RWA Weekly Report | US Senate Crypto Bill Released; GENIUS-Compliant Federally Regulated Stablecoin USDtb Coming Soon (July 23-29)

- 核心观点:RWA市场稳中有调,热度持续上升。

- 关键要素:

- RWA链上总价值251.8亿美元,微降0.12%。

- 持有者总数增至33.1万人,周增3.64%。

- 私人信贷资产152亿美元,主导市场。

- 市场影响:推动链上资产精细化和合规化发展。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

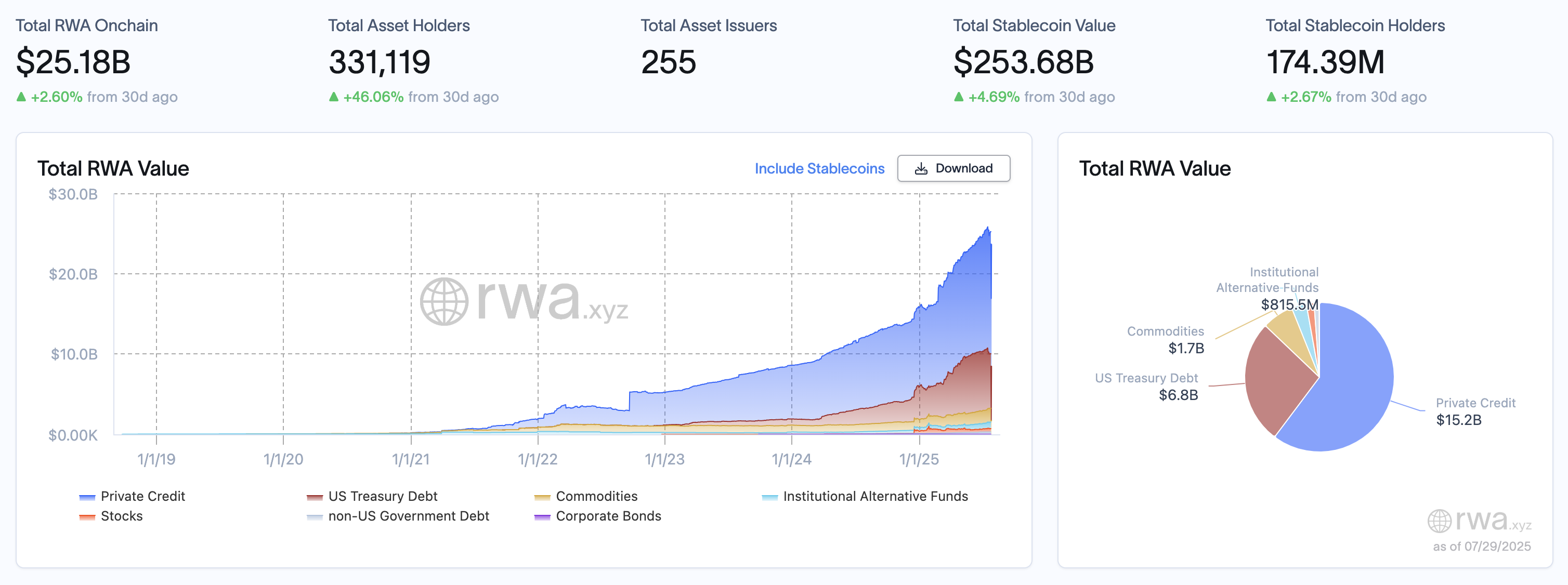

RWA Sector Market Performance

As of July 29, 2025, data from RWA.xyz shows that the total on-chain value of RWA is $25.18 billion , down slightly by $31 million (approximately 0.12%) from $25.49 billion on July 22. Overall, the market remains in a high range, with slight fluctuations. Despite a slight pullback in total market capitalization, ecosystem activity continues to rise. The total number of RWA holders increased from 319,480 to 331,119 , a weekly increase of 11,639 , or 3.64% . The number of asset issuers decreased slightly from 256 to 255, a minimal change. Regarding stablecoins, the total on-chain value increased from $247.72 billion to $253.68 billion , an increase of $5.96 billion, a weekly increase of 2.4% . The number of stablecoin holders increased from 172.94 million to 174.39 million , a weekly increase of 1.45 million, a growth rate of 0.84% .

From an asset management perspective, private credit assets remained at $15.2 billion, continuing to dominate the RWA market. Fund allocations to high-yield, on-chain credit assets remained stable. US Treasury bonds saw a slight pullback, falling from $7 billion to $6.8 billion , a decrease of $200 million. Commodity assets remained unchanged at $1.7 billion , showing a sideways trend. Institutional alternative asset funds saw significant growth this week, increasing by approximately $44.8 million from $770.7 million to $ 815.5 million, a weekly gain of 5.8% .

What are the trends (compared to last week )?

This week, the RWA market continued to demonstrate structural stability with adjustments, while enthusiasm rose against the trend. Despite a slight decrease in total market capitalization to $25.18 billion, the number of on-chain holders reached a new high, with a net increase of over 11,000 in a single week, demonstrating continued growth in market participation and resilience. In terms of fund allocation, private credit remains a core asset, demonstrating a favorable risk-return ratio and serving as an anchor asset in this uncertain cycle. While US Treasury bonds saw a marginal decline, alternative assets continued their upward trend, with a weekly increase of 5.8%. Beyond high-yield investments, the market is also actively exploring non-standard asset products that offer greater flexibility and structural innovation.

From a structural perspective, on-chain assets are no longer simply "debt on-chain" but are gradually entering a refined phase centered on credit stratification, diversified risk models, and scenario-driven approaches . Funds are not exiting the market, but are actively rotating across multiple asset classes. Allocation behavior is beginning to reflect a triple consideration of asset attributes, macroeconomic signals, and on-chain synergy. This shift from a "holding logic" to a "structural logic" is a key sign that the RWA market is entering a new era. Future recommendations focus on the liquidity mechanisms of on-chain credit assets, the regulatory compliance evolution of new non-standard products, and the interoperability of protocols, aiming to identify assets with truly sustainable pricing power amidst structural differentiation.

Review of key events

The US Senate's crypto bill is out, with plans to give regulatory authority primarily to the SEC.

The U.S. Senate Banking Committee released a draft of the Responsible Financial Innovation Act (RFI Act), which proposes bringing most crypto assets under the supervision of the SEC, rather than the Commodity Futures Trading Commission (CFTC), as proposed in the House version of the CLARITY Act. The draft also proposes a "DA Regulation Exemption," clarifies the definition of investment contracts, and authorizes banks to engage in on-chain custody, lending, market making, and other services. The bill aims to establish a clear distinction between crypto-securities and commodities, thereby maintaining the United States' leadership in the digital asset sector.

Anchorage Digital announced a strategic partnership with Ethena Labs to launch USDtb, the first stablecoin in the United States with a GENIUS Act-compliant path. As the only federally chartered crypto bank in the United States, Anchorage Digital will issue USDtb domestically through its stablecoin issuance platform, providing institutional clients with compliant and secure access to the digital dollar.

Tether CEO: We will promote USDT's compliance in the United States

After the GENIUS Act was signed, Tether CEO Paolo Ardoino stated that he would promote USDT to enter the US market through the new law's "foreign issuer channel" and planned to launch a domestically produced dollar stablecoin. Although USDT has never completed a full audit, Tether has pledged to meet compliance requirements within three years.

Circle to Issue Interest-Bearing Stablecoin USYC Natively on BNB Chain

According to BNB Chain's official announcement, Circle will issue USYC, an interest-bearing stablecoin natively on BNB Chain. USYC, backed by US Treasuries, supports on-chain interest calculations and near-instant USDC exchange, allowing users to earn returns while maintaining liquidity. BNB Chain claims that USYC will enhance its RWA ecosystem, improve user capital efficiency, and drive an upgraded DeFi experience.

Goldman Sachs and Bank of New York Mellon jointly launch money market fund tokenization program

Goldman Sachs and Bank of New York Mellon (BNY Mellon) have partnered to launch a blockchain-based money market fund tokenization solution. BNY clients can now invest in tokenized money market funds through the Goldman Sachs platform, with their holdings recorded on-chain. The project, which has attracted participation from major asset managers such as BlackRock, Fidelity, and Federated Hermes, aims to build a real-time, low-friction digital financial infrastructure.

Archax acquires German digital asset firm DDA, expanding its European crypto ETP portfolio

Archax, a UK-based digital asset exchange, will acquire Deutsche Digital Assets (DDA), a German-regulated crypto asset manager, to strengthen its presence in key European financial markets, including the UK, Germany, and France. DDA currently manages approximately $70 million in assets and specializes in distributing crypto exchange-traded products (ETPs) through European banks and asset managers. The acquisition will provide Archax with new licenses under Germany's BaFin, including portfolio management and investment advisory, enabling it to better serve institutional clients in the EU.

CME Group announced it has entered the second phase of its asset and payment tokenization testing program with Google Cloud, focusing on settlement scenarios. The two parties are exploring the use of Google Cloud Universal Ledger to facilitate the tokenization of cash and non-cash assets within the clearing ecosystem. CME Chief Operating Officer Suzanne Sprague stated that the solution is expected to be launched in 2026. CME is also developing stablecoins and cross-asset tokenization approaches to enhance risk management and capital efficiency.

Hot Project Dynamics

R2 (R2USD)

One sentence introduction:

R2 , a stablecoin-backed RWA ETF, aims to become the "Robinhood of Tokenized Yield." By bringing real-income assets like US Treasuries, money market funds, and rentals to the blockchain, and launching the yield-generating stablecoin R2USD, R2 aims to provide low-barrier-to-entry, on-chain "deposit-style income" to users worldwide. R2 focuses on delivering RWA returns to end users. Through the R2USD stablecoin, users can easily access a variety of compliant strategies, including government bonds and private lending, to achieve stable on-chain returns.

Currently, the R2 final test network has over 550,000 users and over 50,000 daily active users. The main network is expected to be officially launched in September.

Latest News:

On July 25, the stablecoin-driven on-chain yield platform R2 was officially selected for the tenth MVB (Most Valuable Builder) ecosystem acceleration program jointly initiated by BNB Chain, YziLabs, and CoinMarketCap.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Latest News:

On July 21, MyStonks announced a deep strategic partnership with BIT, a global professional digital asset trading platform .

On July 29th, the Mystonks platform launched a zero-fee policy for token-to-token transactions . All users will no longer be charged any fees for token swaps within the platform, making trading permanently free. The platform's transparent matching mechanism ensures zero slippage, fully predictable on-chain prices, and its core smart contracts are open and traceable, eliminating any hidden fees.

Related links

Sort out the latest insights and market data for the RWA sector.

" A Deep Dive into Jia Yueting's Entry into RWA: Who is the New Director Behind the Veteran Actor? "

He once used PowerPoint presentations to raise funds for car manufacturing, and now wants to use pre-orders to fund coin creation. Jia Yueting is packaging the "faith economy" into RWA.

Corporate Financing Revolution: Tokenization without Equity Dilution vs. Open Ecosystem Liquidity Engine

Hong Kong's RWA holds a gold mine worth hundreds of billions of yuan. SMEs should not just focus on the kiwifruit on the supply chain, as shortcuts to compliance have emerged.