In-depth research report on stock tokenization: opening the second growth curve of the bull market

1. Introduction and Background

In the past year, the concept of tokenization of real-world assets (RWA) has gradually moved from the marginal narrative of financial technology to the mainstream vision of the crypto market. Whether it is the widespread application of stablecoins in the field of payment and clearing, or the rapid growth of on-chain treasury bonds and bill products, "traditional assets on the chain" has transformed from an idealistic vision to a real experiment. In this trend, the tokenization of stocks, known as "U.S. stocks on the chain", has become one of the most controversial and promising tracks. It carries not only an attempt to transform the liquidity and transaction timeliness of the traditional securities market, but also challenges the regulatory boundaries and opens up cross-market arbitrage space. For the crypto industry, this may be a cross-generational leap that introduces a trillion-dollar asset pool into the on-chain world; for traditional finance, this is more like an "unauthorized" technological breakthrough, which not only brings about an efficiency revolution, but also lays the foundation for governance conflicts.

2. Market Status & Key Path

Although "tokenization" has become one of the most important mid- to long-term narratives in the crypto industry, when it comes to the specific asset class of "stocks", its progress is still slow and the paths are significantly differentiated. Unlike standardized assets such as government bonds, short-term notes, and gold, the tokenization of stocks involves more complex legal ownership issues, transaction time limits, voting rights design, and dividend distribution mechanisms, which also leads to several products currently appearing in the market showing obvious differences in compliance paths, financial structures, and on-chain implementation methods.

One of the projects that has achieved results earlier in this field is Backed Finance. This Swiss-based fintech company has launched several ERC-20 tokens based on real stocks and ETFs in cooperation with regulated securities custodians, trying to build an "intermediary bridge for on-chain securities". Taking its more well-known product wbCOIN as an example, the token claims to be pegged 1:1 to Coinbase's real stocks on Nasdaq, and the custodians Alpaca Securities and InCore Bank promise to redeem real stocks. In theory, it has a closed-loop logic of "subscription-holding-redemption". Backed has also launched multiple tokens such as NVIDIA (BNVDA), Tesla (BTESLA), S&P 500 ETF (BSPY), etc., using chains such as Base and Polygon as circulation carriers to provide investors with on-chain trading entrances. However, there is still a distance between ideal and reality. As of March 2025, the total TVL of multiple stock token products launched by Backed has not exceeded US$10 million, and the average daily trading volume of wbCOIN is even less than US$4,000, with transaction records approaching zero in most time periods. There is not only one reason for this situation. There are early users' uncertainty about the redemption mechanism, the DeFi ecosystem's failure to fully connect with the reality of these tokens, and even some on-chain market makers' judgment that such assets "do not have long-term liquidity expectations." This means that even if the product mechanism has achieved clear asset mapping and a complete custody chain, the lack of trading depth, usage scenarios, and user awareness may still cause tokenized U.S. stocks to fall into the dilemma of "compliant but deserted."

Compared with Backed, Robinhood's tokenization path is more conservative but more systematic. As a platform that has been cautiously deploying crypto business for a long time, Robinhood has chosen to launch regulated stock derivatives tokens in the EU. These tokens are not essentially mapped to real stocks, but price tracking derivatives based on the EU MFT (Multilateral Trading Facility) license. The logic behind it is closer to traditional CFD (Contract for Difference). Traders do not actually hold the underlying stocks, but hold the rights and obligations of the underlying price fluctuations. Although this design sacrifices the purity of the chain of "1: 1 anchoring to real stocks", it greatly reduces regulatory conflicts and custody complexity, thus achieving a compromise of "non-securities but tradable". Robinhood provides complete UI support, asset splitting, dividend distribution, leverage setting and other services, and protects user rights through its own custody account system; more importantly, its future planned Layer-2 network (tentatively named Robinhood Chain) also means that Robinhood is embedding tokenized stocks into its native wallet and crypto trading platform in the form of "application chain". This top-down closed-loop ecosystem may be more suitable for new users to get started, but it also limits the openness of asset circulation. In addition, current trading hours are still restricted to the opening hours of the European financial market, and the on-chain nativeness is still insufficient.

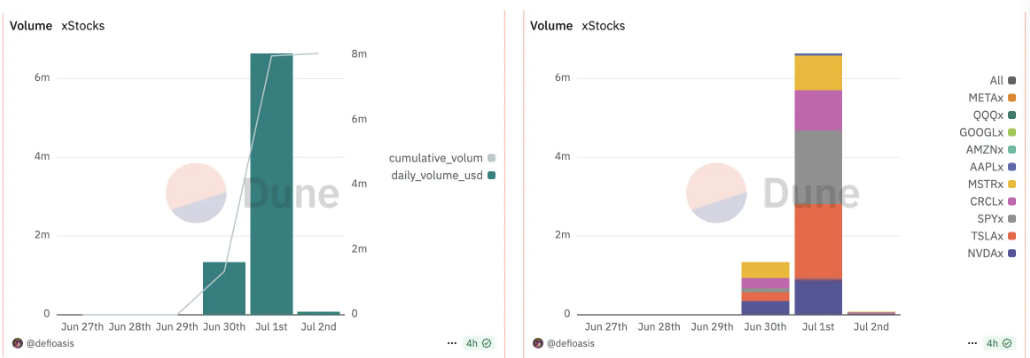

In contrast, the xStocks ecosystem launched by Kraken and its partners provides another path imagination. The solution is based on the Solana chain, with Backed providing the underlying asset tokens. It bypasses US regulation through structured compliance and opens the product to the global non-US market. The biggest feature of xStocks is the "DeFi" of its trading attributes: all tokens can be traded 24/7, with T+0 settlement, on-chain swaps, and stablecoin market making functions. In theory, it can be integrated into existing DeFi tool chains such as lending, perpetual contracts, and cross-chain liquidity bridges. The system also attempts to gather trading depth through on-chain liquidity pools and establish preliminary connections with Solana native DEXs such as Orca and Jupiter. This on-chain native, globally distributed, and composable attribute undoubtedly represents the "ultimate vision" of tokenized stocks, that is, not just a price mapping product, but a cross-market that truly integrates traditional financial assets and crypto infrastructure. However, the biggest problem of xStocks at present is that its user coverage is limited, real subscription/redemption still requires KYC review, and whether its custody path has cross-border legal effect has not yet been determined. In addition, although its trading experience and mechanism have reached the "crypto-native" standard, the actual user scale and on-chain liquidity have not yet formed a scale effect, and there is still a long way to go before mainstream adoption.

From the differences in the layout of these three, it can be seen that there is no unified standard for stock tokenization at present, but each one designs its own path according to its own advantages, regulatory environment, and ecological resources. Among them, Robinhood emphasizes "regulated traditional trading experience plus crypto packaging", Backed emphasizes "on-chain tool contracts that map real assets", and Kraken is more inclined to "build a crypto-native liquidity market". The different paths of the three not only show the diversity of this track, but also reveal the typical characteristics of an immature market: among compliance, asset mapping and user needs, no one can achieve comprehensive coverage, and ultimately it still needs to be eliminated and screened through time test and market feedback.

It can be said that tokenized stocks are still in a very early experimental stage. Although they have a theoretical closed loop, their on-chain activity and financial efficiency are still far below expectations. The key to its future development depends not only on whether the design of the product itself is perfect, but also on whether three major factors can be converged: first, whether it can obtain more real liquidity participants to enter its trading pool to form a price discovery mechanism; second, whether it can integrate more abundant DeFi applications to enhance the use scenarios of tokenized stocks; third, whether supervision will gradually clarify the red line boundaries, so that the platform has the confidence to expand its service scope, especially to cover US users. Before these paths are integrated, tokenized stocks are more like a financial experiment with great potential, rather than a growth engine that can deliver on bull market expectations at this stage.

III. Compliance Mechanism and Implementation Capabilities

In all discussions about tokenized stocks, regulation is always the sword of Damocles hanging over our heads. As one of the most strictly regulated financial assets, stocks are subject to strict laws in their respective jurisdictions in terms of issuance, trading, custody, and clearing. In traditional finance, securities must be registered or exempted before they can be legally sold, and trading venues must also obtain relevant licenses such as exchanges or ATS (alternative trading systems). Reconstructing these securities as "on-chain assets" means not only solving the problem of technical mapping, but also connecting to a clear and executable compliance path. Otherwise, even if the product design is excellent, it will be difficult to break through the legal risks of limited scope of use, inability to promote to qualified investors, and even possible illegal securities issuance. In this regard, the choices and differences of different projects are particularly distinct, which also determines whether they can truly move towards large-scale implementation in the future.

Take Backed Finance as an example. It has adopted the approach closest to the "traditional securities issuance logic" in the compliance path. The stock tokens issued by Backed are essentially restricted securities recognized by Swiss regulators, which means that the purchasers of the tokens must complete KYC/AML audits and promise not to sell to US investors. At the same time, the circulation in the secondary market will also be restricted to "qualified investors only". Although this method is relatively stable in terms of compliance and avoids touching the red line of the US SEC, it also brings the problem of limited circulation and cannot realize the vision of free trading of tokens on the public chain. The more realistic challenge is that this "restricted securities" model requires that every transfer must undergo compliance verification, which greatly weakens its compatibility with the DeFi system. In other words, even if Backed has successfully established a custody mapping relationship between tokens and real stocks with InCore Bank and Alpaca Securities, it still builds a closed ecosystem "within the regulatory sandbox", which is difficult to achieve high-frequency trading, mortgage, leverage and other applications in open financial scenarios.

The path taken by Robinhood is a more clever compliance packaging. Its tokenized stock products are not directly mapped to real stocks, but are "securities derivatives" built on the EU MiFID II regulatory framework. They are technically similar to contracts for difference (CFDs), and are provided with quotes, custody and clearing support by its regulated subsidiaries. This design allows Robinhood to avoid the legal liability of directly holding stocks, while also avoiding the problems of peer-to-peer transactions and physical delivery, so that it can provide related product transactions without a securities license. The advantage of this path is that it has a high degree of compliance certainty, can quickly launch multiple target stock tokens, and promote them based on its existing user system; but its cost is that the assets themselves lack programmability and openness, and cannot be truly embedded in the native financial protocol on the chain. Going further, this "platform custody + derivative tracking" model is essentially still in the category of CeFi (centralized finance). The issuance and settlement of its assets are almost entirely dependent on the internal implementation of the Robinhood system. Users' trust in the underlying assets is still based on their trust in the platform, rather than the autonomous custody and verification mechanism on the chain.

In the case of Kraken and xStocks, we see a more radical and fundamentalist approach to compliance. The tokenization mechanism behind xStocks is technically supported by Backed, but it has taken a gray compliance path of "on-chain autonomy + global non-US user access" in circulation and use. Specifically, this model uses the "restricted securities + private offering" exemption clause in Swiss law to allow Kraken to open its tokenized products to global non-US markets for trading and restrict access to US IPs through on-chain contracts. This approach not only avoids the direct review of securities issuance and exchange supervision by the SEC and FINRA, but also retains the characteristics of free circulation of tokens on the chain, enabling it to access DeFi's lending protocols, AMM market making, cross-chain bridges and other modules to form a relatively complete financial closed loop. However, the risk of this path is that it is extremely dependent on the technical isolation of "non-US user identities". Once a large number of users bypass restrictions, it may still be regarded as "providing illegal securities to US investors", thereby triggering law enforcement risks. What’s more, the US regulators’ determination of “de facto market participation” is often not limited to the setting of technical barriers, but is based on the consequences of the behavior and the actual nationality of the investors. This means that even if Kraken tries its best to avoid it, it may still face the potential threat of regulatory inspections or even sanctions.

From a more macro perspective, at present, whether it is Backed, Robinhood or Kraken, their tokenized stock solutions have not achieved true global compliance coverage, but are more of a strategy of "regional arbitrage + operating within legal gaps". The fundamental reason for this situation is that there are significant differences in the definition of the nature of securities in countries around the world. Taking the United States as an example, the SEC still regards "any token anchored by real equity value" as a security, and its issuance must meet the Howey Test or pass compliance exemptions such as Reg A / Reg D. The European Union is relatively relaxed, allowing some tokens based on derivative structures to exist under the jurisdiction of MTF or DLT Pilot Regime for trading; as for Switzerland, Liechtenstein and other countries, they use sandbox supervision and dual registration systems to attract project parties to conduct pilot issuance. This regulatory fragmentation has created a huge institutional arbitrage space, and also made the landing of tokenized stocks present a situation of "regional compliance and global gray area".

In this complex context, the future of stock tokenization can truly achieve large-scale implementation, which will inevitably rely on breakthroughs in three aspects. The first is the unification of regulatory cognition and the establishment of exemption channels. It is necessary to design a set of legal and replicable compliance templates for tokenized securities, just like the EU MiCA, the UK FCA Sandbox, and the Hong Kong VASP system; the second is the native support of the on-chain infrastructure for compliance modules, including the standardization of KYC modules, whitelist transfers, on-chain audit tracking and other tools, so that compliant securities can be truly embedded in the DeFi system, rather than becoming a liquidity island; the third is the entry of institutional participants, especially the coordination and cooperation of financial intermediaries such as custodian banks, audit firms, and securities firms, so as to solve the problems of asset authenticity and credibility of redemption mechanisms.

It can be said that the compliance mechanism is not a subsidiary issue of stock tokenization, but a key variable for its success or failure. No matter how decentralized the project is, its foundation is still based on the logic of "whether real assets can be reliably mapped"; and the core issue behind this is always whether the legal framework can accept the existence of a new paradigm. For this reason, when we study tokenized stocks, we should not only focus on mechanism innovation and technical architecture, but also understand the boundaries and compromises of institutional evolution, and find a feasible middle path between regulatory reality and on-chain ideals.

IV. Market Analysis and Future Outlook

The total amount of RWA (real world assets) on the blockchain globally is about 17.8 billion US dollars, and stock assets are only 15.43 million US dollars, accounting for only 0.09% of the total size. However, tokenized stocks have increased more than 3 times in half a year, from 50 million US dollars to ~ 150 million US dollars from July 2024 to March 2025.

When we re-examine the actual performance of the tokenized stock track, it is not difficult to find that it has both strong conceptual appeal and extremely complex real-world implementation barriers. From a theoretical perspective, stock tokenization has obvious structural advantages: on the one hand, it maps the most valuable and cognitively based real assets to the chain, bringing a real-world credit anchor to the crypto ecosystem; on the other hand, it realizes transaction automation and real-time settlement through smart contracts, subverting the fundamental logic of the traditional securities market's reliance on centralized clearing houses and T+2 cycles, and releasing extremely high system efficiency. However, in actual operations, these advantages have not yet been transformed into large-scale adoption, but have long been in an embarrassing state of "mechanism established, scenario missing, and liquidity drying up." This also forces us to think further: What is the real growth engine of stock tokenization? Is it possible for it to become a core asset class of crypto finance like stablecoins or on-chain bonds in the future market?

From a structural point of view, the primary value of stock tokenization lies in "connecting the real market with the on-chain market", but the real incremental demand must come from three types of user groups: first, retail investors who hope to bypass traditional financial institutions and participate in the global stock market with a lower threshold; second, high-net-worth individuals and gray funds seeking cross-border asset flows and circumventing capital controls or time zone restrictions; third, DeFi protocols and market makers that aim at arbitrage and structural returns. These three groups of people have jointly shaped the "potential market" for tokenized stocks, but none of them has really entered the market on a large scale. Retail investors often lack on-chain operation experience and lack confidence in the mechanism of "whether they can be redeemed as real stocks"; high-net-worth users have not yet confirmed whether such assets have sufficient privacy protection and risk aversion properties; while DeFi protocols are more inclined to build structured products around high-frequency trading, stablecoins, and derivatives, and have limited interest in stock assets that lack volatility and liquidity. This means that stock tokenization is currently facing the typical market dislocation problem of "financial assets want to be on the chain, but on-chain users are not yet ready to accept them."

Even so, future turning points may still gradually emerge with several key trends. First, the rise of stablecoins provides a solid monetary foundation for the trading and settlement of tokenized stocks. When stablecoins such as USDC, USDT, and PYUSD become the "digital dollar" of on-chain liquidity, stock tokens naturally gain a universal counterparty asset. This allows users to conduct US stock-related transactions without access to the banking system, reducing the entry threshold and capital switching costs, which is especially important for users in developing countries. Secondly, the maturity of DeFi protocols has gradually established the ability to combine "traditional assets on the chain". With the emergence of assets such as tokenized treasury bonds and tokenized money funds, the market's acceptance of "non-crypto native assets on the chain" has increased significantly, and stocks are undoubtedly the next standard asset type that is expected to be accessed. In the future, if an on-chain portfolio tool containing "stocks + bonds + stablecoins" can be formed, it will be extremely attractive to institutional users, and may even evolve into an "on-chain ETF / index fund" similar to traditional brokerages.

Another variable that cannot be ignored is the explosion of L2 and application chain ecology. With the expansion of the user base of Ethereum second-layer networks such as Arbitrum, Base, Scroll, and ZKSync, and the enhancement of the financial nativeness of high-performance chains such as Solana, Sei, and Sui, the "on-chain residence" of stock tokens is no longer limited to isolated asset issuance platforms, but can be directly deployed on chains with deep liquidity and developer bases. For example, if Robinhood's Robinhood Chain successfully embeds the transaction data and capital flow of its hundreds of millions of users, coupled with the compliant opening of on-chain wallets and the integration of KYC custody tools, it is theoretically possible to build a hybrid financial model of "centralized user experience + on-chain asset architecture" in a closed-loop ecosystem, thereby promoting the actual frequency of use of stock tokens and the complexity of financial portfolios. And projects such as xStocks in the Solana ecosystem may also have structural advantages in scenarios such as arbitrage, perpetual contracts, and segmented fixed investments due to their high-frequency trading capabilities and low handling fees.

At the same time, from the perspective of the macro-financial cycle, the emergence of stock tokenization coincides with the critical stage when the global capital market and the crypto market begin to further integrate. With the passage of ETF-based Bitcoin and RWA gradually becoming the focus of on-chain layout of traditional institutions, the crypto world is shifting from "island economy" to "global asset compatibility system". In this context, stocks are undoubtedly the most symbolic connection point. Especially when investors begin to seek more flexible, efficient, 24/7 cross-border allocation tools, "US stocks" in the form of tokens are likely to become the core springboard for global capital flows. This also explains why traditional asset management giants such as Franklin Templeton and BlackRock are studying new structures such as security tokens and on-chain investment funds, with the aim of paving the way for the next stage of market structure changes in advance.

Of course, in the short term, stock tokenization still cannot get rid of several realistic constraints. Liquidity is still scarce, user education costs are high, compliance paths are full of uncertainty, and asset mapping mechanisms still have high trust costs. More importantly, there is no leading project with a "clear first-mover advantage", and there is a lack of standard assets like USDC, WBTC, and sDAI that have become protocol components. This means that the current market is still in the exploratory stage, and each project is trying to overcome the two major challenges of compliance and usability in different ways, but it will take time and patience to achieve standardization and scale.

However, because of this, stock tokenization may be at a "seriously underestimated early starting point". It does not directly assume the currency function like stablecoins, nor does it have native network effects like ETH and BTC, but the ability of "on-chain mapping of the real world" it represents is becoming a key puzzle piece connecting the two major systems. The project with real explosive potential in the future is likely not to be some new asset, but a "compliant integration platform" that can integrate asset custody, transaction matching, KYC review, on-chain combination and off-chain clearing. Its goal is not to completely replace traditional brokerages, but to become the "Web3 compatibility layer" of the global financial system. When such a platform has enough users and infrastructure support, stock tokenization will not only be a narrative, but will become a core component of the on-chain capital market.

V. Conclusion and Recommendations

Looking back at the development of stock tokenization, we can clearly see a typical cyclical phenomenon of "technology first, compliance lagging, and the market waiting". This technology is not a recent invention, nor is it an incomprehensible financial engineering problem. The mechanism logic behind it - mapping real stocks through on-chain assets to enable global, 7 × 24-hour trading and combination capabilities - is fully demonstrated in both technical and financial dimensions. But the real problem is not whether the mechanism itself is feasible, but how this mechanism can find a feasible path to take root and expand steadily in the complex regulatory context, financial infrastructure and market inertia in the real world. In other words, the reason why stock tokenization has not yet achieved explosive growth is not that it is not "good" enough, but that it is not "mature" enough, not "usable" enough, and has not really hit a strategic node where a policy window period and financial needs intersect.

But this situation is quietly changing. On the one hand, the traditional capital market's acceptance of blockchain is rapidly increasing. From Blackstone's on-chain funds, to JPMorgan Chase's on-chain settlement network, to BlackRock's on-chain RWA infrastructure on Ethereum, all of them are sending a strong signal: real-world assets are gradually being on-chain, and the future financial infrastructure will no longer be a binary opposition of "traditional and crypto", but a fusion of the middle ground. In this general trend, stocks, as one of the most mature real assets, have a naturally significant on-chain mapping value. On the other hand, the crypto-native ecosystem itself is also moving from pure speculation to a structural construction stage. From stablecoins, lending agreements to on-chain treasury bonds and ETF attempts, users are beginning to put forward higher requirements for the "stability, liquidity, and compliance" of assets. Stocks, as an asset class, can play a connecting role in this - they represent the cornerstone of credit in the real world, and can be embedded in smart contracts and DeFi modules through tokenization, becoming an important part of the on-chain investment portfolio.

Therefore, stock tokenization is not just an "interesting narrative", but a medium- and long-term opportunity track with real demand foundation, policy game space and technical implementation path. For industry practitioners, there are several clear recommended directions.

First of all, when entering the field of stock tokenization, project parties must make "compliance path design" the first priority, rather than technological innovation or user experience optimization. Projects that really have the opportunity to grow bigger and stronger will be those platforms that can build legal and compliant issuance structures and on-chain transaction mechanisms in friendly jurisdictions such as Switzerland, the European Union, the United Arab Emirates, and Hong Kong. Technology is only a prerequisite, the system is the boundary, and compliance is the moat of growth.

Secondly, the essence of asset tokenization is "infrastructure-level asset issuance", which means that its value does not depend on whether a certain stock is popular, but on whether the entire system can connect to more on-chain protocols and become a standard asset component. Therefore, tokenized stock projects must actively connect with various DeFi protocols to promote the implementation of combination products such as "rTSLA mortgage loans", "aAAPL perpetual contracts", and "SPY ETF token re-pledges". Otherwise, even if there is compliance and custody, it can only become a "conceptual tool" in low-frequency trading scenarios.

Again, user education and product packaging are equally critical. On-chain stock trading cannot continue to maintain the current high-threshold form of "only professional players can understand", but should actively learn from platforms such as Robinhood, eToro, Interactive Brokers, etc., introduce familiar UI language, simplified trading processes and visual profit structures, minimize user barriers, and truly bring traditional investors into the crypto world. For ordinary users, the logic of being able to buy a hand of AAPL with an on-chain wallet is far more attractive than knowing whether the custody structure behind it is based on CSD.

Finally, policy participation and regulatory dialogue must be put in place, especially in regions such as Hong Kong, Abu Dhabi, and London that are actively promoting RWA policy innovation, and should promote the formation of industry self-regulatory organizations, technical standard templates, and pilot regulatory sandboxes. The key to the ultimate success of stock tokenization is not whether a more complex asset packaging structure can be built, but whether policymakers can be convinced that this is a "controllable, incremental, and beneficial financial innovation" rather than another impact and challenge to the existing financial order.

In conclusion, stock tokenization is a proposition full of tension. It connects the oldest financial assets with the latest technological paradigm, and represents a collective demand for "liberalization of capital flows" and "reconstruction of financial infrastructure." In the short term, it will still be a battle of endurance in supervision, cognition, and trust; but in the long run, it may become the "third pillar" after stablecoins and on-chain treasury bonds in the development of on-chain finance. This is not a hype hotspot, but a deep water area, and one of the few directions that are truly worthy of long-term participation and investment in a 3-5 year cycle. If the basic logic of the next bull market is "on-chain real economy," then stocks on the chain are likely to be the most concrete, most valuable, and most controversial key breakthrough.

For investors and institutions, we recommend the following three considerations: short-term, medium-term, and long-term

Short term: focus on product launch, TVL, market-making mechanism, on-chain transaction data, and regulatory developments (such as MiCA and SEC guidelines).

Medium term: Evaluate whether the platform has added perpetual contracts, leverage mechanisms, DeFi support, as well as on-chain indicators such as funding costs and liquidity efficiency.

Long term: Pay attention to whether trading rights are opened to US users, the path of T+0 integration with compliance mechanisms, and the capital redistribution trend between on-chain funds and altcoins and new assets.

In short, the tokenization of US stocks is an "important experiment" in the structural transformation of the crypto market. Although there is no explosive trading volume, it is accumulating the underlying foundation for the second round of bull market. If the three elements of compliance and openness, chain depth and mechanism innovation can be achieved, this "old wine in a new bottle" may become the key engine that truly drives the next wave of growth in the crypto market.