Bankless: With two potential trump cards in hand, can OpenSea bottom out and rebound?

Original title: Can OpenSea Bounce Back?

Original author: William M. Peaster

Original compilation: Luccy, BlockBeats

Editors note: As the worlds first and largest market for discovering, collecting and selling NFTs, OpenSeas NFT transaction volume and market share have recently experienced a sharp decline. Coupled with layoffs, royalties and the Sisyphus incident, OpenSeas development is facing serious resistance.

Bankless senior writer William M. Peaster used Blur as an example to analyze the development potential of OpenSea and how to deal with resistance. He believes that currently, OpenSea has not released its own token or its own L2, which are two potential trump cards. In addition, he also pointed out that even though Blur is currently developing rapidly, users will eventually choose to return to OpenSea in the absence of airdrop incentives.

OpenSea was once the undisputed giant in the crypto space, but theres no denying that its been facing some serious headwinds lately.

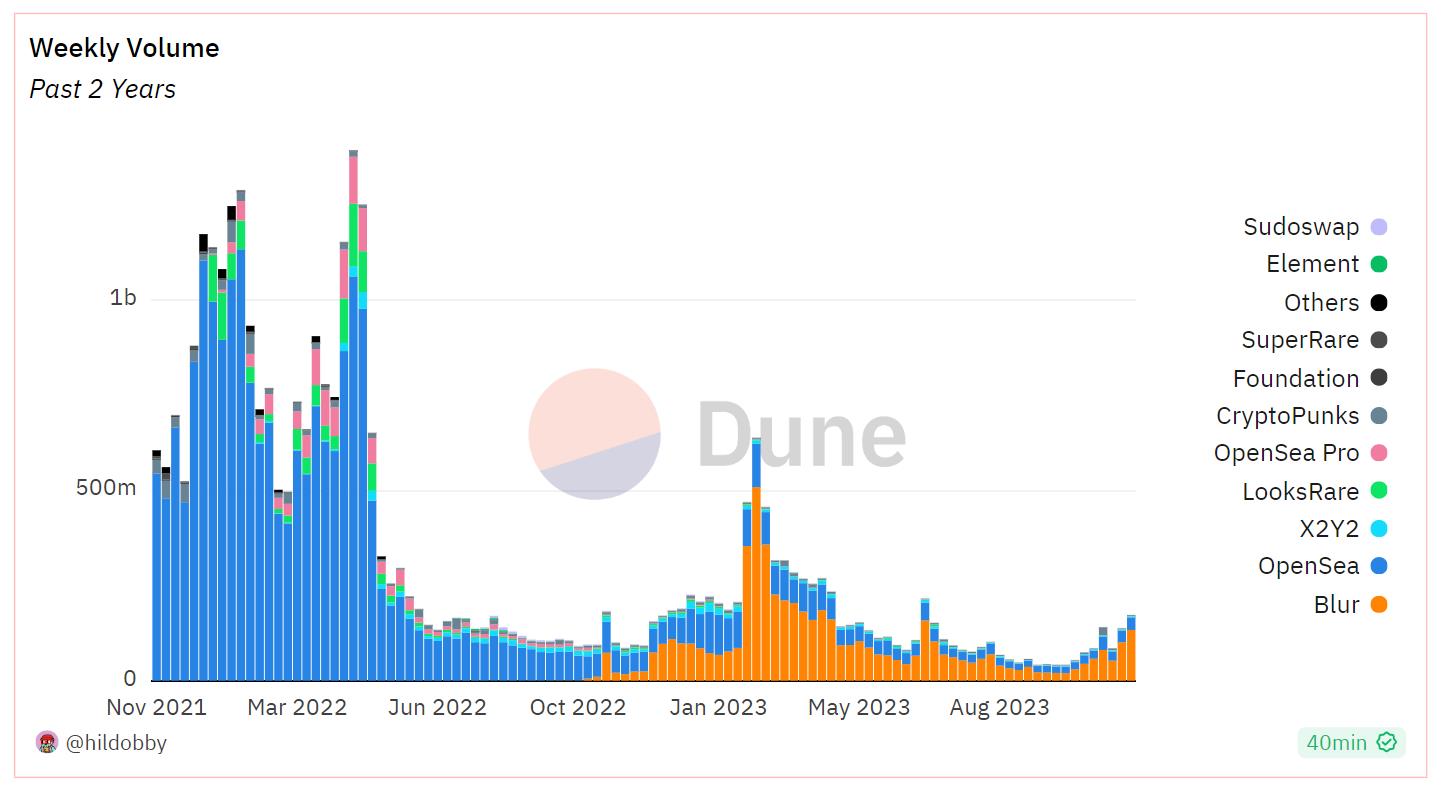

On the one hand, NFT trading volume is down significantly from its 2021 peak, as is OpenSea’s trading volume market share. Recently, the market has also faced massive layoffs, VC expectations have been significantly reduced, and $BLUR is rising again.

The platform is also dealing with an ongoing royalty dispute that has led to a falling out with Yuga Labs, the creator of Bored Ape Yacht Club. The split resulted in Yuga beginning to develop its own marketplace in partnership with emerging OpenSea competitor Magic Eden.

Now that OpenSea is in trouble, can it return to its previous dominance in the NFT field? this is possible. That said, OpenSea needs to take full advantage of its strengths to achieve a lasting renaissance.

humble giant

Those strengths include executives like CEO Devin Finzer, who remains one of the most respected leaders in the space despite OpenSeas many recent setbacks. OpenSea also has strong brand recognition and, even during the recent bear market decline, has more users than most crypto projects have.

But we also heard your feedback loud and clear: Sometimes, OpenSea feels like a follower rather than a leader. Thats not who we want to be. We want to move forward with speed, quality and conviction to make more meaningful bets.

—Devin Finzer, November 3, 2023

The marketplace also offers a range of premium services such as Deals, Studio and OpenSea Pro, which remain my favorite NFT marketplace experience to date.

Beyond that, OpenSea has yet to release its own token or its own L2, so it still has two potential trump cards.

In my opinion, giving up the OS token will bring more attention and interest to Blur, and therefore OpenSea, than BLUR has so far. This would be a huge move that would generate huge activity and could help bring balance to the platform.

OpenSea can launch its own L2 regardless of whether it launches native tokens first. Both Base and Zora Network have had great success with L2 so far, and both are using ETH as gas so far. If OpenSea develops at this level and follows the Frame playbook by deploying an NFT-centric L2, it will automatically become a major contender in the Ethereum rollup scene.

Blur and betrayal of values

As we discuss solutions, one thing is worth reflecting on. Two years ago, at the peak of the NFT bull market, OpenSea made a move that cost it its leading position, which was incredible.

Where OpenSea really starts to go wrong is when it starts trying to compete directly with NFT marketplace Blur. In order to combat this traffic-stealing threat, the platform has betrayed many of its original creator-centric values.

Blur has always built and marketed itself as a platform for “professional traders,” so it’s no surprise that the platform has increased financialization, downplayed NFT visuals, and eschewed secondary royalties set by creators.

Despite its high-profile activity, it will likely never become home to the community of creators that gave OpenSea its dominance in the first place. But in an effort to catch up with Blur and win back sales, OpenSea has backpedaled on secondary royalties, alienating many of its core users, from small independent artists to large studios like Yuga Labs.

Of course, I do think OpenSea can have its cake and eat it too. The platform could have kept creator-set royalties on its main platform and only reserved optional royalties to OpenSea Pro, bringing its branch in line with Blurs direct competitors. Instead, top creators wage war against their core markets and look for other companies with aligned values.

Ultimately, I dont think most users leave OpenSea and choose Blur because of the low cost. Instead, most Blur trading volume is chasing the token incentive, airdrop mining $BLUR.

So if OpenSea starts enforcing creator royalties again, launches governance tokens and OpenSea Network L2, and launches a public reward system for OpenSea Pro users, you have to admit that they will be better off than they are now.

In fact, the demand for the NFT space is broader than Blur addresses. Blurs advanced trading niche is exactly that. Take away the token incentive advantage of Blur, and I think, all else being equal, well see a lot of people come back to OpenSea.

As an NFT power user, I appreciate the more casual feel of OpenSea UX compared to Blurs hyper-financial vibe. NFT is a new type of cultural item full of social magic, and I don’t feel this reality at all on Blur. Interestingly, I sense that many others feel the same way.

So, in order to bring OpenSea back to its former glory and defeat the competition, I suggest a tit-for-tat approach with OS tokens + L2 on one front to win back the degens while returning to its values, updated royalties + casual UX approach, to win back creatives and more casual NFT enthusiasts.

The market is about to unveil its 2.0 vision, so well see if it continues along the same lines. I will say that its hard to say whether OpenSea can achieve the same dominance as it once did, especially with new challengers rising, so the platform definitely faces a battle.

I believe they have the ability, but now only time will tell.