Four Cents’ Ambition: How DeFi Subverts the Stablecoin Market Through Verticalization

- 核心观点:DeFi协议正争夺稳定币储备收益以实现自给自足。

- 关键要素:

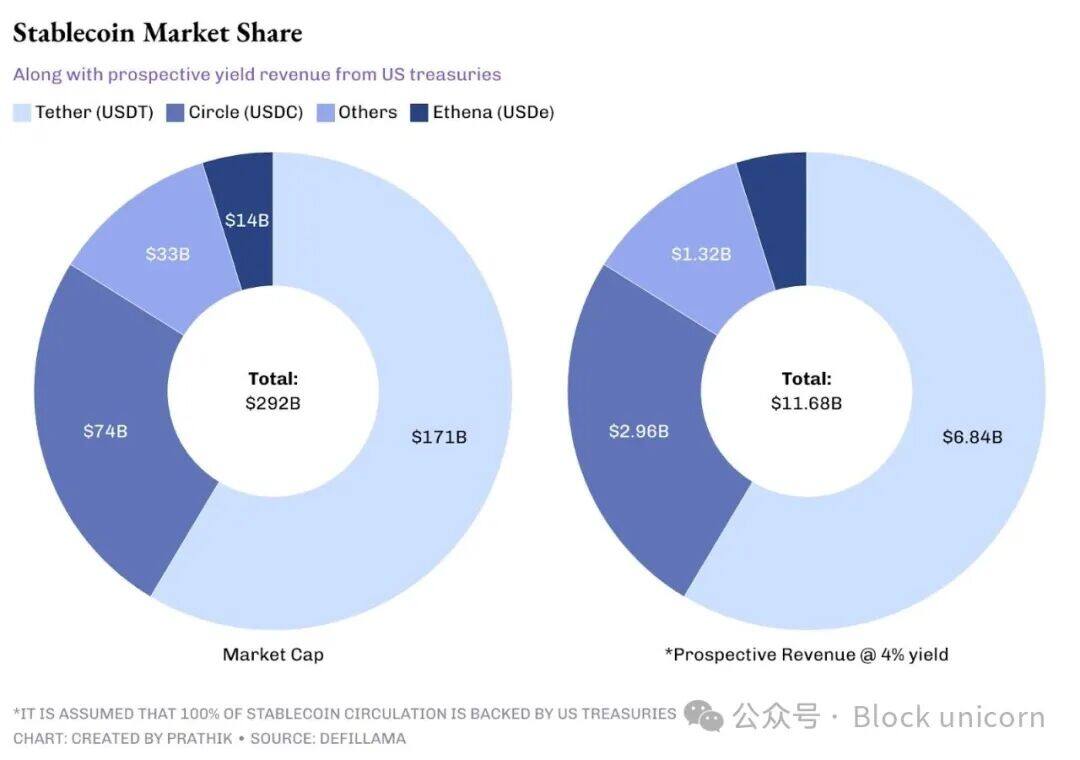

- 稳定币年收益约120亿美元,协议欲夺回。

- Hyperliquid等通过收益回购代币和激励生态。

- Ethena等将收益与代币经济模型绑定。

- 市场影响:可能分流传统稳定币流动性,催生收益型稳定币层。

- 时效性标注:中期影响

Originally Posted by Prathik Desai

Original translation: Block unicorn

Billions of dollars are up for grabs, but the ultimate return is about four cents on the dollar—that's the annual return generated by every dollar of U.S. Treasury debt.

Billions of dollars are up for grabs, but the ultimate return is about four cents on the dollar—that's the annual return generated by every dollar of U.S. Treasury debt.

For nearly a decade, decentralized finance (DeFi) protocols have relied on USDT and USDC as the backbone of their products, while allowing Tether and Circle to capture the returns on their reserves. These companies have raked in billions of dollars in profits through the world's easiest way to generate returns. But now, DeFi protocols want to capture some of these returns themselves.

Tether, the leading stablecoin, currently holds over $100 billion in reserves, generating over $4 billion in interest income. This is more than Starbucks' total profit of $3.761 billion from global coffee sales in its last fiscal year. The USDT issuer achieves this simply by investing its reserves in U.S. Treasuries. Circle adopted a similar approach when it went public last year, emphasizing its floating capital as its core revenue source.

Currently, the total value of stablecoins in circulation exceeds $290 billion, generating approximately $12 billion in revenue annually. This is a significant amount of capital that cannot be ignored. This has sparked a new battleground in DeFi, where protocols are no longer content to let issuers capture these profits. They now want to own the products and their infrastructure.

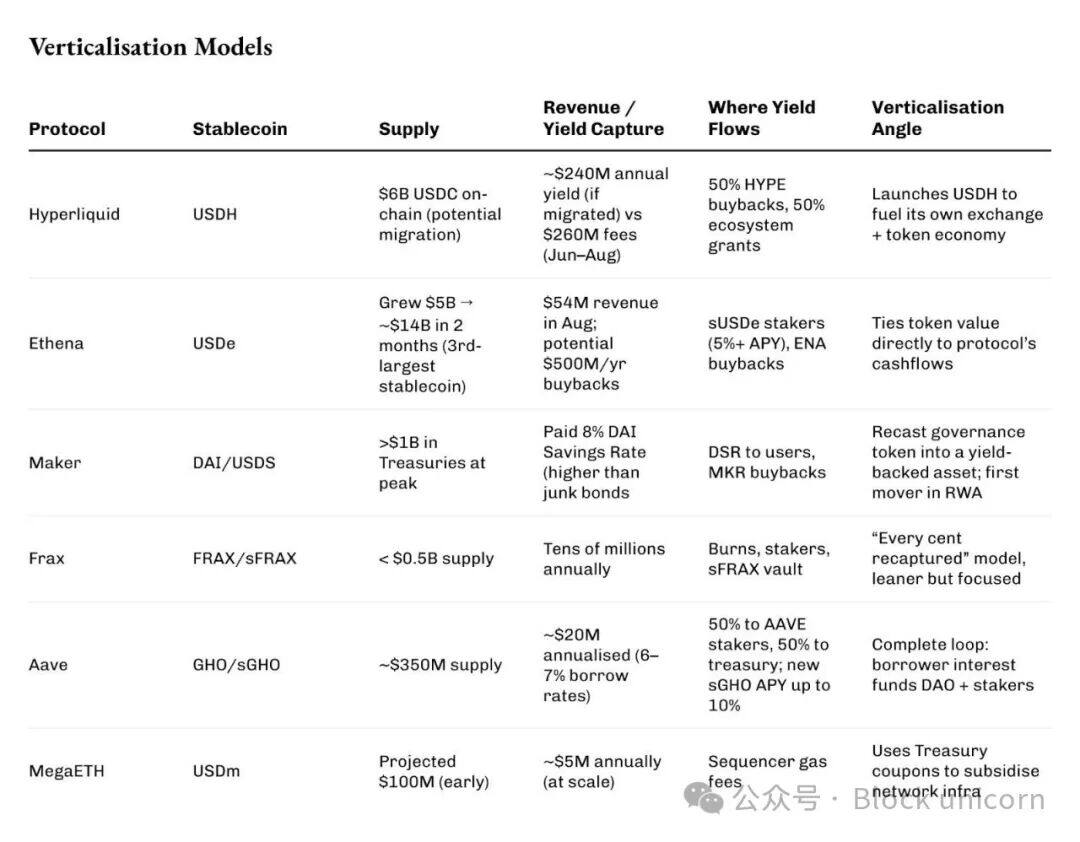

Earlier this month, Hyperliquid launched a bidding war for its native stablecoin, USDH, requiring the winner to return revenue. Native Markets, Paxos, Frax, Agora, and Ethena all participated in the bidding. The eventual winner, Native Markets, pledged to return 100% of USDH treasury revenue to the blockchain: half for HYPE token buybacks and the other half for ecosystem funding.

Currently, Hyperliquid's Layer-1 holds $6 billion in USDC, potentially generating $240 million in revenue. This revenue, previously held by Circle, may now be redirected to burning tokens and incentivizing developers. For reference, Hyperliquid generated $260 million in net revenue from transaction fees in June, July, and August.

Ethena is developing faster and on a larger scale.

In just two months, the circulation of its synthetic stablecoin USDe jumped from $5 billion to nearly $14 billion, surpassing Maker’s DAI to become the third-largest dollar-pegged stablecoin after USDT and USDC.

In August, Ethena’s revenue reached $54 million, a record high so far in 2025. Now, with the official launch of its long-awaited fee conversion mechanism, up to $500 million per year can be redirected to the buyback of ENA, closely tying the fate of the ENA token to the cash flow generated by the system.

Ethena's model involves going long on spot cryptocurrencies, shorting perpetual contracts, and distributing treasury bonds and staking returns. As a result, sUSDe stakers have enjoyed an annualized yield (APY) of over 5% in most months.

Experienced Maker was one of the first companies to use U.S. bonds as reserves for its stablecoin.

Experienced Maker was one of the first companies to use U.S. bonds as reserves for its stablecoin.

At one point, it held over $1 billion in short-term Treasury bills, enabling it to offer an 8% savings rate on Dai, briefly exceeding the average yield on US junk bonds. Excess funds were funneled into its surplus buffer, which was then used for buybacks, destroying tens of millions of MKR tokens. For token holders, this transformed MKR from a mere governance badge into a claim to actual income.

Frax, on the other hand, is smaller in scale but more focused in approach.

Its supply hovers below $500 million, a fraction of Tether's $110 billion, but it's still a money-making machine. Founder Sam Kazemian designed FRAX to reinvest every dollar of reserve revenue back into the system. Some of this revenue is burned, some is shared with stakers, and the rest is deposited into sFRAX, a vault that tracks the Federal Reserve's interest rate. Even at its current scale, the system generates tens of millions of dollars in revenue annually.

Aave’s GHO stablecoin was built with verticalization in mind.

The stablecoin, launched in 2023, currently has $350 million in circulation. The principle is simple: each borrower pays interest directly to the DAO, rather than to an external lender. With a borrowing rate of 6-7%, this will generate approximately $20 million in revenue, half of which will be shared with AAVE stakers, with the remainder going into the treasury. The new sGHO module will offer depositors an annual interest rate of up to 10% (subsidized by the reserve), further enhancing the transaction's appeal. In effect, the DAO is willing to use its own funds, making its stablecoin resemble a savings account.

There are also networks that use stablecoin revenue as raw infrastructure.

MegaETH’s USDm is backed by tokenized treasury bonds, but rather than being paid to holders, its revenue is used to pay rollup sequencer fees. At scale, this could mean millions of dollars per year in gas fees, effectively turning treasury bond coupons into a public good.

The common denominator among all these initiatives is verticalization.

Each protocol is no longer satisfied with relying on someone else's dollar rails. They are minting their own currencies, taking the interest that originally belonged to the issuer, and reusing it for repurchases, treasury bonds, user incentives, and even subsidizing blockchain construction.

While the yield on government bonds may seem dull, in DeFi, it has become the spark for building a self-sustaining ecosystem.

When you compare these models, you’ll see that each protocol is setting different valves to tap into this 4% revenue stream: buybacks, DAOs, sequencers, and users.

When you compare these models, you’ll see that each protocol is setting different valves to tap into this 4% revenue stream: buybacks, DAOs, sequencers, and users.

The income is passive. It makes everyone reckless. Each model has its own bottleneck.

Ethena's peg relies on perpetual funding to remain positive. Maker has experienced real-world loan defaults and has had to cover losses. After Terra's collapse, Frax withdrew funding and scaled back its issuance to prove it wouldn't be the next. All of these institutions rely on one thing: US Treasuries held by custodians like BlackRock. These are decentralized wrappers around highly centralized assets. And with that centralization comes the risk of collapse.

At the same time, new regulations also bring challenges.

The US’s GENIUS Act outright bans interest-bearing stablecoins. Europe’s MiCA legislation imposes restrictions and licensing requirements. DeFi has found workarounds by labeling returns as “buybacks” or “sequencer subsidies,” but the economics remain the same. If regulators choose to take action, they are fully capable of doing so.

However, this approach helps build sustainable business models—something the crypto space has long struggled with. The fact that so many models are working demonstrates the enormous potential that DeFi protocols currently possess. The competition today is for the world's most boring yield. However, the risks are high. Hyperliquid ties it to token burns, Ethena to savings accounts and buybacks, Maker to central bank-style buffers, and MegaETH to rollup operating costs.

I wonder if this movement will cannibalize the market share of the giants, draining liquidity from USDC and USDT. If not, it will certainly expand the market and create a layer of yield-generating stablecoins to sit alongside zero-yield stablecoins.

No one knows yet. But the battle is on, and the battlefield is vast: a stream of interest is flowing from US government debt to tokens, DAOs, and blockchains through protocols.

The more than four cents of profit that once belonged to the issuer is now driving the latest developments in DeFi.