Gate Research: 2025 Global Crypto Private Wealth Management Industry White Paper

- 核心观点:加密财富管理向开放式数字生态转型。

- 关键要素:

- 加密PWM规模超250亿美元,增速超50%。

- 资产扩展至加密、DeFi、NFT与RWA。

- 监管框架MiCA、FATF推动规范化。

- 市场影响:推动财富管理数字化与全球化。

- 时效性标注:中期影响

summary

- The crypto private wealth management industry is shifting from a closed "people + bank" relationship to an "open digital ecosystem." Driven by the growth of global private wealth and high-net-worth individuals, the concentration of leading companies and online presence are increasing simultaneously, with the Asia-Pacific region leading the growth rate.

- North America and Europe are mature and stable, Asia Pacific is experiencing high growth, and the Middle East and Latin America are dominated by family offices. The demands of high-net-worth individuals and ultra-high-net-worth individuals have shifted from "simple returns" to "security, privacy, sustainability and cross-border compliance". Service models are diversifying into a new paradigm that combines offline advisors as the core with data algorithm-driven approaches.

- The asset portfolio has expanded to include crypto, stablecoins, DeFi, NFTs, and RWA. It leverages "on-chain transparency and programmability" to provide services from custody and advisory to yield generation, strategy execution, and on-chain governance. Its core values are security and transparency, diversified returns, privacy, and cross-border efficiency.

- The industry is currently facing new challenges in custody and smart contract security, regulatory uncertainty and tax compliance (with frameworks such as MiCA, FATF, SFC, and MAS promoting standardization).

- In October 2025, the total market capitalization of cryptocurrencies was approximately $3.7 trillion, with about 600 million users; the segmented crypto PWM AUM was approximately $25-40 billion, with an annual growth rate of over 50%, with Switzerland, Singapore, the UAE, and Hong Kong as the main hubs, and gradually forming regulatory, technical, and service standards.

- The encrypted PWM product is divided into the following categories from bottom to top: Basic Custody (Cold/Multi-signature/MPC) → Yield Management (Staking, Liquidity Mining, Yield Aggregation) → Structured (Neutral Strategy, Stablecoin Yield, RWA) → Family Governance (On-chain Trust, Succession, Privacy and Taxation).

- Key risks include regulatory compliance, technology and private keys, contract security, high market volatility and liquidity; meanwhile, institutionalization and CeFi+DeFi hybrid architecture, RWA on-chaining and AI-driven investment advisory will become the main themes.

- Clearer regulations will enhance trust among high-net-worth clients, with licensed institutions becoming a key force. In a neutral scenario, the crypto private wealth management market is projected to reach approximately $120 billion by 2028, and could grow to $200-320 billion in an optimistic scenario.

1. Industry Background and Trends

1.1 Overview of the Private Wealth Management Industry

Private Wealth Management (PWM) is a professional system that provides comprehensive wealth planning, investment advisory, asset allocation, tax and wealth management services to high-net-worth individuals. Originating from the tradition of European private banking, this industry has developed over a century and has become one of the most stable high-end services in the global financial system. PWM's core objective is to help clients preserve and grow their assets over the long term, while balancing risk management, tax compliance, and wealth transfer needs.

Traditional PWM (Personalized Banking) is centered on the "people + bank" model, emphasizing trust relationships and customized solutions. However, in the past decade, changes in wealth structure and the integration of fintech have driven a paradigm shift in the industry. On the one hand, global wealth growth has accelerated, and the number of high-net-worth individuals continues to rise; on the other hand, increased information transparency and the rise of digital assets have altered clients' investment behavior and risk appetite. The PWM industry is evolving from a "closed relationship banking" model to an "open digital ecosystem."

1.2 Global Wealth Management Market Size Trend

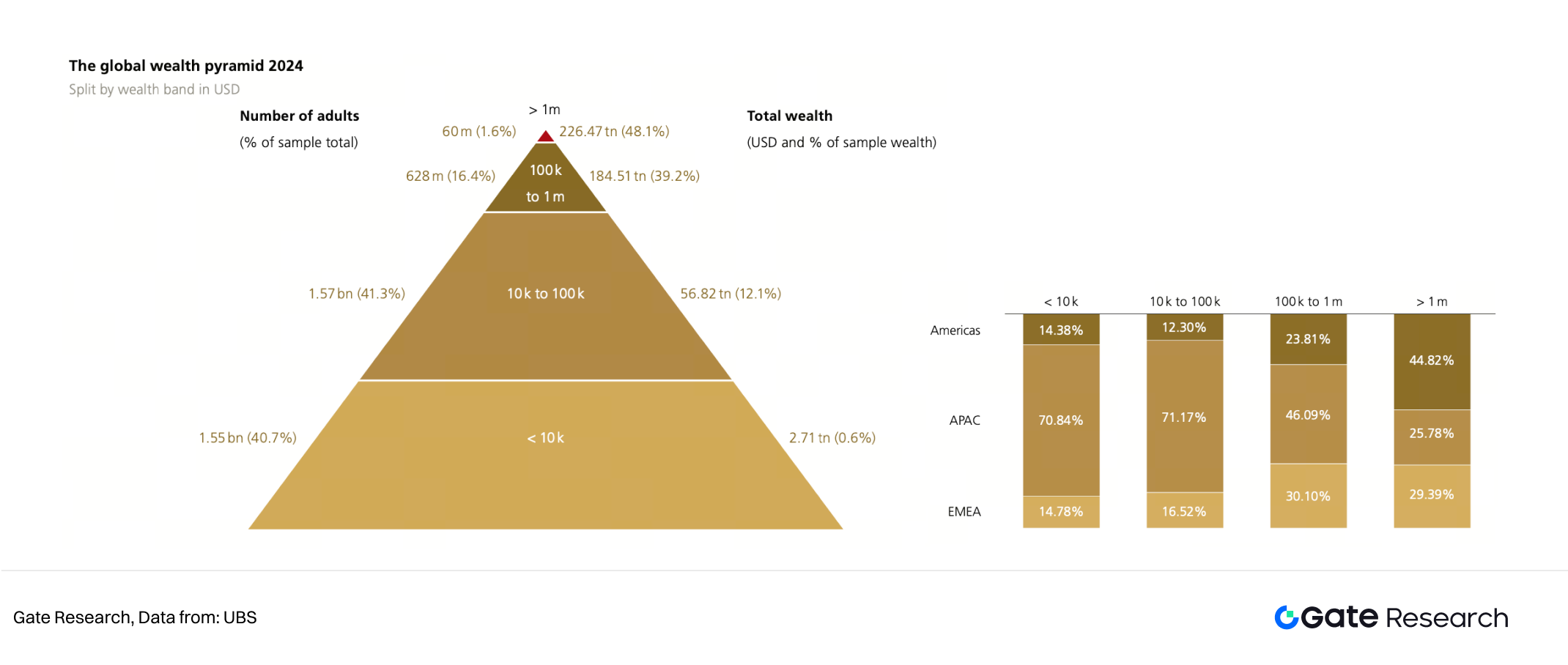

According to the Boston Consulting Group (BCG) Global Wealth Report 2025, global private wealth reached $255 trillion as of March 2025, with approximately 40% held by high-net-worth individuals (HNWIs). It is projected that by 2030, global private wealth will grow at a compound annual growth rate (CAGR) of 5%, reaching approximately $330 trillion. The regional distribution of wealth growth shows a clear shift: the wealth growth rate in the Asia-Pacific region (7%) is significantly higher than that in Europe and the United States (3–4%).

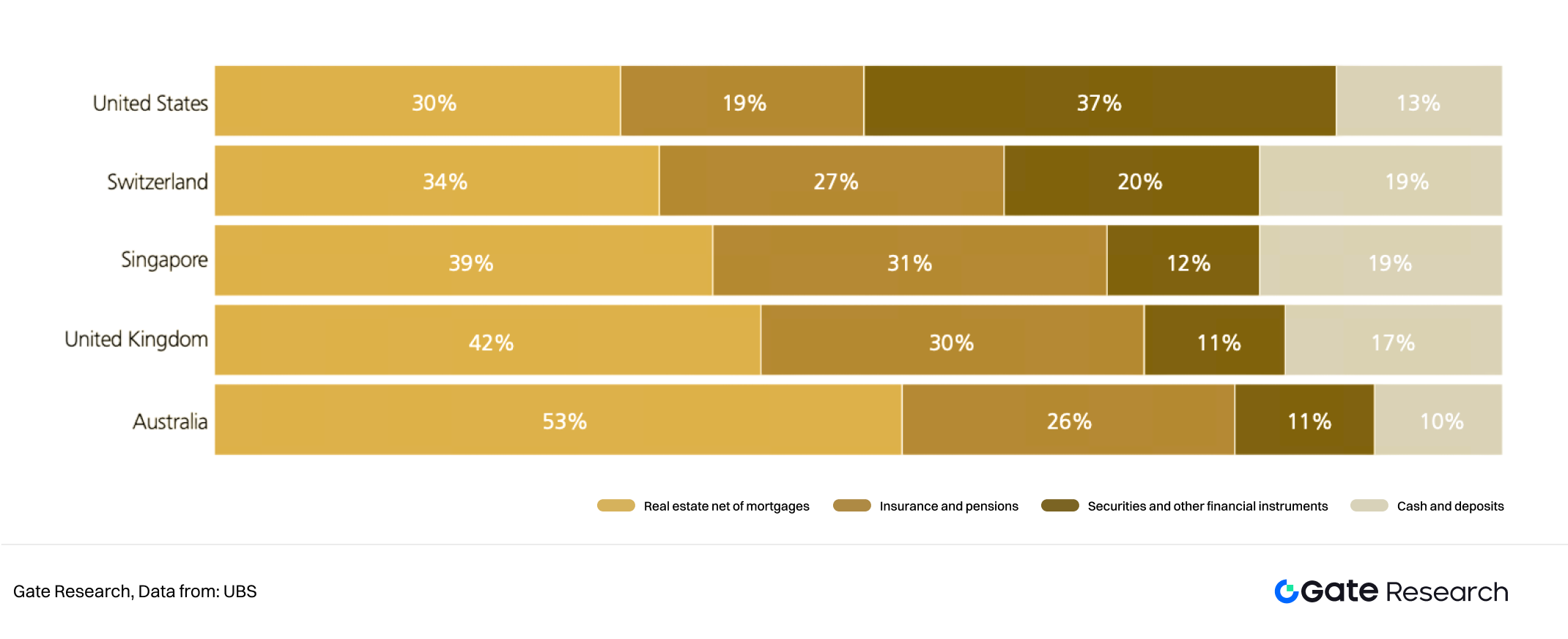

In terms of asset allocation, traditional assets still dominate, with stocks, bonds, and real estate accounting for approximately 80% combined. However, the importance of alternative investments is rising, encompassing categories such as private equity, hedge funds, infrastructure investments, and digital assets. High-net-worth investors are beginning to seek more liquid and innovative allocation models to achieve excess returns and risk diversification.

The concentration of institutional holdings in the global wealth management market is also increasing. The top ten global private banks control more than 50% of the market share. At the same time, the penetration rate of digital PWM services is constantly increasing, with features such as online account opening, robo-advisors, and mobile asset monitoring gradually becoming standard features.

1.3 Global Wealth Management Market Structure

Currently, the global wealth management market can be divided into three main segments based on geographical location:

- North America and Europe : Mature markets with comprehensive regulations and well-developed private banking systems. Traditional institutions such as UBS, Morgan Stanley, and Citi Private Bank possess a large client base and robust trust systems.

- Asia Pacific : Emerging markets are experiencing rapid growth. China, India, Singapore, and Hong Kong are emerging as regional hubs with high levels of wealth digitization, and fintech companies are accelerating their entry into the PWM (Physical Width Modulation) field.

- Middle East and Latin America : Wealth is highly concentrated in family or national funds. Family offices have become the main form of wealth management, combining investment and governance functions.

Future competition will focus on how to integrate digital technologies, cross-border compliance, and multi-asset service capabilities to meet the diverse needs of global clients.

1.4 Evolution of the Needs of High-Net-Worth Individuals

Morgan Stanley research indicates that the wealth management needs of high-net-worth clients are shifting from a "return-oriented" to a "security, privacy, and sustainability-oriented" approach. Traditional clients prioritize long-term stable returns and trust-based wealth transfer, while the new generation of wealthy individuals (especially digital natives) place greater emphasis on flexibility, self-management, and on-chain transparency.

This generational difference has led to a divergence in the service models of PWM institutions: some institutions still adhere to offline advisory relationships as the core, while others have shifted to digital wealth management based on data-driven and algorithmic decision-making. Clients are no longer satisfied with "passive portfolios" but want to participate in strategy formulation and on-chain asset operations.

Furthermore, demand for cross-border asset allocation has increased significantly. With the reduction of capital flow barriers and the clear trend towards global asset integration, tax planning and identity compliance have become new pain points. Clients are increasingly inclined to choose institutions that can provide integrated compliance services across different jurisdictions.

1.5 Private Wealth Management in the Digital Asset Era

The development of blockchain and digital assets has brought about structural changes to the PWM industry. Asset classes have expanded to include cryptocurrencies, stablecoins, DeFi protocols, NFTs, and real-world assets (RWA), extending wealth management from the traditional financial system to the on-chain economy.

The main advantages of digital assets lie in their transparency and programmability. All transactions and asset flows can be verified on-chain, reducing intermediary and trust costs. At the same time, the trend of combining DeFi and CeFi is redefining the boundaries of wealth management services: expanding from custody and advisory services to yield generation, strategy execution, and on-chain governance.

However, digital asset PWM also faces significant challenges, including custody security, smart contract risks, regulatory uncertainty, and tax transparency requirements. Regulatory bodies in various countries are promoting industry standardization through frameworks such as MiCA (EU), FATF (international), SFC (Hong Kong), and MAS (Singapore), providing fundamental institutional guarantees for compliant wealth management.

2. Definition and Standards of Crypto Private Wealth Management

2.1 Definition

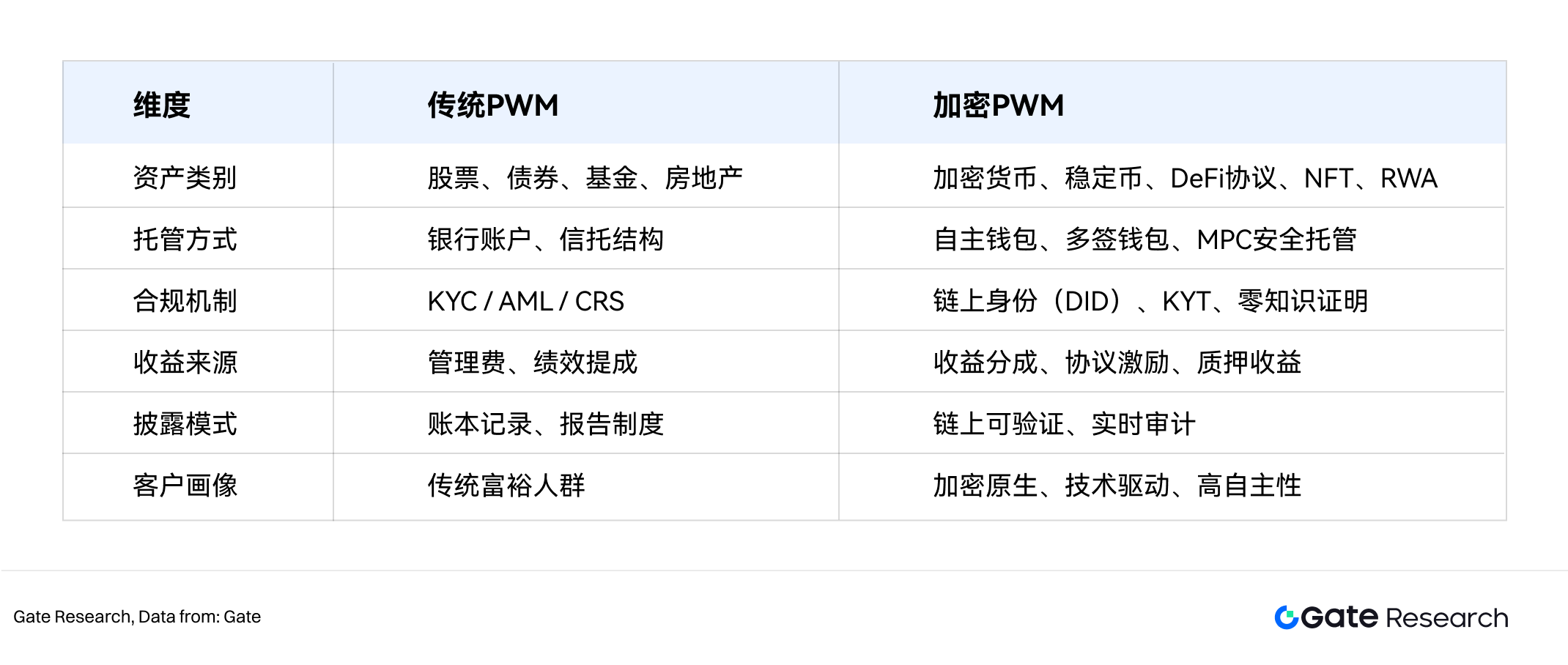

Crypto Private Wealth Management (Crypto PWM) refers to a comprehensive service system that uses digital assets as the core management object and leverages blockchain infrastructure to provide high-net-worth clients with asset custody, allocation, risk management, return optimization, tax planning, and privacy protection. Unlike traditional PWM, Crypto PWM combines "financial expertise" with "on-chain technical capabilities," requiring an understanding of macro-financial logic as well as mastery of smart contracts, cryptographic security, and regulatory compliance.

Crypto PWM's core features include three aspects: first, assets are fully digital; second, all transactions and reports are verifiable on-chain; and third, customers retain ultimate sovereignty over their assets. It represents a structural migration from centralized banking systems to trustless financial networks.

2.2 Differences from traditional PWM

As can be seen, encrypted PWM is more like a "disintermediation-based wealth management infrastructure" that builds a transparent and automated trust mechanism through smart contracts and on-chain identity systems.

2.3 Core Values

The core value of encrypted PWM is mainly reflected in four dimensions:

1. Security and Transparency : On-chain records ensure that asset ownership and transaction paths are traceable, preventing information asymmetry.

2. Diversified Revenue : Achieve compound returns through DeFi protocols, staking, and RWA channels.

3. Sovereignty and privacy protection : Clients retain control of their assets, and privacy is protected through encryption and zero-knowledge technology.

4. Cross-border liquidity and high efficiency : 24-hour uninterrupted settlement reduces cross-border transfer and foreign exchange costs.

2.4 Global Crypto Market Size

As of October 2025, the total market capitalization of global crypto assets was approximately $3.7 trillion, with about 600 million crypto users worldwide, of which nearly 45% were located in Asia. The total value locked (TVL) in the DeFi ecosystem was approximately $120 billion, mainly concentrated on mainstream networks such as Ethereum, Arbitrum, and Solana. Stablecoins had a market capitalization of approximately $160 billion, becoming the core medium for crypto fund flows. Currently, digital assets have gradually evolved from speculative investment tools into institutional asset allocation tools, with an increasing number of banks, family offices, and hedge funds venturing into crypto asset management.

2.5 Market Size of Encrypted PWM

Crypto PWM is still in its early stages. According to estimates from Messari and Galaxy Research, the global assets under management (AUM) of crypto PWM is between $25 billion and $40 billion, with an annual growth rate of over 50%. The main markets are concentrated in Switzerland, Singapore, the UAE, and Hong Kong, which have relatively favorable policy environments in terms of regulation and taxation.

Key participants include:

- Crypto Family Office: Companies like Sygnum and Zerocap provide on-chain trust and family management services;

- Institutional custody and banking platforms: such as Anchorage and Coinbase Institutional;

- DeFi wealth management protocols, such as Yearn, Enzyme, and Sommelier, provide automated yield strategies.

The encrypted PWM market is projected to exceed $100 billion in assets under management by 2030, becoming an important part of the global PWM market.

3. Service Architecture

3.1 User segmentation and profiling

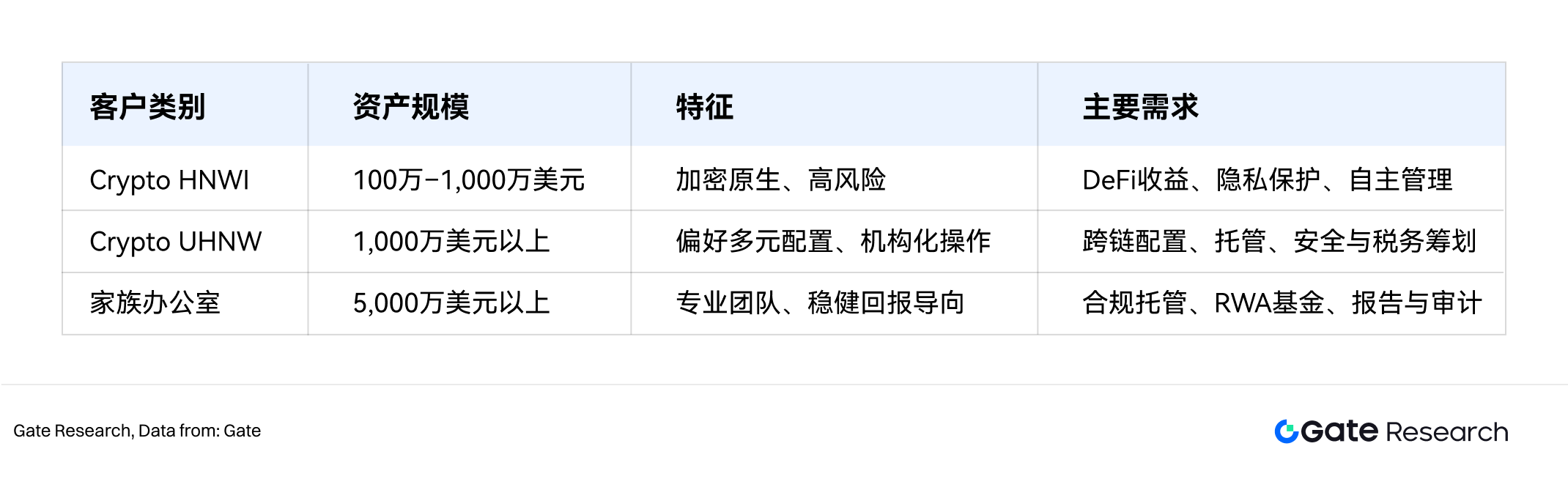

Traditional wealth management (PWM) industries typically categorize clients based on their asset size, while the private wealth management industry generally classifies clients into high-net-worth individuals (HNWI), ultra-high-net-worth individuals (UHNW), and family offices. This article uses the same criteria to classify encrypted PWM clients.

Crypto PWM's client profile exhibits characteristics of "high professionalism and high participation." Crypto HNWI clients tend to participate in asset allocation independently and have high requirements for tools and interface experience; UHNW clients are more concerned about risk control and cross-border compliance; institutional clients value transparency, audit standards, and tax structure design.

Compared to traditional PWM, encrypted PWM customers are younger, more technology-oriented, and possess higher levels of digital finance knowledge. Their needs are no longer limited to "trust advisors" but are more inclined towards "verifiable systems."

3.2 Product Range

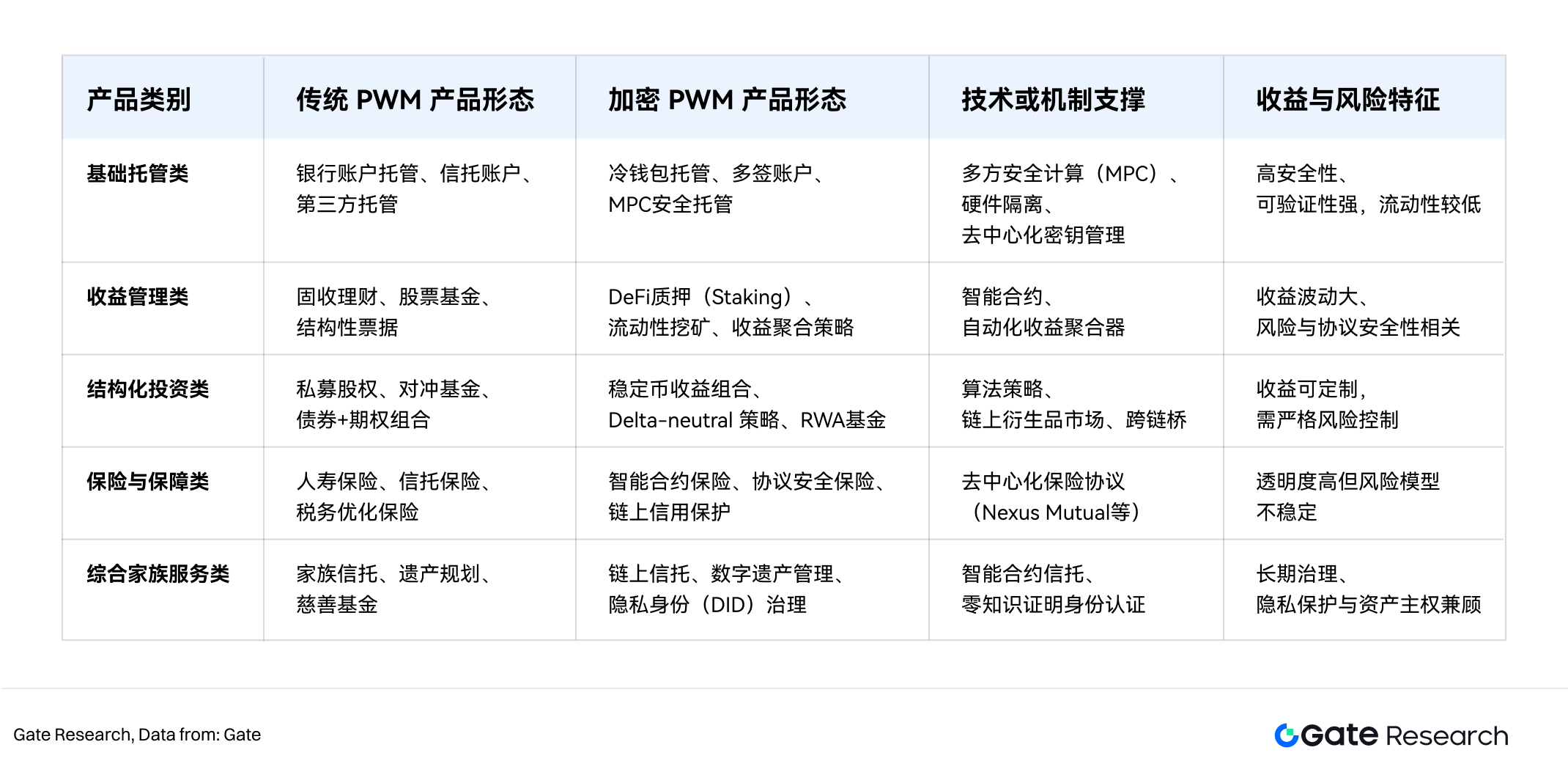

Crypto PWM's product system shares a similar hierarchical logic with traditional private wealth management, progressing from "custody and preservation" to "investment and returns" and then to "inheritance and governance." However, due to differences in underlying assets, technological architecture, and sources of returns, Crypto PWM exhibits significant differences in product composition and risk management methods.

PWM product portfolios can typically be categorized into four types:

1. Basic Custody Solutions : Including cold wallet custody, multi-signature accounts, and MPC secure custody solutions.

2. Yield Management : This includes staking, DeFi liquidity mining, and automated yield aggregation.

3. Structured Investments : These include neutral strategy portfolios, stablecoin yield funds, and RWA asset channels.

4. Comprehensive family services : including on-chain trusts, estate planning, privacy and identity management, and tax advice.

It can be seen that encrypted PWM has achieved a transformation from a closed trust structure to a verifiable open protocol system at the product level. Traditional PWM relies on the legal trust and human advisory systems of financial institutions, while encrypted PWM builds service boundaries through cryptographic trust and code execution logic.

One significant change brought about by this structure is that the product innovation cycle of encrypted PWM is shorter, and new strategies (such as restaking yield combinations and cross-chain RWA funds) can be quickly iterated and launched; at the same time, its risk transmission speed is also faster, requiring PWM institutions to have on-chain risk monitoring and protocol due diligence capabilities.

Furthermore, from a customer experience perspective, the encrypted PWM product portfolio is more modular and customizable. Users can choose a portfolio plan based on their risk appetite, return goals, and compliance status, flexibly switching between a "fully managed mode" and a "self-managed mode." This flexibility makes it highly attractive to high-net-worth young individuals.

3.3 Service Process

A typical encrypted PWM process comprises five phases: customer identification and due diligence (KYC/KYT), asset valuation and allocation advice, execution and custody, performance tracking and auditing, and compliance and tax optimization. After customers complete registration and verification through the on-chain identity system, the advisory team develops an allocation plan based on on-chain data and risk preferences. The execution and custody phase relies on smart contracts and MPC technology for automated execution and security, with all operations verifiable on-chain. Performance reports and risk monitoring are generated in real-time, ensuring transparency and auditability.

3.4 Value-added services

Crypto PWM institutions typically offer a range of value-added services, including educational and research reports, market insights and trend analysis, cross-border tax and legal consulting, privacy and identity management, and on-chain trust structure design. These value-added modules help clients achieve full-cycle management from asset allocation to legacy governance, further enhancing client loyalty and service depth.

4. Product Cases

The following section will use Morgan Stanley as an example to outline the service architecture and investment strategies of traditional private wealth management; at the same time, it will use Gate's private wealth management business as a case study to analyze the characteristics of crypto wealth management in terms of return models, strategy iterations, and client customization, thereby comparing the core differences and practical experience of the two types of institutions.

4.1 Traditional Private Wealth Management Institutions: Morgan Stanley

Traditional wealth management firms typically focus on high-net-worth clients (assets > $5 million), developing comprehensive asset allocation plans tailored to their needs. The world's top 10 wealth management firms (by AUM) include Morgan Stanley, UBS, JP Morgan, and Goldman Sachs. These institutions are mostly top-tier investment banks, enabling them to achieve "integrated resources," allowing clients to benefit from cross-departmental resources and services, including product offerings and investment research capabilities.

Take Morgan Stanley, a top-tier institution, as an example. Morgan Stanley's private wealth management division was established in 1977, covering portfolio management, tax optimization, insurance, and family office services. Its overall wealth management business boasts massive assets under management (AUM), exceeding $8.2 trillion globally as of Q2 2025, accounting for 45% of the company's total revenue. The division employs approximately 80,000 people across 45 countries, with 350 teams dedicated to serving high-net-worth clients with net assets exceeding tens of millions of US dollars, meeting their needs throughout their wealth lifecycle.

It is worth mentioning that starting October 15, 2025, Morgan Stanley is expanding cryptocurrency investment opportunities to all clients and allowing such investments in any type of account, including retirement accounts.

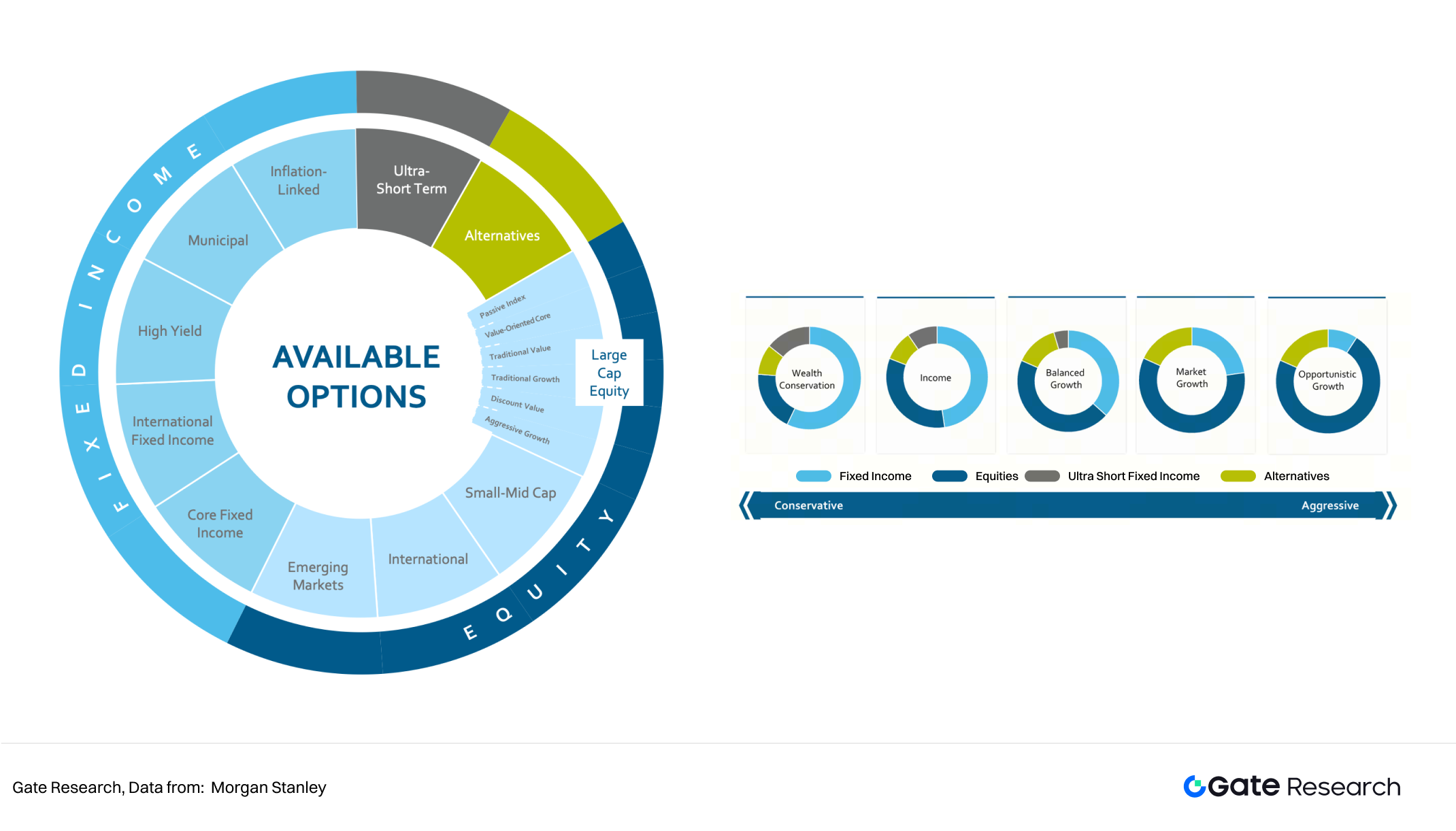

Morgan Stanley's wealth management planning process for clients mainly consists of three steps:

1. Client Goal Setting: This includes family goals, cash flow needs, risk tolerance, intergenerational succession goals, tax and legal constraints, etc. This stage determines the boundaries of long-term strategy and short-to-medium-term tactics.

2. Financial Planning and Asset Allocation: A dual-track approach of strategic and tactical asset allocation is employed. Strategic allocation is typically reviewed annually and adjusted based on long-term capital market assumptions, while tactical allocation is adjusted and updated relatively frequently (approximately 3-5 times per year) based on the CIO's market views. Among these, asset allocation has the greatest impact on portfolio returns, determining approximately 90% of the overall return.

3. Portfolio Construction, Risk and Tax Management: Portfolios are constructed through a hybrid asset allocation strategy that actively seeks excess returns while passively controlling cost and risk, and are further optimized for tax purposes to improve after-tax returns. Based on different clients' risk appetites, we offer five risk-stratified product lines: "Conservative," "Return," "Balanced," "Growth," and "Aggressive." We further cater to clients with varying risk, liquidity, and tax preferences through diversified investment options including equities, fixed income, alternative investments, and tax-efficient strategies.

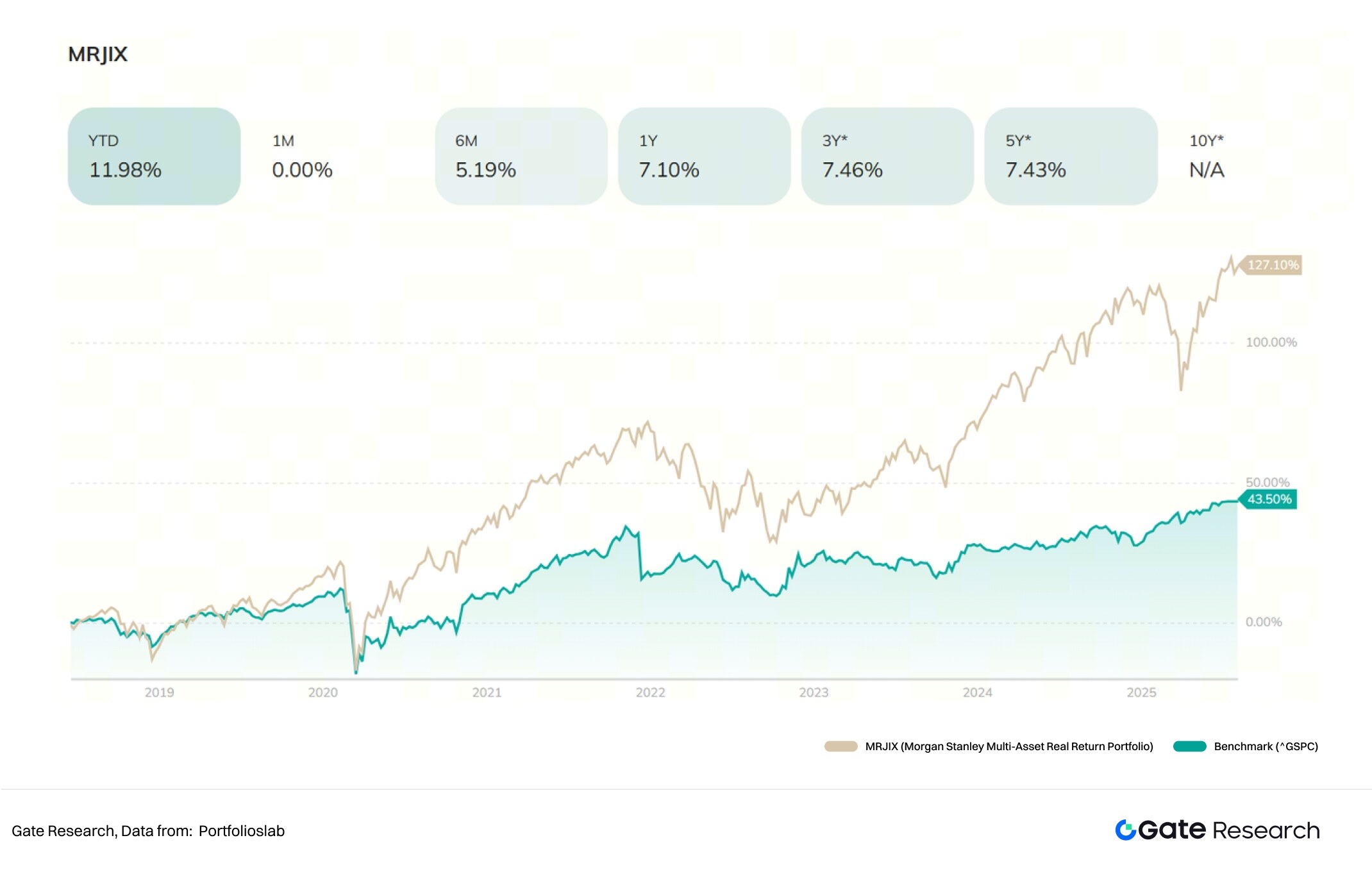

Because PWM products are highly customized, institutions typically do not publicly disclose specific portfolio performance data. For example, Morgan Stanley's MRJIX, a conservative mixed asset strategy fund, has a one-year return of 7.10%, with volatility and maximum drawdown significantly lower than the benchmark S&P 500, fully demonstrating the robust value-added capabilities brought about by diversified asset allocation.

Although specific strategies may differ among different clients, they generally share the following common characteristics in terms of product returns, drawdowns, and strategies:

1. Targeting high-net-worth clients: High-end wealth management products typically require a minimum investment of hundreds of thousands to millions of US dollars. Some structured or private placement products have even higher thresholds to ensure that investors have sufficient risk tolerance and long-term capital stability.

2. The portfolio adheres to the core principle of diversification, covering asset classes such as stocks, bonds, money market instruments, hedge funds, private equity, real estate, and commodities. It is typically constructed using a core-satellite approach, with the core portion focusing on stable returns and defensive allocations (such as high-quality bonds, blue-chip stocks, and cash), while the satellite portion is used to capture growth and excess return opportunities (such as emerging markets, technology stocks, PE/VC funds, or thematic funds).

3. Volatility Control and Drawdown Prevention as a Priority: To protect clients' capital, private wealth management products typically use low leverage. During periods of sharp market decline, the maximum drawdown of the overall portfolio is usually controlled at around 10-15%. In some portfolios where capital preservation is the primary objective, the drawdown may be less than 10%.

4. Stable but not extreme returns: Wealth management institutions' products typically offer annualized target returns of around 5-8%, with a stable asset allocation. Generally, growth assets account for 8-32%, and defensive assets account for around 68-92%. For clients with a more aggressive risk appetite, a certain proportion (approximately 10-30%) of alternative assets may be embedded in the portfolio to pursue excess returns.

5. Emphasize taxation, trusts, and family governance: For example, use trust structures and family trusts to reduce estate tax burdens and legal disputes, while optimizing tax efficiency through tax-advantaged accounts, making wealth management more characteristic of "family asset lifecycle management".

6. Long product cycle: The design and adjustment cycle is often on a yearly or quarterly basis to avoid chasing highs and selling lows. Strategic adjustments are only made when there are significant changes in policies or valuations.

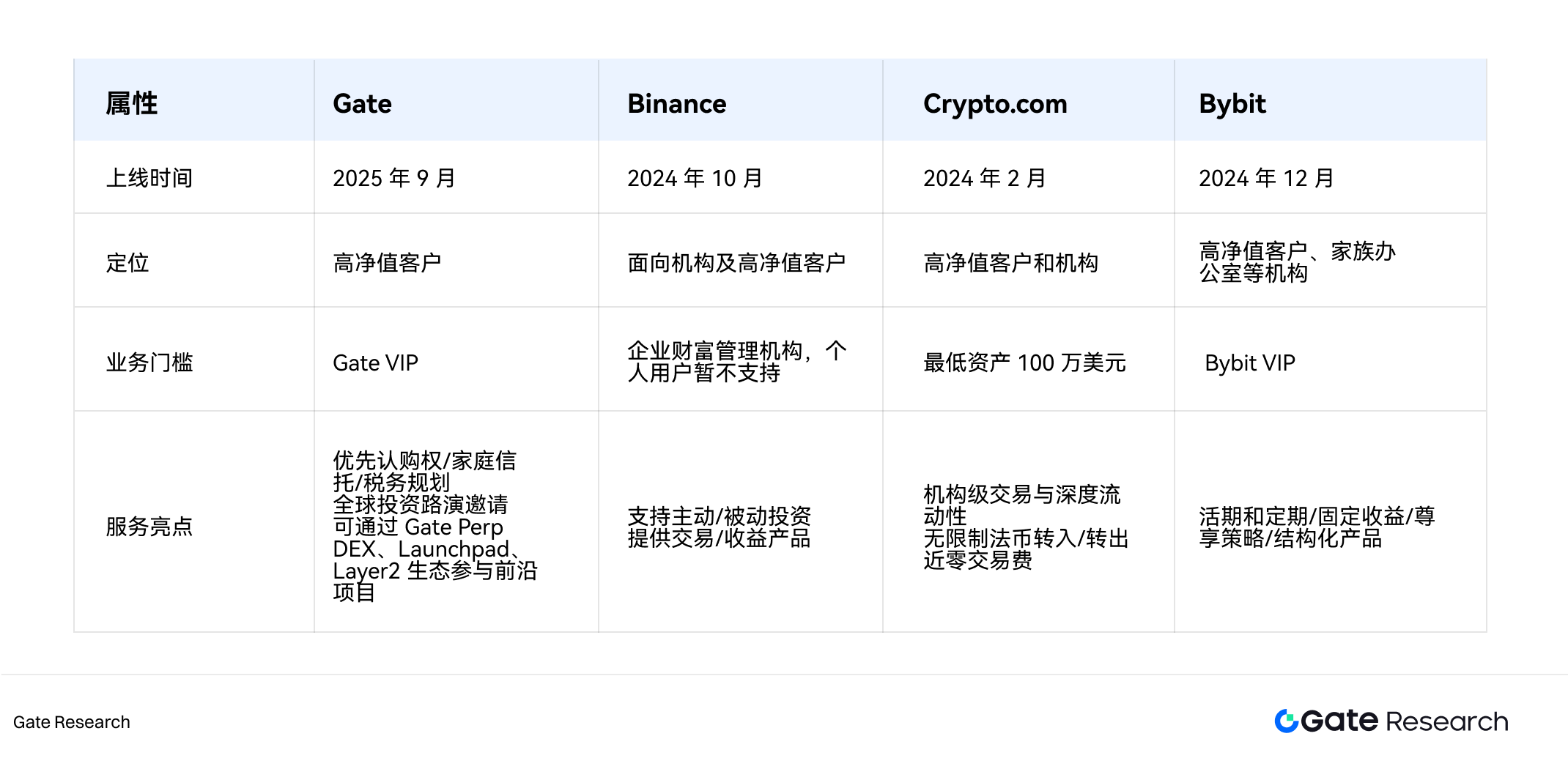

4.2 Case Study: Gate, a Crypto Private Wealth Management Firm

Traditional institutions are guided by long-term, stable growth, while crypto wealth management has developed a more dynamic and flexible profit model in a highly volatile and innovative market. In addition to the common "holding and growing" logic, the sources of income for crypto private wealth management are more diversified, including: staking, lending, liquidity mining, and arbitrage profits, etc.

While their operational logic is more technical and open, crypto wealth management institutions share a service system consistent with traditional institutions, adhering to the same one-stop, end-to-end management philosophy of "needs communication → customized solutions → product configuration → data tracking → regular review." This article will use Gate's private wealth business as an example to illustrate the core objectives, product composition, and return simulation of crypto asset private wealth management.

In September 2025, Gate officially launched its exclusive private wealth management service for high-net-worth clients, leading a new trend of high-end digital finance. With "personalized customization and security compliance" as its core principles, the service is tailored specifically for ultra-high-net-worth clients, aiming to provide a financial service experience and digital asset management solutions comparable to top private banks through personalized asset allocation and professional management.

Key highlights of Gate's private wealth management services include:

1. Top-tier compliance and security: Backed by Gate's global compliance network and multiple security measures, our top-tier risk control system ensures the security of your digital assets, allowing you to invest with peace of mind and secure your wealth.

2. Customized Investment Solutions: Combining clients' investment goals, risk appetite, and market environment, we customize exclusive asset allocations for clients, covering a diverse portfolio of mainstream market assets and hot projects to achieve highly competitive investment returns.

3. Private Advisors and Expert Team: A team of private advisors and professional quantitative experts, including client managers, investment advisors, wealth planning advisors, and day-to-day service specialists, provides clients with one-to-many private banking-level services.

4. Dedicated investment research and analysis support: The Gate platform integrates big data and AI technologies, with a professional quantitative team providing each ultra-high-net-worth client with exclusive industry research reports and strategy optimization suggestions to support their decision-making.

Gate will design personalized asset allocation solutions based on clients' liquidity needs and future plans, covering cryptocurrencies, private equity funds, NFTs, bonds, and stable-yield products. It also includes exclusive value-added services such as ecosystem priority subscription rights, family trusts, and tax planning consultation, which are particularly important for high-net-worth clients with complex cross-border tax situations.

Private wealth clients can choose appropriate strategies based on their risk appetite, such as high-frequency market making, fee arbitrage, term arbitrage, and market maker arbitrage. Furthermore, in the crypto market, clients can participate in cutting-edge projects through Gate Perp DEX, Launchpad, and the Layer 2 ecosystem. In traditional finance, clients can also access stable USD notes, structured financial products, and gold hedging. This dual-channel design allows asset portfolios to combine growth potential with stable returns.

The following example uses the Smart Arbitrage - USDT scheme:

This fund employs a neutral arbitrage strategy, primarily including the following three methods:

1. Cash-futures arbitrage: arbitrage trading based on the basis between spot and futures prices;

2. Funding rate arbitrage: arbitrage using the price anchoring mechanism of perpetual contracts;

3. Market maker arbitrage: Profiting by providing liquidity to the market.

This fund is suitable for investors who "seek long-term, stable returns" and "want to achieve diversified asset allocation," and has the following key advantages:

1. Professional Investment Research Team: The inherent high volatility of the crypto market causes many individual investors to experience significant drawdowns or even liquidation during periods of sharp corrections. However, under the management of a professional team, volatility can be minimized, maximizing alpha returns. For example, the investment research personnel at Gate.com are PhDs and Masters graduates from globally renowned universities, with experience in core departments of well-known trading institutions, possessing practical experience in macro research, quantitative modeling, and risk management.

2. Comprehensive Strategy Risk Control: This includes risk exposure management, position control, early warning and emergency mechanisms, and dynamic strategy adjustments based on real-time market feedback. In extreme market conditions, the system will alert you to triggering risk limits, thereby preventing excessive concentration in a single asset or strategy, effectively reducing portfolio volatility, and ensuring the safety of client assets.

3. Advanced Trading System: The team's high-performance execution engine possesses high-frequency trading capabilities, enabling it to execute orders at the optimal price and significantly reduce slippage. Furthermore, through real-time data monitoring and algorithm optimization, the system maintains stable operation even in situations of liquidity shortages or severe market volatility, accurately capturing short-term arbitrage and spread opportunities.

4. Solid Historical Performance: Since its inception, the team has consistently delivered solid performance. Historical data shows that the product's annualized return has reached 14.89%, with a maximum drawdown controlled within -0.37%, far below the industry average. This achievement not only demonstrates the team's stable trading capabilities across different market cycles but also confirms its outstanding execution in strategy diversification and risk mitigation mechanisms.

Overall, the Gate case demonstrates that crypto private wealth management not only inherits the full-process, customized service concept of traditional wealth management, but also leverages on-chain transparency, programmability, and diversified return mechanisms to achieve dynamic asset appreciation and risk control in highly volatile markets, providing high-net-worth clients with a new paradigm of digital wealth management that combines security and globalization.

4.3 Summary

Overall, at the strategic level, traditional wealth management emphasizes "preservation and inheritance," while crypto wealth management is more flexible and innovative. Unlike traditional institutions that adjust their strategies on a quarterly or annual basis, the high-frequency volatility of the crypto market requires managers to have the ability to "quickly switch" and "dynamically rebalance." Professional teams can adjust positions in real time based on on-chain data, market liquidity, and macroeconomic trends, flexibly switching strategies.

5. Risks and Challenges

Crypto asset private wealth management is in a phase of transition from high-risk speculation to institutional management.

Its core value lies in:

1. Diversified allocation: Expanding new revenue streams through crypto assets;

2. Transparency and Autonomy: On-chain data is verifiable;

3. Global liquidity: 24-hour, borderless asset allocation.

However, its long-term development remains constrained by regulatory certainty, market maturity, and risk management capabilities. Because the cryptocurrency market is still in its developmental stage and highly volatile, many traditional wealth management institutions remain cautious. How to effectively control risks while rationally incorporating crypto assets into clients' wealth allocation systems has become a crucial issue facing the industry. The following content will discuss this from four aspects: compliance risk, technological risk, market volatility risk, and liquidity risk.

5.1 Compliance Risks

Compliance is the primary challenge facing crypto private wealth management institutions. While regulatory and industry reports indicate increased investment in compliance by institutions and wealth management firms, the attitudes of governments and regulatory bodies around the world towards cryptocurrencies are not uniform. Even in countries and regions that are open to crypto assets, their regulatory attitudes and legal frameworks vary significantly. Some countries regard them as securities, financial instruments, or negotiable instruments, while others classify them as commodities or virtual assets, making it difficult to establish unified regulations.

In terms of specific business operations, if a crypto private wealth management institution provides services such as custody, wealth management, and asset advisory, it may need to apply for custody licenses, fund management licenses, and investment advisory licenses; otherwise, it may be considered by regulatory agencies as illegal fundraising or business operations. Furthermore, crypto private wealth management platforms may serve clients in multiple jurisdictions simultaneously, and different regulatory mechanisms may conflict. Institutions need to manage legal conflicts and compliance boundaries effectively.

These regulatory uncertainties will limit cross-border asset migration, custody options, and the design of structured products, thereby affecting the range of marketable products and client returns. Meanwhile, sudden regulatory shifts, such as restrictions on transactions or changes in custody license requirements, may also lead to short-term asset transfers or liquidity contractions, impacting client experience and compliance costs.

Compliance uncertainties pose significant legal risks in the early stages of wealth management operations, necessitating institutions with forward-thinking legal teams and prudent strategies. For crypto asset institutions, establishing a compliance matrix adaptable to multiple jurisdictions and switchable custody and liquidation solutions, such as centralized custody or partnerships with qualified custodians or regulated securities firms, may be the best way to address regulatory complexities.

5.2 Technological Risks

The main technical risks stem from the imperfections of the underlying blockchain technology and the vulnerabilities in digital asset storage and trading. For example, smart contract vulnerabilities, exchange security incidents, or improper private key management can all lead to the theft or permanent loss of customer assets.

In recent years, there have been frequent cases such as the DAO hack and attacks on centralized exchanges that have resulted in large-scale financial losses. For example, as of now, more than $2.17 billion has been stolen from cryptocurrency services.

Historical data shows that DeFi platforms have long been a primary target for hackers, primarily because developers prioritize rapid product launches over security measures. However, in recent years, the focus of hacking attacks has gradually shifted towards centralized services, with notable examples including the $305 million Bitcoin theft from DMM and the $234.9 million theft from WazirX in 2024. Notably, private key leaks accounted for the highest percentage of stolen crypto assets, at 43.8%, highlighting the reliance of centralized services on private key security. Since centralized exchanges manage large amounts of user funds, improper private key management can lead to devastating losses and reputational risks, impacting customer trust. The DMM case exemplifies this, demonstrating the importance of strengthening private key protection and overall security mechanisms.

In addition, mainstream crypto platforms typically rely on third-party or internal custody systems, such as Fireblocks, Ceffu, and BitGo, for their wealth management businesses. While these systems can provide security mechanisms such as multi-signature, MPC, or cold wallets to ensure asset security, there may still be systemic risks such as vulnerabilities in the software itself or centralized management.

For DeFi or structured products, conducting third-party security audits and continuously implementing bug bounty programs are important means of mitigating technical risks. At the same time, wealth management institutions should also establish robust emergency response mechanisms and insurance coverage to minimize potential losses.

5.3 Market volatility risk

The cryptocurrency market is highly volatile, posing a significant market risk to wealth management institutions. Specifically, in extreme market conditions, the intraday price fluctuations of BTC and ETH can reach ±10%, and even structured financial products, such as dual-currency products, may experience principal losses. Although overall volatility has decreased in recent years with the introduction of instruments such as spot ETFs, seasonal fluctuations and event-driven sharp price movements still occur frequently. For example, the cryptocurrency market experienced its largest liquidation event in history in October 2025, demonstrating that short-term factors such as macroeconomic events, regulatory changes, or major on-chain events can still trigger sharp fluctuations, directly impacting net asset value exposure, margin requirements, and liquidity, thus putting pressure on clients' risk tolerance and investment psychology.

This high volatility not only increases the difficulty of portfolio management but also places higher demands on wealth management institutions' risk control, liquidity arrangements, and capital reserves. To cope with volatility risk, institutions should adopt a diversified investment strategy, allocating different crypto assets, stablecoins, and traditional assets to reduce the impact of a single asset on the portfolio. Simultaneously, setting stop-loss orders and risk limits, as well as employing dynamic asset allocation and quantitative risk models, can address unforeseen market events. Furthermore, combining scenario simulations and stress tests to assess the potential impact of extreme market conditions on the portfolio can enhance the scientific rigor of risk warnings and decision-making, thereby more robustly protecting client assets in volatile markets.

5.4 Liquidity Risk

Beyond market volatility, crypto wealth management institutions face a significant liquidity issue. Liquidity risk refers to the difficulty in readily converting assets into cash when market demand is insufficient or trading is restricted. This is particularly pronounced in the crypto market for niche tokens or projects with low secondary market trading volume, potentially leading to clients being unable to quickly liquidate their assets when needed, or being forced to sell at a discount. For example, some DeFi tokens suffer from insufficient trading depth during market downturns, making it difficult for investors to exit quickly and thus amplifying losses.

Historical examples show that the de-anchoring crisis of the algorithmic stablecoin UST in 2022 triggered a depletion of on-chain liquidity pools, further impacting the entire DeFi market. Meanwhile, liquidity risk exists not only in decentralized markets but also plagues centralized platforms. The collapse of FTX exposed typical centralized liquidity mismatch and run risks; when users rushed to withdraw their funds, the platform lacked sufficient reserves, ultimately leading to a systemic collapse.

Similarly, during sharp market sell-offs or extreme volatility, lenders and market makers often choose to withdraw funds, leading to a sharp drop in trading depth, significant price slippage, and amplified short-term liquidity risks. Although data shows that DeFi TVL reached a record high of approximately $237 billion in the third quarter of 2025, indicating some improvement in long-term liquidity, the market's vulnerability remains evident in the face of unforeseen events.

Therefore, strategies to address liquidity risk should include prioritizing highly liquid assets, setting reasonable position ratios, and utilizing derivatives or lending instruments for dynamic liquidity management when necessary. Simultaneously, a liquidity monitoring and early warning mechanism should be established to ensure timely asset allocation under different market conditions. For large redemptions or transactions, a phased execution strategy can be adopted, including signing liquidity support agreements with core market makers and maintaining short-term financing channels to enhance the ability to cope with sudden liquidity shocks.

6. Industry Development Trend Forecast

6.1 Development Direction

As the global crypto asset market continues to mature, the number of high-net-worth individuals continues to rise, leading to a rapid increase in demand for crypto asset investment. More and more investors with assets in the millions of dollars or more are seeking professional and customized asset allocation solutions to preserve and steadily grow their wealth in a volatile market.

Against this backdrop, crypto private wealth management is at a critical juncture, transitioning from the "exploratory phase" to the "systematic development phase." In the coming years, with the acceleration of institutional compliance, the upgrading of investor structures, and the deep integration of traditional finance and crypto finance, the industry is expected to present a more professional, compliant, and diversified landscape.

6.1.1 Cross-border integration and institutionalization are accelerating as the main themes.

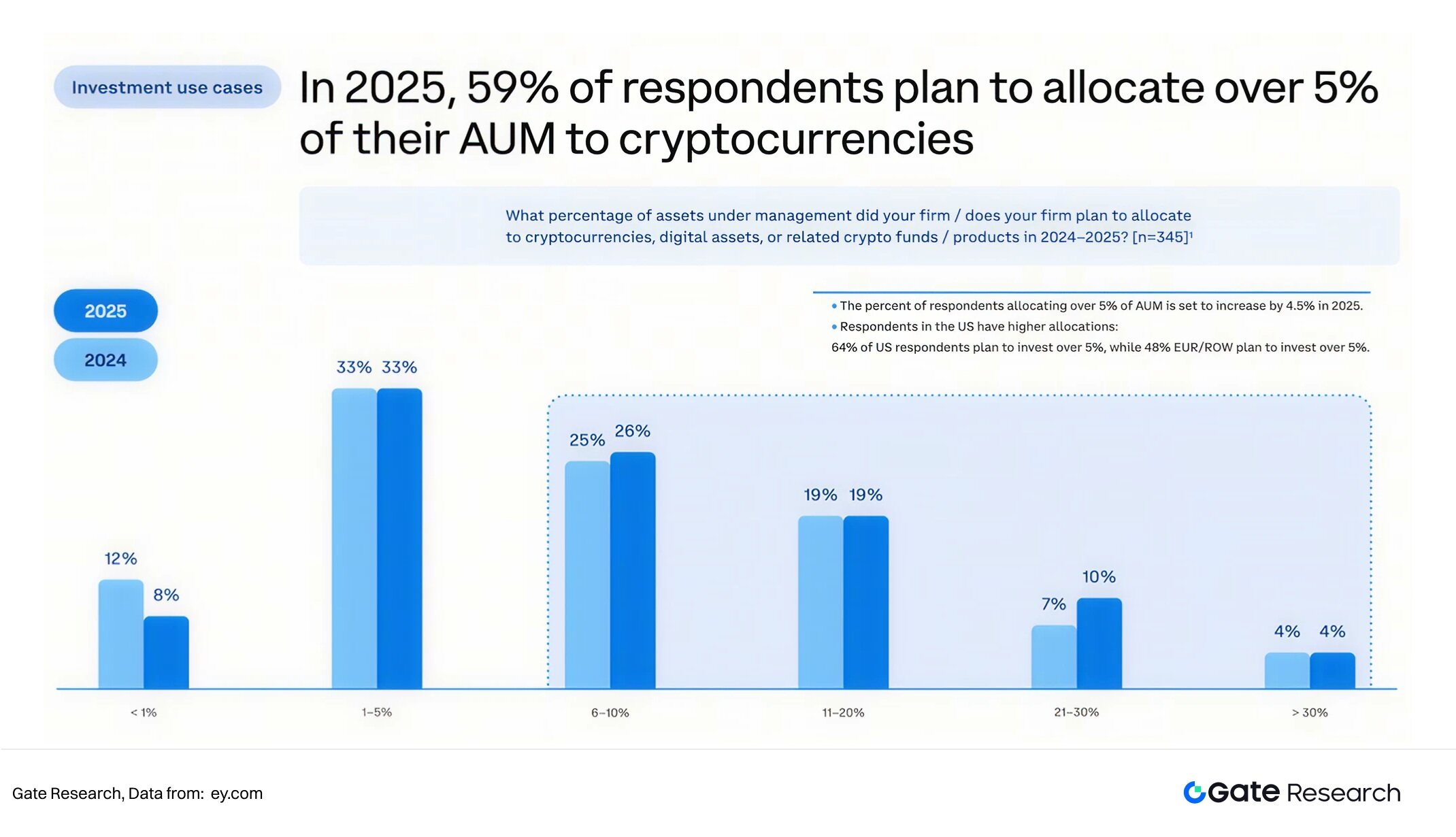

Crypto private wealth management will no longer be an isolated sector, but rather a converged ecosystem involving traditional financial institutions, family offices, and crypto-native platforms. Survey data from 2025 shows that the vast majority of institutions currently have less than 5% exposure to crypto assets, indicating they are still in the early exploratory phase. However, with increased regulatory transparency and the improvement of compliant custody and liquidity infrastructure, this percentage is expected to rise significantly over the next three years, with traditional financial funds flowing into crypto asset classes on a larger scale. At that time, banks, securities firms, and asset management companies are expected to launch crypto wealth management, custody, and structured investment products, forming cooperative or competitive relationships with native exchanges and DeFi protocols to build a multi-layered wealth management system.

The client base will also diversify: on the one hand, the allocation needs of traditional high-net-worth and institutional clients continue to grow, and they tend to access crypto assets through compliant channels; on the other hand, native crypto investors are gradually seeking more systematic asset management and tax planning services, driving the service model from "product-oriented" to "advisory-oriented." Future crypto private wealth management institutions will place greater emphasis on building investment advisory and research support capabilities, providing multilingual, cross-market client service systems. Simultaneously, AI and big data analytics will be deeply embedded in portfolio optimization, risk control, and client profiling to enhance customized services and strategy precision, achieving truly data-driven wealth management.

6.1.2 Product structure evolves from single investment to multi-level allocation

Past crypto wealth management primarily focused on single models such as "high-yield investment" or "single-currency staking." While these yielded significant returns, they were relatively lacking in risk stratification, asset allocation, and strategy diversity. As the market matures and institutional participation increases, crypto wealth products are expected to evolve towards multi-tiered, diversified allocation over the next three years, forming a more robust and structured investment system.

First, at the product level, configuration structures will become more diversified, for example:

1. FOFs (Fund of Funds): Through a combination of various crypto funds such as quantitative, trend-following, and event-driven funds, or multiple asset classes such as DeFi protocols, stablecoins, and NFTs, to optimize returns and diversify risks;

2. Hybrid Allocation of Digital and Traditional Assets: RWA's on-chain implementation will further reshape the yield foundation of crypto wealth. Tokenization of assets such as bonds, gold, and treasury bills not only builds cross-asset yield channels but also enhances the overall portfolio stability;

3. The hybrid architecture of CeFi + DeFi: CeFi platforms leverage their compliance and risk control advantages to provide stable custody and basic returns; DeFi protocols inject high-yield on-chain strategies, thus balancing security and flexibility.

4. AI-driven: Through real-time analysis of volatility, on-chain fund flows and market behavior, AI can automatically optimize investment portfolios and risk exposure, enabling wealth management to move from "experience-based decision-making" to "data-driven".

This trend means that crypto wealth management is shifting from a single focus on "profit pursuit" to "risk control + portfolio management," and is increasingly approaching the family office model in the traditional financial sector in terms of concept.

6.1.3 Compliance and Globalization Strategy

The gradual clarification of the global regulatory landscape is the most certain change for the crypto wealth management industry over the next three years—some countries and regions have already begun to allow crypto asset exchanges, ETFs, custody services, and the implementation of anti-money laundering standards. This regulatory clarity not only enhances high-net-worth clients' trust in crypto asset allocation but also provides wealth management institutions with institutional space for product innovation and risk management. In the next three years, institutions with global custody, cross-border compliance, and multi-currency service capabilities will become the core force in the market, forming a compliant competitive landscape of "licensed operation + multi-asset allocation."

6.2 Future Market Size Forecast

6.2.1 Methods and Assumptions

This article defines the “market size of crypto private wealth management” as the total investable assets (AUM) of clients managed by institutions that specialize in providing crypto asset custody, portfolio management, structured products and customized wealth management services.

Due to the fragmented nature of the data, we adopt the "anchor point-penetration rate" modeling method: taking the current on-chain/ETP/high-net-worth holdings as the anchor point, assuming that private wealth management can gradually absorb a portion of them as manageable AUM, and dynamically adjusting the penetration rate in combination with the speed of institutional and regulatory maturity improvement.

Example of key parameters: On-chain AUM + ETP fungible share + estimated crypto asset holdings of high-net-worth individuals

1. On-chain and crypto asset management AUM: On-chain asset management AUM surged in 2025, estimated at approximately $35 billion (primarily composed of automated yield vaults, structured and active strategies), a year-on-year increase of 118%; the market expects this figure to double in 2026.

2. Crypto-related exchange-traded products (ETPs): ETPs experienced explosive growth in 2024, with AUM reaching $134.5 billion in November 2024, a year-on-year increase of 950%; while on October 18, 2025, AUM was $220.7 billion, a year-on-year increase of 64%.

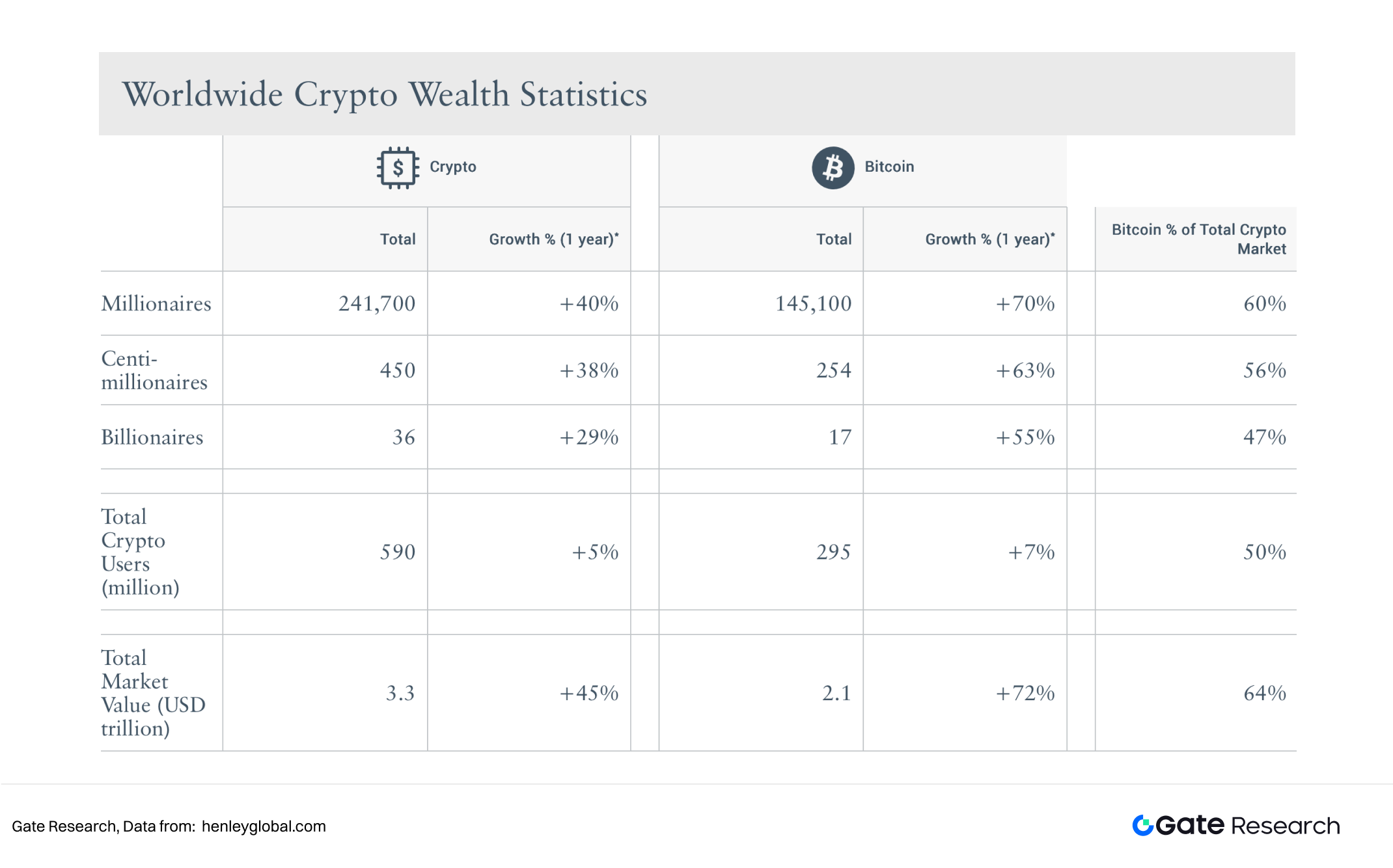

3. High-net-worth holdings: As of June 2025, the global holdings of crypto assets by high-net-worth individuals with assets exceeding one million US dollars exceeded US$242.5 billion, representing a year-on-year increase of 40%.

Therefore, it can be estimated that the total AUM of professionally managed crypto assets is currently $498.2 billion.

While some exchanges, private banks, and family offices have begun offering custody and strategy products, a significant portion of on-chain assets, ETFs, and cryptocurrency holdings by high-net-worth individuals are still managed by native platforms, exchanges, fund managers, or self-managed entities, rather than through private wealth management channels. According to Caia data, traditional private wealth accounts for approximately 16% of alternative wealth. Considering the share held by private banks, high-net-worth clients, and family offices, the overall estimate is that private wealth in traditional finance accounts for approximately 20-30% of total wealth management. As mentioned above, industry research indicates that the productization and custody penetration of crypto private wealth management is still in its early stages, with crypto assets accounting for no more than 5% of total assets under management (AUM). Therefore, a reasonable estimate for the current market coverage of crypto private wealth management is 3-5%.

The estimated current private wealth management scale is (4,982 * 3% = 149; 4,982 * 5% = 249) US$149–249 billion.

6.2.2 Scenario Prediction and Estimation

Forecast period: Starting from the end of 2025, forecasts are made three years later (i.e., the end of 2028).

Assuming that regulations become clearer and institutions and banks gradually provide compliant custody and wealth management products, the industry will rapidly productize but not fully penetrate the market; assuming that on-chain AUM maintains a growth rate of 118%, ETP AUM maintains a growth rate of 64%, and high-net-worth holdings maintain a growth rate of 40%; assuming that the current private wealth penetration rate is 3%, and will be 6% in three years.

1. Neutral Scenario: In this context, the total assets under management (AUM) of professionally managed crypto assets of high-net-worth individuals is $2 trillion, and the crypto private wealth management market is approximately $120 billion, representing a 4.8–8 times increase from current levels.

2. Optimistic Scenario: If major global jurisdictions complete key regulatory frameworks within 1–2 years, and traditional private banks and family offices significantly expand their presence, the penetration rate could further increase to around 8%. In this context, professionally managed crypto asset AUM could grow 5–8 times within 3 years, thereby increasing the crypto private wealth management market size to $200-320 billion.

Over the next three years, the core opportunities for crypto private wealth management lie in institutionalization, compliance, diversified products, and global expansion. By integrating traditional financial and crypto ecosystem resources, building an advisor-driven, multi-tiered investment system, and supplementing it with AI and big data technologies for optimized portfolio and risk management, crypto institutions are poised to gain a competitive edge in a rapidly expanding market.

7. Summary

The emergence of cryptocurrencies has not only provided new market opportunities for wealth managers but also driven innovation in wealth management methods—the traditional "people + bank" model is being supplemented by on-chain digital assets. With global wealth growth and the expansion of the high-net-worth population, the crypto wealth industry is gaining increasing momentum.

The product system of encrypted private wealth management not only covers traditional wealth management categories such as "basic custody, income management, structured investment and family governance", but also focuses on "on-chain verifiability, asset digitization and client asset sovereignty" to achieve diversified returns, controllable risks and efficient cross-border services.

As regulations, technology, and service standards gradually improve, crypto private wealth management is rapidly evolving from the exploratory stage to a more systematic and institutionalized approach. "CeFi and DeFi hybrid architecture, RWA on-chain implementation, and AI-driven robo-advisors" will become the core themes of industry development.

Looking ahead, innovation driven by digitalization and on-chain technology will continue to enhance the engagement and efficiency of wealth management for high-net-worth clients. The crypto private wealth management market is projected to reach $120 billion to $320 billion by 2028, achieving both rapid growth and gradual industry maturation.

References

• Gate, https://www.gate.com/private-wealth

• UBS, https://www.ubs.com/us/en/wealth-management/insights/global-wealth-report.html

• CFAInstitute, https://www.cfainstitute.org/insights/professional-learning/refresher-readings/2025/overview-private-wealth-management

• MorganStanley, https://www.morganstanley.com/what-we-do/wealth-management/private-wealth-management

• Goldman, https://privatewealth.goldmansachs.com/us/en/home

• Morgan Stanley, https://www.morganstanley.com/about-us-ir/shareholder/2q2025.pdf

• Morgan Stanley, https://advisor.morganstanley.com/zach.winning/documents/field/z/za/zachary-winning/MSPS_Pitchbook.pdf

• Morgan Stanley, https://www.morganstanley.com.au/content/dam/msaustralia/others/multi-asset-portfolio-solutions/230220/MAPS-CoreConservativeMonthlyReport_20230220.pdf

• GlobeNewswire, https://www.globenewswire.com/news-release/2025/09/23/3154424/0/en/World-Nears-Quarter-Million-Crypto-Millionaires-in-Historic-Wealth-Boom.html

• Cointelegraph, https://cointelegraph.com/news/defi-tvl-record-237b-dapp-wallets-drop-22-q3-2025

• CoinDesk, https://www.coindesk.com/business/2025/09/25/onchain-asset-management-is-booming-here-s-where-people-are-investing

• Flowtraders, https://flowtraders.com/media/i33f1ipp/crypto-etp-report.pdf

• Chainanalysis, https://www.chainalysis.com/blog/2025-crypto-crime-mid-year-update/

• Caia, https://caia.org/blog/2025/01/13/young-money-quantifying-private-wealth-management-opportunity

• EY, https://www.ey.com/content/dam/ey-unified-site/ey-com/en-us/insights/financial-services/documents/ey-growing-enthusiasm-propels-digital-assets-into-the-mainstream.pdf

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, insights into hot topics, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of any assets and products they intend to purchase before making any investment decisions. Gate assumes no responsibility for any loss or damage arising from such investment decisions.