每周编辑精选 Weekly Editor's Picks(0106-0112)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Bitcoin has returned to dominance and ecological trends, AI and Web3 ecology continue to integrate and collide, regional supervision is clearer and full of competition, the DePIN track has huge development potential, tokenized RWA will become an important part of the new market cycle, SocialFi and Web3 social applications Gaining further attention, decentralized science (Desci) becomes a powerful use case, the GameFi field will transition to Play-and-Earn, and NFT becomes a brand asset.

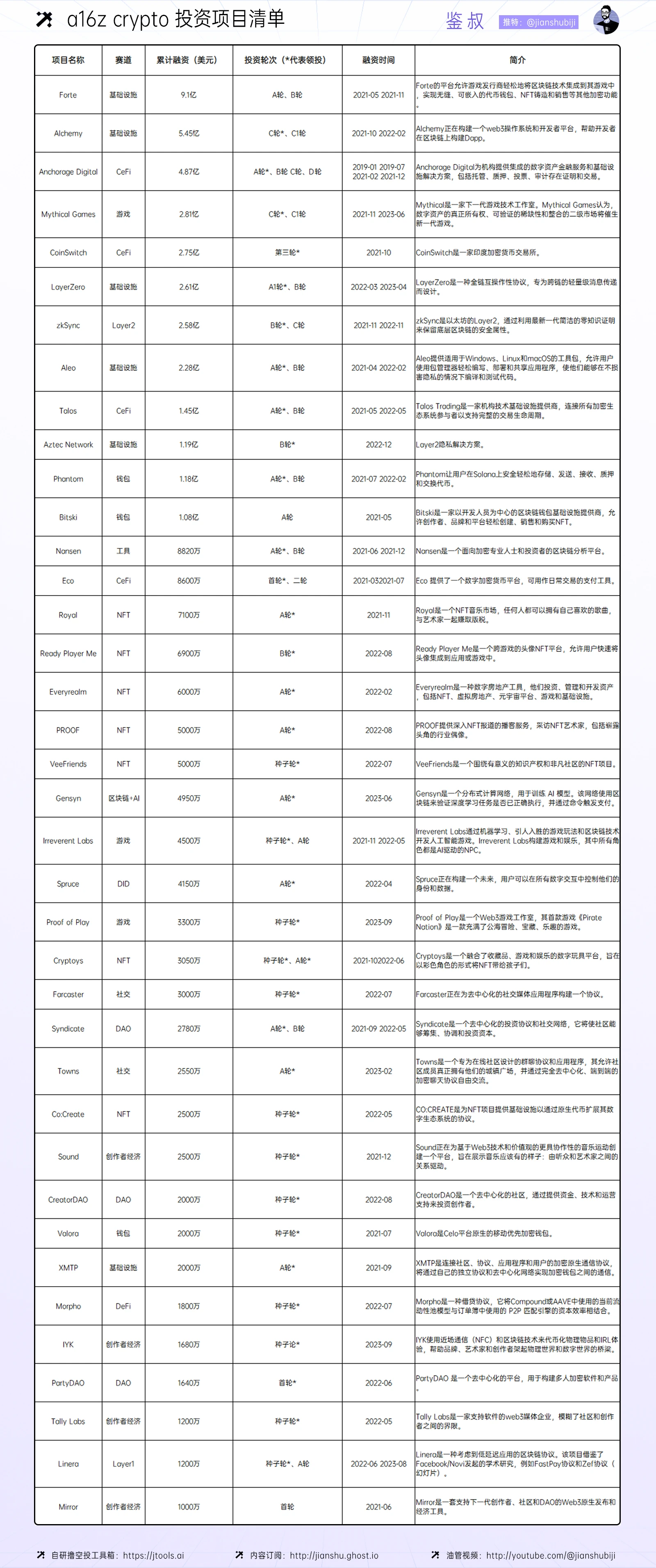

a16z crypto: How is the crypto investment golden finger made?

Potential projects for a16z crypto investment (excluding those that have issued coins, rugs, financing amounts less than 10 million and those that serve traditional industries):

BTC Spot ETF

Coin Metrics: Market Structure for Bitcoin Spot ETFs

The emergence of spot ETFs is an important step in this direction. It is a watershed, ending a decade of exploration, and a critical moment in the evolution of the market.

The derivatives landscape played an important role in shaping the market structure dynamics that preceded ETFs. As CME futures open interest surges to $5.4 billion, we see the digital asset market shifting from being primarily driven by retail investors to a more dynamic institutional playing field. This trend is likely to expand as a host of financial advisors, registered investment advisors (RIAs) and family offices with trillions of dollars in assets under management increasingly incorporate Bitcoin into their traditional investment portfolios.

The ETF fee rate war has begun. What is the purpose of institutional volume fee rates?

Issuers are scrambling to lower ETF fees, and some institutions have even proposed exemption policies such as 0 fee for the first six months.

The fund sponsor is responsible for the management and control of the fund and the marketing of the fund, while the sponsor fee (Sponsor Fee) is used to pay for the costs of managing the ETF, including custody costs, management salaries, securities buying and selling costs, legal expenses, etc.

Since 1997, the reduction of global ETF fees (active and passive) has been an irreversible trend. When compared to other countries around the world, rates in the United States are significantly lower.

Typically, zero-fee ETFs make money by lending shares to customers, selling other products, or offering lower interest rates on cash funds.

If a Bitcoin spot ETF is approved, what impact will it have on Coinbase and MicroStrategy?

With the approval of a spot Bitcoin ETF, MicroStrategy could face stiff competition and lose its position as a Bitcoin proxy in traditional markets. MicroStrategys stock price has soared more than 300% in 2023, outperforming Bitcoin, which has gained about 150% during the same period.

Coinbase is going all-in in the Bitcoin ETF spot race, positioning itself as a trusted custody service. As the exchange becomes the preferred custodian of Bitcoin held by ETF funds, the exchange will earn more revenue and potentially generate more demand from other large players in the traditional investment space. Coinbase can successfully expand its existing model to earn cash flow through various subscriptions and services in addition to revenue from internal trading volume. These factors have given Coinbase stock a solid foundation to attract investors, with its value soaring 370% in 2023, according to TradingView.

The Receipts Depositary Corporation (RDC) will offer Bitcoin depositary receipts similar to American Depositary Receipts (ARDs) and will not require SEC approval. The Bitcoin Depositary Receipts launched by RDC this time represent direct ownership of the underlying Bitcoins, rather than shares in the fund. Simply put, Bitcoin Depository Receipts allow U.S. investors to invest in Bitcoin the same way they invest in overseas companies without running afoul of the Securities Act.

Bitcoin Depository Receipts follow the same structure as American Depository Receipts, which like ADRs operate within a U.S. regulated market infrastructure and are cleared by the Depository Trust Company (DTC).

DeFi

A look at 6 Perp DEXs with unissued coins: What are the potential opportunities?

The development of Perp DEX is not perfect. Some projects have demonstrated the diversity and innovation of the track. Combined with different incentives, there may be projects that can replace the current status of GMX or Synthetix. For users, the sooner they get involved, the better.

But be aware that safety accidents occur frequently on this track.

The article expands to introduce Aark Digital, Drift, Zeta, MYX, Hyperliquid, and Jupiter.

A brief analysis of Curve’s debt problem: the game of liquidity providers

The article discusses the design limitations of CRV from the debt problem of Curve founder Mich, and expresses his high expectations for the future of Curve. It is believed that Mich, as one of the most talented developers, will continue to innovate to promote the sustainable development of the ecosystem. In addition, the article also analyzes the short-selling transactions of @0x Sifu, Curve’s largest liquidity provider, to speculate on Curve’s next development. Curve will have to go through another stress test in the coming weeks when OTC CRV becomes liquid, and founders debt is a systemic risk.

An in-depth analysis of the re-pledge track: attractive returns and fragile house of cards

The concept of restaking is that the same stake used to secure Ethereum PoS can now be used to secure many other networks. Re-staking can be interpreted as programmable staking, where the user chooses to include any positive or negative incentives to secure additional infrastructure. In practice, EigenLayers re-stakeholders provide economic trust (in the form of staked ETH) so anything objectively verifiable can be slashed.

People choose to re-stake for financial incentives and gains. But also be aware that re-staking adds some significant risks, including ETH having to be staked (or LST having to be staked, so the token is not liquid), EigenLayer’s smart contract risk, protocol-specific slashing conditions, liquidity risk, concentration degree of risk. Once the risks are taken into account, the returns are not high for those seeking extreme returns.

Some solutions to mitigate rehypothecation risk include: optimizing rehypothecation parameters (TVL cap, haircut amount, fee allocation, minimum TVL, etc.) and ensuring diversification of funds across AVS. This requires AVS and EigenLayer to work together to ensure there is a plan in place to minimize these risks.

Most of the capital in the re-hypothecation is employment capital and will likely leave after the EigenLayer airdrop.

Restaking narrative is hot, take a look at EVM ecological re-staking projects

Some tokens related to the LRT concept have already experienced good growth. In addition to Restake Finance ($RSTK), which is constantly doubling, projects with issued coins but low market capitalization include KelpDAO, an LRT solution built with rsETH based on EigenLayer. .

Unreleased currency projects include Swell, ether.fi, Renzo, Puffer Finance, which raised $5.5 million, exocore, which focuses on multi-chain restaking, and even lending platforms Ion Protocol and Astrid that serve Staked and Restked assets.

Other ecosystems are also attacking the re-pledge track, such as the Bitcoin staking protocol Babylon, Solana ecosystem Picasso, etc.

After the official launch of the Bitcoin spot ETF, the Ethereum ecosystem is expected to rebound, and three major narratives will be the main theme of the Ethereum ecosystem: the first is the Ethereum second-layer ecosystem that is directly beneficial to the Cancun upgrade, and the second is EigenLayer re-staking Ecology, and the third is Web3 application projects (games, payments, etc.) for Mass Adoption.

The Liquid Restaking project is the most cost-effective way to participate in the EigenLayer re-staking track. You only need to deposit ETH into the relevant agreement to participate.

The article further introduces KelpDAO, Renzo, Swell, and ether.fi.

Web 3.0

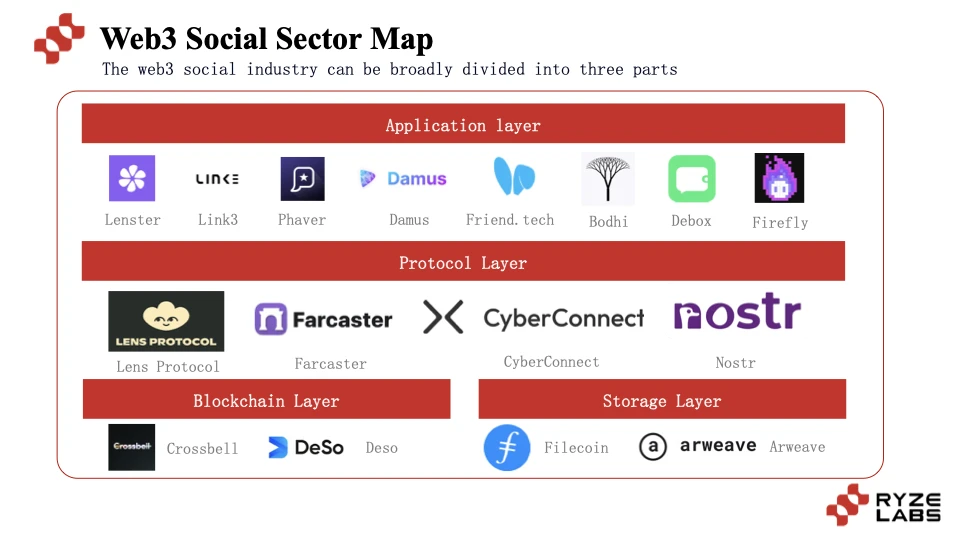

The nature of human needs for social interaction has not changed much with the development of the times. The core needs are summarized as the following four points: maintaining connection and belonging, information learning and exchange, cooperation and mutual assistance, social identity and self-expression. Web2 socialization solves the needs of fast, good and economical. The Web3 social industry can be roughly divided into 4 parts, application layer, protocol layer, blockchain layer and storage layer.

Web3 social networking has not yet seen large-scale application. The challenges and limitations behind it can be summarized as the following points: the trade-off between decentralization and user experience, the replacement cost of social products is very high, the sustainability of data value feeding back to users, The overlap between social target users and Web3 user profiles is low.

An area worthy of attention in the future is the combination of social networking and AI Agent, using AI to create virtual girlfriends, boyfriends, and partners to meet human needs for companionship and emotional support. AI focuses on emotional companionship and support, and Web3 focuses on providing data value to users and resisting censorship. Both are now in their early stages.

inscription

An explosion of SFT? An article exploring the nature of inscribed tokens

The essence of inscription is actually SFT, the third form of token that is different from NFT and FT. Semi-fungible token is a type of token that is between FT and NFT. It can be split and calculated and is unique.

The inscription version of NFT is a veritable full-chain NFT. The content is directly stored in the BTC on-chain space. It only uses sequenced sats to point to the content. This is indeed an advantage.

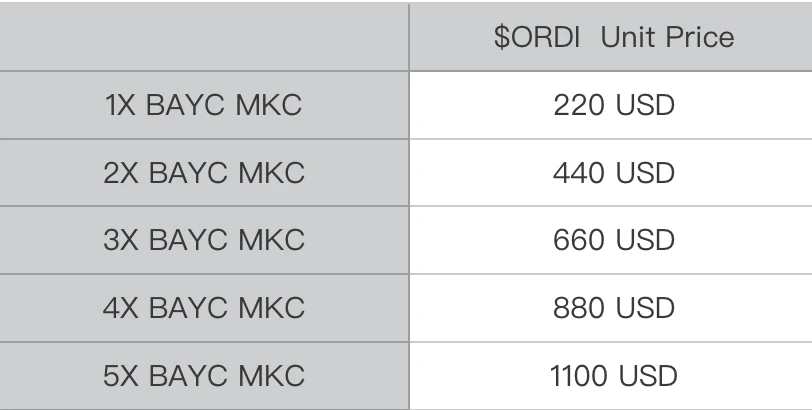

ORDI is the first SFT token in the BTC ecosystem. It is a MEME attribute, so there is no Intrinsic valuation model. In other words, the only limit is your imagination. But we can still make an estimate by reviewing BAYC, the leader in the NFT market.

Ethereum and Scaling

MT Capital: Cancun upgrade injects new vitality into the Ethereum ecosystem

One of the core upgrades of Dencun is the introduction of a new data structure blob through EIP-4844 to store the transaction data submitted by L2 to Ethereum, thereby significantly reducing the transaction cost of Ethereum L2, increasing the transaction throughput of L2, and benefiting the L2 ecosystem.

The Dencun upgrade also introduces a new instant storage operation code through EIP-1153, which supports smart contracts to read and call temporarily stored data, thereby reducing Ethereum’s storage costs and Gas consumption, improving the scalability of the main network, and benefiting the main network. Internet ecological applications.

The Dencun upgrade will promote the prosperity of the L2 ecosystem and drive demand for Infra tracks such as decentralized storage, DA and RaaS. For the application layer, tracks such as Perps, LSD, ReStaking and FOCG will also benefit from the Dencun upgrade.

Multiple ecology and cross-chain

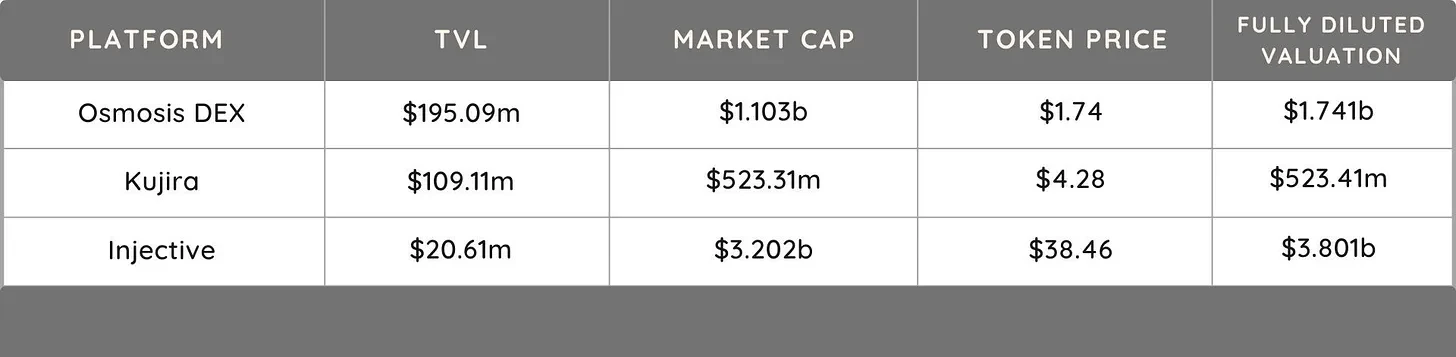

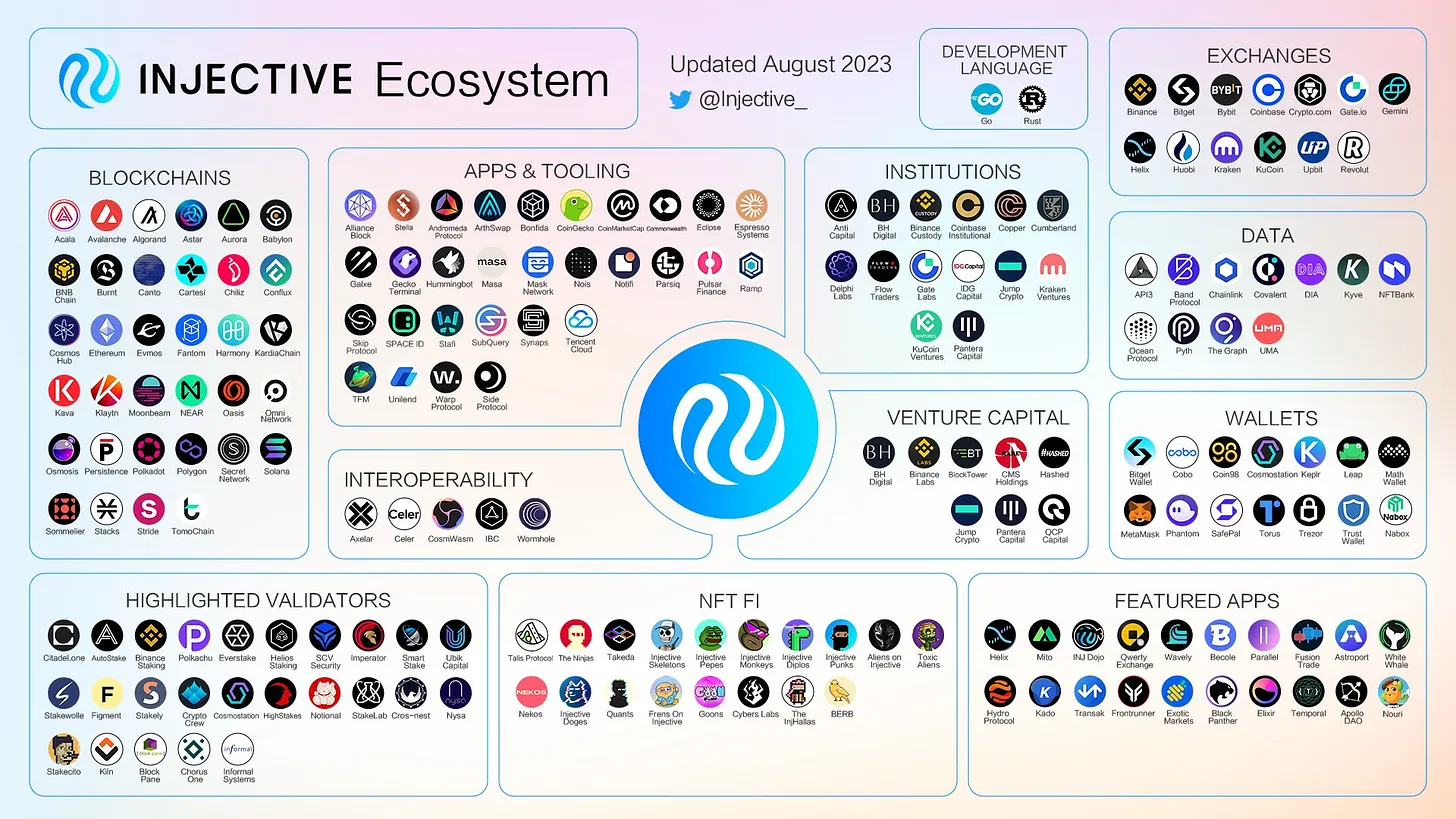

Injective Protocol is an interoperable L1 blockchain optimized for DeFi applications. It comes with out-of-the-box features such as a fully decentralized order book, making it possible to develop applications such as exchanges and prediction markets.

Built using the Cosmos SDK, Injective leverages Tendermint consensus for instant transaction finalization and facilitates fast cross-chain transactions with major networks such as Ethereum and IBC-enabled chains.

Injective Hub is a platform and gateway for interacting with Injective, providing wallet, governance, staking and INJ burning auction functions. The native token INJ is used for governance, staking and dApp value acquisition. The initial supply is 100 million tokens, and a deflation mechanism is implemented through burning auctions.

Injective compared to Kujira and Osmosis

Potential airdrop opportunities include: sending INJ to your Keplr wallet or converting assets to INJ on Osmosis or Astroport; swapping or trading on the Helix app; staking $INJ via the Talis protocol; staking $ via Black Panther validators INJ or deposited into one of its vaults.

Why is interoperability important for DeFi?

To counter the impact of emerging performance chains such as Solana, in addition to protecting DA legitimacy and expanding the Rollup layer 2 camp, Ethereum actually has another way to go: releasing liquidity to the entire chain through interoperability. Rather than letting the bubble get too big and trap itself, it is better to divert some of the overloaded liquidity and let these Old DeFi brands extend their tentacles into the multi-chain environment, thereby creating a new competitive barrier.

Entangle focuses on DeFi ecological projects and provides solutions to promote cross-chain DeFi protocol liquidity interoperability: Liquid Vaults and Oracle, thereby improving capital circulation efficiency and enhancing user experience.

A set of interoperablity solutions specifically designed for DeFi circulation scenarios can help Ethereum alleviate the DeFi consensus overload problem, because there are nesting doll limitations in DeFi operations within a single chain; cross-chain liquidity expansion, cross-chain interoperability allows one to The assets that have been used in the chain flow to other chains to combine the liquidity of other chains to find value. This can not only bring capital and activity to the new chain, but also complete the pressure reduction for the original chain; the DeFi protocol operates stably In the future, the amount of funds, number of users, profitability, etc. will become an intangible brand and reputational asset. Indirectly extending the brand to other chains through interoperability is actually a kind of brand gain.

Hot Topics of the Week

In the past week,SEC officially approves 11 spot Bitcoin ETFs(Interpretation of approval documents,SEC Chairman approves ETF statement,Comments from big guys from all walks of life on the day,Related topics),Spot Bitcoin ETF hits $4.6 billion in first-day trading volume,Robinhood offers trading services for 11 Bitcoin spot ETFs to US users,VanEck will donate 5% of ETF profits to Bitcoin developers,Foreign media:The SEC needs to make a decision on multiple Ethereum spot ETFs before the end of May, and the probability of approval may reach 70%;

In addition, in terms of opinions and voices,Gary Gensler issues crypto investment risk warning,SkyBridge Capital founder: Plans to buy U.S. Bitcoin spot ETF, Standard Chartered Bank:ETFs will attract $50-100 billion in funds, and Bitcoin is expected to exceed $200,000,Vitalik proposes to increase Ethereum network gas limit to 40 million,Founder of Cyber Capital: Monolithic is the future of blockchain scalability;

In terms of institutions, large companies and leading projects,Stablecoin issuer Circle has confidentially submitted an IPO application, and the number of shares it plans to sell has not yet been disclosed.,DCG:Repaid more than $1 billion in debt to creditors, including nearly $700 million in Genesis loans,BC Technology shareholders meeting approves BGX’s subscription agreement and will change its name to OSL Group,Ethereum Goerli testnet Dencun upgrade will be activated at 14:32 on January 17,Arbitrum launches long-term incentive plan proposal,Manta announces airdrop details and inquiry page, NEAR Foundation:Will reduce team members by 40% to consolidate core team;

NFT, GameFi, inscription field,Azuki’s official,Tinfun public sale draw attracted over 25,000 ETH participation,Cursed Inscription is out of print, the last picture of Cursed Inscription is Pizza on Cursed Goose...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~