When Christie's allows buyers to buy houses with cryptocurrency, a new milestone in the RWA track

- 核心观点:加密技术正重塑房地产行业流动性。

- 关键要素:

- 佳士得成立加密房产交易部门。

- 美国房地产70%权益为自有资金。

- RealT平台代币化房产收益6%-16%。

- 市场影响:降低投资门槛,提升流动性。

- 时效性标注:中期影响。

"Buy land! They don't make land anymore." This 20th-century quote, mistakenly attributed to Mark Twain, is a frequently used real estate marketing slogan. Gravity strongly supports this statement. If humans cannot achieve interstellar travel, land will become like Bitcoin, "uninflatable."

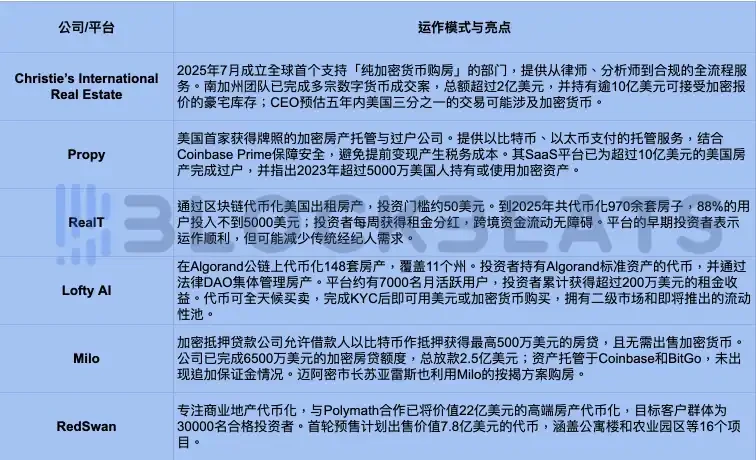

By 2025, the crypto wave had spread from Silicon Valley to Wall Street and finally reached Washington. As compliance gradually progressed, it also began to quietly transform the fundamental structure of the real estate industry. In early July, Christie's International Real Estate officially established a dedicated department for crypto real estate transactions, becoming the first major luxury real estate brokerage brand in the world to fully support "pure digital currency payments" throughout the entire home purchase process.

And this is just the beginning. From Silicon Valley entrepreneurs to Dubai developers, from Beverly Hills mansions in Los Angeles to rental apartments in Spain, a group of real estate trading platforms centered on blockchain technology and digital assets are emerging, forming an emerging "Crypto Real Estate" track.

Why Crypto Could Drive the Next Wave of US Real Estate

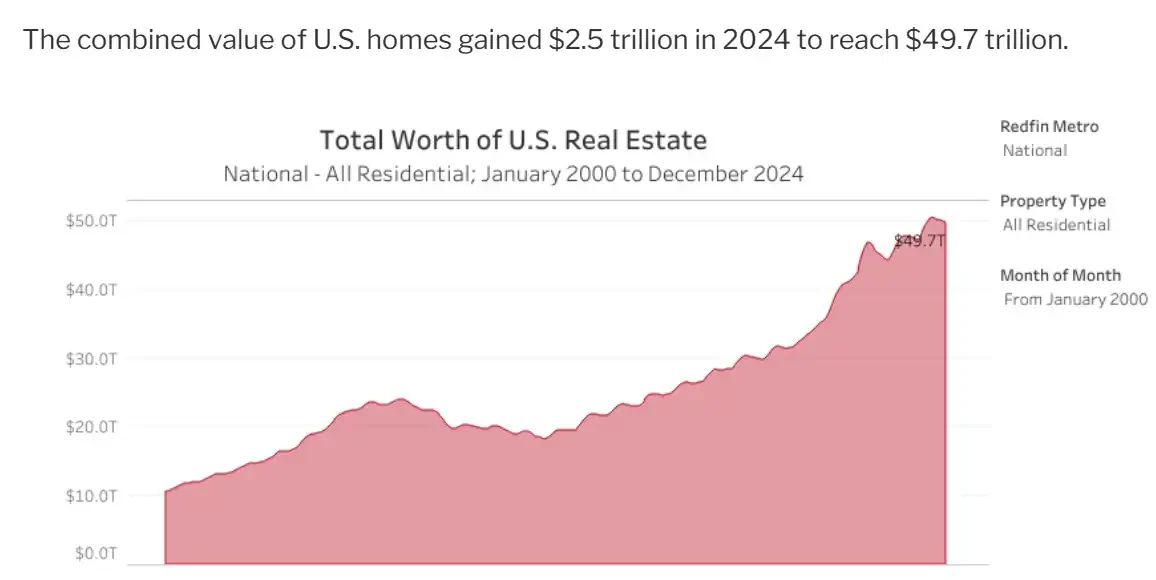

The value of U.S. real estate will be close to $50 trillion in 2024, making it one of the most important asset markets in the world. This figure was approximately $23 trillion in 2014, 10 years ago. The size of assets in this sector has doubled in ten years.

Awealthofcommonsense analysis report on the total volume of US real estate

The June 2025 NAR report shows that the median home price in the United States reached $435,300, up 2% from the same period last year. Housing inventory is approximately 1.53 million units, with a 4.7-month supply-demand ratio. High housing prices and chronic undersupply have raised the barrier to entry. Furthermore, persistently high mortgage rates (the average 30-year fixed rate in July 2025 was approximately 6.75%, while Bitcoin mortgages are currently around 9%), consistently exceeding the annual increase in property values, have suppressed transaction volume. Low liquidity has led real estate investors to seek new sources of liquidity.

High interest rates hinder more than just the low liquidity of real estate investors. Over the past five years, the average wealth of homeowners has increased by $140,000. However, many households are reluctant to use real estate loans to generate liquidity while holding real estate assets. These households generally have only two options for liquidation: selling the entire asset or renting it out. Using real estate loans isn't a good option at current interest rates, and selling doesn't seem to be a better investment decision given rising housing prices.

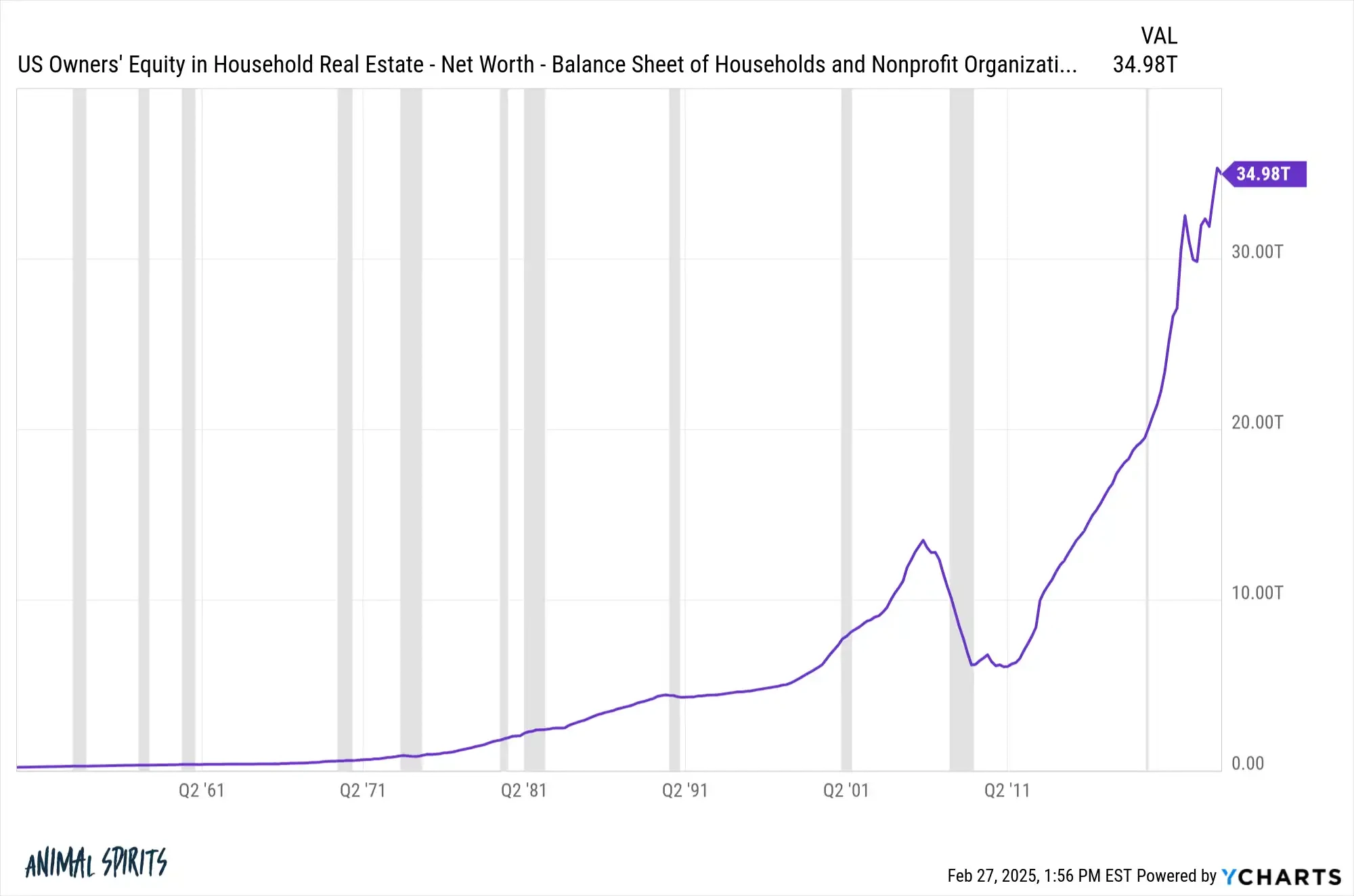

Therefore, within the $50 trillion real estate sector, approximately 70% of the equity ($34.98 trillion) is currently owned by homeowners. This means that only 30% is backed by borrowed funds, with the remainder being the homebuyer's own funds. For example, a family owning a $500,000 property, while they technically own it, would need to deduct the portion of their debt if they wanted to sell it to determine their actual ownership. Based on a 70% equity position, they would only own $350,000 in the property.

US real estate equity holdings, source: Ycharts

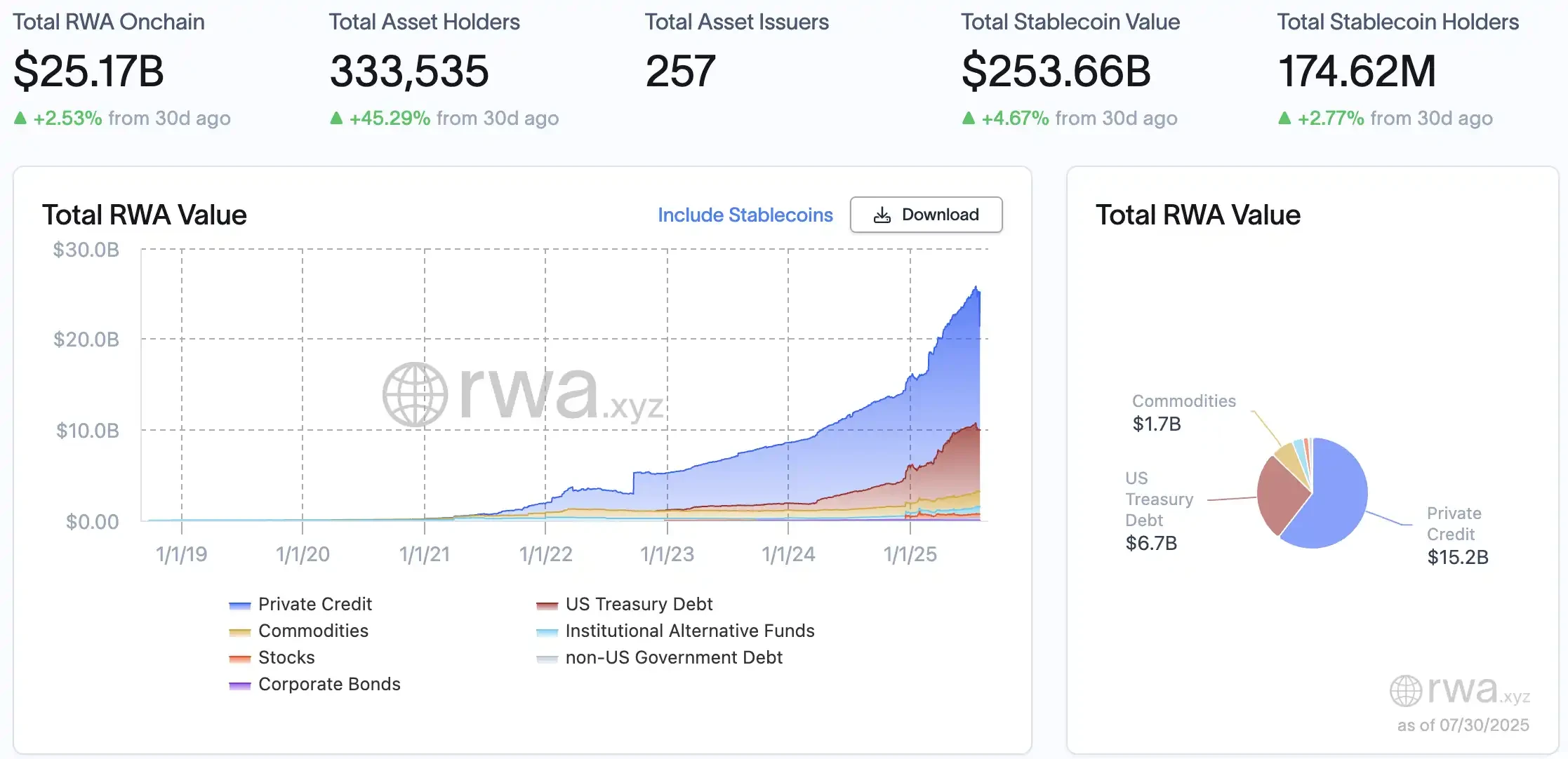

However, the supply and demand relationship alone is far from enough. The concept of RWA has been developing for many years but has only really begun to explode in the past two years, especially after Trump's election in 2025, the upward slope has further increased.

At its core, compliance is paramount, especially for investors in illiquid assets like real estate. In March 2025, William Pulte, the new head of the Federal Reserve's Federal Reserve System (FHFA), ordered mortgage giants Fannie Mae and Freddie Mac to develop a plan to allow crypto assets to be included in reserve assets when assessing the risk of single-family mortgages, without first converting them into US dollars. This policy encourages banks to consider cryptocurrencies as assets eligible for savings, expanding their borrower base.

In July 2025, Trump signed the GENIUS Act and promoted the CLARITY Act. The GENIUS Act recognized stablecoins as legal digital currencies for the first time, requiring them to be fully backed 1:1 with safe assets such as US dollars or short-term Treasury bonds and requiring third-party audits. The CLARITY Act attempts to clarify whether digital tokens are securities or commodities, providing a regulatory path for practitioners.

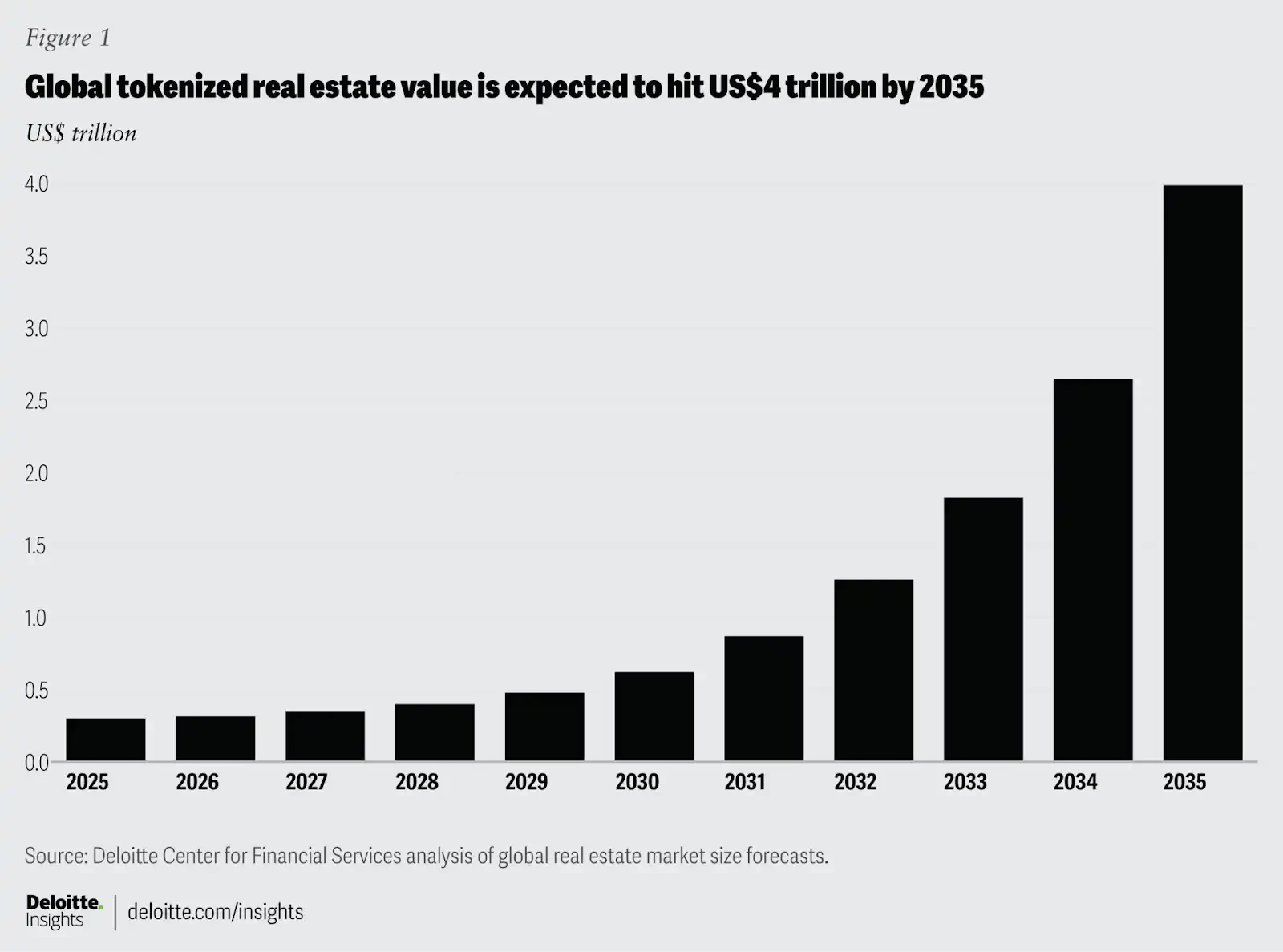

This combination of measures provides a greater margin of safety for the sector. Furthermore, real estate's scarcity, similar to Bitcoin's "impossible to issue more" (land cannot be increased, but real estate itself can; building a house is like mining), makes it easier to integrate the two. Digitalization helps break down high barriers to entry. Deloitte, one of the Big Four accounting firms, predicted in its financial sector report that approximately $4 trillion in real estate could be tokenized by 2035, up significantly from less than $300 billion in 2024.

Tokenization can break up large real estate assets into smaller shares, providing global investors with low barriers to entry and high liquidity, while also creating cash flow for sellers and buyers who otherwise lack capital. That said, the $4 trillion figure, while appealing, remains debatable, just as institutional predictions of ETH's future market capitalization reaching $85 trillion remain debatable. But how far has it really progressed? Perhaps we can find some alpha in the market.

Fragmentation? Lending? Leasing? Providing liquidity? Playing real estate like DeFi

Unlike similar entities with low liquidity, such as gold and art, real estate has inherent financial attributes. This becomes even more diversified when it is connected to Crypto.

Although some people have tried this before, the collaboration between Harbor platform and RealT in 2018 to launch a blockchain-based real estate tokenization service is considered to be one of the earlier and larger real estate tokenization projects.

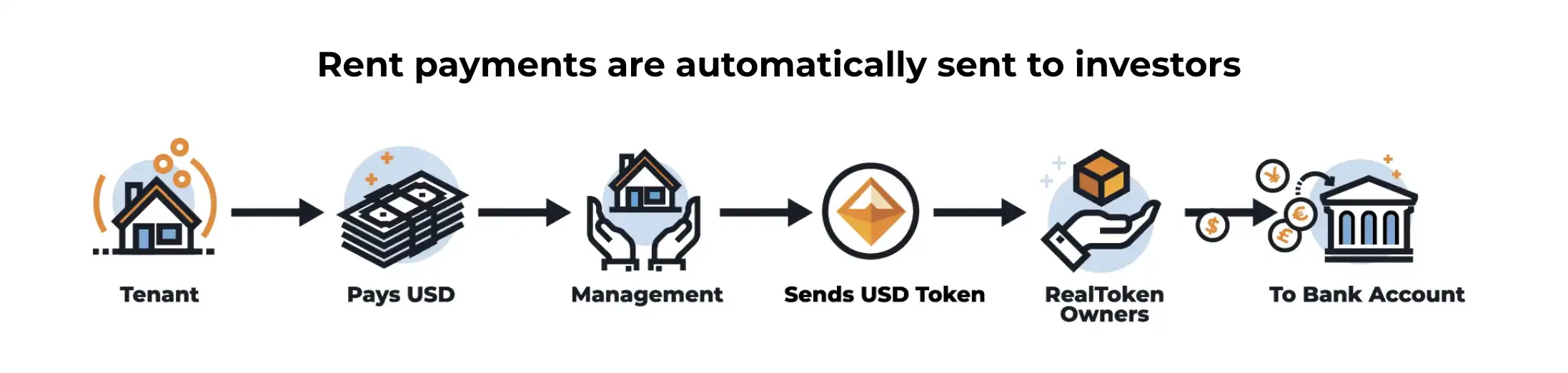

Specifically, the RealT platform uses blockchain to decompose real estate equity into tradable RealTokens. Each property is held by an independent company (Inc/LLC). Investors who purchase RealTokens effectively own a portion of the company's shares and receive a proportional share of rental income. The platform leverages Ethereum's permissioned issuance mechanism to ensure a low investment threshold (typically around $50). Transactions and rental payments are all completed on-chain, eliminating the need for investors to manage the day-to-day management of traditional landlords. RealT distributes rental income to holders weekly in stablecoins (USDC or xDAI).

The expected return is derived from the return on net assets (RONA), which is calculated as the annual net rent divided by the total investment. For example, if the expected annual rental income of a property, after deducting expenses, is $66,096 and the total investment is $880,075, the RONA is 7.51%. This figure does not include leverage or property appreciation gains. The platform's average return currently fluctuates between 6% and 16%.

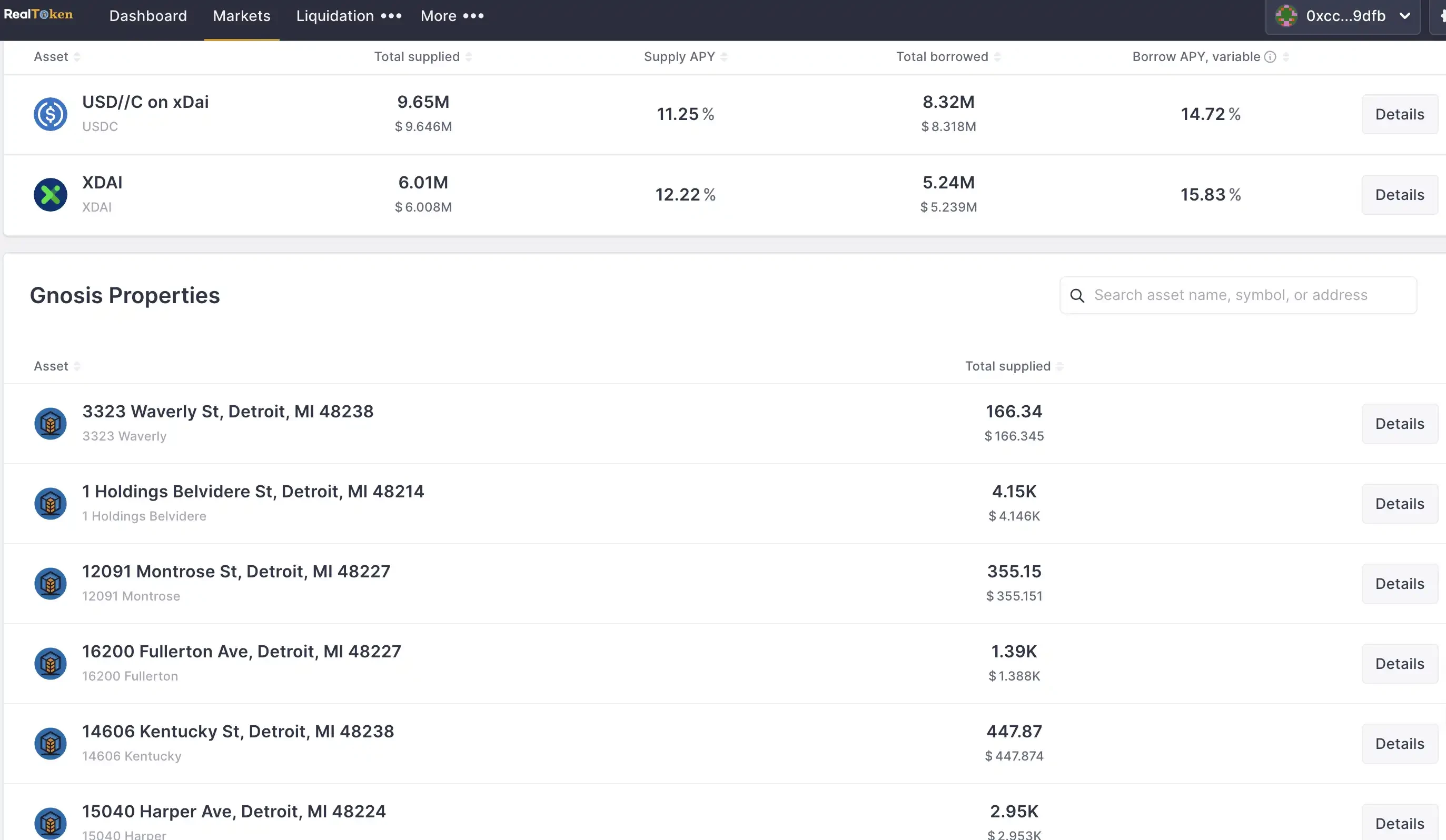

After tokenization, the next step is to apply it. RealT itself has no loans on its properties; all funds come from the sale of RealTokens. However, to allow holders to flexibly utilize their assets, RealT has launched the RMM (Real Estate Money Market) module.

RMM is based on the Aave protocol, allowing you to do two things. First, you can provide liquidity. Much like LP interest in DeFi, investors can deposit USDC or XDAI into RMM and receive the corresponding ArmmToken, which accrues interest in real time. Second, you can borrow by pledging RealTokens. Using RealTokens or stablecoins as collateral, you can borrow assets like XDAI. There are two loan interest rates: a stable rate (similar to a short-term fixed rate, but adjusted when utilization is too high or interest rates are too low) and a variable rate (floating based on market supply and demand).

Opening up the lending channel allows for leverage, much like the real estate speculation groups of more than a decade ago who borrowed money to buy a house, then took out a loan, then used the loan to buy another house. RealTokens are pledged, stablecoins are borrowed, and RealTokens are then purchased again, repeating this process multiple times to increase overall returns. It's important to note that with each additional layer of leverage, the health factor decreases and the risk increases.

Note: The health factor is the inverse of the ratio of collateral value to loan value; the higher the health factor, the lower the risk of liquidation. When the health factor drops to 1, the collateral value equals the loan value, potentially triggering liquidation. Ways to avoid liquidation include partially repaying the loan or adding additional collateral (similar to margin in perpetual contracts).

Beyond real estate as collateral for loans, recent discussions have focused on crypto-backed loans for home purchases. Fintech company Milo allows borrowers to secure mortgages up to 100% using Bitcoin as collateral. By early 2025, it had completed $65 million in crypto-mortgages and disbursed over $250 million in loans. Policymakers are also giving this model the green light. The Federal Housing Finance Agency (FHFA) requires mortgage giants Fannie Mae and Freddie Mac to consider compliant crypto assets in their risk assessments. While interest rates for crypto-mortgages are generally similar to or slightly higher than traditional mortgages, their main appeal lies in the ability to raise funds without having to sell crypto assets.

Further reading: Bitcoin mortgages, a new $6.6 trillion blue ocean

A Redfin survey shows that after the epidemic, about 12% of first-time homebuyers in the United States used cryptocurrency proceeds to pay down payments (sales or mortgage loans). Coupled with the change in policy direction, it will undoubtedly attract "big companies to enter the market", and "Crypto Real Estate" will also welcome the participation of high-end real estate economic companies for the first time.

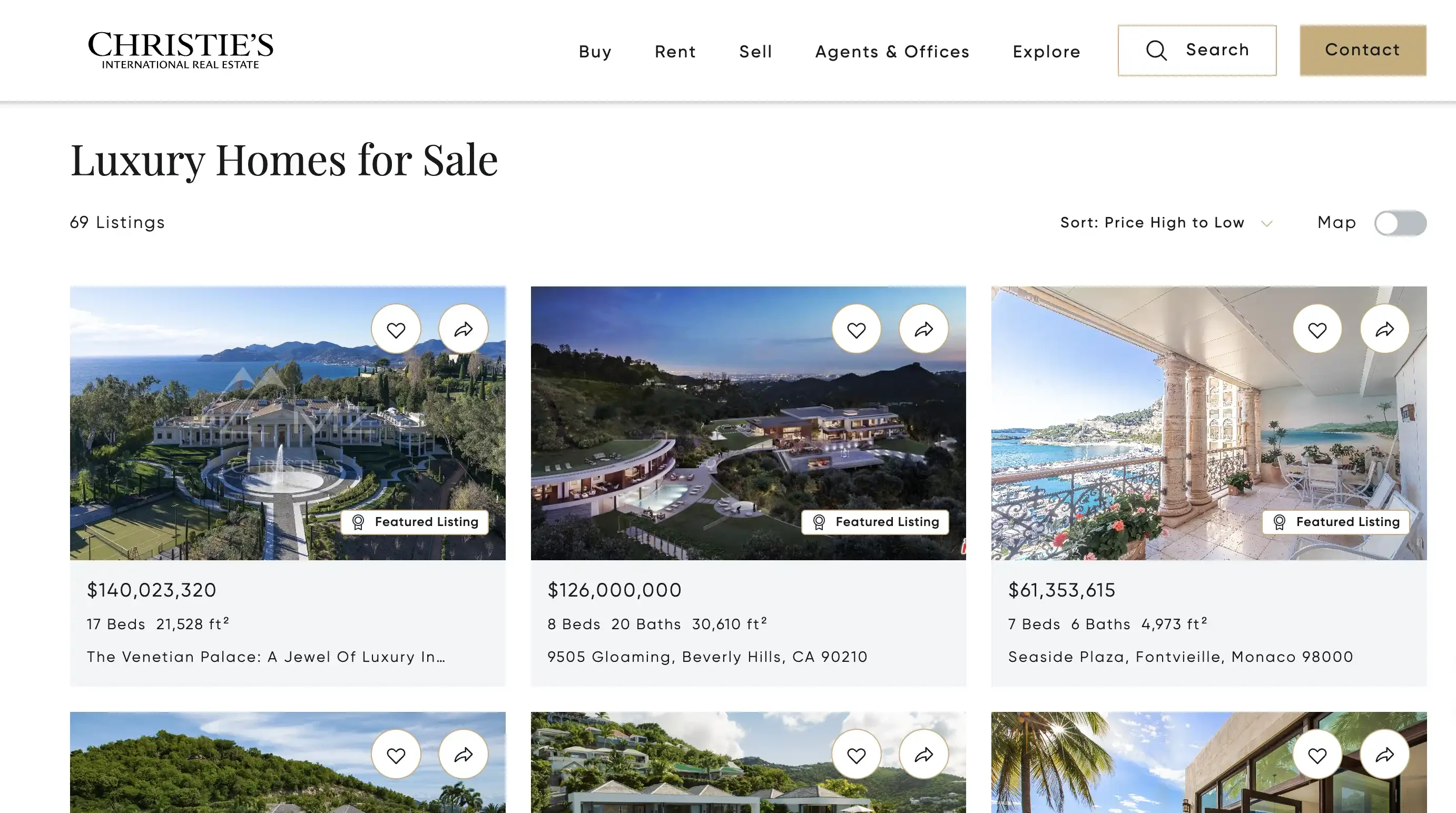

In July 2025, Christie's International Real Estate established the world's first cryptocurrency-focused luxury real estate division, marking a landmark example of the integration of traditional high-end real estate brokerage firms with digital assets. Interestingly, this initiative was not driven by a top-down strategic push, but rather responded to the real needs of high-net-worth clients.

Christie's executives stated, "A growing number of wealthy buyers are looking to complete real estate transactions directly with digital assets, prompting the company to adapt and build a service architecture that supports crypto payments throughout the entire process." In Southern California, Christie's has completed multiple luxury home transactions paid entirely in cryptocurrency, totaling over $200 million, all of which were high-end residences in the "eight-figure" range. Christie's currently holds a crypto-friendly real estate portfolio valued at over $1 billion, encompassing numerous luxury properties that are willing to accept "pure crypto offers."

One of the mansions, "La Fin," is a $118 million mansion located in Bel-Air, Los Angeles. It accepts payments in pure cryptocurrency and has 12 bedrooms and 17 bathrooms. It also features a 6,000-square-foot nightclub, a private wine cellar, a Sub-Zero vodka tasting room, a cigar lounge, and a fitness center with a rock climbing wall. It was previously listed for $139 million. Source: realtor.com

Christie's Crypto Real Estate Department not only provides payment channels based on mainstream crypto assets such as Bitcoin and Ethereum, but also works with custodians and legal teams to ensure that transactions are completed within a compliant framework. This includes cryptocurrency payment custody, tax and compliance support, and asset matching (exclusive crypto real estate portfolios that meet the specific investment needs of high-net-worth clients).

Aaron Kirman, CEO of Christie's Real Estate, predicts that "over the next five years, more than a third of residential real estate transactions in the United States may involve cryptocurrency." Christie's shift demonstrates the penetration of crypto assets among high-net-worth individuals and heralds a structural shift in traditional real estate transaction models.

The infrastructure is becoming more complete, but it seems that user education still has a long way to go.

To date, real estate tokenization projects have begun to gain momentum, but they appear to be falling short of their anticipated success. RealT has tokenized over 970 rental properties, generating nearly $30 million in net rental income for users. Lofty, on the other hand, has tokenized 148 properties across 11 states, attracting approximately 7,000 monthly active users who share in approximately $2 million in annual rental income through their token holdings. The value of these projects hovers in the tens or hundreds of millions of dollars, and their inability to break through may be due to a variety of factors.

On the one hand, blockchain technology does free transactions from geographical constraints, enabling instant cross-border settlement and lower transaction fees than traditional real estate transfers. However, investors should understand that this is not a "zero-cost" ecosystem: token minting fees, asset management fees, transaction commissions, network fees, and potential capital gains taxes all contribute to a new cost structure. Compared to the "one-stop shop" of traditional real estate agents and lawyers, crypto real estate requires investors to proactively learn and understand smart contracts, on-chain custody, and crypto tax regulations.

On the other hand, while liquidity is a selling point, it also comes with increased volatility. Tokenized real estate can be traded 24/7 in the secondary market, allowing investors to collect rent and exit their holdings at any time. However, when liquidity is insufficient, the token price can be significantly higher or lower than the actual valuation of the property itself, with market fluctuations even faster than the physical real estate cycle, increasing the speculative nature of short-term trading.

Furthermore, many platforms have introduced DAO (Decentralized Autonomous Organization) governance, allowing investors to vote on matters like rent and maintenance. This sense of participation, similar to playing Monopoly, lowers the barrier to entry and enhances interactivity. However, it also places new demands on users: they must not only understand property management but also possess awareness of on-chain governance and compliance. Without adequate education, investors may misjudge the risks and view digital real estate as a short-term arbitrage tool rather than a long-term asset allocation.

In other words, the real barrier to entry for crypto real estate lies not in technology but in understanding. Users need to understand mortgage rates, liquidation mechanisms, on-chain governance, tax filings, and more, which is a disruptive shift for those accustomed to traditional homebuying models.

With the gradual clarification of regulations, improved platform experience, and the involvement of mainstream financial institutions, the crypto real estate market is expected to shorten this education curve. However, in the foreseeable future, the industry still needs to invest more resources in user training, risk management education, and compliance guidance to truly transform "crypto real estate" from a niche experiment to a mainstream audience.