The past month has been a heavy loss for Bitcoin investors. The price of the currency has continued to decline since the high of nearly 72,000 at the beginning of last month, and once fell below the 60,000 mark. As the beginning of July, the funds of ETFs have gradually resumed positive inflows, and the price of BTC has also taken advantage of the trend to get rid of the 60,000-62,000 range at the end of last month, challenging 63,200 US dollars twice. This will be the key to witness whether BTC can continue to recover its lost ground, and investors have high hopes for this. But if the challenge fails, BTC is likely to repeat the tragedy of June and fall below 61,000 again. At the same time, Federal Reserve Chairman Powell will deliver a speech on Tuesday, after which many influential US macro data will also be released to the market, such as ADP on Wednesday, the service industry PMI index, and non-agricultural and hourly wages on Friday, which will all be closely watched by the market.

Source: SignalPlus, Economic Calendar

Source: Farside Investors; Trading View

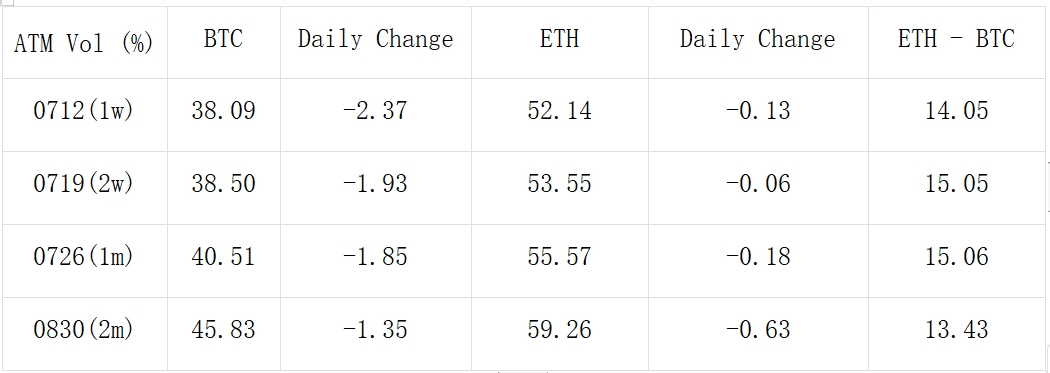

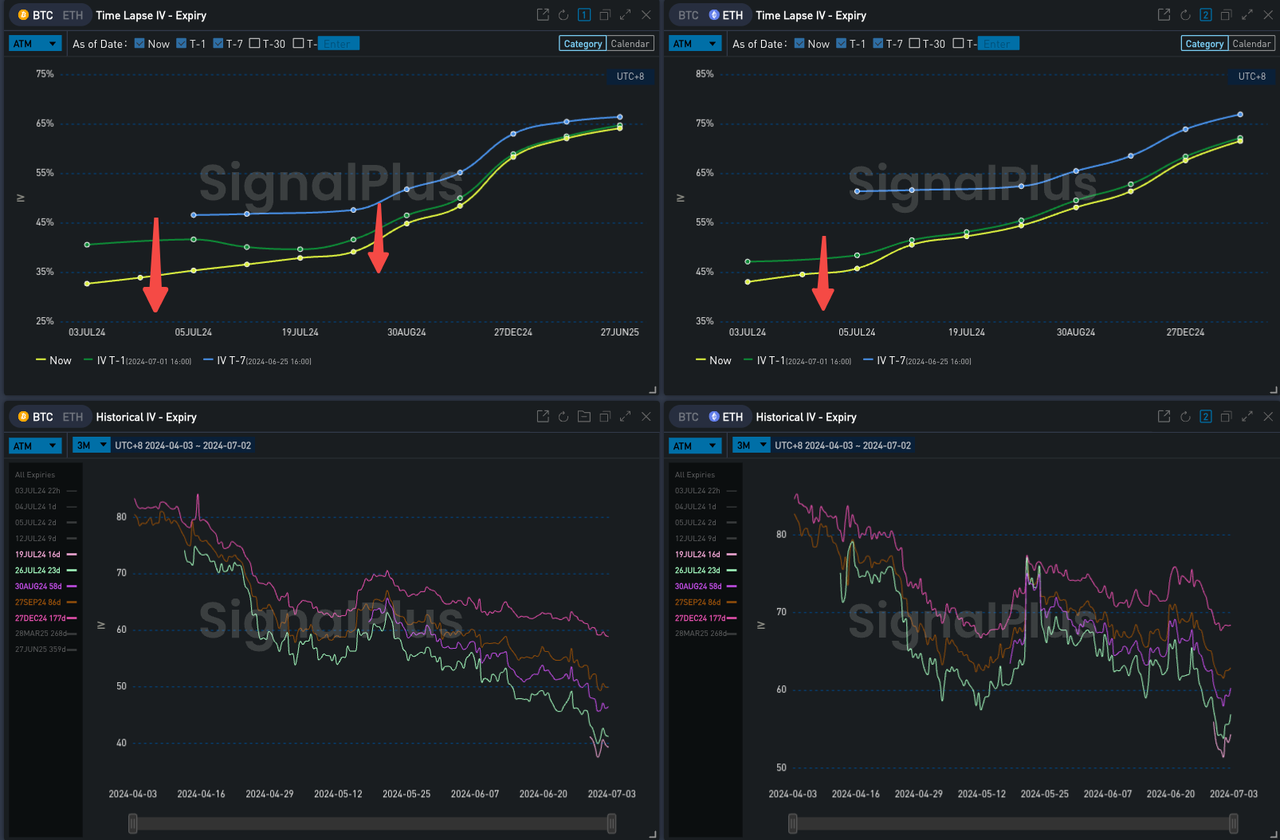

In terms of options, implied volatility is still declining, BTC continues to break the recent historical lows, and ETH IV has experienced several sharp fluctuations after several ETF News shocks, but the overall trend is still downward, currently around 50+%, generally 15% higher than BTC Vol in the same period. Back to the Ethereum ETF, the US SEC returned all the S-1 forms to the issuers, and the market expects that it should be approved within two weeks. In addition, judging from the published rates, in order to seize the market, the Ethereum ETF rate will be lower than that of the Bitcoin ETF, all below 30 basis points.

Source: Deribit (as of 2 JUL 16:00 UTC+8)

Source: SignalPlus

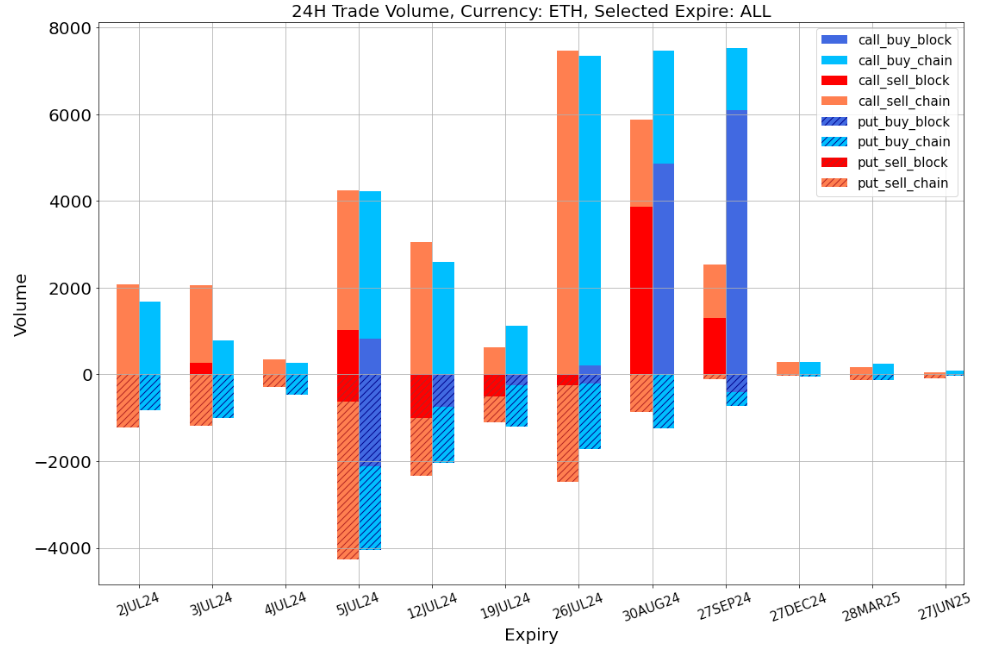

Data Source: Deribit, overall distribution of ETH transactions

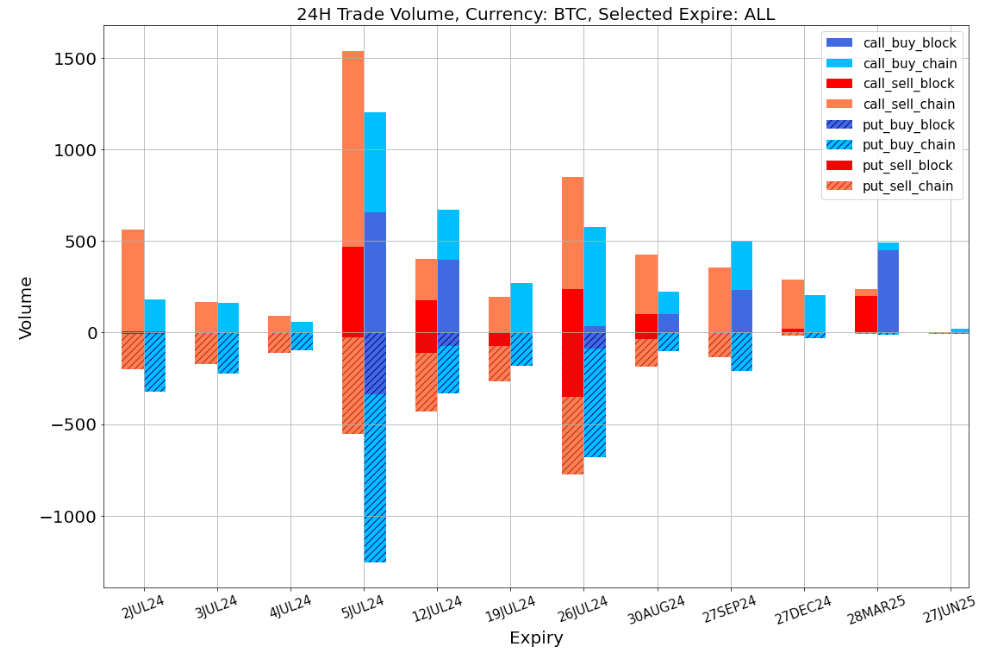

Data Source: Deribit, overall distribution of BTC transactions

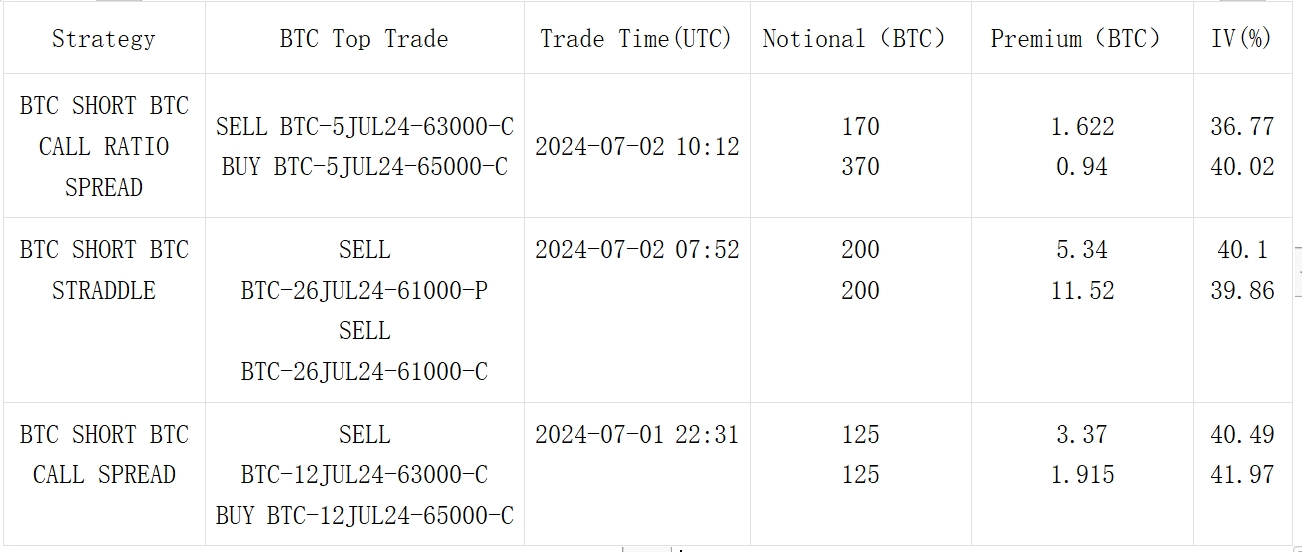

Source: Deribit Block Trade

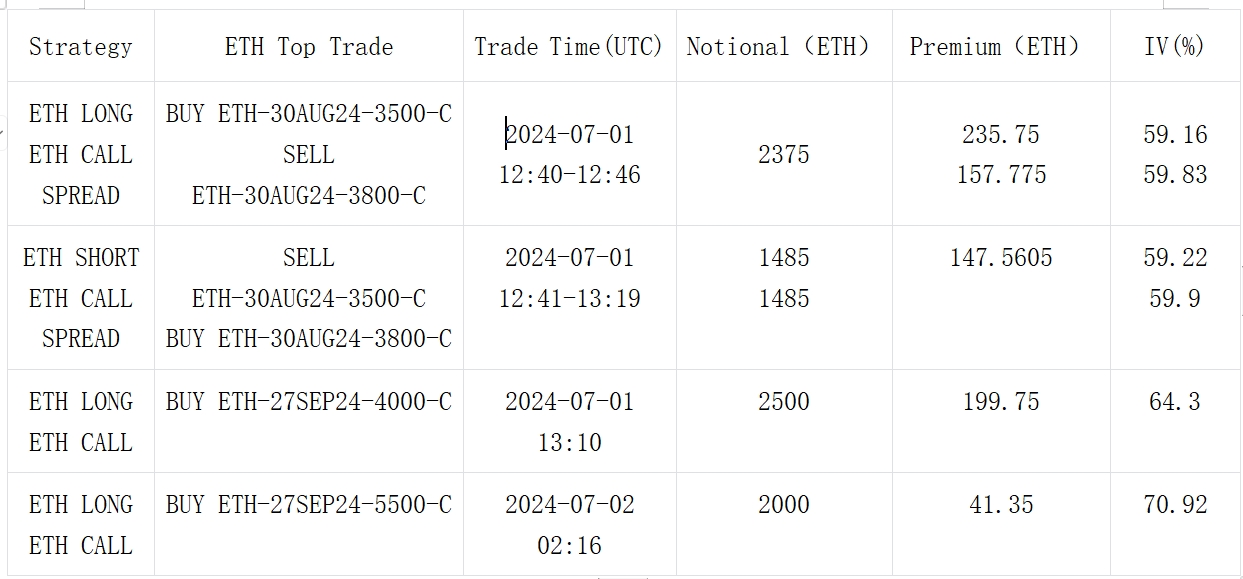

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com