Repurchase distortion and old news are entangled, PUMP's moment of self-affirmation

- 核心观点:Pump.fun回购透明度不足加剧信任危机。

- 关键要素:

- 两笔大额SOL转入回购池但未明确用途。

- 代币价格暴跌60%,回购未提振市场信心。

- 创始人涉Rug Pull旧闻及监管诉讼风险。

- 市场影响:Meme币项目信任门槛进一步抬高。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

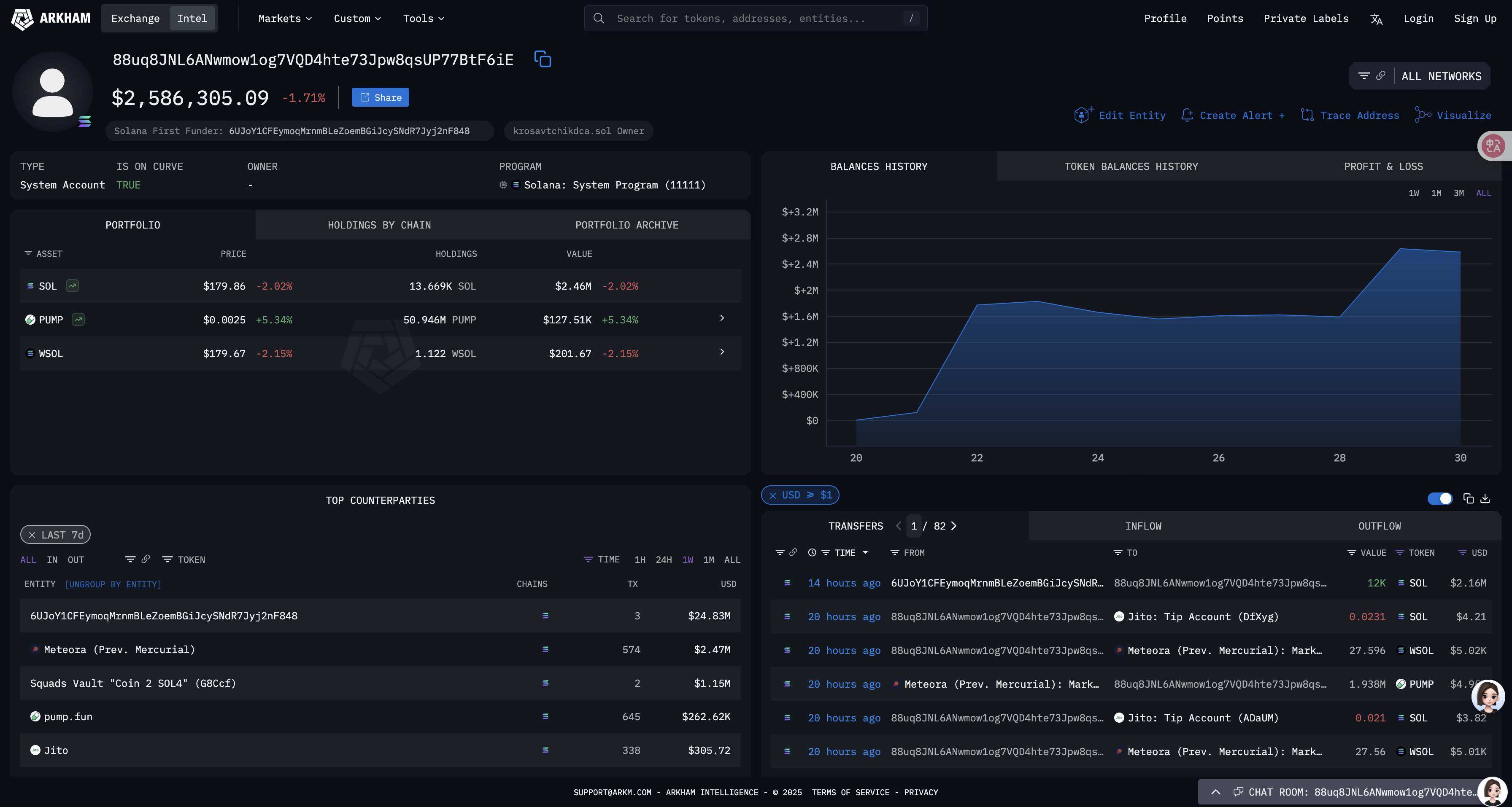

At 4:56 AM on July 30th, on-chain monitoring showed that Pump.fun transferred another 12,000 SOL (approximately $2.16 million) to its "PUMP buyback execution address." This was another large transfer two weeks after the one-time transfer of 187,770 SOL from the fee wallet on July 16th.

While no official announcement of a new buyback cycle or burn plan was made, the community quickly compared this transfer to the previously rumored " 100% buyback of daily revenue ." On-chain observers like Dumpster DAO cautioned that only one day 's revenue had been confirmed to have reached the 100% package requirement, and not all of the packaged amount had been traded. In the absence of deflationary measures like burns and multi-sig lock-up, the "bottom-up buying" remains at the "expected" level.

On the other hand, OKX market data shows that the price of Pump token fell below $0.0023 yesterday , and has retreated more than 60% from its high point on the day of listing on July 16. As of press time, it is currently quoted at $0.002479, with no obvious signs of a pullback.

A "seemingly favorable" deposit, coupled with "deja vu" doubts, added fuel to the trust crisis of Pump.fun that lasted for half a month.

Cryptocurrency prices hit bottom, buybacks questioned: deposits ≠ purchase orders, transparency determines discounts

A speed race of "high valuation-high drawdown"

PUMP launched with a public price of $0.004 and a $4 billion FDV, considered a high-valuation financing round. However, its price plummeted within hours of opening. Multiple on-chain dashboards show that two private equity round addresses cashed out $141 million in six days, realizing a profit of nearly $40 million. Pump.fun has been labeled both a "whale exodus" and a "retail investor takeover."

What about the rumored “100% buyback” slogan?

- Funding source : Commissions - the platform charges 1% and has accumulated over $600 million;

- Implementation path : On July 16 and July 30 , 187,770 and 12,000 SOL were transferred to the repurchase pool in one go respectively;

- Actual buy order : A total of 129,100 SOL on the chain were traded at market price, with the remaining amount remaining at the execution address ( 88uq***F6iE );

- Destination : The 3.828 billion PUMPs obtained from the repurchase were neither destroyed nor entered into the lock-up/treasury multi-signature.

In other words, depositing funds merely highlights potential buying, but fails to answer the three questions of " when will the transaction be completed, where will the purchase be made, and what will be done after the purchase. " The initial purchase price, which averaged $0.0056 , actually resulted in significant losses above the market price over the following two weeks.

External comparison: Bonk.fun's "reflow flywheel" pressure

On July 8, Bonk.fun (LetsBONK)’s share of the new coin issuance market rose to 55.2% for the first time, while Pump.fun’s fell to 34.9% . One of the reasons for this is that Bonk.fun used 58% of its platform revenue to repurchase BONK and immediately destroy it, forming a closed loop of “fees → purchase → destruction → expectation improvement”.

When the opponent writes "buyback + destruction" into the on-chain contract for automatic execution, Pump.fun's "manual payment + undisclosed destination" is naturally subject to a higher discount factor.

Narrative Impact: Solana Co-creates the "Digital Slop"

Even more embarrassing, Anatoly Yakovenko, founder of the underlying public blockchain, derided meme coins and NFTs as " digital slop " in a public conversation with Coinbase, comparing them to opening loot boxes in mobile games. This sentiment quickly spread across social media, branding the "meme × community × early fun" narrative as devoid of intrinsic value, further driving up prices.

Founder Rug's criminal record: the triple shadow of old news, lawsuits and regulation

Questions surrounding the team and its history didn't just begin today. Let's start with some old news. According to a previous WIRED investigation, Pump.fun co-founder and current CTO Dylan Kerler was accused of issuing tokens like eBitcoinCash and EthereumCash in 2017 (when he was 16 years old) under his real name or an alias, then quickly selling them after the price had risen. An analysis by security firm CertiK purportedly characterized this as a "highly suspicious, rug pull"-like operation, with the profit estimated at approximately $75,000 (approximately $400,000 in current terms). As of press time, neither the individuals involved in the report nor Pump.fun officials have publicly responded to the details. In other words, this remains an investigative accusation by the media, but it objectively laid the groundwork for the current debate on trust.

The legal battle intensified significantly in July of this year. The Aguilar v. pump.fun class action lawsuit in the Southern District of New York, filed on July 22nd , introduced RICO (Restricted Income Code) provisions in its amended indictment, naming the Solana Foundation, Solana Labs, and Jito as defendants. The plaintiffs allege that these parties "participated in and benefited from" token design, fee collection, and infrastructure, thereby constituting a "joint offering of unregistered securities." The case is currently in the prosecution and evidence exchange phase, with no court ruling yet ; any conclusion remains subject to judicial proceedings. However, this development has brought the issue of the boundaries of responsibility between public chains and high-profile applications into sharper focus.

On December 3, 2024 , the UK Financial Conduct Authority (FCA) added pump.fun to its "Unauthorized Entity" warning list, subsequently restricting access to UK users. For a meme-based platform driven by "low barriers to entry and high diffusion," this represents both a risk reminder and the real costs of its global narrative, including regional compliance and business contraction.

Even more concerning to the outside world is the reliability of internal governance. A security incident on May 16, 2024 , revealed that the related losses (approximately $1.9 million ) were not caused by a smart contract vulnerability, but rather by a former employee's abuse of authority . For a platform that prides itself on "reducing Rug Risk," this incident is nothing short of ironic: while technically lowering the threshold for issuance and market making, management exposed weaknesses in authority control and process constraints.

From old media reports to escalating litigation, and then to the interrogation of regulators and internal controls, the three parallel threads are working together to show that technology can reduce issuance costs, but it cannot eliminate the cost of trust . When team background, legal uncertainty, and governance gaps are superimposed, the market will naturally factor a higher discount into the PUMP pricing model. Any positive "buyback-to-bottom" action can only offset this structural discount under a verifiable and transparent system .

Conclusion: The next chapter of the trust crisis: three deterministic signals

- Buyback execution rate — continue to track whether the “package balance/actual transaction” is stable and whether funds are transferred on-chain to the DEX or market maker address;

- Where the tokens go — whether the repurchased PUMP will be burned, time-locked, or put into a multi-signature treasury , with a verifiable contract call;

- Institutionalized disclosure - whether the team publishes relevant documents such as the "Repurchase and Governance White Paper" covering the source of funds, price range, frequency, and custody method , and accepts third-party audits.

If all three signals improve simultaneously, Pump.fun still has a chance to rewrite the "1% handling fee → community return" story; otherwise, the logical gap of "deposit ≠ purchase order, purchase order ≠ destruction" will only continue to be magnified by the market.

The narrative of the meme world is always short, flat, and quick: price increases are driven by sentiment, while bottoming out is supported by cash . When buyback plans lack transparency, founders face legal scrutiny, and lawsuits and regulations loom, any new deposit is likely to generate questions rather than exclamation points on the blockchain.

Throwing cold water on the issue may be cruel, but it's a necessary moment of reason in the rapidly evolving Web3 landscape. Pump.fun's next step is to answer not only the question of "where does the money go," but also the question of "where does trust come from."