一览6个未发币的Perp DEX:有哪些潜在机会?

原文作者:蒋海波,PANews

去中心化永续合约交易所(简称为 Perp DEX 或 Perps)可能是少数确定有价值,且又有大量创新项目出现的赛道。虽然 dYdX、GMX、Synthetix 等项目占据了主要的市场,但近期热门的多个未发币的项目都表现出很强的竞争力,包括 Aark Digital、Drift、Zeta、MYX、Hyperliquid、Jupiter 等。多数项目都用积分等形式实现冷启动,提前布局可能有更好的机会,PANews 将在下文详细介绍。

Aark Digital

Aark Digital 是一个基于 Arbitrum 的 Perp DEX,它于今年 7 月宣布完成 Delphi Digital 领投,OKX Ventures、Big Brain Holdings 和 Keyrock 参投的种子轮融资,具体融资金额未披露。

Aark Digital 的主要特点包括:

- 采用虚拟流动性池模型,流动性提供者(LP)仍然作为交易员的对手方。

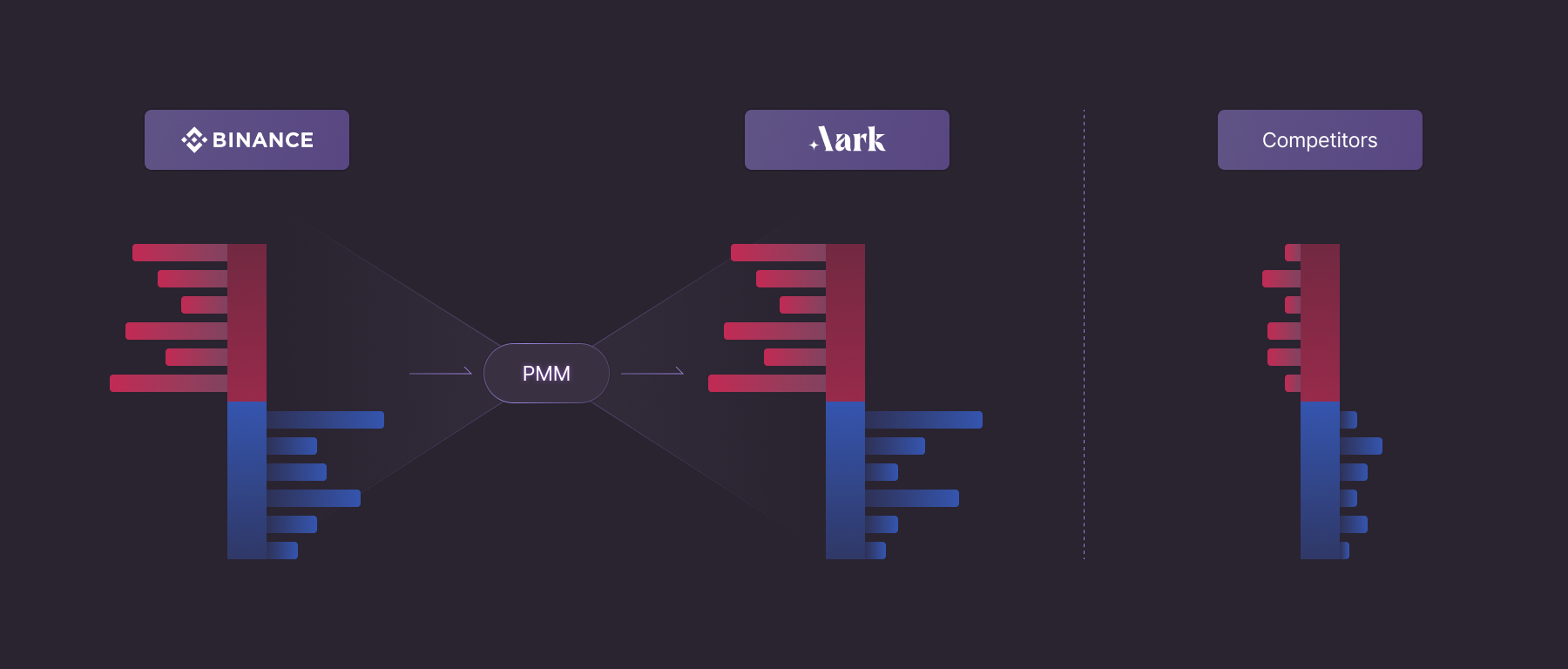

- 平行做市商(PMM)架构。聚合了中心化交易所(CEX)和去中心化交易所(DEX)的流动性。由于它反应了 CEX 的流动性深度,可以防止价格操纵导致的套利损失,并支持长尾资产。同时,它通过资金费用、价格影响等方式来激励多空达到平衡。

- 支持多种抵押品的全仓跨保证金模式。包括常用稳定币(USDC、USDT、DAI)、ETH 和 WBTC 在内的资产都可以作为交易的抵押品,每种抵押品有一个预设的权重。交易时,用户仍将持有自己的抵押品资产,只有在结算时会以 USDC 计算盈亏。

- 提供流动性也和交易一样是一个开设头寸的过程,支持杠杆流动性,支持使用多种抵押品。

- 高效的结算流程。在 Aark 中点击下单即可完成交易,无需等待钱包弹出交易并签名,解决了链上延迟和 Gas 问题,也避免了抢先交易等问题。

整体上,Aark Digital 确实是一个使用体验非常丝滑的 Perp DEX。为了实现冷启动,Aark Digital 采取了一系列措施来激励流动性和交易量。对于流动性,有两轮流动性软锁定计划,目前进行的第二轮为 12 月 20 日-2 月 20 日,共有 20 万 AARK 代币(总量 1 亿)奖励。对于交易量,从 10 月 11 日开始,有一个持续 18 周的挖矿活动,每周分配 20 万 AARK。

Drift

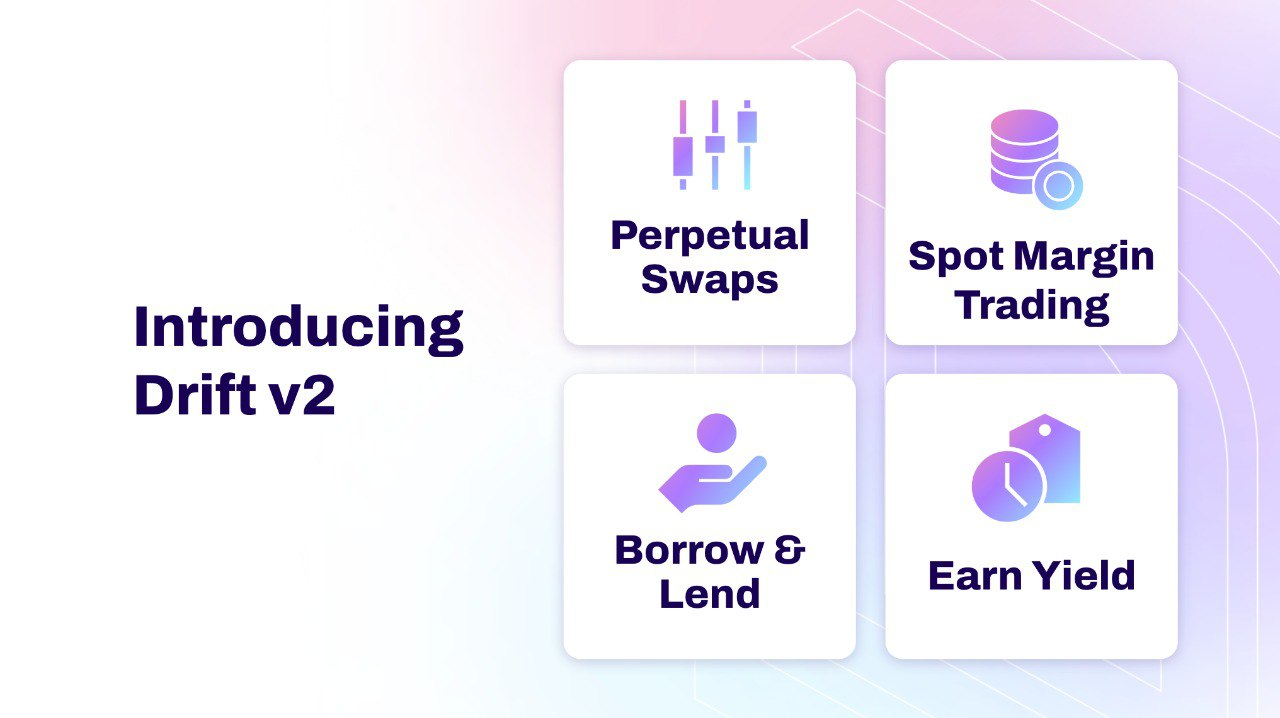

Drift 是一个基于 Solana 的去中心化交易平台,提供现货交易、杠杆交易、永续合约、借贷、赚取收益等多种功能。该项目于 2020 年完成由 Multicoin Capital 领投,Jump Capital、Alameda Research 等参投的 380 万美元融资。

Drift 的功能和特性包括:

- 构建了现货、杠杆、永续合约交易的全套产品。

- 有多种流动性机制,包括虚拟自动做市商(Drift AMM)、去中心化限价单(DLOB)和及时(JIT)拍卖流动性,确保链上的流动性。

- 所有交易优先通过短期的荷兰式拍卖进行,然后由 DAMM 执行,订单簿上的限价单作为最后的补充。

- 有一个保险基金,可以获得协议费用的一部分,但在遭遇损失时,这部分资金将优先用于赔偿。在保险基金中存入 1 万美元即可享受交易手续费折扣。

- 支持多种抵押品作为保证金,且抵押品会自动获得存款收益。会定期自动结算用户的盈亏,这部分资金会转换成用户的存款或债务,也会产生或者需要支付利息。

- 流动性提供者(DLP)可以使用杠杆,可能会损失掉全部的保证金,可以为提供流动性开设独立的子账户。

- Maker 不仅不需要支付手续费,还可以获得2b p 的手续费返点。

Drift 是一个功能强大的 DEX,且在 Solana 的 Perp DEX 中也有最高的 TVL。目前 Drift 有一个每周根据 Taker 交易量进行的抽奖活动 Drift Draw,奖金来源于保险基金,但未见 Drift 明确说明对交易员和流动性提供者提供原生代币激励。

Zeta

Zeta 是 Solana 上的一个衍生品协议,提供永续合约交易服务。它于 2021 年完成由 Jump Capital 领投,Electric Capital、Wintermute、Alameda Research、Solana Capital 等参投的 850 万美元融资。

Zeta 的产品非常简单,只有一个完全链上的限价订单簿,用于永续期货的交易,和 dYdX 类似。

Zeta 目前有一套积分系统 Z-Score,积分越高获得的代币越多。目前第一季 Z-Score 活动已结束,活动期间每作为 Taker 交易 1 美元,获得 1 积分。但 Taker 的手续费比例也相对较高(0.1% );Maker 免手续费,也就没有积分。Zeta 还联合其它项目发行有 Zeta Card,销毁卡片可以获得双倍积分。目前第二季 Z-Score 活动即将开始。

MYX

MYX 是一个扩展能力较强的永续合约协议,于 2023 年 11 月宣布完成由 HongShan 领投,Consensys、Hack VC、OKX Ventures 等参投的 500 万美元融资。

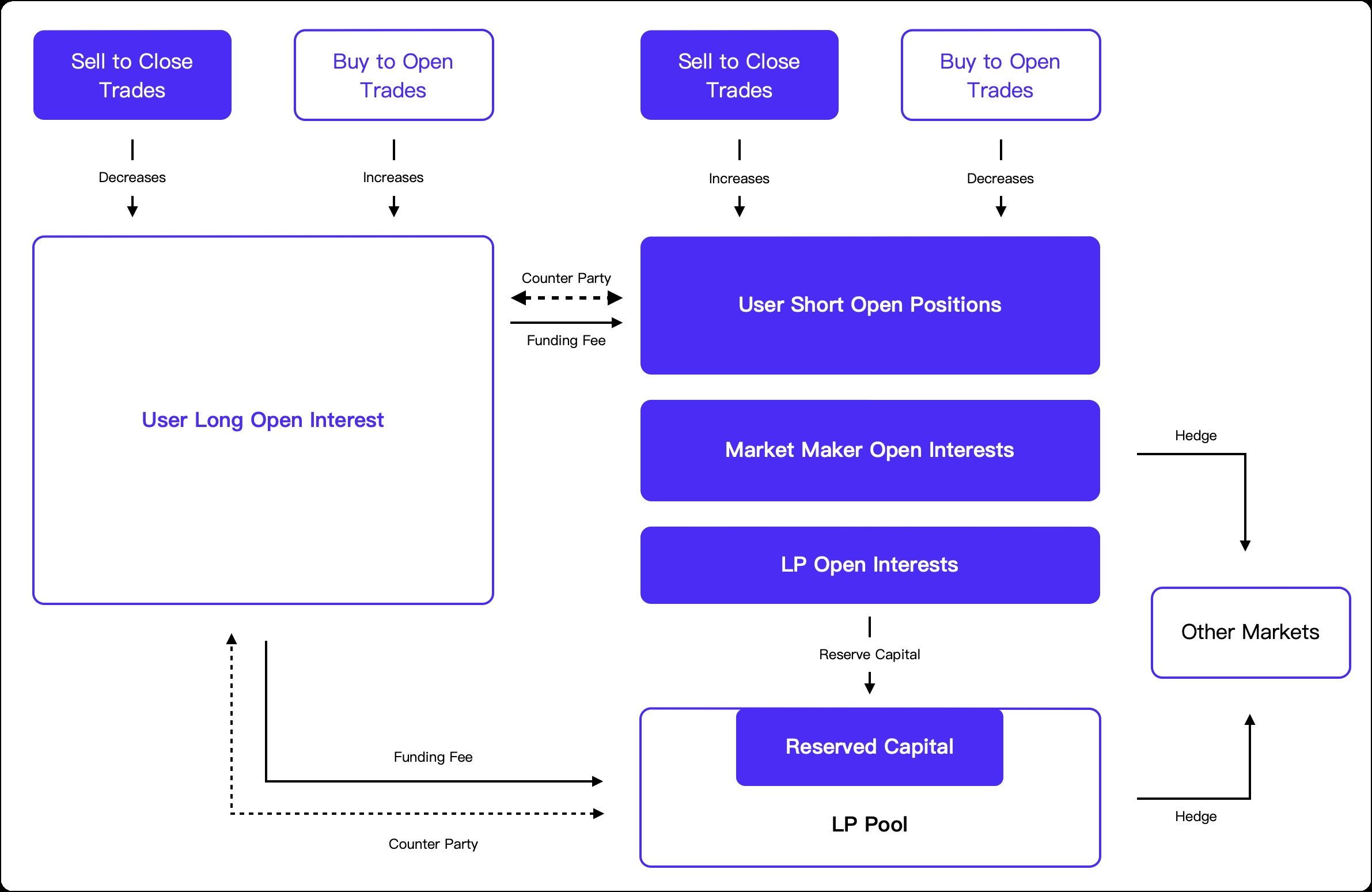

可以说 MYX 直击了 GMX 的痛点,在包括 GMX 在内的大多数 Perp DEX 中,无论多头还是空头开仓,都会占用一部分流动性。当流动性占用达到上限时,也就意味着未平仓量达到上限,只能平仓,不能开仓。MYX 采用了一种独特的匹配池机制,仍然有一个流动性池作为交易员的对手方。当多头和空头仓位想等时,这个时候 LP 是没有作为交易员对手风险的,MYX 认为此时 LP 不持有任何头寸。如果一直保持多空平衡的状态,那么理论上未平仓量就可以无限大。只有多空的差值部分才会使 LP 面临风险,而资金费用又可以激励多空保持平衡。

由于未平仓量不再受流动性池中资金的限制,MYX 相同的流动性可能带来更高的交易量,那么就可以在其它特点上进行让步,如实现零滑点、无需借币费用等。

目前 MYX 正在进行第二阶段的测试,已加入等待名单的用户参与测试可以获得奖励。

Hyperliquid

Hyperliquid 是一个运行在自己的 Layer 1 上的去中心化永续交易所,提供与传统中心化交易所类似的功能。

它主要包含一个订单簿交易所,以 USDC 作为保证金进行交易。它的特点是支持很多长尾资产的交易,可能是唯一支持某些特定资产(如 CANTO)在链上进行杠杆或永续合约交易的项目。另外,Hyperlierliquid 提供了多种做市策略的 Vault,如 HLP(Hyperliquidity Provider),目前显示 APR 为 264% ,但可能是由于最近市场波动较大。

从 11 月 1 日起,Hyperliquid 开始了一套积分系统,在 6 个月时间里每周为用户分配 100 万积分。

Jupiter

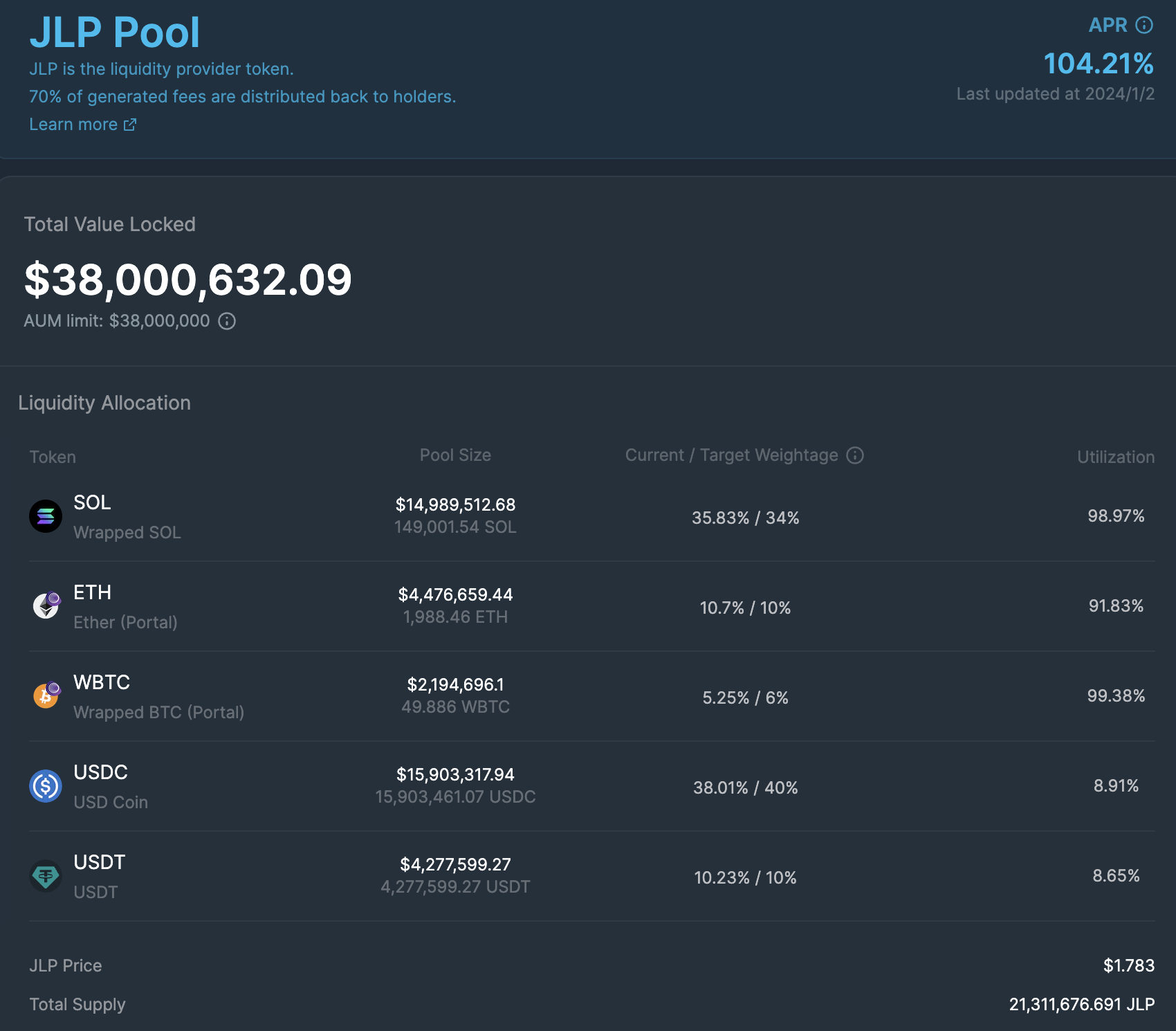

Jupiter 的 JLP 是 Solana 上一个和 GMX 的 GLP 类似的产品,通过一揽子资产提供永续合约交易服务。

虽然它没什么创新,但它在 Solana 上却异常的受欢迎,JLP 的容量长期位于上限处,每次提升后都很快达到上限;JLP 在二级市场上可能会溢价 10% ;永续合约中 SOL、BTC、ETH 的利用率经常达到 100% 。

主要的原因可能在于 Jupiter 极高的估值(在 Aevo 中超过 60 亿美元),且又有 40% 的代币用于空投。部分溢价购买 JLP 的用户和 Jupiter 永续合约上的交易员可能是出于潜在的空投考虑。

小结

Perp DEX 的发展并不完善,某些项目展示了该赛道的多样性和创新性,再结合不同的激励措施,或许会有项目能取代现在 GMX 或 Synthetix 的地位。对于用户,越早参与其中可能越有利。

但要注意,该赛道也安全事故频发。即便是头部项目 dYdX、GMX、Synthetix,也都遭遇过不同程度的攻击,虽然多数情况都只是损失少量资金。新项目可能风险更高。