TL,DR

- In July 2025, the US economy will continue to experience a combination of rising inflation and weakening growth momentum. Both CPI and core inflation are above the Fed's 2% target, making it difficult to support a shift to easing in the short term. While the labor market is generally stable, it has shown marginal weakness. The rebound in consumption is modest and precarious, while high interest rates and credit costs continue to dampen consumer spending. Disagreement within the Federal Reserve over the timing of rate cuts has intensified, with the market anticipating a possible September cut, though this remains dependent on subsequent inflation and employment data. Meanwhile, geopolitical risks and domestic policy wrangling are exacerbating market uncertainty. The Fed is maintaining a high interest rate and a wait-and-see approach, putting pressure on overall market risk appetite.

- Crypto market trading volume saw a significant increase in July, reaching an average daily volume of $161.2 billion, a 56% increase from the previous month. The daily volume exceeded $200 billion several times, bringing the total market capitalization to $3.94 trillion (up 16.2%). BTC held a 60.6% market share, while ETH held an 11.8% market share. Funds were flowing rapidly from BTC to ETH and its ecosystem, and market sentiment was rapidly improving. Newly launched popular tokens were primarily infrastructure projects, with Layer 1 and Layer 2 projects (such as Chainbase, ZKWASM, Caldera, and ERA) attracting the most attention. DeFi applications remained a key growth driver.

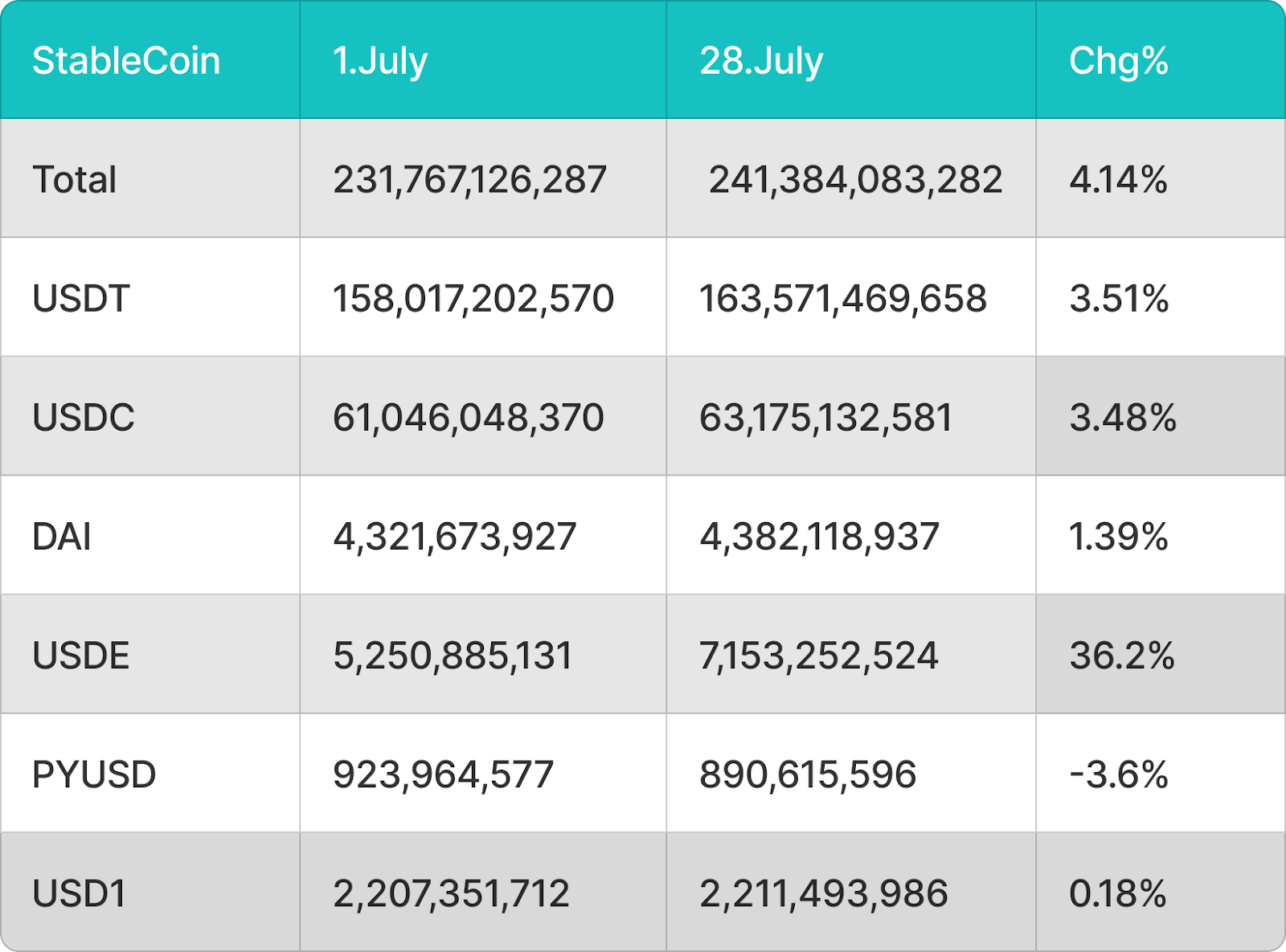

- In July, BTC spot ETFs saw net inflows of $20.15 billion, while ETH saw a net inflow of $10.71 billion, driving price increases of 11.46% and 55.83%, respectively. Ethereum's appeal was stronger. During the same period, the circulating supply of stablecoins surged by $9.617 billion, with the USDE leading the market with a 36.2% monthly surge.

- This week, BTC made several unsuccessful attempts to break through $120,000. It reached a high of $120,113 on July 23rd before retracing to a low of $114,759. Currently trading around $119,600, it remains capped by its 20-day moving average (around $116,300). Ethereum (ETH) has shown the strongest performance, rising from $3,740 to $3,881 over the past two days. ETFs have seen net inflows of $2.4 billion over the past six days. A break above $3,745 could signal a move to $4,094–$4,868. Solver (SOL) has been relatively weak, hitting a low of $184 since falling below $200. It is currently consolidating between $187 and $190. A break below $176 could push it down to $157.

- US-listed companies such as SharpLink and Bitmine have significantly increased their ETH holdings and pledged them on-chain, creating an "Ethereum version of MicroStrategy" and driving ETH's transformation from a technical asset to an institutional reserve asset. The GENIUS Act, the first federal stablecoin law in the United States, officially came into effect, clarifying the regulatory path for stablecoin banks, stimulating stablecoin inflows and accelerating institutional deployment of on-chain payment and settlement applications. The Solana ETF (SSK), the first to support on-chain staking, was listed in the US, pioneering a "staking + cash dividend" structure and marking a new era for crypto ETFs as yield-based products.

- The CLARITY Act has passed the House of Representatives and is now under consideration in the Senate. It is expected to boost compliance and capital inflows into the US crypto market. The Solana spot ETF approval process is accelerating, with multiple institutions submitting applications and the SEC expected to approve the application by October at the latest. An Ethereum-collateralized ETF led by BlackRock is also under review and is expected to be approved in the fourth quarter of 2025.

1. Macro perspective

In July 2025, the US macroeconomy continued to experience a pattern of recurring inflation and weakening growth momentum. While inflation has rebounded somewhat compared to previous months, it remains significantly below the Federal Reserve's 2% target, maintaining a highly prudent monetary policy stance. Furthermore, a marginal cooling in the labor market and a rebound in consumer spending, albeit on a shaky basis, compounded by uncertainties arising from geopolitical and domestic policy wrangling, continued to weigh on market sentiment.

Inflation remains above target

From an inflation perspective, June CPI data showed that the US annualized overall inflation rate rebounded to 2.7%, with core inflation rising slightly year-on-year to 2.9%. The increase in input costs caused by tariff adjustments has led to particularly pronounced price increases in the service sector, particularly in housing, healthcare, and insurance. Several Federal Reserve officials emphasized that current data does not yet support an immediate easing cycle, and the sustainability of core inflation remains to be further confirmed. In the short term, policy will remain focused on maintaining stability.

The labor market is stabilizing but cooling marginally

Nonfarm payrolls increased by 147,000 in June, below the 12-month monthly average. The unemployment rate edged down from 4.2% to 4.1%. Initial jobless claims have declined for six consecutive weeks, indicating the overall resilience of the labor market. However, hiring intentions in sectors like manufacturing and construction have weakened, and employers in some regions have begun to slow the pace of hiring, indicating marginal signs of weakness.

Consumption rebound is moderate

In terms of consumption, retail sales grew by 0.6% month-on-month in June, marking the first rebound in nearly three months. Non-essential goods and online consumption showed relatively positive recovery. However, high interest rates, rising credit costs, and declining savings rates continue to dampen consumers' appetite for mid- to high-end consumption. Data indicates that consumers in many regions remain conservative about high-priced goods, and the recovery momentum in the tourism and accommodation sectors has weakened. While consumption hasn't deteriorated significantly, its resilience remains challenged.

Interest rate policy divergences intensify

Regarding monetary policy, the market generally expects the Federal Reserve to maintain its benchmark interest rate at 4.25%-4.50% at its July 30th FOMC meeting, marking the fifth consecutive pause in rate hikes. Despite marginal improvements in inflation data, disagreements within the Fed regarding the timing of rate cuts have intensified. Some dovish members are calling for a swift rate cut to mitigate potential growth risks, while hawkish members favor holding rates steady until inflation has more clearly subsided. Market expectations currently suggest a rate cut could begin as early as September, with the probability of two cuts this year steadily increasing.

Geopolitical uncertainty

Internationally, the conflict in the Middle East has not significantly subsided, the fighting in Ukraine continues, and while the US and China have resumed trade dialogue, deep differences remain on key issues such as high technology and data regulation. Meanwhile, domestic controversy over the Federal Reserve has sparked political doubts about the independence of monetary policy, putting pressure on policy transparency and credibility. These combined internal and external risks have impacted corporate confidence in medium- and long-term investment, putting continued pressure on market risk appetite.

Outlook

In summary, the US economy in July 2025 is at a critical juncture, characterized by a multifaceted dynamic. Inflation remains below target, employment momentum is weakening, the consumer recovery is fragile, and monetary policy signals remain unclear. In the short term, the Federal Reserve will remain data-driven, maintaining a cautious and observant approach. The market is closely watching the performance of core economic data in August and September, as well as the direction of geopolitical risks. If subsequent data supports a sustained decline in inflation and increasing employment pressures, the Fed may formally initiate interest rate cuts in the fall.

2. Crypto Market Overview

Currency data analysis

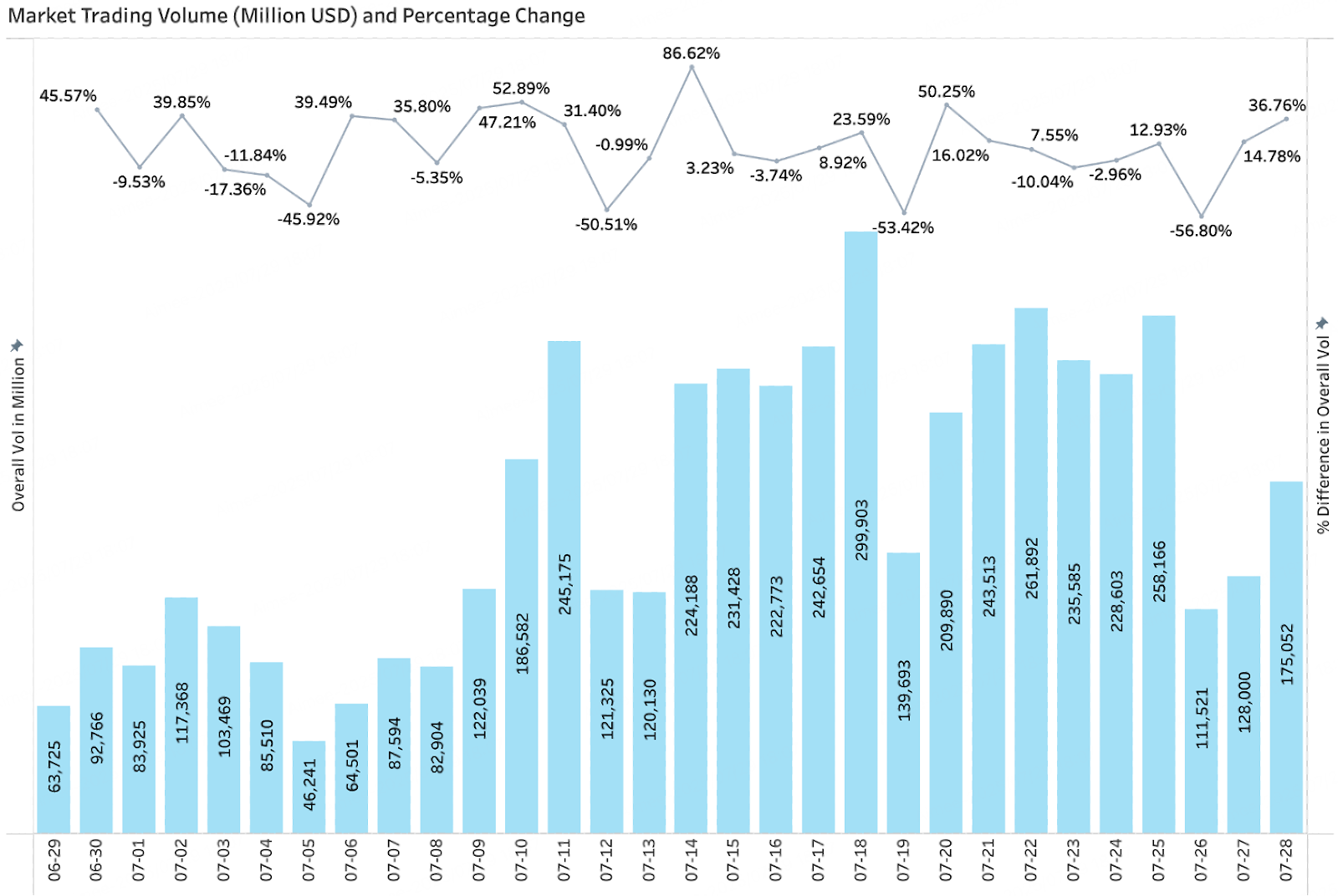

Trading volume & daily growth rate

According to Coingecko data, as of July 28th, overall crypto market trading volume showed a significant upward trend in July, reaching an average daily trading volume of approximately $161.2 billion, a 56% increase over the previous period. Market activity continued to rise, with two periods of particularly high volume, from July 11th to 18th and from July 21st to 25th, when the market saw two rounds of concentrated increases, with single-day trading volumes repeatedly exceeding $200 billion. This reflected a massive influx of capital and a rapid rise in market sentiment. Overall, driven by BTC breaking through its all-time high and ETH leading the way, the market is in a short-term upward cycle, with structural opportunities accelerating and investors' risk appetite significantly increasing.

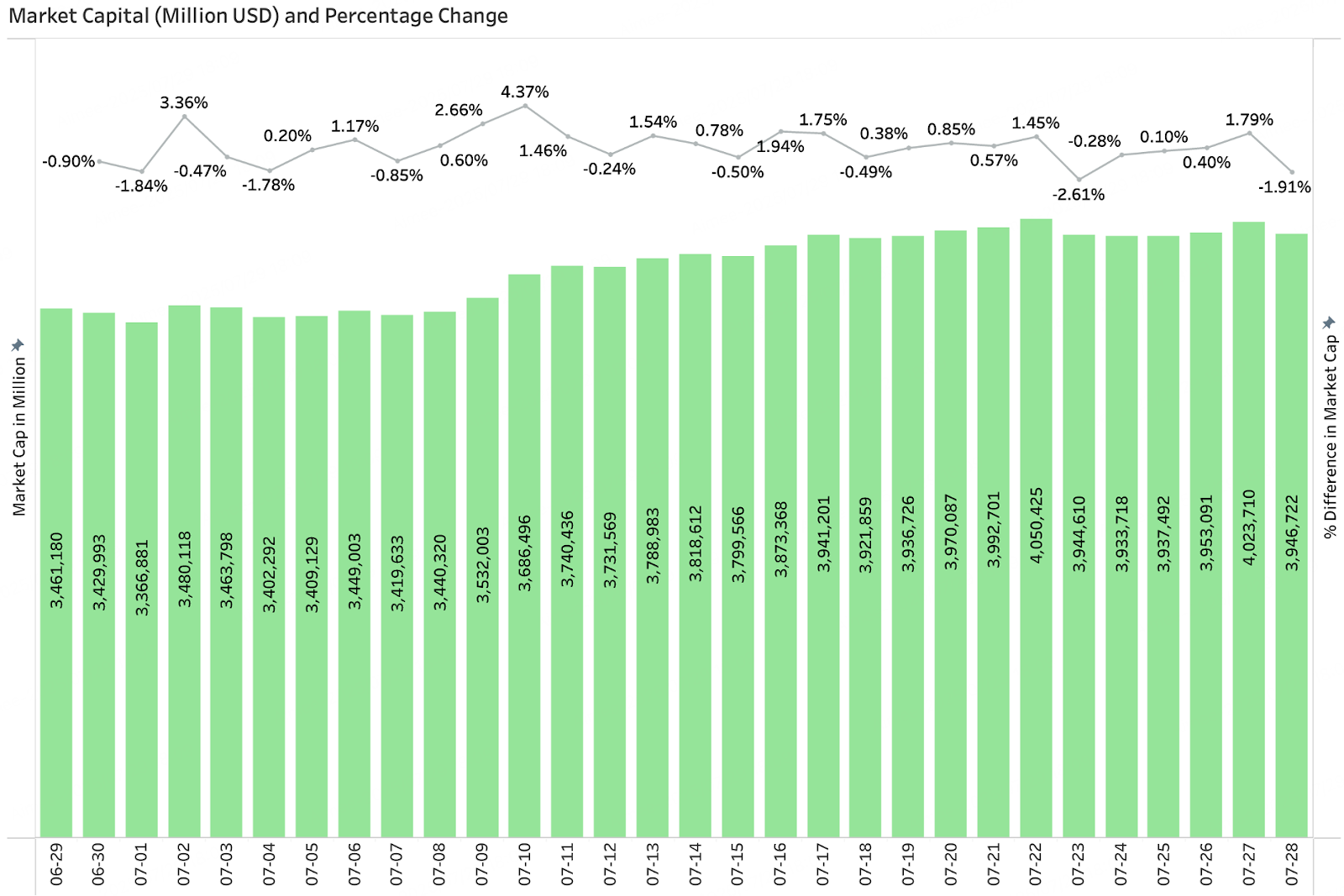

Total market value & daily growth

According to Coingecko data, as of July 28th, the total cryptocurrency market capitalization rose steadily to $3.94 trillion, a 16.2% increase from the previous month. BTC held a 60.6% market share, while ETH's market share rose to 11.8%. The ETH/BTC exchange rate rose to 0.32. ETH has outperformed BTC this cycle, and funds are gradually flowing from BTC to ETH and its ecosystem. The total market capitalization exceeded $4 trillion on July 22nd, setting a new high. Since July 11th, the growth rate has significantly accelerated, reflecting continued capital inflows driven by the rise of mainstream assets and the restoration of market confidence. Driven by BTC's repeated record highs, ETH's strong leadership, and the rotation of hot sectors, the expansion of the crypto market capitalization has shown structural characteristics, indicating that the overall market is entering a new upward cycle.

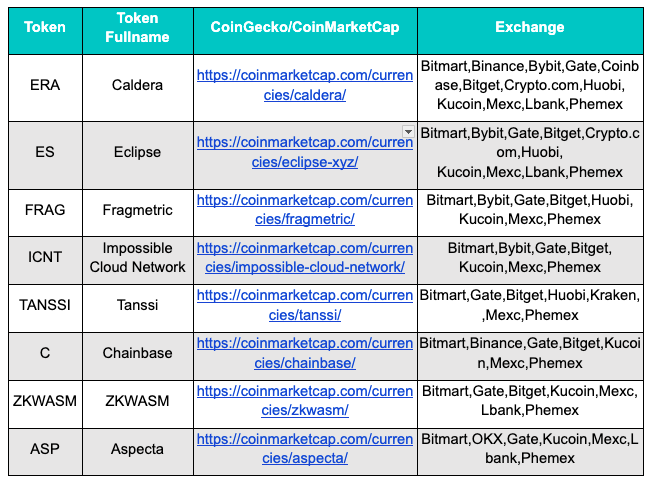

July's new popular tokens

Among the popular tokens launched in July, infrastructure projects were the most popular. Layer 1 and Layer 2 projects—Chainbase, ZKWASM, Caldera, and ERA—were the most popular. DeFi projects like Aspecta also garnered considerable attention, demonstrating the market's dual emphasis on underlying technologies and the decentralized financial ecosystem. Overall, investors showed strong interest in infrastructure projects that enhance blockchain performance and scalability, while DeFi applications remained a key growth driver.

3. On-chain data analysis

3.1 Analysis of BTC and ETH ETF Inflows and Outflows

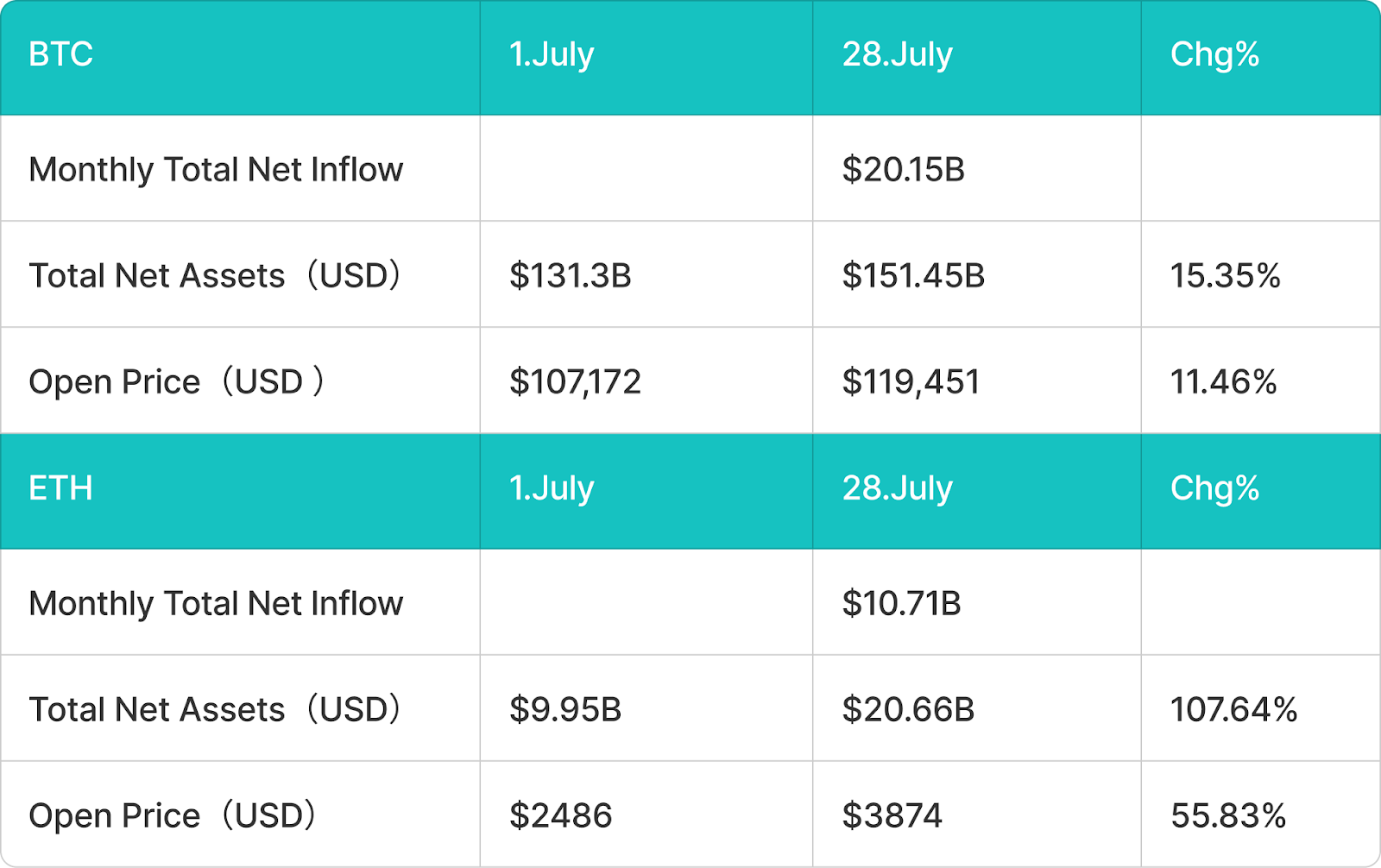

BTC spot ETFs saw a net inflow of $20.15 billion in July

Market sentiment continues to improve, and Bitcoin prices have maintained a steady upward trend. As of July 28th, Bitcoin's opening price for the month rose from $107,172 to $119,451, an increase of 11.46%. Bitcoin spot ETFs saw strong inflows, with a cumulative net inflow of $20.15 billion in July, pushing total net assets from $131.3 billion to $151.45 billion (a 15.35% increase).

ETH spot ETFs saw a net inflow of $10.71 billion in July

Ethereum performed even more impressively, with significant price increases. As of July 28th, ETH's opening price soared from $2,486 to $3,874, a monthly increase of 55.83%. Ethereum spot ETFs also attracted significant capital investment, with net inflows of $10.71 billion in July and total net assets jumping from $9.95 billion to $20.66 billion (a 107.64% increase), reflecting the market's strong confidence in the Ethereum ecosystem.

3.2 Analysis of Stablecoin Inflows and Outflows

The total circulation of stablecoins surged by $9.617 billion in July, with the USDE soaring 36.2% in a single month.

In July, driven by the passage of the Stablecoin Act, the total circulating supply of stablecoins surged by $9.617 billion (+4.14%) to $241.38 billion. USDE led the market with an astonishing 36.2% growth (adding $1.9 billion), while USDT (+$5.55 billion) and USDC (+$2.13 billion) contributed significantly to the increase.

4. Price analysis of mainstream currencies

4.1 Analysis of BTC Price Changes

This week, BTC has repeatedly attempted to break through the $120,000 resistance level, most notably on July 23rd, when it briefly touched $120,113 before retreating under pressure and gradually dropping to around $114,759 (the low of July 25th). The price has rebounded slightly in recent days to around $119,600. Despite this short-term rebound, the price remains below its 20-day moving average (around $116,300), indicating that bears still have some upward momentum.

Technically, BTC is currently consolidating between $110,530 and $116,000, attempting to establish a bottom. A successful rebound from this level would increase the likelihood of a retest of $123,000, potentially opening the way to $135,000. A failure to hold $110,530 could trigger a further decline to the psychologically important $100,000 mark. While the rally over the past two days has boosted confidence, it hasn't broken through key resistance, prompting caution.

4.2 Analysis of ETH Price Changes

ETH has seen strong performance this week, with its price rising from approximately $3,740 to its current price of approximately $3,881 over the past two days, representing a daily increase of approximately 3–4%, significantly outpacing both BTC and SOL in cumulative growth. According to on-chain and ETF data, ETH spot ETFs have attracted approximately $2.4 billion in net inflows over the past six trading days, far exceeding the $827 million in inflows of BTC ETFs over the same period, demonstrating a clear trend of capital concentration towards Ethereum.

Technical analysis shows that ETH is at a critical juncture in its push towards $3,745 resistance. If it can break through and hold this level with significant volume, it could subsequently reach $4,094 resistance, opening a path to $4,868. However, a pullback below $3,500 or the 20-day moving average (around $3,234) could weaken upward momentum and lead to a short-term correction. The recent slight rebound over the past two days could be seen as a prelude to a breakout if the strength continues.

4.3 Analysis of SOL Price Changes

Sol (SOL) has been weak this week. After failing to break through the key $200 resistance level, the price quickly retreated and fell below the $185 round-number support level, reaching a low of around $184. Currently hovering between $190 and $187, the price has formed a typical inverse head and shoulders or cup and handle pattern on the chart. A break above the $180-188 resistance zone could signal an upward reversal, targeting around $220. However, a break below short-term support at $176 (or near the 20-day moving average) could accelerate the correction towards the $157 area.

Over the past two days, Sol has seen only a slight rebound, significantly lagging behind ETH and BTC. Market enthusiasm is low, with new investors showing less interest and long-term holders also showing signs of reducing their holdings. Overall, Sol is still in a correction, with bulls yet to make a significant comeback.

5. Hot events of this month

Ethereum's MicroStrategy drives price gains

Recently, US-listed companies such as SharpLink, Bitmine, Bit Digital, and BTCS have continued to increase their ETH holdings and are establishing an "Ethereum MicroStrategy" through on-chain staking. As of July 21, 2025, SharpLink held approximately 358,000 ETH (with a market capitalization of approximately $1.278 billion), Bitmine held 300,700 ETH, Bit Digital held 120,300 ETH, and BTCS held 31,900 ETH. SharpLink has surpassed the Ethereum Foundation to become the world's largest institutional holder of ETH. Driven by Wall Street investors such as ARK Invest, Bitmine plans to increase its ETH allocation to 5%, further strengthening ETH's market positioning as an "enterprise-grade asset."

With ETH prices rebounding and continued net inflows into ETFs, ETH is undergoing a transformation from a retail-driven technology asset to an institution-led reserve asset. Current institutional holdings exhibit a dual focus: SharpLink represents the native crypto community, while Bitmine represents traditional capital flows. This is driving ETH into a new narrative cycle characterized by a trinity of "staking, reserves, and governance." The overall trend suggests that ETH is entering a phase of institutional revaluation, driven by ETFs, listed companies, and on-chain nodes.

US stablecoin bill passed

On July 17, 2025, the U.S. House of Representatives passed the GENIUS Act by a vote of 308 to 122, and the President signed it into law the following day, marking the first federal regulation in U.S. history regarding U.S. dollar stablecoins. The law establishes the eligibility criteria for "Permitted Payment Stablecoin Issuers" and requires, among other things, that issuers must be federally or state-approved banks or trusts, hold cash or short-term U.S. Treasury bonds as reserves, disclose their balances daily to the public, prohibit the reuse of collateral, offer no interest returns, and be subject to oversight by the Treasury Department, the Office of the Banking Commissioner (OCC), and the Bank Secrecy Act. The bill also exempts stablecoins from securities and commodities laws, explicitly removing them from SEC/CFTC jurisdiction as securities or commodities, placing them solely under the oversight of banking regulators.

Shortly after the signing, the crypto asset market rebounded significantly: major crypto assets such as Bitcoin and Ethereum rose sharply, with Ethereum rising by about 50% in July and Bitcoin's price rising by 10.27%. Stablecoins inflows reached US$9.617 billion. At the financial institution level, payment giants such as JPMorgan, Mastercard, and Visa accelerated the issuance of stablecoins or explored on-chain payment solutions; traditional banks and online platforms (such as Circle, Coinbase, PayPal, Amazon, and Walmart) also quickly followed suit, integrating stablecoins into payment, cross-border settlement, and corporate cash management businesses, thereby promoting the application of stablecoins into the mainstream financial services market.

First Solana-Staking ETF Listed in the US

In July, the United States welcomed the historic launch of the first cryptocurrency ETF permitted for staking: the REX-Osprey Sol + Staking ETF (SSK). The fund received regulatory approval and officially listed on the Cboe BZX exchange earlier this month. The ETF's key feature is its built-in "staking" mechanism: a portion of the fund's Sol assets will be staked on-chain to participate in Solana network validation activities, earning approximately 7% annualized staking rewards and distributing regular cash dividends to investors, similar to the "fixed deposit + dividend" model in traditional finance. Approximately 60% of the fund's Sol assets will be staked on-chain, generating an annualized return of approximately 7%, which will be distributed in cash. The remaining 40% will be invested in an overseas Solana ETP product, circumventing the 19b-4 process and gaining listing approval solely through S-1 registration. This "staking + dividend" structure distinguishes SSK from ETFs that simply track Sol futures, and the market sees it as a landmark achievement following the Trump administration's deregulation of crypto.

Influenced by the news, SOL briefly surged 6% in early July. Grayscale, VanEck, Bitwise, and other institutions have also submitted their S-1 applications for the Solana Spot ETF, with revised versions expected by the end of July. The SEC is expected to complete its review in mid-to-late August (the deadline is October 10th). Furthermore, spot-staking ETFs, including Ethereum, are expected to follow suit and be listed soon.

6. Outlook for next month

CLARITY Act

The highly anticipated Digital Asset Market Clarity Act (CLARITY Act) has successfully passed the U.S. House of Representatives and will officially enter the Senate for deliberation in late July, marking a key step forward in U.S. crypto asset regulation. The bill aims to clarify the classification standards and regulatory boundaries for crypto assets, dividing the responsibilities of the SEC and CFTC for the first time, and providing a clear compliance path for decentralized projects, stablecoins, DeFi protocols, and more. If successfully passed, the bill will have three major positive impacts:

- Enhance regulatory certainty, encourage projects and exchanges to operate in compliance, and boost institutional confidence;

- Giving the CFTC greater regulatory authority and weakening the SEC's regulatory authority is expected to end years of regulatory disputes;

- Confirm the legal status of DeFi and self-custody, reduce the compliance burden on developers, and clear obstacles for decentralized innovation.

Anticipating favorable policies, several blue-chip DeFi projects and exchange-traded assets have rebounded since mid-July. If the Senate's August deliberations proceed smoothly, and the House version maintains its support for DeFi exemptions and "mature chain" provisions, the CLARITY Act is expected to become a significant turning point in driving a new round of compliance and capital inflow into the US crypto market.

SOL Spot ETF and Ethereum Staking ETF Review

Progress on the Solana spot ETF is accelerating. Seven institutions, including Grayscale, VanEck, Fidelity, and Franklin, submitted their S-1 registration statements to the SEC in mid-June. These documents generally cover the staking mechanism and redemption process design. The SEC requires applicants to submit revised versions by July 31st to clarify the specific operational details. Regulations stipulate that the SEC's deadline for reviewing this type of ETF is October 10, 2025. However, if the applicants submit supplemental documents on time, the market generally expects the SEC to make an earlier decision in mid-to-late August. If approved, Solana will become the third mainstream crypto asset to receive spot ETF support, following Bitcoin and Ethereum.

Regarding Ethereum staking ETFs, BlackRock submitted a revised 19b-4 filing on July 16th, proposing to partially or fully stake ETH holdings through a trustee staking service provider to generate additional returns. Grayscale submitted an application to add staking functionality to its ETH trust product earlier this year, but as of June, it was still under review, with approval potentially delayed until October at the latest. The SEC issued its first regulatory guidance for crypto ETFs on July 7th, clarifying that standardized procedures will be implemented for staking, custody, and profit distribution, and considering introducing a unified filing template to shorten the approval process to 75 days. If the overall process proceeds smoothly, the first ETH staking ETFs could be approved as early as the fourth quarter of 2025.

- 核心观点:加密市场7月强势反弹,机构加速布局。

- 关键要素:

- 加密总市值增长16.2%至3.94万亿美元。

- ETH现货ETF净流入107.1亿美元,涨幅55.83%。

- 美国首部稳定币法案通过,市场信心提振。

- 市场影响:加速机构资金入场,推动合规化进程。

- 时效性标注:中期影响。