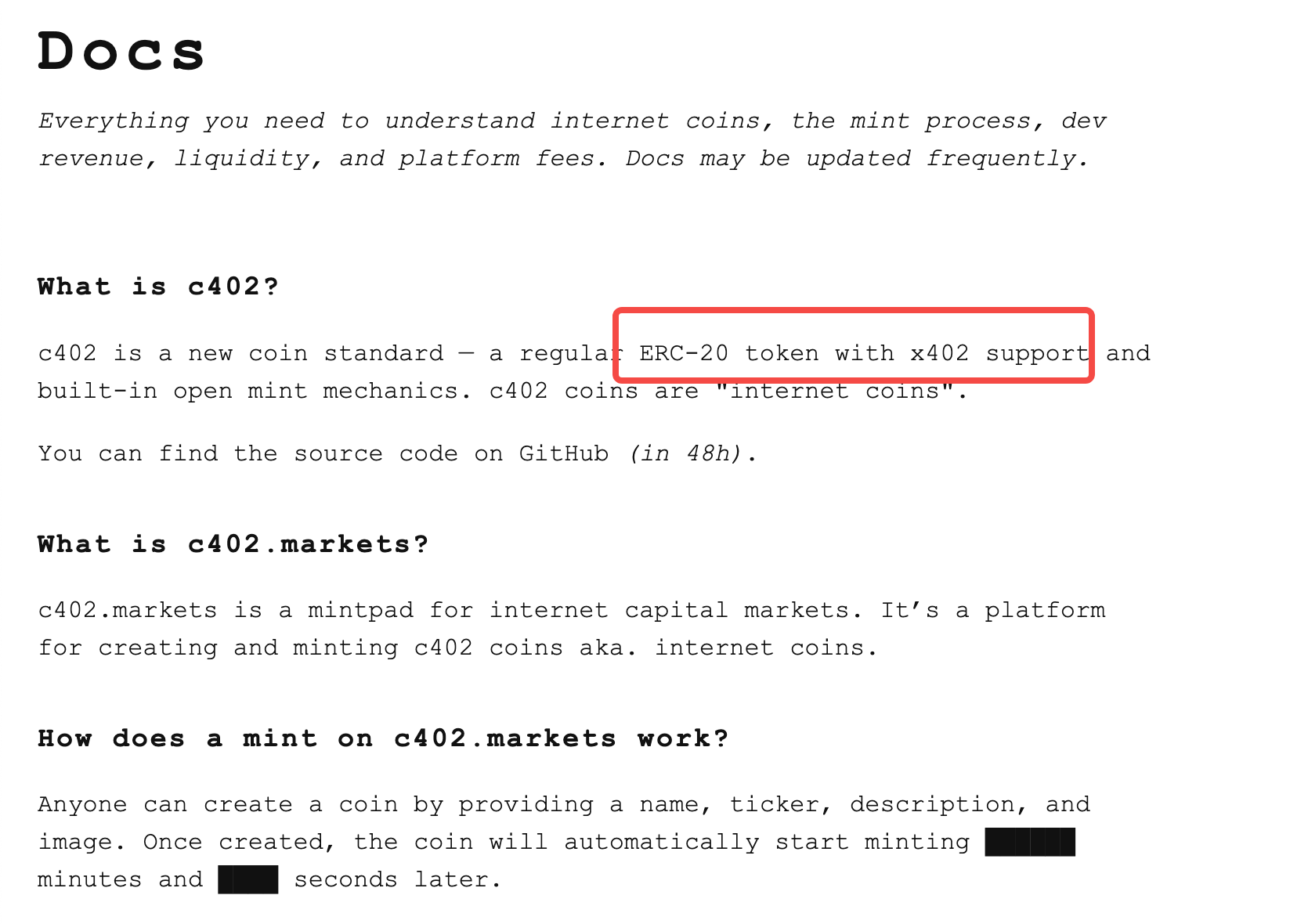

Before discussing the issuance mechanism, it's essential to understand what a "C402 token" is. C402 is a self-innovated token standard, essentially an ERC-20 token that supports the X402 protocol and has a built-in public minting mechanism. Officially, it's referred to as "internet coins."

This means that the tokens issued on c402.markets are not just ordinary ERC-20 tokens, but are natively supported by the x402 payment protocol.

In theory, these tokens could be used directly for payments through AI agents, or in any application that requires an HTTP 402 status code to trigger a payment. However, in reality, most people are more concerned with their speculative value than their technical features .

c402.market's launch mechanism heavily borrows from Pump.fun's "Bonding Curve" model, but with some adjustments. The total supply of each token is fixed at 1 billion, with no team allocation and no reserved shares.

According to the official documentation, the distribution structure for a launch token is as follows:

- 49% are distributed through open casting, with each casting requiring a payment of 1 USDC.

- 49% is automatically used to provide liquidity.

- 2% as a developer reward

Casting process:

- Creating a token : Anyone can create a token by simply providing a name, code, description, and image. A 1 USDC "spam prevention" fee applies to token creation.

- Waiting for minting to begin : After the tokens are created, minting will automatically begin after a fixed time (interestingly, the official documentation uses █ to cover the specific time, which could be anywhere from a few minutes to a dozen minutes; the exact time may only be available after the product is officially launched).

- Purchase Phase : Users mint tokens by paying 1 USDC. The number of minting opportunities is limited.

- Automatic listing : Once all minting quotas are sold out, the collected USDC will be automatically processed.

The principle of PING pairing: USDC → PING → Liquidity Pool

This is the most crucial part of the entire mechanism, and it's also the core logic from which PING can benefit.

According to the description on the project's GitHub, once a c402 token is minted, all the collected USDC will be used to purchase the pair token specified at the time of creation (initially only PING is supported), and then added to the pool as liquidity along with the remaining 49% of the token supply and locked.

For example: Suppose someone creates a token called $COIN and chooses $PING as the paired asset. The minting phase requires a certain number of transactions to be completed; let's say 10,000 transactions; that would be 10,000 USDC.

- Minting phase : Users purchase with USDC, and 10,000 USDC are collected.

- Automatic conversion : This 10,000 USDC will be automatically converted into $PING via Uniswap.

- Providing liquidity : The purchased PING + 490 million $COIN (49% of the supply) will be added to the Uniswap v4 liquidity pool and permanently locked.

- Developer reward : 20 million $COIN (2% supply) will be given to the token creator.

What does this mechanism mean for PING?

Whenever a new token is successfully minted on c402.market, a forced buy order of USDC → PING is generated. If 10 projects complete minting on the platform each day, and each project collects 10,000 USDC, that's 100,000 USDC in PING buy orders per day.

This may explain why the launch of c402.market caused PING prices to surge by 50%; the market is pricing in the potential for continued buying or a successful ecosystem in the future.

Who's making money?

The fee structure for c402.market is as follows:

For the foundry:

- Each minting transaction will be paid 1 USDC.

- 2% will be used as a platform fee (0.02 USDC).

- Gas fees (cheap on the Base chain, but still payable)

For token creators:

- A "spam prevention" fee of 1 USDC is paid when creating a token (c402).

- Receive 2% of the token supply as a reward

- Receive a 1% commission on transactions from the liquidity pool (partially paid in tokens) c402

The document also mentions that if you build your own front-end and set yourself as a referrer, you can take the 2% platform fee, thus achieving zero platform fee casting.

Although initially only PING is supported as the pairing asset, c402.market's GitHub repository has opened a submission mechanism for a "pairing token whitelist." Any project can submit a PR to apply to add its token to the pairing options, but it must have sufficient (locked) liquidity on Uniswap v3 or v4, and the JSON format and image specifications must meet the requirements; after approval, it also needs to be manually whitelisted on-chain.

This means that c402.market may support USDC, ETH, or other tokens as paired assets in the future, not just PING. But at least initially, PING will be the only option.

It's clear that c402.market's mechanism design prioritizes incentivizing token creators , rather than solely benefiting minters and traders. However, as those in the know understand, this could also lead to the platform being flooded with low-quality projects, as creators have an economic incentive to continuously issue new tokens.

As of press time, c402.market has just announced its upcoming launch (November 10th, 10 PM). Many details in the official documentation are still obscured, including specific casting counts, time windows, and the "bribery mechanism."

These measures may be to prevent the robot from preparing in advance, or the team may not have finalized the decision yet.

The real test will come after the first batch of projects are launched, the first batch of liquidity is formed, and the first batch of traders begin to compete; only then will we be able to see how this mechanism performs in practice.

Finally, asset creation and new token offerings will always be the themes of the crypto market, now it's just shifted to the x402 concept; in the absence of many new narratives, cautious participation may be a pragmatic choice.