Market Forecast 2.0 Outlook: 5 New Product Forms Beyond "Pure Gambling"

- 核心观点:预测市场将向多元化应用生态演变。

- 关键要素:

- 影响力市场分离事件概率与价格影响。

- 舆论市场押注集体信念实现快速结算。

- 虚拟体育结合周期性预测与资产交易。

- 市场影响:推动预测机制融入更多金融场景。

- 时效性标注:中期影响

The original text comes from Neel Daftary.

Compiled by Odaily Planet Daily Golem ( @web3_golem )

In the future, prediction markets may be dominated by Polymarket/Kalshi, capturing all the attention and market share. But even so, we may eventually use newly designed prediction markets that can meet everyone's needs and fit their preferences and interests.

How did the trading of Meme coins evolve? In 2015, we only needed to buy tokens with a dog printed on them. By 2025, we needed to learn how to use tools (Axiom), track wallets (Cielo, Nansen, Arkham), and join a community to search for tokens on platforms like Solana, BNB, and Base with other people.

Every opportunity in the crypto space begins with a simple model. Over time, these simple models either die out (e.g., NFTs) or become more complex as more players join, diminishing their early advantages (e.g., Memecoins). Of course, users also crave more complex games, as evidenced by the evolution of most video games (God of War, Assassin's Creed, FIFA, etc.). To maintain appeal and relevance to their core user base, gaming and game-like platforms need to increase functionality and complexity, enabling top players to stand out from the 99%.

When this happens again, and it resonates with the prediction market category, it will no longer be a single, massive platform, but a complete ecosystem encompassing numerous prediction-related applications.

These standalone products can leverage the core mechanisms of prediction markets (incentive-driven prediction and stakeholder engagement) to create entirely new experiences. Here are five highly anticipated categories:

Impact of Expected Transactions: Taking Lightcone as an Example

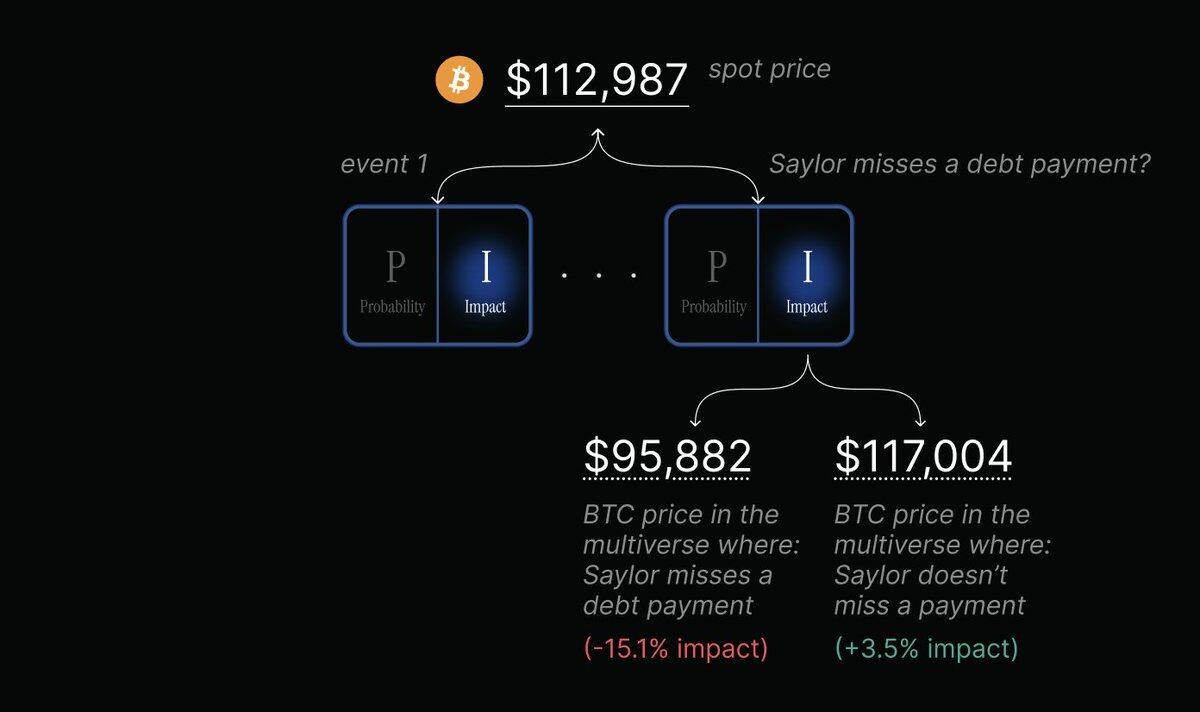

This is perhaps the newest and most complex original concept, transcending the realm of probability to allow users to trade the impact of events.

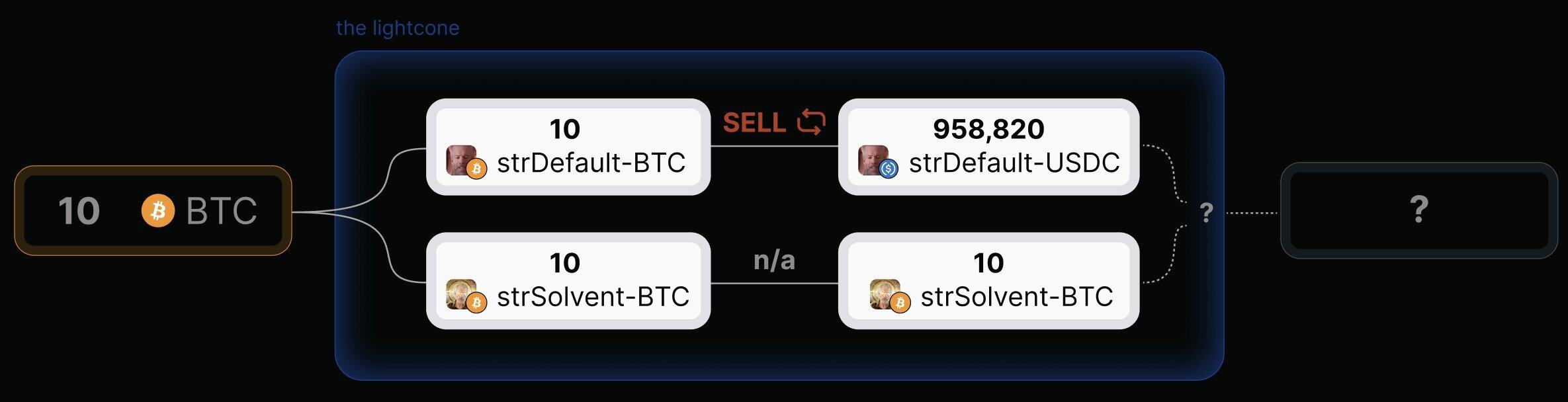

This can be understood as follows: the prediction market tells you the probability (P) of an event occurring, while the spot market tells you the spot price (S) of the event occurring. However, Lightcone 's new category, "Influence Markets," aims to separate and price influence (I).

The platform works by cloning assets into "parallel universes" based on future events. For example, a user could deposit 1 BTC before the US election and then receive two new tradable tokens, Trump-BTC and Kamala-BTC.

These tokens trade in a separate "parallel universe." When an event occurs (for example, if Trump wins), all Trump-BTC can be exchanged for real Bitcoin, while all Kamala-BTC will go to zero (and vice versa).

The advantage of this model is that it has spawned two entirely new applications:

- A new information machine: It provides us with an experimental ground for predicting financial impact. By comparing the prices of Trump-BTC (e.g., $130,000) and Kamala-BTC (e.g., $91,000) with the current spot Bitcoin price ($102,000), the market clearly tells us the expected financial impact of each outcome, completely unrelated to the probability of the outcome occurring.

- Event-based hedging: Traders can hedge specific risks without paying a premium unless the risk occurs. For example, a trader concerned about a specific credit event (such as a Saylor default) could hold strSolvent-BTC while selling their strDefault-BTC in exchange for strDefault-USDC.

If a default occurs, their strDefault-USDC will become real USDC. They successfully hedged and sold Bitcoin before the event; if no default occurs, their strSolvent-BTC can be redeemed for their original Bitcoin. They still hold a long position, and the hedging operation incurred no costs.

This is a complex tool. It removes the "probability" variable from trading, allowing institutions and traders to trade based solely on influencing factors, which is truly a completely new financial foundation.

Public Opinion Market: Betting on Belief

This is a fascinating concept where participants no longer bet on objective facts (such as "Can Ethereum reach $5,000?"), but rather on what people will believe.

For example: "Would more than 70% of participants bet 'yes' in this market?"

This model has two major advantages:

- Fast settlement: The market can settle daily or every few hours based solely on its internal dynamics. It does not rely on slow external oracles.

- Social capital monetization rewards players who can accurately predict collective psychology rather than facts. It is a direct way to monetize cultural influence and cultural understanding.

Currently, platforms such as Melee , vPOP , and opinions.fun are trying to build this model, enabling people to convert social capital into profits.

Virtual Sports: High-Frequency Prediction Market

Virtual sports is a $25 billion industry, at its core a cyclical prediction market.

On the Football.Fun platform, users don't just place a single bet; they make combined predictions. Building a team is essentially a bet on the overall performance of the players, with all players subject to budget constraints.

This model is powerful because:

- It can generate consistent, periodic betting volume (e.g., weekly NFL/NBA/PL tournaments).

- It allows users to monetize the expertise they accumulate by watching more than 10 hours of games per week.

The inherent advantage of cryptocurrencies lies in their tradable assets. Digital player cards are essentially predictions of a player's in-game value. Cryptocurrency-native virtual sports allow players to profit through participation in pure player card trading (similar to gashapon boxes or physical collectibles) and regularly running, cyclical prediction market games.

Opportunity Market: Private Equity Information Mining

This is the second innovative mechanism proposed by the Paradigm team, which enables prediction markets to solve a problem faced by businesses: finding valuable early information.

The model is as follows:

- Venture Capital (VC): Provides all liquidity to the private market (e.g., "Will we invest in startup Y this year?").

- Investigator (Expert): Uses their information and expertise to purchase shares of "Yes".

- Signal: Price increases have become a proprietary aggregation signal for VCs/institutions, suggesting that the market should investigate/re-investigate the project.

This is essentially a decentralized reconnaissance program. It can also solve the "free-rider problem" (the signal is private and only the initiator can access it) and the liquidity problem (the initiator is a permanent market maker) in some way.

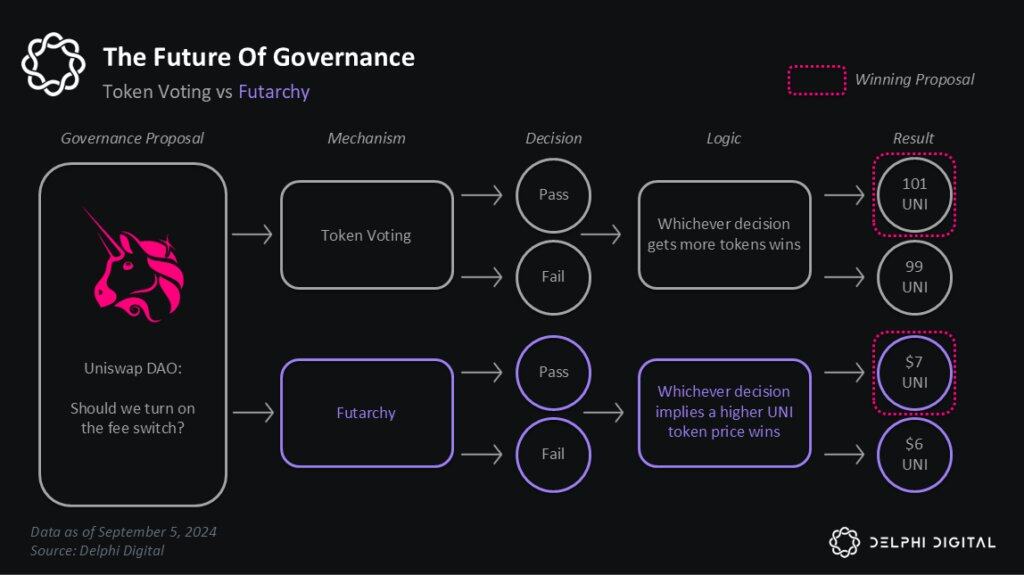

Betting on the wisdom of market governance

This is a governance model that delegates policy-making power to market wisdom. Its core concept is: "People vote based on values, but they bet based on beliefs."

The operation method is as follows:

- A DAO agrees on a certain value or goal (e.g., "maximize monthly active users").

- Submit a proposal ("Proposal 123: Spend 50,000 tokens to launch a new incentive campaign").

- Create two conditional prediction markets: Market A, "If proposal 123 passes, what will the number of monthly active users be on December 31st?"; Market B, "If proposal 123 fails, what will the number of monthly active users be on December 31st?".

- If the price (predicted value) in market A is higher than that in market B, the proposal will be automatically approved.

It forces participants to invest in their beliefs, transforming governance from a subjective popularity contest into an information-driven practice.

But frankly, innovation in the application of prediction markets goes far beyond this. In addition to the applications listed above, we've also seen concepts like the Boring News news platform based on prediction markets and the PolyFund, a dedicated prediction market fund, under development.

The design potential of the prediction market application layer is only just beginning to be explored, and we are not optimistic enough yet.