CLARITY Review Abruptly Delayed, Why Is Industry Division So Severe?

- Core Viewpoint: The U.S. Senate Banking Committee postponed its review due to severe internal industry divisions over the Crypto-Asset Market Structure Act (CLARITY). The bill aims to clarify the regulatory framework for digital assets, but institutions like Coinbase argue the current version has major flaws that could harm industry innovation.

- Key Elements:

- Review Delay: Due to Coinbase's public opposition, the Senate Banking Committee canceled the CLARITY bill review hearing originally scheduled for January 15th; a new date is undetermined.

- Bill Objective: CLARITY aims to delineate regulatory responsibilities between the SEC and CFTC, establishing a clear federal regulatory framework for the U.S. digital asset market to reduce uncertainty.

- Industry Division: Coinbase firmly opposes the current version, arguing it has significant issues regarding DeFi and stablecoin yields; while a16z, Circle, Kraken, and others support moving forward, believing a framework should be established first and then gradually refined.

- Core Points of Contention: Include a potential outright ban on stablecoin yields, imposing burdensome disclosure requirements for token issuance akin to public companies, and potentially inappropriately expanding regulatory obligations for DeFi developers.

- Strategic Differences: Opponents (like Coinbase) fear passing a "bad bill" will stifle innovation long-term; supporters believe having a framework is better than no rules, and it can be amended later.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

On January 15th Beijing time, a sudden change occurred regarding the cryptocurrency market structure bill (CLARITY), which was about to undergo its first Senate review. Eleanor Terrett, a U.S. journalist who has long tracked cryptocurrency legislation, revealed that due to market controversy triggered by Coinbase's sudden opposition to CLARITY, the U.S. Senate Banking Committee has canceled the CLARITY review hearing (markup) originally scheduled for 10:00 AM EST on January 15th (11:00 PM Beijing time tonight). A new review time has not yet been determined.

- Odaily Note: Regarding the CLARITY review, the Senate Agriculture Committee (the primary oversight committee for the CFTC) had also previously planned to conduct a review concurrently with the Senate Banking Committee (the primary oversight committee for the SEC) on January 15th. However, the Senate Agriculture Committee subsequently postponed its review to January 27th. The Senate Banking Committee had been preparing according to the original schedule, but it was suddenly postponed again this morning just before the review.

Introduction to CLARITY (Skip if Familiar)

Last week, we detailed the content, significance, and progress of CLARITY in our article "The Biggest Variable for the Crypto Market Outlook: Can the CLARITY Bill Pass the Senate?".

In short, CLARITY aims to clearly distinguish the classification of digital assets and delineate the regulatory responsibilities of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This would establish a clear, functional federal regulatory framework for the U.S. digital asset market, addressing long-standing issues of regulatory ambiguity and inconsistent enforcement.

For industry participants, the enactment of CLARITY would signify a substantive shift in the regulatory environment. It would mean a more predictable compliance path in the future, allowing market participants to clearly know which activities, products, and transactions fall under regulatory scope. This would reduce long-term regulatory uncertainty, lower litigation risks and regulatory friction, and attract more innovators and traditional financial institutions to enter the market.

For cryptocurrencies themselves, the enactment of CLARITY is expected to promote cryptocurrencies as "an asset class more easily allocated by traditional capital." By resolving institutional uncertainty, it would provide compliant entry paths for long-term capital that was previously unable to enter, thereby raising the valuation floor for the entire market.

Severe Industry Divisions

Clearly, the cryptocurrency industry has placed great expectations for the future regulatory environment on CLARITY. However, as the review approached, major representative companies in the industry expressed starkly different attitudes.

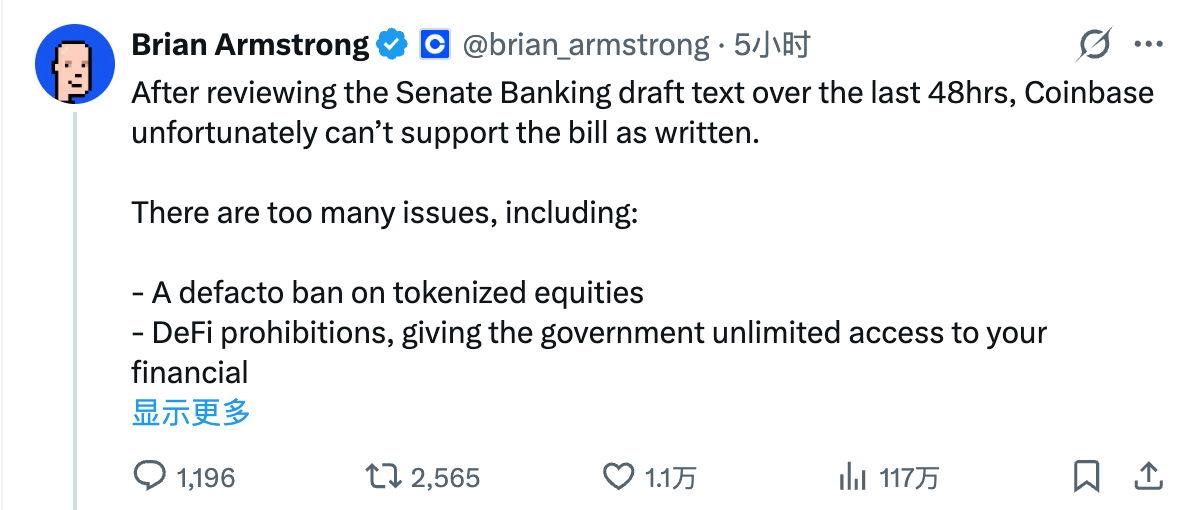

This morning, Coinbase, a significant force in cryptocurrency legislative lobbying, explicitly stated its opposition to the current version of the CLARITY bill.

Coinbase founder Brian Armstrong posted, stating that the bill in its current text is worse than the status quo, and it's better to have no bill than a bad bill — "The bill has major issues with DeFi and stablecoin yields. Some provisions could grant the government unlimited access to personal financial records, harming user privacy, and potentially stifling stablecoin reward mechanisms."

Simultaneously, several other industry representative companies, including a16z, Circle, Kraken, and Ripple, expressed support for the current version of CLARITY.

Chris Dixon, a star partner at a16z (a main proponent of the Web3 narrative), explained: "Crypto developers need clear rules... This bill, at its core, is designed to achieve that. It's not perfect and will need some changes before it becomes law, but if we want the US to remain the best place in the world to build the crypto future, now is the time to move CLARITY forward."

Arjun Sethi, Co-CEO of Kraken, explained that legislating around market structure is inherently complex, and friction is bound to occur. The existence of unresolved issues doesn't mean the effort has failed; it means we are tackling the hardest work... Giving up now would only lock in uncertainty, leaving U.S. companies operating in a gray area while the rest of the world moves forward.

What Exactly Are the Defects in the Current Bill Version?

From the statements above, it's clear that whether it's Coinbase, which firmly opposes, or a16z and Kraken, which have tentatively chosen to support, both sides share a common ground in their attitude towards the current version of CLARITY: they both acknowledge that the current bill is not perfect and has certain defects. The difference lies in that Coinbase chose a more radical stance of resistance, directly labeling it a "bad bill," while a16z and Kraken opted for a more conservative approach, using milder terms like "not perfect" and "unresolved issues."

In fact, disagreements surrounding CLARITY have long existed. After the bill passed the House of Representatives on July 17th last year, it was originally planned for Senate review in mid-last year. However, it was then pushed to October, then to the end of last year, then to 2026, and now it seems it will be delayed again...

As mentioned in our previous article, disagreements surrounding CLARITY mainly focus on DeFi regulation, stablecoin yields, and ethical standards concerning the Trump family.

Regarding the ethical standards issue concerning the Trump family, Jake Chervinsky, one of the industry's most active lawyers and Chief Legal Officer at Variant, explained that while many Democrats have stated they would vote against CLARITY without restrictions on this matter, since ethical issues do not fall under the jurisdiction of the Senate Banking Committee, the review hearing cannot discuss this issue. Therefore, this disagreement is not the current focal point of controversy.

- Odaily Note: This issue will certainly be a key point of attack for Democratic senators during the future full Senate review.

As for other core disagreements, Jake Chervinsky broke them down into five more detailed points, as follows.

Point One: Stablecoin Yield Issue

The GENIUS bill passed last year prohibited interest-bearing stablecoins, a compromise made to secure banking industry support, at the cost of stifling an entire category of innovative products.

However, the banking industry remains dissatisfied with this clause and is attempting to overturn it in CLARITY. This is because while GENIUS stipulated that stablecoin issuers cannot pay holders "any form of interest or yield," it did not restrict third parties from providing yields or rewards. However, the current Section 404 of CLARITY also prohibits third parties from providing yields. If the current version of the bill passes, holding stablecoins would not yield any returns or rewards; incentives could only be obtained through payment activities.

Jake Chervinsky criticized this, stating that restricting stablecoin yields or rewards lacks a sound policy basis. It would only harm U.S. consumer interests, the international standing of the U.S. dollar, and U.S. national security. The reason banks strongly demand this change is that large banks profit over $360 billion annually from payment and deposit services, and interest-bearing stablecoins directly threaten these profits.

Point Two: Tokenization of Securities

Last year, SEC Chairman Paul Atkins initiated Project Crypto, aimed at upgrading the financial system by migrating it onto the blockchain. However, Section 505 of CLARITY seems to prevent the achievement of this goal by depriving it of the power to treat crypto assets fairly.

Paul Atkins emphasized "innovation exemptions," while Section 505 states that no securities regulatory requirements can be exempted or modified simply because a security is issued on-chain, nor can anyone's registration obligations be exempted on this basis.

Point Three: Token Issuance

This is perhaps the most important part of CLARITY, providing builders with a clear path to issue tokens without fear of SEC enforcement for issuing "unregistered securities."

Title 1 of CLARITY covers this path. It is clear but not simple or cheap. Title 1 requires many projects to make disclosures, which in theory is good. The problem lies in the details — Title 1 includes extremely burdensome disclosure requirements, nearly at the equity level, not much different from public companies — including audited financial statements. This system suits mature companies but not startups.

This is just one of many details. Title 1 also requires builders to obtain SEC approval for each token; disclosure obligations must continue long after issuance; the public fundraising cap is $2 billion, etc.

In comparison, creators might as well issue tokens overseas or simply issue stocks.

Point Four: Developer Protection

Developers of non-custodial software are not money transmitters and should not bear user KYC obligations at all — this should be uncontroversial.

However, Title 3 of CLARITY repeatedly hints that regulators may extend their monitoring reach into the DeFi space. These clauses must be deleted or amended.

Point Five: Institutional Access

Regulated financial institutions have always been hesitant to venture into DeFi due to compliance concerns.

Section 308 of CLARITY was intended to solve this problem but made a critical mistake — it imposes additional burdens on institutions, making it even more likely to scare them away from DeFi than the current situation.

The Radicals and the Conservatives

Considering Jake Chervinsky's breakdown of the core issues in the current CLARITY bill, it's easy to understand why Coinbase, a16z, Kraken, and others all agree — this is not a perfect bill.

Faced with a bill containing hidden pitfalls, as representatives of the cryptocurrency industry, Coinbase, a16z, and Kraken share fundamental interests, but they differ in their strategies for securing those interests.

Coinbase has chosen a more radical confrontational stance. Its core logic is that if CLARITY passes with clauses unfavorable to the industry, even if vaguely worded, they could be amplified infinitely at the enforcement level, creating long-term suppression of innovation. The cost of subsequent legal amendments and political resistance might far exceed the cost of continuing to endure the current regulatory uncertainty.

Institutions like a16z, Kraken, and Circle have adopted a more conservative, "realist" strategy. In their view, the biggest problem with the long-standing stagnation of U.S. crypto regulation is not "bad rules," but the complete lack of rules. Even with its flaws, CLARITY at least provides a legislative starting point that can be revised, negotiated, and gradually improved. Once CLARITY is formally enacted, the U.S. crypto industry will have a unified federal framework for the first time, making it more feasible to amend specific clauses later.

There is no simple right or wrong here. The core of the conflict lies in whether the bill should be advanced in its current version and how much compromise cost should be paid for it. This is not "infighting" within the industry. Both sides share the unified goal of making CLARITY better; they have simply chosen different negotiation strategies.

As Jake Chervinsky said: "For better or worse, this text will undergo significant changes before it becomes law. Let's hope it evolves for the better."