Genius operation, exciting moment, the live broadcast illusion created by Pump.fun

- 核心观点:Pump.fun成功转型为社交娱乐平台。

- 关键要素:

- 动态费用模型吸引大量创作者。

- 直播板块推动平台收入暴增。

- 市值突破80亿美元重回第一。

- 市场影响:重塑Meme平台竞争格局。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Golem ( @web3_golem )

Pump.fun's transformation was successful. Overnight, no longer considered an industry "vampire," it became another hope for blockchain mass adoption. " Pump.fun is fundamentally a social product. We never wanted to be a meme coin platform, but rather a platform where all content can be traded ," said Noah, the anonymous co-founder of Pump.fun, in a recent interview .

Two months ago, Pump.fun launched its token offering at a $4 billion valuation. The market generally believed it would become a marker in the meme era, with only a handful of investors confident it could be reborn ( related reading: Two scenarios for PUMP's launch: Which do you believe? ). Following the launch, PUMP's price plummeted, reaching a low of $2 billion. With declining revenue, its meme graduation rate surpassed by LetsBonk, and its token buybacks questioned as a manipulation scheme, Pump.fun was briefly condemned to a "death sentence" in public opinion. However, two months later, Pump.fun's reputation saw a dramatic reversal, with both Upbit and Binance listing PUMP. Pump.fun's market capitalization surpassed $8 billion, completely pacing those who had previously been skeptical.

Putting aside Pump.fun's brilliant trading strategies and well-timed "vision communication," how has Pump.fun's fundamentals changed over the past month? Is the rise of "livestreaming coins" just a flash in the pan? Can the concept of a "super social app" become a new moat for the company, or is it merely an empty narrative designed to boost Pump.fun's valuation in the short term?

Pump.fun's great trading strategy: a comeback after a dark moment

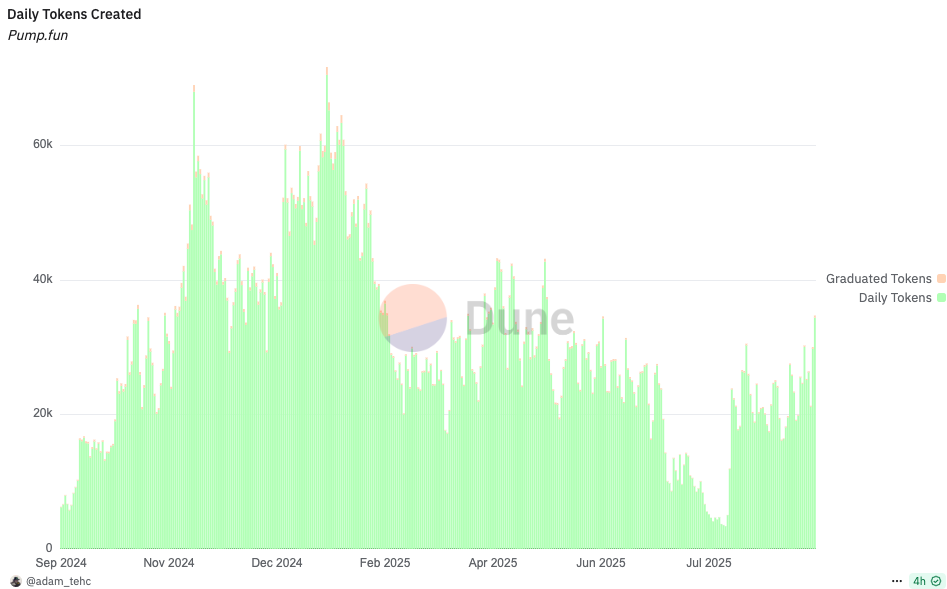

July was perhaps Pump.fun's darkest moment of the year, reflected not only in the widespread negative publicity and the subsequent price drop of its tokens, but also in multiple data points. According to Dune data , fewer than 10,000 tokens were created daily on the Pump.fun platform in July, and the weekly token graduation rate plummeted to a new low of 0.58%. Pump.fun's revenue also declined, reaching a new low of $251,788 on August 2nd , its lowest daily revenue since May 2024. The price of PUMP also hit a low of $0.0022 at the end of July, halving its $4 billion valuation to $2 billion in just one month.

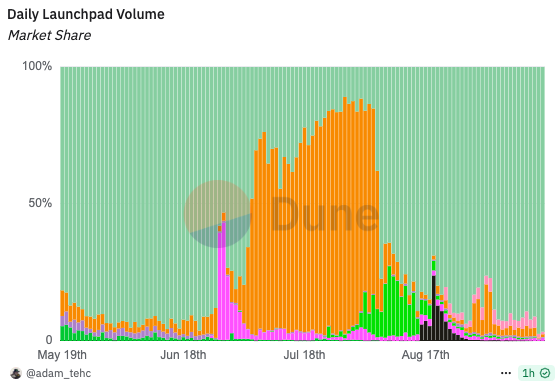

LetsBonk quickly gained ground in the competition, surpassing Pump.fun in terms of platform user activity and token trading volume in July to become the number one meme issuance platform.

LetsBonk leads the market in terms of transaction volume share in July

Just when the market thought Pump.fun was beyond recovery, it staged a comeback in August. On August 5th, the number of tokens created and traded on the Pump.fun platform suddenly skyrocketed, and the token graduation rate also began to recover. While not comparable to the disruptive period of January 2025, on-chain address activity has returned to pre-coin issuance levels in July, and the platform has quickly reclaimed its top spot as a meme issuance platform.

The number of Pump.fun token creations surged in August.

Why did Pump.fun's platform performance suddenly improve in August, regaining market share lost to LetsBonk? It's difficult to explain this. After all, on August 2nd, Pump.fun's daily revenue had just hit a new low since May 2024, so the sudden improvement in the platform's data two days later seems "abrupt." In early August, there were no major meme market trends, and Pump.fun did not launch any meaningful creator incentive programs.

Regarding LetsBonk's declining market share, Solayer core developer Chaofan Shou attributed it to a CPMM upgrade that paralyzed the bot. However, this claim is unfounded, as the LetsBonk upgrade occurred in late August, and Pump.fun had already regained its lead in early August.

Then the recovery of the platform data may be the "great operation" of the Pump.fun team.

Perhaps due to Pump.fun's history as a breeding ground for PVP and fraud, and its founder's questionable character, any action taken by the company is highly susceptible to a crisis of trust, including its token buyback program launched in mid-July. Market concerns about the authenticity and subsequent fate of the repurchased tokens, as well as the discontinuation of the promise of a 100% buyback of daily revenue, led to the July buyback not having a significant positive impact on Pump.fun.

Therefore, on August 5th, Pump.fun launched a revenue dashboard to track its daily revenue and PUMP purchases in real time. Coincidentally, the dashboard's launch coincided with a rebound in platform activity and fee revenue. Pump.fun's buybacks relied on sustained fee revenue, which in turn relied on high trading volume of the platform's Meme coin. Consequently, speculation spread in the market that the Pump.fun team was using fake trading volume to generate false fee revenue, thereby creating a false prosperity for the platform.

Pump.fun Daily Token Buyback

But judging from the results, whether it was a deliberately created illusion or a perfect coincidence, Pump.fun's return to the top of the Meme issuance platform ranking and the impressive repurchase data have enabled it to regain the high ground in terms of coin price and public opinion.

Dynamic Fee Model: Leveraging Project Fundamentals Innovation

Pump.fun's unreasonable creator revenue sharing mechanism was once criticized by the community, and many competitors also sought to compete with Pump.fun by innovating incentive mechanisms and improving the sustainability of memes. In May, Pump.fun announced that it would share 0.05% of PumpSwap transaction fees with token creators. However, this was far less than the 1% transaction fee share offered to creators by LetsBonk during the same period, and therefore failed to attract creators.

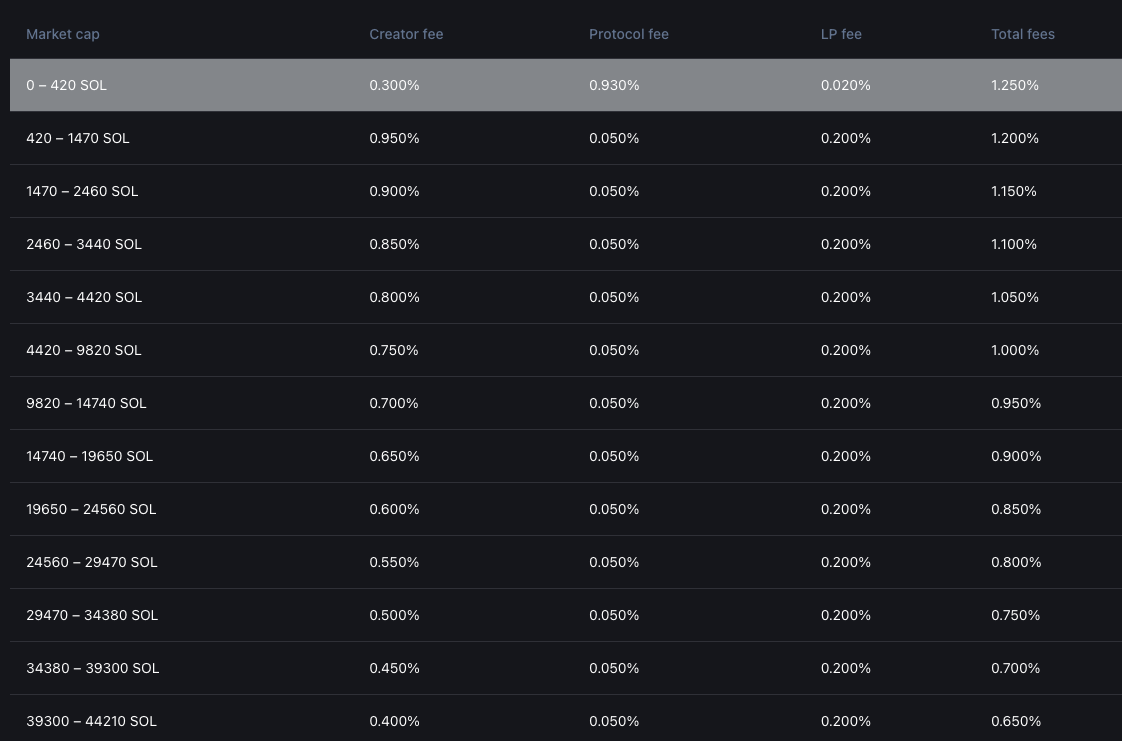

It wasn't until September, when Pump.fun released its dynamic fee model, that the project's fundamentals were considered to have changed. The core of Project Ascend is to tier token creator fees by market capitalization, with higher market capitalizations resulting in lower creator fee percentages. This means that many creators of newly issued, low-market-cap tokens will receive exceptionally high returns. During the "pre-bonding phase," creators receive a 0.3% fee share of transaction volume, which gradually decreases to 0.05% as the token's market capitalization grows.

Project Ascend

The update to the creator fee model also paved the way for the subsequent rise of livestreaming tokens. For any content/entertainment platform, one of its key moats is a steady stream of creators. Creators are inherently profit-driven, so to attract and retain them, platforms must devise a competitive revenue-sharing mechanism. " Our current logic is that if a livestreamer can earn significantly more on Pump.fun than on other platforms, they will attract fans and friends to consume content on Pump.fun, and the network effect will kick in, " said Noah, the anonymous co-founder of Pump.fun.

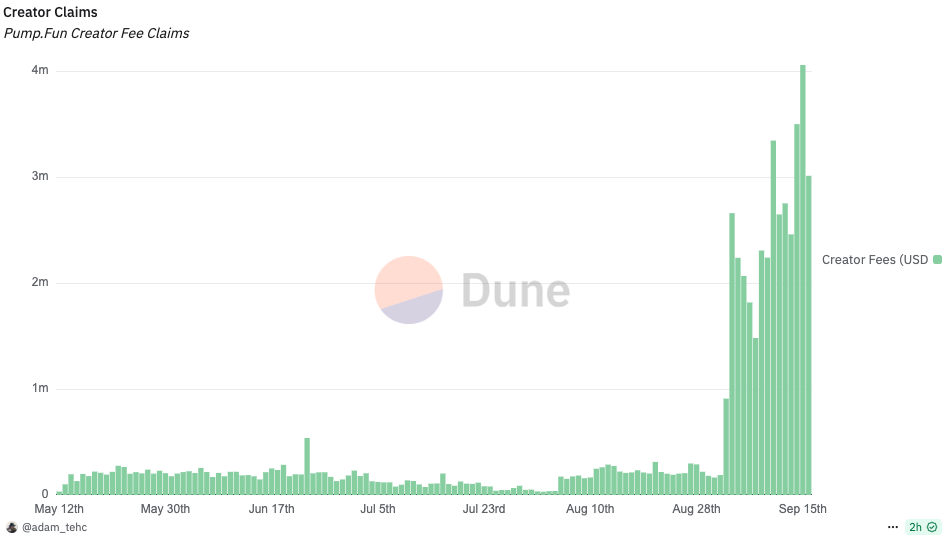

This straightforward logic has indeed driven significant growth for Pump.fun. Since September 3rd, Pump.fun has been distributing millions of dollars in daily revenue to creators. With the flywheel of "increasing revenue from new creators ➡️ more creators joining ➡️ further increasing overall creator revenue," the platform even set a single-day record of $4 million in revenue on September 15th. Pump.fun co-founder Alonstated that the platform's average number of concurrent live streams surpassed Rumble, approaching approximately 1% of Twitch's market share and reaching approximately 10% of Kickstarter's.

From an industry perspective, on September 15, in the Solana coin issuance platform market share ranking in the past 24 hours, pump.fun ranked first with 90.6% , Letsbonk ranked second with 5.18%, and Believe ranked third with 1.66%.

Pump.fun Creator's Share

The explosive growth of live streaming has prompted Solana co-founder Toly to exclaim that Pump.fun has the potential to become a global streaming platform. However, rather than spending large sums of money to directly sign up major influencers from Instagram or TikTok to create content, Pump.fun has opted to cultivate micro-influencers. To support these micro-influencers, Pump.fun spent approximately $500,000 on a batch of "streamer starter kits," which include a camera, monitor, keyboard, mouse, and other equipment to help newcomers get started with live streaming.

The new creator-revenue mechanism has indeed lowered the monetization threshold for smaller influencers and creators, and investors believe that Pump.fun's vision of "defeating Facebook and TikTok" is no longer just empty talk. Pump.fun's fundamental narrative has successfully evolved from a token issuance tool to a social entertainment platform with real-world innovation, redefining the relationship between the platform, creators, and audiences.

Pump.fun's livestreaming craze is unsustainable

With the updated fee model and the launch of the live streaming network flywheel, Pump.fun itself became the biggest beneficiary. Its daily fee revenue surpassed Hyperliquid, making it the highest-earning application in the cryptocurrency space, second only to stablecoin issuers like Tether and Circle. Pump.fun successfully rescued itself and escaped the quagmire of internal competition with other meme coin issuance platforms.

But can live streaming be sustainable and grow into a solid moat for Pump.fun?

Essentially, no matter how Pump.fun redefines itself, livestreaming is simply a different way to attract attention and generate Meme tokens. Players still seek profit. After shutting down its livestreaming function for rectification last November, Pump.fun began gradually reopening in April 2025. While the platform introduced stricter content review and rules, the core PVP nature of the Pump.fun platform remains unchanged.

" We want to combine TikTok, Robinhood, Twitch and Pump.fun to form a super app, allowing Generation Z users to trade, create and consume content here. " This is Pump.fun's crazy vision, but in traditional entertainment live streaming platforms, users are consumers, while on Pump.fun live streaming, users are investors.

On traditional entertainment livestreaming platforms, viewers primarily seek emotional value, even resorting to tipping hosts for it. However, on Pump.fun, viewers, like creators, are driven by profit. Their primary concern isn't whether they enjoy the content, but whether it will create a buzz and drive up token prices. This skewed motivation naturally leads to even more skewed behavior . An ordinary artist livestreaming their creations on Pump.fun won't attract attention, but someone who walks into a gym to steal a hat and gets slapped in the face, or leaks a rapper's unreleased song, will surely draw attention.

Real creators are ignored, while anchors who grab attention with abnormal behavior get a large share of the profits. Under such an unhealthy platform model, it is not only difficult for Pump.fun to accumulate truly high-quality creators, but creators from other platforms will not be willing to sacrifice their reputation to migrate to Pump.fun.

Pump.fun's product strategy still emphasizes the financialization of content, a philosophy that doesn't tolerate audience "slacking off." This means that in this ecosystem, not only do the platform and creators have to make money, but the audience too. " I've actually deleted all social media on my phone because I really don't like it; it sucks your energy. Those who endlessly scroll through their screens, in my opinion, are the worst. If you're really going to do that, why not make it at least financially rewarding, rather than just wasting your time? " Pump.fun's anonymous co-founder, Noah, discussed his views on social media and the product strategy behind Pump.fun on a Delphi Digital podcast.

Noah's statement is like blaming those who spend their time watching "low-fat" videos for not spending it on learning and self-improvement. However, it's precisely because of these people willing to "waste their lives" on social media that a rich and diverse content ecosystem has emerged. Perhaps even more incomprehensible than gambling on losses in MemeCoin is why some people are willing to "tip" streamers without seeking financial rewards.

If Pump.fun continues to adhere to this product logic, it will never surpass traditional social entertainment platforms and will remain nothing more than a token issuance platform for meme hype. The internet is humanity's alter ego, and social entertainment platforms are a kind of "utopia" where people indulge themselves. A young player might watch Pump.fun livestreams trading for hours, then, before bed, open TikTok and watch their favorite streamers to help them fall asleep.

Audiences come for profit and leave when they fail. Livestream influencers are merely a gimmick to attract attention to PvP on Pump.fun, no different in essence from community memes, AI agents, and celebrity tokens. Furthermore, as market conditions change, the PvP cycle will accelerate. According to OKX Wallet data, as of September 17th, only nine Pump.fun livestream tokens with a market capitalization exceeding $1 million remained, compared to 39 just two days prior.

Of course, if you, like Pump.fun's die-hard crypto bull Wei Tuo, believe that "zero-sum", "PVP" and the world heading towards chaos are the basic conditions of this generation of young people, then you should bet on Pump.fun.

Related Reading

Alon's first interview after PumpFun's crazy live broadcast went viral again

Long Pump, Short Human Nature: Debating the 8B Market Cap for Pump Fun