Can XPL, which was snapped up by wealthy investors during its public sale, break the $1 mark when it goes online?

- 核心观点:Plasma获顶级资本投资,定位稳定币专用链。

- 关键要素:

- Tether与Peter Thiel投资。

- 累计融资超5.2亿美元。

- 公售超额认购达7倍。

- 市场影响:推动稳定币支付普及与基建发展。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Amidst cooling market sentiment, Bitcoin and Ethereum prices have retreated, and discussion of major altcoins has also declined. However, among the blockbuster projects still generating significant buzz in the community, in addition to WLFI, which launched yesterday, another major focus is Plasma, a new stablecoin-specific blockchain jointly invested in by stablecoin giant Tether and legendary Silicon Valley investor Peter Thiel. Its token, XPL, is now available for contract trading on several major exchanges.

Why is Plasma so popular in the market?

The reason why Plasma has become the new favorite in the market is that it is endorsed by large institutions and has a clear project positioning.

Plasma boasts strong backing from stablecoin giant Tether and legendary Silicon Valley investor Peter Thiel, a significant endorsement in itself. From late 2024 to early 2025, the project completed its seed and Series A funding rounds, raising a total of $24 million. Subsequently, in May 2025, Founders Fund invested again at a valuation of $500 million. Bitfinex also separately invested $3.5 million to promote USDT adoption within the Bitcoin ecosystem. This intensive fundraising cadence and strong capital base gave Plasma the aura of a "star project" from the outset.

In terms of technical design and product positioning, Plasma departs from the traditional path of general-purpose public chains, instead targeting the native infrastructure of stablecoins. It leverages the Bitcoin mainnet as the final settlement layer, inheriting the security of the UTXO model while also being compatible with the Ethereum Virtual Machine, facilitating seamless migration of smart contracts. Even more appealing is that all on-chain transactions can be paid for gas directly with USDT, and standard USDT transfers are completely free, significantly lowering the barrier to entry for stablecoin payments.

Plasma further strengthens its differentiated advantages with privacy features that allow users to selectively hide transaction information. By bringing BTC on-chain through permissionless bridging technology and integrating it with Tether's deep USD pool, users can exchange and borrow BTC-based stablecoins with low slippage. With its "zero fees, high performance, and secure architecture," Plasma aims to create an on-chain "Visa network," making stablecoin payments a reality for everyday use.

How are Plasma tokens distributed?

XPL Token Model

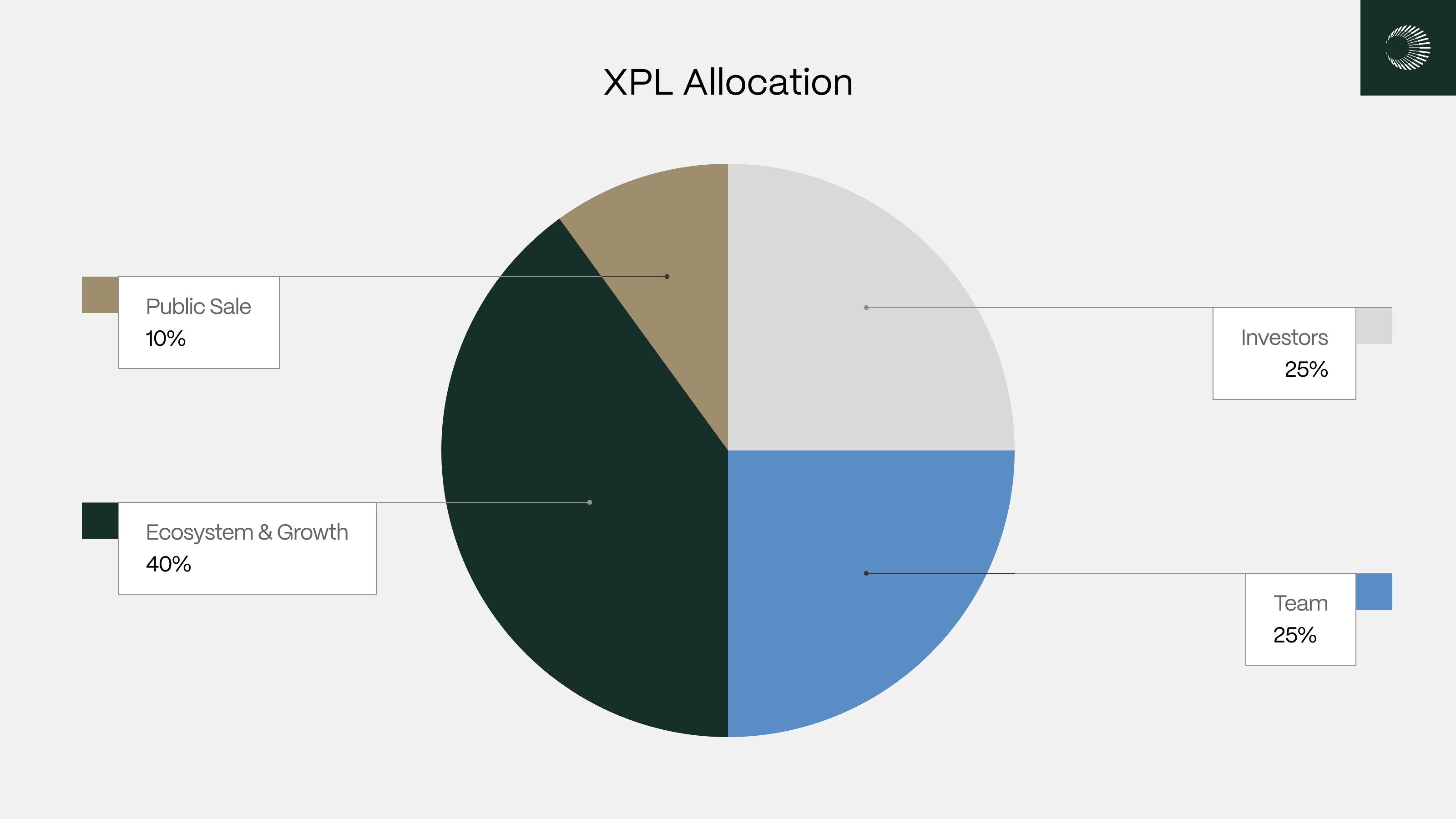

In mid-July, Plasma announced the token economic model of XPL, with a total supply of 10 billion tokens. The specific distribution plan is as follows:

- Public Sale: 10% of the total supply, or 1 billion XPL. XPL held by non-US purchasers will be fully unlocked upon the launch of the Plasma public mainnet beta. XPL held by US purchasers will be locked up for 12 months, fully unlocking on July 28, 2026.

- Ecosystem and Project Growth: 40% of the total supply, or 4 billion tokens. 8% of this total will be allocated to strategic partners to provide DeFi incentives, meet liquidity needs, support exchange integrations, and implement early ecosystem growth activities. This will be unlocked immediately upon the launch of the mainnet beta. The remaining 32% will be allocated to strategic growth initiatives aimed at expanding the utility, liquidity, and institutional adoption of the Plasma network. This will be unlocked pro rata monthly over the three years following the mainnet beta launch.

- Team: 25% of the total supply, or 2.5 billion tokens. One-third will be unlocked one year after the public launch of the mainnet beta, and the remaining two-thirds will be unlocked monthly over the next two years on a pro rata basis.

- Investors: 25% of the total supply, or 2.5 billion tokens. Unlocking schedule is the same as the team.

XPL Token Model

XPL's token economic model is divided into 4 parts, the overall distribution is easy to understand, and the team tokens will not be unlocked until one year after the mainnet test version is launched, so there will be no "dumping" from the project party in the short term.

Below, we focus on the 1 billion tokens in the public sale and the 800 million tokens allocated to strategic partners for ecosystem and project growth.

Public Sale Allocation

The 10% public sale price is US$0.05. Based on the current XPL contract price (currently US$0.62), the yield is over 12 times.

To participate in the Plasma public sale, users must deposit Ethereum mainnet stablecoins into a Plasma Vault. On the evening of June 9th, deposits officially opened, allowing users to deposit USDT, USDC, USDS, or DAI into the Plasma Vault on the Ethereum mainnet. Final allocations are calculated based on a "time-weighted share"—the earlier the deposit and the longer it is held, the larger the allocation.

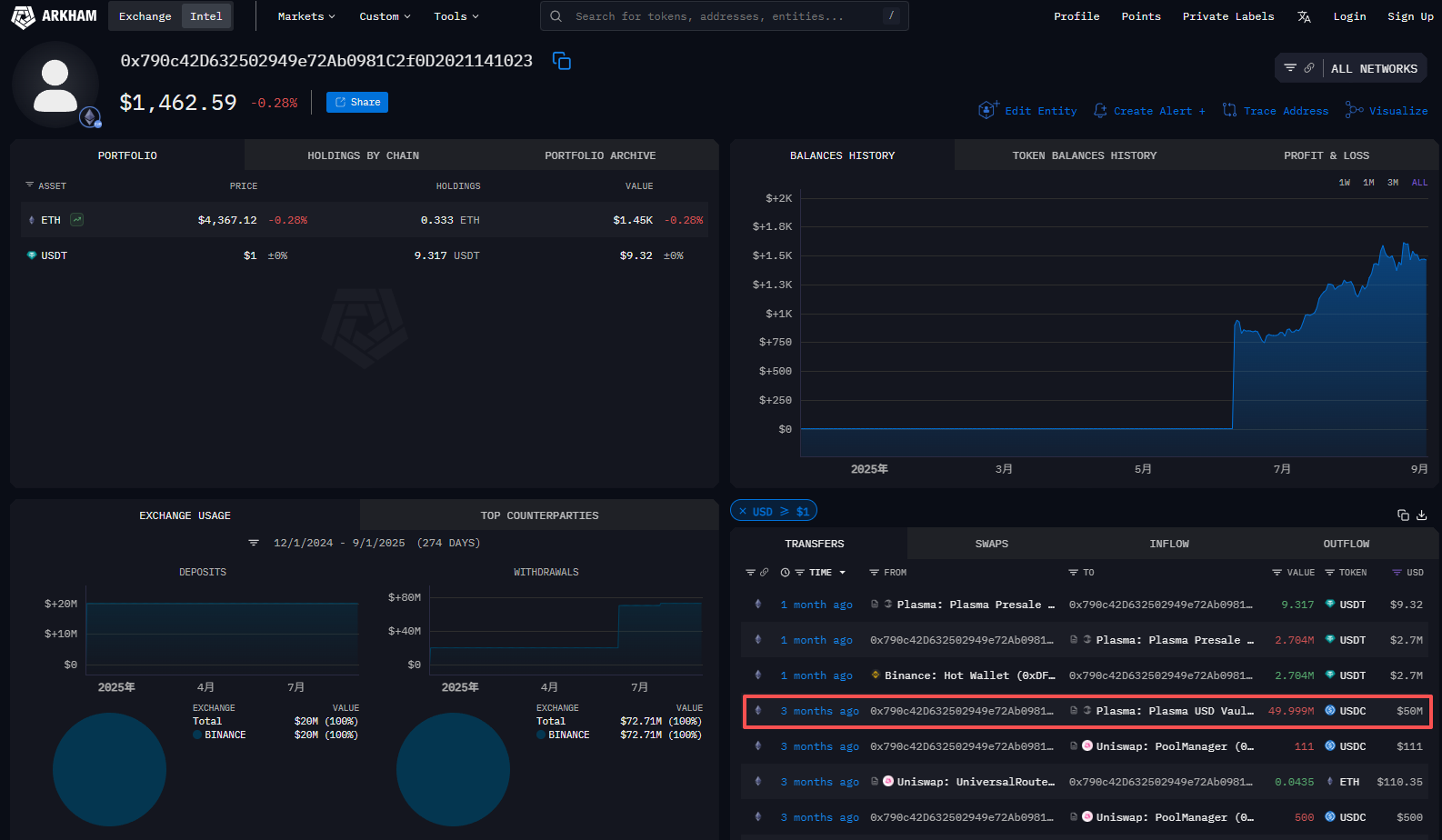

The deposit activity was incredibly popular after its launch, reaching its target amount in just two minutes. Among them, a large whale/institutional address (address: https://intel.arkm.com/explorer/address/0x790c42D632502949e72Ab0981C2f0D2021141023 ) individually staked 50 million USDC, accounting for 20% of the total.

50 million USDC deposited in a single address

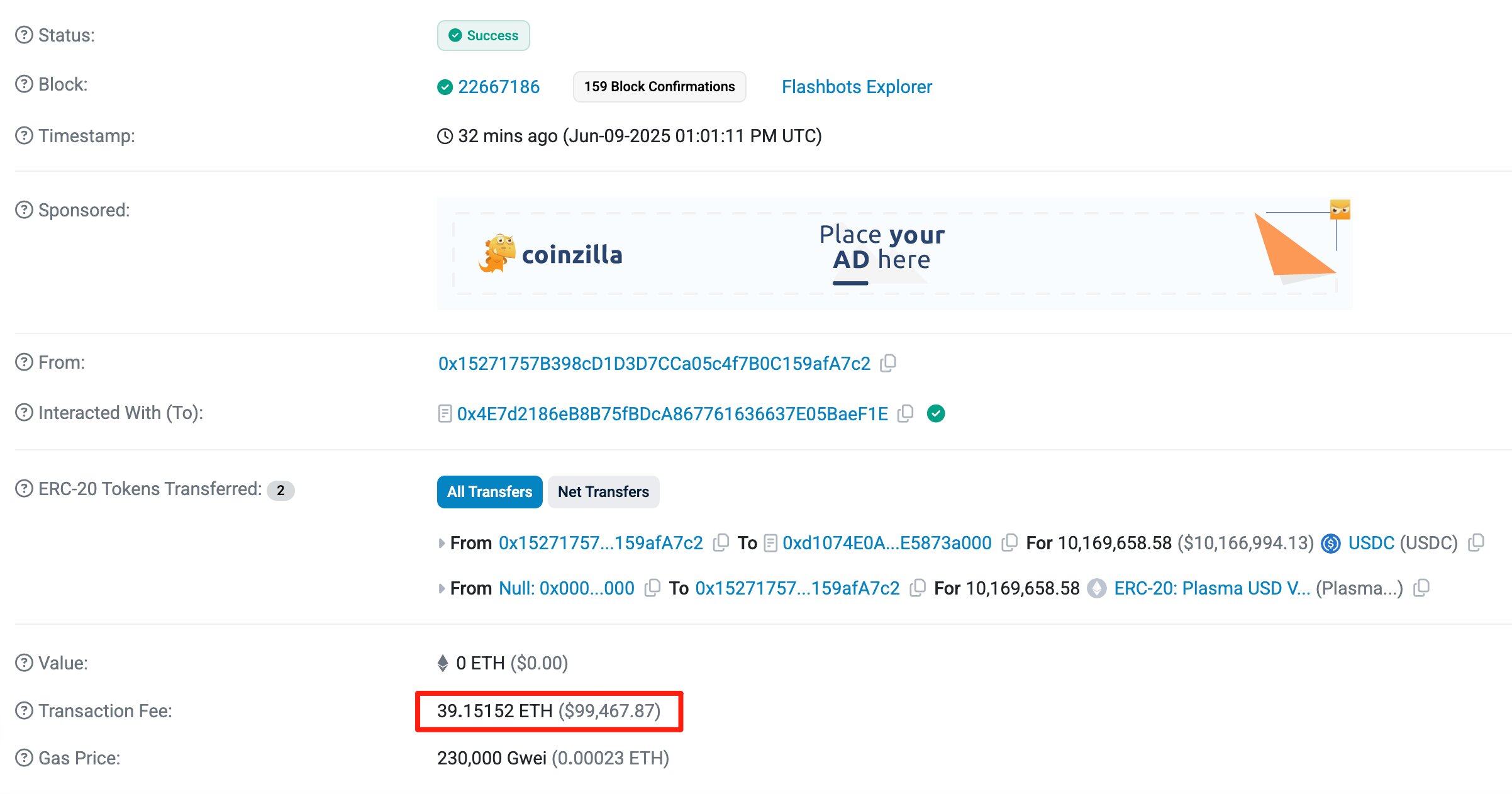

In addition, in order to pledge 10.17 million USDC to Plasma, a whale spent 39.15 ETH (worth about 100,000 US dollars) in gas fees to become the first staking address.

The first completed deposit pledge address Gas cost $100,000

Due to a large number of user feedback that they failed to successfully participate in the deposit activity, Plasma raised the deposit limit to 1 billion USDT. What's exaggerated is that it was "filled up" with 500 million USDT in just half an hour, of which 16.3 million USDT was deposited in the Amber Group associated address and 5 million USDT was deposited in the Spartan Group associated address.

On July 17th, Plasma officially launched its public sale. Eligibility for participation was determined based on the "time-weighted shares" previously deposited into the Vault. The public sale was priced at $0.05 per coin, and the total subscription amount ultimately exceeded $373 million. The subscription was extremely popular, with oversubscription exceeding 7 times.

Binance Wealth Management Allocation

According to official news, Plasma has partnered with Binance to distribute 1% of the total supply of XPL tokens, or 100 million, to users who participate in on-chain coin earning. Users who deposit USDT can also earn an annualized 2% return on their USDT. Initially, Binance set a subscription quota of 250 million USDT, with a maximum of 100,000 USDT per account. This activity sold out in less than an hour. Subsequently, the platform increased the total subscription quota to 1 billion USDT.

In the second round, the new 250 million USDT quota was fully subscribed in just five minutes. To address this, Binance lowered the per-account subscription limit to 10,000 USDT and released the final 500 million USDT quota. Due to the slowdown in subscription activity following the quota reduction, Binance raised the per-account limit to 50,000 USDT, and the remaining quota was fully subscribed within hours.

Based on Binance's final allocation of 1 billion USDT, users will receive approximately 1,000 XPL for every 10,000 USDT deposited. XPL peaked at $0.84 last week, and the current contract price is $0.62. This means that at current prices, a user depositing 10,000 USDT would receive approximately $600 worth of tokens, while at the peak price, the value could reach $840. In addition to the airdropped tokens, the USDT deposit itself earns a 0.33% return over two months, representing a guaranteed return of approximately $33.

Therefore, in summary, for every 10,000 USDT deposited by a user, he or she can ultimately obtain a guaranteed return of $33 + 1,000 XPL tokens (approximately $600 at the current price, and up to $800). The 2-month yield is approximately 6.3%, and the annualized rate is nearly 40%.

It is worth mentioning that in addition to the 100 million tokens allocated to Binance, the distribution of the remaining 700 million XPL tokens for ecosystem and project growth has not yet been announced.

summary

Following the opening of WLFI, the launch of Plasma also became a focus of market attention. Based on the XPL contract price fluctuation range of $0.5 to $0.8 , the total market capitalization of XPL could reach $5 billion to $8 billion. The maximum circulating supply at the opening of the day was approximately 18% (tokens for US KYC users were not immediately unlocked), corresponding to a circulating market capitalization of approximately $900 million to $1.44 billion.

According to Coingecko data, INJ, ranked 100th by market capitalization, has a market capitalization of approximately $1.24 billion. Plasma, backed by strong institutional investors and positioned within the currently popular stablecoin market, could see its price break through $1 and reach an opening market capitalization of $1.8 billion if market sentiment continues. This may just be the beginning of its upward trajectory.