After Hitting $94,000, Holding Firm at $90,000, BTC Continues to Face Risk Appetite Test (01.05~01.11)

- Core View: BTC's rebound was thwarted, and the market is caught in a tug-of-war between bulls and bears.

- Key Factors:

- ETFs and long-term holders selling on rallies, suppressing the price.

- Economic data reinforces soft landing expectations, dashing hopes for a January rate cut.

- Market buying power "supports but fails to lift," lacking momentum to break through key resistance levels.

- Market Impact: Short-term, new buying or an improvement in risk appetite is needed for an upward breakthrough.

- Timeliness Note: Short-term impact.

The markets, projects, tokens, and other information, views, and judgments mentioned in this report are for reference only and do not constitute any investment advice.

This week, BTC opened at $91,499.04 and closed at $90,872.01, down 0.68% with a volatility of 6.15%. Trading volume increased noticeably compared to last week.

As mentioned in previous reports, BTC surged towards $94,000 again this week. The momentum came from the continued improvement in Federal Reserve liquidity and the "soft landing" expectations fueled by US employment data meeting expectations.

However, with no hope for a January rate cut, risk appetite among on-market funds continued to deteriorate. After hitting the resistance level near $94,000, increased selling pressure from BTC ETFs and long-term holders caused the rally to falter, forcing a retreat back to the $90,000 level.

Currently, BTC and the broader crypto market remain in a predicament where buying power provides support but fails to lift prices, while selling pressure intensifies on rallies. A renewed buying sentiment, or an overall improvement in risk appetite, may be necessary for BTC to break through the $94,000 resistance and further expand its rebound space.

Technically, BTC is in a favorable position with rising pullback lows, and the 60-day moving average shows signs of stabilization. Barring negative external shocks, the price may break through $94,000 in the short term, challenging the $95,000 level indicated by the 90-day moving average.

Policy, Macro Finance, and Economic Data

Given the government shutdown, the monthly economic data released by the US this week was the first batch since data normalization, making it highly significant. However, the final results did not exceed market expectations.

On January 8th, initial jobless claims data showed 208,000 applications for the week, slightly below expectations and the previous value. This was mildly positive for risk assets but aligned with "soft landing" expectations, indicating stronger economic resilience.

On January 9th, US December non-farm payrolls (seasonally adjusted) came in at 50,000, below the expected 60,000 and the previous 56,000. However, the unemployment rate was only 4.4%, slightly below the expected 4.5%. Wage growth was 3.8%, higher than the expected 3.6%. These seemingly "conflicting" employment figures suggest the job market crisis is less severe than feared, causing the probability of a January rate cut shown by FedWatch to drop to single digits.

This week's data reinforced the consensus that the economy is heading for a soft landing, with employment cooling but not collapsing. The US stock market, the main battlefield for global capital, remained strong, with the S&P 500 and Dow Jones hitting new all-time highs. The Nasdaq, despite concerns over excessive AI investment, also rose 1.88%, nearing its previous peak. There are signs of capital rotation from tech stocks to consumer, value, and small-to-mid-cap stocks.

The 10-year US Treasury yield closed at 4.173%, with a real yield as high as 1.91%, continuing to exert significant pressure on long-duration assets like tech stocks and BTC.

Crypto Market

Macro liquidity is improving but has not yet reached ample levels, keeping high-risk assets under pressure. If AI tech stocks are suppressed, BTC faces even greater headwinds.

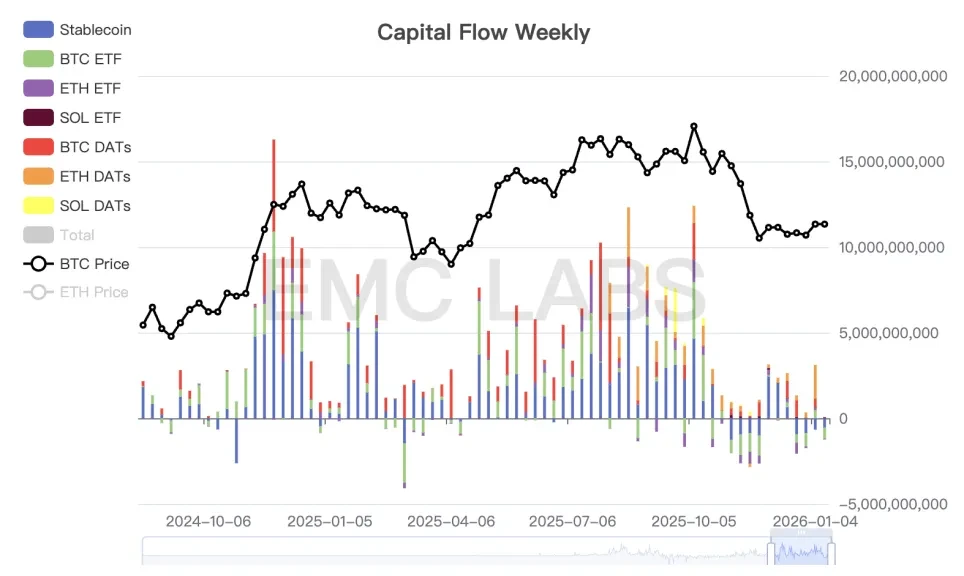

At the capital level, cyclical and short-term funds continue to exit on rallies, while long-term allocation funds are buying at lower levels, creating a fragile balance.

This week, as prices rebounded to previous highs, another wave of selling emerged ahead of major economic and employment data releases.

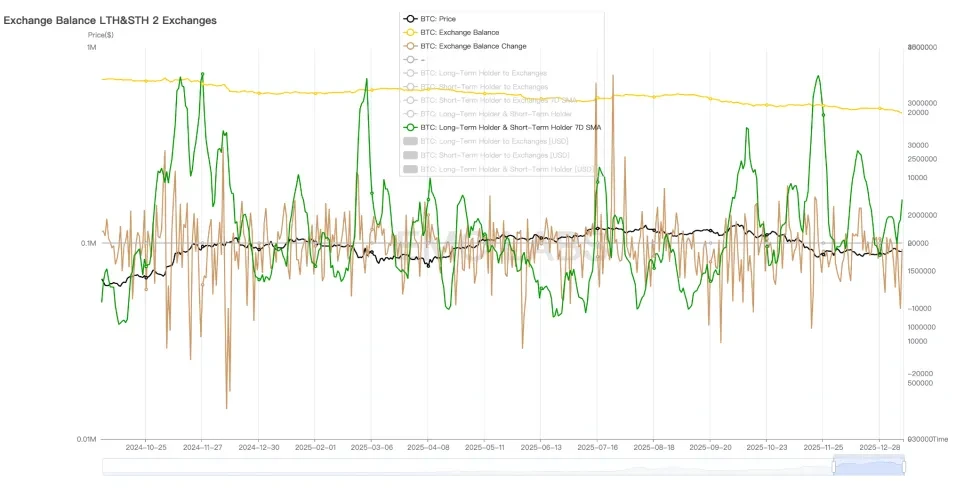

Centralized Exchange Long/Short Holder Selling Statistics (Daily)

This risk-aversion-driven selling is not persistently destructive and is currently diminishing in scale. However, the continued selling by long-term holders remains the most significant medium-term threat to the crypto market.

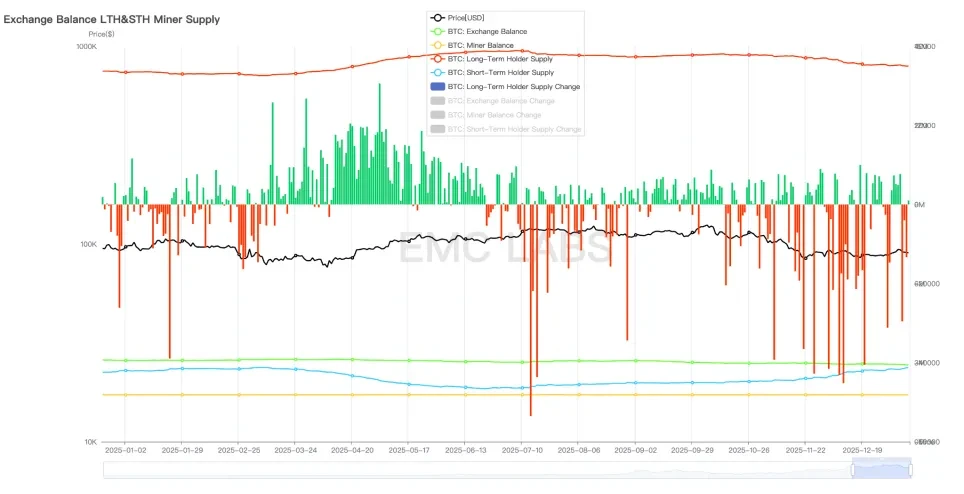

Long-term Holder Position Change Statistics (Daily)

The pace of sustained selling by long-term holders weakened last week but continued, contributing to BTC's reversal after reaching $94,000.

Capital flows confirm this. The largest inflow occurred on January 5th, followed by continuous outflows, resulting in a net outflow for the week: $647 million from BTC ETFs and $539 million from stablecoins.

Crypto Market Capital Inflow/Outflow Statistics (Weekly)

Last week, centralized exchanges saw a net outflow of nearly 25,000 BTC. The supporting force for the market still comes from the "whale and shark" cohort, whose holdings have been steadily increasing over the past week. However, this group currently employs a "support without lifting" strategy, only accumulating at lower levels without creating upward buying pressure.

Cycle Metrics

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, entering the "Downtrend" phase (bear market).

About Us

EMC Labs (Emergent Labs) was founded in April 2023 by crypto asset investors and data scientists. We focus on blockchain industry research and Crypto secondary market investment. With industry foresight, insights, and data mining as our core competencies, we are committed to participating in the booming blockchain industry through research and investment, promoting the benefits that blockchain and crypto assets bring to humanity.

For more information, please visit: https://www.emc.fund