Is MNT's 200% surge just the beginning? Bybit is pumping all its money into Mantle with executives parachuting in and deep integration.

- 核心观点:MNT深度整合Bybit将带来巨大买入压力。

- 关键要素:

- Bybit为全球第二大交易所,日交易量超300亿美元。

- MNT将用于支付手续费和VIP升级,创造实际需求。

- 模型预测年度买入压力可达2-26亿美元。

- 市场影响:显著提升MNT流动性与生态价值。

- 时效性标注:中期影响。

Original article | @Moomsxxx

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Recently, MNT, the native token of the second-layer public chain Mantle, climbed from a low of $0.5 in early July to a high of $1.4, a nearly 200% increase, before retreating to $1.27, becoming the leader in the L2 sector. What exactly is driving MNT's rapid upward movement?

Crypto industry insider @Moomsxxx recently published a post offering a noteworthy perspective: MNT's deep integration into the core business of Bybit, the world's second-largest centralized exchange, could generate significant market demand for MNT. This article, compiled by Odaily Planet Daily, uses a model to predict potential annual buying pressure for MNT, combining trading volume, fees, and future integration plans.

Project Introduction

Mantle Network is a high-performance Ethereum L2 network with a modular architecture that combines Optimistic Rollup with EigenLayer's data availability layer (EigenDA) to achieve low cost, high throughput and fast transaction confirmation, while relying on Ethereum security to provide solid protection.

Mantle was originally launched by BitDAO and completed a brand merger in May 2023 through the BIP-21 proposal. BitDAO was upgraded to the Mantle ecosystem, and the token was converted from BIT to MNT. Early supporters included Bybit, Peter Thiel, Pantera Capital, and others.

Mantle's relationship with Bybit dates back to the BitDAO era, with Bybit providing financial and strategic support as a major backer. Although Mantle has since independently developed into a Layer 2 ecosystem, the two companies maintain a close relationship in terms of funding, ecosystem collaboration, and marketing.

The Mantle project has a treasury of approximately $2.6 billion (as of December 2024), with assets including MNT, BIT, ETH, USDC, and USDT. According to the latest data disclosed on July 30, the total ETH and mETH holdings are 101,867, valued at approximately $388 million, including ETH (4,454), mETH (77,218), and ETH in MI 4 (20,195).

The latest from Mantle

This week, Mantle announced one of its biggest announcements of the year so far: the integration of the MNT token into the core business of Bybit, the world’s second-largest centralized exchange (CEX).

Based on this, I constructed a model that projects average annual buying pressure on MNT to reach nine figures .

background

Bybit is the world's second largest CEX by spot trading volume and ranks third by derivatives trading volume (data source: @coingecko ).

Recently, Bybit’s co-CEO and head of spot business joined Mantle as a core contributor, further strengthening the connection between the exchange and the Mantle ecosystem.

This move aligns closely with Mantle’s strategy to promote the integration of DeFi and TradFi, such as the launch of @URNeobank and its increased focus on real-world assets (RWA). Mantle also plans to embed MNT directly into Bybit’s core products.

The core of this major news is the deep integration of MNT into ByBit’s core business, accompanied by the joining of key team members.

Currently, MNT has been integrated into:

- Bybit Launchpool Project

- Bybit Structured Products

- Bybit OTC Portal

Future planned integration features include:

- Use MNT to pay discounted transaction fees

- Get VIP tier qualifications through MNT

- Trading pairs denominated in MNT

- More applications

Using MNT to pay transaction fees and upgrade VIP levels will become an important practical use of the token - almost an ideal application scenario for the token.

It is worth noting that Bybit’s average daily trading volume over the past year exceeded US$30 billion.

Bybit Fees → MNT Demand Model

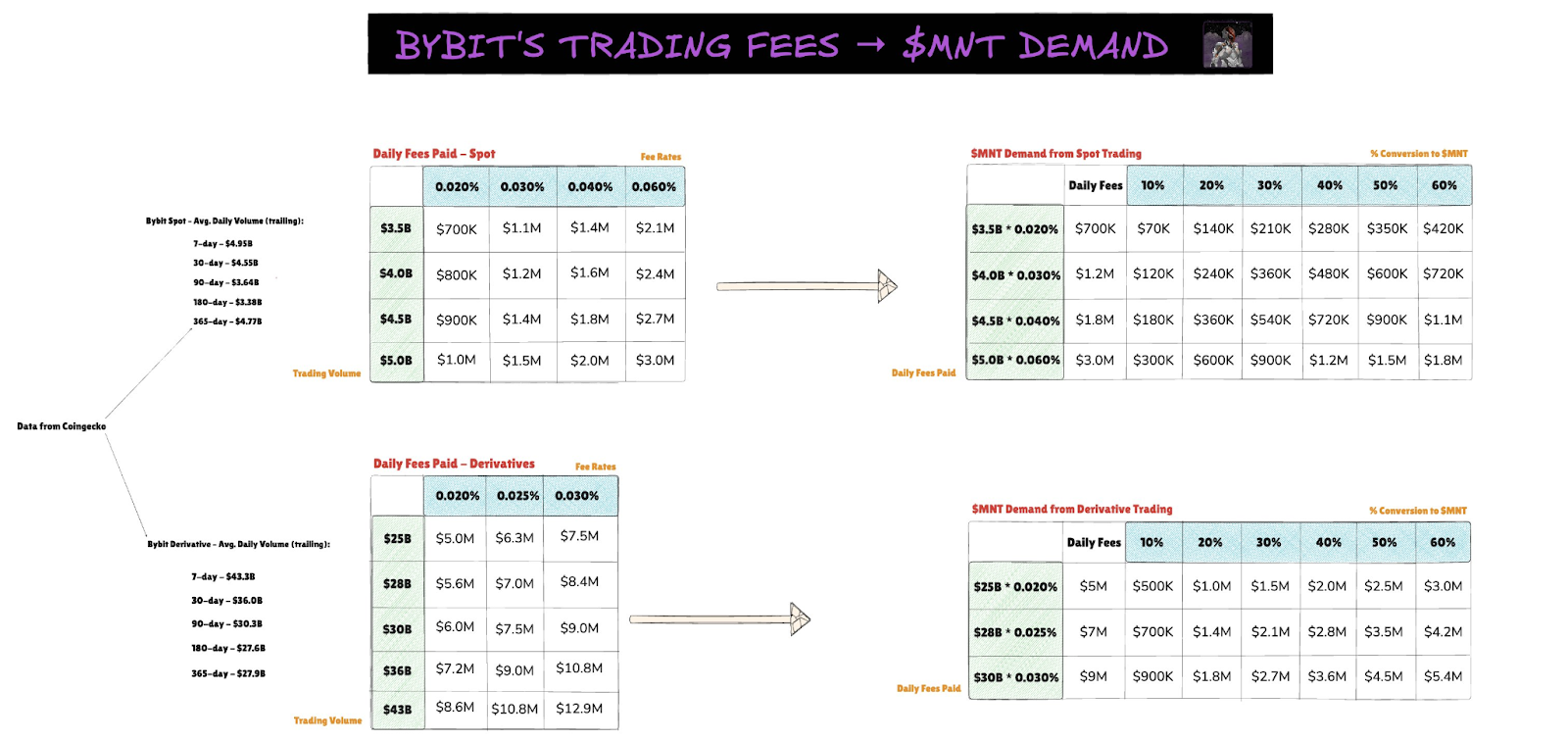

To quantify the potential buying pressure, we built a simple model to calculate the demand for MNT converted from spot and derivatives transaction fees:

Trading volume assumptions

- Spot: According to Bybit’s historical average over the past year, the daily volume is approximately $3.5 to $5 billion.

- Derivatives: approximately $25-43 billion per day, consistent with the historical average over the past year

Effective rate (basis points)

Bybit transaction fees vary depending on the trading pair, user level, and market maker/taker method. I use a weighted average to calculate:

- Derivatives: 0.020% / 0.025% / 0.030%

- Spot: 0.020% / 0.030% / 0.040% / 0.060%

Model calculation method

- Daily Fee: Calculate the daily fee (in USD) for each [trading volume × fee rate] combination.

- MNT buying pressure: Taking the median transaction volume/median fee rate as a benchmark and applying a 10–60% conversion rate scenario, we estimate daily MNT demand.

Model Results

Conservative scenario

- Daily demand: $570,000

- Annual need: $208 million

Even if only 10% of transaction fees go to MNT, the daily demand will be $570,000 and the annual demand will exceed $200 million.

Neutral scene

- Daily demand: $2.46 million

- Annual demand: $898 million

Under the neutral assumption, approximately 30% of transaction fees flow to MNT, with daily demand approaching $2.46 million and annual demand approaching $900 million.

Optimistic scenario

- Daily demand: $7.2 million

- Annual demand: $2.6 billion

In a very optimistic scenario, approximately 60% of transaction fees flow to MNT, with daily demand reaching $7.2 million and annual demand reaching $2.6 billion.

Of course, these figures are based on assumptions and rough estimates, but the trend is very clear: Bybit executives joining Mantle, the launch of Neobank, and MNT’s integration into the world’s second largest CEX are all major catalysts for the ecosystem and token.

Judging from the fundamentals and data, the prospects of MNT are worthy of attention. Its potential value is not only reflected in price fluctuations, but also in the sustainability of ecological integration and practical applications.