A terrifying night of crashes: a record high of $13.5 billion in single-day liquidations, with wealth flowing wildly

- 核心观点:特朗普关税政策引发加密市场全面崩盘。

- 关键要素:

- BTC跌16%破10.2万美元。

- 24小时爆仓191.3亿美元。

- 巨鲸做空获利超3亿美元。

- 市场影响:引发大规模清算与市场恐慌。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

At 5 a.m., the market collapsed.

Last night, Trump announced that he would impose a 100% tariff, which would be added to the existing tariffs . This news was like a lit fuse, detonating the market and causing the panic index to soar.

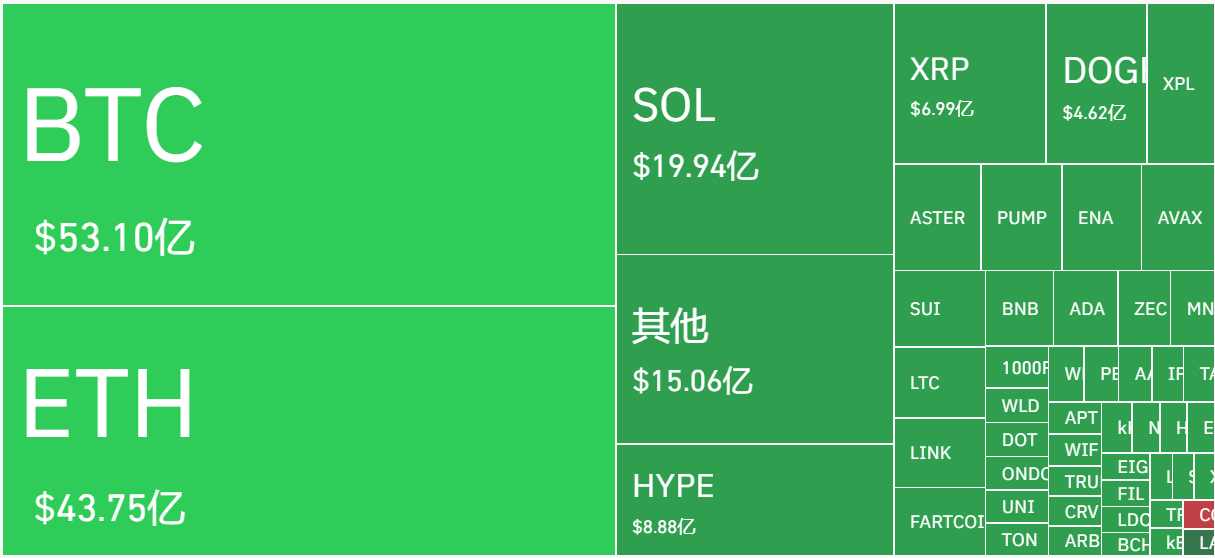

BTC once fell below $102,000, hitting a low of $101,516, with a 24-hour drop of 16% ; ETH hit a low of $3,400, with a 24- hour drop of 22% ; SOL fell below $150, hitting a low of $141.3, with a 24-hour drop of 31.83% .

If mainstream cryptocurrencies are in such a state, the situation for altcoins is even worse. IP, for example, plummeted from a low of $7.8 to around $1 within an hour, a drop of 87%. It has temporarily rebounded to $4.8. PUMP, on the other hand, plummeted from a low of $0.00488 to $0.000411 before recovering to $0.00385.

Binance's staking products, WBETH and BNSOL, were also affected. WBETH plummeted to a low of $430.65, a drop of over 800%, while BNSOL plummeted from $213 to $34.9, a drop of over 500%. Even stablecoins were not spared. USDE briefly hit $0.65, depreciating by 54%, before recovering to around $0.96.

The derivatives market was the most visible amplifier of this collapse. Coinglass data shows that over the past 24 hours, 1.6 million people worldwide experienced margin calls, totaling $19.13 billion, the highest single-day liquidation ever . This included $16.679 billion in long positions and $2.454 billion in short positions. The largest single liquidation occurred in Hyperliquid's ETH-USDT exchange, valued at approximately $203 million.

This time, it is an all-round and indiscriminate sweep of the entire crypto market.

Initially, everyone thought it was a normal minor pullback. After all, just a week earlier, BTC had broken through $126,000, reaching a new all-time high. Standard Chartered Bank raised its forecast to $135,000 in a report, while JPMorgan Chase was even more optimistic, pointing to $165,000.

No one expected that such a high point would become the starting point of the abyss.

Magic operation - escaping the top with a clear card

Even in this market situation, there is no shortage of god-level operations.

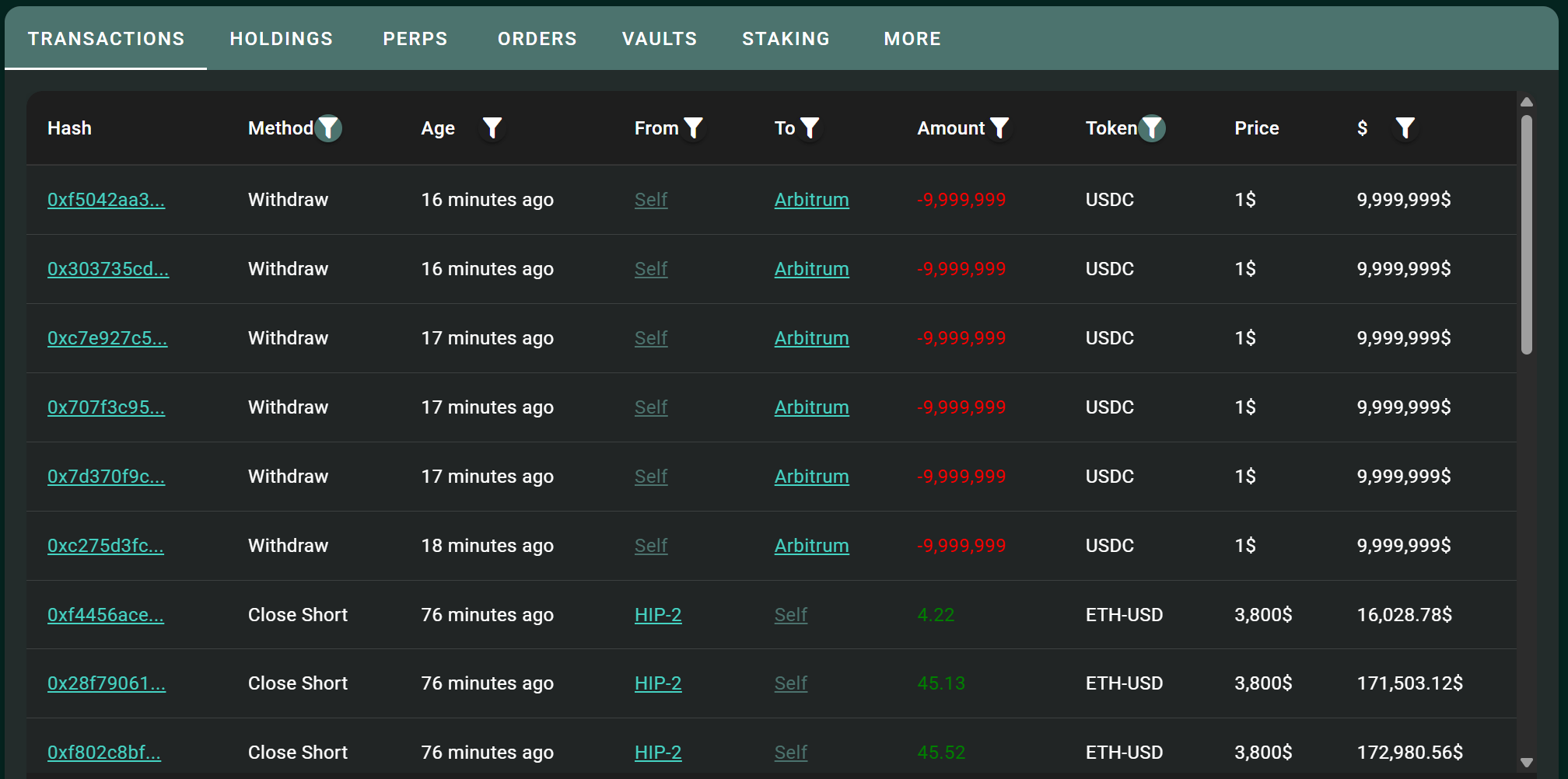

Yesterday, a Bitcoin whale increased its short positions on BTC and ETH, bringing its total position to over $1.1 billion. Currently, on-chain data shows that its position has been completely liquidated, withdrawing $60 million from the Hyperliquild platform. According to on-chain analyst Lookonchain, this OG may be connected to Trend Research, a firm under Yi Lihua.

In fact, Yi Lihua himself has indeed expressed his "bearish" stance on social media many times in recent days.

According to on-chain analyst Lookonchain, Trend Research has deposited 145,000 ETH into exchanges since October 3rd, worth approximately $654 million at the time. As of October 5th, only 7,163 ETH remained on the exchange. A rough estimate suggests the firm has profited as much as $303 million on ETH this round.

Conclusion

Just 2 hours are enough to rewrite the fate of many market participants.

Some people became a speck of dust in the $13.4 billion margin call, while others caught the $60 million opportunity bounty from the collapsing building.

Most of the targets are recovering from the bottom 2 hours ago, while some currencies are "taking the opportunity" to flatten out. Odaily will continue to follow up as soon as possible.