On July 30th, news broke that the cryptocurrency trading platform Kraken was seeking to raise approximately $500 million in funding at a $15 billion valuation, sparking widespread market interest. This news coincided with a gradual warming of the US regulatory environment: in March 2025, the Securities and Exchange Commission (SEC) officially dropped securities violation charges against Kraken, and just last week, Fortune magazine revealed that the FBI had concluded its investigation into Kraken's founder, freeing Kraken from multiple regulatory hurdles. Meanwhile, Kraken's official social media accounts frequently hinted at potential IPO plans, further fueling market speculation.

CRCL's stock price surged as much as 10-fold after its IPO in June, providing a stark contrast to market expectations. If Kraken successfully goes public, it could trigger another wave of excitement—but it's worth keeping an eye on which stocks will be the most hyped.

Pre-IPO investment boom hits, retail investors can also get a head start before listing

With top companies like OpenAI and SpaceX remaining private for extended periods, many original employees and early investors are looking to cash out their holdings before their IPOs. Forge serves as a marketplace connecting these sellers with investors eager to buy in. With Kraken's IPO speculation heating up, if its employees or institutions begin selling their shares, private equity trading platforms like Forge could become an indirect entry point for retail investors to capitalize.

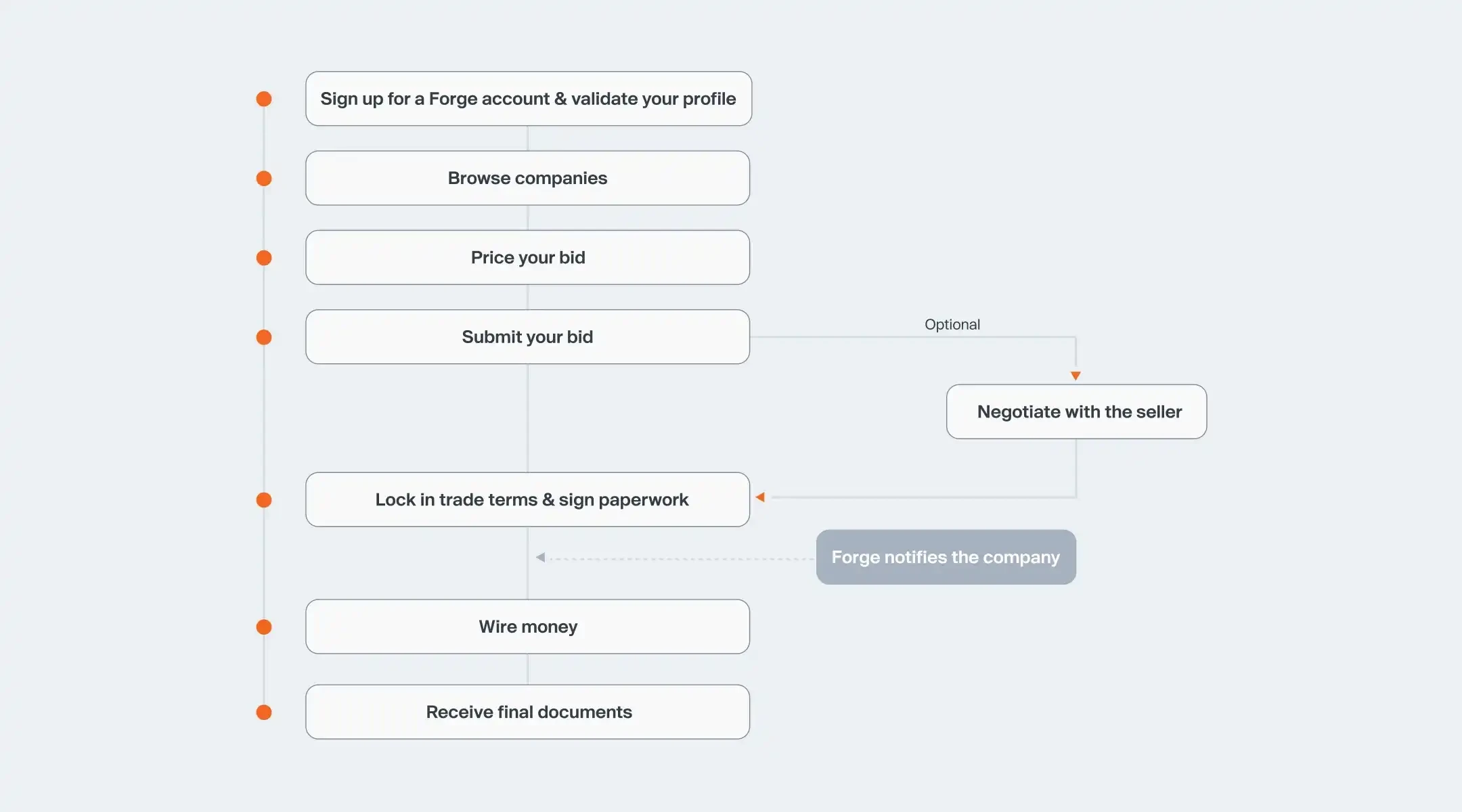

On the Forge platform, investors can typically purchase shares in private companies in two ways: The first is a direct transaction, where you find a Kraken equity holder willing to sell and negotiate a price. Forge will assist with the Know Your Customer (KYC) process, due diligence, and contract signing. The second option is through an SPV transaction (Forge Funds). Forge establishes a dedicated special purpose vehicle (SPV) to pool funds from buyers and purchase the target company's equity. You hold a share of the SPV, not the company's shares. This method bypasses the ROFR and is more suitable for investors seeking quick entry, with transactions even possible within a few days. The SPV is expected to receive liquidity after Kraken's official IPO.

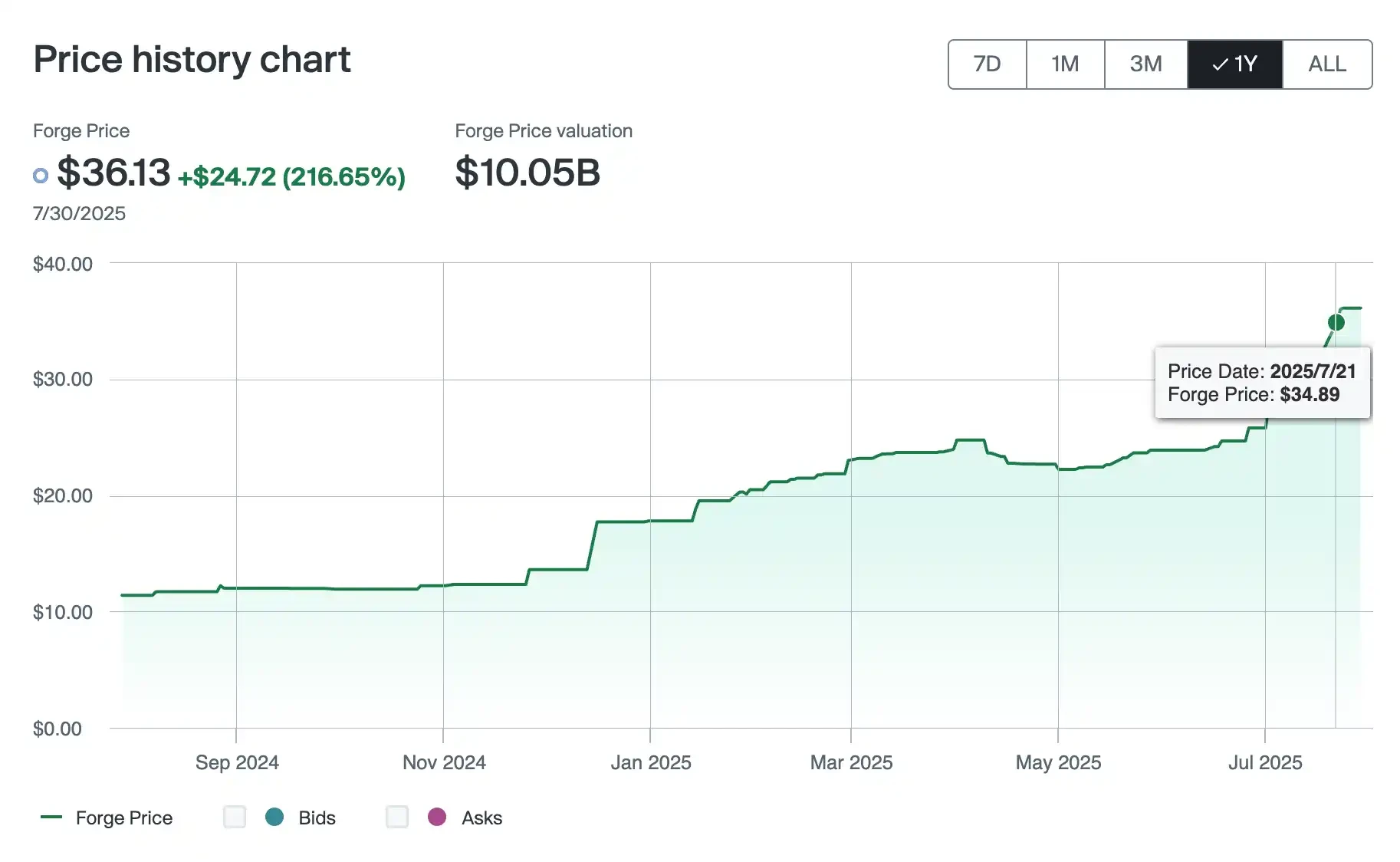

The current price on the Forge platform is $36.13, a 200% increase in a year, reflecting market enthusiasm for Kraken's IPO. With a valuation of approximately $10 billion, if Kraken successfully lists at a valuation of $15 billion, current investors could potentially reap excess returns exceeding 50%.

In addition, the tokenization of private equity is also bringing new investment opportunities to retail investors. Platforms including Republic and Robinhood already support technology companies such as OpenAI and SpaceX. Whether they will also support Kraken in the future is also worth continuing to pay attention to.

Related Reading: Can Retail Crypto Investors Buy SpaceX Equity? A Look at Three Major Private Equity Tokenization Platforms

Benchmarking Coinbase's Base Chain, Ink becomes the core of the next round of L2 narrative

Following Coinbase's launch of the Base Chain, which has become a major traffic hub for the Layer 2 sector, Kraken has officially entered the market, launching its Ink Network as the first step in its Layer 2 strategy. Built on the Ethereum OP Stack, Ink is a Layer 2 blockchain featuring high throughput, low latency, and native compatibility with the Ethereum Virtual Machine (EVM). It aims to become the DeFi hub on the Superchain, providing a solid foundation for future transactions, payments, and on-chain financial infrastructure. The network is spearheaded by Kraken, and its native token, $INK, will be issued by its subsidiary, the Ink Foundation, and distributed to eligible active users and ecosystem participants through an airdrop program on the Kraken exchange. While the specific distribution criteria and timeline have not yet been announced, the news has become a hot topic in the market.

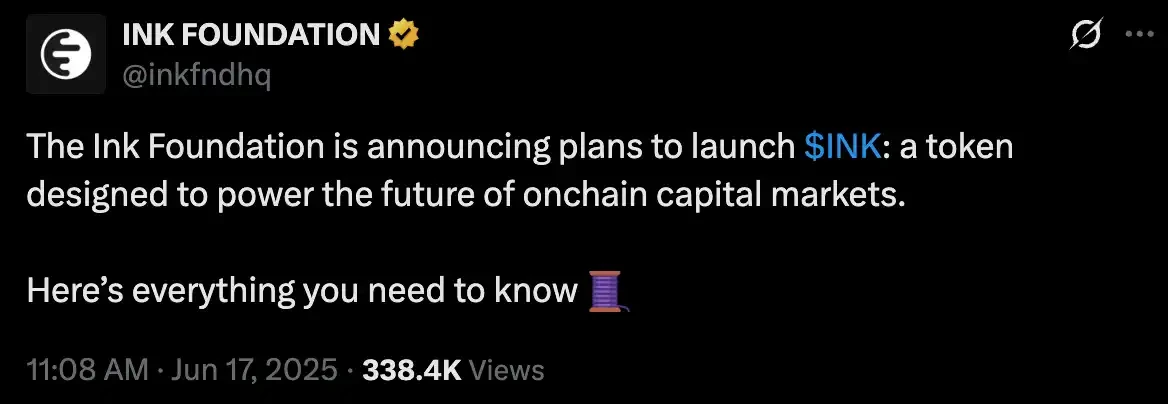

On June 17th, the Ink Foundation announced that the total supply of $INK will be permanently capped at 1 billion, with no additional issuance and no governance rights. $INK will be used solely for ecosystem incentives and user-level usage, positioning itself more like a "fuel" than a traditional governance token. The first clear application scenario is the native liquidity protocol powered by Aave, a key component of Ink's onchain capital stack. This protocol natively integrates lending mechanisms into the Ink chain, providing users with efficient and convenient on-chain fund scheduling services.

Kraken Co-CEO Arjun Sethi stated that Ink's mission is to deeply integrate "production-grade on-chain systems" into Kraken's product ecosystem, driving the strategic migration of centralized platforms to on-chain financial systems. The Ink Foundation Board of Directors called this a "pivotal moment," believing that Ink's launch marks the beginning of the convergence of CeFi and DeFi, and a substantial step forward in the vision of a unified global capital market.

With the official launch of its mainnet, the Ink ecosystem is taking shape. The platform has also launched the memecoin launch tool, Inkypump. Its first mascot token, $ANITA, once reached a market capitalization of $8 million and is currently stabilizing around $4 million. While $INK's TGE has yet to be announced, the market is already anticipating Ink's potential, fueled by the success of Layer 2 projects like Base.

Considering the rapid growth of the Base chain in ecosystem activity, TVL, and the number of projects, as well as the performance of ecosystem tokens built around it, such as $VIRTUAL and $ZORA, Ink, with its direct endorsement from the Kraken team and its dedicated focus on traffic and resources, undoubtedly has the potential to become the next hot L2 mainline. It is foreseeable that once $INK launches and trading becomes available, it will undoubtedly become one of the "orthodox" representatives of CeFi hype. Especially given Kraken's intention to deeply integrate its trading capabilities with on-chain scenarios, Ink is not only an L2, but also potentially the core of Kraken's onchain strategy. For investors seeking to capitalize on Kraken's IPO and the next wave of L2 trends, Ink and its ecosystem deserve close attention.

Summarize

In addition to crypto trading and Layer 2 network development, Kraken has recently been actively expanding its broader financial footprint. In 2025, Kraken acquired Ninja Trader, a leading US retail futures trading platform, for $1.5 billion, securing futures commission merchant status and officially entering the CFTC-regulated derivatives market, establishing a critical link between CeFi and TradFi. Kraken also launched its payment app, Krak, which supports instant remuneration transfers across over 300 crypto and fiat assets. Future expansion plans include lending and credit card services, creating a comprehensive crypto payment experience. This series of initiatives not only lays the foundation for Kraken's development into a super-financial platform but is also seen as a crucial prelude to its long-awaited IPO. With the expansion of its product line, revenue growth, and continued improvement in the regulatory environment, Kraken's path to a public offering is accelerating.

- 核心观点:Kraken 估值飙升,上市预期升温。

- 关键要素:

- Kraken 以 150 亿美元估值融资 5 亿美元。

- 监管压力缓解,SEC 撤销指控。

- Ink 链布局 Layer 2,推动 DeFi 整合。

- 市场影响:或引发新一轮加密投资热潮。

- 时效性标注:中期影响。