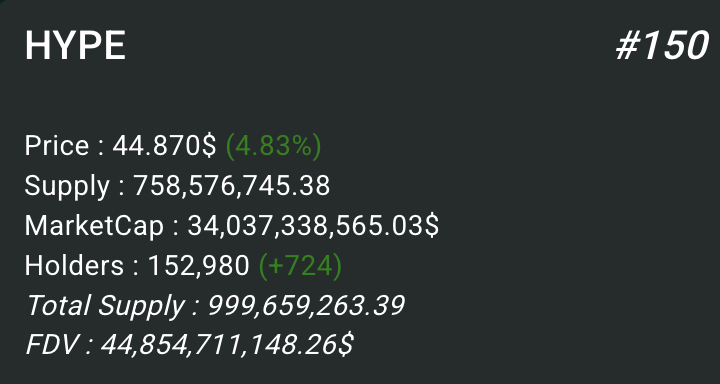

Deconstructing the Panorama of HYPE Valuation: How does Hyperliquid support a market value of tens of billions?

- 核心观点:Hyperliquid(HYPE)估值被严重低估。

- 关键要素:

- 日收入稳定250-300万美元,增长超两倍。

- 团队代币释放缓慢,估值基础合理。

- 传统金融关注度低,潜在资金流入大。

- 市场影响:或引发市场对HYPE价值重估。

- 时效性标注:中期影响。

Original text | Keisan.hl ( @Keisan_Crypto )

Editor | Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: In today's crypto market, rife with bubbles and narratives, how has Hyperliquid (HYPE) so quickly catapulted into the multi-billion dollar market cap club? Is it a result of temporary hype, or is it rooted in the long-term value of its products and mechanisms? Keisan.hl, starting with token economics and comparing leading traditional finance and crypto projects, systematically analyzes Hyperliquid's current market performance and underlying logic, constructing a relatively comprehensive valuation framework.

It's been about six months since I first published my valuation framework for HYPE. A lot has changed in that time, but a lot has also remained constant. I remain as bullish on HYPE as ever.

Let’s look at some data.

Underwriting Revenue

One of the biggest challenges in valuing HYPE is finding a comfortable valuation based on annualized revenue (i.e., cash flow). Hyperliquid is an early-stage startup with rapid growth, so you might consider factoring that growth into your numbers. However, it's also in a cyclical industry, with bear market volumes potentially being approximately 50% lower than bull markets. My personal view is that Hyperliquid's rapid user growth, capital inflows, and other positive catalysts will more than offset the decline in volume associated with a bear market. This is supported by the significant increase in average daily revenue over the past six months.

As for changes in trading volume during a bear market, I believe that even if Bitcoin enters a bear market in the short term, the decline in trading volume will not be as drastic as in the past due to the continued inflow of funds from ETFs and the current more friendly attitude of US policy towards cryptocurrencies. Of course, this is still a factor to consider, and revenue may decrease by approximately 50% over a few years, so we will conservatively use the average trading volume of the recent bull market as our forward benchmark (US$3 million), that is, without considering growth.

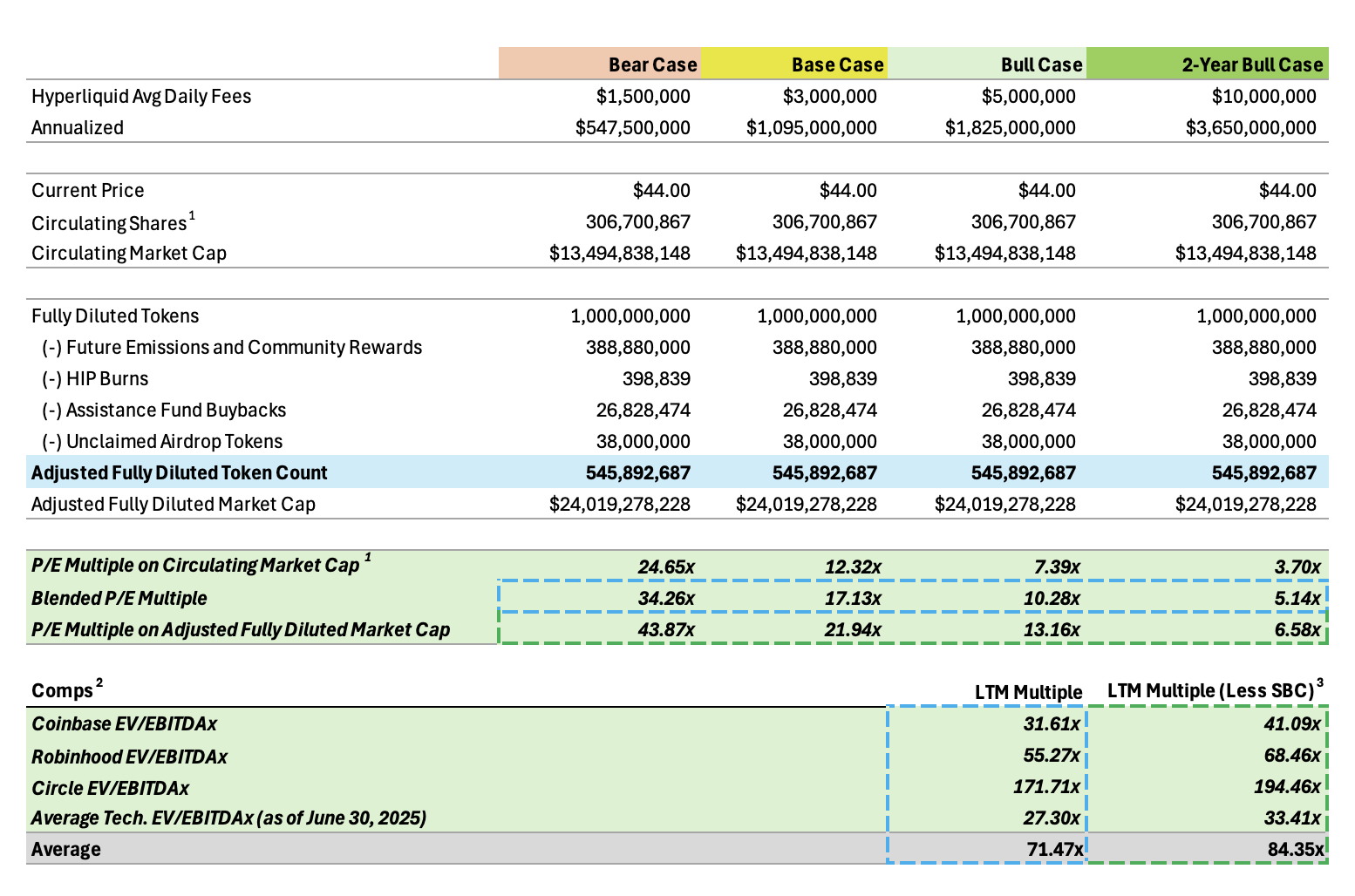

Odaily Note: The author of this article published a valuation framework in January. When compiling, we still used the original valuation method to interpret the data in this chart.

A valuation multiple is made up of two core elements: price (valuation) and earnings (revenue/fees).

First, I split and analyzed the fee data according to different time periods.

I then looked at the total amount of tokens across two dimensions: circulating supply and adjusted fully diluted supply.

- The circulation volume is easy to understand. It is the number of tokens actually circulating in the market, which is roughly equal to the number of airdrops issued, minus the part destroyed through HIP (governance proposal) and the repurchase of the aid fund.

- The concept of fully diluted supply is often confusing, with many mistakenly believing it to be the mandatory reference value for project valuation. In reality, HYPE's fully diluted supply is fixed (no inflation), with 38.888% reserved for future token releases and community rewards. Additionally, 3% is allocated for community funding programs, 1.2% has been repurchased by the fund, and 0.1% has been burned through HIP transaction fees.

In my calculations, I've excluded buybacks and burns , as well as future releases/community grants, which haven't yet been issued. My assumption is that a significant portion of this 38.888% of tokens will be released gradually over a long period of time in the form of staking rewards. As for the community grants, I consider them to be positive expected value (+EV) investments, positive expenditures designed to strengthen the community and ecosystem.

Of the remaining uncirculated tokens , 23.8% is reserved for the team and future members, and 6.0% is reserved for the foundation. I 've included both of these components in the adjusted supply, but this assumption is conservative, as the team is unlikely to sell or distribute these tokens in the near term. The token release cadence is very slow, so they should be heavily discounted in the valuation. It's important to reiterate that this team has no need to cash out or achieve a liquidity event.

Personally, I believe the most reasonable valuation base token count should be somewhere between the circulating supply and the adjusted fully diluted supply.

The price-to-earnings (P/E) ratios calculated based on 7 days of data are as follows:

- The price-to-earnings ratio based on float is approximately 12.3 times

- The price-to-earnings ratio based on adjusted fully diluted supply is approximately 21.9 times

I believe the most reasonable valuation benchmark is somewhere in between these two, which we can call the blended P/E multiple, which is approximately 17.1 .

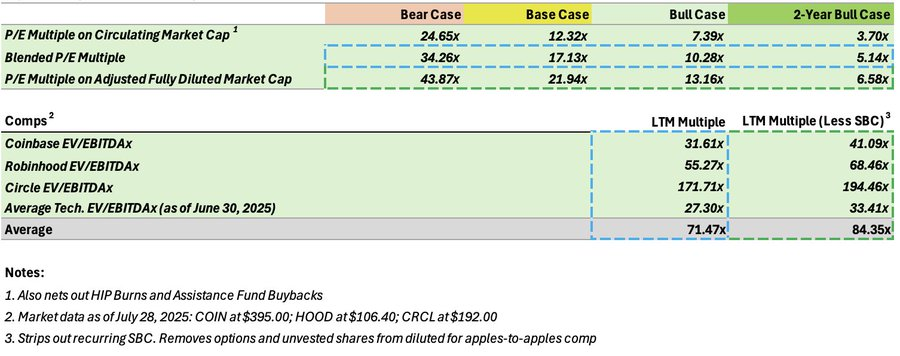

Public Company Comparison (Comps)

Which brings us to the most interesting part of valuation: comparing it to publicly traded companies. HYPE is incredibly cheap at its current price.

If you’ve been following me, you’ve heard me say many times that “no one knows how to value HYPE.” Indeed, many people don’t understand the logic behind this, particularly how team tokens are factored into the fully diluted supply (FDV) and how this aligns with traditional public companies.

Publicly listed companies often issue stock-based compensation (SBCs), primarily to senior management and key employees. Many analysts tend to view these as one-time expenses, excluded from the company's operating expenses. I disagree. In my view, treating annual recurring expenses amounting to hundreds of millions of dollars as one-time expenses is highly unjustified.

I can confirm that Coinbase (COIN), Robinhood (HOOD), and Circle (CRCL) have been paying SBCs for approximately 25% of their adjusted EBITDA for years. These aren't one-time issuances; they're real, ongoing equity expenditures. They go directly into the pockets of executives through additional stock issuances, while also diluting the equity of existing shareholders. These are real costs.

Therefore, if we want to include these expenses in our valuations, we must exclude the stock options already included in equity as they vest over the next few years. I've made the corresponding adjustments in the "LTM Multiple (Excluding SBC)" column by removing the "to-be-issued" SBC shares and adding the SBC amount back into the expense (which these companies often exclude when reporting EBITDA).

Why is this important? Because when many people evaluate HYPE, they count 100% of all tokens held by the team as FDV, but they ignore the fact that listed companies actually have "unlimited FDV" and can continue to distribute SBCs to executives every year.

So, how do you achieve a fair and comparable valuation? Here’s my approach:

- If you want to compare actual net cash flow received by shareholders , use the “LTM Multiple (net of SBC)” to compare public company valuations while counting 100% of Hyperliquid’s team tokens in the total supply.

- If you prefer to report adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), as is customary for public companies (i.e., without considering the sustainability of SBCs) , then use a "blended supply multiple": tokens in circulation (excluding team tokens) + a 50% inclusion of team tokens. This assumes the team has already received half of the tokens, with the remaining half released over the next few years, much like SBCs.

It is worth mentioning that SBC is issued in unlimited quantities, while team tokens are limited in total. You can see that no matter which valuation method is used, HYPE appears to be extremely attractive.

Finally, let's talk about profitability. Coinbase, Robinhood, and Circle have significantly lower free cash flow margins than Hyperliquid. This means that when their revenue declines, their EBITDA shrinks significantly, while their expenses remain substantial. Hyperliquid's free cash flow, on the other hand, is cleaner, more sustainable, and more defensible.

Here’s another piece of data: Coinbase has 4,300 employees, Robinhood has 2,500, and Hyperliquid’s core team has only 12 people.

HYPE's bull market expectations

Speaking of bull market expectations, I think most people are seriously underestimating HYPE's potential. They are simply valuing it based on current revenue and simply discounting the bull market premium.

But have they ever considered how big the TAM (total addressable market) of this market is?

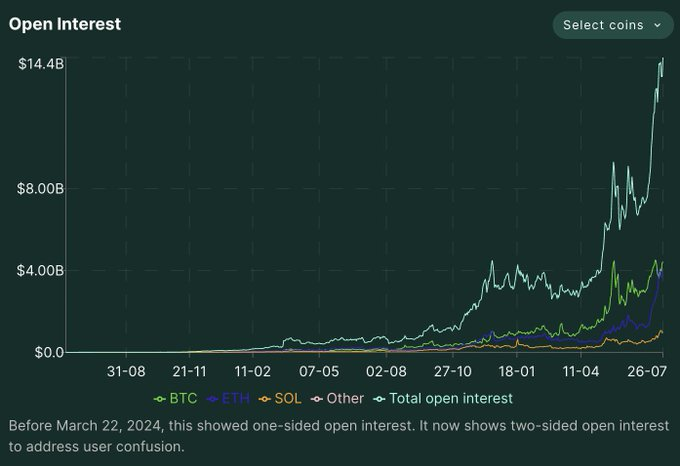

Perpetual contracts are one of the largest markets in the crypto space, second only to stablecoins. Currently, Hyperliquid accounts for approximately 10% of the perpetual contract market. Its share of the spot CLOB (centralized limit order book) market is even lower.

More importantly, HyperEVM is just getting started. HIP-3 and the various new perpetual contracts to be launched in the future will expand Hyperliquid from a "crypto perpetual contract platform" to a "perpetual trading platform for all global assets." The areas I'm most excited about include stocks, pre-IPO private equity, prediction markets, foreign exchange, and commodities.

Perpetual swaps are the best financial products on the planet, and Hyperliquid is the "AWS of perpetual swaps," offering extreme scalability, complete decentralization, and transparency.

Traditional finance and other non-cryptocurrency communities have yet to truly understand the power of perpetual contracts. However, once this product is discovered, its potential will be enormous.

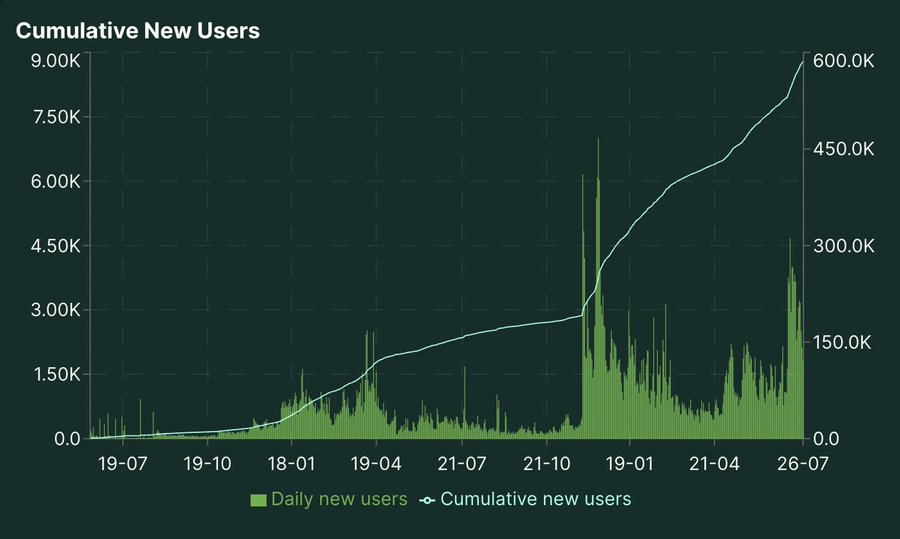

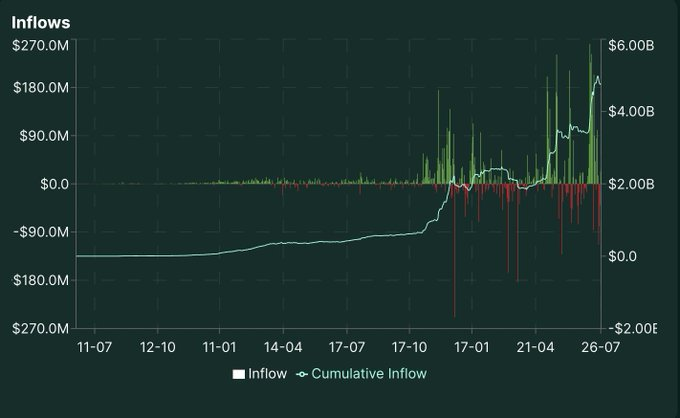

Back to the numbers. Six months ago, when I first wrote the valuation framework, Hyperliquid was generating roughly $1 million in revenue per day (due to a short-term surge in trading volume following the Trump announcement). Now, that number has stabilized between $2.5 and $3 million per day, more than tripling. User and capital inflows have also grown in tandem.

Currently, Hyperliquid accounts for approximately 5% of all CEX trading volume. Imagine if this figure reaches 25% in the next few years, meaning daily revenue could rise to $15 million. Based on this, HYPE's free cash flow valuation multiple would drop to 5x.

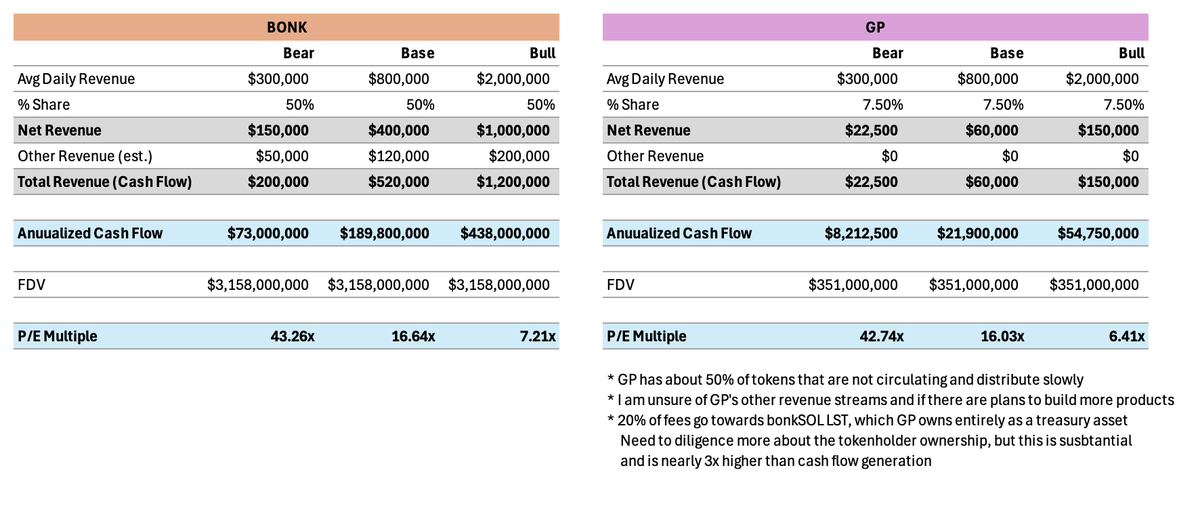

Comparison with other crypto tokens

It’s not really fair to compare HYPE to other tokens because there aren’t many truly comparable projects.

The only references available at the moment are several memecoin launch platforms that have strong product-market fit (PMF) and can generate stable cash flow, such as BONK, GP, and PUMP.

I hold positions in BONK and GP and believe they are among the most undervalued projects currently besides HYPE.

I used to be a long-term investor in PUMP, but I've reduced my holdings. I believe they've been eliminated from the competition, which is understandable. Their model lacks a defensible moat, making it vulnerable to disruption by other platforms. BONK's non-exploitative model is winning, as evidenced by various on-chain data.

Traditional finance's attention

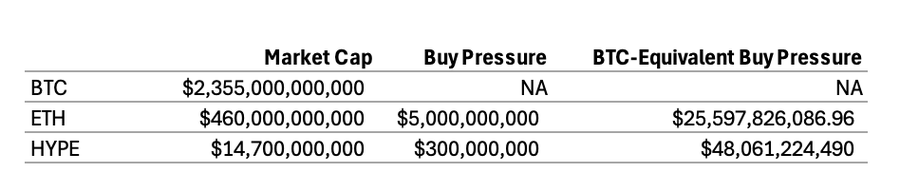

Traditional finance is entering the crypto space. Since the launch of ETFs, Bitcoin and Ethereum have attracted $50 billion to $100 billion in inflows, setting a record for ETFs.

So, what assets are traditional finance most likely to favor? Of course, it is a token that can generate considerable cash flow, has a sustainable moat, and a highly defensible model.

A Bloomberg analyst once asked: "What is behind Hyperliquid?" Although this question is a bit sarcastic, it is exactly the core question that traditional finance has raised about encryption for many years.

And now, we finally have the answer, and it's a complete grand slam answer.

HYPE hasn't been widely discovered in traditional financial circles simply because the team hasn't done any marketing. Any other team would have already made thousands of calls to solicit investment. But Jeff and his team have their own style.

Don't be fooled by appearances, though. Wall Street will eventually discover HYPE.

I believe that once SONN goes online, this will be a huge turning point. SONN has $300 million in reserve funds to purchase HYPE and will fully promote HYPE together with Paradigm and Galaxy Digital.

Odaily Note: SONN is Sonnet BioTherapeutics, which reached an $888 million business combination agreement with Rorschach I LLC to transform it into a crypto reserve company called Hyperliquid Strategies Inc. (HSI).

This purchasing power is equivalent to $48 billion in Bitcoin purchasing power (Bitcoin ETFs have only attracted $15 billion in inflows this year). It can be said to be a super catalyst.

Token Distribution

Currently, HYPE has only about 150,000 holding addresses, which is lower than many memecoins on Solana (for example, SOL has more than 10 million holdings).

The problem is that HYPE's current distribution channels are limited, making it difficult for ordinary users to buy. Most existing holders have already made substantial profits and may not have a strong incentive to continue increasing their holdings. This will inhibit price increases.

But things are changing. Coinbase and Binance declined to list HYPE for obvious reasons. However, many front-ends and fiat on-ramps are being built for Hyperliquid. Phantom launched a perpetual contract front-end based on Hyperliquid's builder code, attracting 15,000 to 20,000 users in two weeks. Leveraging this distribution network could be a huge catalyst for $HYPE, and there are others in the works. I believe treasury companies like SONN and HYPD will also become great distribution networks, not just for large traditional finance funds. This may take time and will become more pronounced as they mature.

Data performance

Hyperliquid's performance is impressive, perhaps even among the best of all cryptocurrencies. After the massive growth Hyperliquid has experienced recently, it's truly astonishing to see where the price is right now. I'll just share a few charts.

User growth has hit a new high since TGE, capital inflows have accelerated and reached a historical high, and open interest (OI) has also reached a historical high.

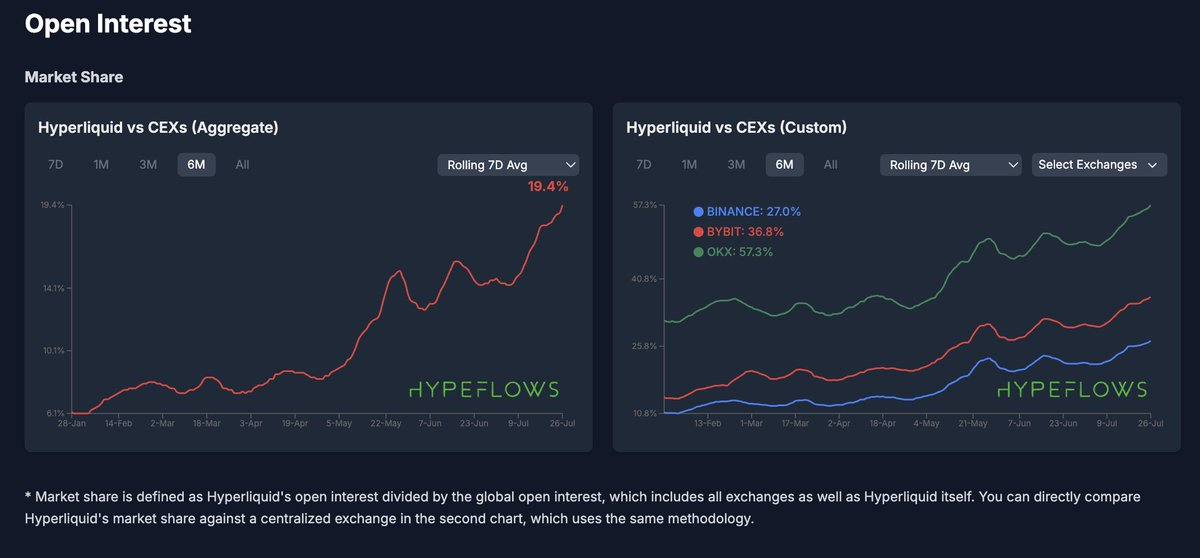

Comparison of Hyperliquid and CEX data: Compared with CEX, trading volume is at a historical high; compared with CEX, holdings continue to break historical highs.

Meanwhile, SWPE (relative premium indicator) is at its lowest point since April, suggesting that current prices are attractive.

The driving force behind the next round of growth

The key factors that I believe will drive HYPE's growth include:

- Front-end distribution: Builder code is one of Hyperliquid's best innovations. The front-end will also handle marketing, something Hyperliquid has never done before.

- Construction of fiat on-ramps: I’ve heard from a few different sources (not directly from Hyperliquid, but Hyperliquid-related apps or frontends) that this is coming soon.

- HIP-3: A new product, only possible on Hyperliquid, which will bring a huge token burn to HYPE.

- SONN: Will bring Wall Street funds into HYPE and inject $300 million of buying pressure into HYPE.

- Spot collateral for perpetual swaps trading: Based on the testnet deployment, this appears to be in the works, and I think this will be a huge unlock for the platform and the HYPE token. We’ll likely see increased trading volume and significant BTC holders depositing funds into Hyperliquid.

- More spot assets are coming online. @hyperunit has been hard at work and continues to list top assets. The PUMP launch was a huge success, a testament to the strength of our team. Hyperliquid listed perpetual contracts before the TGE, and @hyperunit launched spot immediately during the TGE, quickly building the thickest order book. Both events were huge user acquisitions, as evidenced by the inflows during those days.

These are just some of the catalysts. I've been writing for over an hour and still haven't covered them all.

Summarize

HYPE's current valuation is still very cheap. You don't hold enough and may not truly understand its potential.

HYPE's current valuation is still very cheap. You don't hold enough and may not truly understand its potential.