Original author: TechFlow

Question micro-strategy, understand micro-strategy, and become micro-strategy.

Since MicroStrategy took the lead in including Bitcoin (BTC) in its asset reserves in 2020, more and more U.S.-listed companies and even global companies have followed suit, and holding coins has become an obvious trend in the stock and cryptocurrency circles.

As of 2025, the number of companies holding crypto assets has surged from the initial single digits to dozens.

However, this trend of corporate holdings has split into several different trends:

Bitcoin is still a safe choice due to its strongest consensus; Ethereum (ETH) and Solana (SOL) have also attracted many followers due to their widely recognized foundations;

Today, this trend of companies buying coins has even spread to the field of altcoins with smaller market capitalization, such as Fetch.ai's $FET and Bittensor's $TAO in the AI sector.

Looking back at history, ETH fell by about 26.7% in a single day in June 2022, and SOL fell by 43% in November 2022 due to the bankruptcy of FTX. The fragility of AI coins is even more obvious. For example, the advent of DeepSeek's open source AI model has caused a collective retracement of AI Agent tokens on the market chain. FET and TAO, which have larger market capitalizations, have volatility of about 15% and 18% respectively in the past 30 days.

Is it feasible for listed companies to allocate these more volatile altcoins?

Who is planning AI coins?

To answer this question, let’s take a look at which companies are already investing in these AI tokens, as well as the strategies and risks behind them.

Interactive Strength (TRNR): Buy FET, fitness + AI big leap forward

Interactive Strength is a Nasdaq-listed company that primarily sells professional fitness equipment and related digital fitness services. It owns the CLMBR and FORME brands.

To put it simply, it is by selling hardware equipment such as fitness mirrors and climbing machines, supplemented by supporting fitness courses and digital platforms.

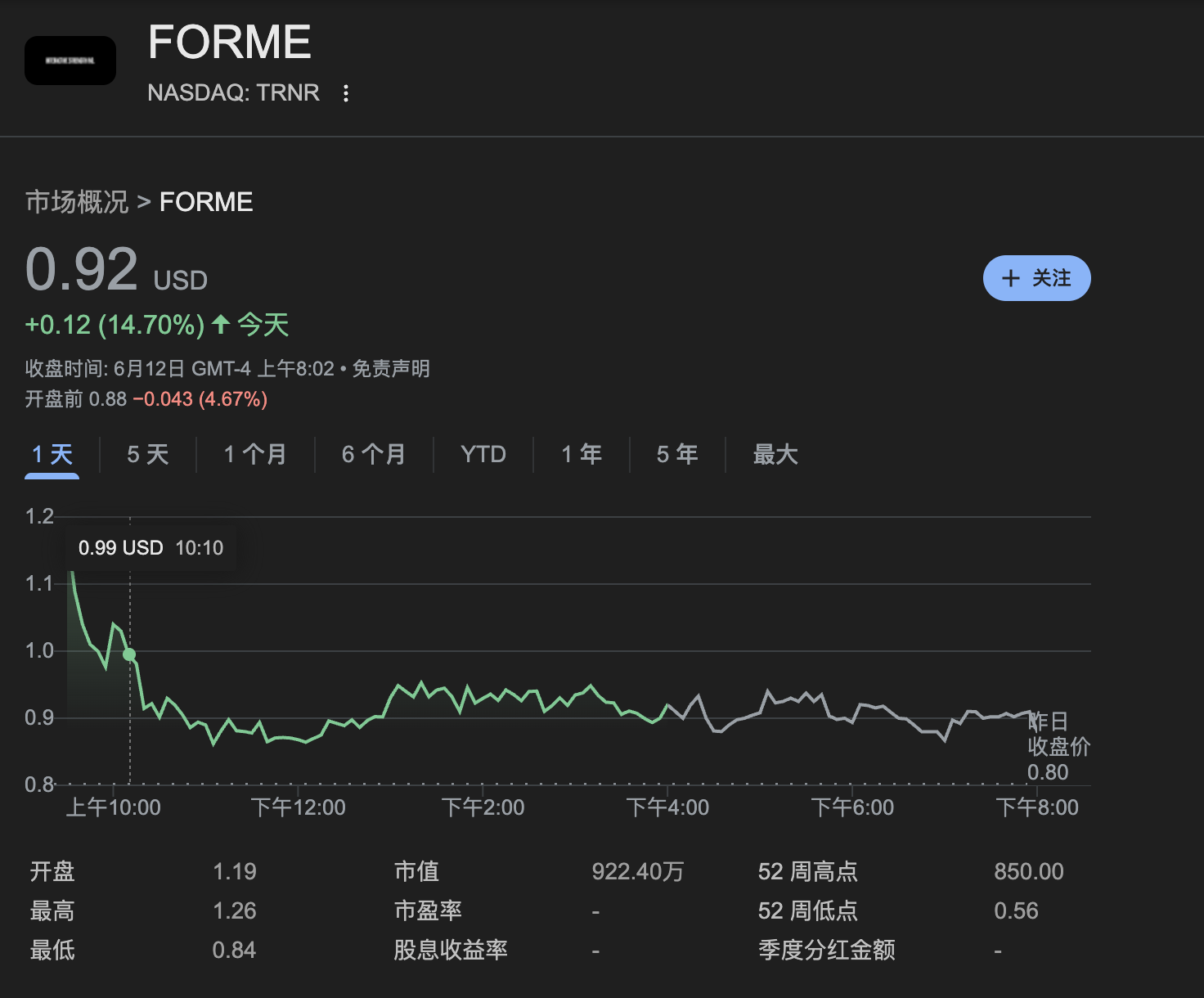

At last count, the company's market value was about $8.4 million.

On June 11, the company announced plans to invest $500 million in $FET tokens as a strategic crypto reserve, which the company plans to use to support AI-driven fitness products.

CEO Ward said the choice of FET over more widely held assets such as Bitcoin reflects the company's plans to incorporate Fetch.ai's technology into its product offerings.

Currently, Interactive Strength has received $55 million in start-up funding from ATW Partners and DWF Labs.

The source of this funding is the so-called "Securities Purchase Agreement", which simply means that the company sells stocks to the above-mentioned investors in exchange for cash, and the purchased FET tokens are kept by BitGo, a professional custodian. In addition, the transaction method is to purchase FET directly from the market rather than over-the-counter (OTC).

ATW Partners is a private equity giant, and DWF Labs is a veteran market maker in the crypto circle. Why are they willing to pay?

The answer may lie in the bundling of interests.

ATW is interested in TRNR's fitness + AI story, and DWF also has the need for market-making $FET.

DWF Labs received 10 million FET from Fetch.ai in September 2024, then deposited these FETs with the exchange and made a market for FET.

After all, if the $500 million is fully in place now, it can buy about 6.41 million $FETs (calculated at the current price of $0.78 per piece). Buying directly on the market may have a positive impact on prices in the short term.

After the news was announced, the market was very receptive.

On the 11th, TRNR's stock price rose by 15%, and $FET also rose by 7%. As of now, it has fallen back.

But like some companies that bought ETH before, the company's total market value is only 8.4 million US dollars. It is not easy to raise 500 million to buy FET. The stock price has to be raised step by step. If the market cools down or the $FET ecosystem fails, the money may be wasted.

In the short term, this move is like a gamble; in the long term, success or failure may depend on whether there is room for the AI fitness business to be implemented.

Synaptogenix (SNPX): Buy TAO, a biotech company turns around with the help of a big boss

Synaptogenix is a biopharmaceutical company focused on developing bryostatin-1-based products for the treatment of neurodegenerative diseases such as Alzheimer's disease. The company has a market cap of just $5 million.

On June 9, the company announced an initial investment of $10 million to purchase Bittensor’s $TAO tokens, with plans to gradually increase the purchase to $100 million.

As for the funds, they initially come from the company's existing cash reserves, and in the future they plan to be supplemented by a $550 million Series D convertible preferred stock private placement. Similar to MicroStrategy, the holders initially hold preferred shares (with fixed dividends) and convert them into common shares under certain conditions, such as when the stock price reaches an agreed price. SNPX uses this to attract institutional funds (hedge funds or family offices).

The manipulator behind this coin purchase transaction is James Altucher, a well-known figure in the investment circle.

James is a widely followed entrepreneur, investor and best-selling author who has founded or invested in more than 20 companies across a variety of fields including technology, finance and media. He was also a hedge fund manager and participated in early-stage investments in many startups.

James publicly promoted the potential of blockchain technology and became an early supporter of the field long before Bitcoin was widely accepted. During the crypto boom in 2017, he was called the "Bitcoin Prophet" due to a large number of online advertisements.

In SNPX’s business, he is responsible for developing and executing $TAO investment strategies. Specifically, he led the token purchase plan, including choosing phased market purchases to optimize costs, and screening Bittensor subnets (such as Subnet 1, which focuses on machine learning tasks) for staking to pursue more returns.

Recently, he has been constantly sharing the logic of trading SNPX and purchasing TAO on X, and bluntly stated that buying SNPX stock is equivalent to buying TAO at half the price.

The key to the joining of bigwigs is that they can attract private equity funds through their personal connections and attract institutional investors to pay attention to the transformation of SNPX, a pharmaceutical company.

Considering the company's motivation, the motivation for this transformation stems from the bottleneck of the biopharmaceutical business. The clinical data of Brujostatin therapy did not meet expectations, the prospects for FDA approval were unclear, and the company's stock price remained sluggish for a long time.

SNPX hopes to realize asset appreciation by holding $TAO and staking income. Public information shows that it even plans to rename the company and stock code to strengthen the positioning of AI tokens.

After the news was made public on the 9th, SNPX's stock price rose by 40% at one point, reflecting the market's short-term optimism about the transformation.

However, the initial investment of $10 million is more than twice the company's market value. If the price of $TAO falls below $300, the asset value may shrink by more than 25%, and the financial risk is significant.

Whether the $550 million private placement can be successful depends largely on James Altucher's appeal and market sentiment. If the funds are not in place, the transformation plan may be interrupted. The income from staking $TAO is not stable compared to the 18% volatility of $TAO tokens in 30 days.

This is clearly a high-risk, high-reward turnaround battle.

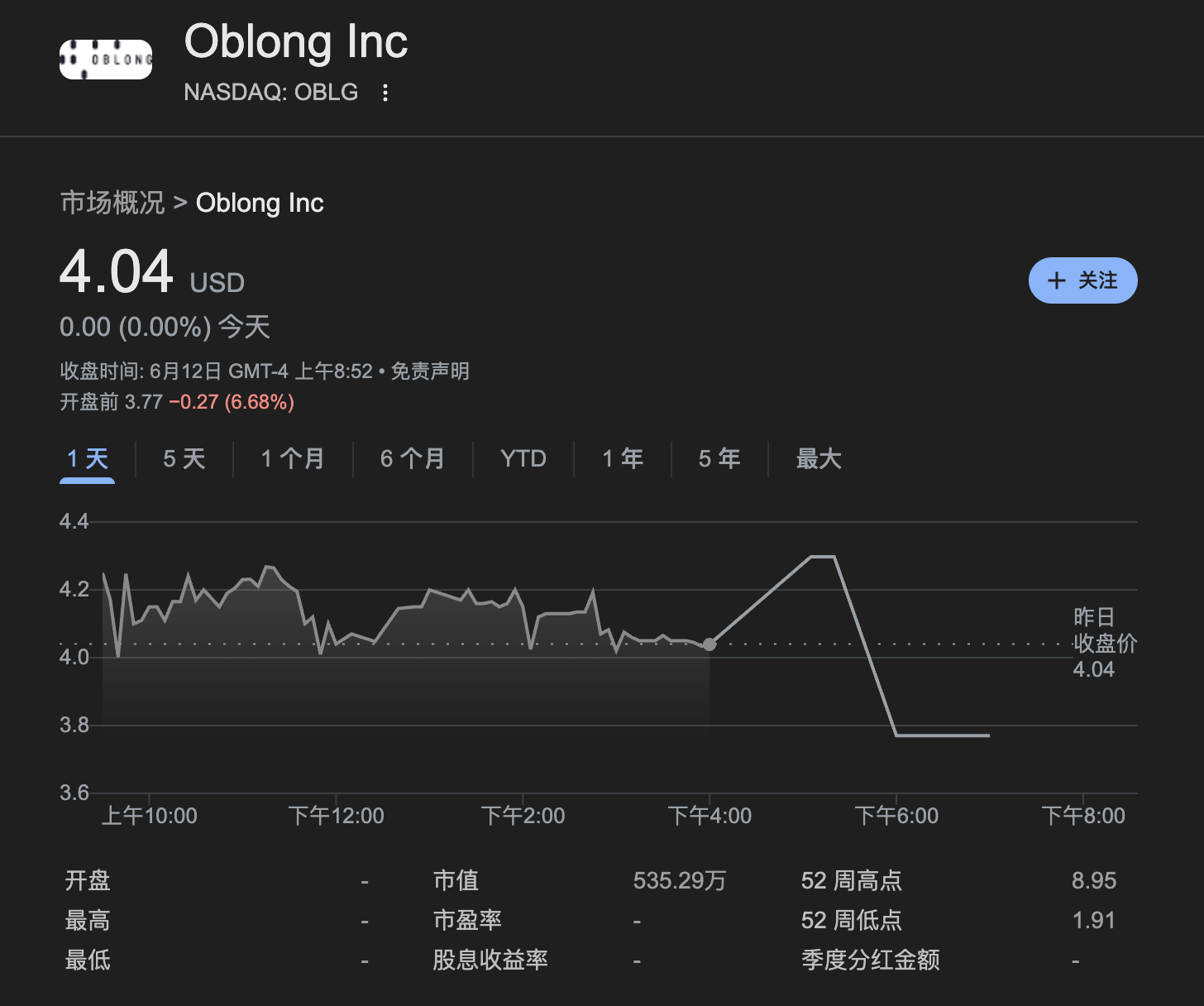

Oblong (OBLG): Buy TAO, a cautious layout in the IT field

Oblong, Inc. (NASDAQ: OBLG) is a technology services provider focusing on IT solutions and video collaboration technologies. Its core product, Mezzanine, is a platform that supports multi-user, multi-device visual collaboration and is widely used in corporate meetings and remote collaboration. The company’s market value is around $5.3 million.

On June 6, Oblong announced that it had raised $7.5 million through a private placement to purchase Bittensor’s $TAO tokens and participate in its Subnet 0 staking program.

Oblong shares rose as much as 12% following the announcement, but have since fallen back to $4.04 at press time.

The placement involves the sale of approximately 1.98 million shares of common stock or equivalent securities at a price of $3.77 per share, which is below the current market price. This also means that the company is selling its shares at a certain discount to attract investors.

This amount of funds, calculated at current prices, can purchase approximately 1,890 $TAO tokens, which is not a large number.

However, you can view the purchase of TAO as a strategic transformation from traditional IT business to AI and digital assets.

Video conferencing solutions are a very competitive field. Although the company's Mezzanine platform has a certain market in the field of video collaboration, its revenue growth has slowed by about 5% since 2023, mainly affected by competing software such as Zoom and Microsoft Teams.

The company's CEO Peter Holst said that the intersection of AI and blockchain is the key to future innovation, and $TAO is seen as a potential asset for crypto AI infrastructure, similar to Bitcoin's early institutional adoption stage.

At the same time, the company plans to realize asset appreciation by holding $TAO and staking income, while exploring the development of Bittensor-based software tools, such as AI-driven meeting assistance functions.

However, Subnet 0 in the TAO subnet mainly focuses on AI directions such as text prompt tasks (such as natural language processing). It is a bit far-fetched to say that Oblong chose this subnet for staking and it is directly related to the video conferencing business. It is more of a consideration of staking income and statement.

This layout is more of a strategic test to test the long-term potential of AI tokens.

Risks and benefits coexist

The trend of corporate currency holdings has expanded from a single asset to diversified options.

But apart from BTC, the volatility of altcoins is significantly higher than BTC. Take TRNR as an example, its market value of $8.4 million plans to raise $500 million. If the price of FET drops sharply, high leverage financing to buy coins is itself a choice with huge financial pressure.

Regulatory risks should not be ignored either. The biggest consideration for listed companies should be compliance. The SEC once classified SOL as a security, but the compliance of AI tokens is still unclear. If regulation is tightened, will companies holding tokens face fines or liquidation?

However, even if the law prohibits it, it can be done. Capital has always been profit-seeking. In the current window period, various companies are scrambling to imitate the encryption reserve strategy, perhaps they have already made a wishful calculation in their minds:

After all, it is a small-cap company that is taking advantage of the capital market's gradual embrace of crypto assets to try its hand at a higher-volatility altcoin. Moreover, the AI narrative is long-lasting, so if it succeeds, the ROI will naturally be very high.

Overall, the allocation of altcoins by listed companies is more like a high-risk, high-return game.

For small-cap companies, this is a capital game of betting on the future, and success or failure will depend on market sentiment, narrative continuity, and actual implementation capabilities.

When the fake bull market is equitized, companies and investors should keep in mind:

Risk is the nature of high-volatility assets, and return is the reward of seizing narratives and opportunities.