ETF费率大战开启,机构卷费率用意为何?

原文作者:Peng SUN,Foresight News

前两日,在美国证券交易委员会(SEC)的要求下,贝莱德、ARK 21 Shares、VanEck、富达、灰度、富兰克林邓普顿等发行商相继提交最后修改的 ETF 申请文件。尤为引人瞩目的是,发行商们争相降低 ETF 费率,甚至个别机构提出在前 6 个月采取 0 费率等豁免政策。

与此同时,美 SEC 主席 Gary Gensler 也两次发推提醒投资加密资产的相关风险。市场行情方面,自 1 月 9 日 0 时起,比特币相继突破 45000、 46000、 47000 美元。目前,比特币价格已维持在 46842 美元上下。

机构的降费潮、SEC 主席的阴阳提醒以及比特币价格的上涨等种种迹象表明,合规的比特币现货 ETF 似乎真的通过在即。多空拉锯的焦灼时刻,ETF 费率大战(Fees War)令人咋舌。那么,这个费率是什么,机构卷费率用意何为?与传统 ETF 相比,比特币现货 ETF 费率水平如何?在低费率的背后,对投资者来说,低费率就是真的赚吗?

一、Sponsor Fee 是什么?

在比特币现货 ETF 中,发起人费用(Sponsor Fee)最早出现在公众眼前是 2023 年 11 月 20 日,当时 ARK Invest 在其比特币现货 ETF 申请文件新增发起人费用(Sponsor Fee)费率,最初费率为 0.8% 。

Sponsor Fee 与基金的发起人(Sponsor)有关。发起人负责管理与控制基金,负责基金的营销,而发起人费用(Sponsor Fee)则是用于支付管理 ETF 的费用,包括托管成本、管理人员工资、买卖证券成本、法律支出等。

二、费率战,大势所趋

1 月 8 日开始至 9 日, 11 家申请比特币现货 ETF 的机构发行商均在最后的修改文件中持续降低费率,在比特币 ETF 市场引发「降费潮」。截至 1 月 10 日,各机构最新费率如下(按照费率从高到低排列):

灰度: 1.5%

Hashdex: 0.9%

Valkyrie: 0.49%

富兰克林邓普顿: 0.29%

富达: 0.25%

VanEck: 0.25%

贝莱德:前 12 个月为 0.2% , 12 个月或 AUM 至 50 亿美元后上调至 0.3%

Galaxy Invesco:前 6 个月为 0 , 6 个月或 AUM 至 50 亿美元后上调至 0.39%

Wisdomtree:前 6 个月为 0 , 6 个月或 AUM 至 10 亿美元后上调至 0.3%

Ark/21 Shares:前 6 个月为 0 , 6 个月或 AUM 至 10 亿美元后上调至 0.25%

Bitwise:前 6 个月为 0 , 6 个月或 AUM 至 10 亿美元后上调至 0.2%

图片来源:James Seyffart

11 家机构,豁免后有 8 家费率低于 0.4% ,而所有机构在豁免后的平均费率则为 0.478% 。

事实上,自 1997 年以来,全球 ETF 费率(主动型与被动型)降低已是一种不可逆的趋势。譬如,美国著名费率卷王 Vanguard、Schwab、贝莱德的 iShares 等 ETF 费率甚至低至 0.03% 左右。另外,据美国受监管基金的主要协会之一投资公司协会(ICI)观察,股票 ETF、债券 ETF、共同基金等各类 ETF 费率在过去 26 年降幅大多超 50% ,低于 0.1% 的比比皆是。据 2021 年火币研究院研究数据显示,美国 ETF 平均成本(含管理费)约为 0.44% 。由此观之,美国发行商们在比特币现货 ETF 降费方面处在平均水准,此乃美国 ETF 环境使然。

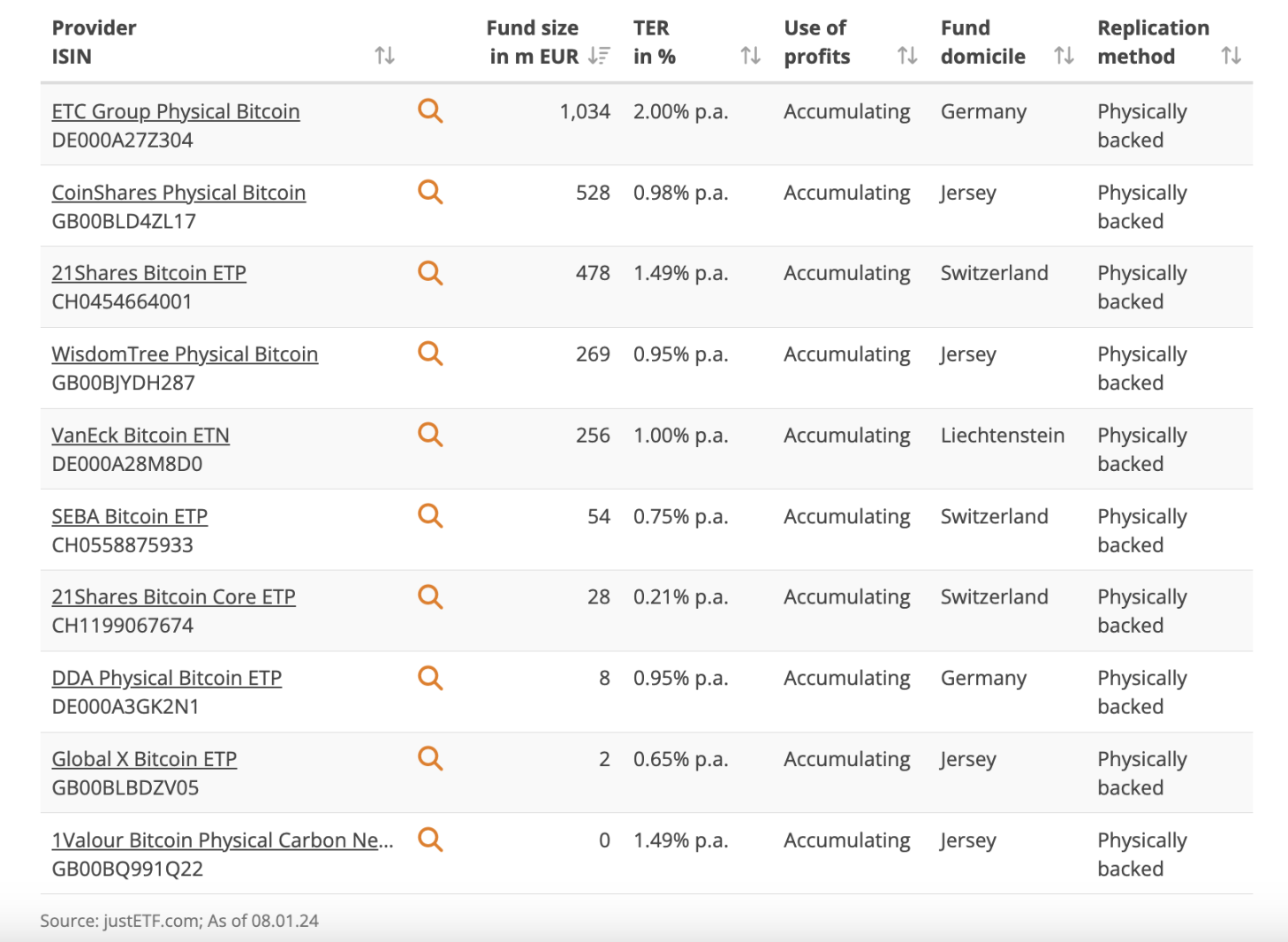

但如果与世界其他国家 / 地区做比较,那么美国则明显较低。譬如,以 BTCC 为代表的加拿大比特币 ETF 费率为 1% ,而欧洲现有 10 个最大的比特币 ETP/ETN 的平均费率为 1.047% 。

考虑到加拿大、欧洲的用户与资金体量均无法与美国匹敌,而在同等情况下美国用户更加青睐 ETF,并倾向于低成本 ETF 产品,也就不难理解美国机构发行商在比特币 ETF 费率方面的内卷。毕竟,美国作为全球第一大 ETF 市场,在同质化竞争下,降费是 ETF 的必经之路,比特币也不例外。

三、降费潮,便宜就是赚?

降费为了吸引更多的用户、资金与市场份额,但低费率一定是便宜的吗?

「当费率低于成本,如何通过管理基金赚钱?」这是 Custodia Bank 创始人兼 CEO Caitlin Long 对比特币现货 ETF 降费潮提出的疑问。

Morningstar 全球 ETF 主管 Ben Johnson 也表示,「世界上没有免费的午餐。如果你免费获得某些东西,那么你很可能会通过付费购买其他东西来补贴它」。通常来说,零费率 ETF 会通过向客户出借股票、销售其他产品或提供较低的现金基金利息来赚钱。但比特币现货 ETF 是否会面临这样的问题呢?发行商会采取哪些方式赚回那部分收益?不得而知。

低费率还引起了 Tether 与 VanEck 战略顾问 Gabor Gurbacs 的顾虑:「当我赚很少甚至赚不到钱时会很害怕。发行人会寻找其他赚钱的方式(证券借贷、交易等),我个人喜欢预先收取更高的费用,并提供明确和可持续的激励措施。如果可能的话,深入研究总持有成本。但 ETF 费率战并非如此。人们喜欢看到数字是低的。」

当然,所有的担心在 ETF 通过面前都显得苍白无力,毕竟我们在见证历史。美国每通过一个 ETF 都带来了万亿级别的蓝海市场,比特币市值现为 8000 亿美元,重返万亿美元市值,为更多用户提供美债之外的分散投资选择,没有什么比这更令人激动的了。

参考文献:国盛证券:《比特币现货 ETF 将带来什么?》, 2024 年 1 月 2 日;Gaurav Roy, Bitcoin Spot Vs Futures ETFs: What’s the Difference?, Jan 4, 2024.邓兴成、李嫣、葛慧:《全球 ETF 发展趋势和未来方向》,深圳证券交易所, 2009 年;Charles Yu, Sizing the Market for a Bitcoin ETF, Galaxy Digital, Oct. 24, 2023.Keris Lahiff, Why zero-fee ETFs are not risk free, March 9, 2019.