1. Introduction: SEC’s new policy and the key turning point of DeFi regulatory landscape

Decentralized Finance (DeFi) has developed rapidly since 2018 and has become one of the core pillars of the global crypto asset system. Through open, permissionless financial protocols, DeFi provides a wealth of financial functions including asset trading, lending, derivatives, stablecoins, asset management, etc. At the technical level, it relies on smart contracts, on-chain settlement, decentralized oracles and governance mechanisms to achieve in-depth simulation and reconstruction of traditional financial structures. Especially since the "DeFi Summer" in 2020, the total locked volume (TVL) of the DeFi protocol has exceeded US$180 billion, indicating that the scalability and market recognition of this field have reached an unprecedented level.

However, the rapid expansion of this field is also accompanied by problems such as ambiguous compliance, systemic risks, and regulatory vacuums. Under the leadership of Gary Gensler, former chairman of the U.S. Securities and Exchange Commission (SEC), U.S. regulators have adopted a stricter and centralized enforcement strategy for the crypto industry as a whole, among which DeFi protocols, DEX platforms, DAO governance structures, etc. have been included in the category of possible illegal securities trading, unregistered brokers or clearing agents. From 2022 to 2024, projects such as Uniswap Labs, Coinbase, Kraken, and Balancer Labs have all been investigated and received enforcement letters in various forms by the SEC or CFTC. At the same time, the long-term lack of criteria for determining whether it is fully decentralized, whether there is public financing, and whether it constitutes a securities trading platform has caused the entire DeFi industry to fall into multiple predicaments such as limited technological evolution, shrinking capital investment, and developer exodus amid policy uncertainty.

This regulatory context has undergone major changes in the second quarter of 2025. In early June, the new SEC Chairman Paul Atkins proposed for the first time at the Congressional Fintech Hearing a positive regulatory exploration path for DeFi, and clarified three policy directions: First, establish an "Innovation Exemption Mechanism" for protocols with a high degree of decentralization, and suspend some registration obligations within a specific pilot scope; second, promote the "Functional Categorization Framework", and classify and regulate based on the business logic and on-chain operations of the protocol, rather than "whether to use Tokens" to identify it as a securities platform; third, include the DAO governance structure and the real asset on-chain (RWA) project in the open financial regulatory sandbox, and connect the rapidly developing technology prototypes with low-risk, traceable regulatory tools. This policy shift echoes the "White Paper on Systemic Risks of Digital Assets" released by the Financial Stability Oversight Committee (FSOC) of the U.S. Treasury Department in May of the same year. The latter first proposed that regulatory sandboxes and functional testing mechanisms should be used to protect the rights and interests of investors while avoiding "stifling innovation".

II. Evolution of the U.S. regulatory path: the transformation logic from “illegal by default” to “functional adaptation”

The evolution of U.S. regulation of decentralized finance (DeFi) is not only a microcosm of its financial compliance framework in response to emerging technology challenges, but also a profound reflection of the trade-off between "financial innovation" and "risk prevention" by regulators. The current SEC's policy stance on DeFi is not an isolated incident, but a product of the gradual evolution of the game between multiple institutions and regulatory logic over the past five years. To understand the basis of its transformation, we need to trace back to the roots of regulatory attitudes in the early days of DeFi, the feedback loop of major law enforcement events, and the systemic tension in the application of federal and state laws.

Since the DeFi ecosystem gradually took shape in 2019, the core regulatory logic of the SEC has always relied on the securities determination framework of the 1946 Howey Test, that is, any contractual arrangement involving capital investment, common enterprise, profit expectations, and reliance on the efforts of others to obtain profits can be regarded as securities transactions and included in the scope of regulation. Under this standard, the vast majority of tokens issued by DeFi protocols (especially those with governance weights or profit distribution rights) are presumed to be unregistered securities, posing potential compliance risks. In addition, according to the Securities Exchange Act and the Investment Company Act, any act of matching, clearing, holding, and recommending digital assets, if there is no clear exemption, may also constitute an illegal act of an unregistered securities broker or clearing agency.

During 2021 and 2022, the SEC took a series of high-profile enforcement actions. Representative cases include Uniswap Labs being investigated for whether it constitutes an "unregistered securities platform operator", Balancer, dYdX and other protocols facing "illegal marketing" charges, and even privacy protocols such as Tornado Cash have been included in the sanctions list by the Treasury Department's Office of Foreign Assets Control (OFAC), showing that regulators have adopted a wide coverage, strong crackdown, and blurred boundary enforcement strategy in the DeFi field. The regulatory tone at this stage can be summarized as "presumption of illegality", that is, the project party must prove that its protocol design does not constitute a securities transaction or is not subject to US jurisdiction, otherwise it will face compliance risks.

However, this regulatory strategy of "enforcement first, rules lagging behind" soon encountered challenges at the legislative and judicial levels. First, the results of many litigation cases gradually exposed the limitations of regulatory judgments under decentralized conditions. For example, in the SEC v. Ripple case, the US court ruled that XRP did not constitute a security in some secondary market transactions, which actually weakened the SEC's position that "all tokens are securities." At the same time, the ongoing legal dispute between Coinbase and the SEC has made "regulatory clarity" a core issue for the industry and Congress to promote crypto legislation. Second, the SEC faces fundamental difficulties in the legal application of structures such as DAO. Since the operation of DAO does not have a traditional legal person identity or beneficiary center, its on-chain autonomy mechanism is difficult to classify as the traditional securities logic of "generating benefits from the efforts of others." Accordingly, regulatory authorities also lack sufficient legal tools to impose effective subpoenas, fines or injunctions on DAOs, thus forming an idling dilemma for law enforcement.

It is against the background of the gradual accumulation of this institutional consensus that the SEC made strategic adjustments after the personnel change in early 2025. The new chairman, Paul Atkins, has long advocated "technological neutrality" as the regulatory bottom line, emphasizing that financial compliance should design regulatory boundaries based on functions rather than technical implementation methods. Under his chairmanship, the SEC established a "DeFi Strategy Research Group" and jointly formed a "Digital Finance Interactive Forum" with the Ministry of Finance to build a risk classification and governance assessment system for major DeFi protocols through data modeling, protocol testing, on-chain tracking and other means. This technology-oriented, risk-stratified regulatory approach represents a transition from the traditional securities law logic to "functionally adaptive regulation", that is, taking the actual financial functions and behavioral patterns of DeFi protocols as the basis for policy design, thereby achieving an organic combination of compliance requirements and technical flexibility.

It should be pointed out that the SEC has not given up its regulatory rights in the DeFi field, but is trying to build a more flexible and iterative regulatory strategy. For example, for DeFi projects with obvious centralized components (such as front-end interface operations, governance multi-signature control, and protocol upgrade permissions), they will be required to fulfill their registration and disclosure obligations first; for highly decentralized, purely on-chain protocols, an exemption mechanism of "technical testing + governance audit" may be introduced. In addition, by guiding project parties to voluntarily enter the regulatory sandbox, the SEC plans to cultivate a "middle ground" for a compliant DeFi ecosystem on the premise of ensuring market stability and user rights, and avoid spillover losses in technological innovation caused by a one-size-fits-all policy.

Overall, the US DeFi regulatory path is gradually evolving from the early strong application of laws and law enforcement suppression to institutional consultation, functional identification, and risk guidance. This shift not only reflects the deepening understanding of technological heterogeneity, but also represents regulators' attempts to introduce new governance paradigms when facing open financial systems. In future policy implementation, how to achieve a dynamic balance between protecting investor interests, ensuring system stability, and promoting technological development will become a core challenge for the sustainability of the DeFi regulatory system in the United States and even the world.

3. Three major wealth codes: value reassessment under institutional logic

With the official implementation of the new SEC regulatory policy, the overall attitude of the US regulatory environment towards decentralized finance has undergone a substantial change, from "ex post enforcement" to "pre compliance" and then to "functional adaptation", bringing long-lost institutional positive incentives to the DeFi sector. Against the backdrop of the gradual clarification of the new regulatory framework, market participants have begun to re-evaluate the underlying value of the DeFi protocol. Many tracks and projects that were previously suppressed by "compliance uncertainty" have begun to show significant revaluation potential and allocation value. From the perspective of institutional logic, the current main line of value revaluation in the DeFi field is mainly concentrated in three core directions: the institutional premium of the compliant intermediary structure, the strategic position of the on-chain liquidity infrastructure, and the credit reconstruction space of the high endogenous return model protocol. These three main lines constitute the key starting point for the next round of DeFi's "wealth code".

First, as the SEC emphasizes the "function-oriented" regulatory logic and proposes to include some front-end operations and service layer protocols in the registration exemption or regulatory sandbox testing mechanism, on-chain compliance intermediaries are becoming a new value depression. Unlike the extreme pursuit of "disintermediation" in the early DeFi ecosystem, the current supervision and market have generated structural demand for "compliant intermediary services", especially in key nodes such as identity verification (KYC), on-chain anti-money laundering (AML), risk disclosure, and protocol governance custody. Projects with clear corporate governance structures and service licenses will become the only way to comply with the path. This trend will enable DID protocols that provide on-chain KYC services, compliance custodians, and front-end operating platforms with high governance transparency to gain higher policy tolerance and investor favor, thereby promoting the transformation of their valuation system from "technical tool attributes" to "institutional infrastructure". It is worth noting that the "compliance chain" module that is rapidly developing in some Layer 2 solutions (such as Rollup with a whitelist mechanism) will also play a key role in the rise of this compliance intermediary structure, providing a trusted execution basis for traditional financial capital to participate in DeFi.

Secondly, as the underlying resource allocation engine of the DeFi ecosystem, the on-chain liquidity infrastructure is regaining strategic valuation support due to the clarification of the system. Although liquidity aggregation platforms represented by decentralized trading protocols such as Uniswap, Curve, and Balancer have faced multiple challenges in the past year, such as liquidity depletion, token incentive failure, and regulatory uncertainty suppression, platforms with protocol neutrality, high composability, and governance transparency will once again become the first choice for structural capital inflows in the DeFi ecosystem under the new policy. In particular, under the principle of "separation of protocol and front-end supervision" proposed by the SEC, the underlying AMM protocol, as an on-chain code execution tool, will significantly reduce its legal risks. Combined with the continuous enrichment of the bridge between RWA (real world assets) and on-chain assets, the on-chain transaction depth and capital efficiency expectations are expected to be systematically repaired. In addition, on-chain oracles and price feed infrastructure represented by Chainlink have become key "risk-controllable neutral nodes" in institutional-level DeFi deployments because they do not constitute direct financial intermediaries in regulatory classification, and they bear important responsibilities for system liquidity and price discovery within the compliance framework.

Once again, DeFi protocols with high intrinsic yields and stable cash flows will usher in a credit repair cycle after the release of institutional pressure, and will once again become the focus of venture capital. In the first few cycles of DeFi development, lending protocols such as Compound, Aave, and MakerDAO have become the credit foundation of the entire ecosystem with their robust collateral models and liquidation mechanisms. However, with the spread of the crypto credit crisis between 2022 and 2023, the balance sheet of DeFi protocols is facing liquidation pressure, and events such as stablecoin depegging and liquidity depletion are frequent. In addition, asset security concerns caused by the gray area of supervision have made these protocols generally face structural risks of weakened market trust and low token prices. Today, after the supervision has gradually clarified and established a systematic recognition path for protocol revenue, governance model, and audit mechanism, these protocols have the potential to become "on-chain stable cash flow carriers" with their quantifiable, on-chain verifiable real income models and low operating leverage. Especially as the DeFi stablecoin model evolves towards "multi-collateral + real-asset anchoring", on-chain stablecoins represented by DAI, GHO, and sUSD will build an institutional moat against centralized stablecoins (such as USDC and USDT) under a clearer regulatory positioning, enhancing their systemic appeal in institutional capital allocation.

It is worth noting that the common logic behind these three main lines is the rebalancing process of converting the "policy recognition dividend" brought by the SEC's new policy into the "market capital pricing weight". In the past, the DeFi valuation system relied heavily on speculative momentum and expectation amplification, lacking a stable institutional moat and fundamental support, which exposed its strong vulnerability in the market counter-cycle. Now, after regulatory risks have been alleviated and legal paths have been confirmed, the DeFi protocol has been able to establish a valuation anchoring mechanism for institutional capital through real on-chain revenue, compliance service capabilities and systematic participation thresholds. The establishment of this mechanism not only enables the DeFi protocol to have the ability to rebuild the "risk premium-return model", but also means that DeFi will have the credit pricing logic of financial-like enterprises for the first time, creating institutional prerequisites for its access to the traditional financial system, RWA docking channels and on-chain bond issuance.

IV. Market response: From TVL surge to asset price revaluation

The release of the new SEC regulatory policy not only released a positive signal of prudent acceptance and functional supervision of the DeFi field at the policy level, but also quickly triggered a chain reaction at the market level, forming an efficient positive feedback mechanism of "institutional expectations-capital repatriation-asset revaluation". The most direct manifestation is the significant recovery of DeFi's total locked-in volume (TVL). Within a week after the release of the new policy, according to the tracking of mainstream data platforms such as DefiLlama, the DeFi TVL on the Ethereum chain quickly jumped from about US$46 billion to nearly US$54 billion, a weekly increase of more than 17%, setting the largest weekly increase since the FTX crisis in 2022. At the same time, the locked-in volume of multiple mainstream protocols such as Uniswap, Aave, Lido, Synthetix, etc. has increased synchronously, and indicators such as on-chain transaction activity, Gas usage, and DEX transaction volume have also recovered comprehensively. This broad-spectrum market response suggests that clear signals from the regulatory level have effectively alleviated institutional and retail investors’ concerns about potential legal risks in DeFi in the short term, thereby driving OTC funds to re-enter the sector and forming a structural incremental liquidity injection.

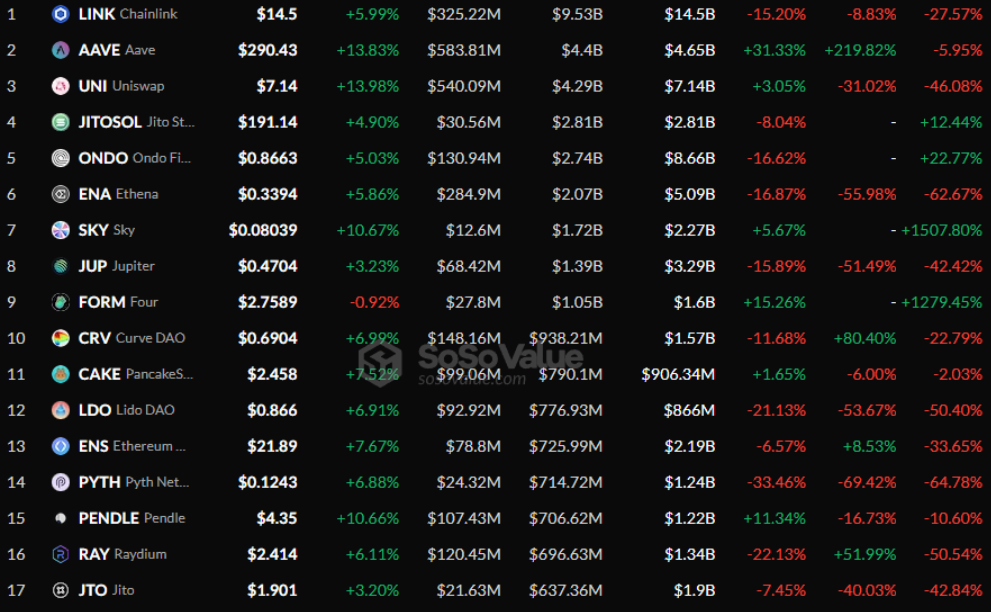

Driven by the rapid return of funds, multiple top DeFi assets have ushered in price revaluations. Taking governance tokens such as UNI, AAVE, and MKR as examples, within a week after the new policy was implemented, their average price increase was between 25% and 60%, far exceeding the increase in BTC and ETH during the same period. This round of price rebound is not simply driven by emotions, but reflects the market's new round of valuation modeling for the future cash flow capacity and institutional legitimacy of DeFi protocols. Previously, due to compliance uncertainties, the valuation system of DeFi governance tokens was often given a large discount by the market, and the real revenue, governance value, and future growth space of the protocol were not effectively reflected in the market value. At present, with the institutional path gradually becoming clear and the legitimacy of operations being tolerated by policies, the market has begun to use traditional financial indicators such as protocol profit multiples (P/E), unit TVL valuation (TVL multiples), and on-chain active user growth models to repair the valuation of DeFi protocols. The return of this valuation methodology not only enhances the investment attractiveness of DeFi assets as "cash flow assets", but also marks the beginning of the evolution of the DeFi market towards a more mature and quantifiable capital pricing stage.

In addition, on-chain data also shows the changing trend of the capital distribution structure. After the release of the new policy, the number of on-chain deposit transactions, the number of users and the average transaction amount of multiple protocols have increased significantly, especially in protocols with high integration with RWA (such as Maple Finance, Ondo Finance, Centrifuge), the proportion of institutional wallets has increased rapidly. Taking Ondo as an example, its short-term U.S. Treasury token OUSG has increased its issuance scale by more than 40% since the release of the new policy, showing that some institutional funds seeking compliance paths are using DeFi platforms to configure on-chain fixed-income assets. At the same time, the inflow of stablecoins in centralized exchanges has shown a downward trend, while the net inflow of stablecoins in DeFi protocols has begun to pick up. This change indicates that investors' confidence in the security of on-chain assets is recovering. The trend of the decentralized financial system regaining the pricing power of funds has initially emerged. TVL is no longer just a short-term flow indicator for speculative behavior, but gradually transformed into a weather vane for asset allocation and capital trust.

It is worth noting that despite the significant market response, the revaluation of asset prices is still in its early stages, and the space for realizing institutional premiums is far from complete. Compared with traditional financial assets, DeFi protocols still face higher regulatory trial and error costs, governance efficiency issues, and on-chain data auditing difficulties, which leads to the market remaining cautious after the risk preference shifts. However, it is precisely this resonance of "institutional risk contraction + value expectation repair" that opens up room for valuation expansion in the future DeFi sector's mid-term market. The current P/S (price-to-sales ratio) of multiple head protocols is still far lower than the mid-term level of the bull market in 2021. Under the premise that real income continues to grow, regulatory certainty will enable its valuation center to gain upward momentum. At the same time, the revaluation of asset prices will also be transmitted to the token design and distribution mechanism. For example, some protocols are restarting the repurchase of governance tokens, increasing the proportion of protocol surplus dividends, or promoting the reform of the staking model linked to protocol revenue, further incorporating "value capture" into the market pricing logic.

5. Future Outlook: Institutional Reconstruction and New Cycle of DeFi

Looking ahead, the SEC's new policy is not only a policy adjustment at the compliance level, but also a key turning point for the DeFi industry to move towards institutional reconstruction and sustainable and healthy development. The policy clarifies the regulatory boundaries and market operation rules, laying the foundation for the DeFi industry to move from the "wild growth" stage to a "compliant and orderly" mature market. In this context, DeFi not only faces a significant reduction in compliance risks, but also ushers in a new development stage of value discovery, business innovation and ecological expansion.

First, from the perspective of institutional logic, the institutional reconstruction of DeFi will have a profound impact on its design paradigm and business model. Traditional DeFi protocols focus more on the automated execution of "code is law", with less consideration of compatibility with the actual legal system, resulting in potential legal gray areas and operational risks. The SEC's new policy clarifies and refines compliance requirements, prompting DeFi projects to design a dual identity system that combines technical advantages with compliance attributes. For example, the balance between compliance identity authentication (KYC/AML) and on-chain anonymity, the attribution of legal responsibilities for protocol governance, and the compliance data reporting mechanism have all become important topics for the design of future DeFi protocols. By embedding compliance mechanisms into smart contracts and governance frameworks, DeFi will gradually form a new paradigm of "embedded compliance", achieve a deep integration of technology and law, and thus reduce the uncertainty and potential penalty risks brought about by regulatory conflicts.

Secondly, institutional reconstruction will inevitably promote the diversification and deepening of DeFi business models. In the past, the DeFi ecosystem over-reliant on short-term incentives such as liquidity mining and transaction fees, making it difficult to continuously create stable cash flow and profitability. Under the guidance of the new policy, project parties will pay more attention to building a sustainable profit model, such as through protocol-layer revenue sharing, asset management services, compliant bond and collateral issuance, RWA (Real-World Asset) on-chain, etc., to gradually form a closed-loop income comparable to traditional financial assets. Especially in terms of RWA integration, compliance signals have greatly enhanced the trust of institutions in DeFi products, allowing diversified asset types including supply chain finance, real estate asset securitization, and bill financing to enter the on-chain ecosystem. In the future, DeFi will no longer be a simple decentralized trading venue, but will become an institutionalized financial infrastructure for the issuance and management of on-chain assets.

Third, the institutional reconstruction of the governance mechanism will also become the core driving force for DeFi to move towards a new cycle. In the past, DeFi governance relied heavily on token voting, which had problems such as excessive decentralization of governance power, low voter turnout, and low governance efficiency, and lacked connection with the traditional legal system. The governance norms proposed by the SEC's new policy have prompted protocol designers to explore a more legally effective governance framework, such as through the registration of DAO legal identity, legal confirmation of governance behavior, and the introduction of a multi-party compliance supervision mechanism to enhance the legitimacy and enforceability of governance. Future DeFi governance may adopt a hybrid governance model, combining on-chain voting, off-chain protocols and legal frameworks to form a transparent, compliant and efficient decision-making system. This will not only help alleviate the risks of power concentration and manipulation in the governance process, but also enhance the protocol's trust in external regulators and investors, becoming an important cornerstone for the sustainable development of DeFi.

Fourth, with the improvement of compliance and governance systems, the DeFi ecosystem will usher in a richer range of participants and capital structure transformation. The new policy has greatly lowered the threshold for institutional investors and traditional financial institutions to enter DeFi. Traditional capital such as large asset management companies, pension funds, and family offices are actively seeking compliant on-chain asset allocation solutions, which will give rise to more customized DeFi products and services for institutions. At the same time, the insurance, credit, and derivatives markets in a compliant environment will also usher in explosive growth, promoting the full coverage of on-chain financial services. In addition, the project party will also optimize the token economic model, strengthen the inherent rationality of tokens as governance tools and value carriers, attract long-term holdings and value investments, reduce short-term speculative fluctuations, and inject continuous momentum into the stable development of the ecosystem.

Fifth, technological innovation and cross-chain integration are the technical support and development engine for the institutional reconstruction of DeFi. Compliance requirements promote the technical innovation of the protocol in terms of privacy protection, identity authentication, contract security, etc., and give rise to the widespread application of privacy protection technologies such as zero-knowledge proof, homomorphic encryption, and multi-party computing. At the same time, cross-chain protocols and Layer 2 expansion solutions will achieve seamless flow of assets and information between multi-chain ecosystems, break the on-chain island effect, and enhance the overall liquidity and user experience of DeFi. In the future, the multi-chain integration ecosystem under the compliance foundation will provide a solid foundation for DeFi's business innovation, promote the deep integration of DeFi with the traditional financial system, and realize a new form of "on-chain + off-chain" hybrid finance.

Finally, it is worth pointing out that although the institutionalization process of DeFi has opened a new chapter, challenges still exist. The stability of policy implementation and international regulatory coordination, the control of compliance costs, the improvement of project compliance awareness and technical capabilities, and the balance between user privacy protection and transparency are all key issues for the healthy development of DeFi in the future. All parties in the industry need to work together to promote the formulation of standards and the construction of self-discipline mechanisms, and use industry alliances and third-party auditing agencies to form a multi-level compliance ecosystem to continuously improve the overall institutionalization level and market trust of the industry.

6. Conclusion: DeFi’s new wealth frontier has just begun

As the forefront of blockchain financial innovation, DeFi is at a critical juncture of institutional reconstruction and technological upgrading. The new SEC policy has brought it an environment where both regulations and opportunities coexist, pushing the industry from wild growth to compliant development. In the future, with the continuous breakthroughs in technology and the improvement of the ecosystem, DeFi is expected to achieve broader financial inclusion and value reshaping, becoming an important cornerstone of the digital economy. However, the industry still needs to continue to work hard in compliance risks, technical security and user education to truly open up the long-term prosperity of the new frontier of wealth. With the new SEC policy, from "innovation exemption" to "on-chain finance" may lead to a full outbreak, the summer of DeFi may reappear, and the blue-chip tokens in the DeFi sector may usher in a revaluation of value.