Tens of millions of dollars in subsidies: A seven-day guide to mining in the Plasma ecosystem

- 核心观点:Plasma推出高收益流动性激励活动。

- 关键要素:

- XPL上线并空投,开盘价达1.6美元。

- 多协议挖矿APR超35%,奖励丰厚。

- 活动持续至10月2日,覆盖主流DeFi池。

- 市场影响:吸引流动性,提升Plasma生态热度。

- 时效性标注:短期影响

On September 25th, the highly anticipated Plasma native token, XPL, launched, reaching a peak of $1.60 upon opening. In addition to those who participated in the presale, those who initially deposited received a substantial airdrop reward. Combined with airdrops from major exchanges, including Binance Alpha's airdrop, where approximately $220 in $XPL could be claimed, the market was truly blessed.

Plasma, which is practically throwing money around like crazy, launched a massive liquidity incentive program shortly after its launch, lasting seven days until October 2nd. This program covers mainstream protocols like Aave, Euler, Fluid, Curve, and Veda. Users can deposit stablecoins into these protocols or hold related tokens to earn XPL rewards.

If you missed out on depositing, pre-sale, or arbitrage opportunities on the on-chain price difference, don’t miss out on this opportunity to grab some of the best deals. BlockBeats has compiled a list of five major mining pools, some of which offer APRs exceeding 35%.

Preparation before digging

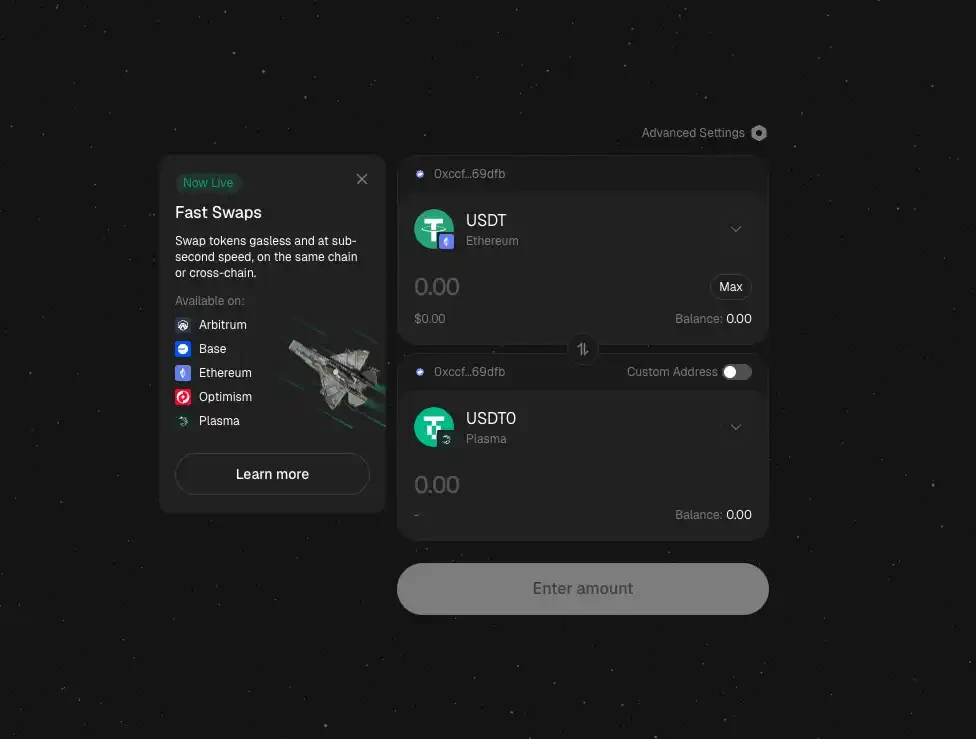

Asset preparation needs to be completed before mining begins. Some protocols need to cross-chain the mainnet USDT to Plasma through Stargate to obtain an equivalent value of USDT 0; at the same time, a small amount of XPL is also required as transaction gas fees (most EVM systems are acceptable).

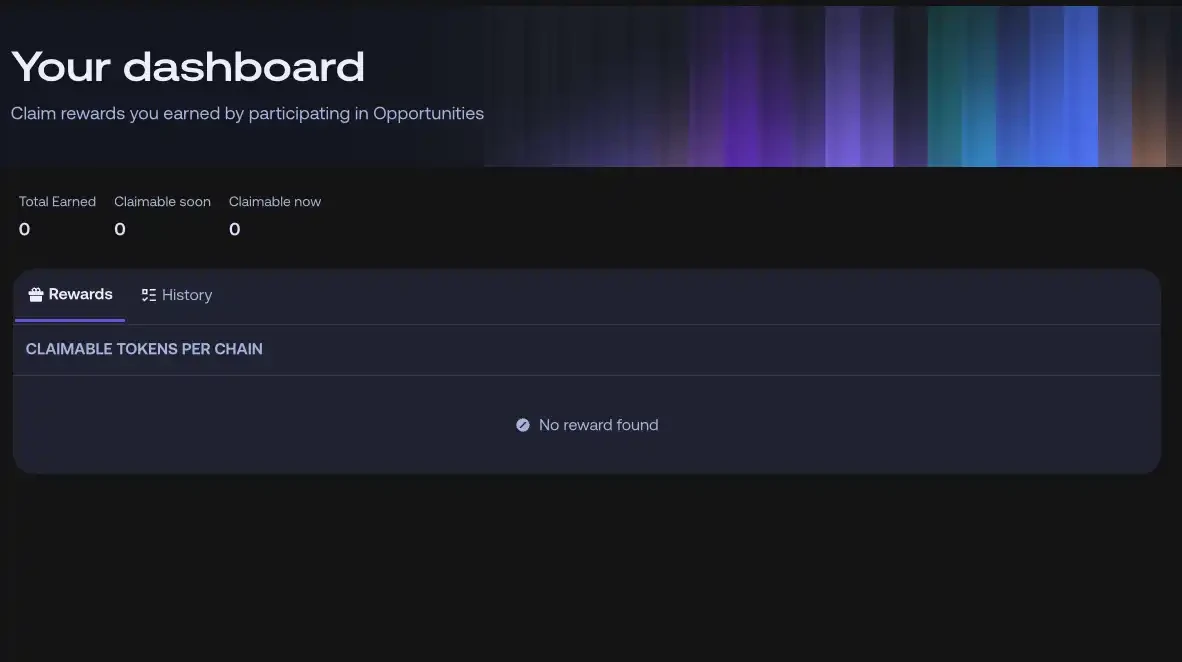

This plasma event is basically in cooperation with Merkl. We can log in to Merkl 's Dashboard at any time to track the rewards. The Merkl platform will automatically calculate the rewards based on the user's deposit size and duration. Users only need to manually claim them regularly.

Which ponds are easy to dig?

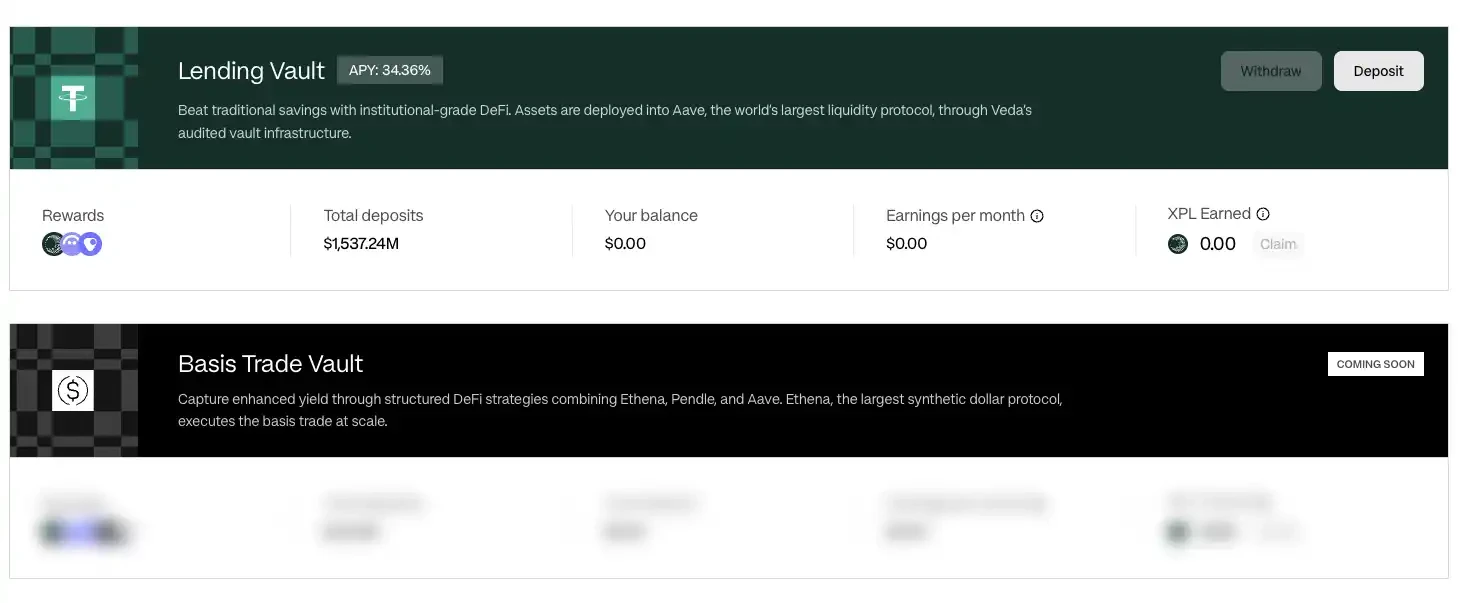

PlasmaUSD Vault

This activity was officially initiated by Plasma. The PlasmaUSD Vault under the Veda protocol distributes WXPL in the form of coin holding and mining. Currently, only the Lending Vault is open, and the Basis Trade Vault will also be opened in the future.

The operation is also quite simple. Just click Deposit to deposit USDT 0/USDT. Holding a share of the Vault, whether on the mainnet or the Plasma chain, you can get WXPL rewards, which can be collected every 8 hours. However, there is a 48-hour withdrawal cooling period for USDT 0 after borrowing.

The current annualized rate of return is approximately 34.36%, and the daily reward amount is as high as 1.4 million US dollars. It is worth noting that the main prize pool of 1 million will only last for 3 days, ending on September 29. It is unclear whether the official will continue to provide incentives in the future.

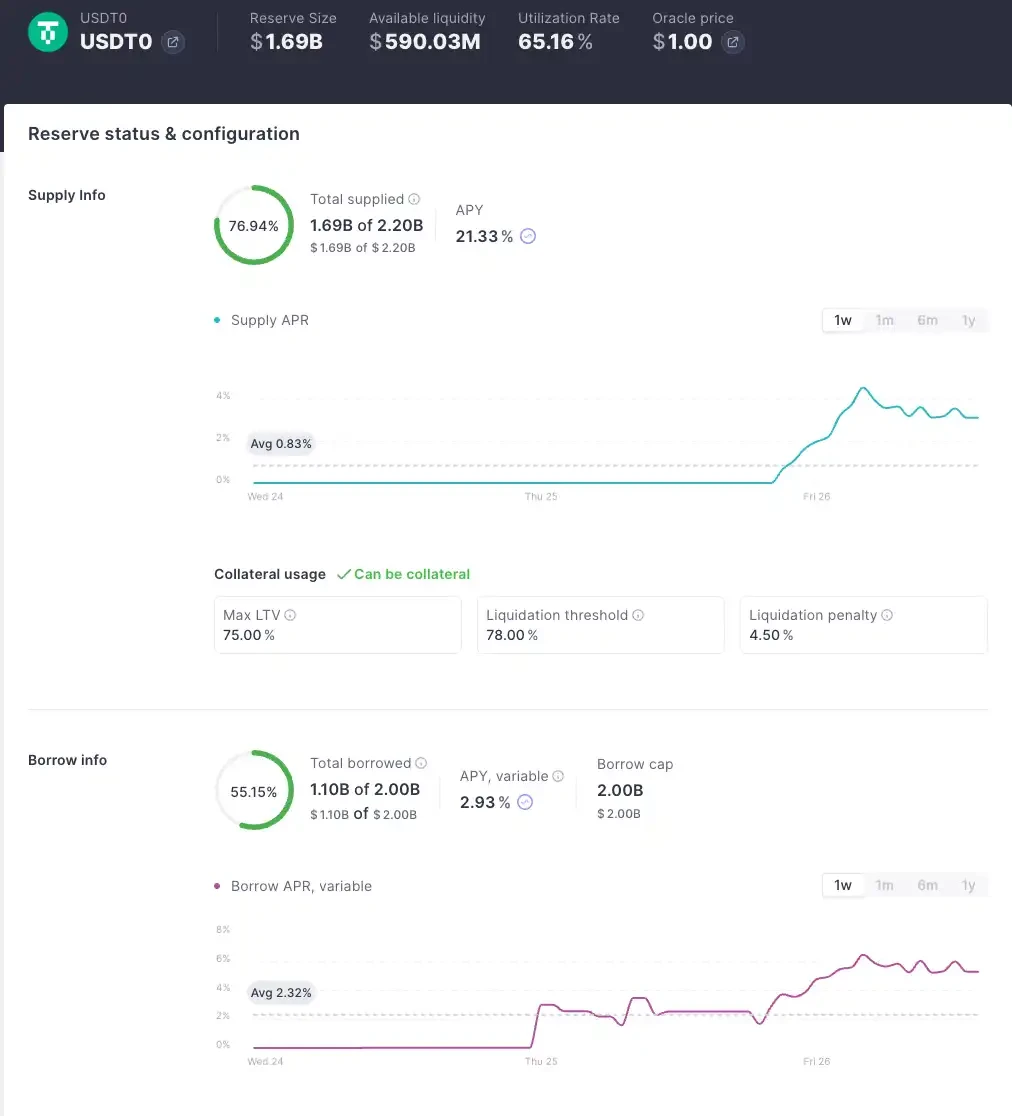

Aave USDT 0

Similar to Plasma's lending vault, depositing USDT 0 on Aave also earns WXPL rewards. Currently, $1.7 billion has been deposited into the protocol, yielding an annualized yield of approximately 21.33% (the protocol's APY is approximately 3.19%, and WXPL's APY is 18.15%), with daily rewards totaling approximately $700,000 worth of XPL.

Compared to Plasma, its advantage is that it can be withdrawn at any time, but it is necessary to provide USDT 0 without holding any USDT 0 or USDe debt, which means that revolving loans cannot be used to increase utilization.

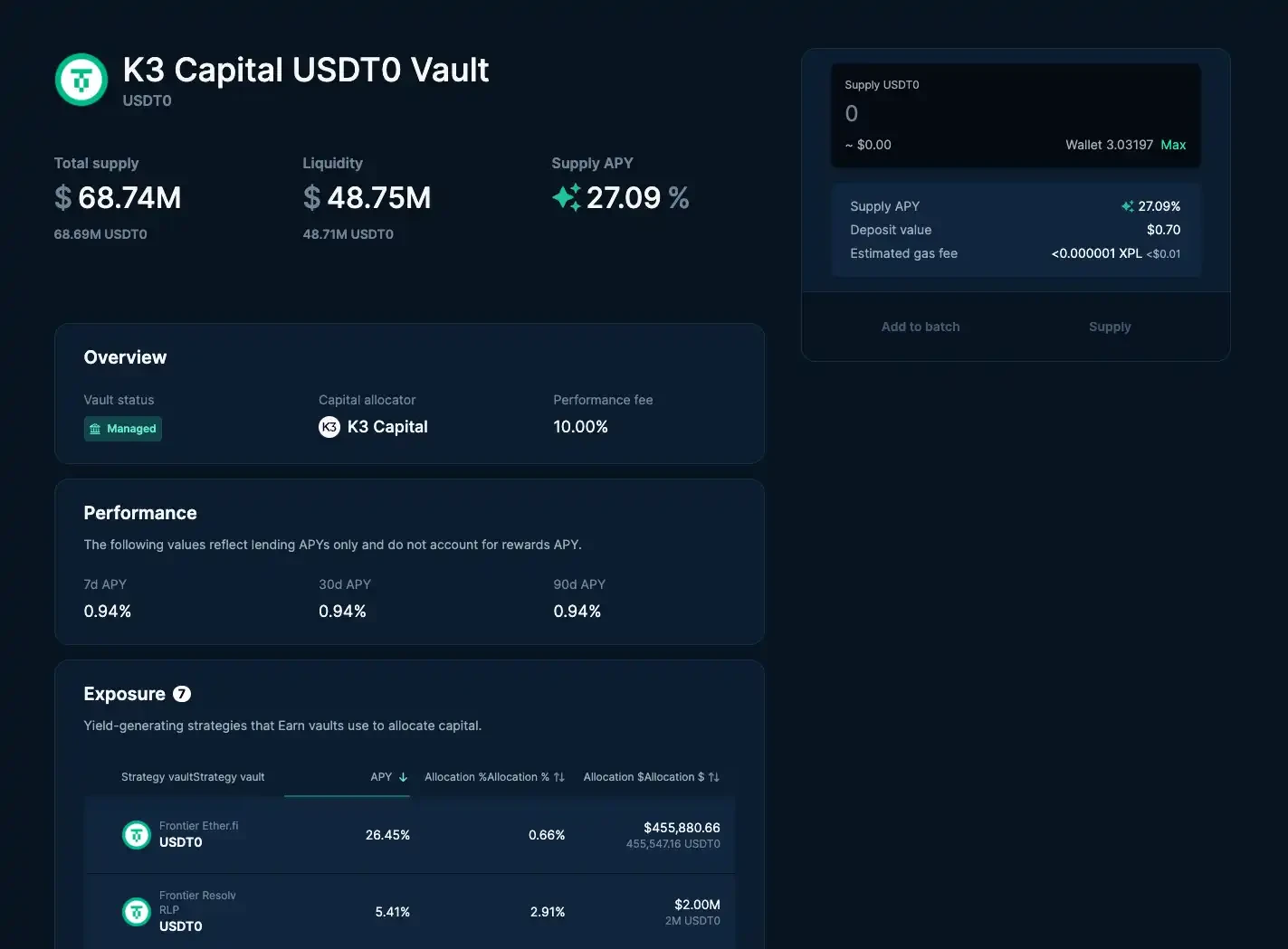

Euler K 3 Capital USDT 0 Vault

In Plasma's Euler protocol, the USDT 0 Vault managed by K 3 Capital currently has an annualized yield of approximately 27%, with daily incentive distribution of approximately US$55,000 worth of WXPL.

Users only need to deposit USDT 0 on the Plasma mainnet and deposit (Supply) USDT 0 into the Vault to start mining.

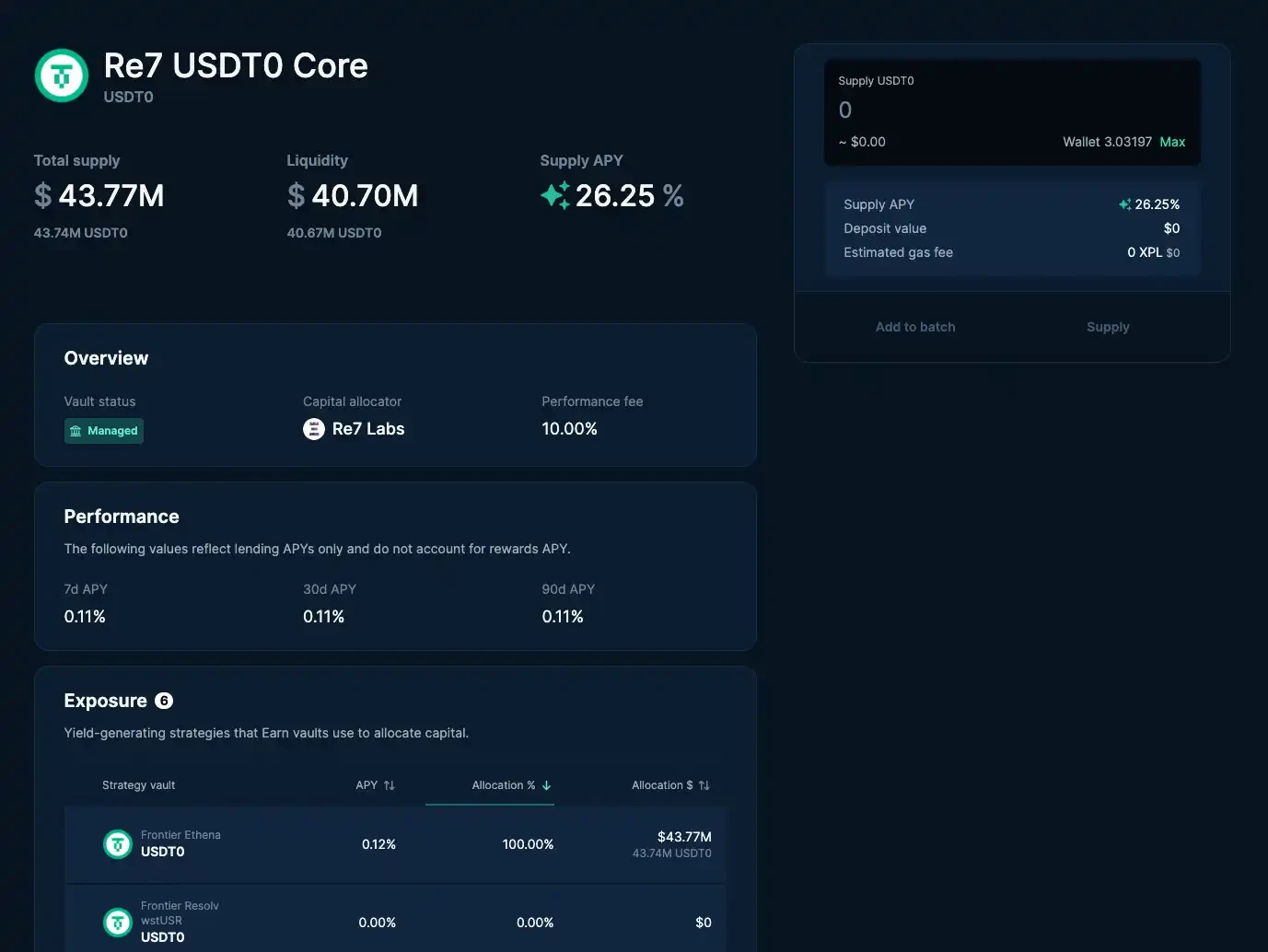

Euler Re 7 Core USDT 0 Vault

Also under the Euler protocol, the Re 7 Core USDT 0 Vault utilizes a lossless, active lending model. Users can participate by depositing USDT 0 into the vault. The pool currently has an annualized yield of approximately 30.43%, with daily rewards of approximately $35,000 in XPL. While Euler's pool has a relatively low TVL, its yield and rewards are impressive, making it suitable for retail investors looking to diversify their holdings.

Fluid fUSDT 0 Vault

Fluid Protocol's fUSDT 0 Vault provides users with rewards for depositing USDT 0, USDe, and ETH into the lending vault, as well as rewards for borrowing USDT 0 using USDai and USDTO as collateral. This means that users can first pledge USDai and USDT 0 to borrow USDT 0 and obtain an annualized yield of approximately 24%.

Then use USDT 0 to provide liquidity to the lending pool, and the current annualized rate of return is about 25%.

It is worth noting that most of the APR activities for borrowing USDT 0 are provided by Plasma activities. The current actual borrowing interest rate is around 3%. If the demand for borrowing increases, the interest rate may rise rapidly, squeezing your net income.