How does Hyperliquid, valued at $25.9 billion, occupy both the infrastructure and application layers?

Original author | Charlie.hl ( @0x Broze ) / supermeow.hl ( @supermeower )

Compiled by | Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's note: Recently, US-listed companies Lion Group Holding and Eyenovia have announced that they will include Hyperliquid's native token HYPE in their balance sheets. This is the first time that the traditional capital market has listed the native token of an emerging DeFi project as a strategic reserve asset after BTC, ETH, BNB, SOL, TRX, and XRP. This move marks the institution's recognition of the security, stability, and economic model behind HYPE, and also means that Hyperliquid is no longer just an on-chain transaction protocol, but is gradually becoming a mainstream candidate for "digital asset financial infrastructure."

This article integrates the research results of Charlie.hl and supermeow.hl, and analyzes from two dimensions: First, how Builder Code drives protocol revenue and ecological expansion; second, how the protocol repurchase mechanism builds a valuation model for HYPE.

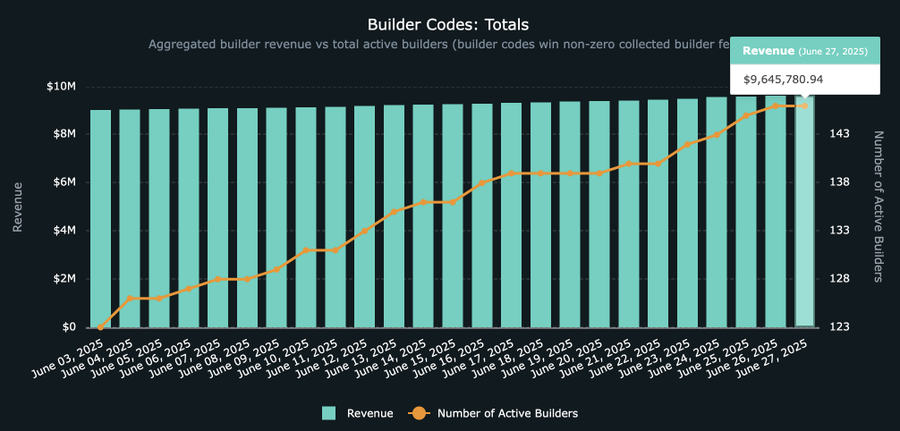

As Hyperliquid Builder Code revenue approaches $10 million, it is necessary to conduct an in-depth analysis of this emerging ecosystem and the applications behind it, and explore its far-reaching significance for Hyperliquid's future direction at the infrastructure level. It is not common for a protocol to dominate both the application layer and the infrastructure layer, but Hyperliquid is moving steadily in this direction, and the concept behind its Builder Code is becoming increasingly clear.

Builder Code: The revenue engine of the open trading ecosystem

For readers who are not familiar with the Hyperliquid ecosystem, what exactly is Builder Code and how does it work?

As the official documentation states: "Builder Code allows developers to charge a fee for orders placed on behalf of users. Each order can be set with a separate Builder Code for maximum flexibility. Users need to set an acceptable maximum fee for each developer and can revoke authorization at any time. Builder Code is handled entirely on-chain as part of the fee logic."

In layman's terms, Builder Code allows applications built on Hyperliquid to charge fees based on the volume of transactions imported. Any platform can integrate Builder Code, and users need to sign an authorization transaction to accept the fee mechanism before trading (this process can currently be seen on the newly launched Felix Trade, which already supports calling Hyperliquid's spot buying and selling functions through @felixprotocol ).

Builder Code Total Revenue: HypeBurn Data

How much profit can Builder Code bring to developers? The maximum fee currently allowed by the protocol is: 0.1% for perpetual contracts and 1% for spot transactions.

Although the 1% spot fee sounds high and has not yet been widely adopted, this rate may become the norm as more long-tail assets are launched on Hyperliquid. For example, Axiom, which focuses on Meme coin trading on Solana, generates more than $1 million in revenue per day by charging a 1% interface fee. Although most of this revenue comes from Solana, as the number of spot deployers on Hyperliquid gradually increases, this type of revenue is expected to be transferred to Hyperliquid.

Who is leading Builder Code? Where is it heading?

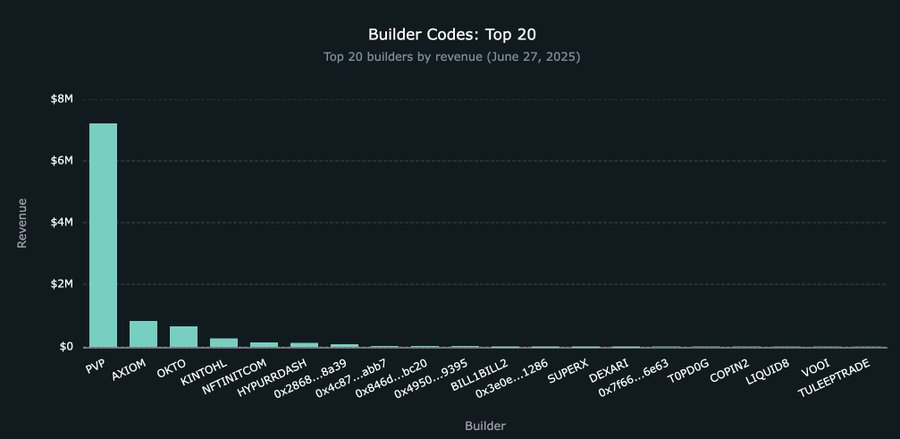

Despite the rapid growth, Builder Code's overall revenue is still in its early stages, with a total of approximately $9.5 million. Among them, @pvp_dot_trade is far ahead with approximately $7.2 million, making it the highest-earning Builder at the moment. But this is just the beginning.

Currently, more than 22 new developers have started to participate in the ecological construction of Builder Code, driving more transaction traffic into Hyperliquid. Among them, @okto_web3 is the closest to a real consumer-grade product. Although its current revenue from Builder Code is only $662,000, this number may change significantly in the future because its business covers more than Hyperliquid.

It should be pointed out that Okto is still a typical crypto-native application, while Liquid and Lootbase are targeting a wider market of ordinary users, providing a trading experience similar to Robinhood, which may be more attractive. At first, people might expect that Builder Code would only be adopted by existing crypto interfaces (such as Axiom) to call HL's underlying infrastructure. But judging from the trends of Liquid and Lootbase, this assumption may need to be revised.

Top 20 Builder Code Apps

However, Hyperliquid is not only a perpetual contract DEX, but also a trading infrastructure. This will become clearer as more large trading platforms choose to access Hyperliquid's Builder Code instead of competing with it head-on.

In this model, the platform no longer needs to build its own market or pull liquidity to launch new currencies. Instead, it can achieve permissionless listing through Hyperliquid's spot deployment and the upcoming HIP-3 proposal, and then integrate Builder Code to build the best interface and user experience to create considerable profits like Axiom and PvP Trade.

The future of Builder Code will depend on whether large interface platforms with strong distribution capabilities but who want to avoid the cost and risk of building their own marketplaces choose to join.

Robinhood and Hyperliquid Builder Code: A Possibility

Take Robinhood as an example. This is a more traditional, non-crypto-native fintech company. If it wants to accelerate the popularity of crypto assets in the application and achieve large-scale fee income, Hyperliquid provides a viable path. In January 2025 alone, Robinhood reported a stock trading volume of $144.7 billion, 166.6 million options contracts, and $20.4 billion in crypto asset trading volume.

This part may deserve a separate article for in-depth analysis, but it is foreseeable that Robinhood only needs to invest about 1 million HYPE (a negligible amount for its capital volume) to start deploying its own market based on Hyperliquid's optimized and battle-proven infrastructure for perpetual contracts, and capture the interface layer's fee income through interface integration Builder Code.

For Robinhood, this architectural decision could not only save months or even years of development time, but also millions of dollars in technology investment costs. The Hyperliquid community completed the underlying work, and Robinhood benefited from it.

HYPE Token Valuation Analysis

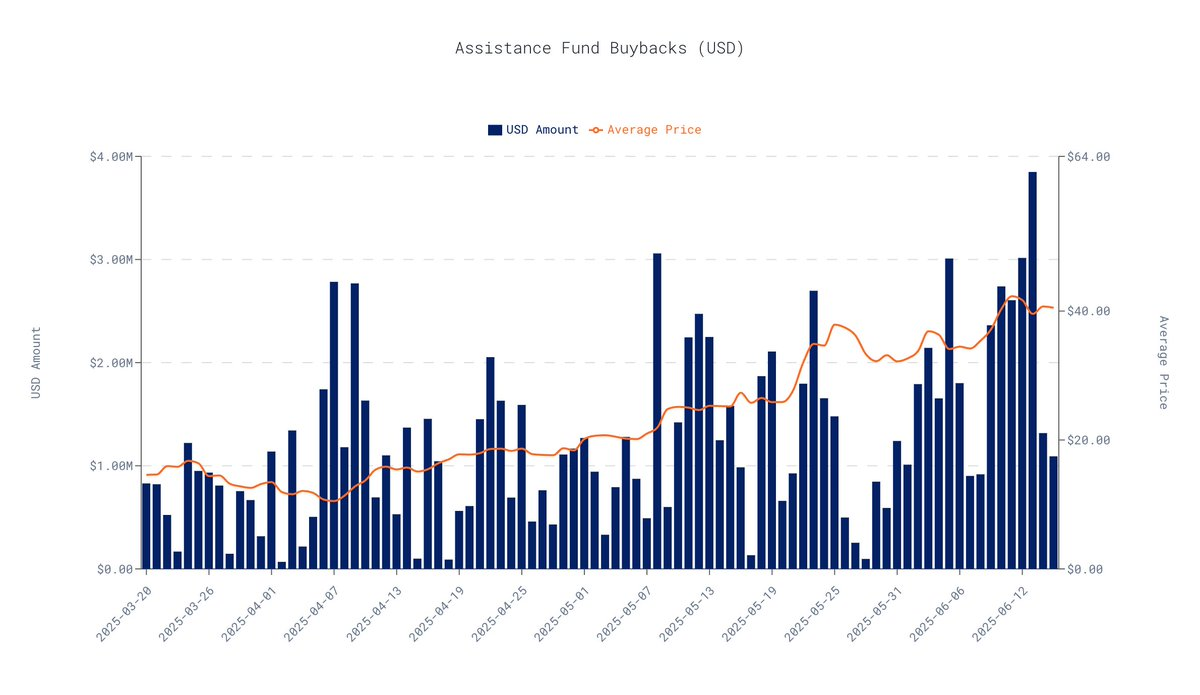

Builder Code demonstrates Hyperliquid’s monetization capabilities at the infrastructure layer, and if Builder Code is the front-end “distribution layer” that drives the prosperity of the trading ecosystem, then the HYPE token is the core value carrier in this system. This analysis attempts to value the HYPE token by comparing the repurchase behavior supported by Hyperliquid protocol funds with the stock repurchase of traditional listed companies.

Using payment processing companies such as Visa and Mastercard as a conservative reference group, this method yields an implied valuation of $25.9 billion for HYPE (or about $76 per HYPE , up 72% from the current price of $44). It is worth noting that this valuation does not yet include the widespread use of HYPE as a Layer-1 native asset.

The valuation methodology is described in detail below.

Quantifying Return on Capital

According to the on-chain data for the past 30 days ending June 16, 2025, the average daily repurchase amount of the Hyperliquid protocol is US$1.63 million. Based on this calculation, its total quarterly repurchase amount is approximately US$146.4 million.

Data from data.asxn.xyz

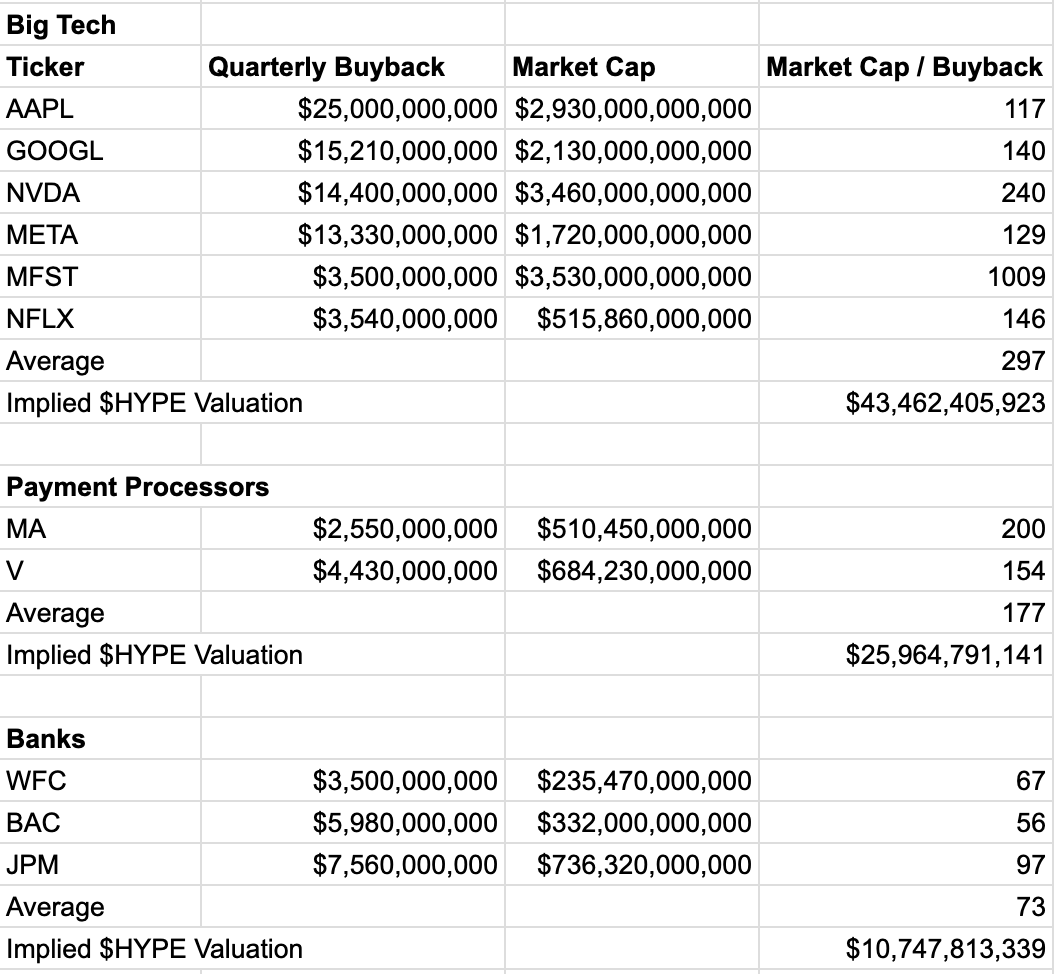

In order to assess the market's valuation of similar cash flows, we refer to the multiple indicator of "market value/quarterly repurchase amount" of listed companies. This multiple reflects how much market value the market is willing to give to each dollar of repurchase behavior, and it varies significantly among different industries, reflecting the market's confidence in its growth and stability.

Comparison of multiples of various industries:

Technology giants (average multiple: 296x) : Companies such as NVIDIA and Google are given extremely high valuations due to their rapid growth, technological innovation and market dominance.

Payment industry (average multiple: 177x) : Such as Visa and Mastercard, as financial infrastructure with high profits and strong network effects, the multiples are stable and high.

Banking industry (average multiple: 73.3x) : such as JPMorgan and Bank of America, are mature institutions with slowing growth and high regulatory pressure, so their valuation multiples are lower.

In the above comparison, the payment industry is the most suitable for Hyperliquid's business model. Like Visa or Mastercard, Hyperliquid is a key infrastructure in the financial system: it has high profit margins, its business model is directly linked to transaction volume, and the network effect continues to strengthen. The more users and liquidity, the greater the value of the platform.

Although HYPE can be compared to technology companies in some aspects, using valuation multiples of the technology industry will lead to exaggeration and lack of practical reference. In contrast, the valuation multiples of the payment industry are more conservative and more comparable.

After applying the payment industry multiples, HYPE's implied valuation is:

Quarterly buyback estimate: $146.4M

Payment industry valuation multiple: 177x

Implied valuation : $146.4M × 177 = $25.9B

HYPE unit price : about $ 76 (about 72% higher than the current $ 44)

Note: $44 is the value of HYPE at the time of this article’s publication

This valuation is not only impressive, but also highly conservative. It is based on one core metric and deliberately ignores the multiple other sources of value that HYPE possesses. Why is this valuation conservative?

Focusing on a single dimension : This model does not take into account the value premium of HYPE as a high-performance Layer-1 native token, its role in the governance mechanism, or future staking rewards.

Based on historical data : The data used is only the performance of the past 30 days and does not take into account the potential boost to the repurchase amount from Hyperliquid's subsequent revenue growth or market share increase.

The model uses the average valuation multiples of the payment industry, avoiding the high multiples commonly seen in the technology industry, further ensuring the conservatism of the valuation.

Summary: The buyback framework provides a clear valuation “bottom line” for HYPE

Although it is difficult for any single method to cover the full value of crypto assets, using strong protocol repurchases as an anchor and combining real cash flow to value does provide HYPE with a data-backed value benchmark. As the Hyperliquid ecosystem continues to develop, this valuation "floor" is expected to continue to rise.