Tether Becomes the World's 18th Largest Holder of US Treasury Bonds: A Complete Analysis of Stablecoins' Money-Making Techniques

- 核心观点:稳定币发行商成美债大买家,重塑金融格局。

- 关键要素:

- Tether美债持仓1200亿美元,全球第18大持有者。

- 稳定币总市值2697亿美元,USDT和USDC占85%。

- 稳定币商业模式依赖无成本存款和美债利差。

- 市场影响:增强美元流动性,但或威胁传统信贷体系。

- 时效性标注:长期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Recently, the latest data disclosed by Tether shows that the size of its holdings of U.S. Treasury bonds has exceeded US$ 120 billion. This figure not only surpasses the holdings of sovereign states such as the UAE and Germany, but also pushes a stablecoin issuer to the throne of the world's 18th largest U.S. Treasury bond holder.

For those familiar with the crypto market, this figure is astonishing; in the eyes of traditional finance, it is more like a structural "financial tectonic movement." Some believe that stablecoin issuers such as Circle and Tether are swallowing up more U.S. Treasury bonds than most countries, which may reshape the U.S. economy.

In the eyes of supporters, this is a new extension of the US dollar's hegemony: through on-chain liquidity and global payment networks, stablecoins provide an unprecedented lever for the US dollar to consolidate its dominance in international trade and digital assets. However, critics warn that even if stablecoins only account for a small portion of the entire market, they could lead to financial instability in the banking industry because they could siphon funds from bank deposits. Since deposits are essential liquidity for loans, stablecoins are likely to threaten the credit system.

The prosperity and oligopoly of the stablecoin market

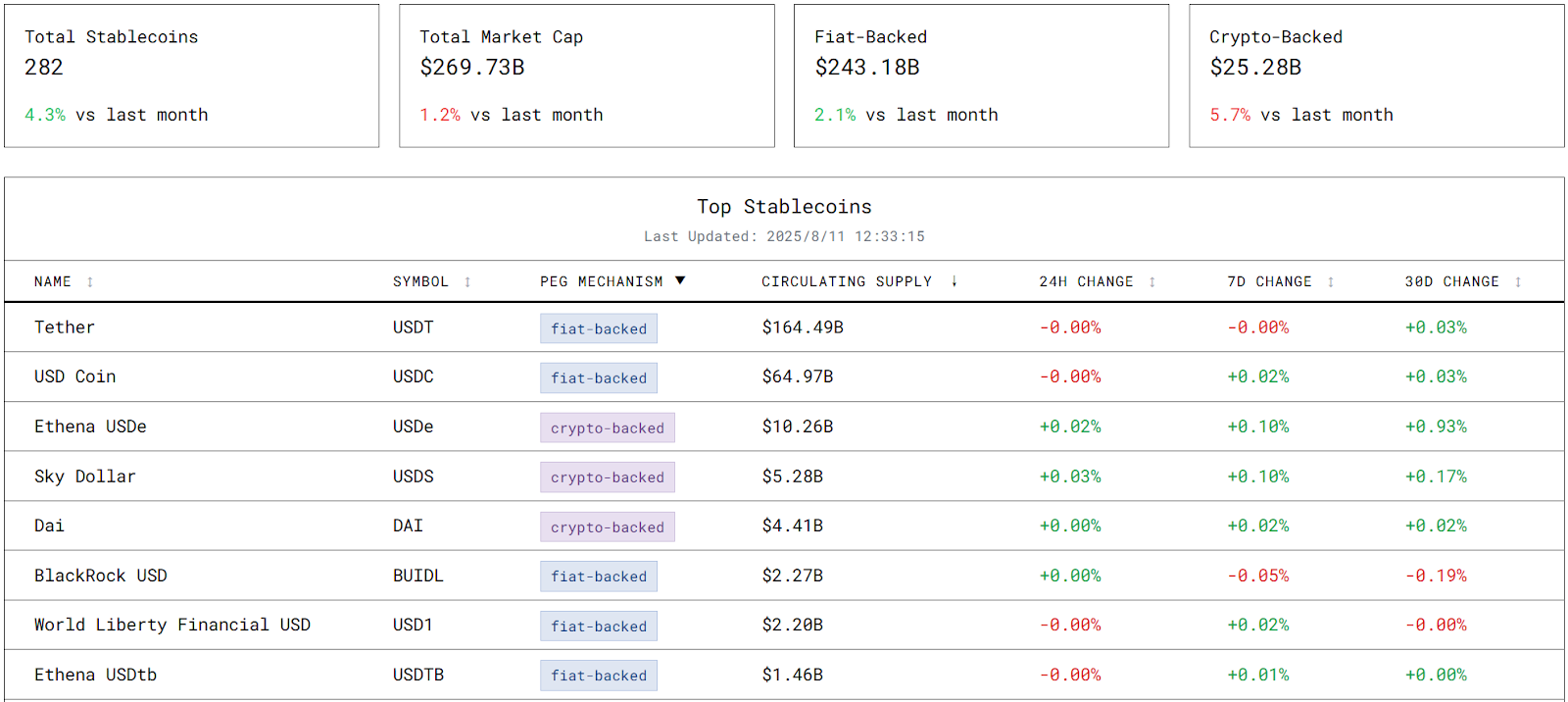

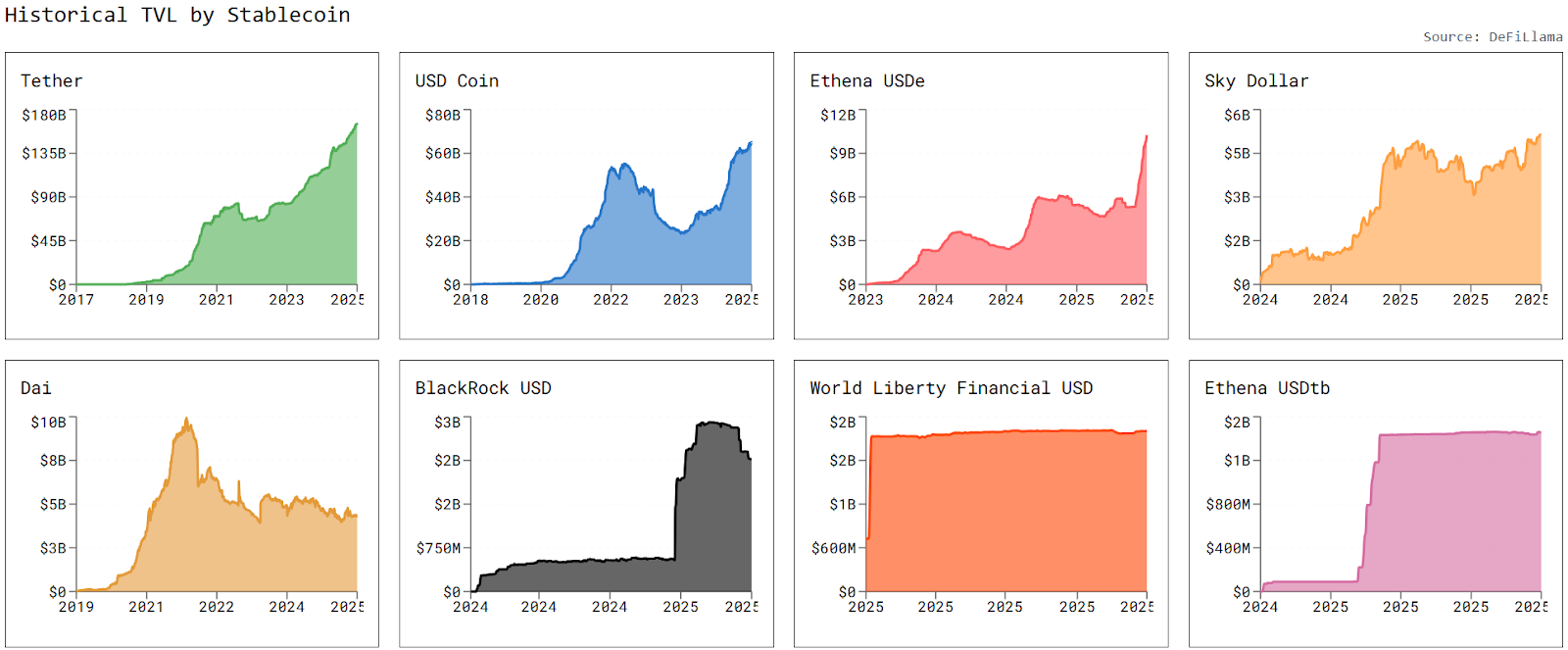

The stablecoin market is experiencing a liquidity boom. According to data from stablecoins.asxn.xyz , the total global stablecoin market capitalization has soared to $269.73 billion, a record high. Tether's USDT holds the top spot with a market capitalization of $164.49 billion, followed closely by Circle's USDC at $64.97 billion. Together, the two hold over 85% of the market share, forming a clear oligopoly.

The stablecoin market is experiencing a liquidity boom. According to data from stablecoins.asxn.xyz , the total global stablecoin market capitalization has soared to $269.73 billion, a record high. Tether's USDT holds the top spot with a market capitalization of $164.49 billion, followed closely by Circle's USDC at $64.97 billion. Together, the two hold over 85% of the market share, forming a clear oligopoly.

What’s even more interesting is that despite this highly centralized landscape, the market’s innovative vitality has not been suppressed. Since 2024, the total number of stablecoins has increased to 282 , and new scenarios, from on-chain payments to cross-border settlements, are constantly giving rise to new categories.

In terms of market capitalization curve, USDT has been rising steadily, USDC has slowed down since May 2025, and the decentralized stablecoin USDe recorded a monthly increase of more than 75% in July, becoming a "dark horse" that disrupted the market.

USDT and USDC: Two Paths, Two Logics

Although both USDT and USDC promise a 1:1 anchor to the US dollar, they have chosen completely different directions in their development paths and brand positioning.

Tether (USDT): Controversial Pioneer of Marketization

USDT, issued by Tether Limited, a Hong Kong-registered and Switzerland-based company, dominates the stablecoin market with a market-oriented approach. With a wide range of trading pairs and a massive circulation volume, USDT has become the most commonly used stablecoin in the crypto market, even navigating a gray area. However, its reserve transparency has long been criticized. In October 2021, Tether was fined $41 million by US regulators for reserve issues. Despite regularly publishing reserve reports, the lack of audit frequency and detail has led to market doubts about its trustworthiness.

Circle (USDC): A robust choice for compliance

In contrast, USDC takes a compliant approach. It's issued by the Centre Alliance, a consortium co-founded by Circle and Coinbase. Circle, a fintech company regulated by the US Financial Conduct Authority (FinCEN), publishes monthly reserve reports audited by third-party accounting firms such as Grant Thornton, demonstrating sufficient US dollar reserves. While USDC's market size is smaller than USDT's, it's highly sought after in decentralized finance (DeFi) and institutional trading for its transparency and regulatory compliance.

This is not only the difference between two products, but also two strategic bets on the future: one bets on market efficiency and liquidity, and the other bets on institutional trust and compliance moats.

The money-making logic of stablecoins: cost-free deposits and huge profits

The business model of stablecoin issuers is the clearest and most straightforward in the crypto industry. Its core is to attract deposits at no cost and maintain a stable interest rate spread. When a user exchanges $100 for 100 stablecoins, that $100 becomes the issuer's reserve. Since stablecoins pay no interest to users, the issuer effectively receives a cost-free deposit. These funds can then be invested in highly liquid, low-risk assets like U.S. Treasuries and repurchase agreements, earning a stable interest return.

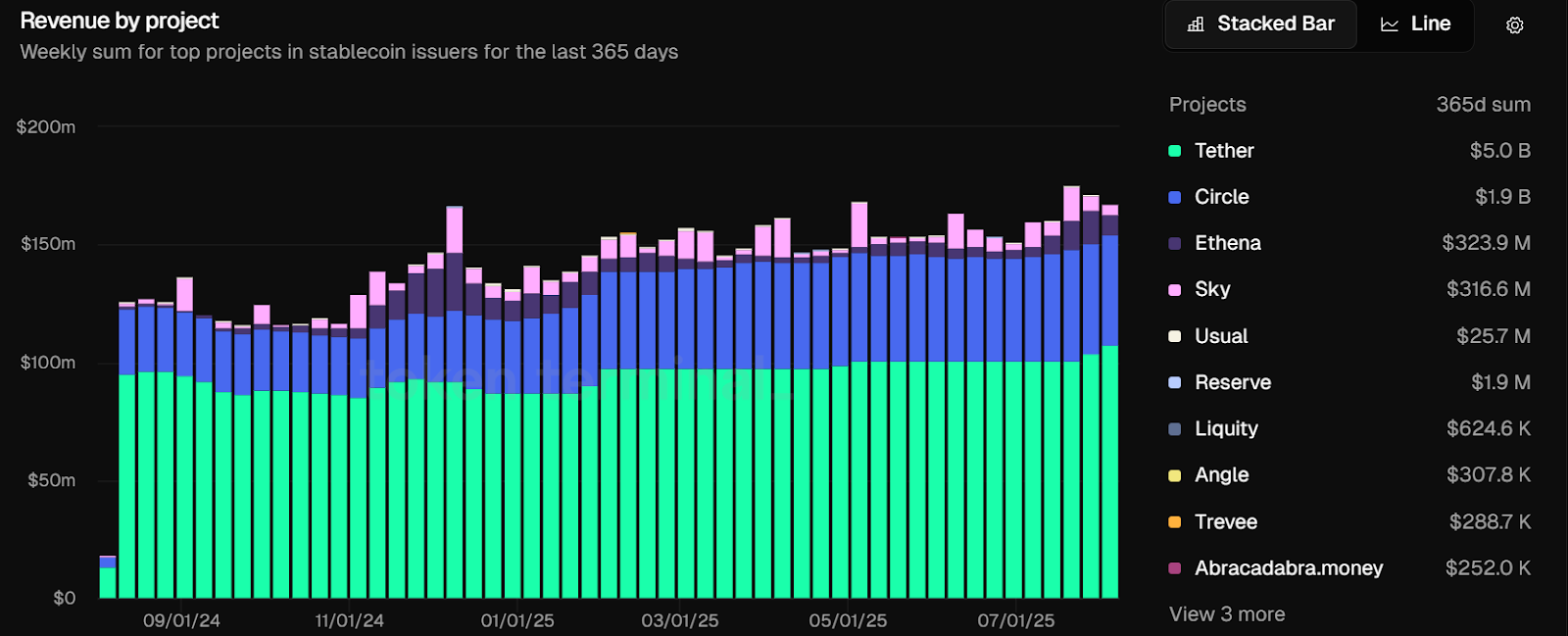

With a capital pool of hundreds of billions of dollars, this model has become a continuously operating profit machine: stable returns and controllable risks. It is almost the most predictable business model in the crypto industry.

For example, Tether's asset portfolio consists of over 80% in cash equivalents, such as U.S. Treasuries, 5% in Bitcoin, and the remainder in corporate bonds, precious metals, and secured loans. By the second quarter of 2025, Tether's U.S. Treasury holdings will reach $127 billion ($105.5 billion in direct holdings and $21.3 billion in indirect holdings), surpassing South Korea's $124.2 billion and ranking 18th globally.

The significance of this holding structure lies not only in the profitability of the stablecoin market but also in its role in the US dollar liquidity cycle . Stablecoins provide global users with instant access to US dollars, while simultaneously channeling these funds back into the US Treasury market, forming a "dollar-on-chain-US Treasury" circulation channel. This channel enhances global demand for US Treasury bonds, but can also amplify liquidity fluctuations in extreme circumstances, as stablecoin redemption demand is more immediate and concentrated than traditional bank deposits.

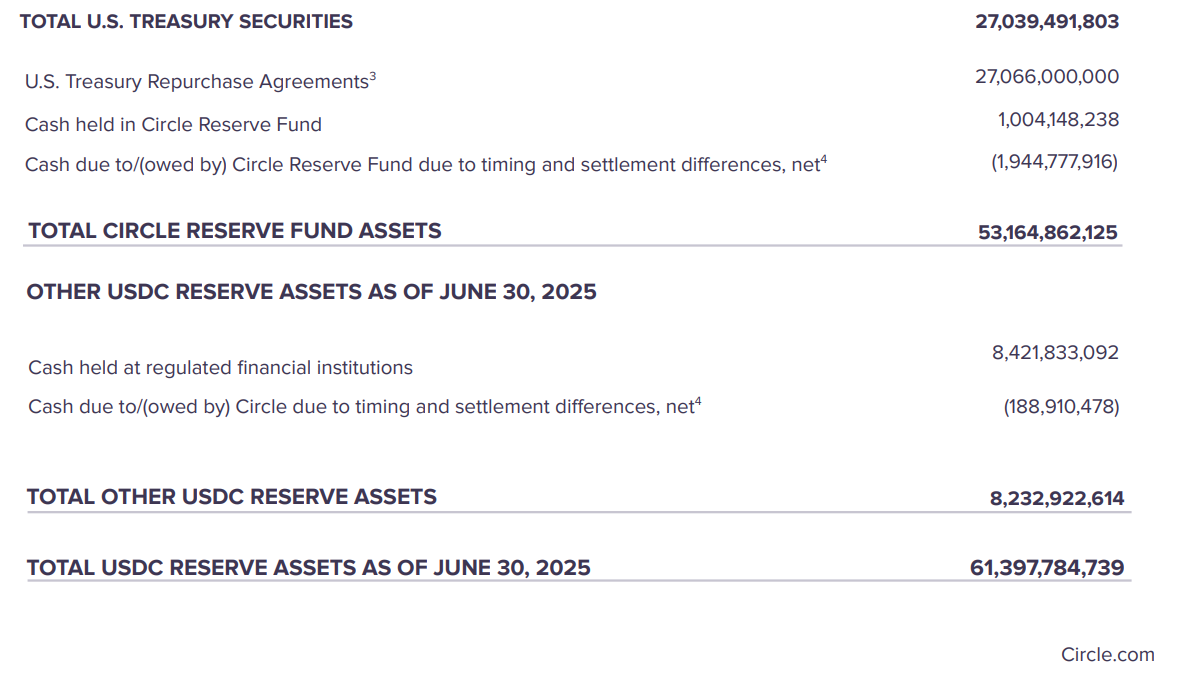

Circle's asset allocation is more conservative: 44% in U.S. Treasuries, 44% in Treasury repurchase agreements, and 14% in bank deposits. As of June 30, 2025, its Treasury bonds and repurchase agreements totaled approximately $53 billion. This allocation is more aligned with the risk management principles of traditional financial institutions and ensures a relatively robust balance between short-term repayments and interest rate spread income.

Financial performance: the other side of profit

According to financial data from the second quarter of 2025, Tether's total assets reached $162.57 billion, total liabilities (token issuance) were $157.11 billion, net assets were approximately $5.47 billion, and shareholder capital remained stable. In the second quarter alone, Tether achieved a net profit of $4.9 billion, bringing its total profit to $5.7 billion in the first half of the year. Of this, $3.1 billion came from recurring profits and $2.6 billion from valuation increases on its gold and Bitcoin holdings. This means that a significant portion of its profit structure relies on asset price fluctuations. While the current market environment is favorable, valuation gains could shrink rapidly in a cyclical downturn.

Circle, on the other hand, exhibits more "bank-like" financial characteristics—as of June, total assets were $61.39 billion and total liabilities were $61.33 billion, with assets slightly exceeding liabilities. According to data from tokenterminal.com , the protocol generated $1.9 billion in revenue over the past year, primarily from interest income on Treasury bonds and repurchase agreements, with little reliance on high-volatility assets. This model is particularly attractive in the current era of high interest rates, but revenue pressures could increase if the US enters a cycle of rate cuts.

On July 18, 2025, US President Trump signed the GENIUS Act, defining new boundaries for the stablecoin industry and marking a turning point in the transition of stablecoins from fringe innovation to mainstream finance. This legislation not only responds to industry expansion but also reflects the US's intention to incorporate stablecoins into its "digital dollar" strategy.

For compliant issuers like Circle, the bill represents an expansion of market potential; however, for Tether, its global market advantage may be challenged by pressure to maintain reserve transparency and compliance standards. Regardless of the ultimate outcome, stablecoins are becoming a tool for extending the US dollar's hegemony in the digital age, creating new uncertainties in the global financial system.