From early June to early July of this year, $IMF, the MemeFi project on the Ethereum mainnet, saw its value surge nearly 70-fold. Although $IMF gradually retraced 50% after reaching a record high of $70 million in market capitalization, a dramatic drop of nearly 85% yesterday caused market volatility.

$IMF's drop shocked Zhu Su

What happened to cause such a huge drop in $IMF?

What is the IMF?

The IMF (International Meme Fund) is a decentralized financial platform tailored for mainnet memes. Users can use their meme tokens, such as $PEPE, $JOE, and $MOG, as collateral to borrow the stablecoin $USDS, allowing them to cash out without having to sell. Furthermore, through modules like Accelerate and Amplify, project owners and major investors can leverage and pump prices, implement circular lending to protect the market, and even create the illusion of "locked-up" positions while actually enabling premature sales and shadow fund management.

Through the IMF, the circular lending of meme coins can be realized, achieving "left foot on right foot", for example:

- Buy $10,000 PEPE

- Deposit PEPE into the IMF and borrow $5,000 USDS

- Exchange USDS for PEPE

- Deposit the remaining $5,000 PEPE to lower the loan-to-value ratio (LTV)

Currently, the TVL of IMF is still about 166.5 million US dollars, with a total of about 54 million US dollars of $USDS deposited, about 29.22 million US dollars of $PEPE, about 20.58 million US dollars of $stETH, about 44.4 million US dollars of $MOG, about 5.88 million US dollars of $JOE, about 4.94 million US dollars of $SPX and about 7.5 million US dollars of $IMF as collateral.

Why did $IMF plummet?

According to an official tweet released by the IMF, the sudden plunge in $IMF was not due to problems with the protocol itself, but because the $IMF token itself was sold off. The sell-off triggered more panic selling and chain liquidations, which led to a sharp drop in the price of $IMF.

The official tweet also stated that due to the speed and frequency of liquidations, some bad debts (approximately 1% of deposited USDS) accumulated. This was less than the total returns generated by lenders, resulting in no net loss. Furthermore, the issues in the $IMF lending market did not affect other lending pairs on the platform.

@2025 Spider tweeted that his friend sold $100,000 worth of $IMF at 1.02 USDT, triggering a chain reaction of liquidations. He stated that his friend had no intention of sabotaging the IMF project and that the project should close its IMF lending positions, otherwise USDS would be at significant risk. He also stated that the team's oracle was slow to update, and even when most IMF/USDT positions were already insolvent, the oracle still hadn't updated to the latest price.

Regarding the IMF's opening of its own platform currency $IMF for collateralized lending, @2025 Spider and the Chinese KOL "Professor Suo said" both raised questions:

Someone asked @2025 Spider in a tweet, "Is the IMF a scam?" @2025 Spider said that the team members are good, but they shouldn't open up $IMF collateral loans, otherwise it would be reasonable to assume they want to cash out by selling their own tokens in disguise, just like the founder of CRV. He also said that the loan amount to $IMF exceeds the $IMF UniSwap pool itself, which is also inappropriate from a risk control perspective.

Professor Suo's argument, through on-chain records, directly questions whether the IMF team themselves pledged tokens to trigger FOMO and then sold them to cash out:

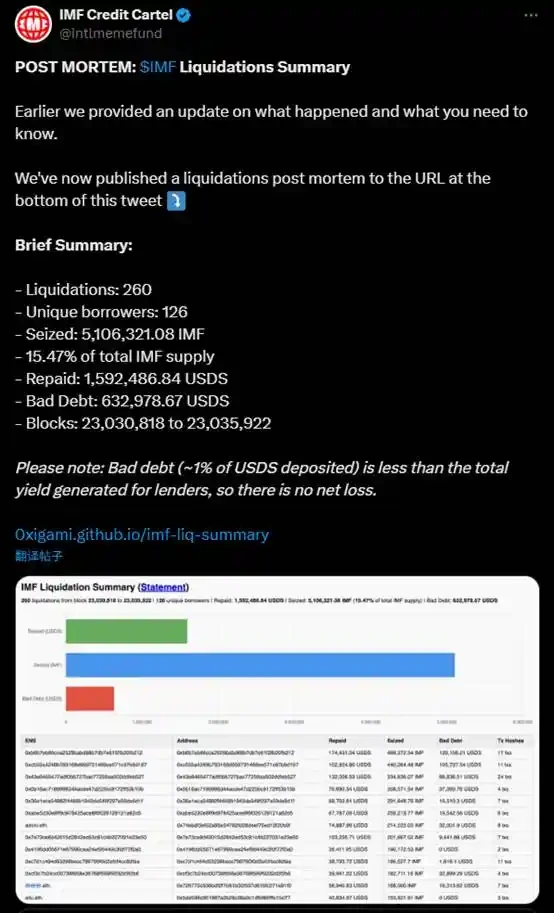

The IMF's official Twitter account published a detailed report on the series of liquidations this afternoon. A total of 260 liquidations occurred, involving 126 individual borrowers, representing 15.47% of the total $IMF supply.

Conclusion

After the incident, $IMF rebounded nearly 4 times from its lowest point. Currently, its price is still nearly 3 times that of the lowest point, and its market value has rebounded to nearly 21 million US dollars.

However, the controversy surrounding $IMF is unlikely to end. On July 24th, @alex_eph 612, a major holder of the popular Ethereum meme coin $APU, criticized the IMF. He claimed that the IMF was initiated by a conspiracy group consisting of $PEPE, $MOG, and Milady, and that its business model involved soliciting free tokens from other organic meme coin communities in exchange for short-term buying from the IMF, which the conspiracy then resells.

The IMF quickly hit back, stating that no bribes were demanded and that the criteria for listing lending pairs were public and voted on by $IMF holders:

Ethereum’s “meme flywheel” may still have to weather some storms.

- 核心观点:$IMF暴跌因连环清算与风控缺陷。

- 关键要素:

- 连环清算致$IMF价格暴跌85%。

- 预言机延迟更新加剧清算风险。

- 团队被质疑抵押套现操纵市场。

- 市场影响:MemeFi项目信任危机加剧。

- 时效性标注:短期影响。