Oversold Rebound Kicks Off New Year's Market, Reducing Positions at Highs is More Prudent | Guest Analysis

- Core View: Analyst Cody, based on Elliott Wave Theory analysis, believes Bitcoin is currently in the C-2 wave rebound phase within the C wave correction. The strength and height of the rebound (especially whether it breaks through the $74,500-$79,500 resistance zone) are key to judging the subsequent force of the C-3 wave decline.

- Key Elements:

- Technical Structure: Bitcoin's correction since the January 14th high follows an A-B-C three-wave structure. The current C wave is internally unfolding in a three-part pattern (C-1, C-2, C-3). The C-1 wave decline is complete, and the C-2 wave rebound is underway.

- Key Price Levels: The C-2 wave rebound faces two core resistance zones: $74,500 (primary pressure) and $79,500 (strong resistance). The key support zone below is located in the $60,000-$62,500 region.

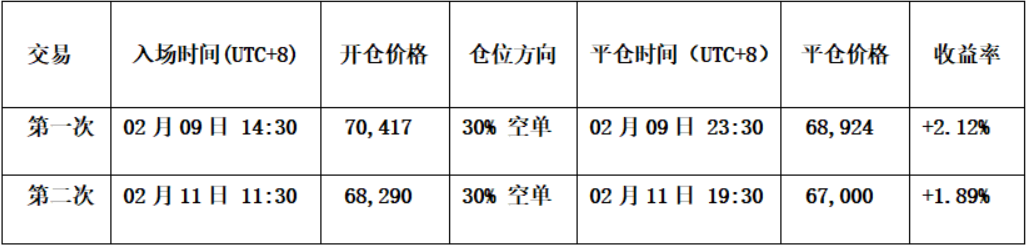

- Strategy Verification: Last week's short-term strategy (two short position operations) achieved a cumulative return of approximately 4.01%; the medium-term strategy ($89,000 short position) had a profit of about 22.71% as of last week's close.

- Model Signals: The daily-level momentum quantitative model shows that bullish momentum is beginning to accumulate. The sentiment quantitative model indicates that the oversold market sentiment has been repaired, but the weekly level still shows a bearish trend.

- This Week's Strategy: Continue holding the 60% medium-term short position; for short-term trading, plan to establish short positions when encountering resistance in the $72,500-$74,500 or $79,500-$80,600 regions, combined with model signals.

Hello everyone, I'm your old friend Cody, a featured market analyst at Odaily. Before we dive into today's Bitcoin market analysis, I'd like to say:

Tomorrow is the first day of the Lunar New Year. I'd like to take this opportunity to wish all our readers a happy and prosperous New Year in advance.

The past year has been full of market ups and downs, with smooth sailing phases and periods of repeated volatility. Regardless of your investment results this year, I hope that in the new year, all readers can maintain a stable mindset, clear rhythm, and controllable risks.

Cody also sends his most sincere wishes:

Wishing everyone great success, immediate blessings, consistently green portfolios, and peace for your families in the new year.

Holidays are brief, but the market never stops.

Returning to the market itself, during this special time window of the Spring Festival, some noteworthy changes are emerging in Bitcoin's price structure, capital behavior, and market sentiment.

Core Summary of the Trading Weekly Report:

• Updated Trend Structure: Analysis of the internal Wave C-2 movement within Bitcoin's declining Wave C, and interpretation of the future Wave C-3 decline structure after the rebound concludes. (Detailed in Figure 1)

• Strategy Execution (Short-term) Effectiveness Verification: Last week's trading strictly followed the established short-term strategy, completing a second short-term operation (1x leverage) and successfully achieving a cumulative return of approximately 4.01%. (Detailed in Table 1)

• Strategy Execution (Mid-term) Effectiveness Verification: Following the established mid-term strategy last week, we continued holding the short position established at $89,000 (1x leverage). As of last week's close, the profit was approximately 22.71%, with a maximum profit during the period of about 32.58%.

• Core View (Short-term) Verification: Last week, Bitcoin found support near $65,000 and transitioned into a volatile rebound. Multiple technical signals collectively pointed to this level potentially being the low point of Wave C-1. The current price action aligns with the previous expectation of an oversold rebound for Wave C-2, with the market structure gradually transitioning towards a recovery phase.

The following sections will provide a detailed review of the market forecast, strategy execution, and specific trading process.

1. Detailed Explanation of Bitcoin's Internal Three-Segment Correction Structure within Wave C

Bitcoin Daily K-line Chart

Figure 1

As clearly pointed out in the weekly review on February 8th, Bitcoin's correction since the high on October 6, 2025, follows the classic A-B-C three-wave structure. Several possible internal structures for the subsequent Wave C were also projected. Currently, given that both Wave A and Wave B internally exhibit clear three-segment sub-wave structures, and based on the principles of alternation and consistency in Elliott Wave Theory, the probability is highest that Wave C will also complete its correction internally with a three-segment structure (i.e., C-1, C-2, C-3).

Below, we will conduct a detailed analysis of the potential three-segment correction structure within Wave C:

1. Overview of the Main Decline Segment of Wave C

• Time and Magnitude: Wave C began on January 14, 2026, and has lasted approximately 32 days as of the time of analysis, with a maximum decline of 38.7%. This aligns with the characteristic of Wave C as the "main declining wave," typically having the largest magnitude and intense price action.

2. Wave C-1: Segment 6-7 in the chart, the first driving decline (Completed)

• This decline lasted from January 14th to February 6th, spanning 23 days. Its target was achieved, pushing the price down to around $60,000, forming the first "foot" of Wave C.

3. Wave C-2: Segment 7-8 in the chart (dashed line), the rebound/correction segment (Ongoing)

• Current Phase: The rebound starting from the low on February 6th can currently be defined as Wave C-2.

• Technical Pattern Confirmation: On the daily chart, the candlestick combination formed from February 5th to 8th constitutes a "reversal bottom candlestick pattern", initially suggesting exhaustion of downward momentum. Subsequently, the candlesticks from February 11th to 13th further formed a "confirmed bottom candlestick pattern", strengthening the validity of February 6th as a short-term bottom. Currently, the price is oscillating upwards along the short-term uptrend line connecting the lows of February 6th and 12th. If the market trajectory changes later, I will share updates with you.

• Key Resistance Zone: Based on historical price action, the primary resistance zone for the C-2 rebound is around $74,500. This area is not only the lower boundary of the previous consolidation range but also resonates with technical key points like the 50% Fibonacci retracement level of Wave A's decline. A more significant resistance zone is located around $79,500. This area is the dense trading zone (consolidation range) formed during the previous C-1 decline and is expected to constitute strong resistance.

4. Wave C-3: Segment 8-9 in the chart (dashed line), the final decline segment (Potential future occurrence)

• Technical Pattern Confirmation: On the daily chart, a decisive break below the short-term uptrend line connecting the lows of February 6th and 12th by the future price may be a key condition for judging the formation of Wave C-3.

• This correction segment will need to break below the February 6th low (around $60,000) to complete the wave structure's integrity. The final decline's time and magnitude will depend on the strength and height of the Wave C-2 rebound.

5. Core View Summary:

The market is currently in the anticipated Wave C-2 rebound phase. The strength and height of this rebound, particularly whether it can effectively break through the core resistance band of $74,500 ~ $79,500, will be a key observation window for judging the subsequent intensity and target of the Wave C-3 decline. Traders should closely monitor market reactions near the aforementioned price levels.

2. Review of Last Week's Bitcoin Trading Strategy and Key Levels: (02.09~02.15)

1. Short-term Trading Strategy Review: As shown in (Figure 2)

We strictly followed the trading signals from our self-constructed Spread Trading Model and Momentum Quantification Model, combined with market trend forecasts, to complete two short-term operations, achieving a cumulative profit of 4.01%.

Figure 2

• First Trade (Profit 2.12%):

• Entry: The price rebounded to near the $72,500 resistance line and encountered resistance. Simultaneously, the Spread Quantification Model triggered a top warning signal (green dot), and the Momentum Quantification Model issued a "bullish to bearish" signal. Therefore, a 30% short position was established at $70,417.

• Risk Control: Initial stop-loss for the short position was set at $74,500.

• Exit: When the price fell to around $68,000, the candlestick combination showed bottoming signals, coupled with resonant bottom signals from both models, we closed the entire position at $68,924.

• Second Trade (Profit 1.89%):

• Entry: The price rebounded near the short-term downtrend line and showed resistance signals. Simultaneously, the momentum line of the Momentum Quantification Model formed another "death cross" below the zero line, turning bearish. A 30% short position was established at $68,290.

• Risk Control: Initial stop-loss for the short position was set at $70,000.

• Exit: The price encountered resistance near $66,500, coupled with resonant bottom signals from both models, the entire position was closed at $67,000.

Bitcoin 30-minute K-line Chart: (Momentum Quantification Model + Spread Trading Model)

2. Mid-term Trading Strategy Review:

Mid-term Strategy: Continued holding the 60% short position established around $89,000 as planned. As of last week's close, the profit was 22.71%.

3. Key Level Review:

Resistance levels observed in the $72,000~$74,500 region;

Support levels observed in the $60,000~$62,500 region.

3. Analysis of Bitcoin's Current Market Technical Indicators: Comprehensive Judgment Based on Multiple Models and Dimensions

Combined with market movements, based on my self-constructed trading system, I conduct an in-depth analysis of multiple Bitcoin technical indicators from perspectives such as multiple models and multiple dimensions.

1. As shown in (Figure 3), analysis from the weekly chart:

Bitcoin Weekly K-line Chart: (Momentum Quantification Model + Sentiment Quantification Model)

Figure 3

• Momentum Quantification Model: Technical indicators show the momentum line declining synchronously, negative energy bars are still expanding, but the expansion force is weakening, with no momentum divergence signal appearing.

Momentum Quantification Model indicates: Price decline index: High

• Sentiment Quantification Model: Blue sentiment line value 34, intensity zero; Yellow sentiment line value 10, intensity zero, peak value is 0.

Sentiment Quantification Model indicates: Price bottom support index: Neutral

• Digital Monitoring Model: Bottom digital monitoring signal has not appeared.

Digital Monitoring Model indicates: Digital bottom signal not present; Weekly K-line closed as a small bearish candle with upper and lower shadows, decline approximately 2.15%.

The above data suggests: Bitcoin weekly chart shows a bearish trend with narrowing declines. Currently, it is in a consolidation pattern within the downtrend.

2. As shown in (Figure 4), analysis from the daily chart:

Bitcoin Daily K-line Chart: (Momentum Quantification Model + Sentiment Quantification Model)

Figure 4

• Momentum Quantification Model: Last week's overall market showed a "decline first, then rise" pattern. Post-market on Sunday, the momentum line formed its first "golden cross" below the zero axis, while the energy bars "turned from negative to positive".

Momentum Quantification Model indicates: Bullish momentum is beginning to accumulate, and short-term trends are expected to gradually strengthen.

• Sentiment Quantification Model: After the sentiment model triggered a bottom warning signal (red dot), the two sentiment lines began to turn upward. Post-market on Sunday last week, the sentiment lines left the oversold area and turned to a slow upward movement.

Sentiment Quantification Model indicates: The timeliness of the bottom warning signal has been validated by the market. Sentiment lines are slowly turning upward, and market oversold sentiment is being repaired.

The above data suggests: The daily chart bearish trend has not changed. The current price action is of an oversold rebound nature. Currently, a minor rebound can be observed; please control short-term long positions carefully.

4. This Week's Market Forecast: (02.16~02.22)

1. Core View for This Week: The Wave C-2 rebound has most likely formed. Focus on the performance of the bull-bear battle when the price rebounds to the core resistance zone.

• For investors who participated in this round of short-term rebound, the strategy should be "sell on rallies, lock in profits";

• For investors trapped in previous positions, resolutely execute "sell on rallies, roll operations, control risks".

2. Core Resistance Levels:

• First Resistance Zone: $72,000-$74,500 region (near last April's low)

• Second Resistance Zone: $79,500-$80,600 region (near the Wave B starting point)

3. Core Support Levels:

• First Support Level: Around $65,000 (low point of the previous K-line bottom candlestick pattern)

• Second Support Level: $60,000-$62,500 region (near the February 6th low)

• Third Support Level: Around $57,400 (near the 210-week moving average)

5. This Week's Trading Strategy (Excluding Sudden News Impact): (02.16~02.22)

1. Mid-term Strategy: Maintain the 60% short position. If the rebound effectively breaks above $74,500, the position can be reduced to 40%.

2. Short-term Strategy: Utilize 30% of capital, set stop-loss points, and look for "spread" trading opportunities based on support and resistance levels. (Using 30/60 minutes as the operation cycle).

3. Since the market's medium-term direction is bearish, short-term operations should follow the principle of "go with the trend, sell on rallies". To dynamically respond to the market's complex evolution and combine signals from the self-built trading models, we have formulated two short-term operation plans, A/B:

• Plan A: If the price rebounds to the $72,500~$74,500 region and encounters resistance:

• Entry: