As someone who plays prediction markets every day, I've witnessed these innovations and changes

- Core Viewpoint: While Polymarket has garnered significant attention due to potential airdrop expectations, several emerging prediction market platforms are attempting to achieve breakthroughs in user experience and community stickiness by introducing differentiated innovations such as yield-bearing positions, short-video-style interactions, and community-exclusive events.

- Key Elements:

- Yield-Bearing Position Mechanism: Platforms like predict.fun connect user collateral to yield-generating strategies on DeFi protocols like Venus Protocol, providing an additional ~3%-5% APY on locked funds, independent of prediction profits or losses.

- Interaction Experience Revolution: Some platforms adopt browsing modes similar to short videos (swiping up/down or left/right), aiming to transform prediction behavior from low-frequency trading to high-frequency content consumption, thereby lowering the barrier to entry.

- Community-Exclusive Event Markets: Emerging platforms design prediction events around hotspots within crypto communities (e.g., topics related to Binance, CZ), enhancing localized participation and community dissemination, differentiating themselves from generic event markets.

- Clear Points Incentive Pathway: Unlike the "blind farming" on Polymarket, many emerging platforms feature points systems, providing users with clearer, visualized guidance for airdrop strategies.

Original | Odaily (@OdailyChina)

Author | Asher (@Asher_ 0210)

"Polymarket has such good liquidity, besides farming points for potential token airdrops, why would anyone use other prediction market platforms?" This is a question I've been pondering while recently exploring various prediction markets.

Admittedly, Blockratize, the parent company of Polymarket, recently filed a trademark application for "POLY" during its token issuance planning phase. Coupled with previous clear statements from Polymarket executives about plans to launch a native token and conduct an airdrop, the market widely expects that farming Polymarket might be the next "big opportunity." However, unlike other emerging prediction markets, Polymarket currently does not have a clear points or task incentive system in place. Users find it difficult to dynamically adjust their "farming" strategies based on feedback from incentive mechanisms, to some extent, they are still in a "blind farming" hard mode.

In contrast, most of these emerging prediction market platforms have introduced points mechanisms, allowing users to have a clearer "path to an airdrop strategy" while participating in platform trading. Although many of these prediction market platforms are still in their early stages, with certain bugs that often draw community criticism, during the actual experience, one can indeed discover some differentiated highlights that are "distinct from Polymarket."

Below, we will introduce several highlights summarized from recent experiences with different prediction market platforms.

Highlight One: Position Funds No Longer "Idle," Prediction Positions Can Also Generate Continuous Yield

In traditional prediction markets (like Polymarket, Kalshi), after users buy YES/NO positions, the funds are typically locked until the event is settled. During this period, these funds cannot participate in other strategies nor generate any yield, essentially representing "idle capital" with a significant opportunity cost.

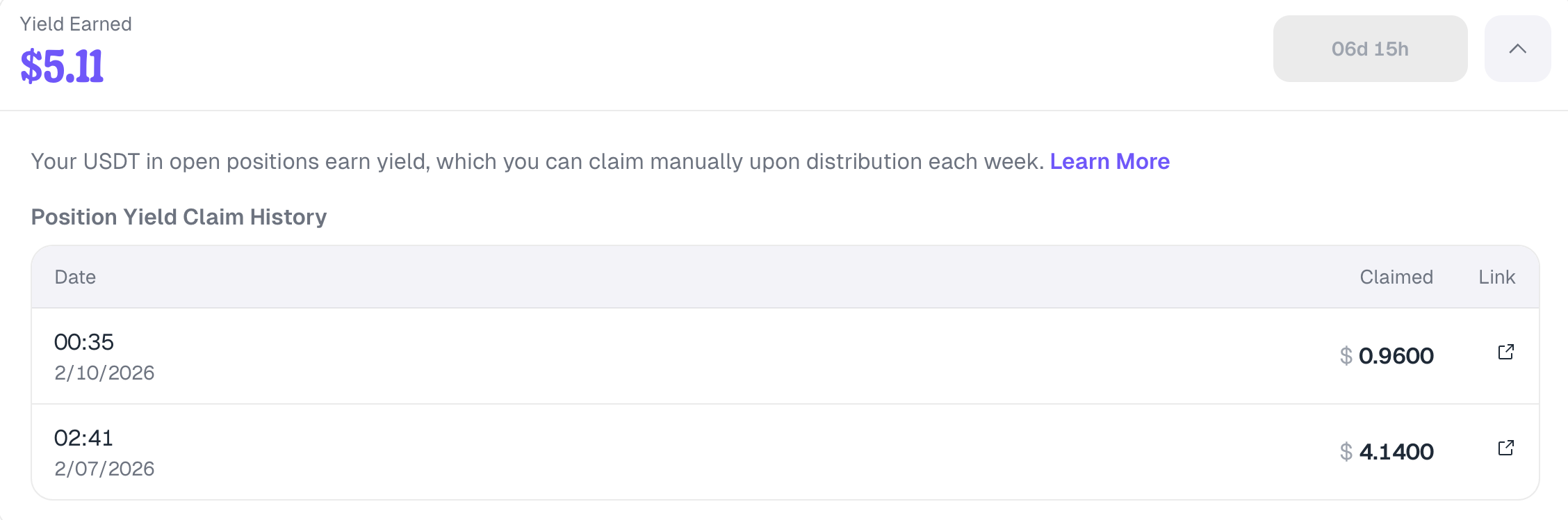

predict.fun attempts to change this. The platform connects the collateral funds users provide for predictions to low-risk yield-generating strategies within the BNB Chain ecosystem, allowing positions to automatically generate stablecoin yield while held. According to an official announcement on January 8, 2026, predict.fun has partnered with Venus Protocol. Users' locked USDT collateral assets are automatically deposited into Venus's money market to earn interest, thereby generating additional yield while waiting for the event outcome.

This means users' funds continue to "work" on-chain during the holding period, with common stablecoin annual percentage yield (APY) levels typically around 3%–5% (depending on the underlying DeFi strategy and market conditions). More importantly, this yield is independent of the prediction outcome—regardless of whether the final prediction is successful, the yield generated during the holding period can be claimed separately, adding an extra layer of passive income on top of the prediction's profit or loss.

From a product mechanism perspective, this design essentially transforms "dead money" in traditional prediction markets into "active money," and is one of predict.fun's most distinctive differentiating features. The platform has already opened the position yield claim function. Users can claim accumulated position yield at a fixed time every Tuesday, giving long-term holdings a clearer compound yield logic at the strategy level.

predict.fun Position Yield Claim Screenshot

Highlight Two: Short Video-style Swiping Experience, Bringing Prediction Markets Closer to "Content Consumption Products"

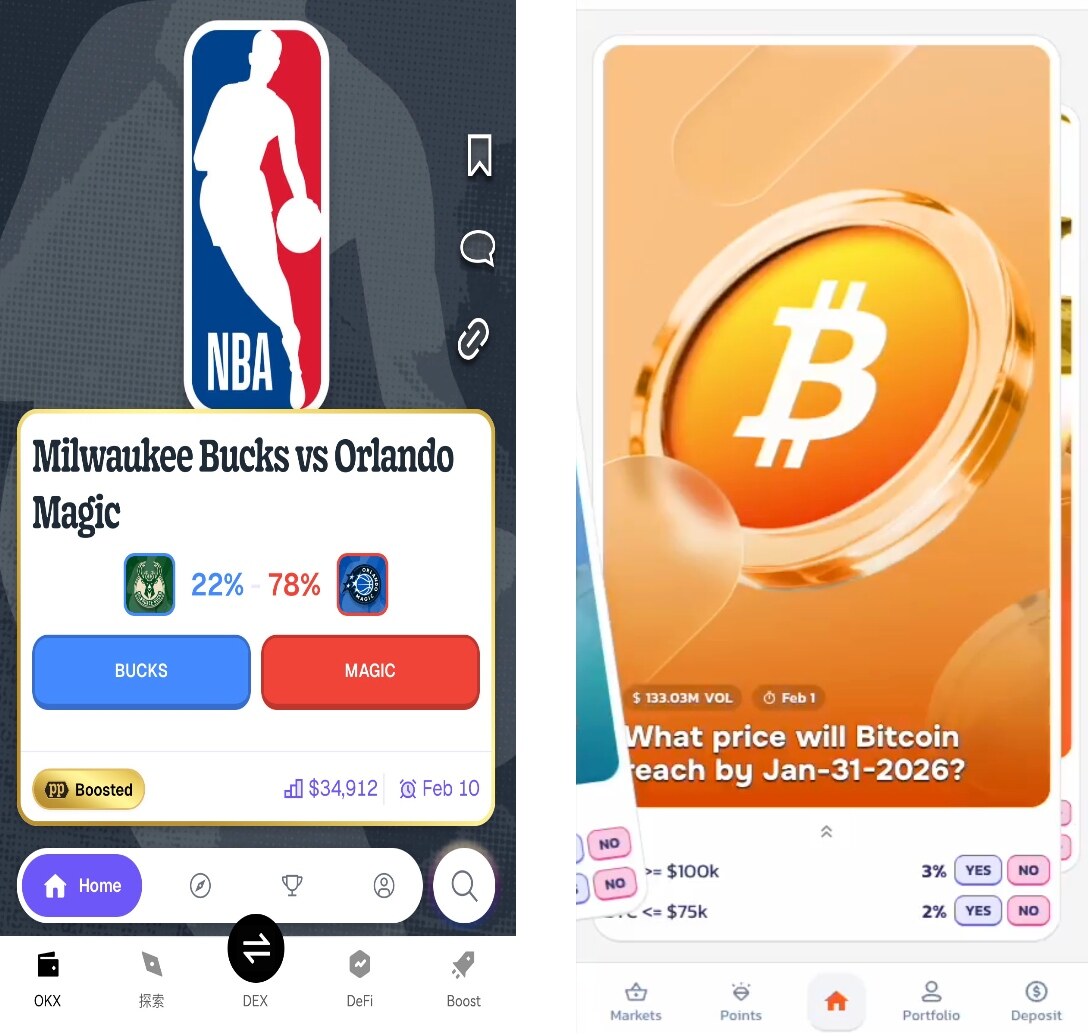

Unlike the trading-terminal-like interface of traditional prediction markets, some emerging prediction market platforms are noticeably aligning their interaction design more with content platforms, attempting to lower the participation barrier and increase user dwell time. For example, in predict.fun's mobile interface, one screen corresponds to one prediction event. Users can quickly browse different markets by swiping up and down, with the overall experience more akin to the information feed mode of short video platforms. This design allows users to naturally discover prediction subjects they are interested in while continuously "scrolling through markets," without actively searching for events, significantly improving browsing efficiency and participation frequency.

Similarly, Probable adopts a left-right swiping interaction method, making the prediction behavior feel closer to the information matching logic of social products in terms of experience. From a product thinking perspective, the core of such designs is not merely UI optimization, but an attempt to transform prediction markets from "low-frequency trading tools" into "high-frequency content consumption entry points."

Schematic Diagram of Mobile Interaction Methods for Two Prediction Market Platforms (Left: predict.fun; Right: Probable)

predict.fun founder Dingaling also mentioned in a Space that he hopes to build prediction markets into a usage scenario similar to short video apps—where users can place bets while browsing trending events and fun topics in their daily lives, and further enhance community engagement and user stickiness through features like comments and interactions.

From an experience perspective, this information-feed-style interaction is itself a quite attractive product innovation. Compared to the traditional method of actively searching for markets, swiping to browse allows users to continuously "scroll through markets" during fragmented time, naturally generating participation behavior while consuming content, making the prediction market experience more lightweight and fluid.

Highlight Three: "Exclusive Event Markets" Centered on Community Hotspots, Enhancing Localized Sense of Participation

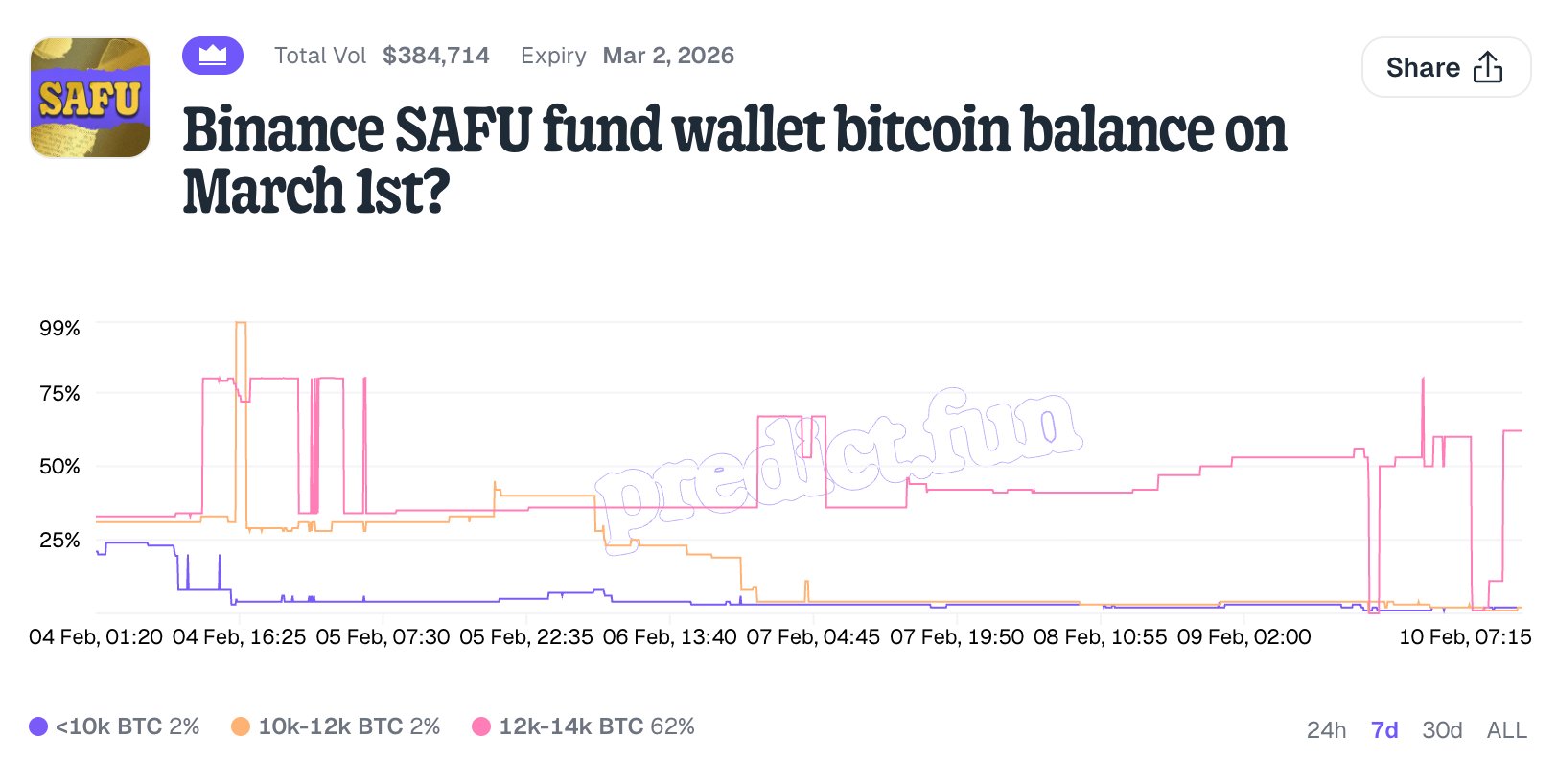

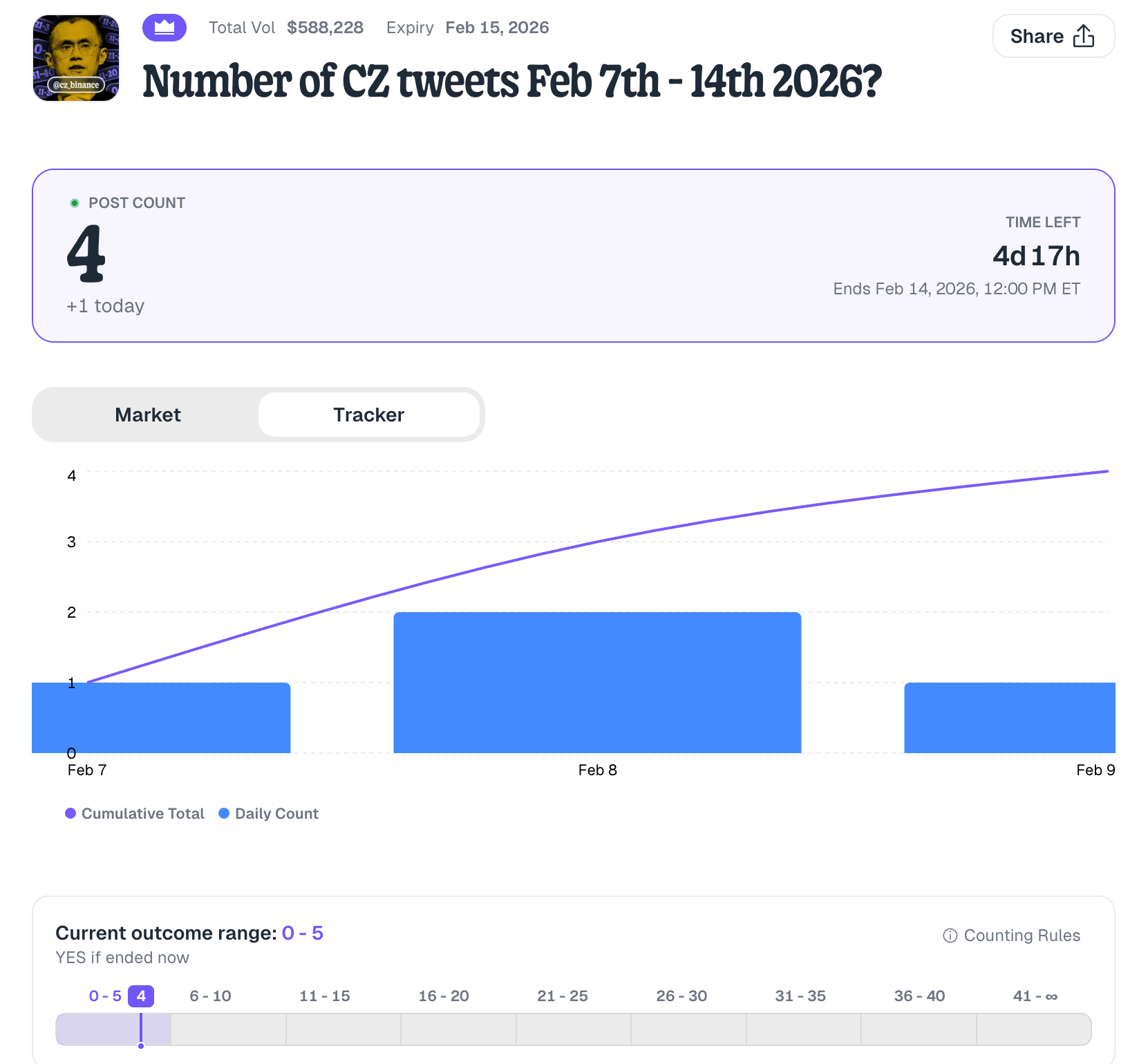

Beyond product mechanisms and interaction experience, some emerging prediction market platforms are also attempting differentiated routes in market content design. That is, instead of simply replicating generic events already available on Polymarket or Kalshi, they are launching more niche "exclusive event markets" around topics of high interest within the crypto community. For example, prediction events on predict.fun centered around Binance and community hotspots, including "Changes in Bitcoin Balance of Binance SAFU Fund Wallet on March 1st" and "Number of CZ's Tweets Between February 7 and 14, 2026," belong to topic types closer to the daily discussions of crypto users.

Exclusive Prediction Events Launched on predict.fun

Compared to traditional macro events or generic political/sports markets, these prediction events with distinct community attributes are more likely to stimulate user discussion and dissemination, and easier to generate participation heat within specific user groups. From a platform operation perspective, the continuous launch of exclusive events essentially builds a content supply with platform characteristics, making the prediction market not just a "trading venue," but gradually becoming a gathering place for community hotspot sentiment and narratives.

From the above events, it can be seen that predict.fun is consciously pursuing differentiation at the "event supply" level, rather than simply replicating markets already existing on Polymarket or Kalshi. Designing prediction events around CZ, the Binance ecosystem, and community discussion hotspots makes it easier for the platform to generate spread and participation within specific user groups. This content strategy is also becoming an important operational direction for some emerging prediction markets.

It is worth noting that among the currently active emerging prediction markets, a significant portion of projects originate from the BNB Chain ecosystem, and their user structure is also noticeably more skewed towards the Asian community. Against this backdrop, community culture, niche culture, and even participation behaviors with more "fandom-like" characteristics are gradually becoming important factors influencing prediction market event design and dissemination. In this context, for emerging prediction market platforms, the Asian community culture formed around differentiated event design and the more "fandom-like" participation behaviors are becoming a direction worthy of focused study. Related impacts will be further discussed in subsequent articles.

Related Content

Hot Sector, New Interaction Opportunities: Three Prediction Markets Favored by YZi Labs

Step-by-Step Guide to Participating in predict.fun, Backed by CZ