After the plunge, how does Ethena (USDe) perform with negative fees?

Original - Odaily

Author - Azuma

This past weekend, the cryptocurrency market experienced a sharp correction not seen in a long time.

OKX market data shows that BTC has dropped as low as 60,000 USDT, ETH has directly fallen below the 2,800 USDT mark, and the maximum declines of other mainstream Alt-coins have generally reached 30% -50%.

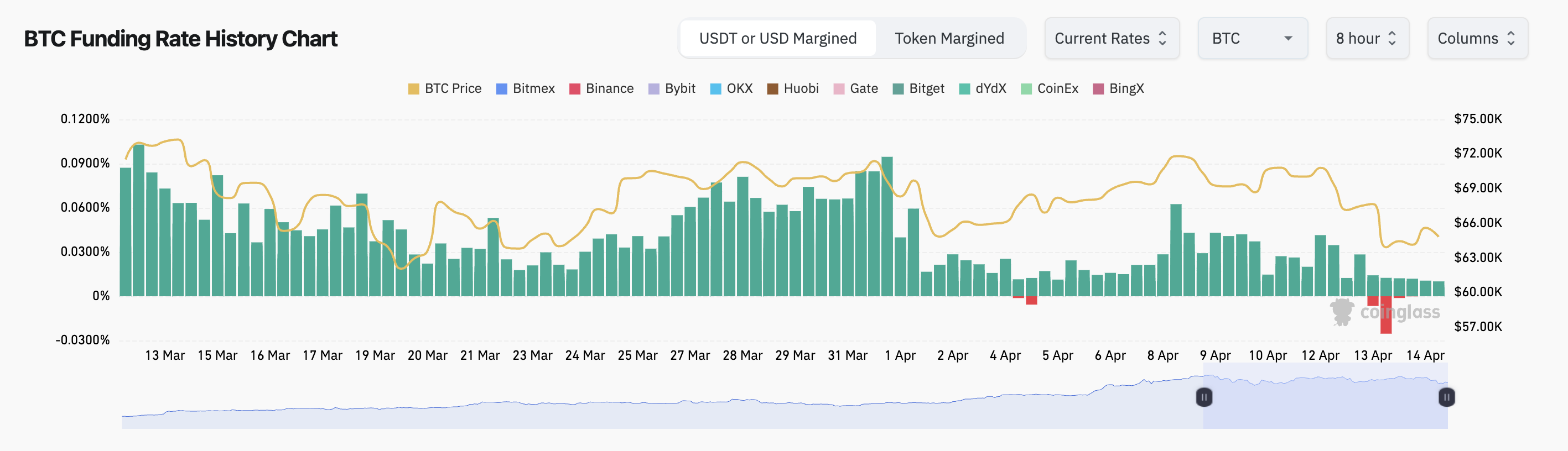

Under the extreme market conditions, the funding rate in the contract market, which has been high for a long time, has also turned around and even turned negative for a time.

For Ethena (USDe), which uses funding rate arbitrage as a weapon, this mutation is like a stress test that was too late to rehearse.

A brief analysis of USDe: the magic of funding rates

For users who are not familiar with Ethena, you can read A brief analysis of Ethena Labs: Valuation of US$300 million, a stablecoin disruptor in the eyes of Arthur Hayes》。

in short,USDe is a new stablecoin project that is collateralized by an equal amount of long spot ETH (recently adding support for BTC) and short futures ETH.

USDes largest label is Delta Neutral. The so-called Delta, in finance, is an indicator used to measure the impact of changes in underlying asset prices on changes in investment portfolios. Based on the product nature of USDe, since the collateral assets of this stablecoin are composed of equal amounts of long spot ETH and short futures ETH, the delta value of the spot position is 1 and the delta value of the futures short exposure is -1 , the Delta value after hedging the two is 0, that is, Delta neutrality is achieved.

Compared with traditional stablecoin projects, the biggest feature of USDe is its more imaginative yield space.

The first is the stable income from spot long pledge. Ethena supports staking spot ETH through liquidity staking derivative protocols such as Lido, thereby earning an annualized return of 3% - 5%.

The second is the unstable income from the futures short funding rate.Users who are familiar with contracts all understand the concept of funding rate. Although funding rate is an unstable factor,But for short positions, the funding rate will be positive most of the time in the long run, which also means that overall returns will be positive.

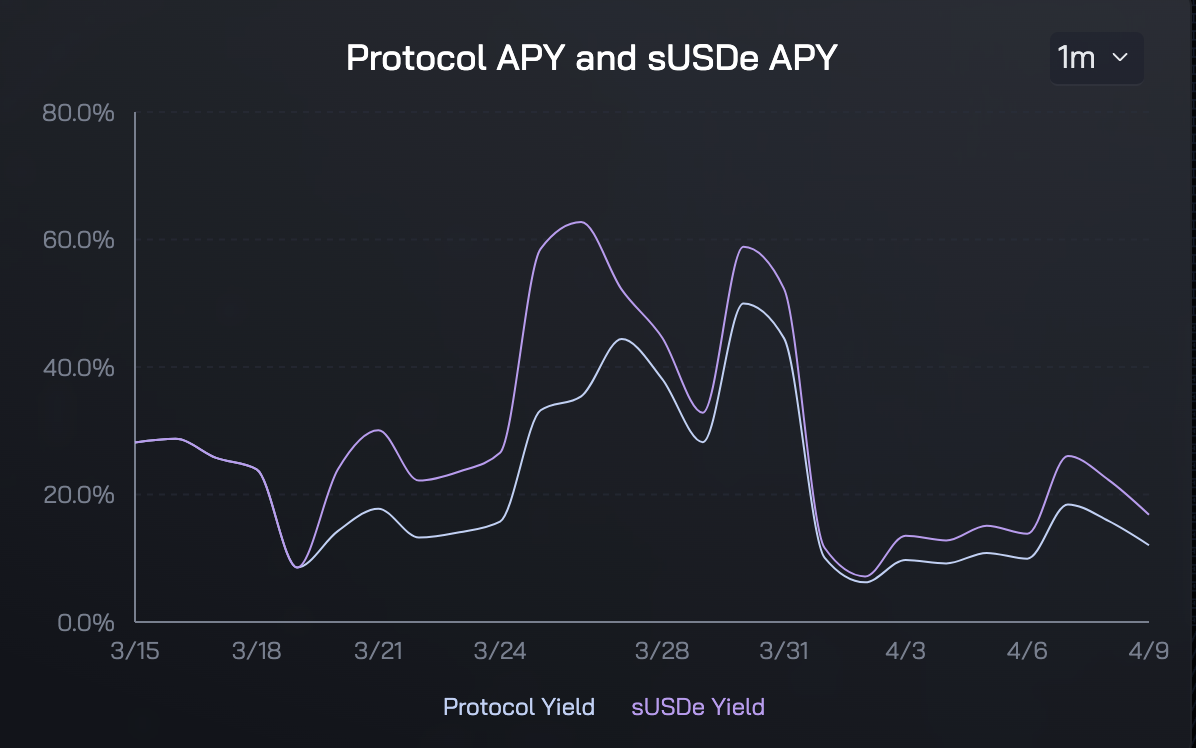

The superposition of the two returns has achieved a considerable rate of return for USDe. Official data shows that the yield rate of sUSDe (USDe pledged certificate token) has performed quite amazingly in the past month. The protocol yield rate has reached a maximum of 49.96% and a minimum of 6.23%; sUSDe has reached a maximum of 62.74% and a minimum of 7.15%. .

Odaily Note: The yield data given on Ethena’s official website are often delayed for several days, and the latest data for the two days on weekends have not yet been updated.

The challenge of negative rates

However, there is a general premise for the above data performance——Over the past month, rates in the contract market have been almost always positive, meaning that short positions can be compensated by rates from long positions.

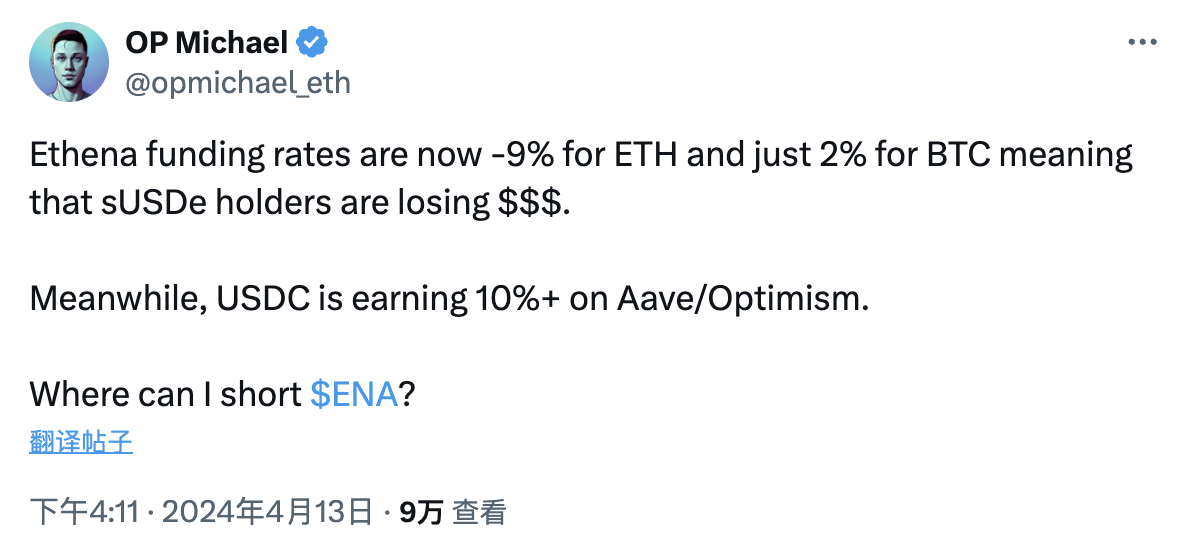

As the fee rate turns negative, the situation will turn 180 degrees. At this time, the short position needs to start paying the fee rate to the long position as compensation. For Ethena and USDe, which are backed by the short position, at this time The agreement will begin to suffer losses.

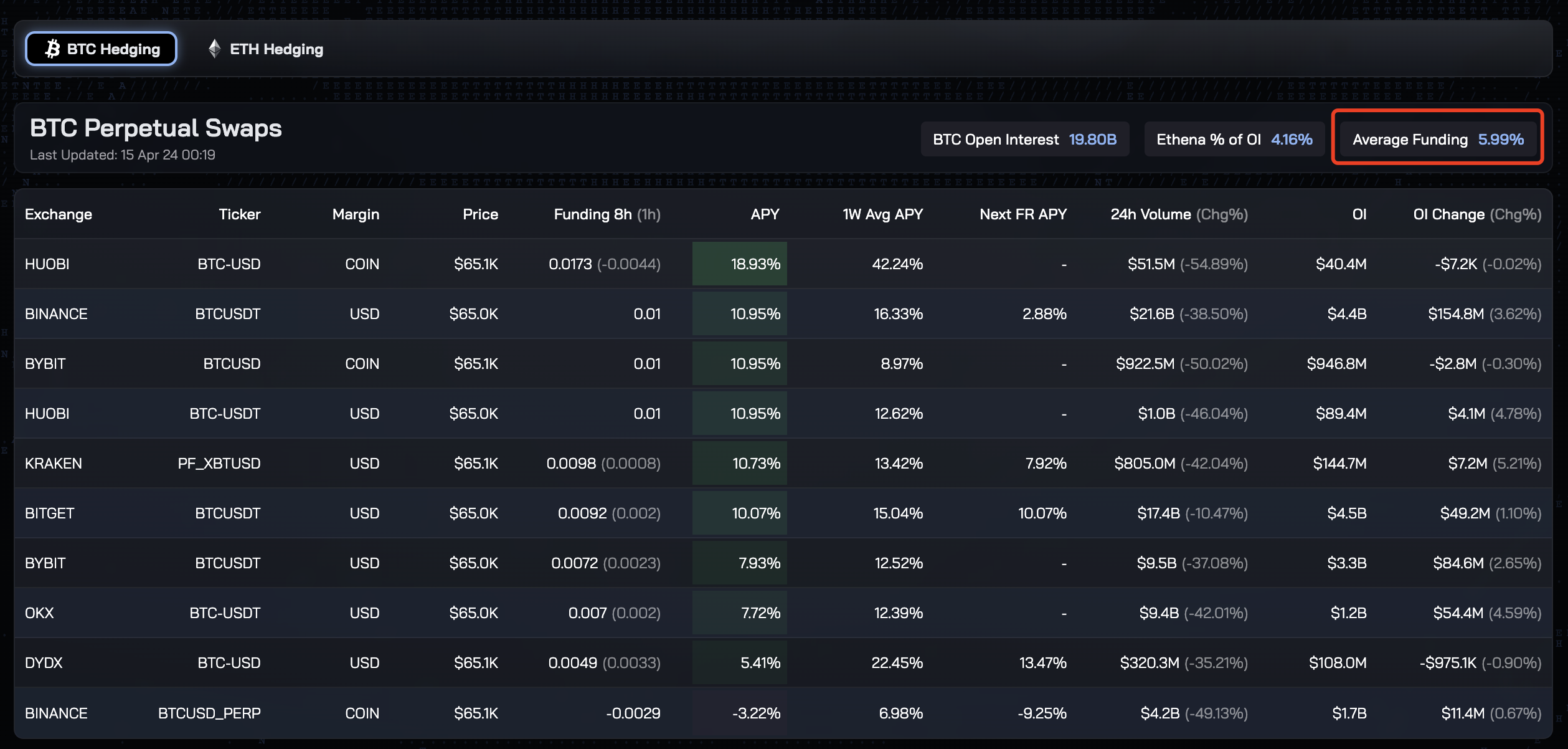

Overseas KOL @OP Michael recorded the overall position rate situation of Ethena when the market sentiment was extremely pessimistic on April 13 - the comprehensive rate of ETH was -9% at one time, and the comprehensive rate of BTC was only 2%. The agreement and sUSDe holdings All have begun to face losses.

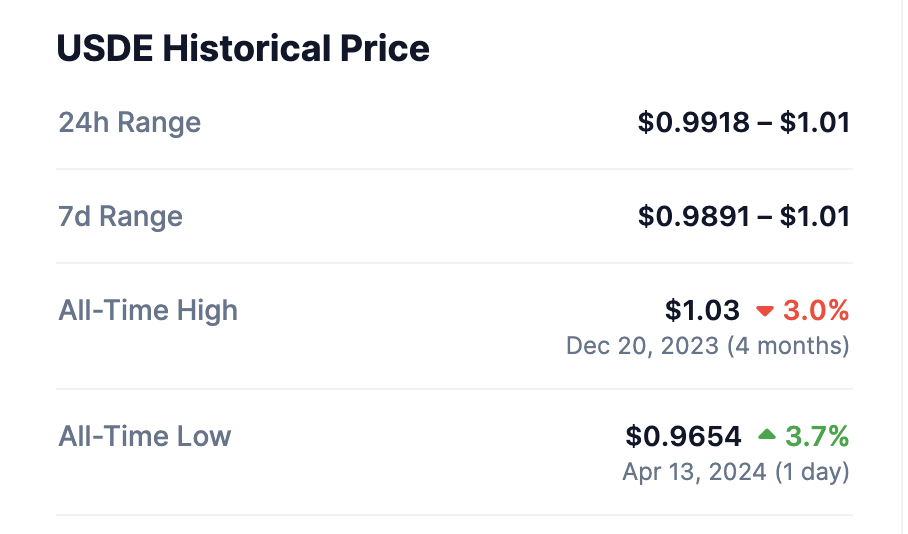

As the situation changed, USDe also faced a certain amount of selling pressure.In the short term, it was once detached to US$0.965, and the price of ENA also plummeted to around US$0.9.

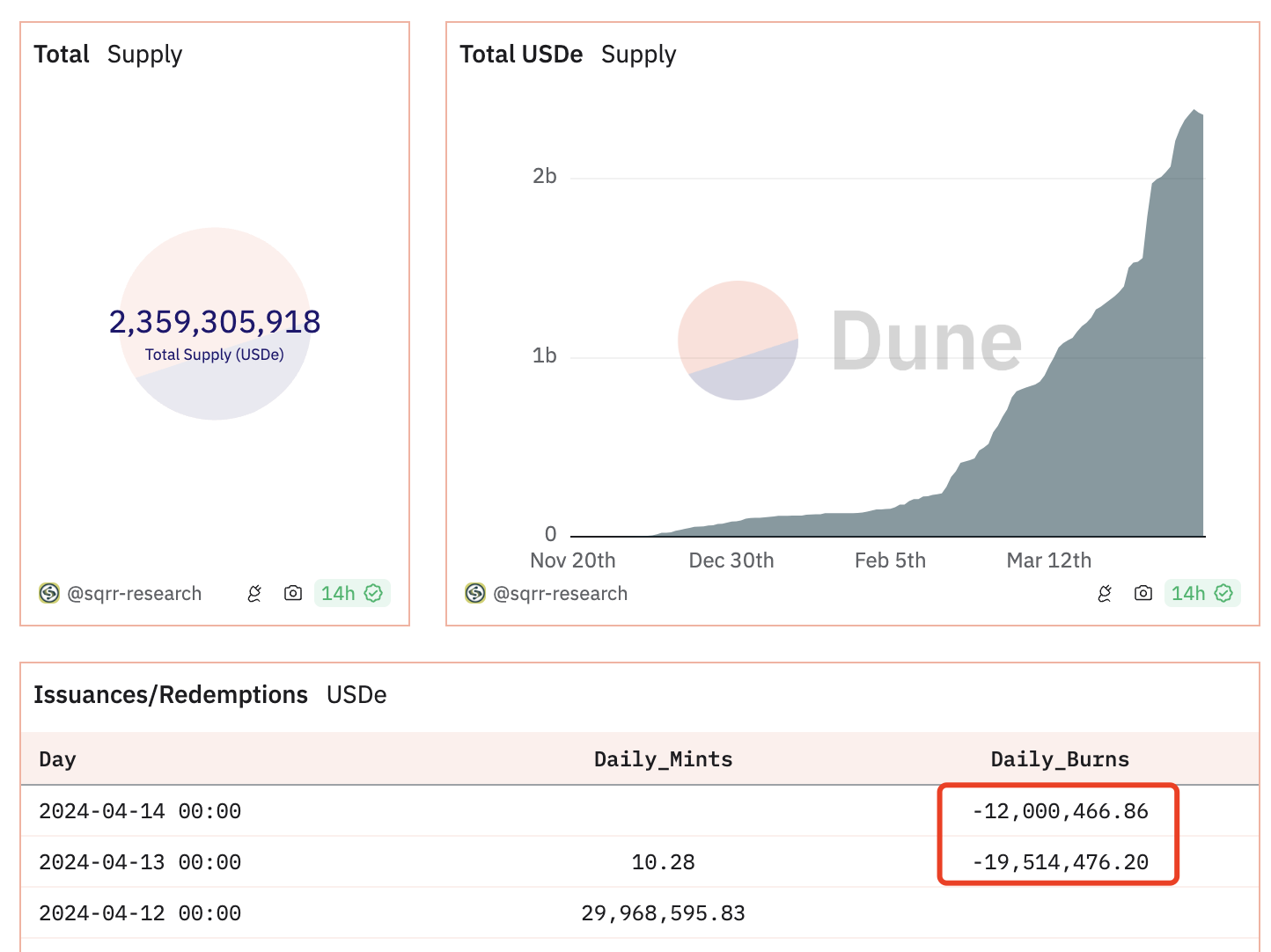

Dune data shows,The continued growth of USDe supply has been interrupted by this sudden stress test. Tens of millions of dollars have been burned in the past two days.(Essentially closing the mortgage position and redeeming it).

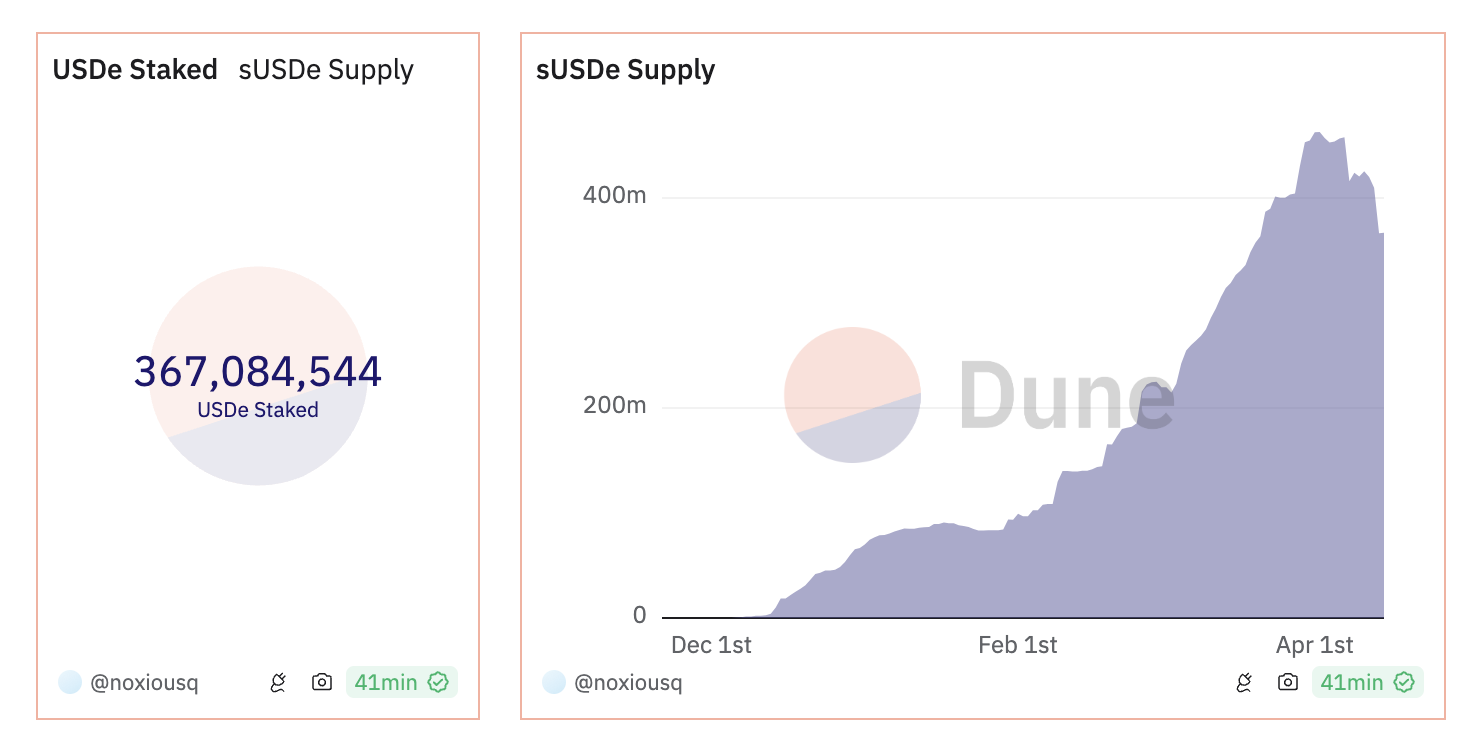

sUSDes data reduction is more intuitive. In the past half month or so, perhaps the market has noticed the trend of weakening rates, and nearly $100 million of sUSDe has been unsecured.

KOL @OP Michael pointed out that there are currently about 170 million sUSDe in the cooling-off period for unplacing, accounting for about 30% of the total pledged amount.

The rebound comes and the test ends

Fortunately, the crisis hanging over Ethenas head did not last long.

As the market gradually stabilized and rebounded slightly this morning, the funding rate in the contract market gradually turned positive - that is, the agreement has returned to positive income status. As of the time of publication, the comprehensive rate for Ethenas ETH positions is 5.56%, and the comprehensive rate for BTC positions is 5.99%.

With the pressure temporarily lifted, USDe has also regained its anchor (in fact, USDes unanchoring did not last long after the protocol proved to be redeemable smoothly), and ENA has also rebounded above $1.1.

In short, the two-day market change over the weekend gave us an excellent window to observe Ethena. Ethena’s performance once again proved that “positive rates can become a super engine for the growth of USDe, but in turn negative rates can also It will become a huge challenge for the protocol to operate or even survive.”

The bull market may not be over yet. For Ethena, the golden age of USDe is still continuing, but this also means that the real challenge has not yet begun.