Gate Research: Funding Drops to $3.68 Billion in July, with Capital Focusing on Growth Projects and Mainstream Asset Reserves | A Panoramic Interpretation of Web 3 Funding in July 2025

- 核心观点:Web3融资头部化,传统资本深度融合。

- 关键要素:

- 7月融资36.8亿美元,132笔。

- CeFi和区块链服务占融资70%。

- Series A轮占比44.4%,增长验证为主。

- 市场影响:推动行业成熟化与商业化发展。

- 时效性标注:中期影响。

summary

- According to data released by Cryptorank Dashboard on August 5, 2025, the Web 3 industry completed 132 financings in July 2025, with a total financing amount of US$3.68 billion, continuing the strong capital enthusiasm.

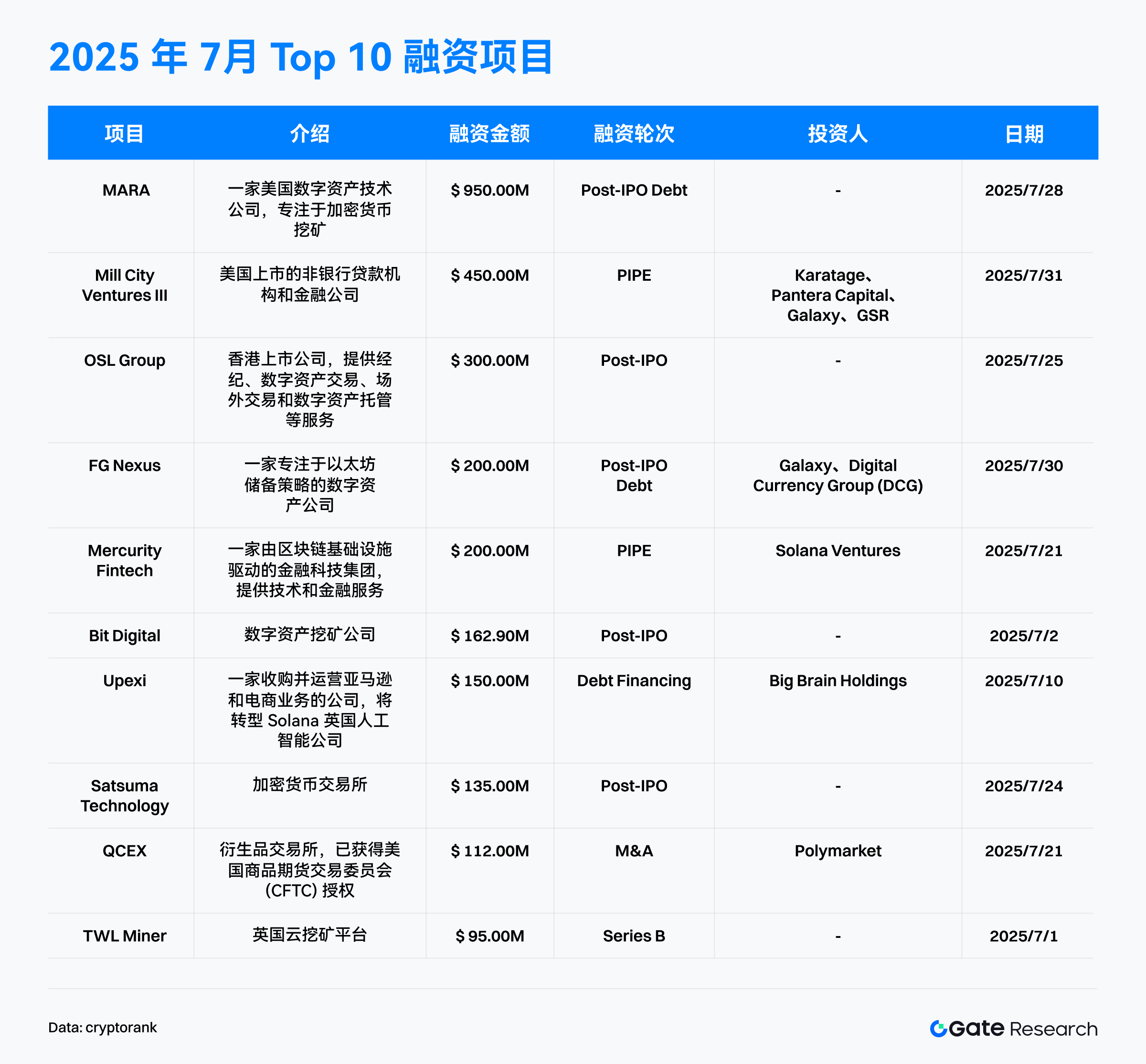

- Looking at the top 10 funding projects, the financing landscape shows a clear trend toward a more centralized and institutionalized approach. Traditional financing methods like post-IPOs and PIPEs (private placement offerings) are becoming mainstream, signaling the increasing integration of Web 3 with traditional capital markets.

- Many projects have explicitly stated that they will use part of the financing funds to purchase mainstream crypto assets such as BTC, ETH, SOL as treasury reserves. This trend is gradually becoming the new normal in the industry.

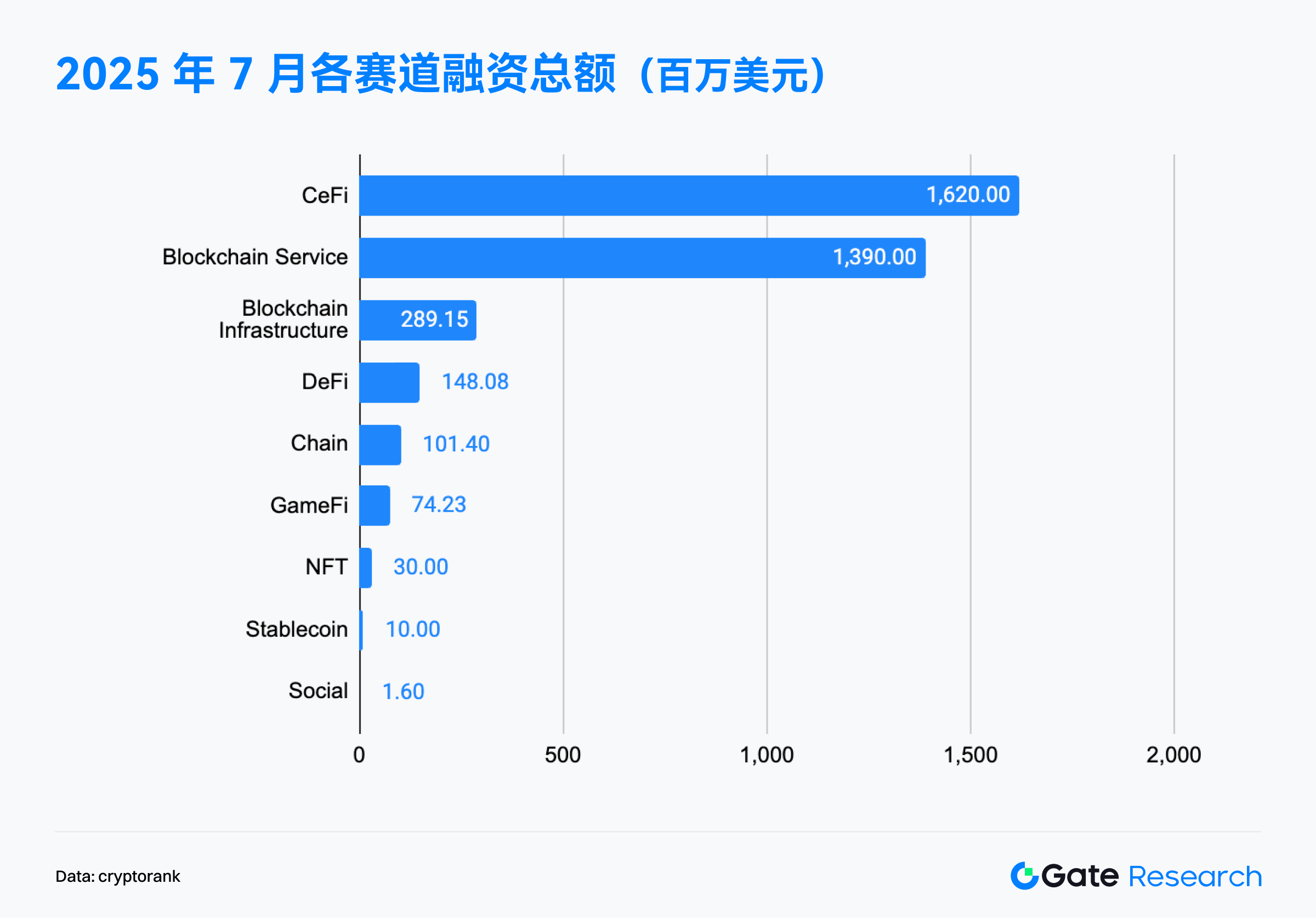

- Financing is mainly concentrated in CeFi (US$1.62 billion) and blockchain services (US$1.4 billion), showing a structural trend of "infrastructure first, service as king, and application differentiation"; capital is continuing to bet on centralized service platforms with business closed-loop capabilities and the ability to bridge Web 2 and Web 3.

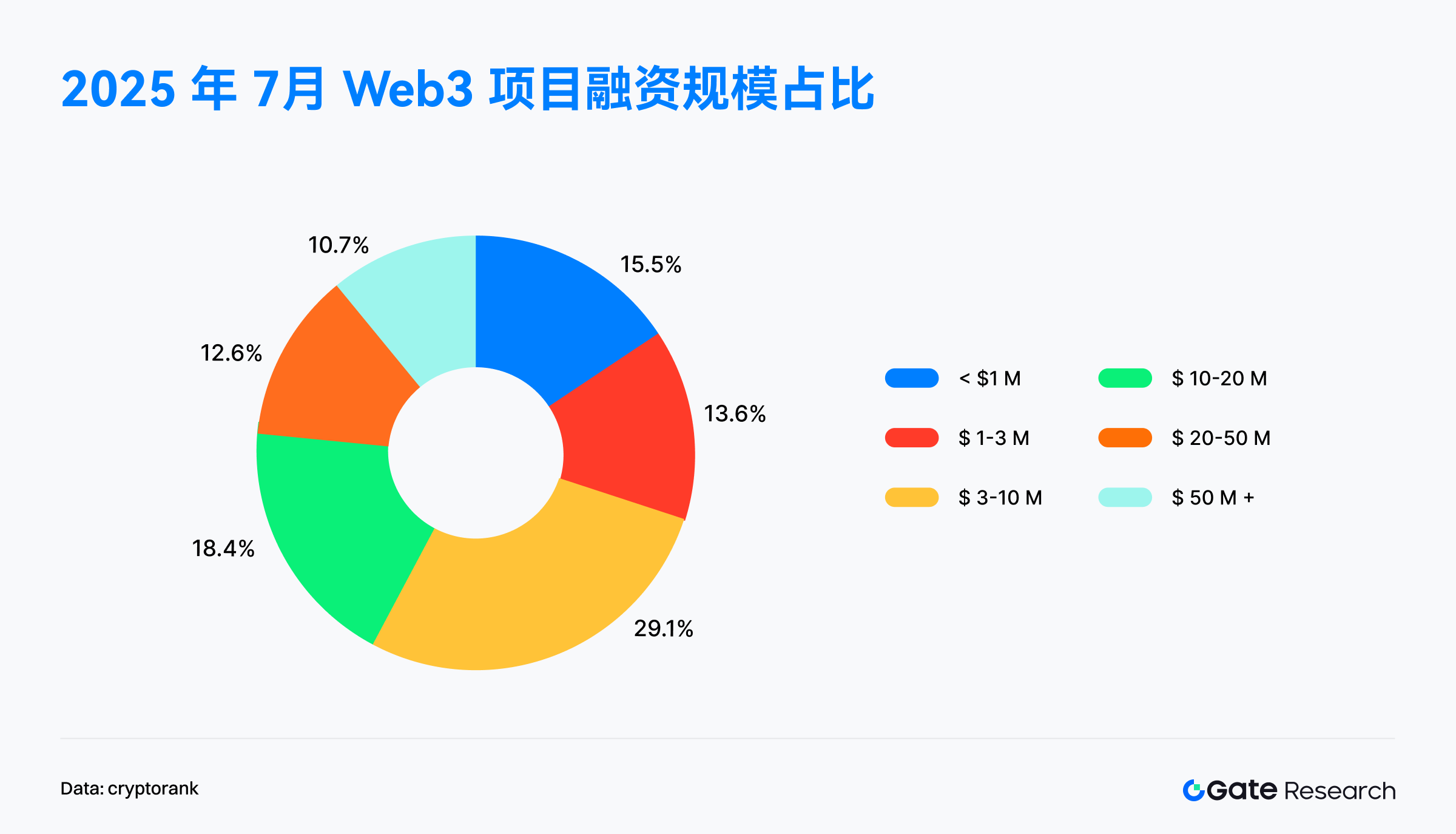

- In terms of funding size, while early-stage projects are injecting vitality into the ecosystem and leading projects are building confidence, the largest concentration of capital remains in growth-stage projects, with funding between $3 million and $20 million, representing a staggering 47.5%. These projects, often in the late stages of product-market fit (PMF) and on the verge of expansion, are currently the focus of investment.

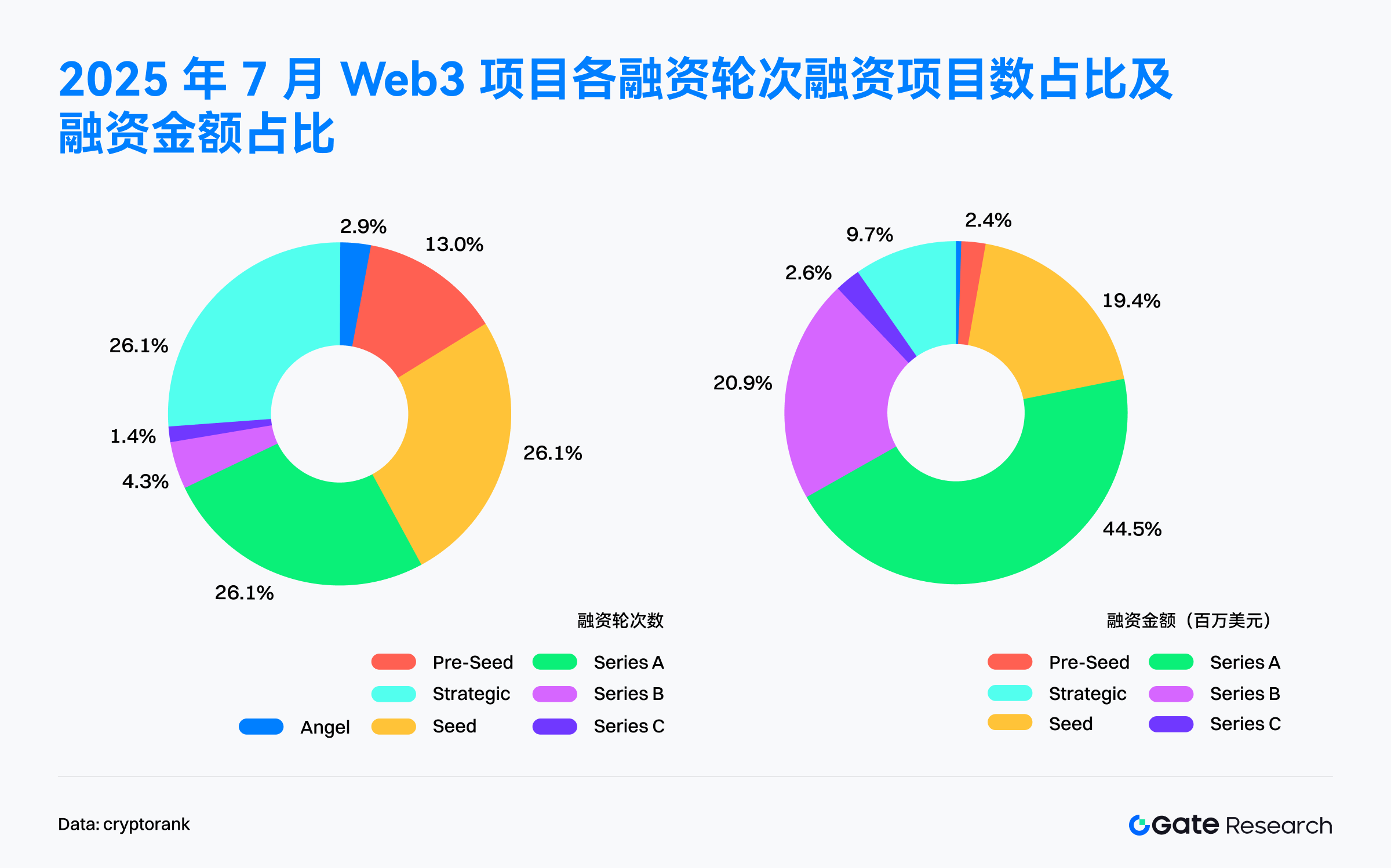

- In terms of funding rounds, growth-stage rounds were the most active, with Series A funding leading the way, accounting for 44.4% of total funding. Capital is shifting from a "story-driven" approach to a "growth-proven" approach, investing heavily in projects with clear market paths, mature technologies, and commercialization capabilities.

- At the investment institution level, Colosseum ranked as the most active institution in July with 9 investments.

Financing Overview

According to data released by Cryptorank on August 5, 2025, the Web 3 industry completed 132 financings in July 2025, with a total financing amount of US$3.68 billion [1]. It should be noted that due to the influence of statistical caliber, this amount is slightly different from the total financing amount after adding up each item (approximately US$3.77 billion); to maintain the consistency of the analytical data caliber, this article uniformly uses the original statistical data provided by Cryptorank Dashboard.

Compared to the 119 financings worth $5.14 billion in June 2025, the number of financings in July increased by 10.92% month-over-month, but the total amount decreased by 28.4%. This "increase in volume and decrease in price" phenomenon was primarily due to the emergence of several large financings in June, particularly in areas such as compliant financial services, listed company expansion, and deep integration with traditional finance. Circle led the way with its $1.1 billion IPO, while there were five large financings exceeding $400 million. In July, only two financings exceeded $400 million, with the highest being MARA's $900 million post-IPO financing on July 28, which was also lower than the previous month's high.

Looking back at the year-round trends, funding activity dipped briefly in early 2025, remaining in the $1 billion to $1.2 billion range in January and February. However, the market rapidly heated up starting in March, with funding exceeding $5 billion in March and reaching a two-year high of $5.17 billion in June. This trend, characterized by concentration, high-value, and institutionalization, suggests the market is maturing.

While funding levels declined in July, they remain high overall, with continued growth in funding activity, reflecting continued market enthusiasm and solid investor confidence. The Web 3 industry is entering a new phase characterized by accelerated capital allocation and structural development.

The top 10 financing projects in the Web 3 industry in July 2025 showed a clear trend of "head-end" and "institutionalization" in the financing structure. The total financing amount of the top ten projects this month reached US$275 million, and the single financing amount was generally in the billion-dollar level. The top projects significantly drove the overall financing amount. Among them, MARA ranked first with US$950 million in post-IPO convertible bond financing, demonstrating the strong financing capabilities of crypto mining companies in the capital market; followed by Mill City Ventures III, which received US$450 million in PIPE private placements. The funds will be used to establish the Sui Treasury, reflecting the continued attention and deep participation of traditional financial institutions in the public chain ecosystem. [2]

In terms of financing rounds and methods, post-IPO and PIPE (private placement) have become the mainstream, accounting for over 60% of projects. This concentration is particularly high in the CeFi and blockchain service sectors, demonstrating that listed or near-listed companies remain a popular target for capital and the continued integration of Web 3 and traditional financial markets. Several projects have also explicitly used raised funds to purchase mainstream crypto assets (such as BTC, ETH, and SOL), indicating that crypto assets are becoming a vital component of corporate financial reserves and demonstrating confidence in their long-term value.

In addition, this month's large-scale financing also saw an M&A transaction (QCEX was acquired by Polymarket) and a traditional Series B financing (TWL Miner received US$95 million), injecting new variables and growth momentum into the market.

Overall, the Web 3 financing market in July showed strong capital injection, high concentration, and a preference for mainstream asset allocation, indicating that the industry is entering a mature stage led by leading projects and with a stable funding structure.

According to data from the Cryptorank Dashboard, Web 3 funding in July 2025 showed a trend of strong institutions, a focus on compliance, and a focus on infrastructure. Funding was heavily concentrated in CeFi and blockchain services, with these two sectors accounting for over 70% of the total funding for the month. This pattern reflects investors' strong appreciation for platforms that bridge the traditional financial and crypto worlds and offer both compliance and ease of use.

The CeFi sector ($1.62 billion) continued its strong performance, driven by numerous PIPEs, post-IPOs, and M&A transactions, demonstrating a clear institutional dominance and concentration of leading investors in funding. Exchanges, custodians, and crypto asset management platforms remain key investment areas, seen as the core entry points for traditional users and capital to enter the Web 3 market on a large scale.

Meanwhile, the blockchain services sector continues to gain prominence, attracting nearly $1.4 billion in investment. Considered the "water seller" of the Web 3 ecosystem, this sector encompasses essential B-side services such as APIs, data analysis, node services, and security audits. As Web 3 complexity increases, investors are optimistic about specialized, efficient developer and enterprise-grade tools, believing they will be key to driving industry maturity and large-scale adoption.

In contrast, although the total financing amount of Blockchain Infrastructure ($289 million) and Chain ($101 million) is not high, it shows that investors still attach importance to the long-term value of the underlying technology and continue to invest to solve key issues such as scalability, security, and interoperability, building a solid foundation for the entire ecosystem.

Compared with the hot development of infrastructure and centralized platforms, the financing enthusiasm of decentralized applications (dApp) is relatively flat and fragmented:

- DeFi secured approximately $148 million in funding, representing only 4% of total funding. After experiencing initial market excitement and risk, the market has become more cautious, with investors favoring projects with sustainable business models and strong risk management capabilities.

- GameFi and NFT have only received approximately US$104 million in total financing, indicating that these two once-hot tracks have entered a cooling-off period, with investors paying more attention to actual user experience and sustainable economic models.

- The social track only received US$1.6 million, reflecting that it still faces challenges in user growth and commercialization.

- Although the stablecoin sector has only raised US$10 million in funding, it is regaining capital attention due to the gradual clarification of stablecoin regulatory policies, and a related application ecosystem is also beginning to take shape.

Overall, Web 3 funding trends in July 2025 highlight a clear pattern: infrastructure prioritized, services king, and application differentiation. Capital is focusing on centralized service platforms capable of achieving closed-loop business models and bridging Web 2 and Web 3, while continuously providing funding for infrastructure improvements. While consumer-oriented decentralized applications still hold potential, investor enthusiasm has significantly cooled, entering a phase of rational selection. This signals that the Web 3 market is transitioning from its early "experimental" phase into a more mature commercial development cycle.

According to the financing data of 103 Web 3 projects disclosed in July 2025, the investment focus of the overall financing market has gradually shifted to the mid-term growth stage, preferring projects with clear growth paths and implementation capabilities.

Mid-sized projects with funding rounds between $3 million and $10 million were the most active, accounting for 29% . These typically correspond to Series A or B rounds, indicating that a large number of Web 3 projects have advanced beyond product/market fit (PMF) and are seeking funding to expand their teams and ecosystems. Investors are showing the strongest interest in this phase.

Looking further, the $3-10 million and $10-20 million ranges combined accounted for 47.5% of the total, fully reflecting the current market trend of "investing for growth." Investors are more inclined to invest in projects that have demonstrated potential and have initially validated their business models, aiming to build competitive advantages and secure a leading position.

Meanwhile, large financings exceeding $20 million remained active, accounting for over 22% of the total (including projects with financings exceeding $50 million) . This funding primarily flowed to leading CeFi companies, listed companies, or mergers and acquisitions, highlighting investors' strong recognition of leading companies and their deep integration with traditional finance.

In contrast, early-stage financing of less than US$1 million accounted for 15.5%, and the US$1-3 million range accounted for 13.6% . This shows that although the market has become more rational and the financing difficulty of start-up projects has increased, new entrepreneurial teams and innovative ideas continue to emerge, providing impetus for the long-term and healthy development of the ecosystem.

In summary, the Web 3 funding market in July 2025 exhibits a typical "olive-shaped" structure: small at both ends and large in the middle. Early-stage innovative projects inject vitality into the ecosystem, leading projects build market confidence, and the real focus of capital is on growth-oriented projects with a range of $3 million to $20 million. Investment logic is also shifting from "storytelling" to "growth-focused," with capital increasingly favoring teams with established, sustainable business models and expansion potential.

According to the financing data of 67 Web 3 projects disclosed in July 2025, the financing activities showed the typical structural characteristics of "active growth rounds and high concentration of capital in Series A":

- In terms of the number of rounds , Seed, Series A and Strategic rounds were the most active, accounting for 26.1% respectively, indicating that the market remains enthusiastic about early-stage exploration and ecosystem collaborative layout, while also paying close attention to projects entering the growth stage and with verification capabilities.

- In terms of funding distribution , Series A rounds dominated, absorbing 44.4% of all funding raised for the month, demonstrating that investors are focusing their efforts on projects that have achieved product-market fit (PMF) and possess the potential for rapid expansion. Series B rounds also accounted for 20.9%, with Series A and B rounds combined accounting for over 65%, clearly demonstrating a shift in investment preference towards mature mid- to late-stage projects.

In contrast, although there is a certain amount of early-stage financing (Angel, Pre-Seed), accounting for nearly 16% , the total financing amount accounts for less than 3% of the total, indicating that the "high frequency and small amount" early-stage investment strategy is still continuing, the investment threshold is getting higher, and the screening of high-quality projects is more stringent.

In addition, although the number of projects in the strategic round is the same as that of the Seed and A rounds, the financing amount accounts for only 9.7% , indicating that this type of financing is more inclined towards small investments in ecological synergy and resource complementarity, rather than mainstream capital investment.

While the majority of projects have clearly labeled funding rounds, "Undisclosed" rounds still comprise a significant portion. This includes a significant number of financing methods common in traditional financial markets, such as PIPEs (Private Placement) and Post-IPOs (Post-IPO), demonstrating the deepening integration of Web 3 projects with traditional capital mechanisms. Furthermore, many projects with undisclosed funding rounds explicitly use the proceeds to purchase mainstream crypto assets like BTC, ETH, and SOL as treasury reserves. This type of "financial allocation" financing is not included in the Cryptorank Dashboard's regular round statistics, but it is becoming a new trend.

Overall, the Web 3 financing market in July 2025 showed a clear trend of growth-round dominance and deepening institutionalization. Capital is no longer blindly chasing early-stage narratives, but is instead heavily betting on projects with proven market capabilities, regulatory compliance pathways, and commercial closures, particularly mid- to late-stage teams in the Series A and B stages. At the same time, traditional financial instruments, such as PIPEs and post-IPOs, are rapidly integrating into the Web 3 ecosystem. Projects allocating financing funds to crypto assets also reflects the diversification and maturity of their financial structures and strategies.

According to data released by Cryptorank on August 5, 2025, Colosseum ranked as the most active Web 3 investment institution in July, with nine investments, demonstrating its high frequency and breadth of coverage in early-stage projects. Following closely behind were Coinbase Ventures (7 investments) and Animoca Brands (5 investments), maintaining their roles as strategic industry investors, focusing on infrastructure development and content ecosystem expansion.

Looking at investment rounds, Amber Group, Susquehanna International Group (SIG), CoinFund, and Faction, among others, have led numerous rounds, demonstrating their strong leadership in project valuation, resource acquisition, and ecosystem collaboration. Institutions with traditional financial backgrounds, such as SIG and Amber Group, are increasingly playing a key role as accelerators in the Web 3 space.

Overall, leading capital remains active in the current market, and emerging and traditional capital are rapidly converging. The frequent convergence of traditional financial institutions and crypto-native funds in the early stages of investment is jointly driving the Web 3 ecosystem towards a more mature and refined capital operation model.

Financing projects highlighted in July

Delabs Games

Introduction: Delabs Games is a studio focused on Web 3 game development. It was founded in 2021 by former Nexon executive James Joonmo Kwon. Since its establishment, the team has continued to create a number of blockchain games, including "Rumble Racing Star", "Space Frontier" and "Metabolts", and is committed to building a Web 3 gaming experience that is both fun and playable from scratch. [3]

On July 21, Delabs Games announced the completion of a $5.2 million Series A funding round led by Hashed, bringing its total funding to $17.2 million. [4]

Investment institutions/angel investors: Hashed, TON Ventures, Kilo Fund, IVC, Taisu Ventures, Arche Fund (Coin 98), Yield Guild Games (YGG), Everyrealm, Jets Capital, etc.

Highlights:

- Delabs is committed to breaking the centralized limitations of traditional games, combining blockchain technology to empower players with ownership of game assets. It also lowers the development threshold through its generative AI platform, Verse 8, supporting users and creators to build multiplayer game scenarios through natural language prompts, thereby promoting community-driven content co-creation and economic cycles.

- The first game, Boxing Star X, demonstrated the feasibility of the "light social + Web 3" gaming business model, generating over $300,000 in monthly revenue, with an ARPPU exceeding $200, and its global user base poised to surpass 2 million. The game recently ranked seventh on DappRadar's global game chart, surpassing well-known projects like Axie Infinity. The next game, Ragnarok Online, has not yet been released, but pre-registrations have already exceeded 100,000, and market interest continues to grow.

- The team boasts a prime background in the convergence of Web 2 and Web 3. Founder James Joonmo Kwon, formerly CEO of Nexon, spearheaded phenomenal games like MapleStory and Dungeon & Fighter. Co-CEO JC Kim is a co-founder of Planetarium, deeply involved in the blockchain gaming ecosystem and promoting the integration of traditional gaming and crypto. Planetarium's strong investor base includes NFT influencer Dingaling, digital asset fund Grail, game accelerator Liquid X, and the co-founder of YGG, providing the team with a robust network of ecosystem resources.

Gaia Labs

Introduction: Gaia is a decentralized artificial intelligence network that aims to redefine how intelligence is built, distributed, and owned. Its peer-to-peer infrastructure allows anyone to run AI models and agents on a global network of independent nodes, ensuring transparency, privacy, and resilience. Gaia Labs is the team responsible for the initial development of the Gaia network. [5]

On July 23, Gaia Labs announced the completion of a total of $20 million in seed and Series A funding rounds, led by ByteTrade, SIG Capital (Susquehanna), Mirana, and Mantle Eco Fund. [6]

Investment institutions: ByteTrade, SIG Capital (Susquehanna), Mirana, Mantle Eco Fund, EVM Capital, Taisu Ventures, NGC Ventures, Selini Capital, Presto, Stake Capital, FactBlock, G 20, Amber, Cogitent Ventures, Paper Ventures, Republic Crypto, Outlier Ventures, MoonPay, BitGo, SpiderCrypto, Consensys Mesh wait.

Highlights:

- Gaia is building the world's leading decentralized AI inference network. Its core architecture is based on a distributed node system, deploying a large number of independently operated AI nodes globally to create an open, transparent, and resilient intelligent network. Official data shows that the Gaia network currently has over 700,000 active nodes, executing over 17 trillion AI inference tasks. Nodes are distributed across thousands of application chains and blockchain ecosystems, and are supported by over one million independent wallets.

- The Gaia network's node mechanism is a technical highlight. Each node can host AI models and independently execute inference tasks. Node operators can choose to run nodes on local devices, GPU servers, or even personal computers. Gaia Labs has integrated several mainstream open-source large-scale language models (LLMs) as the network's "core models," including Meta's LLaMA series, Google's Gemma/CodeGemma, Microsoft's Phi series, and Alibaba's Qwen model, providing a diverse and high-performance model foundation for the AI network.

- One of the network's key applications is the Gaia AI Phone, an AI-native smartphone planned by Gaia Labs. This high-performance device, built on the Galaxy S 25 Edge hardware, differs significantly from other "AI phones" on the market in that all AI models and agents run locally on the device's chip. This eliminates the need for cloud computing or uploading user data, fundamentally guaranteeing data ownership and privacy.

- In terms of security and trustworthiness, the Gaia network has introduced a "verifiable reasoning" mechanism, ensuring the reliability of AI calculation results through methods such as node staking. Furthermore, Gaia Labs continues to improve its developer toolchain, providing an open AI agent framework and SDK, aiming to make it as easy for developers to develop and deploy AI applications on Gaia as using WordPress.

Syntetika

Introduction: Syntetika is a decentralized platform that supports the tokenization and trading of various assets. The platform covers yield-generating crypto products, tokenized shares of private companies (including unlisted companies), and digital representations of real-world assets (RWA). [7]

On July 17, Hilbert Group announced that its tokenization platform and decentralized exchange Syntetika had completed a $2.5 million seed round of financing. [8]

Investors: Russell Thompson, chief investment officer of Hilbert Group, John Lilic, Hilbert advisor and head of Nordark, Alex Berto, former co-founder and venture capitalist of Aave and Allez Labs, and others.

Highlights:

- Syntetika specializes in issuing and trading compliant tokenized assets, integrating blockchain infrastructure with regulatory compliance mechanisms. The platform incorporates Galactica's zero-knowledge Know Your Customer (zkKYC) system, ensuring user privacy while enabling enterprise-grade audit capabilities. The platform aims to build a decentralized and compliant digital asset ecosystem. Its vision is to simplify the issuance, trading, and management of on-chain assets, improving the efficiency and security of traditional asset circulation.

- Syntetika integrates DeFi traffic with structured asset design capabilities to create a tokenized asset issuance platform for institutions. Its first product is a tokenized version of Hilbert Group's Bitcoin Income Strategy, enabling users to earn additional income while holding BTC. Leveraging Hilbert's expertise in quantitative finance, Syntetika aims to provide structured on-chain income products for both institutional and individual users.

- The platform has established a strategic advisory committee, which includes members including Chiliz Chief Strategy Officer Max Rabinovitch, Blum CTO Vladimir Maslyakov, former Citigroup Head of Tokenization Chirdeep Chhabra, and Polygon Consultant John Lilic, to provide rich industry resources and strategic guidance for the platform's development.

Blockskye

Introduction: Blockskye is a blockchain-based corporate travel and payment platform designed to streamline booking, expense tracking, and reconciliation processes. By integrating with KAYAK for Business and PwC systems, the platform eliminates middlemen and pays suppliers directly through its Blockskye Pay system. [9]

On July 17, Blockskye announced the completion of a $15.8 million Series C funding round, led by Blockchange. This round of funding will be used to expand into the European, Latin American, and Asian markets, and to develop real-time payment products based on stablecoins. [10]

Investment institutions/angel investors: Blockchange, United Airlines Ventures, Lightspeed Faction, KSV Global, Lasagna, Litquidity Ventures, Longbrook Ventures, TFJ Capital, etc.

Highlights:

- Blockskye uses blockchain technology to streamline corporate travel processes, supporting flight booking, expense management, and payment settlement. It bypasses traditional intermediaries like travel agencies and credit card networks and connects directly with suppliers like airlines. Current clients include PwC, TripAdvisor, and Diageo. With this new round of funding, the company plans to expand into more Fortune 500 companies and accelerate its expansion into Europe, Latin America, and Asia.

- Blockskye's real-time ownership tracking capabilities significantly optimize resource allocation, helping agencies reduce expenses by 84% and recover millions of dollars in unused airfare. The company claims the platform can help businesses reduce overall travel costs by approximately 14.5%.

- Blockskye is launching a next-generation payment product featuring a transaction-by-transaction settlement mechanism based on stablecoins. Unlike traditional corporate payment systems that rely on batch processing, Blockskye enables real-time settlement at the transaction level, ensuring transparent, controllable, and delay-free fund flows, bringing a structural transformation to corporate payment systems. Blockskye goes beyond simply adding a blockchain to credit card or invoicing systems; instead, it aims to rebuild corporate travel and payment infrastructure from the ground up, creating a truly full-stack travel operating system powered by data synchronization and smart contracts.

Limitless

Introduction: Limitless is a decentralized prediction market platform where users can place bets on real-world events, similar to binary options. The platform generates daily markets based on public price data, with a structure similar to zero-day-to-expiry (0 DTE) options, providing a high-frequency, short-term trading experience, helping users capture rapidly changing market opportunities. [11]

On July 1, Limitless announced the completion of a $4 million strategic financing, bringing the total amount of funding raised for the project to $7 million. [12]

Investors: Coinbase Ventures, 1 Confirmation, Maelstrom, Collider, Node Capital, Paper Ventures, Public Works, Punk DAO, WAGMI Ventures, etc.

Highlights:

- Limitless combines order book trading with innovative liquidity mechanisms to provide an efficient and flexible trading experience. The platform features a dual order book system (yes/no) for each market, supporting both market and limit orders. It also utilizes a share consolidation and splitting mechanism to improve capital utilization efficiency. A daily USDC reward program incentivizes liquidity providers (LPs) to place orders close to the mid-price to narrow the bid-ask spread. Market results are provided by the Pyth Network oracle, and the platform also provides open APIs and smart contract interfaces for easy developer integration.

- Limitless has grown into the largest prediction market on the Base Chain, with total contract volume exceeding $250 million. Users can trade on predictions about the price movements of specific assets over the next few minutes, hours, or even a day, providing a simple, accessible high-frequency trading method that significantly lowers the barrier to entry.

- Limitless has launched a user rewards points program in preparation for its Token Offering (TGE). Users can accumulate points by trading, providing liquidity, and inviting friends to participate on the platform, which will earn them a chance to win future token airdrops. As one of the first prediction market platforms to reward early adopters with tokens, Limitless is attracting a large number of active users.

summary

In July 2025, the Web 3 industry raised $3.68 billion across 132 financing rounds, demonstrating continued capital enthusiasm. This month's funding trend showed a trend of "head-end" and "institutionalization," with traditional financing pathways such as post-IPOs and PIPEs becoming increasingly mainstream, signaling the deep integration of Web 3 with traditional capital markets. Notably, a growing number of projects are using raised funds to purchase mainstream crypto assets as treasury reserves. Funding primarily flowed into CeFi ($1.62 billion) and blockchain services ($1.4 billion), highlighting the structural trend of "infrastructure first, services second." Application-layer funding was relatively flat. The market's focus shifted to mid-stage growth, with projects in the $3 million to $20 million range accounting for 47.5%, with Series A rounds being the most active. This suggests that capital is shifting from a "story-driven" approach to a "growth-proof" approach, with investments becoming more targeted and strategic.

This month's highlighted funding rounds further demonstrate the Web 3 market's trend toward maturity and diversification. Delabs Games showcases breakthroughs in user experience and business models for Web 3 games, emphasizing player ownership and AI empowerment. Gaia Labs represents the rise of decentralized AI infrastructure, connecting the real world through innovative applications like AI phones. Fundraising rounds by Syntetika and Blockskye highlight the enormous potential of tokenized assets (RWAs) and blockchain in enterprise applications such as travel payments, as well as their emphasis on compliance and real-time settlement. Limitless, a prediction market, reflects a continued focus on innovation in on-chain financial instruments and user incentives. Overall, the Web 3 funding market is entering a more mature commercial development cycle, led by leading projects.

References:

- Cryptorank , https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Delabs Games, https://delabs.gg/

- GamesBeat, https://gamesbeat.com/with-5-2 m-series-a-delabs-games-levels-up-web 3-ambitions/

- Gaia, https://www.gaianet.ai/

- Gaia, https://www.gaianet.ai/blog/gaia-labs-raises-20 m-series-a/

- Syntetika, https://syntetika.io/

- Hilbert Group, https://hilbert.group/en/hilbert-group-closes-heavily-oversubscribed-seed-round-for-syntetika-tokenisation-and-decentralised-trading-platform/

- Blockskye, https://www.blockskye.com/

- The Block, https://www.theblock.co/post/363173/blockskye-funding-blockchain-corporate-travel

- Limitless, https://limitless.exchange/simple/markets/59

- Cointelegraph, https://cointelegraph.com/press-releases/limitless-raise-4 m-strategic-funding-launch-points-ahead-of-tge

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot spot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market carries a high level of risk. Users are advised to conduct independent research and fully understand the nature of the assets and products being purchased before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.