Following CEX and Wallet, OKX enters the payment market

As one of the trendsetters in the Web3 industry, OKX is at the forefront of product technology or narrative direction, and can quickly establish an industry paradigm. On April 28, the "secret business line" mentioned by OKX CEO Star during the 2024 New Year's greetings was finally revealed - the digital asset payment tool OKX Pay. With the launch of OKX Pay, the three major business strategies of OKX were officially clarified: centralized exchanges, on-chain portals, and decentralized digital asset payments .

Relying on OKX's over 100 million existing users, OKX Pay completed a cold start at the beginning of its launch and quickly entered the crypto payment track. In the next stage, as it further connects to the B-side merchant network and superimposes the OKX Card in cooperation with global payment service providers such as Mastercard, OKX Pay is expected to achieve instant payment and settlement of crypto assets in some regions supported by the world, open up the path from online transactions to offline consumption, and truly promote the integration of crypto assets into the "last mile" of daily life. At the same time, with its Web2-like product experience, OKX Pay is also opening up channels for the large-scale implementation of Web3 applications. Or as Star imagines: "Road to the Next Billion Users".

The ideal is full of hope, but the reality is worth exploring. What exactly does OKX Pay really leverage when it comes to payment? Is it a wider range of users, a larger market, or the deep integration of the crypto world with daily life? Let's start from the beginning.

OKX Pay is gaining attention

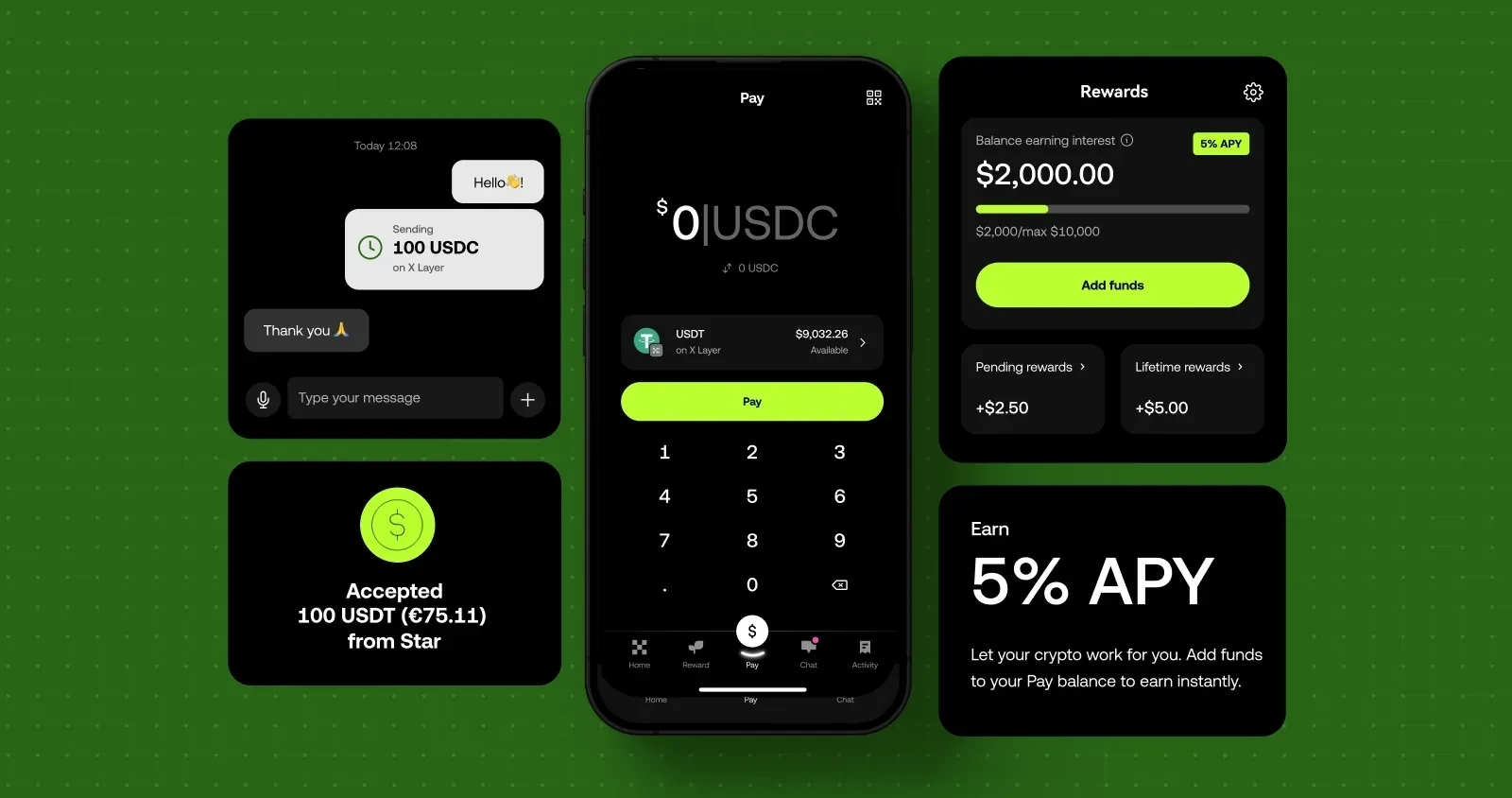

The first version of OKX Pay launched three core functions: digital asset payment, social networking, and asset management. For novice users, the entire process of OKX Pay can be summarized as "You have an OKX exchange account → Activate OKX Pay smart account → Recharge USDT/USDC stablecoins → Easily make on-chain payments → Currently the official automatically subsidizes your balance up to 5% annualized incentives → Create a group with friends and send digital asset red envelopes to each other during chats". It not only reuses CEX's existing KYC to enjoy convenience, but also uses AA multi-signature technology to ensure asset security and meet compliance audits such as AML. It is worth mentioning that if you lose your Passkey, you can easily retrieve your wallet through the ZK email recovery function.

After OKX Pay went online, it quickly swept social media, and KOLs posted articles praising its innovative on-chain social payment experience: the exclusive group limited to 100 people was instantly full, and it was still not enough after upgrading to 500 people. Many people even called on OKX Pay to lift the group size limit. In addition, the red envelopes sent out were snapped up. OKX Pay originally planned to rely on the two major incentives of "5% annual subsidy" and "X Layer transaction fee-free" to quickly attract users, but it was the social and digital asset red envelope functions that made it unexpectedly popular.

OKX Pay also supports scanning or displaying QR codes for encrypted asset payments, providing a convenient Web2-like experience; coupled with zero handling fees, stablecoin payments that arrive in seconds, and seamlessly embedded text/voice chats and digital asset red envelopes, these advantages make OKX Pay the best entry point for novice users to enter the on-chain social payment. However, OKX Pay still has shortcomings in the first version: for example, it is only available in some regions; the public chains supported are relatively limited; groups cannot scan codes to add people, and group nicknames cannot be modified at will; address book synchronization permissions cannot be turned off, etc. Although these functional deficiencies require subsequent iterations, they also reflect the users' great enthusiasm and participation in social payment gameplay.

Entering the stablecoin payment market

Since OKX Pay already supports the two major stablecoins USDT/USDC, let’s explore from the perspective of stablecoins whether its business model is robust enough and has sustainable profit potential?

As of April 2025, the global stablecoin market value has exceeded US$240 billion, becoming a key force in promoting cross-border payment innovation. Thunes' research points out that stablecoins are reaching an inflection point in the field of B2B trade and fast settlement, with more than 70% of cross-border transactions using stablecoins to reduce the high intermediary fees and long delays of traditional wire transfers. Compared with traditional SWIFT wire transfers or credit card networks, cross-border transactions settled using stablecoins can reduce costs by more than 40%, increase speeds by several times, and significantly improve payment efficiency. In addition, banking institutions such as FV Bank predict that inter-enterprise stablecoin payments will surpass traditional methods this year, which provides support for OKX Pay's large-scale enterprise-level applications from an institutional level.

Driven by huge demand, traditional payment giants have tried crypto payments: Visa uses the Ethereum network to provide USDC directional clearing services for banks and large FinTechs, and PayPal uses Paxos Trust to centrally issue and support the buying, selling and transfer of PYUSD in its own custody account, seamlessly introducing crypto funds into the existing legal currency payment system. However, as a purely on-chain native product, OKX Pay achieves zero-fee on-chain final settlement with the help of OKX Wallet's AA smart account architecture and X Layer ZK L2 network based on Polygon CDK. This not only allows users to control their assets, but also paves the way for the integration of payment processes with DeFi ecosystems, smart contracts and other PayFi scenarios in the Wallet in the future, opening up a truly innovative digital asset payment experience.

More importantly, by establishing a closed-loop compliance system with local institutions and industry partners, OKX Pay can quickly win the trust of businesses and large merchants. For example, by providing a set of SDKs and APIs, merchants can access this large and liquid payment pool, and can further join hands with traditional payment networks such as Mastercard and Stripe to connect the on-chain stablecoin and bank card system, and achieve cross-border instant settlement in some regions supported by the world. With the advantages of low cost, high security and fast arrival, OKX Pay not only strengthens the competitive barriers of the OKX ecosystem, but also forces peers such as Binance Pay, Kraken Pay, Crypto.com Pay, and Coinbase Pay to accelerate technology and compliance innovation, thereby giving OKX the possibility of overtaking on the curve in the encrypted payment track.

Three major business lines established

OKX's strategic layout has gradually become clear, forming three core business segments: centralized trading (CEX), on-chain entry (Wallet) and decentralized payment (OKX Pay). This in-depth layout not only meets the diverse needs of users from asset trading, on-chain interaction to daily payment, but also marks the strategic upgrade of OKX's transformation from a traditional digital asset trading platform to a comprehensive Web3 service provider with financial infrastructure capabilities.

Among these three sectors, the centralized trading platform is still the core hub of the OKX ecosystem. With its deep liquidity foundation, millisecond-level matching engine and global compliance layout, it provides users with an efficient and secure crypto asset trading experience. As a one-stop entrance to Web3, OKX Wallet supports core functions such as multi-chain asset management, DApp interaction, NFT browsing and DEX trading, greatly reducing the technical threshold for ordinary users to enter the on-chain world. OKX Pay plays a key role in the field of decentralized payment, supporting instant zero-fee payments on the chain for mainstream stablecoins including USDT and USDC, and actively promotes the popularization and application scenario expansion of encrypted payments in some regions supported by the world through cooperation with traditional financial service providers such as Mastercard.

Through the coordinated development of these three sectors, OKX has created a crypto ecosystem with closed-loop functions and interconnected scenarios. The various business sectors have formed complementary advantages and jointly promoted the continuous optimization of user experience, showing significant advantages in terms of the convenience and security of asset transactions, as well as the accessibility and availability of on-chain applications. This strategic synergy not only significantly improves the fluency and integrity of the overall user experience, but also enhances the stickiness and activity of users on the OKX platform. On this basis, OKX continues to promote the penetration of encryption technology and applications into the mainstream market, injecting new momentum into the development of the industry, and becoming a bridge and accelerator for the popularization of the encryption field.

From tools to lifestyle

OKX Pay has broken through the cross-border settlement barriers in some regions supported by the world through zero-fee stablecoin payments, and has greatly lowered the threshold for crypto payments with the help of a smooth Web2-like experience. It is not just a payment tool, but is gradually becoming the infrastructure of the Web3 era. With the strategic synergy of the three major business segments, OKX Pay is building a complete crypto ecological closed loop and redefining the application scenarios of crypto assets in daily life. With the full rollout of OKX Card and merchant networks, crypto payments are expected to be integrated into our daily lives as naturally as scanning code shopping.

OKX Pay is responding to this expectation at the fastest speed. Sherry, head of OKX Pay, disclosed in a Space sharing that the product completed 4 iterations within the first 8 months of its launch, and each update was a deep reflection and strategic layout of the future payment ecosystem. Such a high-frequency innovation rhythm not only reflects the team's persistence in product excellence, but also means that OKX Pay is using technological innovation as an engine to gradually turn the vision of integrating crypto assets into daily payments into reality. Through continuous iteration, OKX Pay continues to break through technical bottlenecks and scenario limitations, accelerate the implementation of crypto payments from theoretical concepts to life practices, and strive to open up the "last mile" for crypto assets to integrate into daily life.

Disclaimer: This article only represents the author's views. This article is not intended to provide (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professional for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.